Filed Pursuant to Rule 424(b)(5)

File Numbers 333 254110 01 and 333 254110

PROSPECTUS SUPPLEMENT

(To Prospectus dated March 19, 2021)

AIR T FUNDING

$6,450,000

258,000 Shares of 8% Alpha Income Trust Preferred Securities

(Liquidation amount $25.00 per Capital Security)

guaranteed by

Air T, Inc.

This prospectus supplement and the accompanying prospectus relate to the offer and sale from time to time of up to 258,000 shares of our Alpha Income Preferred Securities, $25.00 liquidation value per share, (which we refer to in this prospectus supplement as “Capital Securities”), having an aggregate offering price of up to $6,450,000. Sales of the Capital Securities will be made through Ascendiant Capital Markets, LLC (the “sales agent”) as sales agent pursuant to the terms of the at the market offering agreement between us and the sales agent. Sales of our Capital Securities, if any, may be made in transactions that are deemed to be “at-the-market offerings” as defined in Rule 415 under the Securities Act of 1933, as amended (the “Securities Act”), including sales made directly on the NASDAQ Capital Market (“NASDAQ”) or sales made to or through a market maker other than on an exchange, at market prices prevailing at the time of sale or in negotiated transactions. In the event that any sales are made pursuant to the at the market offering agreement which are not made directly on NASDAQ or on any other existing trading market for our Capital Securities at market prices at the time of sale, including, without limitation, any sales to the sales agent acting as principal or sales in negotiated transactions, we will file a prospectus supplement describing the terms of such transaction, the amount of shares sold, the price thereof, the applicable compensation, and such other information as may be required pursuant to Rule 424 and Rule 430B of the Securities Act, as applicable, within the time required by Rule 424 of the Securities Act. No Capital Securities have been sold during the previous twelve (12) months.

The Capital Securities may be redeemed, in whole or in part, at any time on or after June 7, 2024 at a redemption price equal to the total liquidation amount plus accumulated and unpaid distributions to the date of redemption. In addition, the Capital Securities may be redeemed in whole if a tax event (as defined herein) or investment company event (as defined herein) occur and are continuing.

The Capital Securities are listed on NASDAQ under the symbol “AIRTP.” The last reported sales price of our Capital Securities on NASDAQ on October 12, 2023 was $19.31 per share.

The sales agent will receive a commission of 3.0% of the gross sales price per share for any shares sold through it as our sales agent under the at the market offering agreement. We have also agreed to reimburse certain expenses of the sales agent in connection with the at the market offering agreement as further described in the Plan of Distribution section. Subject to the terms and conditions of the at the market offering agreement, the sales agent will use its commercially reasonable efforts to sell on our behalf any Capital Securities to be offered by us under the at the market offering agreement. The offering of Capital Securities pursuant to the at the market offering agreement will terminate upon the earlier of (1) the sale of $6,450,000 of Capital Securities subject to the at the market offering agreement, (2) March 19, 2024, and (3) the termination of the at the market offering agreement, pursuant to its terms, by either the sales agent or us.

Investing in the Capital Securities involves a high degree of risk. Before buying any Capital Securities, you should carefully consider the risks that we have described in “Supplemental Risk Factors” beginning on page S-4 of this prospectus supplement, as well as those described in our filings under the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

The Capital Securities are not deposits or other obligations of a depository institution and are not insured by the Federal Deposit Insurance Corporation, the Bank Insurance Fund or any other governmental agency.

The Securities and Exchange Commission and state securities regulators have not approved or disapproved these securities or determined if this prospectus supplement or the accompanying prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

ASCENDIANT CAPITAL MARKETS, LLC

The date of this prospectus supplement is October 18, 2023.

TABLE OF CONTENTS

Prospectus Supplement

Page

Prospectus

Page

| | | | | |

| ABOUT THIS PROSPECTUS | 1 |

| ABOUT AIR T, INC. AND THE ISSUER TRUST | 2 |

| RISK FACTORS | 4 |

| CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS | 18 |

| WHERE YOU CAN FIND MORE INFORMATION | 18 |

| INCORPORATION OF CERTAIN INFORMATION BY REFERENCE | 18 |

| USE OF PROCEEDS | 19 |

| SELLING SECURITYHOLDERS | 19 |

| PLAN OF DISTRIBUTION | 21 |

| SECURITIES THAT MAY BE OFFERED | 24 |

| DESCRIPTION OF CAPITAL STOCK | 25 |

| DESCRIPTION OF WARRANTS | 28 |

| DESCRIPTION OF DEPOSITARY SHARES | 30 |

| DESCRIPTION OF UNITS | 31 |

| DESCRIPTION OF DEBT SECURITIES | 32 |

| DESCRIPTION OF CAPITAL SECURITIES, CAPITAL SECURITIES WARRANTS, JUNIOR SUBORDINATED DEBENTURES AND GUARANTEE | 35 |

| LEGAL MATTERS | 55 |

| EXPERTS | 55 |

| DISCLOSURE OF COMMISSION POSITION ON INDEMNIFICATION | 55 |

We have not, and the sales agent has not, authorized any dealer, salesperson or other person to give any information or to make any representation other than those contained in or incorporated by reference into this prospectus supplement, the accompanying prospectus or any applicable free writing prospectus. You must not rely upon any information or representation not contained in or incorporated by reference into this prospectus supplement, the accompanying prospectus or any applicable free writing prospectus as if we had authorized it. This prospectus supplement, the accompanying prospectus and any applicable free writing prospectus do not constitute an offer to sell or the solicitation of an offer to buy any securities other than the registered securities to which they relate, nor does this prospectus supplement, the accompanying prospectus

or any applicable free writing prospectus constitute an offer to sell or the solicitation of an offer to buy securities in any jurisdiction to any person to whom it is unlawful to make such offer or solicitation in such jurisdiction. You should not assume that the information contained in this prospectus supplement, the accompanying prospectus, the documents incorporated herein and therein by reference and any applicable free writing prospectus is correct on any date after their respective dates, even though this prospectus supplement, the accompanying prospectus or an applicable free writing prospectus is delivered or securities are sold on a later date. Our business, financial condition, results of operations and cash flows may have changed since those dates.

ABOUT THIS PROSPECTUS SUPPLEMENT

This prospectus supplement and the accompanying prospectus are part of a shelf registration statement that we filed with the Securities and Exchange Commission (the “SEC”). Our shelf registration statement allows us to offer from time to time a wide array of securities. In the accompanying prospectus, we provide you with a general description of the securities we may offer from time to time under our shelf registration statement and other general information that may apply to this offering. In this prospectus supplement, we provide you with specific information about the Capital Securities that we are selling in this offering. Both this prospectus supplement and the accompanying prospectus include important information about us, the Capital Securities and other information that you should know before investing. This prospectus supplement also adds, updates and changes information contained in the accompanying prospectus. You should carefully read both this prospectus supplement and the accompanying prospectus as well as additional information described under “Where You Can Find More Information” before investing in the Capital Securities.

Generally, when we refer to this “prospectus supplement,” we are referring to both this prospectus supplement and the accompanying prospectus, as well as the documents incorporated by reference herein and therein. If information in this prospectus supplement is inconsistent with the accompanying prospectus, you should rely on this prospectus supplement.

Air T, Inc. is a Delaware corporation. Its principal executive office is located at 11020 David Taylor Drive, Suite 305, Charlotte, North Carolina 28262, and its telephone number is (980) 595-2840. Air T, Inc. created Air T Funding by the execution of a Trust Agreement and a Certificate of Trust that was filed with the Secretary of State of Delaware on September 28, 2018. The Trust Agreement was most recently amended and restated by that certain Second Amended and Restated Trust Agreement dated June 23, 2021 and the First Amendment to the Second Amended and Restated Trust Agreement dated January 28, 2022. The principal executive office of the Trust is located at the Delaware Trust Company, 251 Little Falls Drive, New Castle, DE 19808, and the telephone number of the trust is (980) 595-2840. Air T, Inc’s website is located at www.airt.net. The information contained on Air T’s website is not part of this prospectus supplement or the accompanying prospectus.

WHERE YOU CAN FIND MORE INFORMATION

Air T is required to file annual, quarterly and current reports, proxy statements and other information with the SEC under the Exchange Act. Air T’s filings with the SEC are available to the public through the SEC’s Internet site at http://www.sec.gov and through the NASDAQ Stock Market at One Liberty Plaza, New York, New York 10006. Air T makes available free of charge on its website (https://www.airt.net) its Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and all amendments to those reports as soon as reasonably practicable after such material is electronically filed with the SEC. The information contained on or that may be accessed through our website is not part of, and is not incorporated by reference into this Prospectus Supplement.

We have filed a registration statement on Form S-3 with the SEC relating to the securities covered by this prospectus supplement. This prospectus supplement and the accompanying prospectus are a part of the registration statement and do not contain all of the information in the registration statement. Whenever a reference is made in this prospectus to a contract or other document of ours, please be aware that the reference is only a summary and that you should refer to the exhibits that are part of the registration statement for a copy of the contract or other document. You may review a copy of the registration statement through the SEC’s Internet site.

Additional copies of this prospectus supplement and the accompanying prospectus may be obtained, without charge, by writing to us at Air T, Inc. or the Trust, at 11020 David Taylor Drive, Suite 305, Charlotte, North Carolina 28262, telephone number is (980) 595-2840, Attention: Corporate Secretary. You may also contact the Corporate Secretary at (980) 595-2840.

INCORPORATION BY REFERENCE

The SEC’s rules allow us to “incorporate by reference” information into this prospectus supplement. This means that we can disclose important information to you by referring you to another document. Any information referred to in this way is considered part of this prospectus supplement from the date we file that document. Any reports filed by us with the SEC after the date of this prospectus supplement and before the date that the offerings of the securities by means of this prospectus supplement are terminated will automatically update and, where applicable, supersede any information contained in this prospectus supplement or incorporated by reference in this prospectus supplement.

We incorporate by reference into this prospectus supplement the following Air T and Trust documents or information filed with the SEC:

(6) All documents filed by us under Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act (excluding any information that is deemed to have been “furnished” and not “filed” with the SEC) on or after the date of this prospectus supplement and before the termination of the offerings to which this prospectus supplement relates.

We will provide without charge to each person, including any beneficial owner, to whom this prospectus supplement is delivered, upon his or her written or oral request, a copy of any or all documents referred to above which have been or may be incorporated by reference into this prospectus supplement, excluding exhibits to those documents unless they are specifically incorporated by reference into those documents. You can request those documents from the Corporate Secretary, Air T, Inc., at 11020 David Taylor Drive, Suite 305, Charlotte, North Carolina 28262. You may also contact the Corporate Secretary at (980) 595-2840.

FORWARD-LOOKING STATEMENTS

This prospectus supplement contains or incorporates by reference forward-looking statements within the meaning of Section 27A of the Securities Act and Section 21E of the Exchange Act, which reflect our current views with respect to, among other things, our operations and financial performance. In some cases, you can identify these forward-looking statements by the use of words such as “outlook”, “believes”, “expects”, “potential”, “continues”, “may”, “will”, “should”, “seeks”, “approximately”, “predicts”, “intends”, “plans”, “estimates”, “anticipates” or the negative version of these words or other comparable words. Such forward-looking statements are subject to various risks and uncertainties. These forward-looking statements are not historical facts and are based on current expectations, estimates and projections about Air T, Inc.’s industry, management’s beliefs and certain assumptions made by management, many of which, by their nature, are inherently uncertain and beyond our control.

Accordingly, there are or will be important factors that could cause actual outcomes or results to differ materially from those indicated in these statements. All statements other than statements of historical fact are forward-looking statements and are based on various underlying assumptions and expectations and are subject to known and unknown risks, uncertainties and assumptions, and may include projections of our future financial performance based on our growth strategies and anticipated trends in our business. We believe these factors include, but are not limited to, those described under the “Supplemental Risk Factors” section of this prospectus supplement and under “Risk Factors” in Item 1A of our most recent Annual Report on Form 10-K and Form 10-K/A for the fiscal year ended March 31, 2023, filed with the SEC on June 27, 2023 and June 28, 2023, respectively (“2023 Annual Report”), and Item 1A of any subsequently filed Quarterly Reports on Form 10-Q, as such factors may be updated from time to time in our periodic filings with the SEC (which documents are incorporated by reference herein), as well as the other information contained or incorporated by reference in this prospectus supplement. These factors should not be construed as exhaustive and should be read in conjunction with the other cautionary statements that are included or incorporated by reference in this prospectus supplement. We undertake no obligation to publicly update or review any forward-looking statement, whether as a result of new information, future developments or otherwise.

You should rely only on the information contained or incorporated by reference in this prospectus supplement and the accompanying prospectus. Air T Funding and Air T, Inc. have not authorized anyone to provide you with information other than that contained or incorporated by reference in this prospectus supplement and the accompanying prospectus. The information in this prospectus supplement and the accompanying prospectus may

only be accurate as of their respective dates. In this prospectus supplement, references to the “Trust” mean Air T Funding and references to “Air T” or “we” mean Air T, Inc. together with its subsidiaries, unless the context indicates otherwise.

The Trust and Air T are offering to sell the Capital Securities, and are seeking offers to buy the Capital Securities, only in jurisdictions where offers and sales are permitted. The distribution of this prospectus supplement and the accompanying prospectus and the offering of the Capital Securities in certain jurisdictions may be restricted by law. Persons outside the United States who come into possession of this prospectus supplement and accompanying prospectus must inform themselves about and observe any restrictions relating to the offering of the Capital Securities and the distribution of this prospectus supplement and the accompanying prospectus outside the United States. This prospectus supplement and the accompanying prospectus do not constitute, and may not be used in connection with, an offer or solicitation by anyone in any jurisdiction in which such offer or solicitation is not authorized or in which the person making such offer or solicitation is not qualified to do so or to any person to whom it is unlawful to make such offer or solicitation.

PROSPECTUS SUPPLEMENT SUMMARY

The following information concerning Air T, the Trust, the Capital Securities to be issued by the Trust, the Guarantee to be issued by Air T with respect to the Capital Securities and the 8.0% Junior Subordinated Debentures to be issued by Air T supplements, and should be read in conjunction with, the information contained in the accompanying prospectus. If the information set forth in this prospectus supplement differs in any way from the information set forth in the accompanying prospectus, you should rely on the information set forth in this prospectus supplement.

Air T, Inc.

Air T is a holding company with a portfolio of operating businesses and financial assets. Air T’s goal is to prudently and strategically diversify Air T’s earnings power and compound its free cash flow per share over time.

Air T currently operates in four industry segments:

•Overnight air cargo, which operates in the air express delivery services industry;

•Ground equipment sales, which manufactures and provides mobile deicers and other specialized equipment products to passenger and cargo airlines, airports, the military and industrial customers;

•Commercial jet engines and parts, which manages and leases aviation assets; supplies surplus and aftermarket commercial jet engine components; provides commercial aircraft disassembly/part-out services; sells commercial aircraft engines and parts; and procures services and overhaul and repair services to aircraft companies; and

•Corporate and other, which acts as the capital allocator and resource for other segments. Further, Corporate and other also comprises insignificant businesses and business interests.

Each business segment has separate management teams and infrastructures that offer different products and services.

Air T Funding

The Trust is a Delaware statutory business trust. The Trust exists solely to:

•issue and sell its common securities to Air T;

•issue and sell its Capital Securities to the public;

•use the proceeds from the sale of its common securities and Capital Securities to purchase Junior Subordinated Debentures from Air T; and

•engage in other activities that are necessary, convenient or incidental to these purposes.

Delaware Trust Company, a Delaware chartered trust company is the Delaware and Property Trustee of the Trust. Two officers of Air T act as administrative trustees of the Trust. Delaware Trust Company is also the Indenture Trustee under the Subordinated Indenture dated as of June 10, 2019, as amended and supplemented.

As of September 29, 2023, there are $100,000,000 authorized amount of Capital Securities, par value $25.00, 1,240,085 Capital Securities outstanding. The Capital Securities are listed for trading on NASDAQ and trade under the symbol “AIRTP.”

The rights of the holders of Capital Securities are described in the applicable Trust Agreement and the Delaware Statutory Trust Act. The principal executive office of the Trust is located at the Delaware Trust Company, 251 Little Falls Drive, New Castle, DE 19808, and the telephone number of the trust is (980) 595-2840.

The Trust is a “finance subsidiary” of Air T within the meaning of Rule 3-10 of Regulation S-X under the Securities Act of 1933, as amended, and as a result the Trust does not file periodic reports with the SEC under the Securities Exchange Act of 1934, as amended.

The Offering

The Trust is offering its Capital Securities in an at the market offering. The Trust will use all of the proceeds from the sale of its Capital Securities and its common securities to purchase Junior Subordinated Debentures of Air T. The Junior Subordinated Debentures are and will be the Trust’s only assets. Air T will fully and unconditionally guarantee the obligations of the Trust, based on its combined obligations under the Guarantee, the trust agreement and the junior subordinated indenture.

The Capital Securities

If you purchase Capital Securities, you will be entitled to receive cumulative cash distributions at an annual rate of $2.00 for each Capital Security, which represents 8.0% of the liquidation amount of $25 for each Capital Security. If the Trust is terminated and its assets distributed, for each Capital Security you own, you are entitled to receive a like amount of Junior Subordinated Debentures or the liquidation amount of $25 plus accumulated but unpaid distributions from the assets of the Trust available for distribution, after it has paid liabilities owed to its creditors. Accordingly, you may not receive the full liquidation amount and accumulated but unpaid distributions if the Trust does not have enough funds.

Distributions will accumulate from the date the Trust issues Capital Securities. The Trust will pay the distributions quarterly on February 15, May 15, August 15 and November 15 of each year. These distributions may be deferred for up to 20 consecutive quarters. The Trust will only pay distributions when it has funds available for payment.

| | | | | |

| Securities Offered | The Capital Securities represent undivided beneficial interests in the Trust’s assets, which will consist solely of the Junior Subordinated Debentures and payments thereunder. |

| Distributions | The Distributions payable on each Capital Security will be fixed at a rate per annum of 8% of the Liquidation Amount of $25.0 per Capital Security, will be cumulative, will accrue from the date of issuance of the Capital Securities, and will be payable quarterly in arrears on the 15th day of February, May, August and November of each year (subject to possible deferral as described below). Additionally, from time to time the Board of Air T may in its sole discretion may declare Distributions in addition to the Distributions equal to the 8.0% per annum Liquidation Amount of the Capital Securities. |

| | | | | |

| Extension Periods | So long as no Debenture event of default has occurred and is continuing, Air T will have the right, at any time on or after, June 7, 2024, to defer payments of interest on the Junior Subordinated Debentures by extending the interest payment period thereon for a period not exceeding 20 consecutive quarters with respect to each deferral period (each an “Extension Period”), provided that no Extension Period may extend beyond the Stated Maturity of the Junior Subordinated Debentures. If interest payments are so deferred, Distributions on the Capital Securities will also be deferred and Air T will not be permitted, subject to certain exceptions described herein, to declare or pay any cash distributions with respect to Air T’s capital stock or debt securities that rank pari passu with or junior to the Junior Subordinated Debentures. During an Extension Period, Distributions will continue to accrue with income thereon compounded quarterly. |

| Maturity | The Junior Subordinated Debentures will mature on June 7, 2049, which date may be shortened (such date, as it may be shortened, the “Stated Maturity”) to a date not earlier than June 7, 2024. |

| Redemption | At any time on or after June 7, 2024, the Capital Securities are subject to mandatory redemption upon repayment of the Junior Subordinated Debentures at maturity or their earlier redemption in an amount equal to the amount of Junior Subordinated Debentures maturing on or being redeemed at a redemption price equal to the aggregate liquidation amount of the Capital Securities plus accumulated and unpaid distributions thereon to the date of redemption. The Junior Subordinated Debentures are redeemable prior to maturity at the option of Air T (i) on or after June 7, 2024, in whole at any time or in part from time to time, or (ii) at any time, in whole (but not in part), upon the occurrence and during the continuance of a tax event or an investment company event, in each case at a redemption price equal to 100% of the principal amount of the Junior Subordinated Debentures so redeemed, together with any accrued but unpaid interest to the date fixed for redemption. |

| Distribution of Junior Subordinated Debentures | Air T has the right at any time to terminate the Trust and cause the Junior Subordinated debentures to be distributed to holders of Capital Securities in liquidation of the Trust. |

| | | | | |

| Guarantee | Taken together, Air T’s obligations under various documents described herein, including the Guarantee, provide a full guarantee of payments by the Trust of distributions and other amounts due on the Capital Securities. Under the Guarantee, Air T guarantees the payment of Distributions by the Trust and payments on liquidation of or redemption of the Capital Securities (subordinate to the right to payment of senior and subordinated debt of Air T, as defined herein) to the extent of funds held by the Trust. If the Trust has insufficient funds to pay distributions on the Capital Securities (i.e., if Air T has failed to make required payments under the Junior Subordinated Debentures), a holder of the Capital Securities would have the right to institute a legal proceeding directly against Air T to enforce payment of such distributions to such holder. |

| Ranking | Generally, the Capital Securities will rank pari passu, and payments thereon will be made pro rata, with the Common Securities of the Trust held by Air T. The obligations of Air T under the Guarantee, the Junior Subordinated Debentures and other documents described herein are unsecured and rank subordinate and junior in right of payment to all current and future Senior and Subordinated Debt, the amount of which is unlimited. At June 30, 2023, the aggregate outstanding Senior and Subordinated Debt of Air T was approximately $96.4 million (which figure does not include the trust preferred debt of $25.6 million). In addition, because Air T is a holding company, all obligations of Air T relating to the securities described herein will be effectively subordinated to all existing and future liabilities of the Air T’s subsidiaries. Air T may cause additional Capital Securities to be issued by the Trust or trusts similar to the Trust in the future, and there is no limit on the amount of such securities that may be issued. In this event, Air T’s obligations under the Junior Subordinated Debentures to be issued to such other trusts and Air T’s guarantees of the payments will rank pari passu with Air T’s obligations under the Junior Subordinated Debentures and the Guarantee, respectively |

| Voting Rights | The holders of the Capital Securities will generally have limited voting rights relating only to the modification of the Capital Securities, the dissolution, winding-up or termination of the Trust and certain other matters described herein. |

| | | | | |

| Use of Proceeds | The Trust will invest all of the proceeds from the sale of the Capital Securities in the Junior Subordinated Debentures. Air T intends to use the net proceeds from the sale of the Junior Subordinated Debentures for general corporate purposes, which may include investments in or advances to its existing or future subsidiaries, repayment of its obligations that have matured and reduction of other debt. |

| Manner of Offering | “At the market offering” that may be made from time to time through our sales agent, Ascendiant Capital Markets, LLC. See “Plan of Distribution.” |

| Under the terms of the “at the market offering” agreement, we also may sell Capital Securities to the sales agent, as principal for its own account, at a price per share to be agreed upon at the time of sale. If we sell Capital Securities to the sales agent, acting as principal, we will enter into a separate terms agreement with that sales agent, setting forth the terms of such transaction, and we will describe the terms agreement in a separate prospectus supplement or pricing supplement. |

| The proceeds from this offering, if any, will vary depending on the number of Capital Securities that we offer and the offering price per Capital Security. We may choose to raise less than the maximum $6,450,000 in gross offering proceeds permitted by this prospectus supplement. |

| Risk Factors | Before deciding to invest in the Capital Securities, you should read carefully the risks set forth under the heading “Supplemental Risk Factors” beginning on page S-5 of this prospectus supplement, and the risk factors set forth under the heading “Risk Factors” in the Prospectus and under the heading “Item 1A. Risk Factors” of our 2023 Annual Report as well as any subsequent Quarterly Reports on Form 10-Q or Current Reports on Form 8-K for certain considerations relevant to an investment in our securities. |

| NASDAQ Symbol | AIRTP |

| Transfer Agent and Registrar | Equiniti Trust Company, LLC |

| Form of Capital Securities | The Capital Securities will be represented by one or more global securities that will be deposited with, or on behalf of, and registered in the name of The Depository Trust Company (“DTC”) or its nominee. This means that you will not receive a certificate for your Capital Securities and the Capital Securities will not be registered in your name. Rather, your broker or other direct or indirect participant of DTC will maintain your position in the Capital Securities. |

SUPPLEMENTAL RISK FACTORS

Investing in the Capital Securities involves risks. In deciding whether to invest in the Capital Securities, you should carefully consider the following risk factors and the risk factors included in our Annual Report as well as any subsequent Quarterly Reports on Form 10-Q or Current Reports on Form 8-K in addition to the other information contained in this prospectus supplement and the accompanying prospectus and the information incorporated by reference herein and therein. The risks and uncertainties described below and in our other filings with the SEC are not the only ones we face. Additional risks and uncertainties that we are unaware of, or that we currently deem immaterial, also may become important factors that affect us. If any of these risks occur, our business, financial condition or results of operations could be materially and adversely affected. In that case, the value of the Capital Securities and your investment could decline. See “Forward-Looking Statements.”

Because the Trust will rely on the payments it receives on the Junior Subordinated Debentures to fund all payments on the Capital Securities, and because the Trust may distribute the Junior Subordinated Debentures in exchange for the Capital Securities, you are making an investment decision with regard to the Junior Subordinated Debentures as well as the Capital Securities. You should carefully review the information in this prospectus supplement and the accompanying prospectus about both of these securities and the Guarantee.

The ranking of Air T’s obligations under the Junior Subordinated Debentures and the Guarantee creates a risk that the Trust may not be able to pay amounts due to holders of the Capital Securities.

The ability of the Trust to pay amounts due to holders of the Capital Securities is solely dependent upon Air T making payments on the Junior Subordinated Debentures as and when required. All obligations of Air T under the Guarantee, the Junior Subordinated Debentures and other documents described herein are unsecured and rank subordinate and junior in right of payment to all current and future Senior and Subordinated Debt, the amount of which is unlimited. At June 30, 2023, the aggregate outstanding Senior and Subordinated Debt of Air T was approximately $96.4 million (which figure does not include the trust preferred debt of $25.6 million). None of the Indenture, the Guarantee or the Trust Agreement places any limitation on the amount of secured or unsecured debt, including Senior and Subordinated Debt, that may be incurred by Air T or its subsidiaries. Further, there is no limitation on Air T’s ability to issue additional Junior Subordinated Debentures in connection with any further offerings of Capital Securities, and such additional debentures would rank pari passu with the Junior Subordinated Debentures.

Air T has the option to extend the interest payment period; tax consequences of a deferral of interest payments.

So long as no Debenture Event of Default (as defined) has occurred and is continuing, at any time on or after, June 7, 2024, Air T has the right under the Indenture to defer the payment of interest on the Junior Subordinated Debentures at any time or from time to time for a period not exceeding 20 consecutive quarters with respect to each Extension Period, provided that no Extension Period may extend beyond the Stated Maturity of the Junior Subordinated Debentures. As a consequence of any such deferral, quarterly Distributions on the Capital Securities by the Trust will be deferred (and the amount of Distributions to which holders of the Capital Securities are entitled will accumulate additional amounts thereon at the rate of 8% per annum, compounded quarterly, from the relevant payment date for such Distributions, to the extent permitted by applicable law) during any such Extension Period. During any such Extension Period, Air T will be prohibited from making certain payments or distributions with respect to Air T’s capital stock (including dividends on or redemptions of common or preferred stock) and from making certain payments with respect to any debt securities of Air T that rank pari passu with or junior in interest to the Junior Subordinated Debentures; however, Air T will NOT be restricted from (a) paying dividends or distributions in common stock of Air T, (b) redeeming rights or taking certain other actions under a stockholders’ rights plan, (c) making payments under the Guarantee or (d) making purchases of common stock generally or related to the issuance of common stock or rights under any of Air T’s benefit plans for its directors, officers or employees. Further, during an Extension Period, Air T would have the ability to continue to make payments on Senior and Subordinated Debt. At June 30, 2023, the aggregate outstanding Senior and Subordinated Debt of Air T was approximately $96.4 million (which figure does not include the trust preferred debt of $25.6 million). Prior to the termination of any Extension Period, Air T may further extend such Extension Period provided that such extension does not cause such Extension Period to exceed 20 consecutive quarters or to extend beyond the Stated Maturity. Upon the termination of any Extension Period and the payment of all interest then accrued and unpaid (together with interest thereon at the annual rate of 8%, compounded quarterly, to the extent permitted by applicable law), Air T may elect to begin a new Extension Period subject to the above requirements. There is no limitation on the number of times that Air T may elect to begin an Extension Period.

Because Air T believes the likelihood of it exercising its option to defer payments of interest is remote, the Junior Subordinated Debentures will be treated as issued without “original issue discount” for United States federal income tax purposes. As a result, holders of Capital Securities will include interest in taxable income under their own methods of accounting (i.e., cash or accrual). Air T has no current intention of exercising its right to defer payments of interest by extending the interest payment period on the Junior Subordinated Debentures. However, should Air T elect to exercise its right to defer payments of interest in the future (which shall be possible at any time on or after, June 7, 2024), the market price of the Capital Securities is likely to be adversely affected. A holder that disposes of such holder’s Capital Securities during an Extension Period, therefore, might not receive the same return on such holder’s investment as a holder that continues to hold the Capital Securities.

Tax event redemption or investment company act redemption.

Upon the occurrence and during the continuation of a Tax Event or an Investment Company Event, Air T has the right to redeem the Junior Subordinated Debentures in whole (but not in part) at 100% of the principal amount together with accrued but unpaid interest to the date fixed for redemption within 90 days following the occurrence of such Tax Event or Investment Company Event and therefore cause a mandatory redemption of the Trust Securities.

A “Tax Event” means the receipt by Air T and the Trust of an opinion of counsel experienced in such matters to the effect that, as a result of any amendment to, or change (including any announced prospective change) in, the laws (or any regulations thereunder) of the United States or any political subdivision or taxing authority thereof or therein, or as a result of any official administrative pronouncement or judicial decision interpreting or applying such laws or regulations, which amendment or change is effective or such pronouncement or decision is announced on or after the original issuance of the Capital Securities, there is more than an insubstantial risk that (i) the Trust is, or will be within 90 days of the date of such opinion, subject to United States federal income tax with respect to income received or accrued on the Junior Subordinated Debentures, (ii) interest payable by Air T on the Junior Subordinated Debentures is not, or within 90 days of such opinion, will not be, deductible by Air T, in whole or in part, for United States federal income tax purposes, or (iii) the Trust is, or will be within 90 days of the date of the opinion, subject to more than a de minimis amount of other taxes, duties or other governmental charges.

An “Investment Company Event” means the receipt by Air T and the Trust of an opinion of counsel experienced in such matters to the effect that, as a result of any change in law or regulation or a change in interpretation or application of law or regulation by any legislative body, court, governmental agency or regulatory authority, the Trust is or will be considered an “investment company” that is required to be registered under the Investment Company Act, which change becomes effective on or after the original issuance of the Capital Securities.

Air T may cause the Junior Subordinated Debentures to be distributed to the holders of the Capital Securities.

Air T will have the right at any time to terminate the Trust and cause the Junior Subordinated Debentures to be distributed to the holders of the Capital Securities in liquidation of the Trust. Because holders of the Capital Securities may receive Junior Subordinated Debentures in liquidation of the Trust and because Distributions are otherwise limited to payments on the Junior Subordinated Debentures, prospective purchasers of the Capital Securities are also making an investment decision with regard to the Junior Subordinated Debentures and should carefully review all the information regarding the Junior Subordinated Debentures contained herein.

There are limitations on direct actions against Air T and on rights under the Guarantee.

Under the Guarantee, Air T guarantees the payment of Distributions by the Trust and payments on liquidation of or redemption of the Capital Securities (subordinate to the right to payment of Senior and Subordinated Debt of the Company) to the extent of funds held by the Trust. If the Trust has insufficient funds to pay Distributions on the Capital Securities (i.e., if Air T has failed to make required payments under the Junior Subordinated Debentures), a holder of the Capital Securities would have the right to institute a legal proceeding directly against Air T for enforcement of payment to such holder of the principal of or interest on such Junior Subordinated Debentures having a principal amount equal to the aggregate Liquidation Amount of the Capital Securities of such holder (a “Direct Action”). Except as described herein, holders of the Capital Securities will not be able to exercise directly any other remedy available to the holders of the Junior Subordinated Debentures or assert directly any other rights in respect of the Junior Subordinated Debentures.

Under the Guarantee, Delaware Trust Company is the indenture trustee (the “Guarantee Trustee”). The holders of not less than a majority in aggregate Liquidation Amount of the Capital Securities have the right to direct the time, method and place of conducting any proceeding for any remedy available to the Guarantee Trustee in respect of the Guarantee or to direct the exercise of any trust power conferred upon the Guarantee Trustee under the

Guarantee Agreement. Any holder of the Capital Securities may institute a legal proceeding directly against Air T to enforce its rights under the Guarantee without first instituting a legal proceeding against the Trust, the Guarantee Trustee or any other person or entity. The Trust Agreement provides that each holder of the Capital Securities by acceptance thereof agrees to the provisions of the Guarantee Agreement and the Indenture.

The covenants in the Indenture are limited.

The covenants in the Indenture are limited, and there are no covenants relating to Air T in the Trust Agreement. As a result, neither the Indenture nor the Trust Agreement protects holders of Junior Subordinated Debentures, or Capital Securities, respectively, in the event of a material adverse change in Air T’s financial condition or results of operations or limits the ability of Air T or any subsidiary to incur additional indebtedness. Therefore, the provisions of these governing instruments should not be considered a significant factor in evaluating whether Air T will be able to comply with its obligations under the Junior Subordinated Debentures or the Guarantee.

Holders of the Capital Securities will generally have limited voting rights.

Holders of the Capital Securities will generally have limited voting rights relating only to the modification of the Capital Securities and certain other matters. In the event that (i) there is a Debenture Event of Default (as defined herein) with respect to the Junior Subordinated Debentures, (ii) the Property Trustee fails to pay any distribution on the Capital Securities for 30 days (subject to deferral of distributions), (iii) the Property Trustee fails to pay the redemption price on the Capital Securities when due upon redemption, (iv) the Property Trustee fails to observe a covenant in the Trust Agreement for the Capital Securities for 60 days after receiving a Notice of Default, or (v) the Property Trustee is declared bankrupt or insolvent and not replaced by the Company within 60 days, the holders of a majority of the outstanding Capital Securities will be able to remove the Property Trustee and the Indenture Trustee (but not the Administrative Trustees who may only be removed by Air T as holder of the Common Securities).

The public market for the Capital Securities is limited; Market prices for the Capital Securities may fluctuate based on numerous factors and there is no assurance of an active and liquid trading market.

The Capital Securities are currently listed on the NASDAQ and trade under the symbol “AIRTP.” There can be no assurance that an active and liquid trading market for the Capital Securities will continue or that a continued listing of the Capital Securities will be available on NASDAQ. Future trading prices of the Capital Securities will depend on many factors including, among other things, prevailing interest rates, the operating results and financial condition of Air T, and the market for similar securities. There can be no assurance as to the market prices for the Capital Securities or the Junior Subordinated Debentures that may be distributed in exchange for the Capital Securities if Air T exercises its right to terminate the Trust. Accordingly, the Capital Securities that an investor may purchase, or the Junior Subordinated Debentures that a holder of the Capital Securities may receive in liquidation of the Trust, may trade at a discount from the price that the investor paid to purchase the Capital Securities offered hereby.

PLAN OF DISTRIBUTION

We have entered into an at the market offering agreement with Ascendiant Capital Markets, LLC, the sales agent, under which we may issue and sell over a period of time, and from time to time, Capital Securities having an aggregate offering price of up to $6,450,000 through the sales agent. This prospectus supplement relates to our ability to issue and sell over a period of time, and from time to time, up to $6,450,000 of our Capital Securities through the sales agent. Sales of the Capital Securities to which this prospectus supplement and the accompanying prospectus relate, if any, will be made by means of ordinary brokers’ transactions on NASDAQ, or otherwise at market prices prevailing at the time of sale or negotiated transactions, or as otherwise agreed with the sales agent. In the event that any sales are made pursuant to the at the market offering agreement which are not made directly on NASDAQ or on any other existing trading market for the Capital Securities at market prices at the time of sale, including, without limitation, any sales to the sales agent acting as principal or sales in negotiated transactions, we will file a prospectus supplement describing the terms of such transaction, the amount of shares sold, the price thereof, the applicable compensation, and such other information as may be required pursuant to Rule 424 and Rule 430B under the Securities Act, as applicable, within the time required by Rule 424 under the Securities Act. To the extent required by Regulation M, as our sales agent, the sales agent will not engage in any transactions that stabilize our Capital Securities while the offering is ongoing under this prospectus supplement.

Upon written instructions from us, the sales agent will offer the shares of Capital Securities, subject to the terms and conditions of the at the market offering agreement, on a daily basis or as otherwise agreed upon by us and the sales agent. We will designate the maximum amount of shares of Capital Securities to be sold through the sales

agent on a daily basis or otherwise determine such maximum amount together with the sales agent, subject to certain limitations set forth by the SEC. Subject to the terms and conditions of the at the market offering agreement, the sales agent will use its commercially reasonable efforts to sell on our behalf all of the shares of Capital Securities so designated or determined. We may instruct the sales agent not to sell shares of Capital Securities if the sales cannot be effected at or above the price designated by us in any such instruction. We or the sales agent may suspend the offering of shares of Capital Securities being made through the sales agent under the at the market offering agreement upon proper notice to the other party.

For its service as sales agent in connection with the sale of shares of our Capital Securities that may be offered hereby, we will pay the sales agent an aggregate fee of 3.0% of the gross sales price per share for any shares sold through it acting as our sales agent. The remaining sales proceeds, after deducting any expenses payable by us and any transaction fees imposed by any governmental, regulatory or self-regulatory organization in connection with the sales, will equal our net proceeds for the sale of such shares. We have agreed to reimburse the sales agent for certain of its expenses in an amount not to exceed $30,000 (excluding reimbursement to the sales agent of any periodic due diligence fees), subject to compliance with FINRA Rule 5110(f)(2)(D)(i).

The sales agent will provide written confirmation to us following the close of trading on NASDAQ on each day in which shares of Capital Securities are sold by it on our behalf under the at the market offering agreement. Each confirmation will include the number of shares sold on that day, the gross sales price per share, the compensation payable by us to the sales agent and the proceeds to us net of such compensation.

Settlement for sales of Capital Securities will occur, unless the parties agree otherwise, on the third business day following the date on which any sales were made in return for payment of the proceeds to us net of compensation paid by us to the sales agent. There is no arrangement for funds to be received in an escrow, trust or similar arrangement.

We will deliver to NASDAQ copies of this prospectus supplement and the accompanying prospectus pursuant to the rules of NASDAQ. Unless otherwise required, we will report at least quarterly the number of shares of Capital Securities sold through the sales agent under the at the market offering agreement, the net proceeds to us and the compensation paid by us to the sales agent in connection with the sales of Capital Securities.

In connection with the sale of Capital Securities on our behalf, the sales agent may be deemed to be an “underwriter” within the meaning of the Securities Act, and the compensation paid to the sales agent may be deemed to be underwriting commissions or discounts. We have agreed, under the at the market offering agreement, to provide indemnification and contribution to the sales agent against certain civil liabilities, including liabilities under the Securities Act.

In the ordinary course of their business, the sales agent and/or its affiliates may perform investment banking, broker-dealer, financial advisory or other services for us for which they may receive separate fees.

We estimate that the total expenses from this offering payable by us, excluding compensation payable to the sales agent under the at the market offering agreement, will be approximately $60,000.

The offering of Capital Securities pursuant to the at the market offering agreement will terminate upon the earlier of (1) the sale of $6,450,000 of shares of our Capital Securities subject to the at the market offering agreement, (2) March 19, 2024, and (3) the termination of the at the market offering agreement, pursuant to its terms, by either the sales agent or us.

VALIDITY OF SECURITIES

Certain legal matters in connection with the Capital Securities will be passed upon for us by Winthrop & Weinstine, P.A., Minneapolis, Minnesota. Certain legal matters relating to the securities will be passed upon for the sales agent by Clyde Snow & Sessions, PC, Salt Lake City, Utah.

EXPERTS

The consolidated financial statements incorporated by reference in this Prospectus Supplement, have been audited by Deloitte & Touche LLP, an independent registered public accounting firm, as stated in their report. Such financial statements have been so incorporated by reference in reliance upon the report of such firm given their authority as experts in accounting and auditing.

27015879v8

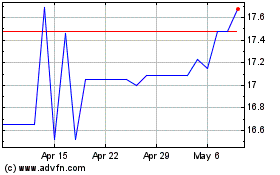

Air T (NASDAQ:AIRTP)

Historical Stock Chart

From Mar 2024 to Apr 2024

Air T (NASDAQ:AIRTP)

Historical Stock Chart

From Apr 2023 to Apr 2024