Form 8-K - Current report

06 September 2023 - 6:30AM

Edgar (US Regulatory)

0000353184false00003531842023-08-302023-09-050000353184us-gaap:CommonStockMember2023-08-302023-09-050000353184airt:CumulativeCapitalSecuritiesMember2023-08-302023-09-05

______________________________________________________________________________

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

______________________________________________________________________________

FORM 8-K

______________________________________________________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported): August 30, 2023

______________________________________________________________________________

AIR T, INC.

(Exact Name of Registrant as Specified in Charter)

______________________________________________________________________________

| | | | | | | | | | | | | | |

| Delaware | | 001-35476 | | 52-1206400 |

(State or Other Jurisdiction of Incorporation) | | (Commission File Number) | | (I.R.S. Employer Identification No.) |

11020 David Taylor Drive, Suite 350,

Charlotte, North Carolina 28262

(Address of Principal Executive Offices, and Zip Code)

________________(980) 595-2840__________________

Registrant’s Telephone Number, Including Area Code

Not applicable___

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | |

| ☐ | Written communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communication pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communication pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock | AIRT | NASDAQ Global Market |

| Alpha Income Preferred Securities (also referred to as 8% Cumulative Capital Securities) (“AIP”) | AIRTP | NASDAQ Global Market |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | |

| Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2). |

| ☐ | Emerging growth company |

| ☐ | If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. |

Item 1.01 Entry into a Material Definitive Agreement.

Amendment Of Old National Bank Revolver

On August 30, 2023, Contrail Aviation Support, LLC (“CAS”) a 79%-owned subsidiary of Air T, Inc., entered into the Sixth Amendment to Supplement #2 to Master Loan Agreement and the Fifth Amended and Restated Promissory Note with Old National Bank (“ONB”). The principal purpose of the amended documents was to extended the maturity date of the revolving $25,000,000 facility provided by ONB to November 24, 2025 or such earlier date on which the revolving note becomes due and payable pursuant to the supplement or the master loan agreement. The material terms of the revolving facility remain the same, including the payment terms and interest rate except that the change in control event of default provision was revised to provide as follows: “(h) Control in Control of Operations. If the CEO Joe Kuhn, or a CEO acceptable to the Lender, in its reasonable discretion, has its employment with the Borrowers terminated for any reason, or ceases to oversee the day-to-day operations of Borrowers.” The amended documents are effective September 5, 2023.

The foregoing summary of the terms of the amended agreement and promissory note are qualified in their entirety by reference to the amendment and amended and restated promissory note filed as Exhibits 10.1 and 10.2 herewith, which are incorporated herein by reference.

Item 2.03 Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

To the extent required by Item 2.03 of Form 8-K, the information contained in Item 1.01 of this Current Report on Form 8-K is incorporated by reference into this Item 2.03.

Item 9.01 Financial Statements and Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Company has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: September 5, 2023

AIR T, INC.

By: /s/ Brian Ochocki

Brian Ochocki, Chief Financial Officer

Contrail Aviation Support, LLC Loan No. 20007260597 September 5, 2023 Note FIFTH AMENDED AND RESTATED PROMISSORY NOTE REVOLVING NOTE $25,000,000.00 Effective Date: September 5, 2023 THIS FIFTH AMENDED AND RESTATED PROMISSORY NOTE REVOLVING NOTE (this “Note”) amends and restates the Promissory Note dated March 2, 2018 in the original principal amount of Twenty Million Dollars ($20,000,000.00) as amended and restated by the First Amended and Restated Promissory Note Revolving Note dated June 24, 2019 in the original principal amount of Twenty Million Dollars ($20,000,000.00), as further amended and restated by the Second Amended and Restated Promissory Note Revolving Note dated January 24, 2020 in the original principal amount of Forty Million Dollars ($40,000,000.00), as further amended and restated by the Third Amended and Restated Promissory Note Revolving Note dated September 2, 2021 in the original principal amount of Twenty Five Million Dollars ($25,000.000.00), and as further amended and restated by the Fourth Amended and Restated Promissory Note Revolving Note dated May 26, 2023 in the original principal amount of Twenty Five Million Dollars ($25,000,000.00) (collectively, the “Original Note”) executed by CONTRAIL AVIATION SUPPORT, LLC (“Borrower”) in favor of OLD NATIONAL BANK (the “Lender,” and together with Borrower, collectively the “Parties”). Borrower and Lender desire to amend and restate the Original Note in its entirety as follows: FOR VALUE RECEIVED, on or before the Revolving Note Maturity Date (as defined in the Master Loan Agreement referred to below), Borrower promises to pay to the order of Lender, or its assignee, the principal sum of Twenty-Five Million Dollars ($25,000,000.00), or such lesser amount as is shown to be outstanding according to the records of Lender, together with interest on the principal balance outstanding from time to time at such rates and payable at such times as set forth below. 1, RATE OF INTEREST The principal amount of the Loan outstanding from time to time shall bear interest at the variable rate of 1-MONTH SOFR Rate (as defined in the Master Loan Agreement referenced below) plus 3.56448% per annum and such rate shall be adjusted on the 1st day of each month. 2. PAYMENTS Payments of both principal and interest are to be made in immediately available funds in lawful currency of the United States of America at the office of Lender, or such other place as the holder hereof shall designate to the undersigned in writing. Unless required by applicable law, and prior to any default being declared, payments will be applied first to any accrued unpaid interest; then to principal; then to escrow; then to any late charges; and then to any unpaid collection costs. Funds shall be deemed received by Lender on the next business day if not received by 12:00 p.m. local time at the location payments hereunder are to be made.

Borrower shall make the following payments during the following periods: (a) Monthly Payments. Monthly payments of accrued unpaid interest only on the Revolving Loans due in arrears on the 1 day of each month, commencing on October 1, 2023, together with a final payment of the outstanding principal balance together with all accrued but unpaid interest together with such other amounts as shall then be due and owing from Borrower to Lender under the Revolving Loans due on the Revolving Note Maturity Date; (b) Revolving Loan Resting Period. Borrower shall cause the total outstanding principal balance of all Revolving Loans to be zero (0) for at least thirty (30) consecutive days during the term of the Revolving Loans, or if the term of the Revolving Loans exceeds one (1) year, during each annual period ending on the anniversary of the date of the Revolving Loans (the “Resting Period”). Notwithstanding the foregoing, Borrower shall have no obligation to cause a Resting Period if at the time such Resting Period would be required the Borrower has achieved a Debt Service Coverage Ratio of 1.10:1. For purposes of this section only, Debt Service Coverage Ratio shall mean a ratio, the numerator of which shall be EBITDA for the 12-month period then ended and the denominator being Debt Service. FINAL PAYMENT MATURITY DATE Notwithstanding anything set forth above, all sums due under this Note, both principal and interest, if not sooner paid, shall be due and payable on November 24, 2025 (“Revolving Note Maturity Date”). PREPAYMENTS; MINIMUM FINANCE CHARGE Borrower agrees that all loan fees and other prepaid finance charges are earned fully as of the date of the Revolving Loan and will not be subject to refund upon early payment (whether voluntary or as a result of default), except as otherwise required by law. In any event, even upon full prepayment of this Note, Borrower understands that Lender is entitled to a minimum finance charge of $95.00. Other than Borrower’s obligation to pay any minimum finance charge, Borrower may pay without penalty all or a portion of the amount owed earlier than it is due. Early payments will not, unless agreed to by Lender in writing, relieve Borrower of Borrower’s obligation to continue to make payments under the payment schedule. Rather, early payments will reduce the principal balance due and may result in Borrower making fewer payments. Borrower agrees not to send Lender payments marked “paid in full,” “without recourse,” or similar language. If Borrower sends such a payment, Lender may accept it without losing any of Lender’s rights under this Note, and Borrower will remain obligated to pay any further amounted owed to Lender. All written communications concerning disputed amounts, including any check or other payment instrument that indicates that the payment constitutes “payment in full” of the amount owed or that is tendered with other conditions or limitations or as full satisfaction of a disputed amount must be mailed or delivered to: Old National Bank, PO Box 3728, Evansville, IN 47736-3728.

PAYMENT DUE DATE/FAILURE TO PAY (a) All payments due under this Note shall be made without demand and received on the dates set forth in Section 2 above; (b) In the event of a default as defined in this Note, or as set forth in the Master Loan Agreement or any Collateral Documents or Guaranties, at the option of Lender, for so long as the default exists, interest on the outstanding principal balance hereof shall accrue and will be paid at the rate in effect from time to time hereunder plus an additional 3% per annum, but in no event shall such default rate exceed, however, the maximum rate permitted by law (“Default Interest Rate”); and (c) Any installment of principal and/or interest due hereunder which is not received on or before the 10th day following the date on which it is due shall be subject to a late payment fee of 5% of the amount owed on such installment (but not less than $50.00) for the purpose of defraying the expense incident to handling such delinquent payment (this payment is in addition to the amount set forth in (b) above). INTEREST RATE COMPUTATION Interest on this Note is computed on a 365/360 basis; that is, by applying the ratio of the interest rate over a year of 360 days, multiplied by the outstanding principal balance, multiplied by the actual number of days the principal balance is outstanding. All interest payable under this Note is computed using this method. PLACE OF PAYMENT All payments shall be made to Lender at the address on the interest billing statement provided by Lender or at the address of Lender set forth in Section 13 of this Note, at any branch of Lender, or such other place as Lender may from time to time designate in writing. MASTER LOAN AGREEMENT This Note evidences indebtedness incurred under; is the “Revolving Note” referred to in; and is subject to the terms and provisions of the Master Loan Agreement by and between Borrower, Contrail Aviation Leasing, LLC and Lender of even date herewith (as amended, restated, supplemented or otherwise modified from time to time, including, but not limited to, by Supplements thereto, the “Master Loan Agreement”). Capitalized terms not otherwise defined herein shall have the meaning ascribed to them in the Master Loan Agreement. This Note is secured by the Collateral Documents. The terms of the Collateral Documents are incorporated herein and made a part hereof by reference.

10. 11. DEFAULT In the event of the occurrence of an Event of Default under the Master Loan Agreement, and after giving effect to any applicable right to cure provided by the Master Loan Agreement, Lender may, at its option and without notice, declare this Promissory Note to be, and this Promissory Note shall thereupon become, immediately due and payable, together with accrued interest thereon. Without limiting the foregoing right and without limiting any other rights and remedies of the Lender at law or in equity, the Lender is also entitled to the rights and remedies provided for in the Master Loan Agreement and the Collateral Documents and may enforce the covenants, agreements and undertakings of Borrower contained therein and may exercise the remedies provided for thereby or otherwise available in respect thereto, all in accordance with the terms thereof. In addition to any other right, Lender may apply and/or set-off against amounts due it hereunder any deposits, account balances, or other credits of any Borrower in the possession of or in transit to Lender, and Borrower hereby grants Lender a security interest in all of the foregoing. WAIVERS Except as herein provided, Borrower and all others who may become liable for all or part of the principal balance hereof or for any obligations of Borrower to Lender or the holder hereof (a) forever waive presentment, protest and demand, notice of protest, demand and dishonor and non-payment of this Note, and all other notices in connection with the delivery, acceptance, performance, default or enforcement of the payment of this Note, (b) agree that the time of payment of the debt or any part thereof may be extended from time to time without modifying or releasing the lien of the Collateral Documents or the liability of Borrower or any other such parties, the right of recourse against Borrower and such parties being hereby reserved by Lender; and (c) agree that time is of the essence. Borrower agrees to pay all reasonable costs of collection when incurred, whether suit be brought or not, including reasonable attorneys’ fees and costs of suit and preparation therefore, and to perform and comply with each of the covenants, conditions, provisions and agreements of Borrower contained in this Note, the Master Loan Agreement and Collateral Documents. It is expressly agreed by Borrower that no extensions of time for the payment of this Note, nor the failure on the part of Lender to exercise any of its rights hereunder, shall operate to release, discharge, modify, change or affect the original liability under this Note, the Master Loan Agreement or any of the Collateral Documents, either in whole or in part. WAIVER OF JURY TRIAL BORROWER HEREBY WAIVES ANY AND ALL RIGHT TO TRIAL BY JURY IN ANY ACTION OR PROCEEDING RELATING TO THIS INSTRUMENT AND TO ANY OF THE LOAN DOCUMENTS, THE OBLIGATIONS HEREUNDER OR THEREUNDER, ANY COLLATERAL SECURING THE OBLIGATIONS, OR ANY TRANSACTION ARISING THEREFROM OR CONNECTED THERETO. BORROWER REPRESENTS THAT THIS WAIVER IS KNOWINGLY, WILLINGLY AND VOLUNTARILY GIVEN.

12. 13. COMPLIANCE This Note is to be governed by, and construed and enforced in accordance with, the laws of the State of Wisconsin (without giving effect to Wisconsin’s principles of conflicts of law), except to the extent (a) of procedural and substantive matters relating only to the creation, perfection, foreclosure and enforcement of rights and remedies against specific collateral, which matters shall be governed by the laws of the state in which the collateral is located (the “Collateral State”), and (b) that the laws of the United States of America and any rules regulations, or orders issued or promulgated thereunder, applicable to the affairs and transactions entered into by the Lender, otherwise preempt Collateral State law or Wisconsin law; in which event such federal law shall control. Borrower hereby irrevocably submits to the jurisdiction of any Wisconsin or federal court sitting in Milwaukee, Wisconsin (or, with respect to the matters set forth in subsection (a) above, any state in which the property encumbered by the Collateral Documents is located) over any suit, action or proceeding arising out of or relating to this Note or any of the Loan Documents. Borrower hereby waives any right to object to the location of venue in any Wisconsin or federal court sitting in Milwaukee, Wisconsin, or, with respect to the matters set forth in subsection (a) above, to the appropriate court located in the Collateral State, concerning any suit, action or proceeding arising out of or relating to this Note or any of the Loan Documents and waives any objection which it may have at any time to the laying of venue in any proceedings brought in any such court, waives any claim that such proceedings have been brought in an inconvenient forum and further waives the right to object, with respect to such proceedings, that such court does not have jurisdiction over such party to object to the choice of governing law set forth in this section. Borrower acknowledges that the loan evidenced by this Note was solicited, negotiated, closed and funded in the State of Wisconsin, and waives any implication that the laws of any other state shall apply for usury purposes. NOTICES All notices, requests and demands to be made hereunder to the parties hereto must be in writing and must be delivered to the applicable address stated below by any of the following means: (a) personal service; (b) electronic communication, including, but not limited to, electronic mail, telex, telegram or telecopying (and if by telex, telegram or telecopying, then only if confirmed in writing sent by registered or certified, first class mail, return receipt requested); or (c) registered or certified, first class mail, return receipt requested. Such addresses may be changed by notice to the other parties given in the same manner as provided above. Any notice, demand or request sent pursuant to either subsection (a) or (b) hereof will be deemed received upon such personal service or upon dispatch by electronic means, and, if sent pursuant to subsection (c) will be deemed received three (3) days following deposit in the mail. Borrower: CONTRAIL AVIATION SUPPORT, LLC 435 Investment Court Verona, WI 53593-8788

14. 15. 16. Lender: OLD NATIONAL BANK 23 W. Main St. Madison, WI 53703 INTEREST NOT TO EXCEED MAXIMUM ALLOWED BY LAW. If from any circumstances whatsoever, by reason of acceleration or otherwise, the fulfillment of any provision of this Note involves transcending the limit of validity prescribed by any applicable usury statute or any other applicable law, with regard to obligations of like character and amount, then the obligations to be fulfilled will be reduced to the limit of such validity as provided in such statute or law, so that in no event shall any exaction be possible under this Note in excess of the limit of such validity. SUCCESSORS All rights, powers, privileges and immunities herein granted to Lender shall extend to its successors and assigns and any other legal holder of this Note, with full right by Lender to assign and/or sell same. NOT A NOVATION; AMENDMENT AND RESTATEMENT This Note is an amendment and restatement of the Original Note. It is not intended, and shall not be deemed or construed as a novation of the Original Note and the validity, priority and enforceability of the Original Note shall not be impaired hereby. [remainder of page intentionally left blank; signature page follows]

The undersigned agrees to pay all costs of collection, including reasonable attorneys’ fees. IN WITNESS WHEREOF, the Parties have executed this Note intending it to be effective as of the Effective Date. BORROWER: LENDER: CONTRAIL AVIATION SUPPORT, LLC OLD NATIONAL BANK By: By: Joseph Kuhn Tommy Olson Its: CEO Its: SVP [Signature Page to Fifth Amended and Restated Promissory Note Revolving Note]

The undersigned agrees to pay all costs of collection, including reasonable attorneys’ fees. IN WITNESS WHEREOF, the Parties have executed this Note intending it to be effective as of the Effective Date. BORROWER: LENDER: CONTRAIL AVIATION SUPPORT, LLC OLD NATIONAL BANK By: By: vorimy O07 Joseph Kuhn Tommy Olson Its: CEO Its: SVP [Signature Page to Fifth Amended and Restated Promissory Note Revolving Note]

SIXTH AMENDMENT TO SUPPLEMENT #2 TO MASTER LOAN AGREEMENT THIS SIXTH AMENDMENT TO SUPPLEMENT #2 TO MASTER LOAN AGREEMENT (this “Sixth Amendment”) is made effective as of September 5, 2023, by and between CONTRAIL AVIATION SUPPORT, LLC (“CAS”) and OLD NATIONAL BANK (the “Lender, and together with CAS, collectively the “Parties”) and amends that certain Supplement #2 to Master Loan Agreement, as previously amended by that First Amendment to Supplement #2 to Master Loan Agreement, with an effective date of June 24, 2019, that Second Amendment to Supplement #2 to Master Loan Agreement, with an effective date of January 24, 2020, that Third Amendment to Supplement #2 to Master Loan Agreement with an effective date of September 25, 2020, that Fourth Amendment to Supplement #2 to Master Loan Agreement with an effective date of September 2, 2021 and that Fifth Amendment to Supplement #2 to Master Loan Agreement with an effective date of May 26, 2023 (collectively, the “Supplement”), by and among CAS and Lender. RECITALS The Parties, along with Contrail Aviation Leasing, LLC (“CAL”), are parties to a Master Loan Agreement dated June 24, 2019 (the “Master Loan Agreement”). The Parties are parties to the Supplement. The Supplement is a Supplement to and under the Master Loan Agreement. The Parties desire to further amend the Supplement as provided below. AGREEMENT In consideration of the recital, the promises and agreements set forth in the Supplement, as amended hereby, and for other good and valuable consideration, the receipt and sufficiency of which is hereby acknowledged, the Parties agree as follows: 1. DEFINITIONS AND REFERENCES. Capitalized terms not otherwise defined herein have the meanings assigned in the Supplement and the Master Loan Agreement. All references to the Supplement contained in the Master Loan Agreement, Collateral Documents and the other Loan Documents shall mean the Supplement as amended by this Sixth Amendment. 2. AMENDMENT TO EXTEND REVOLVING NOTE MATURITY DATE. Section 1 of the Supplement is hereby amended by deleting the existing definition of “Revolving Note Maturity Date” in its entirety and replacing it with the following: “Revolving Note Maturity Date” means November 24, 2025, or such earlier date on which the Revolving Note becomes due and payable pursuant to this Supplement or the Master Loan Agreement.

AMENDMENT TO EVENTS OF DEFAULT; REMEDIES Section 8 is hereby amended by deleting Section 8.1(h) in its entirety and replacing it with the following: (h) Change in Control of Operations. If the CEO Joe Kuhn, or a CEO acceptable to the Lender, in its reasonable discretion, has its employment with the Borrowers terminated for any reason, or ceases to oversee the day-to-day operations of Borrowers. EFFECTIVENESS OF THIS SIXTH AMENDMENT. This Sixth Amendment shall become effective only upon completion of the following: (a) execution and delivery by the Parties of both this Sixth Amendment and the Fifth Amended and Restated Promissory Note Revolving Note in a form identical to that attached hereto as Exhibit A; and (b) payment by CAS to Lender of a renewal fee in the amount of $50,000.00. Upon execution and delivery of the Fifth Amended and Restated Promissory Note Revolving Note, such note shall constitute the Revolving Note defined in the Supplement and Exhibit A hereto shall replace and constitute Exhibit B to the Supplement. NO WAIVER. Nothing contained herein shall be construed as a waiver by Lender of: (a) any of its rights and remedies under the Supplement, Master Loan Agreement, the Loan Documents, at law or in equity; or (b) CAS’s continued compliance with each representation, warranty, covenant and provision of the Supplement, the Master Loan Agreement and the other Loan Documents. CAS acknowledges and agrees that no waiver of any provision of the Master Loan Agreement or the other Loan Documents by Lender has occurred and that nothing contained herein shall impair the right of Lender to require strict performance by CAS of the Supplement, the Master Loan Agreement and the other Loan Documents. Further, CAS acknowledges and agrees that no delay by Lender in exercising any right, power or privilege under the Supplement, the Master Loan Agreement or any other Loan Document shall operate as a waiver thereof, and no single or partial exercise of any right, power or privilege thereunder shall preclude other or further exercise thereof or the exercise of any other right, power or privilege. REPRESENTATIONS AND WARRANTIES. CAS represents and warrants to Lender that: (a) The execution and delivery of this Sixth Amendment is within its power and authority, has been duly authorized by all proper action on the part of CAS, is not in violation of any existing law, rule or regulation of any governmental agency or authority, any order or decision of any court, the organizational documents of CAS or the terms of any agreement, restriction or undertaking to which CAS is a party or by which it is bound, and do not require the approval or consent of any

(b) (c) governmental body, agency or authority or any other person or entity other than those consents and approvals in full force and effect. This Sixth Amendment has been duly executed and delivered by CAS and constitutes a legal, valid and binding obligation of CAS, enforceable in accordance with its terms, subject to applicable bankruptcy, insolvency, reorganization, moratorium or other laws affecting creditors’ rights generally and subject to general principles of equity, regardless of whether considered in a proceeding in equity or at law. The representations and warranties contained in the Master Loan Agreement are correct and complete as of the date of this Sixth Amendment (except to the extent such representation or warranty relates to a stated earlier date in which case it shall continue to be true and correct as of such date), and no condition or event exists or act has occurred that, with or without the giving of notice or the passage of time, would constitute a Default or an Event of Default under the Master Loan Agreement. MISCELLANEOUS. (a) (b) (c) (d) (e) Expenses and Fees. CAS agrees to pay on demand all reasonable out-of-pocket costs and expenses paid or incurred by Lender in connection with the negotiation, preparation, execution and delivery of this Sixth Amendment, and all amendments, forms, certificates agreements, documents and instruments related hereto and thereto, including the reasonable fees and expenses of Lender’s outside counsel. Amendments and Waivers. This Sixth Amendment may not be changed or amended orally, and no waiver hereunder may be oral, but any change or amendment hereto or any waiver hereunder must be in writing and signed by the party or parties against whom such change, amendment or waiver is sought to be enforced. Headings. The headings in this Sixth Amendment are intended solely for convenience of reference and shall be given no effect in the construction or interpretation of this Sixth Amendment. Affirmation. Each Party hereto affirms and acknowledges that the Supplement as amended by this Sixth Amendment remains in full force and effect in accordance with its terms, as amended hereby. Counterparts. This Sixth Amendment may be executed in one or more counterparts, each of which shall constitute an original, but all of which when taken together shall constitute but one and the same instrument. Delivery of an executed counterpart hereto by facsimile or by electronic transmission of a portable document file (PDF or similar file) shall be as effective as delivery of a manually executed counterpart signature page hereto. [remainder of page intentionally left blank; signature page follows]

IN WITNESS WHEREOF, the Parties have executed this Sixth Amendment intending it to be effective as of the day and year first above written. BORROWER: LENDER: CONTRAIL AVIATION SUPPORT, LLC OLD NATIONAL BANK By: San | Viz BY: Joseph Kuhn Tommy Olson Its: CEO Its: SVP [Signature Page to Sixth Amendment to Supplement#2]

IN WITNESS WHEREOF, the Parties have executed this Sixth Amendment intending it to be effective as of the day and year first above written. BORROWER: LENDER: CONTRAIL AVIATION SUPPORT, LLC OLD NATIONAL BANK By: By: Pony Often Joseph Kuhn Tommy Olson Its: CEO Its: SVP {Signature Page to Sixth Amendment to Supplement#2]

EXHIBIT A TO SIXTH AMENDMENT TO SUPPLEMENT #2 (see attached)

v3.23.2

Cover

|

Sep. 05, 2023 |

| Entity Information |

|

| Document Type |

8-K

|

| Document Period End Date |

Sep. 05, 2023

|

| Entity Registrant Name |

AIR T, INC.

|

| Entity Incorporation, State |

DE

|

| Entity File Number |

001-35476

|

| Entity Tax Identification Number |

52-1206400

|

| Entity Address, Street |

11020 David Taylor Drive, Suite 350,

|

| Entity Address, City |

Charlotte

|

| Entity Address, State |

NC

|

| Entity Address, Postal Zip Code |

28262

|

| City Area Code |

980

|

| Local Phone Number |

595-2840

|

| Written Communications |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0000353184

|

| Amendment Flag |

false

|

| Amendment Description |

|

| Document Effective Date |

Aug. 30, 2023

|

| Soliciting Material |

false

|

| Common Stock |

|

| Entity Information |

|

| Title of 12(b) Security |

Common Stock

|

| Trading Symbol |

AIRT

|

| Security Exchange Name |

NASDAQ

|

| Cumulative Capital Securities |

|

| Entity Information |

|

| Title of 12(b) Security |

Alpha Income Preferred Securities (also referred to as 8% Cumulative Capital Securities) (“AIP”)

|

| Trading Symbol |

AIRTP

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionDescription of changes contained within amended document.

| Name: |

dei_AmendmentDescription |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe date when a document, upon receipt and acceptance, becomes officially effective, in YYYY-MM-DD format. Usually it is a system-assigned date time value, but it may be declared by the submitter in some cases.

| Name: |

dei_DocumentEffectiveDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=airt_CumulativeCapitalSecuritiesMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

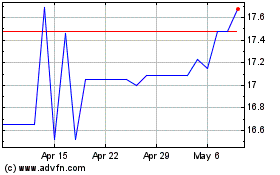

Air T (NASDAQ:AIRTP)

Historical Stock Chart

From Mar 2024 to Apr 2024

Air T (NASDAQ:AIRTP)

Historical Stock Chart

From Apr 2023 to Apr 2024