Filed Pursuant to Rule 424(b)(3)

Registration No. 333-272736

Prospectus

AVALON GLOBOCARE CORP.

Up to $3,500,000

Common Stock

We have entered into a sales

agreement with Roth Capital Partners, LLC (which we refer to herein as Roth Capital Partners or, the sales agent) relating to the issuance

and sale of our common stock offered by this prospectus. In accordance with the terms of the sales agreement, we may offer and sell shares

of our comment stock under this prospectus having an aggregate offering price of up to $3,500,000 from time to time through or to Roth

Capital Partners, as sales agent or principal.

Our common stock is traded

on the Nasdaq Capital Market, or NASDAQ, under the symbol “ALBT.” On June 27, 2023, the closing sale price of our common stock

on NASDAQ was $1.48 per share. The aggregate market value of our outstanding common stock held by non-affiliates is $10,580,091 based

on 10,239,307 shares of outstanding common stock, of which 4,640,391 shares are held by non-affiliates, and a per share price of $2.28,

which was the closing sale price of our common stock as quoted on the Nasdaq Capital Market on June 6, 2023. Pursuant to General Instruction

I.B.6 of Form S-3, in no event will we sell shares pursuant to this prospectus with a value of more than one-third of the aggregate market

value of our common stock held by non-affiliates in any 12-month period, so long as the aggregate market value of our common stock held

by non-affiliates is less than $75,000,000. During the 12 calendar months prior to, and including, the date of this prospectus, we have

not sold any securities pursuant to General Instruction I.B.6 of Form S-3.

Sales of shares of our common

stock under this prospectus, if any, may be made by any method deemed to be an “at the market offering” as defined in Rule

415 under the Securities Act of 1933, as amended, or the Securities Act.

The sales agent is not required

to sell any specific number of shares of our common stock. The sales agent has agreed to use its commercially reasonable efforts consistent

with its normal trading and sales practices, on mutually agreed terms between the sales agent and us. There is no arrangement for funds

to be received in any escrow, trust or similar arrangement. The sales agent will be entitled to compensation under the terms of the sales

agreement at a commission rate equal to 3.0% of the gross proceeds of the sales price of common stock that they sell. The net proceeds

from any sales under this prospectus will be used as described under “Use of Proceeds.” The proceeds we receive from sales

of our common stock, if any, will depend on the number of shares actually sold and the offering price of such shares.

In connection with the sale

of common stock on our behalf, Roth Capital Partners will be deemed to be an underwriter within the meaning of the Securities Act, and

its compensation as the sales agent will be deemed to be underwriting commissions or discounts. We have agreed to provide indemnification

and contribution to Roth Capital Partners with respect to certain liabilities, including liabilities under the Securities Act.

Investing in our

securities is highly speculative and involves a high degree of risk. You should read carefully and consider the information

contained in and incorporated by reference under “Risk Factors” beginning on page 4 of this prospectus, and the

risk factors contained in other documents incorporated by reference.

Neither the Securities

and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus

is truthful or complete. Any representation to the contrary is a criminal offense.

Roth Capital Partners

The date of this prospectus is June 28, 2023

TABLE OF CONTENTS

You should rely only on

the information we have provided or incorporated by reference in this prospectus or in any prospectus supplement. We have not authorized

anyone to provide you with information different from that contained or incorporated by reference in this prospectus or in any prospectus

supplement.

This prospectus and any

prospectus supplement is an offer to sell only the securities offered hereby, but only under circumstances and in jurisdictions where

it is lawful to do so.

You should assume that

the information contained in this prospectus and in any prospectus supplement is accurate only as of their respective dates and that any

information we have incorporated by reference is accurate only as of the date of the document incorporated by reference, regardless of

the time of delivery of this prospectus or any prospective supplement for any sale of securities.

ABOUT THIS PROSPECTUS

This prospectus is part of

a registration statement that we filed with the Securities and Exchange Commission, or SEC, utilizing a shelf registration process. Under

the shelf registration process, we may offer shares of our common stock having an aggregate offering price of up to $3,500,000 from time

to time under this prospectus at prices and on terms to be determined by market conditions at the time of offering.

This prospectus describes

the specific terms of the common stock we are offering and also adds to, and updates information contained in the documents incorporated

by reference into this prospectus. To the extent there is a conflict between the information contained in this prospectus, on the one

hand, and the information contained in any document incorporated by reference into this prospectus that was filed with the SEC before

the date of this prospectus, on the other hand, you should rely on the information in this prospectus. If any statement in one of these

documents is inconsistent with a statement in another document having a later date —for example, a document incorporated by reference

into this prospectus — the statement in the document having the later date modifies or supersedes the earlier statement.

You should rely only on the

information contained in, or incorporated by reference into this prospectus and in any free writing prospectus that we may authorize for

use in connection with this offering. We have not, and Roth Capital Partners has not, authorized any other person to provide you with

different information. If anyone provides you with different or inconsistent information, you should not rely on it. We are not, and Roth

Capital Partners is not, making an offer to sell or soliciting an offer to buy our securities in any jurisdiction in which an offer or

solicitation is not authorized or in which the person making that offer or solicitation is not qualified to do so or to anyone to whom

it is unlawful to make an offer or solicitation. You should assume that the information appearing in this prospectus, the documents incorporated

by reference into this prospectus, and in any free writing prospectus that we may authorize for use in connection with this offering,

is accurate only as of the date of those respective documents. Our business, financial condition, results of operations and prospects

may have changed since those dates. You should read this prospectus, the documents incorporated by reference into this prospectus, and

any free writing prospectus that we may authorize for use in connection with this offering, in their entirety before making an investment

decision. You should also read and consider the information in the documents to which we have referred you in the sections of this prospectus

entitled “Where You Can Find More Information” and “Incorporation by Reference.”

We are offering to sell, and

seeking offers to buy, shares of common stock only in jurisdictions where offers and sales are permitted. The distribution of this prospectus

and the offering of the common stock in certain jurisdictions may be restricted by law. Persons outside the United States who come into

possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of the common stock

and the distribution of this prospectus outside the United States. This prospectus does not constitute, and may not be used in connection

with, an offer to sell, or a solicitation of an offer to buy, any securities offered by this prospectus by any person in any jurisdiction

in which it is unlawful for such person to make such an offer or solicitation.

We further note that the representations,

warranties and covenants made by us in any agreement that is filed as an exhibit to any document that is incorporated by reference into

the prospectus and accompanying prospectus were made solely for the benefit of the parties to such agreement, including, in some cases,

for the purpose of allocating risk among the parties to such agreement, and should not be deemed to be a representation, warranty or covenant

to you. Moreover, such representations, warranties or covenants were accurate only as of the date when made. Accordingly, such representations,

warranties and covenants should not be relied on as accurately representing the current state of our affairs.

Unless otherwise stated, all

references to “us,” “our,” “Avalon,” “we,” the “Company” and similar designations

refer to Avalon GloboCare Corp. and its subsidiaries. Our logo, trademarks and service marks are the property of Avalon GloboCare Corp.

and its consolidated subsidiaries. Other trademarks or service marks appearing in this prospectus are the property of their respective

holders.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus and the documents

incorporated by reference herein contains forward-looking statements that reflect our current expectations and views of future events.

The forward-looking statements are contained principally in the sections included or incorporated by reference herein entitled “Risk

Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” Readers

are cautioned that known and unknown risks, uncertainties and other factors, including those over which we may have no control and others

listed in the “Risk Factors” section of this prospectus, may cause our actual results, performance or achievements to be materially

different from those expressed or implied by the forward-looking statements.

You can identify some of these

forward-looking statements by words or phrases such as “may,” “will,” “expect,” “anticipate,”

“aim,” “estimate,” “intend,” “plan,” “believe,” “is/are likely to,”

“potential,” “continue” or other similar expressions. We have based these forward-looking statements largely on

our current expectations and projections about future events that we believe may affect our financial condition, results of operations,

business strategy and financial needs. These forward-looking statements include statements relating to:

| ● | our

ability to successfully complete research and further development; |

| ● | our

ability to negotiate strategic partnerships, where appropriate, for our services, products and product candidates; |

| ● | our

ability to commercialize our services, products and product candidates and the growth of the markets for those product candidates; |

| ● | our

ability to develop and commercialize services and products before competitors that are superior to the alternatives developed by such

competitors; |

| ● | our

ability to develop technological capabilities, including identification of novel and clinically important targets, exploiting our existing

technology platforms to develop new services and product candidates; |

| ● | our

ability to raise sufficient capital to fund our programs, on terms acceptable to us, or at all. If we are unable to raise the funds necessary

to meet our long-term liquidity needs, we may have to delay or discontinue the development of one or more programs, raise funds at significant

discount or on other unfavorable terms, if at all, or sell all or part of our business; |

| ● | our

ability to protect our intellectual property rights and our ability to avoid intellectual property litigation, which can be costly and

divert management time and attention; |

| ● | our

ability to develop and commercialize products without infringing the intellectual property rights of third parties; |

| ● | heightened

competition from commercial clinical testing companies, IDNs, physicians and others; |

| ● | increased

pricing pressure from customers, including payers and patients, and changing relationships with customers, payers, suppliers or strategic

partners; |

| ● | impact

of changes in payment mix, including increased patient financial responsibility and any shift from fee-for-service to discounted, capitated

or bundled fee arrangements; |

| ● | adverse

actions by government, including healthcare reform that focuses on reducing healthcare costs but does not recognize the value and importance

to healthcare of clinical testing or innovative solutions, unilateral reduction of fee schedules payable to us, unilateral recoupment

of amounts allegedly owed and competitive bidding; |

| ● | adverse

results from pending or future government investigations, lawsuits or private actions. These include, in particular, monetary damages,

loss or suspension of licenses or criminal penalties; |

| |

● |

the impact of the COVID-19 pandemic on our business or on the economy generally; and |

| |

|

|

| |

● |

a decline in economic conditions, including the impact of an inflationary environment. |

These forward-looking statements

involve numerous risks and uncertainties. Although we believe that our expectations expressed in these forward-looking statements are

reasonable, our expectations may later be found to be incorrect. Our actual results of operations or the results of other matters that

we anticipate could be materially different from our expectations. Important risks and factors that could cause our actual results to

be materially different from our expectations are generally set forth in “Risk Factors,” “Management’s Discussion

and Analysis of Financial Condition and Results of Operations,” “Business,” “Regulation” and other sections

included or incorporated by reference in this prospectus. You should thoroughly read this prospectus and the documents incorporated herein

by reference with the understanding that our actual future results may be materially different from and worse than what we expect. We

qualify all of our forward-looking statements by these cautionary statements.

The forward-looking statements

made in this prospectus relate only to events or information as of the date on which the statements are made in or incorporated by reference

in this prospectus. Except as required by law, we undertake no obligation to update or revise publicly any forward-looking statements,

whether as a result of new information, future events or otherwise, after the date on which the statements are made or to reflect the

occurrence of unanticipated events. You should read this prospectus, the documents incorporated by reference into this prospectus and

the documents we have filed as exhibits to the registration statement, of which this prospectus forms a part, completely and with the

understanding that our actual future results may be materially different from what we expect.

PROSPECTUS SUMMARY

This summary highlights

selected information contained elsewhere in this prospectus. This summary does not contain all the information that you should consider

before investing in our Company. You should carefully read the entire prospectus, including all documents incorporated by reference herein.

In particular, attention should be directed to our “Risk Factors,” “Information With Respect to the Company,”

“Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the financial statements

and related notes thereto contained herein or otherwise incorporated by reference hereto, before making an investment decision.

Corporate Overview

We are dedicated to developing

and delivering innovative, transformative, precision diagnostics and clinical laboratory services. Our main strategy is to acquire

ownership or license rights in precision diagnostic assets, genetic testing and clinical laboratory companies through joint ventures,

share ownership structures or distribution rights. We plan to play a leading role in the innovation of diagnostic testing, utilizing

proprietary technology to deliver precise, genetics-driven results. As a first major step into the laboratory market, we completed an

acquisition of a 40% membership interest in Laboratory Services MSO, LLC, which closed in February 2023.

We have the following areas of focus:

Laboratory Acquisitions

We have embarked on a laboratory rollup strategy

focused on forming joint ventures and acquiring laboratories that are accretive to our commercial strategy. As a first step, in February

of 2023, we acquired a 40% membership interest in Laboratory Services MSO.

| ● | Lab

Services MSO is focused on delivering high quality services related to toxicology and wellness testing and provides a broad portfolio

of diagnostic tests including drug testing, toxicology, and a broad array of test services, from general bloodwork to anatomic pathology,

and urine toxicology. Specific capabilities include STAT blood testing, qualitative drug screening, genetic testing, urinary testing,

and sexually transmitted disease testing. The panels that Lab Services MSO tests for are thyroid panel, comprehensive metabolic panel,

kidney profile, liver function tests, and other individual tests. Through Lab Services MSO, we use fast, accurate, and efficient equipment

to provide practitioners with the tools to quickly determine if a patient is following their designated treatment plan. In most instances,

we are able to provide a practitioner with qualitative drug class results the same day the sample is received. Lab Services MSO provides

a menu of extensive chemistry tests that physicians can use to obtain information to better treat their patients and maintain their overall

wellness. Lab Services MSO has developed a premier reputation for customer service and fast turnaround times. |

| ● | Lab

Services MSO is also focused on commercialization of genetic-based proprietary testing. The first area of focus in this area is

confirmatory genetic testing during toxicology screening and genetic testing to screen for addictive propensity. Lab Services MSO

laboratory plans to focus on diagnostic testing utilizing proprietary technology to deliver precise genetic driven results. |

Product Commercialization

We are exploring the commercialization and development

of a versatile breathalyzer system.

| ● | The

KetoAir breathalyzer is a handheld device that allows the user to detect acetone levels in exhaled breath. The acetone level is

in concentration units (ppm, part-per-million) such that the user will know his/her real-time ketosis status: inadequate ketosis (0-3.99

ppm), mild ketosis (4-9.99 ppm), optimal ketosis (10-40 ppm), or alarming level (> 40 ppm). The breathalyzer is registered with the

United States FDA as a Class I medical device. The device is also paired with an “AI Nutritionist” software program (via

Bluetooth connection) which is downloadable from Google Play (for Android mobile phones, approved) and iPhone (the app is currently being

reviewed by Apple iOS AppStore). It helps users to monitor and manage their ketogenic diet and related programs. We believe the

KetoAir breathalyzer can be an essential tool to help diabetic patients adhere to their therapeutic programs and optimize their ketogenic

dietary management. |

| ● | We

were granted exclusive distributorship rights for the KetoAir breathalyzer in the following territories: North America, South America,

the EU and the UK. We had a pilot launch and exhibition of the KetoAir breathalyzer in this year’s KetoCon conference in

Austin, Texas (April 21-23, 2023). For our commercialization strategy, we intend to target the diabetes and obesity markets. We

are evaluating options for commercialization, including identifying distribution partners or distributing KetoAir ourselves. |

Research and Development

| ● | We

are focused on bringing forward intellectual property through joint patent filings with the Massachusetts Institute of Technology (MIT).

We completed a sponsored research and co-development project with MIT led by Professor Shuguang Zhang as Principal Investigator. Using

the unique QTY code protein design platform, six water-soluble variant cytokine receptors have been successfully designed and tested

to show binding affinity to the respective cytokines. We currently are focused on bringing forward the intellectual property associated

with this program through joint patent submissions. |

Other Areas

In order to preserve cash and focus on our core

laboratory rollup strategy and product commercialization, we have currently suspended all research and development efforts related to

cellular therapy in order to redirect our funding efforts to our core business strategies outlined above.

Corporate Information

Our principal executive offices

are located at 4400 Route 9 South, Suite 3100, Freehold, New Jersey 07728 and our telephone number is (732) 780-4400, and our Internet

website address is https://www.avalon-globocare.com. The information on our website is not a part of, or incorporated in, this prospectus.

THE OFFERING

| Common stock offered by us: |

|

Shares of our common stock having an aggregate offering price of up to $3,500,000. |

| |

|

|

| Common stock to be outstanding after the offering |

|

11,980,601 shares of

common stock, assuming the sale of the full $3,500,000 worth of our common stock in this offering (which is 1,741,294 shares of common

stock at an assumed sales price of $2.01 per share, which was the closing price of our common stock on the Nasdaq Capital Market on June

14, 2023). The actual number of shares issued in this offering will vary depending on the number of shares sold in this offering and

the sales price at which shares may be sold from time to time during this offering. |

| |

|

|

| Manner of offering |

|

“At the market

offering” as defined in Rule 415(a)(4) under the Securities Act that may be made from time to time through our sales agent, Roth

Capital Partners, LLC. See “Plan of Distribution” on page 9 of this prospectus |

| |

|

|

| Use of Proceeds |

|

We intend to use the

net proceeds from these sales for research and development expenses, working capital and other general corporate purposes, which may

include funding acquisitions or investments in businesses, products or technologies that are complementary to our own and reducing indebtedness.

|

| |

|

|

|

Risk Factors

|

|

An investment

in our securities is highly speculative and subject to substantial risks. You should consider the “Risk Factors”

and the “Cautionary Note Regarding Forward-Looking Statements” included and incorporated by reference in this prospectus

and the accompanying prospectus, including the risk factors incorporated by reference from our filings with the SEC. |

| |

|

|

| Nasdaq Capital Market symbol |

|

“ALBT”

|

The discussion and table above

are based on 10,239,307 shares of common stock outstanding as of June 14, 2023, and excludes the following securities as of that date:

| |

● |

767,303 shares of common stock issuable upon the exercise of outstanding options at a weighted average exercise price of $11.92 per share, of which 727,970 options were vested as of June 14, 2023; |

| |

|

|

| |

● |

354,464 shares of common stock issuable upon the exercise of outstanding warrants at a weighted average exercise price of $6.91 per share, of which 248,964 warrants were exercisable as of June 14, 2023; |

| |

|

|

| |

● |

900,000 shares of common stock issuable upon conversion of our outstanding Series A Convertible Preferred Stock, assuming a conversion price of $10.00 per share; |

| |

|

|

| |

● |

2,910,053 shares of common stock issuable upon conversation of our outstanding Series B Convertible Preferred Stock at a conversion price of $3.78 per share; |

| |

|

|

| |

● |

333,333 shares of common stock underlying convertible note at a conversion price of $4.50; and |

| |

|

|

| |

● |

625,703 shares of our common stock available for future issuance under our 2019 and 2020 Incentive Stock Plan. |

RISK FACTORS

Investing in our securities

is highly speculative and involves a high degree of risk. Before deciding whether to invest in our securities, you should carefully

consider the risk factors we describe in this prospectus and in any related free writing prospectus that we may authorize to be provided

to you or in any report incorporated by reference into this prospectus, including our Annual Report on Form 10-K for the year ended December

31, 2022, or any Annual Report on Form 10-K or Quarterly Report on Form 10-Q that is incorporated by reference into this prospectus after

the date of this prospectus. Although we discuss key risks in those risk factor descriptions, additional risks not currently known to

us or that we currently deem immaterial also may impair our business. Our subsequent filings with the SEC may contain amended and updated

discussions of significant risks. We cannot predict future risks or estimate the extent to which they may affect our financial performance.

Risks Related to This Offering

You may experience immediate and substantial dilution as a result

of this offering.

The offering price per share

in this “at the market” offering program may exceed the net tangible book value per share of our common stock. Assuming that

an aggregate of 1,741,294 shares of our common stock are sold under the program at a price of $2.01 per share pursuant to this prospectus,

which was the last reported sale price of our common stock on The Nasdaq Capital Market on June 14, 2023, for aggregate proceeds of $3,245,000

after deducting commissions and estimated aggregate offering expenses payable by us, you would experience immediate dilution of $0.07

per share, representing a difference between our as adjusted net tangible book value per share as of March 31, 2023 after giving effect

to this offering and the assumed offering price. The exercise of outstanding stock options or warrants may result in further dilution

of your investment. See the section entitled “Dilution” on page 6 of this prospectus for a more detailed illustration of the

dilution you would incur if you participate in this offering.

Management will have broad discretion as

to the use of the proceeds from this offering and may not use the proceeds effectively.

Because we have not designated

the amount of net proceeds from this offering to be used for any particular purpose, our management will have broad discretion as to the

application of the net proceeds from this offering and could use them for purposes other than those contemplated at the time of the offering.

Our management may use the net proceeds for corporate purposes that may not improve our financial condition or market value.

Future sales of substantial amounts of our

common stock, or the possibility that such sales could occur, could adversely affect the market price of our common stock.

We may issue up to $3,500,000

of common stock from time to time in this offering. The issuance from time to time of shares in this offering, as well as our ability

to issue such shares in this offering, could have the effect of depressing the market price or increasing the market price volatility

of our common stock. See “Plan of Distribution” on page 9 of this prospectus for more information about the possible adverse

effects of our sales under the sales agreement.

It is not possible to predict the actual

number of shares we will sell under the sales agreement, or the gross proceeds resulting from those sales.

Subject to certain limitations

in the sales agreement and compliance with applicable law, we have the discretion to deliver a placement notice to the sales agent at

any time throughout the term of the sales agreement. The number of shares that are sold through the sales agent after delivering a placement

notice will fluctuate based on a number of factors, including the market price of the common stock during the sales period, the limits

we set with the sales agent in any applicable placement notice, and the demand for our common stock during the sales period. Because the

price per share of each share sold will fluctuate during the sales period, it is not currently possible to predict the number of shares

that will be sold or the gross proceeds to be raised in connection with those sales. Further, we are not obligated to sell any shares

under the sales agreement, so you should not invest in our securities in reliance on the fact that we will actually raise new capital

via the at the market sales program covered by this prospectus.

The common stock offered hereby will be

sold in an “at the market offering,” and investors who buy shares at different times will likely pay different prices.

Investors who purchase shares

in this offering at different times will likely pay different prices, and so may experience different levels of dilution and different

outcomes in their investment results. We will have discretion, subject to market demand, to vary the timing, prices, and numbers of shares

sold in this offering. In addition, there is no minimum or maximum sales price for shares to be sold in this offering. Investors may experience

a decline in the value of the shares they purchase in this offering as a result of sales made at prices lower than the prices they paid.

USE OF PROCEEDS

We may issue and sell shares

of common stock having aggregate sales proceeds of up to $3,500,000 from time to time, before deducting sales agent commissions and expenses.

The amount of proceeds from this offering will depend upon the number of shares of our common stock sold and the market price at which

they are sold. There can be no assurance that we will be able to sell any shares under or fully utilize the sales agreement with Roth

Capital Partners. We intend to use the net proceeds of this offering, if any, for research and development expenses, working capital and

other general corporate purposes, which may include funding acquisitions or investments in businesses, products or technologies that are

complementary to our own and reducing indebtedness.

However, the nature, amounts

and timing of our actual expenditures may vary significantly depending on numerous factors. For example, we may also elect to use proceeds

from this offering to acquire complimentary technologies, products or businesses, although we are not a party to any letters of intent

or definitive agreements for any such acquisition. As a result, our management has and will retain broad discretion over the allocation

of the net proceeds from this offering. We may find it necessary or advisable to use the net proceeds from this offering for other purposes,

and we will have broad discretion in the application of net proceeds from this offering.

Pending our use of the net

proceeds from this offering, we intend to invest the net proceeds in a variety of capital preservation investments, including short-term,

investment-grade, interest-bearing instruments and U.S. government securities.

DILUTION

If you invest in our common

stock, your interest will be diluted immediately to the extent of the difference between the public offering price per share and the adjusted

net tangible book value per share of our common stock after this offering.

Our net tangible book value

on March 31, 2023 was approximately $19,910,000, or $1.96 per share. “Net tangible book value” is total assets minus the sum

of liabilities and intangible assets. “Net tangible book value per share” is net tangible book value divided by the total

number of shares outstanding.

After giving effect to the

sale of shares of our common stock in the aggregate amount of $3,500,000 in this offering at an assumed offering price of $2.01 per share,

which was the last reported sale price of our common stock on The Nasdaq Capital Market on June 14, 2023, and after deducting estimated

offering commissions and expenses payable by us, our net tangible book value as of March 31, 2023 would have been approximately $23,155,000,

or $1.94 per share of common stock. This represents an immediate decrease in net tangible book value of $0.02 per share to our existing

stockholders and an immediate dilution in net tangible book value of $0.07 per share to investors participating in this offering. The

following table illustrates this dilution per share to investors participating in this offering:

| Assumed offering price per share | |

| | | |

$ | 2.01 | |

| Net tangible book value per share as of March 31, 2023 | |

$ | 1.96 | | |

| | |

| Decrease per share attributable to new investors | |

$ | (0.02 | ) | |

| | |

| Net tangible book value per share after giving effect to this offering | |

$ | 1.94 | | |

| | |

| Dilution per share to new investors | |

| | | |

$ | 0.07 | |

The table above assumes, for

illustrative purposes, that an aggregate of 1,741,294 shares of our common stock are sold at a price of $2.01 per share, the last reported

sale price of our common stock on The Nasdaq Capital Market on June 14, 2023, for aggregate gross proceeds of $3,500,000. The shares sold

in this offering, if any, will be sold from time to time at various prices.

The above discussion and table

are based on 10,164,307 shares of our common stock outstanding as of March 31, 2023 and excludes, as of that date:

| |

● |

767,303 shares of common stock issuable upon the exercise of outstanding options at a weighted average exercise price of $12.36 per share, of which 728,637 options were vested as of March 31, 2023; |

| |

|

|

| |

● |

123,964 shares of common stock issuable upon the exercise of outstanding warrants at a weighted average exercise price of $12.5 per share, all of which were exercisable as of March 31, 2023; |

| |

|

|

| |

● |

900,000 shares of common stock issuable upon conversion of our outstanding Series A Convertible Preferred Stock, assuming a conversion price of $10.00 per share; |

| |

|

|

| |

● |

2,910,053 shares of common stock issuable upon conversation of our outstanding Series B Convertible Preferred Stock at a conversion price of $3.78 per share; and |

| |

|

|

| |

● |

625,703 shares of our common stock available for future issuance under our 2019 and 2020 Incentive Stock Plan. |

To the extent that any of

our outstanding options or warrants are exercised, we grant additional options or other awards under our stock incentive plan or issue

additional warrants, or we issue additional shares of common stock in the future, there may be further dilution.

DESCRIPTION OF SECURITIES WE ARE OFFERING

Common Stock

As of June 5, 2023, there

were 10,239,307 shares of common stock issued and outstanding, held of record by approximately 223 stockholders. Subject to preferential

rights with respect to any outstanding preferred stock, all outstanding shares of common stock are of the same class and have equal rights

and attributes.

Dividends

The holders of our common

stock are entitled to receive, ratably, out of the funds legally available, any dividends only if, and as declared by our board of directors,

or a duly authorized committee of our board of directors, subject to any preferential dividend or other rights of the then outstanding

preferred stock.

Voting Rights

Each share of common stock

entitles the holders of our common stock to one vote per share on all matters submitted to a vote by our stockholders, including the election

of directors; provided, that, unless otherwise required by law, holders of our common stock are not entitled to vote on any amendment

to our Certificate of Incorporation (or on any amendment to a certificate of designations of any series of undesignated preferred stock)

that relates solely to the terms of one or more outstanding series of our preferred stock, if the holders of such affected series are

entitled, either separately or together as a class with the holders of one or more other such series, to vote thereon pursuant to our

Certificate of Incorporation. Holders of our common stock do not have cumulative voting rights.

Election of Directors

Directors hold office until

the next annual meeting of stockholders after their election and are eligible for re-election at such meeting. Directors are elected by

a plurality of the votes properly cast on the election of directors at a meeting where a majority of the voting power of the outstanding

shares entitled to vote is present in person or represented by proxy, at the meeting.

Rights Upon Liquidation and Dissolution

In the event of a liquidation,

dissolution or winding up of the Company, the holders of our common stock are entitled to receive, ratably, the net assets of the Company

available for distribution to our stockholders after the payment of all debts and other liabilities and subject to any preferential or

other rights of any then outstanding preferred stock.

Other Rights

Holders of our common stock

have no preemptive, subscription, redemption or conversion rights. The rights, preferences and privileges of holders of common stock are

subject to and may be adversely affected by the rights of the holders of shares of any series of preferred stock that we may designate

and issue in the future.

Change in Control

Provisions of Delaware law

and our certificate of incorporation and bylaws could make the acquisition of our company by means of a tender offer, proxy contest or

otherwise, and the removal of incumbent officers and directors, more difficult. These provisions include:

Delaware Business Combination Statute

We are subject to Section

203 of the DGCL. Subject to certain exceptions, Section 203 of the DGCL prevents a publicly held Delaware corporation from engaging in

a “business combination” with any “interested stockholder” for three (3) years following the date that the person

became an interested stockholder, unless the interested stockholder attained such status with the approval of our board of directors or

unless the business combination is approved in a prescribed manner. A “business combination” includes, among other things,

a merger or consolidation involving us and the “interested stockholder” and the sale of more than ten percent (10%) of our

assets. In general, an “interested stockholder” is any entity or person beneficially owning fifteen percent (15%) or more

of our outstanding voting stock and any entity or person affiliated with or controlling or controlled by such entity or person.

Removal

of Directors

Our

Certificate of Incorporation provides that our directors may be removed only by the affirmative vote of a majority of the voting power

of the outstanding shares of capital stock then entitled to vote at an election of directors. In addition, at least forty-five (45) days

prior to any annual or special meeting of stockholders at which it is proposed that a director be removed from office, written notice

of such proposed removal and the alleged grounds thereof must be sent to the director whose removal will be considered at the meeting.

Amendment of Certificate of Incorporation and

Bylaws

The DGCL provides generally

that the affirmative vote of a majority of the shares entitled to vote on any matter is required to amend a corporation’s certificate

of incorporation or by-laws, unless a corporation’s certificate of incorporation or by-laws, as the case may be, requires a greater

percentage. Our Bylaws may be amended or repealed by the affirmative vote of a majority vote of our board of directors then in office

or the affirmative vote of the holders of at least seventy five percent (75%) of the voting power of the outstanding shares entitled to

vote on such amendment or repeal, voting as a single class; provided, however, that if our board of directors recommends that stockholders

approve such amendment or repeal at such meeting of stockholders, such amendment or repeal will only require the affirmative vote of the

majority of the voting power of the outstanding shares entitled to vote on such amendment or repeal, voting together as a single class.

In addition, the Company reserves the right to amend or repeal the Certificate of Incorporation in the manner now or hereafter prescribed

by statute and by the Certificate of Incorporation, and any rights conferred upon the stockholders in the Certificate of Incorporation

are granted subject to this reservation. Whenever any vote of the holders of our capital stock is required to amend or repeal any provision

of the Certificate of Incorporation, and in addition to any other vote of holders of capital stock that is required by the Certificate

of Incorporation or by law, such amendment or repeal will require the affirmative vote of the majority of the voting power of the outstanding

shares of capital stock entitled to vote on such amendment or repeal, and the affirmative vote of the majority of the voting power of

the outstanding shares of each class entitled to vote thereon as a class, at a duly constituted meeting of stockholders called expressly

for such purpose.

Exclusive Forum Selection

Our Bylaws provide that, unless

we consent in writing to the selection of an alternative forum, the Court of Chancery in the State of Delaware shall be the sole and exclusive

forum for (i) any derivative action or proceeding brought on behalf of the Company, (ii) any action asserting a claim of breach of a fiduciary

duty owed by any director, officer, stockholder or other employee of the Company to the Company or the Company’s stockholders, (iii)

any action asserting a claim arising pursuant to any provision of the DGCL or the Certificate of Incorporation or the Bylaws, or (iv)

any action asserting a claim against the Company governed by the internal affairs doctrine. Any person or entity purchasing or otherwise

acquiring any interest in shares of capital stock of the Company shall be deemed to have notice of and consented to the provisions of

our exclusive forum selection as set forth in our Bylaws under “Exclusive Jurisdiction of Delaware Courts.” Although

our Bylaws contain the choice of forum provision described above, it is possible that a court could rule that such a provision is

inapplicable for a particular claim or action or that such provision is unenforceable.

Market, Symbol and Transfer Agent

Our common stock is listed

for trading on the Nasdaq Capital Market under the symbol “ALBT”. The transfer agent and registrar for our common stock is

VStock Transfer, LLC.

PLAN OF DISTRIBUTION

We have entered into a sales

agreement with Roth Capital Partners on June 16, 2023, which we filed as an exhibit to the registration statement of which this prospectus

forms a part. Under the terms of the sales agreement, we may offer and sell up to $3,500,000 of shares of our common stock under this

prospectus (the “Offering”), from time to time through or to Roth Capital Partners, as sales agent or principal. Sales of

shares of our common stock, if any, under this prospectus may be made by any method deemed to be an “at the market offering”

as defined in Rule 415 under the Securities Act. We may instruct the sales agent not to sell common stock if the sales cannot be effected

at or above the price designated by us from time to time. We or the sales agent may suspend the offering of common stock upon notice and

subject to other conditions.

The sales agent will offer

our common stock subject to the terms and conditions of the sales agreement as agreed upon by us and the sales agent. Each time we wish

to issue and sell common stock under the sales agreement, we will notify the sales agent of the number or dollar value of shares to be

issued, the time period during which such sales are requested to be made, any limitation on the number of shares that may be sold in one

day, any minimum price below which sales may not be made and other sales parameters as we deem appropriate. Once we have so instructed

the sales agent, unless the sales agent declines to accept the terms of the notice, the sales agent has agreed to use its commercially

reasonable efforts consistent with its normal trading and sales practices to sell such shares up to the amount specified on such terms.

The obligations of the sales agent under the sales agreement to sell our common stock are subject to a number of conditions that we must

meet.

We will pay the sales agent

commissions for its services in acting as agent in the sale of our common stock at a commission rate equal to 3.0% of the gross sale price

per share sold. We estimate that the total expenses for the offering, excluding compensation and reimbursement payable to the sales agent

under the sales agreement, will be approximately $100,000. We have also agreed to reimburse the sales agent for its reasonable out-of-pocket

expenses, including attorney’s fees, for this Offering, in an amount not to exceed $50,000, in addition to up to $5,000 per quarterly

due diligence update session for Roth Capital Partners’ counsel’s fees.

Settlement for sales of common

stock will occur on the second business day following the date on which any sales are made, or on some other date that is agreed upon

by us and the sales agent in connection with a particular transaction, in return for payment of the net proceeds to us. There is no arrangement

for funds to be received in an escrow, trust or similar arrangement.

In connection with the sale

of the common stock on our behalf, Roth Capital Partners will be deemed to be an underwriter within the meaning of the Securities Act,

and its compensation as sales agent will be deemed to be underwriting commissions or discounts. We have agreed to provide indemnification

and contribution to Roth Capital Partners against certain civil liabilities, including liabilities under the Securities Act.

This offering pursuant to

the sales agreement will terminate upon the earlier of (1) the issuance and sale of all shares of our common stock subject to the sales

agreement; and (2) the termination of the sales agreement as permitted therein.

The sales agent and its affiliates

have in the past and may in the future provide various investment banking and other financial services for us and our affiliates, for

which services it has received and may in the future receive customary fees. Without limiting the generality of the foregoing, Roth Capital

Partners, acted as placement agent under the public offering we completed in April 2019.

The prospectus for the offering

in electronic format may be made available on websites maintained by the sales agent. To the extent required by Regulation M, the sales

agent will not engage in any market making activities involving our common stock while the offering is ongoing under this prospectus.

This summary of the material provisions of the sales agreement does not purport to be a complete statement of its terms and conditions.

A copy of the sales agreement is filed as an exhibit to the registration statement of which this prospectus forms a part and is incorporated

by reference in this prospectus.

LEGAL MATTERS

The validity of the issuance

of the common stock offered by this prospectus will be passed upon for us by Lowenstein Sandler LLP, New York, New York. Roth Capital

Partners, LLC is being represented in connection with this offering by Duane Morris LLP, New York, New York.

EXPERTS

The financial statements of

Avalon GloboCare Corp. as of and for the years ended December 31, 2022 and 2021, appearing in the Company’s Annual Report on Form

10-K for the fiscal year ended December 31, 2022, have been audited by Marcum LLP, an independent registered public accounting firm, as

set forth in their report (which report includes an explanatory paragraph regarding the existence of substantial doubt about the Company’s

ability to continue as a going concern), and have been incorporated herein by reference in reliance upon such report given on the authority

of such firm as experts in accounting and auditing, in giving said reports.

The financial statements of

Laboratory Services MSO, LLC and Affiliates as of and for the years ended December 31, 2022 and 2021, filed in the Company’s Current

Report on Form 8-K/A, filed on April 26, 2023, have been audited by Marcum LLP, an independent registered public accounting firm, as set

forth in their report, and have been incorporated herein by reference, in reliance upon such report given on the authority of such firm

as experts in accounting and auditing, in giving said reports.

WHERE YOU CAN FIND MORE INFORMATION

This prospectus is part of

the registration statement on Form S-3 we filed with the SEC under the Securities Act and does not contain all the information set forth

in the registration statement. Whenever a reference is made in this prospectus to any of our contracts, agreements or other documents,

the reference may not be complete and you should refer to the exhibits that are a part of the registration statement or the exhibits to

the reports or other documents incorporated by reference into this prospectus for a copy of such contract, agreement or other document.

Because we are subject to the information and reporting requirements of the Securities Exchange Act of 1934, as amended, or the Exchange

Act, we file annual, quarterly and current reports, proxy statements and other information with the SEC. Our SEC filings are available

to the public over the Internet at the SEC’s website at http://www.sec.gov.

INCORPORATION OF CERTAIN INFORMATION BY REFERENCE

We are “incorporating

by reference” certain documents we file with the SEC, which means that we can disclose important information to you by referring

you to those documents. The information in the documents incorporated by reference is considered to be part of this prospectus. Statements

contained in documents that we file with the SEC and that are incorporated by reference in this prospectus will automatically update and

supersede information contained in this prospectus, including information in previously filed documents or reports that have been incorporated

by reference in this prospectus, to the extent the new information differs from or is inconsistent with the old information. We have filed

or may file the following documents with the SEC and they are incorporated herein by reference as of their respective dates of filing:

| |

● |

our Annual Report on Form

10-K for the year ended December 31, 2022, as filed with the SEC on March 30, 2023; |

| |

● |

our Quarterly Report on Form 10-Q for the quarter ended March 31, 2023, as filed with the SEC on May 22, 2023; |

| |

● |

our Current Reports on Form 8-K as filed with the SEC on January 4, 2023, January 11, 2023, January 23, 2023, February 13, 2023, May 26, 2023 and June 16, 2023 and our Current Reports on Form 8-K/A as filed with the SEC on April 26, 2023 and May 26, 2023; and |

| |

● |

the description of our common stock contained in our Registration Statements on Form 8-A filed with the SEC on October 28, 2016 and November 2, 2018, including any amendments and reports filed for the purpose of updating such description, including the description of our common stock included as Exhibit 4.9 to our Annual Report on Form 10-K for the year ended December 31, 2022, filed with the SEC on March 30, 2023. |

We also incorporate by reference

all documents we file under Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act (other than any portions of filings that are furnished

rather than filed pursuant to Items 2.02, 7.01 or 9.01 of a Current Report on Form 8-K) (a) after the initial filing date of the

registration statement of which this prospectus is a part and before the effectiveness of the registration statement and (b) after

the effectiveness of the registration statement and before the filing of a post-effective amendment that indicates that the securities

offered by this prospectus have been sold or that deregisters the securities covered by this prospectus then remaining unsold. The most

recent information that we file with the SEC automatically updates and supersedes older information. The information contained in any

such filing will be deemed to be a part of this prospectus, commencing on the date on which the document is filed.

Any statement contained in

a document incorporated or deemed to be incorporated by reference in this prospectus shall be deemed modified, superseded or replaced

for purposes of this prospectus to the extent that a statement contained in this prospectus, or in any subsequently filed document that

also is deemed to be incorporated by reference in this prospectus, modifies, supersedes or replaces such statement. Any statement so modified,

superseded or replaced shall not be deemed, except as so modified, superseded or replaced, to constitute a part of this prospectus. None

of the information that we disclose under Items 2.02 or 7.01 of any Current Report on Form 8-K or any corresponding information, either

furnished under Item 9.01 or included as an exhibit therein, that we may from time to time furnish to the SEC will be incorporated by

reference into, or otherwise included in, this prospectus, except as otherwise expressly set forth in the relevant document. Subject to

the foregoing, all information appearing in this prospectus is qualified in its entirety by the information appearing in the documents

incorporated by reference.

You may request, orally or

in writing, a copy of these documents, which will be provided to you at no cost (other than exhibits, unless such exhibits are specifically

incorporate by reference), by contacting Luisa Ingargiola, c/o Avalon GloboCare Corp., at 4400 Route 9 South, Suite 3100, Freehold, New

Jersey 07728. Our telephone number is (732) 780-4400. Information about us is also available at our website at https://www.avalon-globocare.com.

However, the information in our website is not a part of this prospectus and is not incorporated by reference.

Up to $3,500,000

Common Stock

PROSPECTUS

Roth Capital

Partners

June 28, 2023

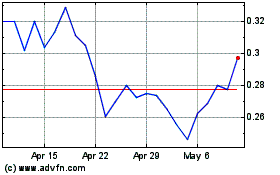

Avalon GloboCare (NASDAQ:ALBT)

Historical Stock Chart

From Jan 2025 to Feb 2025

Avalon GloboCare (NASDAQ:ALBT)

Historical Stock Chart

From Feb 2024 to Feb 2025