0001362468falseLas VegasNV00013624682023-11-022023-11-02

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington D.C. 20549

_____________________________________________

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 2, 2023

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Allegiant Travel Company | | | | |

| | (Exact name of registrant as specified in its charter) | | |

| | | | | | | | | | |

| Nevada | | 001-33166 | | 20-4745737 | |

| (State or other jurisdiction of incorporation) | | (Commission File Number) | | (I.R.S. Employer Identification No.) | |

| | | | | | | | | | |

| | 1201 North Town Center Drive | | | | |

| | Las Vegas, NV | | 89144 | | |

| | (Address of principal executive offices) | | (Zip Code) | | |

Registrant’s telephone number, including area code: (702) 851-7300

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | N/A | | | | |

| (Former name or former address, if changed since last report.) | |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol | | Name of each exchange on which registered |

Common stock, par value $0.001 | | ALGT | | NASDAQ Stock Market |

Indicate by check mark whether the registrant is an emerging growth company as in Rule 405 of the Securities Act of 1933 (Section 17 CFR §230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (Section 17 CFR §240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Section 2 Financial Information

Item 2.02 Results of Operations and Financial Condition.

On November 2, 2023, Allegiant Travel Company (the “Company”) issued the press release attached as Exhibit 99.1 to this Form 8-K concerning our results of operations for the quarter and nine months ended September 30, 2023.

This information is being furnished under Item 2.02 of Form 8-K. This report and Exhibit 99.1 are deemed to be furnished and are not considered “filed” with the Securities and Exchange Commission. As such, this information shall not be incorporated by reference into any of our reports or other filings made with the Securities and Exchange Commission.

Non-GAAP Financial Measures: The press release contains non-GAAP financial measures as such term is defined in Regulation G under the rules of the Securities and Exchange Commission. While the Company believes these financial measures are useful in evaluating the Company’s performance, this information should be considered to be supplemental in nature and not as a substitute for or superior to the related financial information prepared in accordance with GAAP. Further, these non-GAAP financial measures may differ from similarly titled measures presented by other companies.

Forward-Looking Statements: Under the safe harbor provisions of the Private Securities Litigation Reform Act of 1995, statements in the press release that are not historical facts are forward-looking statements. These forward-looking statements are only estimates or predictions based on our management's beliefs and assumptions and on information currently available to our management. Forward-looking statements include our statements regarding future airline operations, revenue, expenses and earnings, ASM growth, expected capital expenditures, the cost of fuel, the timing of aircraft acquisitions and retirements, the number of contracted aircraft to be placed in service in the future, our ability to consummate announced aircraft transactions, the capital expenditure budget and timing for completion and opening of our Sunseeker Resort and Aileron Golf Course, as well as other information concerning future results of operations, business strategies, financing plans, competitive position, industry environment, and potential growth opportunities. Forward-looking statements include all statements that are not historical facts and can be identified by the use of forward-looking terminology such as the words "believe," "expect," “guidance,” "anticipate," "intend," "plan," "estimate," “project”, “hope” or similar expressions.

Forward-looking statements involve risks, uncertainties and assumptions. Actual results may differ materially from those expressed in the forward-looking statements. Important risk factors that could cause our results to differ materially from those expressed in the forward-looking statements generally may be found in our periodic reports filed with the Securities and Exchange Commission at www.sec.gov. These risk factors include, without limitation, the impact of Hurricane Ian on our Florida markets and on completion of Sunseeker Resort, the impact and duration of the COVID-19 pandemic on airline travel and the economy, an accident involving, or problems with, our aircraft, public perception of our safety, our reliance on our automated systems, our reliance on third parties to deliver aircraft under contract to us on a timely basis, risk of breach of security of personal data, volatility of fuel costs, labor issues and costs, the ability to obtain regulatory approvals as needed , the effect of economic conditions on leisure travel, debt covenants and balances, the impact of government regulations on the airline industry, the ability to finance aircraft to be acquired, the ability to obtain necessary government approvals to implement the announced alliance with Viva Aerobus and to otherwise prepare to offer international service from our markets, terrorist attacks, risks inherent to airlines, our competitive environment, our reliance on third parties who provide facilities or services to us, the impact of management changes and the possible loss of key personnel, economic and other conditions in markets in which we operate, the ability to successfully develop a resort in Southwest Florida, increases in maintenance costs, cyclical and seasonal fluctuations in our operating results and the perceived acceptability of our environmental, social and governance efforts.

Any forward-looking statements are based on information available to us today and we undertake no obligation to update publicly any forward-looking statements, whether as a result of future events, new information or otherwise.

Section 9 Financial Statements and Exhibits

Item 9.01 Financial Statements and Exhibits.

a.Not applicable.

b.Not applicable.

c.Not applicable.

d.Exhibits

| | | | | |

| Exhibit No. | Description of Document |

| |

| |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, Allegiant Travel Company has duly caused this Report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| Date: November 2, 2023 | ALLEGIANT TRAVEL COMPANY | |

| | | | |

| | | |

| | | | |

| By: | /s/ Robert J. Neal | |

| Name: | Robert J. Neal | |

| | Title: | Senior Vice President and Chief Financial Officer | |

EXHIBIT INDEX

| | | | | |

| Exhibit No. | Description of Document |

| |

| |

ALLEGIANT TRAVEL COMPANY

THIRD QUARTER 2023 FINANCIAL RESULTS

Third quarter 2023 GAAP diluted loss per share of $(1.44)

Third quarter 2023 diluted earnings per share, excluding special charges of $0.09(1)(4)(5)

Third quarter 2023 airline only diluted earnings per share, excluding special charges of $0.31(1)(6)

Sunseeker Resort to open December 15, 2023

LAS VEGAS. November 2, 2023 — Allegiant Travel Company (NASDAQ: ALGT) today reported the following financial results for the third quarter 2023, as well as comparisons to the prior year:

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Consolidated | Three Months Ended September 30, | | Percent Change | | | | |

| (unaudited) (in millions, except per share amounts) | 2023 | | 2022 | | | | YoY | | | | | | | | |

| Total operating revenue | $ | 565.4 | | | $ | 560.3 | | | | | 0.9 | % | | | | | | | | |

| Total operating expense | 583.2 | | | 591.2 | | | | | (1.4) | % | | | | | | | | |

| Operating loss | (17.9) | | | (30.9) | | | | | 42.1 | % | | | | | | | | |

| | | | | | | | | | | | | | | |

| Loss before income taxes | (29.9) | | | (56.2) | | | | | 46.7 | % | | | | | | | | |

| | | | | | | | | | | | | | | |

| Net loss | (25.1) | | | (46.5) | | | | | 46.0 | % | | | | | | | | |

| | | | | | | | | | | | | | | |

| Diluted loss per share | (1.44) | | | (2.58) | | | | | 44.2 | % | | | | | | | | |

Sunseeker special charges, net of recoveries (4) | 17.4 | | | 35.0 | | | | | (50.3) | % | | | | | | | | |

Airline special charges (4) | 15.2 | | | 0.1 | | | | | NM | | | | | | | | |

Diluted earnings (loss) per share excluding special charges net of recoveries(1)(5) | 0.09 | | | (0.96) | | | | | 109.4 | % | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Airline only | Three Months Ended September 30, | | Percent Change(2) | | | | |

| (unaudited) (in millions, except per share amounts) | 2023 | | 2022 | | | | YoY | | | | | | | | |

Airline operating revenue | $ | 565.4 | | | $ | 560.3 | | | | | 0.9 | % | | | | | | | | |

Airline operating expense (1) | 559.5 | | | 553.5 | | | | | 1.1 | % | | | | | | | | |

Airline operating income | 5.8 | | | 6.8 | | | | | (14.7) | % | | | | | | | | |

Airline loss before income taxes (1) | (7.4) | | | (17.3) | | | | | 57.2 | % | | | | | | | | |

Airline net loss (1) | (5.6) | | | (15.2) | | | | | 63.2 | % | | | | | | | | |

Airline special charges (4) | 15.2 | | | 0.1 | | | | | NM | | | | | | | | |

Airline net income (loss), excluding special charges (1)(3)(6) | 5.9 | | | (15.1) | | | | | NM | | | | | | | | |

Airline operating margin, excluding special charges (1)(6) | 3.7 | % | | 1.2 | % | | | | 2.5 | | | | | | | | | |

Airline diluted earnings (loss) per share, excluding special charges (1)(6) | 0.31 | | | (0.84) | | | | | 136.9 | % | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Consolidated | Nine Months Ended September 30, | | Percent Change | | | | |

| (unaudited) (in millions, except per share amounts) | 2023 | | 2022 | | | | YoY | | | | | | | | |

| Total operating revenue | $ | 1,898.9 | | | $ | 1,690.3 | | | | | 12.3 | % | | | | | | | | |

| Total operating expense | 1,688.5 | | | 1,687.8 | | | | | — | % | | | | | | | | |

| Operating income | 210.4 | | | 2.4 | | | | | NM | | | | | | | | |

| | | | | | | | | | | | | | | |

| Income (loss) before income taxes | 160.8 | | | (60.9) | | | | | 364.0 | % | | | | | | | | |

| | | | | | | | | | | | | | | |

| Net income (loss) | 119.6 | | | (50.0) | | | | | 339.2 | % | | | | | | | | |

| | | | | | | | | | | | | | | |

| Diluted earnings (loss) per share | 6.43 | | | (2.78) | | | | | 331.3 | % | | | | | | | | |

Sunseeker special charges, net of recoveries (4) | 4.6 | | | 35.0 | | | | | NM | | | | | | | | |

Airline special charges (4) | 15.2 | | | 0.4 | | | | | NM | | | | | | | | |

Diluted earnings (loss) per share excluding special charges(1)(5) | 7.22 | | | (1.16) | | | | | 722.4 | % | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Airline only | Nine Months Ended September 30, | | Percent Change(2) | | | | |

| (unaudited) (in millions, except per share amounts) | 2023 | | 2022 | | | | YoY | | | | | | | | |

| Airline operating revenue | $ | 1,898.8 | | | $ | 1,690.3 | | | | | 12.3 | % | | | | | | | | |

Airline operating expense (1) | 1,668.0 | | | 1,645.4 | | | | | 1.4 | % | | | | | | | | |

| Airline operating income | 230.9 | | | 44.9 | | | | | 414.3 | % | | | | | | | | |

Airline income (loss) before income taxes (1) | 181.9 | | | (12.5) | | | | | NM | | | | | | | | |

Airline net income (loss) (1) | 137.3 | | | (11.0) | | | | | 1,348.2 | % | | | | | | | | |

Airline special charges (4) | 15.2 | | | 0.4 | | | | | NM | | | | | | | | |

Airline net income (loss), excluding special charges (1)(3)(6) | 148.8 | | | (10.7) | | | | | NM | | | | | | | | |

Airline operating margin, excluding special charges (1)(6) | 13.0 | % | | 2.7 | % | | | | 10.3 | | | | | | | | | |

Airline diluted earnings (loss) per share, excluding special charges (1)(6) | 8.00 | | | (0.59) | | | | | NM | | | | | | | | |

(1)Denotes a non-GAAP financial measure. Refer to the Non-GAAP Presentation section within this document for further information and for calculation of per share figures.

(2)Except Airline operating margin, excluding special charges, which is percentage point change.

(3)Utilizing an airline-only effective tax rate of 24.5% for 2023 and 12.0% for 2022.

(4)In 2023 and 2022, we recognized as special charges the full amount of estimated property damage to Sunseeker Resort due to weather and other insured events less the amount of recognized insurance recoveries through the end of the applicable period. In 2023 we also recognized accelerated depreciation as special charges related to our revised fleet plan. We sometimes refer to these amounts as “specials” in this earnings release.

(5)Adjusted to exclude the impacts of property damage to Sunseeker Resort, net of recoveries, and aircraft accelerated depreciation charges resulting from our revised fleet plan, as described above.

(6)Adjusted to exclude accelerated depreciation charges related to our revised fleet plan, as described above.

NM Not meaningful

* Note that amounts may not recalculate due to rounding

“I am excited to be back in the role of CEO, particularly as the team continues to deliver strong operational and financial performance”, stated Maurice J. Gallagher, Jr., chairman and CEO of Allegiant Travel Company. “The third quarter marked another quarter of airline operating profits, excluding special charges. Year to date we have delivered industry-leading financial performance yielding an adjusted airline-only operating margin of 13 percent. These accomplishments are directly attributable to Team Allegiant. You are the best in the industry, and I thank you for all your hard work and dedication.

“As we move into the fourth quarter, we are all but done with the completion of Sunseeker Resort. Construction crews are wrapping up the last details, and we expect the property to open on December 15. A main driver behind my endorsement of this property was the quality of the management team. They have navigated the project from its inception nearly five years ago and they are world renowned. My conviction around the success of the property remains strong, and I am thrilled to begin realizing the benefits that Sunseeker Resort will provide.

“One of our primary focuses remains on enhancing our brand. The Allegiant credit card continues to materially impact the bottom line through new cardholder acquisitions and continued increases in cardholder spend. Year to date, we have received $88 million in remuneration from our partner, Bank of America. We expect this number to continue growing. Our investment in the Allegiant Extra product also continues to surpass our expectations. Currently 14 aircraft have been retrofitted with this product and we expect roughly one-third of the fleet to be retrofitted by the end of 2024. These diversified revenue streams, coupled with our unique, low-utilization model will continue to differentiate us from our peers.”

“I am proud of the teams’ efforts to deliver another profitable quarter in what is historically our weakest quarter of the year,” stated Gregory Anderson, president of Allegiant Travel Company. “Despite fuel costs rising nearly 30 percent intra-quarter, the team delivered an airline-only adjusted earnings per share of $0.31 driven by an increase in TRASM of 1.4 percent over the prior year. This increase in unit revenue was extra impressive given the unprecedented strength of off-peak leisure demand during the same period last year. While leisure demand during our peak periods continues to outperform pre-pandemic levels, we experienced a return of normalization during the off-peak periods. Our ability to match capacity with leisure demand trends was nicely put on display as we reduced capacity by 45 percent during the off-peak period of September versus the peak season of July.

“We are continuing to strengthen our foundation by reinvesting back into the airline’s future. During the third quarter, we successfully launched SAP and Navitaire – technology enhancements that will support our planned growth for years to come. Furthermore, we have readied ourselves for the delivery of our first Boeing 737 MAX aircraft in early 2024. This aircraft will strengthen our flexibility by providing more diversity in fleet composition further enabling us to deploy the right gauge aircraft in the right markets at the right times.

“It’s an exciting time to be part of Team Allegiant. Several of our major initiatives will take shape in the coming months. These initiatives, coupled with our differentiated model, will help drive the long-term success of the company. This could not be achieved without the dedication and efforts of our team members throughout the organization. You are inspiring, and I extend my sincerest thanks.”

Third Quarter 2023 Results and Highlights

•Income before income tax, excluding specials(1)(3)(4) of $2.7M, yielding a pre-tax margin of 0.5%

•Airline-only income before income tax, excluding specials(1)(5) of $7.9M, yielding a pre-tax margin of 1.4%

•Operating income, excluding specials(1)(3)(4) of $14.7M, yielding an operating margin of 2.6%

•Airline-only operating income, excluding specials(1)(5) of $21.0M, yielding an airline-only operating margin of 3.7%

•Consolidated EBITDA, excluding specials(1)(3)(4) of $70.3M, yielding an EBITDA margin of 12.4%

•Airline-only EBITDA, excluding specials(1)(5) of $76.6M a 13.5% margin

•Total operating revenue of $565.4M, up 0.9% over the prior year and the highest third-quarter total in company history

•Total fixed fee contracts revenue of $17.7M, up 11.7% year-over-year

•TRASM(2) of 12.78 ¢, up 1.4% year-over-year on scheduled service capacity decrease of 0.8% year-over-year

•When compared to 2019, we are the only US carrier, among carriers having reported third quarter results, to be up more than 10 percent in both system available seat miles (ASMs) and TRASM(2) during the quarter as well as year to date

•Total average fare of $129.23, up 2.6% year-over-year

•Total average ancillary fare of $71.80, up 11.0% year-over-year

•$88 million in year-to-date remuneration received from Bank of America, up 26% from the prior year

•Announced a collaboration with global entertainment icon Carrie Underwood in support of the company's Allways Rewards Visa® card and loyalty program

•Allways Rewards program enrolled 478K new members during the quarter, bringing total members to 16.7M

•Airline-only operating CASM, excluding fuel and special charges(3), of 8.49 ¢, up 9.5% year-over-year

•Includes $18.7M in incremental cost related to accrual of pilot retention bonuses

•Excludes $15.2M in accelerated depreciation related to the early retirement of 21 airframes to be retired between 2023 through 2025

Year to date 2023 Results

•Income before income tax, excluding specials(1)(3)(4) of $180.6M yielding a pre-tax margin of 9.5%

•Operating income, excluding specials(1)(3)(4) of $230.2M, yielding an operating margin of 12.1%

•Consolidated EBITDA, excluding specials(1)(3)(4) of $394.4M, yielding an EBITDA margin of 20.8%

(1)Denotes a non-GAAP financial measure. Refer to the Non-GAAP Presentation section within this document for further information and for calculation of per share figures.

(2)TRASM represents total passenger revenue per scheduled service available seat mile.

(3)In 2023 and 2022, we recognized as special charges the full amount of estimated property damage to Sunseeker Resort due to weather and other insured events less the amount of recognized insurance recoveries through the end of the applicable period. In 2023 we also recognized accelerated depreciation as special charges related to our revised fleet plan.

(4)Adjusted to exclude the impacts of property damage to Sunseeker Resort, net of recoveries, and aircraft accelerated depreciation charges resulting from our revised fleet plan, as described above.

(5)Adjusted to exclude accelerated depreciation charges related to our revised fleet plan, as described above.

Balance Sheet, Cash and Liquidity

•Total available liquidity at September 30, 2023 was $1.3B, which included $1.0B in cash and investments, and $279.9M in undrawn revolving credit facilities and PDP facilities

•$24.5M in cash from operations during the third quarter 2023

•Total debt at September 30, 2023 was $2.3B

•Net debt at September 30, 2023 was $1.3B

•Secured $412M in financing commitments during the quarter of which $196M was used to refinance seven Airbus A320 aircraft and $216M is committed to finance four Boeing 737 MAX aircraft to be delivered in 2024

•Debt principal payments of $143.5M during the third quarter

•Includes $113M prepayment of aircraft-secured facilities during the quarter

•Year-to-date principal payments of $293M, including a total of $174M in prepayments

•Issued notice to call $150M, 8.5% senior secured notes with the balance to be paid during the fourth quarter

•Returned $11M in dividends during the third quarter

•Air traffic liability at September 30, 2023 was $395.8M

Airline Capital Expenditures

•Third quarter capital expenditures of $157.6M, which included $112.1M for aircraft purchases and inductions, pre-delivery deposits, and other related costs, and $45.5M in other airline capital expenditures

•Third quarter deferred heavy maintenance spend was $13.8M

Sunseeker Resort Charlotte Harbor

•Total capital expenditures(1) as of September 30, 2023 were $653M

•Third quarter capital expenditures(1) were $71.6M

•Recorded a special charge, net of insurance recoveries, of 17.4M during the third quarter 2023 related to estimated property damages at Sunseeker Resort resulting from various weather events, including Hurricane Idalia

(1)Total capital expenditures is inclusive of Sunseeker Resort, Aileron Golf Club, remediation work related to weather and insurance events, accrued expenditures not yet paid and pre-COVID expenditures included as part of the COVID impairment. Capitalized interest, operating expenses, special charges related to COVID, and estimated losses related to insurance events have been excluded from these figures.

| | | | | | | | | | | |

| Guidance, subject to revision | | |

| | |

| Full-year 2023 guidance | | Previous | Current |

| | | |

| System ASMs - year over year change | | 0 to 3% | ~1.8% |

| Scheduled service ASMs - year over year change | | 0 to 3% | ~1.5% |

| | | |

| Fuel cost per gallon | | $ | 2.90 | | $ | 3.12 | |

| Available seat miles (ASMs)/gallon | | ~84 | ~84 |

| Depreciation expense (millions) | | $230 to $235 | $225 to $230 |

| Interest expense (millions) | | $145 to $150 | $145 to $150 |

Capitalized interest (1) (millions) | | ($30) to ($35) | ($40) to ($45) |

| Interest income (millions) | | $40 to $45 | $40 to $45 |

Earnings per share - airline only, excluding specials(2) | | $10.50 - $13.00 | $7.75 to $8.50 |

Loss per share - Sunseeker, excluding specials (3) | | ~($1.25) | ~($1.75) |

| | | |

| Airline CAPEX | | | |

Aircraft, engines, induction costs, and pre-delivery deposits (millions)(4) | | $490 to $500 | $430 to $440 |

| Capitalized deferred heavy maintenance (millions) | | $60 to $70 | $60 to $70 |

| Other airline capital expenditures (millions) | | $140 to $145 | $150 to $155 |

| | | |

| Recurring principal payments (millions) | | $210 to $215 | $150 to $155 |

| | | | | | | | | | | |

| Sunseeker Resort Charlotte Harbor Project (millions) | | | |

Total projected capital expenditures (5) | | $695 | $720 |

| Capital expenditures funded or expected to be funded by Allegiant | | | $370 |

| Project debt incurred through September 30, 2023 | | | $350 |

(1)Includes capitalized interest related to Sunseeker as well as on pre-delivery deposits on new aircraft.

(2)Earnings per share calculation is airline only. It includes accruals for increases in pilot and flight attendant compensation beginning in May. Actual results will differ based on economic terms agreed upon and the timing of the collective bargaining agreements. These differences may be material.

(3)Excludes recoveries that may be received related to business interruption insurance claim.

(4)Excludes capitalized interest related to pre-delivery deposits on new aircraft.

(5)Total projected capital expenditures does not reflect the impairment or special charges related to COVID or insurance claims. Excludes amounts to remediate physical damage to the property resulting from Hurricane Ian, or other subsequent insurance events.

Aircraft Fleet Plan by End of Period

| | | | | | | | | | | | | | | | | |

| | | | | | | |

| | | | | | | |

| Aircraft - (seats per AC) | | | | 1Q23 | 2Q23 | 3Q23 | YE23 |

| A319 (156 seats) | | | | 35 | | 35 | | 35 | | 35 | |

| A320 (177 seats) | | | | 19 | | 19 | | 19 | | 19 | |

| A320 (180-186 seats) | | | | 70 | | 72 | | 73 | | 73 | |

| Total | | | | 124 | | 126 | | 127 | | 127 | |

The table above is provided based on the company’s current plans and is subject to change. The numbers exclude aircraft expected to be delivered before the end of 2023 for revenue service beginning in 2024.

Allegiant Travel Company will host a conference call with analysts at 12:30 p.m. ET Thursday, November 2, 2023 to discuss its third quarter 2023 financial results. A live broadcast of the conference call will be available via the Company’s Investor Relations website homepage at http://ir.allegiantair.com. The webcast will also be archived in the “Events & Presentations” section of the website.

Allegiant Travel Company

Las Vegas-based Allegiant (NASDAQ: ALGT) is an integrated travel company with an airline at its heart, focused on connecting customers with the people, places and experiences that matter most. Since 1999, Allegiant Air has linked travelers in underserved cities to world-class vacation destinations with all-nonstop flights and industry-low average fares. Today, Allegiant serves communities across the nation, with base airfares less than half the cost of the average domestic round trip ticket. For more information, visit us at Allegiant.com. Media information, including photos, is available at http://gofly.us/iiFa303wrtF.

Media Inquiries: mediarelations@allegiantair.com

Investor Inquiries: ir@allegiantair.com

Under the safe harbor provisions of the Private Securities Litigation Reform Act of 1995, statements in this press release that are not historical facts are forward-looking statements. These forward-looking statements are only estimates or predictions based on our management's beliefs and assumptions and on information currently available to our management. Forward-looking statements include our statements regarding future airline operations, revenue, expenses and earnings, available seat mile growth, expected capital expenditures, the cost of fuel, the timing of aircraft acquisitions and retirements, the number of contracted aircraft to be placed in service in the future, our ability to consummate announced aircraft transactions, the capital expenditures budget and timing for completion and opening of our Sunseeker Resort and Aileron Golf Club, as well as other information concerning future results of operations, business strategies, financing plans, industry environment and potential growth opportunities. Forward-looking statements include all statements that are not historical facts and can be identified by the use of forward-looking terminology such as the words "believe," "expect," “guidance,” "anticipate," "intend," "plan," "estimate", “project”, “hope” or similar expressions.

Forward-looking statements involve risks, uncertainties and assumptions. Actual results may differ materially from those expressed in the forward-looking statements. Important risk factors that could cause our results to differ materially from those expressed in the forward-looking statements generally may be found in our periodic reports filed with the Securities and Exchange Commission at www.sec.gov. These risk factors include, without limitation, the impact of Hurricane Ian on our Florida markets and completion of Sunseeker Resort, the impact and duration of the COVID-19 pandemic on airline travel and the economy, an accident involving, or problems with, our aircraft, public perception of our safety, our reliance on our automated systems, our reliance on third parties to deliver aircraft under contract to us on a timely basis, risk of breach of security of personal data, volatility of fuel costs, labor issues and costs, the ability to obtain regulatory approvals as needed , the effect of economic conditions on leisure travel, debt covenants and balances, the impact of government regulations on the airline industry, the ability to finance aircraft to be acquired, the ability to obtain necessary government approvals to implement the announced alliance with Viva Aerobus and to otherwise prepare to offer international service, terrorist attacks, risks inherent to airlines, our competitive environment, our reliance on third parties who provide facilities or services to us, the impact of management changes and the possible loss of key personnel, economic and other conditions in markets in which we operate, the ability to successfully develop a resort in Southwest Florida, increases in maintenance costs, cyclical and seasonal fluctuations in our operating results, and the perceived acceptability of our environmental, social and governance efforts.

Any forward-looking statements are based on information available to us today and we undertake no obligation to update publicly any forward-looking statements, whether as a result of future events, new information or otherwise.

Detailed financial information follows:

Allegiant Travel Company

Consolidated Statements of Income

(in thousands, except per share amounts)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended September 30, | | Percent Change |

| | 2023 | | 2022 | | | | YoY | | |

| OPERATING REVENUES: | | | | | | | | | |

| Passenger | $ | 516,251 | | | $ | 516,476 | | | | | — | % | | |

| Third party products | 30,944 | | | 27,132 | | | | | 14.0 | | | |

| Fixed fee contracts | 17,741 | | | 15,881 | | | | | 11.7 | | | |

| Other | 423 | | | 836 | | | | | (49.4) | | |

| Total operating revenues | 565,359 | | | 560,325 | | | | | 0.9 | | | |

| OPERATING EXPENSES: | | | | | | | | | |

| Aircraft fuel | 167,861 | | | 208,175 | | | | | (19.4) | | | |

| Salaries and benefits | 163,004 | | | 137,336 | | | | | 18.7 | | | |

| Station operations | 64,630 | | | 66,302 | | | | | (2.5) | | | |

| Depreciation and amortization | 55,816 | | | 50,092 | | | | | 11.4 | | | |

| Maintenance and repairs | 35,477 | | | 32,177 | | | | | 10.3 | | | |

| Sales and marketing | 28,468 | | | 25,815 | | | | | 10.3 | | | |

| Aircraft lease rentals | 5,906 | | | 5,905 | | | | | — | | | |

| Other | 29,432 | | | 30,292 | | | | | (2.8) | | | |

| | | | | | | | | |

| Special charges, net of recoveries | 32,648 | | | 35,142 | | | | | (7.1) | | |

| Total operating expenses | 583,242 | | | 591,236 | | | | | (1.4) | | | |

| OPERATING LOSS | (17,883) | | | (30,911) | | | | | 42.1 | | | |

| OTHER (INCOME) EXPENSES: | | | | | | | | | |

| Interest expense | 39,233 | | | 34,242 | | | | | 14.6 | | | |

| Interest income | (12,444) | | | (4,918) | | | | | (153.0) | | |

| Capitalized interest | (14,888) | | | (4,296) | | | | | (246.6) | | |

| | | | | | | | | |

| | | | | | | | | |

| Other, net | 135 | | | 223 | | | | | (39.5) | | |

| Total other expenses | 12,036 | | | 25,251 | | | | | (52.3) | | | |

| LOSS BEFORE INCOME TAXES | (29,919) | | | (56,162) | | | | | 46.7 | | | |

| INCOME TAX BENEFIT | (4,853) | | | (9,703) | | | | | 50.0 | | | |

| NET LOSS | $ | (25,066) | | | $ | (46,459) | | | | | 46.0 | | | |

| | | | | | | | | |

| | | | | | | | | |

| Loss per share to common shareholders: | | | | | | | | | |

| Basic | ($1.44) | | | ($2.58) | | | | | 44.2 | | | |

| Diluted | ($1.44) | | | ($2.58) | | | | | 44.2 | | | |

Weighted average shares outstanding used in computing earnings per share attributable to common shareholders(1): | | | | | | | | | |

| Basic | 17,721 | | | 18,014 | | | | | (1.6) | | | |

| Diluted | 17,721 | | | 18,014 | | | | | (1.6) | | | |

(1)The Company's unvested restricted stock awards are considered participating securities as they receive non-forfeitable rights to cash dividends at the same rate as common stock. The basic and diluted earnings per share calculations for the periods presented reflect the two-class method mandated by ASC Topic 260, "Earnings Per Share." The two-class method adjusts both the net income and the shares used in the calculation. Application of the two-class method reduced basic and diluted earnings per share by $0.03 for 2023 and did not have a significant impact on the basic and diluted earnings per share for 2022.

Allegiant Travel Company

Airline Operating Statistics

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended September 30, | | Percent Change(1) |

| 2023 | | 2022 | | | | YoY | | |

| AIRLINE OPERATING STATISTICS | | | | | | | | | |

| Total system statistics: | | | | | | | | | |

| Passengers | 4,292,031 | | | 4,359,417 | | | | | (1.5) | % | | |

| Available seat miles (ASMs) (thousands) | 4,433,767 | | | 4,450,595 | | | | | (0.4) | | | |

| | | | | | | | | |

| | | | | | | | | |

| Airline operating expense per ASM (CASM) (cents) | 12.62 | ¢ | | 12.43 | ¢ | | | | 1.5 | | | |

| Fuel expense per ASM (cents) | 3.79 | ¢ | | 4.68 | ¢ | | | | (19.0) | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Airline operating CASM, excluding fuel (cents) | 8.83 | ¢ | | 7.75 | ¢ | | | | 13.9 | | | |

| Departures | 29,251 | | | 29,432 | | | | | (0.6) | | | |

| Block hours | 67,312 | | | 67,277 | | | | | 0.1 | | | |

| Average stage length (miles) | 858 | | | 857 | | | | | 0.1 | | | |

| Average number of operating aircraft during period | 126.8 | | | 115.1 | | | | | 10.2 | | | |

| Average block hours per aircraft per day | 5.8 | | | 6.4 | | | | | (9.4) | | | |

| Full-time equivalent employees at end of period | 5,578 | | | 5,285 | | | | | 5.5 | | | |

| Fuel gallons consumed (thousands) | 54,320 | | | 54,044 | | | | | 0.5 | | | |

| ASMs per gallon of fuel | 81.6 | | | 82.4 | | | | | (1.0) | | | |

| Average fuel cost per gallon | $ | 3.09 | | | $ | 3.85 | | | | | (19.7) | | | |

| Scheduled service statistics: | | | | | | | | | |

| Passengers | 4,234,196 | | | 4,316,163 | | | | | (1.9) | | | |

| Revenue passenger miles (RPMs) (thousands) | 3,744,225 | | | 3,820,339 | | | | | (2.0) | | | |

| Available seat miles (ASMs) (thousands) | 4,280,034 | | | 4,315,984 | | | | | (0.8) | | | |

| Load factor | 87.5 | % | | 88.5 | % | | | | (1.0) | | | |

| Departures | 28,040 | | | 28,436 | | | | | (1.4) | | | |

| Block hours | 64,857 | | | 65,182 | | | | | (0.5) | | | |

| Average seats per departure | 176.8 | | | 175.8 | | | | | 0.6 | | | |

Yield (cents) (2) | 6.49 | ¢ | | 6.92 | ¢ | | | | (6.2) | | | |

Total passenger revenue per ASM (TRASM) (cents)(3) | 12.78 | ¢ | | 12.60 | ¢ | | | | 1.4 | | | |

Average fare - scheduled service(4) | $ | 57.43 | | | $ | 61.26 | | | | | (6.3) | | | |

Average fare - air-related charges(4) | $ | 64.50 | | | $ | 58.40 | | | | | 10.4 | | | |

| Average fare - third party products | $ | 7.31 | | | $ | 6.29 | | | | | 16.2 | | | |

| Average fare - total | $ | 129.23 | | | $ | 125.95 | | | | | 2.6 | | | |

| Average stage length (miles) | 864 | | | 860 | | | | | 0.5 | | | |

| Fuel gallons consumed (thousands) | 52,491 | | | 52,491 | | | | | — | | | |

| Average fuel cost per gallon | $ | 3.07 | | | $ | 3.84 | | | | | (20.1) | | | |

| Percent of sales through website during period | 95.1 | % | | 96.1 | % | | | | (1.0) | | | |

| Other data: | | | | | | | | | |

| Rental car days sold | 335,542 | | | 364,481 | | | | | (7.9) | | | |

| Hotel room nights sold | 54,447 | | | 71,205 | | | | | (23.5) | | | |

(1)Except load factor and percent of sales through website, which is percentage point change.

(2)Defined as scheduled service revenue divided by revenue passenger miles.

(3)Various components of this measurement do not have a direct correlation to ASMs. These figures are provided on a per ASM basis to facilitate comparison with airlines reporting revenues on a per ASM basis.

(4)Reflects division of passenger revenue between scheduled service and air-related charges in Company's booking path.

Allegiant Travel Company

Consolidated Statements of Income

(in thousands, except per share amounts)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | |

| | Nine Months Ended September 30, | | Percent Change |

| | 2023 | | 2022 | | | | YoY | | |

| OPERATING REVENUES: | | | | | | | | | |

| Passenger | $ | 1,768,274 | | | $ | 1,573,041 | | | | | 12.4 | % | | |

| Third party products | 85,886 | | | 77,399 | | | | | 11.0 | | | |

| Fixed fee contracts | 43,599 | | | 38,186 | | | | | 14.2 | | | |

| Other | 1,096 | | | 1,654 | | | | | (33.7) | | | |

| Total operating revenues | 1,898,855 | | | 1,690,280 | | | | | 12.3 | | | |

| OPERATING EXPENSES: | | | | | | | | | |

| Aircraft fuel | 520,018 | | | 629,600 | | | | | (17.4) | | | |

| Salaries and benefits | 499,798 | | | 411,027 | | | | | 21.6 | | | |

| Station operations | 192,864 | | | 198,954 | | | | | (3.1) | | | |

| Depreciation and amortization | 164,430 | | | 145,618 | | | | | 12.9 | | | |

| Maintenance and repairs | 95,553 | | | 91,120 | | | | | 4.9 | | | |

| Sales and marketing | 85,265 | | | 75,462 | | | | | 13.0 | | | |

| Aircraft lease rentals | 18,973 | | | 17,489 | | | | | 8.5 | | | |

| Other | 91,757 | | | 83,137 | | | | | 10.4 | | | |

| | | | | | | | | |

| Special charges, net of recoveries | 19,828 | | | 35,426 | | | | | (44.0) | | |

| Total operating expenses | 1,688,486 | | | 1,687,833 | | | | | — | | | |

| OPERATING INCOME | 210,369 | | | 2,447 | | | | | 8,497.0 | | | |

| OTHER (INCOME) EXPENSES: | | | | | | | | | |

| Interest expense | 112,707 | | | 78,530 | | | | | 43.5 | | | |

| Interest income | (34,418) | | | (7,909) | | | | | (335.2) | | | |

| Capitalized interest | (28,949) | | | (7,594) | | | | | (281.2) | | |

| | | | | | | | | |

| | | | | | | | | |

| Other, net | 185 | | | 318 | | | | | (41.8) | | | |

| Total other expenses | 49,525 | | | 63,345 | | | | | (21.8) | | | |

| INCOME (LOSS) BEFORE INCOME TAXES | 160,844 | | | (60,898) | | | | | 364.1 | | | |

| INCOME TAX PROVISION (BENEFIT) | 41,292 | | | (10,916) | | | | | 478.3 | | | |

| NET INCOME (LOSS) | $ | 119,552 | | | $ | (49,982) | | | | | 339.2 | | | |

| | | | | | | | | |

| | | | | | | | | |

| Earnings (loss) per share to common shareholders: | | | | | | | | | |

| Basic | $6.44 | | | ($2.78) | | | | | 331.7 | | | |

| Diluted | $6.43 | | | ($2.78) | | | | | 331.3 | | | |

Weighted average shares outstanding used in computing earnings per share attributable to common shareholders(1): | | | | | | | | | |

| Basic | 17,879 | | | 17,985 | | | | | (0.6) | | | |

| Diluted | 17,913 | | | 17,985 | | | | | (0.4) | | | |

(1)The Company's unvested restricted stock awards are considered participating securities as they receive non-forfeitable rights to cash dividends at the same rate as common stock. The basic and diluted earnings per share calculations for the periods presented reflect the two-class method mandated by ASC Topic 260, "Earnings Per Share." The two-class method adjusts both the net income and the shares used in the calculation. Application of the two-class method reduced earnings per share by $0.25 for basic and diluted earnings per share for 2023, and it did not have a significant impact on the basic and diluted earnings per share for 2022.

Allegiant Travel Company

Operating Statistics

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | |

| | Nine Months Ended September 30, | | Percent Change(1) |

| 2023 | | 2022 | | | | YoY | | |

| OPERATING STATISTICS | | | | | | | | | |

| Total system statistics: | | | | | | | | | |

| Passengers | 13,196,465 | | | 12,834,078 | | | | | 2.8 | % | | |

| Available seat miles (ASMs) (thousands) | 14,164,936 | | | 14,060,825 | | | | | 0.7 | | | |

| | | | | | | | | |

| | | | | | | | | |

| Airline operating expense per ASM (CASM)(cents) | 11.78 | ¢ | | 11.70 | ¢ | | | | 0.7 | | | |

| Fuel expense per ASM (cents) | 3.67 | ¢ | | 4.48 | ¢ | | | | (18.1) | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Airline operating CASM, excluding fuel (cents) | 8.11 | ¢ | | 7.22 | ¢ | | | | 12.3 | | | |

| Departures | 90,792 | | | 90,064 | | | | | 0.8 | | | |

| Block hours | 215,716 | | | 212,403 | | | | | 1.6 | | | |

| Average stage length (miles) | 883 | | | 885 | | | | | (0.2) | | | |

| Average number of operating aircraft during period | 124.7 | | | 112.7 | | | | | 10.6 | | | |

| Average block hours per aircraft per day | 6.3 | | | 6.9 | | | | | (8.7) | | | |

| Full-time equivalent employees at end of period | 5,578 | | | 5,285 | | | | | 5.5 | | | |

| Fuel gallons consumed (thousands) | 170,271 | | | 167,070 | | | | | 1.9 | | | |

| ASMs per gallon of fuel | 83.2 | | | 84.2 | | | | | (1.2) | | | |

| Average fuel cost per gallon | $ | 3.05 | | | $ | 3.77 | | | | | (19.1) | | | |

| Scheduled service statistics: | | | | | | | | | |

| Passengers | 13,076,015 | | | 12,736,268 | | | | | 2.7 | | | |

| Revenue passenger miles (RPMs) (thousands) | 11,947,986 | | | 11,646,212 | | | | | 2.6 | | | |

| Available seat miles (ASMs) (thousands) | 13,778,994 | | | 13,716,838 | | | | | 0.5 | | | |

| Load factor | 86.7 | % | | 84.9 | % | | | | 1.8 | | | |

| Departures | 87,800 | | | 87,475 | | | | | 0.4 | | | |

| Block hours | 209,468 | | | 206,868 | | | | | 1.3 | | | |

| Average seats per departure | 176.1 | | | 175.7 | | | | | 0.2 | | | |

Yield (cents) (2) | 7.55 | ¢ | | 6.94 | ¢ | | | | 8.8 | | | |

Total passenger revenue per ASM (TRASM) (cents)(3) | 13.46 | ¢ | | 12.03 | ¢ | | | | 11.9 | | | |

Average fare - scheduled service(4) | $ | 68.95 | | | $ | 63.44 | | | | | 8.7 | | | |

Average fare - air-related charges(4) | $ | 66.28 | | | $ | 60.07 | | | | | 10.3 | | | |

| Average fare - third party products | $ | 6.57 | | | $ | 6.08 | | | | | 8.1 | | | |

| Average fare - total | $ | 141.80 | | | $ | 129.59 | | | | | 9.4 | | | |

| Average stage length (miles) | 889 | | | 889 | | | | | — | | | |

| Fuel gallons consumed (thousands) | 165,599 | | | 162,933 | | | | | 1.6 | | | |

| Average fuel cost per gallon | $ | 3.05 | | | $ | 3.77 | | | | | (19.1) | | | |

| Percent of sales through website during period | 95.3 | % | | 96.2 | % | | | | (0.9) | | | |

| Other data: | | | | | | | | | |

| Rental car days sold | 1,081,483 | | | 1,161,579 | | | | | (6.9) | | | |

| Hotel room nights sold | 193,643 | | | 222,334 | | | | | (12.9) | | | |

(1)Except load factor and percent of sales through website, which is percentage point change.

(2)Defined as scheduled service revenue divided by revenue passenger miles.

(3)Various components of this measurement do not have a direct correlation to ASMs. These figures are provided on a per ASM basis to facilitate comparison with airlines reporting revenues on a per ASM basis.

(4)Reflects division of passenger revenue between scheduled service and air-related charges in Company's booking path.

Summary Balance Sheet

| | | | | | | | | | | | | | | | | |

Unaudited (millions) | September 30, 2023 (unaudited) | | December 31, 2022 | | Percent Change |

| Unrestricted cash and investments | | | | | |

| Cash and cash equivalents | $ | 284.2 | | | $ | 230.0 | | | 23.6 | % |

| Short-term investments | 651.2 | | | 725.1 | | | (10.2) | |

| Long-term investments | 71.6 | | | 63.3 | | | 13.1 | |

| Total unrestricted cash and investments | 1,007.0 | | | 1,018.4 | | | (1.1) | |

| Debt | | | | | |

| Current maturities of long-term debt and finance lease obligations, net of related costs | 266.0 | | | 152.9 | | | 74.0 | |

| Long-term debt and finance lease obligations, net of current maturities and related costs | 2,020.0 | | | 1,944.1 | | | 3.9 | |

| Total debt | 2,286.0 | | | 2,097.0 | | | 9.0 | |

| Debt, net of unrestricted cash and investments | 1,279.0 | | | 1,078.6 | | | 18.6 | |

| Total Allegiant Travel Company shareholders’ equity | 1,343.1 | | | 1,220.7 | | | 10.0 | |

EPS Calculation

The following table sets forth the computation of net income per share, on a basic and diluted basis, for the periods indicated (share count and dollar amounts other than per-share amounts in table are in thousands):

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Basic: | | | | | | | |

| Net income (loss) | $ | (25,066) | | | $ | (46,459) | | | $ | 119,552 | | | $ | (49,982) | |

| Less income allocated to participating securities | (452) | | | — | | | (4,397) | | | — | |

| Net income (loss) attributable to common stock | $ | (25,518) | | | $ | (46,459) | | | $ | 115,155 | | | $ | (49,982) | |

| Earnings (loss) per share, basic | $ | (1.44) | | | $ | (2.58) | | | $ | 6.44 | | | $ | (2.78) | |

| Weighted-average shares outstanding | 17,721 | | | 18,014 | | | 17,879 | | | 17,985 | |

| Diluted: | | | | | | | |

| Net income (loss) | $ | (25,066) | | | $ | (46,459) | | | $ | 119,552 | | | $ | (49,982) | |

| Less income allocated to participating securities | (452) | | | — | | | (4,389) | | | — | |

| Net income (loss) attributable to common stock | $ | (25,518) | | | $ | (46,459) | | | $ | 115,163 | | | $ | (49,982) | |

| Earnings (loss) per share, diluted | $ | (1.44) | | | $ | (2.58) | | | $ | 6.43 | | | $ | (2.78) | |

Weighted-average shares outstanding (1) | 17,721 | | | 18,014 | | | 17,879 | | | 17,985 | |

| Dilutive effect of stock options and restricted stock | — | | | — | | | 238 | | | — | |

| Adjusted weighted-average shares outstanding under treasury stock method | 17,721 | | | 18,014 | | | 18,117 | | | 17,985 | |

| Participating securities excluded under two-class method | — | | | — | | | (204) | | | — | |

| Adjusted weighted-average shares outstanding under two-class method | 17,721 | | | 18,014 | | | 17,913 | | | 17,985 | |

(1)Dilutive effect of common stock equivalents excluded from the diluted per share calculation is not material.

Appendix A

Non-GAAP Presentation

Three and Nine Months Ended September 30, 2023

(Unaudited)

Airline operating expense, airline income before income taxes, airline net income, and airline diluted earnings per share all eliminate the effects of non-airline activity as such activity is not reflective of airline operating performance. We also present these airline-only metrics excluding special charges related to accelerated depreciation on early retirement of certain airframes. Management believes the exclusion of these special charges enhance comparability of financial information between periods. Airline earnings before interest, taxes, depreciation and amortization ("Airline EBITDA") eliminates the effects of non-airline operating activity and other items. As such, all of these are non-GAAP financial measures. We believe the presentation of these measures is relevant and useful for investors because it allows them to better gauge the performance of the airline and to compare our results to other airlines.

We present both operating expense and CASM excluding aircraft fuel expense and special charges as fuel price volatility impacts the comparability of year over year financial performance. We believe the adjustment for fuel expense allows investors to better understand our non-fuel costs and related performance.

We present consolidated operating income, EBITDA, and diluted earnings per share excluding Sunseeker special charges, net of recoveries, and airline special charges, to exclude the impact of losses and insurance recoveries incurred primarily as the result of hurricane and other insured events and accelerated depreciation on early retirements of certain airframes. Management believes these measures enhance comparability of financial information between periods.

EBITDA, EBITDA excluding special charges, and Airline EBITDA excluding special charges, as presented in this press release, are supplemental measures of our performance that are not required by, or presented in accordance with, accounting principles generally accepted in the United States (“GAAP”). These are not measurements of our financial performance under GAAP and should not be considered in isolation or as an alternative to net income or any other performance measures derived in accordance with GAAP or as an alternative to cash flows from operating activities as a measure of our liquidity.

We define “EBITDA” as earnings before interest, taxes, depreciation and amortization. We also adjust EBITDA within this release to exclude non-airline activity and special charges. We caution investors that amounts presented in accordance with this definition may not be comparable to similar measures disclosed by other issuers, because not all issuers and analysts calculate EBITDA in the same manner.

We use EBITDA and Airline EBITDA to evaluate our operating performance and liquidity, and these are among the primary measures used by management for planning and forecasting of future periods. We believe these presentations of EBITDA are relevant and useful for investors because they allow investors to view results in a manner similar to the method used by management and make it easier to compare our results with other companies that have different financing and capital structures. EBITDA has important limitations as an analytical tool. These limitations include the following:

•EBITDA does not reflect our capital expenditures, future requirements for capital expenditures or contractual commitments to purchase capital equipment;

•EBITDA does not reflect interest expense or the cash requirements necessary to service principal or interest payments on our debt;

•although depreciation and amortization are non-cash charges, the assets that we currently depreciate and amortize will likely have to be replaced in the future, and EBITDA does not reflect the cash required to fund such replacements; and

•other companies in our industry may calculate EBITDA differently than we do, limiting its usefulness as a comparative measure.

Presented below is a quantitative reconciliation of these adjusted numbers to the most directly comparable GAAP financial performance measure, which we believe is net income.

The SEC has adopted rules (Regulation G) regulating the use of non-GAAP financial measures. Because of our use of non-GAAP financial measures in this press release to supplement our consolidated financial statements presented on a GAAP basis, Regulation G requires us to include in this press release a presentation of the most directly comparable GAAP measure, which is operating revenue, operating expenses, operating income, income before income taxes, net income, and net income per share and a reconciliation of the non-GAAP measures to the most comparable GAAP measure. Our utilization of non-GAAP measurements is not meant to be considered in isolation or as a substitute for operating revenue, operating expenses, operating income, income before income taxes, net income, net income per share, or other measures of financial performance prepared in accordance with GAAP. Our use of these non-GAAP measures may not be comparable to similarly titled measures employed by other companies in the airline and travel industry. The reconciliation of each of these measures to the most comparable GAAP measure for the periods is indicated below.

Reconciliation of Non-GAAP Financial Measures

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Reconciliation of net income and earnings per share excluding special charges net of recoveries (millions except share and per share numbers) | | | | | | | |

| Income (loss) before income taxes as reported (GAAP) | $ | (29.9) | | | $ | (56.2) | | | $ | 160.8 | | | $ | (60.9) | |

Special charges, net of recoveries(4) | 32.6 | | | 35.1 | | | 19.8 | | | 35.4 | |

Income (loss) before income taxes excluding special charges net of recoveries(1) | 2.7 | | | (21.1) | | | 180.6 | | | (25.5) | |

| Income tax expense (benefit) as reported (GAAP) | (4.9) | | | (9.7) | | | 41.3 | | | (10.9) | |

Income tax expense (benefit) excluding special charges net of recoveries(1) | 0.7 | | | (3.8) | | | 46.4 | | | (4.6) | |

Net income (loss) excluding special charges net of recoveries(1) | 2.0 | | | (17.3) | | | 134.2 | | | (20.9) | |

Net (income) allocated to participating securities excluding special charges net of recoveries(1) | (0.5) | | | — | | | (4.9) | | | — | |

Net income (loss) attributable to common stock excluding special charges net of recoveries(1) | 1.5 | | | (17.3) | | | 129.3 | | | (20.9) | |

| | | | | | | |

| Diluted shares as reported (GAAP) (thousands) | 17,721 | | | 18,014 | | | 17,913 | | | 17,985 | |

| | | | | | | |

| Diluted earnings (loss) per share as reported (GAAP) | $ | (1.44) | | | $ | (2.58) | | | $ | 6.43 | | | $ | (2.78) | |

Diluted earnings (loss) per share excluding special charges net of recoveries(1) | $ | 0.09 | | | $ | (0.96) | | | $ | 7.22 | | | $ | (1.16) | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Reconciliation of airline operating expense, operating income, income before income taxes, net income excluding special charges (millions) | | | | | | | |

| Operating expense as reported (GAAP) | $ | 583.2 | | | $ | 591.2 | | | $ | 1,688.5 | | | $ | 1,687.8 | |

Non-airline operating expense(1) | 23.7 | | | 37.8 | | | 20.5 | | | 42.5 | |

Airline operating expense(1) | 559.5 | | | 553.4 | | | 1,668.0 | | | 1,645.3 | |

Airline special charges(1)(3) | 15.2 | | | 0.1 | | | 15.2 | | | 0.4 | |

Airline operating expense, excluding special charges(1)(5) | $ | 544.3 | | | $ | 553.3 | | | $ | 1,652.8 | | | $ | 1,644.9 | |

| | | | | | | |

| Operating income (loss) as reported (GAAP) | $ | (17.9) | | | $ | (30.9) | | | $ | 210.4 | | | $ | 2.4 | |

| Non-airline operating (loss) | (23.7) | | | (37.8) | | | (20.5) | | | (42.5) | |

Airline special charges(1)(3) | 15.2 | | | 0.1 | | | 15.2 | | | 0.4 | |

Airline operating income, excluding special charges(1)(5) | $ | 21.0 | | | $ | 7.0 | | | $ | 246.1 | | | $ | 45.3 | |

Airline operating margin, excluding special charges(1)(5) | 3.7 | % | | 1.2 | % | | 13.0 | % | | 2.7 | % |

| | | | | | | |

| Income (loss) before income taxes as reported (GAAP) | $ | (29.9) | | | $ | (56.2) | | | $ | 160.8 | | | $ | (60.9) | |

| | | | | | | |

| | | | | | | |

Non-airline (loss) before income taxes(1) | (22.6) | | | (38.9) | | | (21.0) | | | (48.4) | |

Airline special charges(1)(3) | 15.2 | | | 0.1 | | | 15.2 | | | 0.4 | |

Airline income (loss) before income taxes, excluding special charges(1)(5) | $ | 7.9 | | | $ | (17.2) | | | $ | 197.0 | | | $ | (12.1) | |

| | | | | | | |

| Net income (loss) as reported (GAAP) | $ | (25.1) | | | $ | (46.5) | | | $ | 119.6 | | | $ | (50.0) | |

Non-airline net loss(1) | (15.8) | | | (31.2) | | | (14.0) | | | (38.9) | |

Airline special charges(1)(3) | 15.2 | | | 0.1 | | | 15.2 | | | 0.4 | |

Airline net income (loss), excluding special charges(1)(2)(5) | $ | 5.9 | | | $ | (15.2) | | | $ | 148.8 | | | $ | (10.7) | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Reconciliation of airline diluted earnings per share (millions, unless otherwise noted) | | | | | | | |

| Net income (loss) as reported (GAAP) | $ | (25.1) | | | $ | (46.5) | | | $ | 119.6 | | | $ | (50.0) | |

| Less: Net income allocated to participating securities | (0.5) | | | — | | | (4.4) | | | — | |

| Net income (loss) attributable to common stock | $ | (25.6) | | | $ | (46.5) | | | $ | 115.2 | | | $ | (50.0) | |

| | | | | | | |

Airline net income, excluding special charges(1)(2)(5) | 5.9 | | | (15.2) | | | 148.8 | | | (10.7) | |

| Less: Airline net income allocated to participating securities | (0.5) | | | — | | | (5.5) | | | — | |

Airline net income (loss) attributable to common stock, excluding special charges(1)(2)(5) | $ | 5.4 | | | $ | (15.2) | | | $ | 143.3 | | | $ | (10.7) | |

| | | | | | | |

| Diluted shares used for computation - GAAP (thousands) | 17,721 | | | 18,014 | | | 17,913 | | | 17,985 | |

Diluted shares used for computation - Airline only, excluding special charges (thousands)(1) | 17,740 | | | 18,014 | | | 17,913 | | | 17,985 | |

| | | | | | | |

| Diluted earnings (loss) per share as reported (GAAP) | $ | (1.44) | | | $ | (2.58) | | | $ | 6.43 | | | $ | (2.78) | |

Airline diluted earnings (loss) per share, excluding special charges(1)(5) | $ | 0.31 | | | $ | (0.84) | | | $ | 8.00 | | | $ | (0.59) | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Reconciliation of airline operating CASM excluding fuel and special charges (millions) | | | | | | | |

| Consolidated operating expense (GAAP) | $ | 583.2 | | | $ | 591.2 | | | $ | 1,688.5 | | | $ | 1,687.8 | |

| Less aircraft fuel expense | 167.9 | | | 208.2 | | | 520.0 | | | 629.6 | |

Less non-airline operating expense(1) | 23.7 | | | 37.8 | | | 20.5 | | | 42.5 | |

Less airline special charges(3) | 15.2 | | | 0.1 | | | 15.2 | | | 0.4 | |

Total airline operating expense less fuel and airline special charges(1)(5) | $ | 376.4 | | | $ | 345.1 | | | $ | 1,132.8 | | | $ | 1,015.3 | |

| | | | | | | |

| System available seat miles (millions) | 4,433.8 | | | 4,450.6 | | | 14,164.9 | | | 14,060.8 | |

| Cost per available seat mile (cents) | 13.15 | | | 13.28 | | | 11.92 | | | 12.00 | |

| Cost per available seat mile excluding non-airline expense (cents) | 12.62 | | | 12.44 | | | 11.78 | | | 11.70 | |

| Cost per available seat mile excluding fuel, non-airline expense, and airline special charges (cents) | 8.49 | | | 7.75 | | | 8.00 | | | 7.22 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Reconciliation of operating income excluding special charges (millions) | | | | | | | |

| Operating income (loss) as reported (GAAP) | $ | (17.9) | | | $ | (30.9) | | | $ | 210.4 | | | $ | 2.4 | |

Sunseeker special charges, net of recoveries(3) | 17.4 | | | 35.0 | | | 4.6 | | | 35.0 | |

Airline special charges(3) | 15.2 | | | 0.1 | | | 15.2 | | | 0.4 | |

Operating income, excluding special charges(1)(4) | $ | 14.7 | | | $ | 4.2 | | | $ | 230.2 | | | $ | 37.8 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Consolidated EBITDA (millions) | | | | | | | |

| Net income (loss) as reported (GAAP) | $ | (25.1) | | | $ | (46.5) | | | $ | 119.6 | | | $ | (50.0) | |

| Interest expense, net | 11.9 | | | 25.0 | | | 49.3 | | | 63.0 | |

| Income tax expense (benefit) | (4.9) | | | (9.7) | | | 41.3 | | | (10.9) | |

Depreciation and amortization(5) | 55.8 | | | 50.1 | | | 164.4 | | | 145.6 | |

| | | | | | | |

Consolidated EBITDA(1) | $ | 37.7 | | | $ | 18.9 | | | $ | 374.6 | | | $ | 147.7 | |

| | | | | | | |

| Airline EBITDA, excluding special charges (millions) | | | | | | | |

| Net income (loss) as reported (GAAP) | $ | (25.1) | | | $ | (46.5) | | | $ | 119.6 | | | $ | (50.0) | |

Non-airline net (loss)(1) | (19.5) | | | (31.3) | | | (17.8) | | | (38.9) | |

Airline net income (loss)(1) | (5.6) | | | (15.2) | | | 137.4 | | | (11.1) | |

Airline interest expense, net(1) | 13.0 | | | 23.9 | | | 48.8 | | | 57.1 | |

Airline income tax expense (benefit)(1)(2) | (1.8) | | | (2.1) | | | 44.6 | | | (1.5) | |

Airline depreciation and amortization(1)(5) | 55.7 | | | 50.1 | | | 164.2 | | | 145.6 | |

Airline special charges(1)(5) | 15.2 | | | 0.1 | | | 15.2 | | | 0.4 | |

Airline EBITDA, excluding special charges(1)(5) | $ | 76.6 | | | $ | 56.8 | | | $ | 410.2 | | | $ | 190.5 | |

| | | | | | | |

| Consolidated EBITDA, excluding special charges (millions) | | | | | | | |

| Net income (loss) as reported (GAAP) | $ | (25.1) | | | $ | (46.5) | | | $ | 119.6 | | | $ | (50.0) | |

| Interest expense, net | 11.9 | | | 25.0 | | | 49.3 | | | 63.0 | |

| Income tax expense (benefit) | (4.9) | | | (9.7) | | | 41.3 | | | (10.9) | |

Depreciation and amortization(5) | 55.8 | | | 50.1 | | | 164.4 | | | 145.6 | |

Special charges, net of recoveries(3) | 32.6 | | | 35.1 | | | 19.8 | | | 35.4 | |

Consolidated EBITDA, excluding special charges(1)(4) | $ | 70.3 | | | $ | 54.0 | | | $ | 394.4 | | | $ | 183.1 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

(1)Denotes non-GAAP figure.

(2)Utilizing an airline-only effective tax rate of 24.5% for 2023 and 12.0% for 2022.

(3)In 2023 and 2022, we recognized as special charges the full amount of estimated property damage to Sunseeker Resort due to weather and other insured events less the amount of recognized insurance recoveries through the end of the applicable period. In 2023 we also recognized accelerated depreciation as special charges related to our revised fleet plan.

(4)Adjusted to exclude the impacts of property damage to Sunseeker Resort, net of recoveries, and aircraft accelerated depreciation charges resulting from our revised fleet plan, as described above.

(5)Adjusted to exclude accelerated depreciation charges related to our revised fleet plan, as described above.

* Note that amounts may not recalculate due to rounding

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

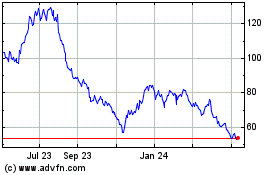

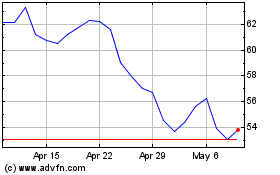

Allegiant Travel (NASDAQ:ALGT)

Historical Stock Chart

From Apr 2024 to May 2024

Allegiant Travel (NASDAQ:ALGT)

Historical Stock Chart

From May 2023 to May 2024