Issuer Free Writing Prospectus

Filed Pursuant to Rule 433

Dated November 6, 2023

Relating to Preliminary Prospectus Supplement Dated November 6, 2023

Registration Statement No. 333-271517

8,800,000 Shares of Common Stock

3,200,000 Pre-funded Warrants to Purchase Shares of Common Stock

This free writing prospectus relates only to the public offering of shares of common stock and pre-funded warrants to purchase shares of common stock by Alpine Immune Sciences, Inc. and should be read together with the preliminary prospectus supplement dated November 6, 2023, or the Preliminary Prospectus Supplement, and the accompanying base prospectus, in each case, including the documents incorporated by reference therein. The information in this free writing prospectus updates and, to the extent inconsistent, supersedes the information in the Preliminary Prospectus Supplement. This free writing prospectus supplements the Preliminary Prospectus Supplement primarily to reflect the addition of certain pre-funded warrants, and the shares of common stock issuable upon the exercise of such pre-funded warrants, to the securities being offered by Alpine Immune Sciences, Inc., and the final pricing terms agreed to by Alpine Immune Sciences, Inc. and the underwriters in this offering. Except as otherwise indicated, all information in this free writing prospectus and the Preliminary Prospectus Supplement assumes no exercise by the underwriters of their option to purchase additional shares of common stock and no exercise of the pre-funded warrants included in this offering.

This free writing prospectus is qualified in its entirety by reference to the Preliminary Prospectus Supplement and the accompanying base prospectus, in each case, including the documents incorporated by reference therein. Financial information and other information presented in the Preliminary Prospectus Supplement or incorporated by reference therein is deemed to have changed to the extent affected by the changes described herein. This free writing prospectus should be read together with the Preliminary Prospectus Supplement and the accompanying base prospectus, in each case, including the documents incorporated by reference therein, before making a decision in connection with an investment in the securities. Capitalized terms used in this free writing prospectus but not defined have the meanings given to them in the Preliminary Prospectus Supplement.

| | | | | | | | |

| Issuer | | Alpine Immune Sciences, Inc. |

| |

| Common stock offered by us | | 8,800,000 shares (10,600,000 shares if the underwriters’ option to purchase additional shares is exercised in full). |

| |

| | | | | | | | |

| Pre-funded warrants offered by us | | We are also offering, in lieu of common stock to certain investors that so choose, pre-funded warrants to purchase 3,200,000 shares of common stock. The purchase price of each pre-funded warrant will equal the public offering price per share minus $0.001. The exercise price of each pre-funded warrant will equal $0.001 per share. Each pre-funded warrant will be exercisable from the date of issuance until the date the warrant is exercised in full, subject to an ownership limitation. See “Description of Pre-Funded Warrants.” This free writing prospectus and the Preliminary Prospectus Supplement also relate to the offering of the shares of common stock issuable upon the exercise of such pre-funded warrants. The lock-up restrictions described in the Preliminary Prospectus Supplement under “Underwriting” will not apply to the issuance of shares of common stock upon the exercise of the pre-funded warrants during the 60-day period following the date of the final prospectus supplement to be filed in connection with this offering. |

| |

| Public offering price | | $12.50 per share of common stock and $12.499 per pre-funded warrant. |

| Net proceeds | | We estimate that the net proceeds to us from this offering will be approximately $140.5 million, or approximately $161.7 million if the underwriters exercise in full their option to purchase additional shares of common stock, after deducting underwriting discounts and commissions and estimated offering expenses payable by us. We will receive nominal proceeds, if any, from the exercise of the pre-funded warrants. |

| |

| Nasdaq trading symbol | | Our shares of common stock are listed on Nasdaq under the symbol “ALPN.” There is no established public trading market for the pre-funded warrants, and we do not expect a market to develop. We do not intend to list the pre-funded warrants on Nasdaq or any other national securities exchange or nationally recognized trading system. Without an active trading market, the liquidity of the pre-funded warrants will be limited. See “Description of Pre-Funded Warrants”. |

RISK FACTORS

We will have broad discretion in the use of proceeds from this offering and our existing cash and cash equivalents and marketable securities, and may invest or spend the proceeds in ways with which you do not agree and in ways that may not yield a return.

We will have broad discretion in the application of the net proceeds to us from this offering, including for any of the purposes described in the section of this prospectus supplement entitled “Use of Proceeds,” and our existing cash and cash equivalents and marketable securities. You may not agree with our decisions, and our use of the proceeds and our existing cash and cash equivalents and marketable securities may not improve our results of operations or enhance the value of our shares of common stock. You will be relying on the judgment of our management regarding the application of the proceeds of this offering. The results and effectiveness of the use of proceeds are uncertain, and we could spend the proceeds in ways that you do not agree with or that do not improve our results of operations or enhance the value of our shares of common stock. Our failure to apply these funds effectively could have a material adverse effect on our business, delay the development of our product candidates and cause the price of our shares of common stock to decline.

New investors in our shares of common stock or pre-funded warrants will experience immediate and substantial dilution after this offering.

Since the public offering price for our shares of common stock and pre-funded warrants in this offering is substantially higher than the net tangible book value per share of common stock outstanding prior to this offering, you will suffer immediate and substantial dilution in the net tangible book value of the shares of common stock or pre-funded warrants you purchase in this offering. If the underwriters exercise their option to purchase additional shares of common stock, you will experience additional dilution. See the section entitled “Dilution” below for a more detailed discussion of the dilution you will incur if you purchase shares in this offering.

The issuance of additional shares of common stock could be dilutive to stockholders if they do not invest in future offerings. In addition, we have a significant number of options to purchase our shares of common stock outstanding. If these options are exercised, you may incur further dilution. Moreover, to the extent that we issue additional options to purchase, or securities convertible into or exchangeable for, shares of common stock in the future and those options or other securities are exercised, converted or exchanged, stockholders may experience further dilution.

There is no public market for the pre-funded warrants being offered in this offering.

There is no public trading market for the pre-funded warrants being offered in this offering, and we do not expect a market to develop. In addition, we do not intend to list the pre-funded warrants on Nasdaq or any other national securities exchange or nationally recognized trading system. Without an active trading market, the liquidity of the pre-funded warrants will be limited.

We will not receive a significant amount or any additional funds upon the exercise of the pre-funded warrants.

Each pre-funded warrant is exercisable for $0.001 per share of common stock underlying such warrant, which may be paid by way of a cashless exercise, in which the holder would receive upon such exercise the net number of shares of common stock determined according to the formula set forth in the pre-funded warrant. Accordingly, we will not receive a significant amount or any additional funds upon the exercise of the pre-funded warrants.

Holders of the pre-funded warrants will have no rights as stockholders until such holders exercise their pre-funded warrants and acquire shares of our common stock.

Until holders of the pre-funded warrants exercise their pre-funded warrants and acquire shares of our common stock, such holders will have no rights with respect to the shares of common stock underlying such pre-funded

warrants. Upon exercise of the pre-funded warrants, the holders will be entitled to exercise the rights of a holder of common stock only as to matters for which the record date occurs after the exercise date.

Significant holders or beneficial owners of our common stock may not be permitted to exercise the pre-funded warrants that they hold.

A holder of the pre-funded warrants will not be entitled to exercise any portion of any pre-funded warrant that, upon giving effect to such exercise, would cause (i) the aggregate number of shares of our common stock beneficially owned by such holder (together with its affiliates) to exceed 9.99% of the number of shares of our common stock outstanding immediately after giving effect to the exercise; or (ii) the combined voting power of our securities beneficially owned by such holder (together with its affiliates) to exceed 9.99% of the combined voting power of all of our securities outstanding immediately after giving effect to the exercise, as such percentage ownership is determined in accordance with the terms of the pre-funded warrants and subject to such holder’s rights under the pre-funded warrants to increase or decrease such percentage to any other percentage not in excess of 19.99% upon at least 61 days’ prior notice from the holder to us. As a result, you may not be able to exercise your pre-funded warrants for shares of our common stock at a time when it would be financially beneficial for you to do so. In such a circumstance, you could seek to sell your pre-funded warrants to realize value, but you may be unable to do so in the absence of an established trading market.

USE OF PROCEEDS

We estimate that the net proceeds to us from this offering will be approximately $140.5 million, or approximately $161.7 million if the underwriters exercise in full their option to purchase additional shares of common stock, after deducting underwriting discounts and commissions and estimated offering expenses payable by us. We will receive nominal proceeds, if any, from the exercise of the pre-funded warrants.

DILUTION

If you invest in our common stock or pre-funded warrants, your interest will be diluted immediately to the extent of the difference between the public offering price per share of common stock or pre-funded warrant you will pay in this offering and the as adjusted net tangible book value per share of our common stock after this offering. Net tangible book value per share of common stock represents our total tangible assets less total liabilities, divided by the number of shares of common stock outstanding.

As of June 30, 2023, our net tangible book value was approximately $169.4 million, or $3.45 per share of common stock. After giving effect to our issuance and sale of 8,800,000 shares of common stock and pre-funded warrants to purchase 3,200,000 shares of common stock in this offering, at the public offering price of $12.50 per share of common stock and $12.499 per pre-funded warrant, including shares of common stock issuable upon exercise of the pre-funded warrants but excluding any resulting accounting impact associated therewith, and after deducting underwriting discounts and commissions and estimated offering expenses payable by us, the as adjusted net tangible book value as of June 30, 2023 would have been $309.9 million, or $5.07 per share of common stock. This represents an immediate increase in as adjusted net tangible book value to existing stockholders of $1.62 per share of common stock and an immediate dilution to new investors purchasing shares of common stock and pre-funded warrants in this offering of $7.43 per share of common stock.

The following table illustrates this per share dilution to the new investors purchasing shares of common stock in this offering:

| | | | | | | | | | | | | | | | | | | | |

| Public offering price per share | | | | | $ | 12.50 | |

| Net tangible book value per share at June 30, 2023 | | $ | 3.45 | | | | |

| Increase in net tangible book value per share attributable to new investors purchasing shares of common stock and pre-funded warrants in this offering | | 1.62 | | | | |

| As adjusted net tangible book value per share after this offering | | $ | 5.07 | | | | |

| Dilution per share to new investors in this offering | | | | | $ | 7.43 | |

If the underwriters exercise their option to purchase an additional 1,800,000 shares of common stock in full, at the public offering price of $12.50 per share of common stock, the as adjusted net tangible book value per share after giving effect to this offering would be $5.26 per share of common stock, representing an immediate increase in net tangible book value (including shares of common stock issuable upon exercise of the pre-funded warrants but excluding any resulting accounting impact associated therewith, and after deducting underwriting discounts and commissions and estimated expenses payable by us) to existing stockholders of $1.81 per share of common stock and immediate dilution in net tangible book value of $7.24 per share of common stock to new investors.

The foregoing table and calculations are based on 49,124,640 shares of common stock outstanding as of June 30, 2023, and excludes:

•8,018,310 shares of common stock issuable upon the exercise of outstanding options to purchase shares of common stock under our equity incentive plans as of June 30, 2023, at a weighted average exercise price of $8.24 per share of common stock;

•160,000 shares of common stock issuable upon the exercise of stand-alone inducement options to purchase shares of common stock issued to certain of our officers outside of our equity incentive plans as of June 30, 2023, at an exercise price of $8.38 per share of common stock;

•385,000 shares of common stock issuable upon the exercise of stand-alone inducement options to purchase shares of common stock issued to certain of our officers outside of our equity incentive plans, granted after June 30, 2023, at a weighted average exercise price of $12.36 per share of common stock;

•110,230 restricted stock units outstanding as of June 30, 2023;

•487,049 shares of common stock reserved for future issuance as of June 30, 2023 under our 2018 Equity Incentive Plan;

•45,211 shares of common stock reserved for future issuance as of June 30, 2023 under our employee stock purchase plan;

•3,656,497 shares of common stock issuable upon the exercise of warrants outstanding as of June 30, 2023, at a weighted-average exercise price of $12.66 per share; and

•pre-funded warrants to purchase up to 3,236,824 shares of common stock outstanding as of June 30, 2023, at an exercise price of $0.001 per share.

DESCRIPTION OF PRE-FUNDED WARRANTS

The following is a summary of certain terms and conditions of the pre-funded warrants being offered in this offering. The following description is subject in all respects to the provisions contained in the pre-funded warrants.

Form

The pre-funded warrants will be issued as individual warrant agreements to the purchasers. The form of pre-funded warrant will be filed as an exhibit to a Current Report on Form 8-K that we expect to file with the SEC.

Term

The pre-funded warrants will expire on the date the warrant is exercised in full.

Exercisability

The pre-funded warrants are exercisable at any time after their original issuance. The pre-funded warrants will be exercisable, at the option of each holder, in whole or in part by delivering to us a duly executed exercise notice and by payment in full of the exercise price in immediately available funds for the number of shares of common stock purchased upon such exercise. As an alternative to payment in immediately available funds, the holder may, in its sole discretion, elect to exercise the pre-funded warrant through a cashless exercise, in which the holder would receive upon such exercise the net number of shares of common stock determined according to the formula set forth in the pre-funded warrant. No fractional shares of common stock will be issued in connection with the exercise of a pre-funded warrant. In lieu of fractional shares, we will pay the holder an amount in cash equal to the fractional amount multiplied by the last closing trading price of our shares of common stock on the exercise date.

Exercise Limitations

We may not effect the exercise of any pre-funded warrant, and a holder will not be entitled to exercise any portion of any pre-funded warrant that, upon giving effect to such exercise, would cause: (i) the aggregate number of shares of common stock beneficially owned by such holder (together with its affiliates) to exceed 9.99% of the number of shares of common stock outstanding immediately after giving effect to the exercise; or (ii) the combined voting power of our securities beneficially owned by such holder (together with its affiliates) to exceed 9.99% of the combined voting power of all of our securities outstanding immediately after giving effect to the exercise, as such percentage ownership is determined in accordance with the terms of the pre-funded warrants. However, any holder of a pre-funded warrant may increase or decrease such percentage to any other percentage not in excess of 19.99% upon at least 61 days’ prior notice from the holder to us.

Exercise Price

The exercise price of our shares of common stock purchasable upon the exercise of the pre-funded warrants is $0.001 per share. The exercise price of the pre-funded warrants and the number of shares of common stock issuable upon exercise of the pre-funded warrants is subject to appropriate adjustment in the event of certain share dividends and distributions, share splits, share combinations, reclassifications or similar events affecting our shares of common stock, as well as upon any distribution of assets, including cash, shares or other property, to our stockholders.

Transferability

Subject to the restrictions on transfer set forth in the pre-funded warrants and applicable laws, the pre-funded warrants may be offered for sale, sold, transferred or assigned without our consent.

Exchange Listing

There is no established trading market for the pre-funded warrants, and we do not expect a market to develop. We do not intend to apply for the listing of the pre-funded warrants on Nasdaq, any other national securities exchange or any other nationally recognized trading system.

Fundamental Transactions

Upon the consummation of a fundamental transaction (as described in the pre-funded warrants, and generally including any merger or consolidation with or into another person, any sale of all or substantially all of our and our subsidiaries’ assets, any reclassification of our common stock (subject to exceptions) and any statutory exchange of our common stock), the holders of the pre-funded warrants will be entitled to receive, upon exercise of the pre-funded warrants, the kind and amount of securities, cash or other property that such holders would have received had they exercised the pre-funded warrants immediately prior to such fundamental transaction, without regard to any limitations on exercise contained in the pre-funded warrants.

No Rights as a Stockholder

Except by virtue of such holder’s ownership of our common stock, the holder of a pre-funded warrant does not have the rights or privileges of a holder of our shares of common stock, including any voting rights, until such holder exercises the pre-funded warrant.

MATERIAL UNITED STATES FEDERAL INCOME TAX CONSIDERATIONS

General Treatment of Pre-Funded Warrants

Although the law in this area is not completely settled, the pre-funded warrants are generally expected to be treated as shares of our common stock for U.S. federal income tax purposes and a holder of pre-funded warrants should generally be taxed in the same manner as a holder of common stock as described in the Preliminary Prospectus Supplement. Accordingly, no gain or loss should be recognized upon the exercise of a pre-funded warrant and, upon exercise, the holding period of a pre-funded warrant should carry over to the common shares received. Similarly, the tax basis of a pre-funded warrant should carry over to the shares of common stock received upon exercise, increased by the exercise price (if applicable). You should discuss with your tax advisor the consequences of the acquisition, ownership and disposition of the pre-funded warrants, as well as the exercise of, certain adjustments to, and any payments in respect of the pre-funded warrants (including potential alternative characterizations). The balance of this discussion generally assumes that the characterization described above is respected for U.S. federal income tax purposes.

Tax Considerations Applicable to U.S. Holders

U.S. Holder Defined

For purposes of this discussion, you are a U.S. holder if you are a beneficial owner of our common stock or pre-funded warrants that is any of the following (or treated as any of the following) and is not a partnership (or other entity classified as a partnership for U.S. federal income tax purposes):

•an individual who is a citizen or resident of the United States (for U.S. federal income tax purposes);

•a corporation or other entity taxable as a corporation created or organized in the United States or under the laws of the United States or any political subdivision thereof;

•an estate whose income is subject to U.S. federal income tax regardless of its source; or

•a trust (x) whose administration is subject to the primary supervision of a U.S. court and that has one or more U.S. persons who have the authority to control all substantial decisions of the trust or (y) that has made a valid election under applicable Treasury Regulations to be treated as a U.S. person.

Distributions

We do not currently anticipate declaring or paying cash dividends on our common stock in the foreseeable future. However, if we do make distributions on our common stock, those payments will constitute dividends for U.S. federal income tax purposes to the extent paid from our current or accumulated earnings and profits, as determined under U.S. federal income tax principles. To the extent those distributions exceed both our current and accumulated earnings and profits, the excess will constitute a return of capital and will first reduce your basis in our common stock, but not below zero, and then will be treated as gain from the sale of stock as described below under “Tax Considerations Applicable to U.S. Holders—Gain on Disposition of Common Stock or Pre-Funded Warrants.” If you are a non-corporate U.S. holder, and certain requirements are met, a preferential U.S. federal income tax rate will apply to any dividends paid to you if you meet certain holding period requirements.

If you are a corporate shareholder, distributions constituting dividends for U.S. federal income tax purposes may be eligible for the dividends received deduction, or DRD. No assurance can be given that we will have sufficient earnings and profits (as determined under U.S. federal income tax principles) to cause any distributions to be eligible for a DRD. In addition, a DRD is available only if certain holding periods and other taxable income requirements are satisfied.

The taxation of a distribution (including a constructive distribution) received with respect to a pre-funded warrant should be treated as a distribution on our common stock as described in this section, although other treatments

may also be possible. You should consult your tax advisors regarding the proper treatment of any payments in respect of the pre-funded warrants.

Gain on Disposition of Our Common Stock or Pre-Funded Warrants

Upon a sale or other taxable disposition of our common stock or pre-funded warrants, you generally will recognize capital gain or loss in an amount equal to the difference between the amount realized and your adjusted tax basis in the common stock or pre-funded warrant. Capital gain or loss will constitute long-term capital gain or loss if your holding period for the common stock or pre-funded warrant exceeds one year. The deductibility of capital losses is subject to certain limitations. U.S. holders who recognize losses with respect to a disposition of our common stock or pre-funded warrants should consult their own tax advisors regarding the tax treatment of such losses.

Certain Adjustments to Pre-Funded Warrants

Under Section 305 of the Code, an adjustment to the number of shares of common stock that will be issued upon the exercise of the pre-funded warrants, or an adjustment to the exercise price of the pre-funded warrants, may be treated as a constructive distribution to you of the pre-funded warrants if, and to the extent that, such adjustment has the effect of increasing your proportionate interest in our earnings and profits or assets, depending on the circumstances of such adjustment (for example, if such adjustment is to compensate for a distribution of cash or other property to our shareholders).

Lapse of Pre-Funded Warrants

If a U.S. holder allows a pre-funded warrant to expire unexercised, such U.S. holder will recognize a capital loss in an amount equal to such holder’s tax basis in pre-funded warrant. The deductibility of capital losses is subject to certain limitations.

Information Reporting and Backup Withholding

Information reporting requirements generally will apply to payments of dividends (including constructive dividends) on the common stock or pre-funded warrants and to the proceeds of a sale or other disposition of common stock or pre-funded warrants paid by us to you unless you are an exempt recipient, such as certain corporations. Backup withholding will apply to those payments if you fail to provide your taxpayer identification number, or certification of exempt status, or if you otherwise fail to comply with applicable requirements to establish an exemption.

Backup withholding is not an additional tax. Rather, any amounts withheld under the backup withholding rules may be allowed as a refund or a credit against your U.S. federal income tax liability, if any, provided the required information is timely furnished to the IRS. You should consult your own tax advisors regarding their qualification for exemption from information reporting and backup withholding and the procedure for obtaining such exemption.

Tax Considerations Applicable to Non-U.S. Holders

Non-U.S. Holder Defined

For purposes of this discussion, you are a non-U.S. holder if you are a beneficial owner of our common stock or pre-funded warrants that is not a U.S. holder, a partnership (or other entity classified as a partnership for U.S. federal income tax purposes), or a partner in a partnership.

Distributions

We have never declared or paid cash dividends on our common stock, and we do not anticipate paying any dividends on our common stock in the foreseeable future. However, if we do make distributions on our common stock, those payments will constitute dividends for U.S. federal income tax purposes to the extent paid from our current or accumulated earnings and profits, as determined under U.S. federal income tax principles. To the extent those distributions exceed both our current and our accumulated earnings and profits, the excess will constitute a return of capital and will first reduce your basis in our common stock, but not below zero, and then will be treated as gain from the sale of stock.

Subject to the discussions below on effectively connected income, backup withholding and FATCA withholding, any dividend paid to you generally will be subject to U.S. federal withholding tax either at a rate of 30% of the gross amount of the dividend or such lower rate as may be specified by an applicable income tax treaty between the United States and your country of residence. In order to receive a reduced treaty rate, you must provide the applicable withholding agent with an IRS Form W-8BEN or W-8BEN-E or other appropriate version of IRS Form W-8 certifying qualification for the reduced rate. A non-U.S. holder of shares of our common stock eligible for a reduced rate of U.S. federal withholding tax pursuant to an income tax treaty may obtain a refund of any excess amounts withheld by filing an appropriate claim for refund with the IRS. If the non-U.S. holder holds our common stock through a financial institution or other agent acting on the non-U.S. holder’s behalf, the non-U.S. holder will be required to provide appropriate documentation to the agent, which then will be required to provide certification to the applicable withholding agent, either directly or through other intermediaries.

Dividends received by you that are treated as effectively connected with your conduct of a U.S. trade or business (and, if required by an applicable income tax treaty, such dividends are attributable to a permanent establishment or fixed base maintained by you in the United States) are generally exempt from the 30% U.S. federal withholding tax, subject to the discussion below on backup withholding and FATCA withholding. In order to obtain this exemption, you must provide the applicable withholding agent with a properly executed IRS Form W-8ECI or other applicable IRS Form W-8 properly certifying such exemption. Such effectively connected dividends, although not subject to U.S. federal withholding tax, are taxed at the same rates applicable to U.S. persons, net of certain deductions and credits. In addition, if you are a corporate non-U.S. holder, dividends you receive that are effectively connected with your conduct of a U.S. trade or business may also be subject to a branch profits tax at a rate of 30% or such lower rate as may be specified by an applicable income tax treaty between the United States and your country of residence. You should consult your tax advisor regarding the tax consequences of the ownership and disposition of our common stock, including any applicable tax treaties that may provide for different rules.

The taxation of a distribution (including a constructive distribution) received with respect to a pre-funded warrant should be treated as a distribution as described in this section, although other treatments may also be possible. You should consult your own tax advisors regarding the proper treatment of any payments in respect of the pre-funded warrants.

Gain on Disposition of Our Common Stock or Pre-Funded Warrants

Subject to the discussion below regarding backup withholding and FATCA withholding, you generally will not be required to pay U.S. federal income tax on any gain realized upon the sale or other disposition of our common stock or pre-funded warrants unless:

•the gain is effectively connected with your conduct of a U.S. trade or business (and, if an applicable income tax treaty so provides, the gain is attributable to a permanent establishment or fixed base maintained by you in the United States);

•you are an individual who is present in the United States for a period or periods aggregating 183 days or more during the calendar year in which the sale or disposition occurs and certain other conditions are met; or

•our common stock or pre-funded warrants constitute a United States real property interest by reason of our status as a United States real property holding corporation, or USRPHC, for U.S. federal income tax

purposes at any time within the shorter of the five-year period preceding your disposition of, or your holding period for, our common stock or pre-funded warrants.

We believe that we are not currently and will not become a USRPHC for U.S. federal income tax purposes, and the remainder of this discussion so assumes. However, because the determination of whether we are a USRPHC depends on the fair market value of our United States real property interests relative to the fair market value of our U.S. and worldwide real property interests plus our other assets used or held for use in a trade or business, there can be no assurance that we will not become a USRPHC in the future. Even if we become a USRPHC, however, as long as our common stock is regularly traded on an established securities market, your common stock will be treated as United States real property interests only if you actually (directly or indirectly) or constructively hold more than five percent of such regularly traded common stock at any time during the shorter of the five-year period preceding your disposition of, or your holding period for, our common stock. Special rules may apply to non-U.S. holders of pre-funded warrants, who should consult their tax advisors regarding the application of these rules.

If you are a non-U.S. holder described in the first bullet above, you will be required to pay tax on the gain derived from the sale (net of certain deductions and credits) under regular U.S. federal income tax rates applicable to U.S. persons, and a corporate non-U.S. holder described in the first bullet above also may be subject to the branch profits tax at a 30% rate, or such lower rate as may be specified by an applicable income tax treaty. If you are an individual non-U.S. holder described in the second bullet above, you will be subject to tax at 30% (or such lower rate specified by an applicable income tax treaty) on the gain derived from the sale, which gain may be offset by U.S. source capital losses for the year, provided you have timely filed U.S. federal income tax returns with respect to such losses. You should consult your tax advisor regarding any applicable income tax or other treaties that may provide for different rules.

Certain Adjustments to Pre-Funded Warrants

Under Section 305 of the Code, an adjustment to the number of shares of common stock that will be issued upon the exercise of the pre-funded warrants, or an adjustment to the exercise price of the pre-funded warrants, may be treated as a constructive distribution to you of the pre-funded warrants if, and to the extent that, such adjustment has the effect of increasing your proportionate interest in our earnings and profits or assets, depending on the circumstances of such adjustment (for example, if such adjustment is to compensate for a distribution of cash or other property to our shareholders).

Information Reporting and Backup Withholding

Generally, we or the applicable paying agent must report annually to the IRS the amount of dividends paid to you, your name and address, and the amount of tax withheld, if any. A similar report will be sent to you. Pursuant to applicable income tax treaties or other agreements, the IRS may make these reports available to tax authorities in your country of residence.

Payments of dividends or of proceeds on the disposition of common stock or pre-funded warrants made to you may be subject to information reporting and backup withholding unless you establish an exemption, for example, by properly certifying your non-U.S. status on an IRS Form W-8BEN, W-8BEN-E or W-8ECI (or another appropriate version of IRS Form W-8) or you otherwise meet the documentary evidence requirements for establishing that you are not a U.S. person or otherwise establish an exemption. Notwithstanding the foregoing, backup withholding and information reporting may apply if either we or the applicable paying agent has actual knowledge, or reason to know, that you are a U.S. person.

Backup withholding is not an additional tax; rather, the U.S. federal income tax liability, if any, of persons subject to backup withholding may be reduced by the amount of tax withheld. If withholding results in an overpayment of taxes, a refund or credit may generally be obtained from the IRS, provided that the required information is furnished to the IRS in a timely manner.

Foreign Account Tax Compliance Act

Sections 1471-1474 of the Code and the Treasury Regulations issued thereunder, commonly referred to collectively as the Foreign Account Tax Compliance Act, or FATCA, generally impose a U.S. federal withholding tax of 30% on dividends on, and, subject to the proposed Treasury Regulations discussed below, the gross proceeds from a sale or other disposition of, our common stock or pre-funded warrants, paid to a “foreign financial institution” (as specially defined under these rules), unless such institution enters into an agreement with the U.S. government to, among other things, withhold on certain payments and to collect and provide to the U.S. tax authorities substantial information regarding the U.S. account holders of such institution (which include certain equity and debt holders of such institution, as well as certain account holders that are foreign entities with U.S. owners) or otherwise establishes an exemption. FATCA also generally imposes a U.S. federal withholding tax of 30% on dividends on, and, subject to the proposed Treasury Regulations discussed below, the gross proceeds from a sale or other disposition of, our common stock or pre-funded warrants paid to a “non-financial foreign entity” (as defined under these rules) unless such entity provides the withholding agent with a certification identifying the direct and indirect U.S. owners of the entity, certifies that it does not have any substantial U.S. owners, or otherwise establishes an exemption. The withholding obligations under FATCA generally apply to dividends on our common stock or pre-funded warrants. The U.S. Department of the Treasury has issued proposed Treasury Regulations providing that, if finalized in their present form, the withholding obligations under FATCA would not apply with respect to payment of gross proceeds from a sale or other disposition of common stock or pre-funded warrants. The proposed Treasury Regulations may be relied upon until final Treasury Regulations are issued. Under certain circumstances, a non-U.S. holder might be eligible for refunds or credits of taxes withheld under FATCA. An intergovernmental agreement between the United States and an applicable foreign country may modify the requirements described in this paragraph. You are encouraged to consult with your own tax advisors regarding the possible implications of FATCA on your investment in our common stock or pre-funded warrants.

You are urged to consult your tax advisor with respect to the application of the U.S. federal income tax laws to your particular situation, as well as any tax consequences of the purchase, ownership and disposition of our common stock or pre-funded warrants, arising under the U.S. federal estate or gift tax laws or under the laws of any state or local, non-U.S. or other taxing jurisdiction or under any applicable tax treaty.

GENERAL

Additional conforming changes are hereby made to the Preliminary Prospectus Supplement to reflect the changes described in this free writing prospectus. All terms of the Preliminary Prospectus Supplement applicable to our shares of our common stock will be applicable to the shares of common stock underlying the pre-funded warrants upon issuance.

Alpine Immune Sciences, Inc. has filed a registration statement (including a preliminary prospectus supplement dated November 6, 2023 and the accompanying base prospectus) with the SEC for the offering to which this communication relates, which registration statement was declared effective on May 9, 2023. Before you invest, you should read the preliminary prospectus supplement and the accompanying base prospectus and other documents Alpine Immune Sciences, Inc. has filed with the SEC for more complete information about Alpine Immune Sciences, Inc. and the offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, copies may be obtained by contacting Morgan Stanley & Co. LLC, Attention: Prospectus Department, 180 Varick Street, 2nd Floor, New York, New York 10014, by telephone: 1-866-718-1649, or by email at prospectus@morganstanley.com; Cowen and Company, LLC, 599 Lexington Avenue, New York, NY 10022, by telephone at (833) 297-2926, or by email at Prospectus_ECM@cowen.com; Leerink Partners LLC, Attention: Syndicate Department, 53 State Street, 40th Floor, Boston, MA 02109, by telephone at (800) 808-7525, ext. 6105, or by email at syndicate@leerink.com; RBC Capital Markets, Attention: Equity Capital Markets, 200 Vesey Street, 8th Floor, New York, NY 10281, by telephone at (877) 822-4089, or by e-mail at equityprospectus@rbccm.com.

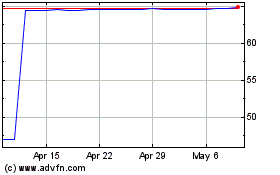

Alpine Immune Sciences (NASDAQ:ALPN)

Historical Stock Chart

From Apr 2024 to May 2024

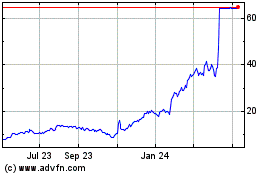

Alpine Immune Sciences (NASDAQ:ALPN)

Historical Stock Chart

From May 2023 to May 2024