AN2 Therapeutics Reports Second Quarter 2024 Financial Results and Recent Business and Scientific Highlights

14 August 2024 - 6:01AM

Business Wire

Cash, cash equivalents, and investments of

$104.5 million at June 30, 2024; cash runway anticipated to fund

operations through 2027

AN2 Therapeutics, Inc. (Nasdaq: ANTX), a biopharmaceutical

company focused on discovering and developing novel small molecule

therapeutics derived from its boron chemistry platform today

reported financial results for the quarter ended June 30, 2024.

“We reported results from the EBO-301 Phase 2/3 study in

patients with treatment-refractory MAC lung disease last week and

over the coming months will further analyze the data to determine

next steps in NTM lung disease,” said Eric Easom, Co-Founder,

Chairman, President and CEO. “Despite this setback, we remain well

positioned as a company - we have a boron chemistry platform with

two development programs that are expected to advance into clinical

trials in 2025. AN2-502998 is expected to enter Phase 1 with an aim

to cure chronic Chagas disease, a potentially life-threatening

illness that causes severe cardiac disease and where there are

limited to no treatment options. We also plan to initiate a Phase 2

trial with epetraborole for the treatment of melioidosis, a deadly

bacterial infection and global bioterrorism threat. Additionally,

we have a pipeline of internally developed boron-based compounds in

research targeting high unmet needs in infectious disease and

oncology and we have the financial runway to allow us to achieve

multiple inflection points over the next three years.”

Second Quarter & Recent Business Updates:

Termination of Epetraborole Pivotal Phase 2/3 Clinical Study

in TR-MAC Lung Disease AN2 recently announced topline results

from the Phase 2 part of the EBO-301 Phase 2/3 study evaluating

epetraborole on top of an optimized background regimen in

treatment-refractory MAC lung disease. The Phase 2 part of the

study met its primary objective of demonstrating the potential

validation of a novel patient-reported outcome (PRO) tool and a

higher PRO-based clinical response rate in the epetraborole + OBR

arm vs. placebo + OBR. However, sputum culture conversion at Month

6, a key secondary endpoint, was similar between treatment arms.

Based on the topline data, the Company has terminated the Phase 2

and Phase 3 parts of the EBO-301 trial. Oral epetraborole 500 mg

daily was generally well-tolerated and the study was not terminated

due to safety concerns. The Company plans to further analyze the

EBO-301 data to better understand the results and their impact on

the ongoing development of epetraborole for nontuberculous

mycobacteria (NTM) lung disease.

Published New Epetraborole Data in Antimicrobial Agents in

Chemotherapy In July, the company published a study in the

journal Antimicrobial Agents in Chemotherapy, which highlighted the

efficacy of epetraborole against M. abscessus in a mouse lung

infection model. The study suggests that epetraborole could become

an important therapy to address the high unmet need for effective

oral treatment options for M. abscessus lung disease.

Selected Second Quarter Financial Results

- Research and Development (R&D) Expenses: R&D

expenses for the second quarter of 2024 were $12.1 million compared

to $13.5 million for the same period during 2023 due to decreased

chemistry manufacturing and controls activity and decreased

expenses for completed Phase 1 clinical trials, partially offset by

increased Phase 2/3 clinical trial costs, increased consulting and

outside service costs and increased personnel-related

expenses.

- General and Administrative (G&A) Expenses: G&A

expenses for the second quarter of 2024 were $3.7 million compared

to $3.1 million for the same period during 2023 due to an increase

in personnel-related expenses and professional and outside

services.

- Other Income, Net: Other income, net for the second

quarter of 2024 was $1.4 million compared to $0.8 million for the

same period during 2023 due to increased interest income based on

higher interest rates and higher cash, cash equivalents and

investment balances.

- Net loss: Net loss for the second quarter of 2024 was

$14.4 million, compared to $15.8 million for the same period during

2023.

- Cash Position: The Company had cash, cash equivalents,

and investments of $104.5 million at June 30, 2024, which is

expected to fund operations through 2027.

About AN2 Therapeutics, Inc.

AN2 Therapeutics, Inc. is a biopharmaceutical company focused on

discovering and developing novel small molecule therapeutics

derived from its boron chemistry platform. AN2 has a pipeline of

boron-based compounds in development for Chagas disease, NTM, and

melioidosis, along with early-stage programs focused on targets in

infectious diseases and oncology. For more information, please

visit our website at www.an2therapeutics.com.

Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of

1995. Forward-looking statements expressed or implied in this press

release include, but are not limited to, statements regarding: the

Company’s plans to shift its focus to its internal boron chemistry

platform and ongoing pipeline programs; cash runway; analysis and

expectations regarding data analysis from the Phase 2/3 trial in

treatment-refractory MAC lung disease; future development of

epetraborole for M. abscessus and other forms of NTM; initiation,

advancement and timing of the Company’s clinical trials;

achievement and timing of potential inflection points; the ability

to identify development candidates for infectious diseases or

oncology targets; development of AN2-502998 for Chagas disease;

development of epetraborole for melioidosis; potential of the

Company’s boron chemistry platform and epetraborole; and other

statements that are not historical fact. These statements are based

on AN2’s current estimates, expectations, plans, objectives, and

intentions, are not guarantees of future performance and inherently

involve significant risks and uncertainties. Actual results and the

timing of events could differ materially from those anticipated in

such forward-looking statements as a result of these risks and

uncertainties, which include, but are not limited to, risks and

uncertainties related to: potential disruptions related to AN2’s

restructuring plans and its ability to implement its plans for its

internal boron chemistry platform and ongoing pipeline programs;

timely enrollment of patients in AN2’s existing and future clinical

trials; AN2’s ability to procure sufficient supply of its product

candidates for its existing and future clinical trials; the

potential for results from clinical trials to differ from

preclinical, early clinical, preliminary or expected results;

significant adverse events, toxicities or other undesirable side

effects associated with AN2’s product candidates; the significant

uncertainty associated with AN2’s product candidates ever receiving

any regulatory approvals; continued funding by the National

Institute of Allergy and Infectious Disease (NIAID) of the

Company’s development program for melioidosis; AN2’s ability to

obtain, maintain or protect intellectual property rights related to

its current and future product candidates; implementation of AN2’s

strategic plans for its business and product candidates; the

sufficiency of AN2’s capital resources and need for additional

capital to achieve its goals; global macroeconomic conditions and

global conflicts and other risks, including those described under

the heading “Risk Factors” in AN2’s Annual Reports on Form 10-K and

Quarterly Reports on Form 10-Q, and AN2’s other reports filed with

the U.S. Securities and Exchange Commission (SEC). These filings,

when made, are available on the investor relations section of AN2’s

website at www.an2therapeutics.com and on the SEC’s website at

www.sec.gov. Forward-looking statements contained in this press

release are made as of this date, and AN2 undertakes no duty to

update such information except as required under applicable

law.

AN2 THERAPEUTICS, INC.

CONDENSED STATEMENTS OF

OPERATIONS AND COMPREHENSIVE LOSS

(in thousands, except share

and per share data)

(unaudited)

Three Months Ended June

30,

Six Months Ended June

30,

2024

2023

2024

2023

Operating expenses:

Research and development

$

12,149

$

13,538

$

26,804

$

25,523

General and administrative

3,731

3,063

7,372

7,117

Total operating expenses

15,880

16,601

34,176

32,640

Loss from operations

(15,880

)

(16,601

)

(34,176

)

(32,640

)

Other income, net

1,445

797

3,124

1,513

Net loss attributable to common

stockholders

$

(14,435

)

$

(15,804

)

$

(31,052

)

$

(31,127

)

Net loss per share attributable to common

stockholders, basic and diluted

$

(0.48

)

$

(0.81

)

$

(1.04

)

$

(1.60

)

Weighted-average number of shares used in

computing net loss per share, basic and diluted

29,824,725

19,497,494

29,794,001

19,442,010

Other comprehensive loss:

Unrealized (loss) gain on investments

(80

)

56

(302

)

255

Comprehensive loss

$

(14,515

)

$

(15,748

)

$

(31,354

)

$

(30,872

)

AN2 THERAPEUTICS, INC.

CONDENSED BALANCE

SHEETS

(in thousands)

June 30, 2024

(unaudited)

December 31, 2023

Assets

Current assets:

Cash and cash equivalents

$

26,769

$

15,647

Short-term investments

77,771

91,648

Prepaid expenses and other current

assets

2,898

3,212

Long-term investments

—

27,194

Other assets, long-term

1,043

1,043

Total assets

$

108,481

$

138,744

Liabilities and stockholders’

equity

Current liabilities:

Accounts payable

$

1,885

$

2,676

Other current liabilities

8,242

11,367

Total liabilities

10,127

14,043

Stockholders’ equity

98,354

124,701

Total liabilities and stockholders’

equity

$

108,481

$

138,744

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240813783660/en/

Lucy O. Day Chief Financial Officer

l.day@an2therapeutics.com

Anne Bowdidge Investor Relations

abowdidge@an2therapeutics.com

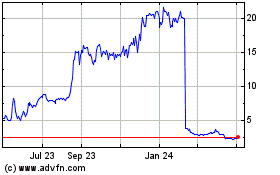

AN2 Therapeutics (NASDAQ:ANTX)

Historical Stock Chart

From Oct 2024 to Nov 2024

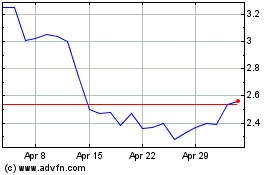

AN2 Therapeutics (NASDAQ:ANTX)

Historical Stock Chart

From Nov 2023 to Nov 2024