false

0001697532

0001697532

2024-08-07

2024-08-07

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d)

of

the Securities Exchange Act of 1934

Date of Report (Date of

earliest event reported): August 7, 2024

APPLIED THERAPEUTICS, INC.

(Exact name of registrant as specified in its charter)

| Delaware |

|

001-38898 |

|

81-3405262 |

(State or Other Jurisdiction of

Incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer Identification No.) |

545 Fifth Avenue, Suite 1400

New York, NY 10017 |

|

10017 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s telephone number,

including area code: (212) 220-9226

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written communications pursuant to Rule 425 under the Securities

Act (17 CFR 230.425) |

| | |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange

Act (17 CFR 240.14a-12) |

| | |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under

the Exchange Act (17 CFR 240.14d-2(b)) |

| | |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under

the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of

the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which

registered |

| Common Stock |

|

APLT |

|

The Nasdaq Global Market |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or

Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company x

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act.

Item

2.02. Results of Operations and Financial Condition.

On August 7, 2024, Applied Therapeutics, Inc. (the “Company”)

issued a press release announcing its financial results for the quarter ended June 30, 2024. A copy of the press release is furnished

as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

The information provided in this Form 8-K, including Exhibit 99.1

hereto, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the

“Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference

into any of the Company’s filings under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth

by specific reference in such filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits:

The following exhibit is attached with this current report on Form 8-K:

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

APPLIED THERAPEUTICS, INC. |

| |

|

|

| Dated: August 7, 2024 |

By: |

/s/ Shoshana Shendelman |

| |

Name: |

Shoshana Shendelman |

| |

Title: |

President and Chief Executive Officer |

Exhibit 99.1

Applied Therapeutics Reports Second Quarter

2024 Financial Results

- NDA and MAA

for govorestat for treatment of Classic Galactosemia under FDA Priority Review and EMA review; PDUFA target action date of November 28,

2024, and EMA decision expected in early Q1 2025

- FDA Genetic

Metabolic Diseases Advisory Committee (GeMDAC) Meeting to discuss NDA for govorestat for the treatment of Classic Galactosemia tentatively

scheduled for October 9, 2024

- Company aligned

with the Neurology I Division on plans to submit an NDA under Accelerated Approval for govorestat for the treatment of SORD Deficiency;

Expect to submit an NDA in early Q1 2025

NEW YORK, August 7,

2024 – Applied Therapeutics, Inc. (Nasdaq: APLT) (the “Company”), a clinical-stage biopharmaceutical

company developing a pipeline of novel drug candidates against validated molecular targets in indications of high unmet medical need,

today reported financial results for the second quarter ended June 30, 2024.

“Momentum continues with our steady regulatory progress in Classic

Galactosemia and SORD Deficiency,” said Shoshana Shendelman, PhD, Founder and CEO of Applied Therapeutics. “We are incredibly

pleased to share our alignment with the Neurology Division of the FDA regarding a potential second NDA submission for govorestat for the

treatment of SORD Deficiency. Both Galactosemia and SORD Deficiency are rare neurological diseases with no currently approved treatment

options. At Applied, we are dedicated to creating transformative treatments for rare diseases, and we continue to work closely with regulatory

agencies and patient advocacy groups to ensure that treatments become available for patients with these debilitating diseases.”

Recent Highlights

| · | Govorestat PDUFA Target Action Date of November 28, 2024; MAA under

CHMP Review by EMA; Updated Cognition Data Included in Review. In the process of preparing for the United States Food and Drug Administration

(FDA) inspection, it was discovered that the vendor hired to compile NIH Toolbox data for the Company used an adult formula for calculation

of about one third of composite cognition and motor skills scores. Adjusting the formula to the pediatric formula resulted in significantly

improved data for cognition as compared to the prior data, demonstrating improvement in the govorestat (AT-007) treated group of approximately

8 points on a standard scale, which was statistically significant compared to placebo (p=0.032). This also resulted in a statistically

significant effect on the primary endpoint sensitivity analysis which included cognition (p=0.034). The motor skills data did not change

substantially. These updates were disclosed and discussed with the FDA and European Medicines Agency (EMA) and will be used

in the ongoing evaluation of the New Drug Application (NDA) and Marketing Authorization Application (MAA). As previously announced, the

FDA Prescription Drug User Fee Act (PDUFA) target action date is November 28, 2024. Govorestat was previously granted Pediatric Rare

Disease designation and will qualify for a Priority Review Voucher (PRV) upon approval. The Company has also submitted a MAA for govorestat

for the treatment of Classic Galactosemia to the EMA, which was validated in December 2023 and is under review by the EMA’s

Committee for Medicinal Products for Human Use (CHMP). As previously announced, in April 2024, the EMA granted a 3-month extension

to the Day 120 clock stop period to allow sufficient time for responses to the CHMP’s Day 120 list of questions. The Company expects

a decision by the EMA early in the first quarter of 2025. The NDA and MAA submission packages are supported by rapid and sustained reduction

in galactitol, which resulted in a meaningful benefit on clinical outcomes across pediatric patients, alongside a favorable safety profile.

The submission packages include clinical outcomes data from the Phase 3 registrational ACTION-Galactosemia Kids study in children aged

2-17 with Galactosemia, the Phase 1/2 ACTION-Galactosemia study in adult patients with Galactosemia, and preclinical data. If approved,

govorestat would be the first medication indicated for the treatment of Galactosemia and would be Applied Therapeutics’ first commercial

product. |

| · | FDA Advisory Committee Meeting to Review Govorestat NDA for the Treatment

of Classic Galactosemia Tentatively Scheduled for October 9, 2024. The FDA notified the Company of their tentative plans to convene

the Genetic Metabolic Diseases Advisory Committee (GeMDAC) on October 9, 2024, to discuss the Company’s NDA for govorestat

for the treatment of Classic Galactosemia. The date is tentative and has not yet been confirmed in the federal register. The newly formed

GeMDAC will consist of experts in the fields of medical genetics, inborn errors of metabolism, epidemiology, and other related specialties. |

| · | Company Aligned with the Neurology I Division of the FDA on Potential

Submission of an NDA for Govorestat for the Treatment of SORD Deficiency Under Accelerated Approval. In July 2024, the Company

held a Type C meeting with the FDA to align on the regulatory path forward for govorestat for the treatment of SORD Deficiency. The Neurology

I Division confirmed that the data generated to-date was appropriate for a potential NDA submission under the FDA’s Accelerated

Approval Program, and discussed the design of a new confirmatory study to be completed as a post-marketing requirement. The Company plans

to hold a pre-NDA meeting to discuss administrative aspects of the submission in the second half of this year, and expects to submit an

NDA early in the first quarter of 2025. If govorestat is approved for the treatment of Classic Galactosemia, the regulatory submission

for the treatment of SORD will be submitted as a supplementary New Drug Application (sNDA). Patients in the INSPIRE study will be offered

open-label govorestat treatment and will be followed for additional safety data generation. The review and potential approval of govorestat

for SORD is independent of the ongoing review of govorestat for Classic Galactosemia. |

| · | APLT

Added to Russell 3000® Index. In June 2024, as part of the Russell

indexes annual reconstitution, the Company was added to the Russell 3000®

Index, a market capitalization-weighted equity index that tracks the performance of the largest

3,000 U.S. stocks. Membership of the Russell indexes is primarily determined by objective,

market-capitalization rankings and style attributes. Russell indexes are widely used by investment

managers and institutional investors for index funds and as benchmarks for active investment

strategies. |

| · | Participated in Multiple Medical and Patient Advocacy Group Focused Conferences.

In the second and third quarters of 2024, the Company deepened its relationships and partnership with the patient community, presenting

data and giving keynote addresses at the following medical meetings and patient advocacy group conferences: |

| o | Hereditary Neuropathy Foundation (HNF) Charcot-Marie Tooth Syndrome (CMT) Summit, June 7-8 in San Diego, California; |

| o | Charcot-Marie-Tooth Associate (CMTA) Strategy to Accelerate Research (STAR) Advisory Board meeting held June 21 in Montreal,

Canada; |

| o | Peripheral Nerve Society (PNS) 2024 Annual Meeting, held June 22-25 in Montreal, Canada; |

| o | Sponsored and presented at the 2024 Galactosemia Foundation Conference, held July 18-20 in Concord, North Carolina. |

Financial Results

| · | Cash and cash equivalents and short-term investments

totaled $122.2 million as of June 30, 2024, compared with $49.9 million at December 31, 2023. |

| · | Research

and development expenses for the three months ended June 30, 2024, were $10.0 million,

compared to $11.9 million for the three months ended June 30, 2023. The decrease of

approximately $1.9 million was primarily related to decreased expenses associated with clinical

and pre-clinical expenses for the near completion of AT-001 and AT-007 and drug manufacturing

and formulation costs, partially offset by an increase in regulatory and personnel expenses. |

| · |

General and administrative expenses were $10.6 million for the

three months ended June 30, 2024, compared to $5.3 million for the three months ended June 30, 2023. The increase of

approximately $5.3 million was primarily related to an increase in legal and professional fees of $1.3 million, an increase in

commercial expenses to support planned commercialization of govorestat of $3.5 million, and an increase in personnel expenses of $1.1 million due

to increased headcount and salary increases, offset by a decrease in stock-based compensation, insurance expenses and other

miscellaneous expense. |

| · | Net

income for the second quarter of 2024 was $2.9 million, or $0.02 per basic common share

and a net loss of $0.13 per diluted common share, compared to a net loss of $29.6 million,

or $0.37 per basic and diluted common share, for the second quarter of 2023. |

| · | Cash runway: The Company expects

that its cash and cash equivalents will fund the business into 2026. Additionally, the Company expects that the sale of the priority

review voucher (PRV), which would be granted upon a potential NDA approval of govorestat for the treatment of Galactosemia, could

substantially extend the Company’s cash runway. |

About Applied Therapeutics

Applied Therapeutics is a clinical-stage biopharmaceutical company

developing a pipeline of novel drug candidates against validated molecular targets in indications of high unmet medical need. The Company’s

lead drug candidate, govorestat, is a novel central nervous system penetrant Aldose Reductase Inhibitor (ARI) for the treatment of CNS

rare metabolic diseases, including Galactosemia, SORD Deficiency, and PMM2-CDG. The Company is also developing AT-001, a novel potent

ARI, for the treatment of Diabetic Cardiomyopathy, or DbCM, a fatal fibrosis of the heart. The preclinical pipeline also includes AT-003,

an ARI designed to cross through the back of the eye when dosed orally, for the treatment of Diabetic retinopathy.

To learn more, please visit www.appliedtherapeutics.com

and follow the company on Twitter @Applied_Tx.

Forward-Looking Statements

This press release contains “forward-looking statements”

that involve substantial risks and uncertainties for purposes of the safe harbor provided by the Private Securities Litigation Reform

Act of 1995. Any statements, other than statements of historical fact, included in this press release regarding the strategy, future operations,

prospects, plans and objectives of management, including words such as “may,” “will,” “expect,” “anticipate,”

“plan,” “intend,” “predicts” and similar expressions (as well as other words or expressions referencing

future events, conditions or circumstances) are forward-looking statements. These include, without limitation, statements regarding the

(i) Company’s expectation that its cash and cash equivalents will fund the business into 2026; (ii) the likelihood that

the Company’s ongoing NDA and MMA submissions will be approved and the timing of any decision and (iii) statements related

to the scheduling or timing of any potential FDA or EMA meetings, interactions or submissions. Forward-looking statements in this release

involve substantial risks and uncertainties that could cause actual results to differ materially from those expressed or implied by the

forward-looking statements, and we, therefore cannot assure you that our plans, intentions, expectations or strategies will be attained

or achieved.

Such risks and uncertainties include, without limitation, (i) our

plans to develop, market and commercialize our product candidates, (ii) the initiation, timing, progress and results of our current

and future preclinical studies and clinical trials and our research and development programs, (iii) our ability to take advantage

of expedited regulatory pathways for any of our product candidates, (iv) our estimates regarding expenses, future revenue, capital

requirements and needs for additional financing, (v) our ability to successfully acquire or license additional product candidates

on reasonable terms and advance product candidates into, and successfully complete, clinical studies, (vi) our ability to maintain

and establish collaborations or obtain additional funding, (vii) our ability to obtain and timing of regulatory approval of our current

and future product candidates, (viii) the anticipated indications for our product candidates, if approved, (ix) our expectations

regarding the potential market size and the rate and degree of market acceptance of such product candidates, (x) our ability to fund

our working capital requirements and expectations regarding the sufficiency of our capital resources, (xi) the implementation of

our business model and strategic plans for our business and product candidates, (xii) our intellectual property position and the

duration of our patent rights, (xiii) developments or disputes concerning our intellectual property or other proprietary rights,

(xiv) our expectations regarding government and third-party payor coverage and reimbursement, (xv) our ability to compete in

the markets we serve, (xvi) the impact of government laws and regulations and liabilities thereunder, (xvii) developments relating

to our competitors and our industry, (xviii) our ability to achieve the anticipated benefits from the agreements entered into in

connection with our partnership with Advanz Pharma and (xiv) other factors that may impact our financial results. In light of the

significant uncertainties in these forward-looking statements, you should not rely upon forward-looking statements as predictions of future

events. Although we believe that we have a reasonable basis for each forward-looking statement contained in this press release, we cannot

guarantee that the future results, levels of activity, performance or events and circumstances reflected in the forward-looking statements

will be achieved or occur at all. Factors that may cause actual results to differ from those expressed or implied in the forward-looking

statements in this press release are discussed in our filings with the U.S. Securities and Exchange Commission, including the “Risk

Factors” contained therein. Except as otherwise required by law, we disclaim any intention or obligation to update or revise any

forward-looking statements, which speak only as of the date they were made, whether as a result of new information, future events or circumstances

or otherwise.

Contacts

Investors:

Julie Seidel/Andrew Vulis

646-970-0543

appliedtherapeutics@argotpartners.com

Media:

media@appliedtherapeutics.com

Applied Therapeutics, Inc.

Condensed Balance Sheets

(in thousands, except share and per share data)

(Unaudited)

| | |

As of | | |

As of | |

| | |

June 30, | | |

December 31, | |

| | |

2024 | | |

2023 | |

| ASSETS | |

| | | |

| | |

| CURRENT ASSETS: | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 122,197 | | |

$ | 49,898 | |

| Security deposits and leasehold improvements | |

| 253 | | |

| 254 | |

| Prepaid expenses and other current assets | |

| 5,122 | | |

| 4,234 | |

| Total current assets | |

| 127,572 | | |

| 54,386 | |

| Operating lease right-of-use asset | |

| 206 | | |

| 447 | |

| TOTAL ASSETS | |

$ | 127,778 | | |

$ | 54,833 | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY/(DEFICIT) | |

| | | |

| | |

| CURRENT LIABILITIES: | |

| | | |

| | |

| Current portion of operating lease liabilities | |

$ | 185 | | |

$ | 429 | |

| Accounts payable | |

| 2,683 | | |

| 1,742 | |

| Accrued expenses and other current liabilities | |

| 10,296 | | |

| 15,286 | |

| Warrant liabilities | |

| 42,192 | | |

| 53,725 | |

| Total current liabilities | |

| 55,356 | | |

| 71,182 | |

| NONCURRENT LIABILITIES: | |

| | | |

| | |

| Noncurrent portion of operating lease liabilities | |

| 30 | | |

| 38 | |

| Clinical holdback - long-term portion | |

| — | | |

| 759 | |

| Total noncurrent liabilities | |

| 30 | | |

| 797 | |

| Total liabilities | |

| 55,386 | | |

| 71,979 | |

| STOCKHOLDERS’ EQUITY/(DEFICIT): | |

| | | |

| | |

| Common stock, $0.0001 par value; 250,000,000 shares authorized as of June 30, 2024 and 200,000,000 shares authorized as of December 31, 2023; 114,846,271 shares issued and outstanding as of June 30, 2024 and 84,869,832 shares issued and outstanding as of December 31, 2023 | |

| 11 | | |

| 8 | |

| Preferred stock, par value $0.0001; 10,000,000 shares authorized as of June 30, 2024 and December 31, 2023; 0 shares issued and outstanding as of June 30, 2024 and December 31, 2023 | |

| — | | |

| — | |

| Additional paid-in capital | |

| 622,007 | | |

| 451,432 | |

| Accumulated deficit | |

| (549,626 | ) | |

| (468,586 | ) |

| Total stockholders' equity/(deficit) | |

| 72,392 | | |

| (17,146 | ) |

| TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY/(DEFICIT) | |

$ | 127,778 | | |

$ | 54,833 | |

Applied Therapeutics, Inc.

Condensed Statements of Operations

(in thousands, except share and per share data)

(Unaudited)

| | |

Three Months Ended | | |

Six Months Ended | |

| | |

June 30, | | |

June 30, | |

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| REVENUE: | |

| | | |

| | | |

| | | |

| | |

| License revenue | |

$ | — | | |

$ | — | | |

$ | — | | |

$ | 10,660 | |

| Research and development services revenue | |

| 144 | | |

| — | | |

| 334 | | |

| — | |

| Total revenue | |

| 144 | | |

| — | | |

| 334 | | |

| 10,660 | |

| COSTS AND EXPENSES: | |

| | | |

| | | |

| | | |

| | |

| Research and development | |

| 10,004 | | |

| 11,883 | | |

| 22,221 | | |

| 27,818 | |

| General and administrative | |

| 10,580 | | |

| 5,293 | | |

| 19,646 | | |

| 10,876 | |

| Total costs and expenses | |

| 20,584 | | |

| 17,176 | | |

| 41,867 | | |

| 38,694 | |

| LOSS FROM OPERATIONS | |

| (20,440 | ) | |

| (17,176 | ) | |

| (41,533 | ) | |

| (28,034 | ) |

| OTHER (EXPENSE) INCOME, NET: | |

| | | |

| | | |

| | | |

| | |

| Interest income | |

| 628 | | |

| 408 | | |

| 1,215 | | |

| 628 | |

| Change in fair value of warrant liabilities | |

| 22,744 | | |

| (12,804 | ) | |

| (40,660 | ) | |

| (12,335 | ) |

| Other (expense) income, net | |

| (34 | ) | |

| (5 | ) | |

| (62 | ) | |

| 27 | |

| Total other income (expense), net | |

| 23,338 | | |

| (12,401 | ) | |

| (39,507 | ) | |

| (11,680 | ) |

| Net income (loss) | |

$ | 2,898 | | |

$ | (29,577 | ) | |

$ | (81,040 | ) | |

$ | (39,714 | ) |

| Net income (loss) per share attributable to common stockholders—basic | |

$ | 0.02 | | |

$ | (0.37 | ) | |

$ | (0.60 | ) | |

$ | (0.59 | ) |

| Net income (loss) per share attributable to common stockholders—diluted | |

$ | (0.13 | ) | |

$ | (0.37 | ) | |

$ | (0.60 | ) | |

$ | (0.59 | ) |

| Weighted-average common stock outstanding—basic | |

| 143,934,239 | | |

| 79,041,695 | | |

| 134,627,942 | | |

| 67,762,501 | |

| Weighted-average common stock outstanding—diluted | |

| 152,392,748 | | |

| 79,041,695 | | |

| 134,627,942 | | |

| 67,762,501 | |

v3.24.2.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

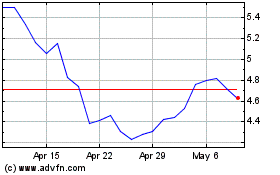

Applied Therapeutics (NASDAQ:APLT)

Historical Stock Chart

From Nov 2024 to Dec 2024

Applied Therapeutics (NASDAQ:APLT)

Historical Stock Chart

From Dec 2023 to Dec 2024