Filed Pursuant to Rule 424(b)(3)

Registration No. 333-261679

PROSPECTUS SUPPLEMENT NO. 2

(To the Prospectus dated December 23, 2021)

20,143,404 Shares of Common Stock

This prospectus supplement supplements the prospectus, dated December 23, 2021 (as amended, the “Prospectus”), which forms a part of our registration statement on Form S-1 (No. 333-261679). This prospectus supplement is being filed to update and supplement the information in the Prospectus with the information contained in our Current Report on Form 8-K filed with the Securities and Exchange Commission on January 31, 2022 (the “Current Report”) other than the information included in Item 2.01 and Exhibit 99.1, which was furnished and not filed. Accordingly, we have attached the Current Report to this prospectus supplement.

The Prospectus and this prospectus supplement relate to the offer and resale of up to 20,143,404 shares (the “Shares”) of our common stock, $0.0001 per share (the “Common Stock”), by B. Riley Principal Capital, LLC (the “Selling Stockholder”). The shares included in the Prospectus consist of shares of Common Stock that we have issued or that we may, in our discretion, elect to issue and sell to the Selling Stockholder, from time to time after the date of the Prospectus, pursuant to a common stock purchase agreement we entered into with the Selling Stockholder on December 15, 2021 (the “Purchase Agreement”), in which the Selling Stockholder has committed to purchase from us, at our direction, up to $100,000,000 of our Common Stock, subject to terms and conditions specified in the Purchase Agreement. Concurrently with our execution of the Purchase Agreement on December 15, 2021, we issued 197,628 shares of Common Stock to the Selling Stockholder as consideration for its irrevocable commitment to purchase shares of our Common Stock at our election in our sole discretion, from time to time after the date of the Prospectus, upon the terms and subject to the satisfaction of the conditions set forth in the Purchase Agreement. See the section titled “Committed Equity Financing” in the Prospectus for a description of the Purchase Agreement and the section titled “Selling Stockholder” in the Prospectus for additional information regarding the Selling Stockholder.

We are not selling any shares of Common Stock being offered by the Prospectus and will not receive any of the proceeds from the sale of such shares by the Selling Stockholder. However, we may receive up to $100,000,000 in aggregate gross proceeds from sales of our Common Stock to the Selling Stockholder that we may, in our discretion, elect to make, from time to time after the date of the Prospectus, pursuant to the Purchase Agreement.

The Selling Stockholder may sell or otherwise dispose of the shares of Common Stock included in the Prospectus in a number of different ways and at varying prices. See the section titled “Plan of Distribution” in the Prospectus for more information about how the Selling Stockholder may sell or otherwise dispose of the Common Stock being offered in the Prospectus. The Selling Stockholder is an “underwriter” within the meaning of Section 2(a)(11) of the Securities Act of 1933, as amended.

The Common Stock is listed on the Nasdaq Global Select Market (“Nasdaq”) under the symbol “APPH”. On January 28, 2022, the last reported sales price of our Common Stock on Nasdaq was $3.40 per share.

This prospectus supplement should be read in conjunction with the Prospectus, including any amendments or supplements thereto, which is to be delivered with this prospectus supplement. This prospectus supplement is qualified by reference to the Prospectus, including any amendments or supplements thereto, except to the extent that the information in this prospectus supplement updates and supersedes the information contained therein.

This prospectus supplement is not complete without, and may not be delivered or utilized except in connection with, the Prospectus, including any amendments or supplements thereto.

We are incorporated in Delaware as a public benefit corporation. See “Prospectus Summary — Public Benefit Corporation” in the Prospectus.

Investing in our securities involves a high degree of risk. You should review carefully the risks and uncertainties described in the section titled ”Risk Factors” beginning on page 11 of the Prospectus and under similar headings in any amendments or supplements to the Prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities, or passed upon the accuracy or adequacy of this prospectus supplement or the Prospectus. Any representation to the contrary is a criminal offense.

Prospectus Supplement dated January 31, 2022.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 31, 2022

AppHarvest, Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

|

Delaware

|

001-39288

|

82-5042965

|

|

(State or other jurisdiction of incorporation)

|

(Commission File Number)

|

(IRS Employer Identification No.)

|

|

|

|

|

|

|

|

|

500 Appalachian Way

Morehead, KY

|

40351

|

|

(Address of principal executive offices)

|

(Zip Code)

|

Registrant’s telephone number, including area code: (606) 653-6100

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligations of the registrant under any of the following provisions:

|

|

|

|

|

|

|

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of each exchange on which registered

|

|

Common Stock, $0.0001 par value per share

|

|

APPH

|

|

The Nasdaq Stock Market LLC

|

|

Warrants, each whole warrant exercisable for one share of Common Stock at an exercise price of $11.50 per share

|

|

APPHW

|

|

The Nasdaq Stock Market LLC

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

|

|

|

|

|

|

|

|

Emerging growth company

|

☐

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On January 31, 2022, AppHarvest, Inc. (the “Company”), issued a press release announcing certain preliminary unaudited financial results for the quarter and year ended December 31, 2021. The preliminary results are based on currently available information and do not present all necessary information for a complete understanding of the Company’s financial condition as of December 31, 2021 or its results of operations for the quarter and year ended December 31, 2021. A copy of the press release is attached hereto as Exhibit 99.1.

The press release attached hereto as Exhibit 99.1 is furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or subject to the liabilities of that Section or Sections 11 and 12(a)(2) of the Securities Act of 1933, as amended. The information contained herein and in the accompanying Exhibit 99.1 shall not be incorporated by reference into any filing with the Securities and Exchange Commission made by us, whether made before or after the date hereof, regardless of any general incorporation language in such filing.

Item 8.01 Other Events.

On January 31, 2022, the Company announced that the 15-acre Berea, Kentucky, salad greens facility and the 60-acre Richmond, Kentucky, tomato facility are both approximately 65% complete and expected to be fully operational by the end of 2022. A 30-acre Somerset, Kentucky, berry facility is more than 50% complete and is also expected to be operational by the end of 2022.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Exhibit No.

|

|

Description

|

|

99.1

|

|

|

|

104

|

|

Cover Page Interactive Data File (embedded within the Inline XBRL document).

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

AppHarvest, Inc.

|

|

|

|

|

Dated: January 31, 2022

|

|

|

|

By:

|

/s/ Loren Eggleton

|

|

|

|

Loren Eggleton

|

|

|

|

Chief Financial Officer

|

|

|

|

(Principal Financial Officer and Principal Accounting Officer)

|

AppHarvest (NASDAQ:APPH)

Historical Stock Chart

From Apr 2024 to May 2024

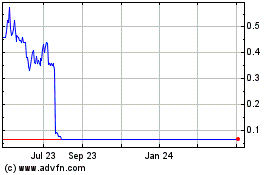

AppHarvest (NASDAQ:APPH)

Historical Stock Chart

From May 2023 to May 2024