UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

|

☐

|

Preliminary Proxy Statement

|

| |

|

|

☐

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

| |

|

| ☒ |

Definitive Proxy Statement

|

| |

|

| ☐ |

Definitive Additional Materials

|

| |

|

|

☐

|

Soliciting Material Pursuant to Section 240.14a-12

|

ARAVIVE, INC.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (check the appropriate box):

|

☒

|

No fee required.

|

| |

|

|

☐

|

Fee paid previously with preliminary materials.

|

| |

|

|

☐

|

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a6(i)(1) and 0-11.

|

3730 Kirby Drive, Suite 1200

Houston, Texas 77098

AMENDMENT NO. 1 TO PROXY STATEMENT

For the 2023 Annual Meeting of Stockholders to be held on October 2, 2023

Explanatory Note

This Amendment No.1 to the Proxy Statement (this “Amendment”) is being filed to amend the definitive proxy statement filed by Aravive, Inc. (the “Company”) with the U.S. Securities and Exchange Commission (“SEC”) on September 5, 2023 (the “Proxy Statement”) and made available to the Company’s stockholders in connection with the solicitation of proxies by the Company’s Board of Directors (the “Board”) for use at the 2023 Annual Meeting of Stockholders, scheduled to be held on Monday, October 2, 2023 at 8:00 a.m. Eastern Time (the “Annual Meeting”). This Amendment is being filed with the SEC on or about September 22, 2023.

Except as specifically amended herein, all information in the Proxy Statement remains unchanged. No other changes have been made to the Proxy Statement. If you have already returned your proxy card or provided voting instructions, you do not need to take any action unless you wish to change your vote. This Amendment should be read in conjunction with the Proxy Statement, which should be read in its entirety and is available free of charge on the SEC’s website at www.sec.gov. Page number references below are to page numbers in the Proxy Statement, and capitalized terms used but not defined herein have the meanings set forth in the Proxy Statement. To the extent the information in this Amendment differs from or conflicts with the information contained in the Proxy Statement, the information set forth in this Amendment shall be deemed to supersede the respective information in the Proxy Statement.

This Amendment is being filed to correct the disclosure in the Proxy Statement related to, and calculated based upon, the number of the Company’s shares outstanding on the Record Date, August 3, 2023, which number was inadvertently understated in the Proxy Statement. Accordingly, this Amendment(i) updates the disclosure on pages 2, 6 and 54 of the Proxy Statement regarding the number of shares of common stock outstanding and entitled to vote on the Record Date of the Annual Meeting; (ii) updates the disclosure on pages 39, 41, 45 and 47 related to the percentage of the Company’s shares owned, as of August 3, 2023, by members of our Board of Directors and Executive Officers who have indicated that they will vote in favor of the Assignment; and the Dissolution; and (ii) updates the table on page 54 of the Proxy Statement under the heading “Security Ownership of Certain Beneficial Owners and Management”. On the Record Date there were 62,068,380 shares of common stock outstanding and entitled to vote.

******

On page 2, “Who can vote at the 2023 Annual Meeting” is amended and restated in its entirety as follows:

|

Q:

|

Who can vote at the 2023 Annual Meeting?

|

|

A:

|

Only stockholders of record at the close of business on August 3, 2023 (the “Record Date”), will be entitled to vote at the 2023 Annual Meeting. On the Record Date, there were 62,068,380 shares of common stock outstanding and entitled to vote.

Stockholder of Record: Shares Registered in Your Name

If on August 3, 2023 your shares were registered directly in your name with the Company’s transfer agent, American Stock Transfer & Trust Company, LLC, then you are a stockholder of record. As a stockholder of record, you may directly vote your shares in person at the 2023 Annual Meeting or submit a proxy to have your shares voted. Even if you plan to attend the 2023 Annual Meeting, we urge you to fill out and return the enclosed proxy card or submit a proxy on the internet or by telephone as instructed below to ensure your vote is counted.

Beneficial Owner: Shares Registered in the Name of a Broker or Bank

If on August 3, 2023 your shares were held, not in your name, but rather in an account at a brokerage firm, bank, dealer or other similar organization, then you are the beneficial owner of shares held in “street name” and these proxy materials are being forwarded to you by that organization. The organization holding your account is considered to be the stockholder of record for purposes of voting at the 2023 Annual Meeting. As a beneficial owner, you have the right to direct your broker or other agent regarding how to vote the shares in your account. You will receive voting instructions from your broker, bank or nominee describing the available processes for voting your stock.

|

******

On page 6, “How many shares are outstanding and how many votes is each share entitled?” is amended and restated in its entirety as follows:

|

Q:

|

How many shares are outstanding and how many votes is each share entitled?

|

|

A:

|

Each share of our common stock that is issued and outstanding as of the close of business on August 3, 2023, the Record Date, is entitled to be voted on all items being voted on at the 2023 Annual Meeting, with each share being entitled to one vote on each matter. As of the Record Date, August 3, 2023, 62,068,380 shares of common stock were issued and outstanding.

|

On page 39, “What vote of stockholders is required to approve the Assignment?” is amended and restated in its entirety as follows:

What vote of stockholders is required to approve the Assignment?

Under Section 271(a) of the General Corporation Law of the State of Delaware (“Delaware Law”), a Delaware corporation must obtain stockholder approval, by the holders of a majority of the voting power of the outstanding stock of the corporation entitled to vote thereon, before proceeding with a sale of all or substantially all of its property and assets, as contemplated by the Assignment. The Board therefore is seeking stockholder approval of the Assignment in order to comply with Delaware Law. Members of our Board of Directors and Executive Officers holding, in the aggregate, 43.3% of our outstanding shares as of August 3, 2023, have indicated that they will vote in favor of the Assignment.

******

On page 41, the first paragraph under “INTEREST OF CERTAIN PERSONS IN THE ASSIGNMENT” is amended and restated in its entirety as follows:

Members of the Board of Directors and Executive Officers holding, in the aggregate, 26,865,750 shares of our common stock, representing 43.3% of our outstanding shares as of August 3, 2023, including a majority of the members of the Board of Directors, have voted in favor of submitting the Assignment to a vote of stockholders. If the stockholders approve the Assignment and the Board of Directors effects the Assignment, upon the appointment of the Assignee one or more members of the Board of Directors may resign as directors of the Company.

******

On page 45, “What vote of stockholders is required to approve the Dissolution?” is amended and restated in its entirety as follows:

What vote of stockholders is required to approve the Dissolution?

Approval of the Dissolution requires approval by the holders of a majority of the voting power of all outstanding shares of the Company. Members of our Board of Directors and Executive Officers holding, in the aggregate, 43.3% of our outstanding shares as of August 3, 2023, which includes a majority of the members of the Board of Directors, have indicated that they will vote in favor of the Dissolution.

******

On page 47, the first paragraph under “INTEREST OF CERTAIN PERSONS IN THE DISSOLUTION” is amended and restated in its entirety as follows:

Members of the Board of Directors and Executive Officers owning, in the aggregate, 26,865,750 shares of our common stock, representing 43.3% of the voting stock as of August 3, 2023, which includes a majority of the members of the Board of Directors, have voted in favor of submitting the Dissolution to a vote of stockholders.

******

On page 54 under the heading, “SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT” the table is amended and restated in its entirety as follows:

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information regarding the beneficial ownership of our common stock as of August 3, 2023 by: (i) each director; (ii) each of the executive officers named in the Summary Compensation Table; (iii) all current executive officers and directors of the Company as a group; and (iv) all those known by us to be beneficial owners of more than five percent of its common stock.

| |

|

Beneficial Ownership (1)

|

|

|

Beneficial Owner

|

|

Number of Shares

|

|

|

Percent of Total

|

|

|

Greater than 5% stockholders other than executive officers and directors:

|

|

|

|

|

|

|

|

|

|

Eshelman Ventures, LLC (2)

|

|

|

42,684,225 |

|

|

|

53.9 |

%

|

|

Invus Public Equities, L.P and its affiliated entities (3)

|

|

|

6,381,331 |

|

|

|

9.99 |

%

|

|

Entities affiliated with BVF Partners (4)

|

|

|

6,363,134 |

|

|

|

9.99 |

%

|

|

Entities affiliated with Baker Bros. Advisors, L.P. (5)

|

|

|

4,660,700 |

|

|

|

7.5 |

%

|

|

Named Executive officers and directors:

|

|

|

|

|

|

|

|

|

|

Fredric N. Eshelman, Pharm. D. (6)

|

|

|

42,830,855 |

|

|

|

54.0 |

%

|

|

Amato Giaccia, Ph.D. (7)

|

|

|

1,798,042 |

|

|

|

2.9 |

%

|

|

Michael W. Rogers (8)

|

|

|

149,886 |

|

|

|

* |

|

|

Eric Zhang (9)

|

|

|

2,102,432 |

|

|

|

3.3 |

%

|

|

Rudy Howard (10)

|

|

|

112,365 |

|

|

|

* |

|

|

Gail McIntyre (11)

|

|

|

634,574 |

|

|

|

1.0 |

%

|

|

Leonard Scott Dove (12)

|

|

|

75,000 |

|

|

|

* |

|

|

Peter T.C. Ho, M.D., Ph.D. (13)

|

|

|

247,259 |

|

|

|

* |

|

|

John A. Hohneker, M.D. (14)

|

|

|

137,553 |

|

|

|

* |

|

|

Sigurd C. Kirk (15)

|

|

|

137,553 |

|

|

|

* |

|

|

Vinay Shah (16)

|

|

|

594,049 |

|

|

|

1.0 |

%

|

|

All current executive officers and directors as a group (10 persons) (17)

|

|

|

48,225,519 |

|

|

|

58.8 |

%

|

|

*

|

Represents beneficial ownership of less than one percent (1%) of the outstanding common stock.

|

|

(1)

|

This table is based upon information supplied by officers, directors and principal stockholders and Schedules 13D and 13G filed with the SEC. Unless otherwise indicated in the footnotes to this table and subject to community property laws where applicable, we believe that each of the stockholders named in this table has sole voting and investment power with respect to the shares indicated as beneficially owned. Applicable percentages are based on 62,068,380 shares outstanding on August 3, 2023, adjusted as required by rules promulgated by the SEC. Beneficial ownership of shares is determined in accordance with the rules of the SEC and includes voting and investment power with respect to the shares. Shares of common stock subject to outstanding options that are exercisable within 60 days of August 3, 2023 are deemed outstanding for computing the percentage of ownership of the person holding such options. Shares of Common Stock issuable upon exercise of the Warrants issued in the Private Placement and other financing are deemed outstanding for computing the percentage of ownership of the person holding such Warrants. Unless otherwise indicated, the address of each beneficial owner listed in the table below is c/o Aravive, Inc., River Oaks Tower, 3730 Kirby Drive, Suite 1200, Houston, Texas 77098.

|

|

(2)

|

Information for Eshelman Ventures, LLC is based upon a Schedule 13D/A filed with the SEC on November 3, 2022. Consists of: (i) 25,517,889 shares of Common Stock directly held by Eshelman Ventures, LLC, an entity wholly owned by Dr. Eshelman; (ii) 860,216 shares of Common Stock issuable upon exercise of the March Warrants; and (iii) 16,306,120 shares of Common Stock issuable upon exercise of the October Warrants. The address for Eshelman Ventures, LLC is 319 North 3rd Street, Suite 301, Wilmington, North Carolina 28401.

|

|

(3)

|

Information is based upon a Schedule 13G/A filed with the SEC on February 13, 2023 by Invus Public Equities, L.P (“Invus Public Equities”), Invus Public Equities Advisors, LLC (“Invus PE Advisors”), Artal International S.C.A (“Artal International”), Artal International Management S.A. (“Artal International Management”), Artal Group S.A. (“Artal Group”), Westend S.A.(“Westend”), Stichting Administratiekabntoor Westland (“Stichting”) and Mr. Amaury Wittouck (“Wittouck”), as updated for the outstanding share number as of August 3, 2023, assuming no sales of shares or exercises subsequent to the filing of the Schedule 13G/A. Invus Public Equities directly holds 4,572,515 shares of Common Stock and October Warrants to purchase an additional 7,609,522 shares of common stock, subject to a 9.99% beneficial ownership limitation in the warrants. As of December 31, 2022, Invus Public Equities and its affiliated entities listed above beneficially owned an aggregate of 6,132,553 shares of Common Stock, consisting of (i) 4,572,515 shares of Common Stock and (ii) 1,560,038 shares of Common Stock issuable upon exercise of certain of the October Warrants. Based on the updated outstanding share number as of August 3, 2023, assuming no sales of shares or exercises subsequent to the filing of the Schedule 13G/A, as of August 3, 2023, Invus Public Equities, L.P and its affiliated entities, beneficially 6,381,331 shares of Common Stock including 1,808,816 shares of Common Stock issuable upon exercise of certain of the October Warrants. Invus PE Advisors, as the general partner of Invus Public Equities, controls Invus Public Equities and accordingly may be deemed to beneficially own the shares of Common Stock held by Invus Public Equities. The Geneva branch of Artal International, as the managing partner of Invus PE Advisors, controls Invus PE Advisors and, accordingly, may be deemed to beneficially own the shares of Common Stock that Invus PE Advisors Artal International Management, as the managing partner of Artal International, controls Artal International and, accordingly, may be deemed to beneficially own the shares of Common Stock that Artal International may be deemed to beneficially own. Artal Group, as the sole stockholder of Artal International Management, controls Artal International Management and, accordingly, may be deemed to beneficially own the shares of Common Stock that Artal International Management may be deemed to beneficially own. Westend, as the parent company of Artal Group, controls Artal Group and, accordingly, may be deemed to beneficially own the shares of Common Stock that Artal Group may be deemed to beneficially own. The Stichting, as majority shareholder of Westend, controls Westend and, accordingly, may be deemed to beneficially own the shares of common stock that Westend may be deemed to beneficially own. Mr. Wittouck, as the sole member of the board of the Stichting, controls the Stichting and, accordingly, may be deemed to beneficially own the shares of common stock that the Stichting may be deemed to beneficially own. The address for Invus Public Equities and Invus PE Advisors is 750 Lexington Avenue, 30th Floor, New York, New York 10022. The address for Artal International, Artal International Management and Artal Group, Westend is Valley Park, 44, Rue de la Vallée, L-2661, Luxembourg. The address for Stichting is Claude Debussylaan, 46, 1082 MD Amsterdam, The Netherlands. The address for Wittouck is Valley Park, 44, Rue de la Vallée, L-2661, Luxembourg.

|

|

(4)

|

Information is based on a Schedule 13G filed with the SEC on November 7, 2022 by Biotechnology Value Fund, L.P. (“BVF”), BVF I GP LLC (“BVF GP”), Biotechnology Value Fund II, L.P.(BVF 2”), BVF II GP LLC (“BVF 2 GP”), Biotechnology Value Trading Fund OS LP (“Trading Fund OS”), BVF Partners OS Ltd. (‘Partners OS”) , BVF GP Holdings LLC (“BVF GPH”), BVF Partners L.P. (‘Partners”), BVF Inc., and Mark N. Lampert (“Lampert”) (BVF, BVF GP, BVF 2, BVF 2 GP, Trading Fund OS, Partners OS, BVF GPH, Partners, BVF Inc. and Lampert collectively, the “BVF Affiliates”) as updated for the outstanding share number as of August 3, 2023, assuming no sales of shares or exercises subsequent to the filing of the Schedule 13G. As of the close of business on November 7, 2022 (i) BVF beneficially owned 3,908,320 shares of Common Stock including 1,324,744 shares of Common Stock underlying certain October Pre-Funded Warrants held by it and excluding 1,961,882 shares of common stock underlying certain October Pre-Funded Warrants held by it; (ii) BVF2 beneficially owned 1,961,528 shares of Common Stock, excluding 2,495,477 shares of Common Stock underlying the October Pre-Funded Warrants held by it; and (iii) Trading Fund OS beneficially owned 191,368 shares of Common Stock, excluding 243,461 shares of Common Stock underlying the October Pre-Funded Warrants held by it. BVF GP, as the general partner of BVF, may be deemed to beneficially own the 3,908,320 shares of Common Stock beneficially owned by BVF. BVF2 GP, as the general partner of BVF2, may be deemed to beneficially own the 1,961,528 shares of Common Stock beneficially owned by BVF2. Partners OS, as the general partner of Trading Fund OS, may be deemed to beneficially own the 191,368 shares of Common Stock beneficially owned by Trading Fund OS. BVF GPH, as the sole member of each of BVF GP and BVF2 GP, may be deemed to beneficially own the 5,869,848 shares of Common Stock beneficially owned in the aggregate by BVF and BVF2. Partners, as the investment manager of BVF, BVF2 and Trading Fund OS, and the sole member of Partners OS, may be deemed to beneficially own the 6,109,058 shares of Common Stock beneficially owned in the aggregate by BVF, BVF2 and Trading Fund OS and held in a certain Partners managed account (the “Partners Managed Account”), including 47,842 shares of Common Stock held in the Partners Managed Account, which excludes 60,865 shares of Common Stock underlying the October Pre-Funded Warrants held in the Partners Managed Account. BVF Inc., as the general partner of Partners, may be deemed to beneficially own the 6,109,058 shares of Common Stock beneficially owned by Partners. Mr. Lampert, as a director and officer of BVF Inc., may be deemed to beneficially own the 6,109,058 shares of Common Stock beneficially owned by BVF Inc. The October Pre-Funded Warrants and the October Warrants are subject to a 9.99% beneficial ownership limitation in the October Warrants. Based on the updated outstanding share number as of August 3, 2023, assuming no sales of shares or exercises subsequent to the filing of the Schedule 13G, as of August 3, 2023 the BVF Affiliates, beneficially own 6,363,134 shares of Common Stock including 1,626,662 shares of Common Stock issuable upon exercise of certain of the October Warrants. The address for Biotechnology Value Fund, L.P., BVF I GP LLC, Biotechnology Value Fund II, L.P., BVF II GP LLC, BVF GP Holdings LLC, BVF Partners L.P., BVF Inc., and Mark N. Lampert is 44 Montgomery St., 40Th Floor, San Francisco, California 94104. The address for Biotechnology Value Trading Fund OS LP and BVF Partners OS Ltd.is PO Box 309 Ugland House, Grand Cayman, KY1-1104.

|

|

(5)

|

Information is based on a Schedule 13G filed with the SEC on February 14, 2023 by Baker Bros. Advisors LP (the “Adviser”), Baker Bros. Advisors (GP) LLC (the “Adviser GP”), Felix J. Baker and Julian C. Baker (collectively, the “Baker Brothers Reporting Persons”) as updated for the outstanding share number as of August 3, 2023, assuming no sales of shares or exercises subsequent to the filing of the Schedule 13G. 667, L.P. and Baker Brothers Life Sciences, L.P. (collectively, the “Funds”) own 447,661 and 4,138,743, shares of our Common Stock, respectively. The Funds also hold October Warrants to purchase an aggregate of 4,586,404 shares of Common Stock, subject to a 4.99% beneficial ownership limitation in the October Common Stock Warrants and a 7.5% beneficial ownership limitation in the October Pre-Funded Warrants. Based on the updated outstanding share number as of August 3, 2023, assuming no sales of shares or exercises subsequent to the filing of the Schedule 13G, as of August 3, 2023 the Baker Brothers Reporting Persons, beneficially own 4,660,700 shares of Common Stock including 74,296 shares of Common Stock issuable upon exercise of certain of the October Warrants. Pursuant to the management agreements, as amended, among the Adviser, the Funds and their respective general partners, the Funds’ respective general partners relinquished to the Adviser all discretion and authority with respect to the investment and voting power of the securities held by the Funds, and thus the Adviser has complete and unlimited discretion and authority with respect to the Funds’ investments and voting power. The Adviser GP is the sole general partner of the Adviser. The Adviser GP, Felix J. Baker and Julian C. Baker as managing members of the Adviser GP, and the Adviser may be deemed to be beneficial owners of securities of the Issuer directly held by the Funds. The business address for Baker Brothers Reporting Persons is 860 Washington Street, 3rd Floor, New York, New York 10014.

|

|

(6)

|

Includes 146,630 shares of Common Stock issuable pursuant to stock options exercisable within 60 days of August 3, 2023, 860,216 shares of Common Stock issuable upon exercise of the March Warrants, and 16,306,120 shares of Common Stock issuable upon exercise of the October Warrants.

|

|

(7)

|

Includes an aggregate of 312,626 shares of Common Stock issuable pursuant to stock options exercisable within 60 days of August 3, 2023 and 271,768 shares of Common Stock issuable upon exercise of the October Warrants.

|

|

(8)

|

Includes an aggregate of 149,886 shares of Common Stock issuable pursuant to stock options exercisable within 60 days of August 3, 2023.

|

|

(9)

|

Includes an aggregate of 155,592 shares of Common Stock issuable pursuant to stock options exercisable within 60 days of August 3, 2023 and 543,537 shares of Common Stock issuable upon exercise of the October Warrants.

|

|

(10)

|

Includes an aggregate of 90,625 shares of Common Stock issuable pursuant to stock options exercisable within 60 days of August 3, 2023 and 10,870 shares of Common Stock issuable upon exercise of the October Warrants.

|

|

(11)

|

Includes an aggregate of 512,231 shares of Common Stock issuable pursuant to stock options exercisable within 60 days of August 3, 2023 and 54,353 shares of Common Stock issuable upon exercise of the October Warrants.

|

|

(12)

|

Includes an aggregate of 75,000 shares of Common Stock issuable pursuant to stock options exercisable within 60 days of August 3, 2023.

|

|

(13)

|

Includes: (i) 54,353 shares of Common Stock owned by the Peter Ho Trust 2016 (the “Peter Ho Trust”); (ii) 1,000 shares owned by the Hui Ping Ho Trust 2016 (the “Hui Ping Ho Trust”); and (iii) an aggregate of 137,553 shares of Common Stock issuable pursuant to stock options exercisable within 60 days of August 3, 2023 and 54,353 shares of Common Stock issuable upon exercise of the October Warrants. Dr. Ho is the beneficiary and co-trustee of the Peter Ho Trust, with shared voting and disposition power over the shares held by the Peter Ho Trust together with his wife, Hui Ping Ho, as co-trustee of the Peter Ho Trust. Hui Ping Ho is the beneficiary and co-trustee of the Hui Ping Ho Trust, with shared voting and disposition power over the shares held by the Hui Ping Ho Trust, together with Dr. Ho, as co-trustee of the Hui Ping Ho Trust. The address for the Peter Ho Trust and the Hui Ping Ho Trust is c/o Aravive, Inc. River Oaks Tower, 3730 Kirby Drive, Suite 1200, Houston, Texas 77098.

|

|

(14)

|

Includes an aggregate of 137,553 shares of Common Stock issuable pursuant to stock options exercisable within 60 days of August 3, 2023.

|

|

(15)

|

Includes an aggregate of 137,553 shares of Common Stock issuable pursuant to stock options exercisable within 60 days of August 3, 2023.

|

|

(16)

|

Includes an aggregate of 403,207 shares of Common Stock issuable pursuant to stock options exercisable within 60 days of August 3, 2023.

|

|

(17)

|

Consists of 28,269,053 shares held by the directors and current executive officers, an aggregate of 1,855,249 shares issuable pursuant to stock options exercisable within 60 days of August 3, 2023 and 18,101,217 shares of Common Stock issuable upon exercise of the March and October Warrants. As of September 1, 2023, we had 73,562,648 shares of Common Stock outstanding and our directors and current executive officers beneficially owned 51. 6 % of our outstanding shares of Common Stock.

|

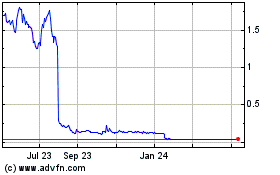

Aravive (NASDAQ:ARAV)

Historical Stock Chart

From Mar 2024 to May 2024

Aravive (NASDAQ:ARAV)

Historical Stock Chart

From May 2023 to May 2024