UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

14A

(Rule

14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☐

Filed by a Party other than the Registrant ☒

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☒ | Soliciting Material Under § 240.14a-12 |

AMERISERV FINANCIAL, INC.

|

(Name of Registrant as Specified In Its Charter)

|

| |

DRIVER MANAGEMENT COMPANY LLC

DRIVER OPPORTUNITY PARTNERS I LP

J. ABBOTT R. COOPER

|

(Name of Persons(s) Filing Proxy Statement, if other than the Registrant)

|

Payment of Filing Fee (Check all boxes that apply):

| ☐ | Fee paid previously with preliminary materials |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

Driver Management Company

LLC, together with the other participants named herein (collectively, “Driver”), intends to nominate director candidates and

file a preliminary proxy statement and accompanying WHITE proxy card with the Securities and Exchange Commission to be used to solicit

votes for the election of its slate of highly-qualified director nominees at the 2023 annual meeting of shareholders of AmeriServ Financial,

Inc., a Pennsylvania corporation (the “Company”).

Item 1: On January 12,

2023, J. Abbott R. Cooper, Managing Member of Driver Management Company LLC (“Driver Management”), was quoted in the following

article by American Banker:

Activist investor wants multiple seats on Pennsylvania

bank's board

By John Reosti January 12, 2023,

5:39 p.m.

After accumulating an 8% ownership stake in AmeriServ

Financial, a prominent activist investor is seeking a big say in how the Johnstown, Pennsylvania, community bank is run.

Abbott Cooper, founder and managing member of Driver

Management Co. in New York, has a track record of pursuing change at community banks he deems "underperforming." Cooper says

he believes the $1.4 billion-asset AmeriServ — which reported a return on assets of 0.65% and an efficiency ratio north of

81% through the first nine months of 2022 — is ripe for a shake-up.

To that end, Cooper is seeking three seats on AmeriServ's

board. Cooper said he is likely to occupy one of the seats himself. He wants the other two for a pair of colleagues, though he has yet

to identify them.

AmeriServ has 10 directors, including President and

CEO Jeffrey Stopko. According to the company's most recent proxy statement, three directors are up for reelection in 2023.

AmeriServ hasn't ruled out agreeing to Cooper's terms.

It said Thursday in a written statement it was "always open to considering director candidates put forth by shareholders."

"In addition to asking Driver to share its ideas

for enhancing our ongoing value-creation efforts, we have invited the firm to provide director-candidate biographies and make individuals

available for interviews," the company added.

However, Cooper said he is disinclined to give the

board a say in the matter.

"We've asked them to make changes at the board

level," Cooper said in an interview. "If they're not ready to do that, we'll take the matter to the shareholders. … We

don't have any interest in letting a board that has done nothing for shareholders over the past 20 years limit who shareholders can vote

for as directors."

AmeriServ has been a presence in Johnstown for well

over a century, with community-banking roots stretching back to 1901. Founded as United States National Bank of Johnstown, it rebranded

as AmeriServ in May 2001. It put Stopko in charge in 2015.

For the first nine months of 2022, AmeriServ reported

net income of $6.5 million, up 23% from the same period in 2021. Cooper is focused more on AmeriServ's performance metrics, most notably

its efficiency ratio and return on assets, both of which lag industry averages. The efficiency ratio in particular "is way too high,"

Cooper said. According to the Federal Deposit Insurance Corp., the average ROA for community banks was 1.13% on Sept. 30. The average

efficiency ratio was 60%.

Cooper labeled the company a "prolonged underperformer."

"The management team is just not doing it, and

the board doesn't want to hold them accountable for poor performance," Cooper said.

For its part, AmeriServ said it "has been producing

strong year-over-year net income and earnings-per-share growth thanks to our balance sheet strength, risk management efforts and diversification

of our revenue streams in areas such as wealth management. As we've emerged from the pandemic, our strategy has helped drive solid total

shareholder returns on an absolute and relative basis."

One area where AmeriServ appears to have had few if

any problems is asset quality. Net charge-offs are near rock bottom while nonperforming assets were 0.44% of total loans on Sept. 30.

Cooper is no stranger to proxy contests.

Indeed, since 2020, Cooper and Driver have launched

campaigns against three community banks, First United Corp. in Oakland, Maryland, Republic First Bancorp in Philadelphia and Codorus

Valley Bancorp in York, Pennsylvania. In April 2021, the $1.8 billion-asset First United agreed to pay Driver $9.8 million to

settle outstanding litigation and purchase its shares in the company.

Codorus and Republic both entered into cooperation

agreements, agreeing to add Driver-nominated candidates to their boards of directors. The $2.3 billion-asset Codorus appointed John Kiernan

April 12. Republic First, with $6 billion of assets, appointed Peter Bartholow Oct. 4.

Many of his investments proceed more smoothly. On

Monday, The First of Long Island Corp. in Melville, New York, agreed to nominate Cooper for a director seat at its 2023 annual meeting

and renominate him in 2025 as part of a cooperation agreement between the company and Driver.

"We look forward to having Mr. Cooper join the

board of The First of Long Island Corporation and believe that his experience in, and knowledge of, the financial services business will

add value to the board's governance and oversight deliberations and responsibilities," Chairman Walter Teagle said Monday in a press

release.

Cooper owns about 136,000 shares of The First of

Long Island, amounting to an ownership stake of just under 1%.

Item 2: On January 12,

2023, Driver published the following message on Twitter:

Item 3: On January 12,

2023, Driver published the following message on LinkedIn:

Item 4: On January 13,

2023, J. Abbott R. Cooper, Managing Member of Driver Management was quoted in the following article by S&P Global:

Activist investor pushes for board seats, pay review

at AmeriServ Financial

Friday, January 13, 2023 3:33 PM ET

By Jake Mooney

Driver Management Co. LLC is pushing for a "complete

overhaul" at AmeriServ Financial Inc., demanding the appointment of three new board members, thorough reviews of compensation practices

and the performance of President and CEO Jeffrey Stopko.

Driver held an 8.05% stake in AmeriServ Financial

as of Dec. 29, 2022, making it the company's top institutional shareholder, according to S&P Global Market Intelligence data. AmeriServ

Financial is the holding company of AmeriServ Financial Bank.

In letters to AmeriServ Chairman Allan Dennison beginning

in November 2022, Driver Managing Member Abbott Cooper criticized AmeriServ's historic return on assets, which he said has underperformed

peers in the Dow Jones U.S. MicroCap Banks Index over the last decade.

Cooper wrote that Dennison had attributed the lag

in part to costs associated with AmeriServ's unionized labor force, which contrasts with its competitors. The investor said he has spoken

with other AmeriServ shareholders, and believes most share his view that the company "habitually blames poor performance on the costs

of a unionized workforce, rather than on a complacent management team and an irresponsible board of directors."

Cooper in the December 2022 letter asked for AmeriServ

to appoint him and two others identified by Driver to three vacant board seats, and to make him chair of the nominating and corporate

governance committee. He also asked for another Driver appointee to become chair of the compensation committee. Cooper is further seeking

to be appointed as a member of the company's executive committee, and for that committee to review Stopko's performance and identify possible

successors. He also is pushing for a review of executive and board compensation and the creation of targeted incentives to improve performance.

Driver would be willing to formalize the actions in

a cooperation agreement, he said.

A spokesperson for AmeriServ in an email to S&P

Global Market Intelligence said the company has produced "strong year-over-year net income and earnings per share growth" and

touted its revenue diversification in areas like wealth management.

"As we've emerged from the pandemic, our strategy

has helped drive solid total shareholder returns on an absolute and relative basis," the spokesperson said.

The company is "always open to considering director

candidates put forth by shareholders," the spokesperson said, and it has invited Driver to provide director candidate biographies

and make individuals available for interviews.

CERTAIN INFORMATION CONCERNING THE PARTICIPANTS

Driver Management Company LLC, together with the other

participants named herein (collectively, “Driver”), intends to nominate director candidates and file a preliminary proxy statement

and accompanying WHITE universal proxy card with the Securities and Exchange Commission (“SEC”) to be used to solicit votes

for the election of its slate of highly-qualified director nominees at the 2023 annual meeting of shareholders of AmeriServ Financial,

Inc., a Pennsylvania corporation (the “Company”).

DRIVER STRONGLY ADVISES ALL SHAREHOLDERS OF THE COMPANY

TO READ THE PROXY STATEMENT AND OTHER PROXY MATERIALS AS THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. SUCH PROXY

MATERIALS WILL BE AVAILABLE AT NO CHARGE ON THE SEC’S WEB SITE AT HTTP://WWW.SEC.GOV.

IN ADDITION, THE PARTICIPANTS IN THIS PROXY SOLICITATION WILL PROVIDE COPIES OF THE PROXY STATEMENT WITHOUT CHARGE, WHEN AVAILABLE, UPON

REQUEST. REQUESTS FOR COPIES SHOULD BE DIRECTED TO THE PARTICIPANTS’ PROXY SOLICITOR.

The participants in the proxy solicitation are anticipated

to be Driver Management Company LLC (“Driver Management”), Driver Opportunity Partners I LP (“Driver Opportunity”)

and J. Abbott R. Cooper.

As of the date hereof, the participants in the proxy

solicitation beneficially own in the aggregate 1,477,919 shares of Common Stock, par value $0.01 per share, of the Company (the “Common

Stock”). As of the date hereof, Driver Opportunity directly beneficially owns 201,000 shares of Common Stock, including 1,000 shares

held in record name. Driver Management, as the general partner of Driver Opportunity and investment manager to certain separately managed

accounts (the “SMAs”), may be deemed to beneficially own the (i) 201,000 shares of Common Stock directly beneficially owned

by Driver Opportunity and (ii) 1,477,919 shares of Common Stock held in the SMAs. Mr. Cooper, as the managing member of Driver Management,

may be deemed to beneficially own the (i) 201,000 shares of Common Stock directly beneficially owned by Driver Opportunity and (ii) 1,477,919

shares of Common Stock held in the SMAs.

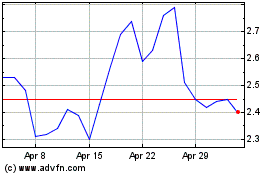

AmeriServ Financial (NASDAQ:ASRV)

Historical Stock Chart

From Mar 2024 to Apr 2024

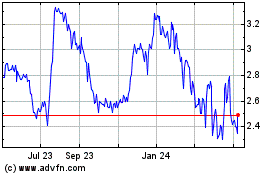

AmeriServ Financial (NASDAQ:ASRV)

Historical Stock Chart

From Apr 2023 to Apr 2024