false

0001350102

0001350102

2024-03-06

2024-03-06

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C.

20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d) of

The

Securities Exchange Act of 1934

Date of Report (Date of

earliest event reported): March 7, 2024 (March

6, 2024)

ASCENT SOLAR

TECHNOLOGIES, INC.

(Exact name of registrant

as specified in its charter)

| Delaware |

|

001-32919 |

|

20-3672603 |

| (State or other jurisdiction of incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer Identification No.) |

| |

12300 Grant Street |

|

| |

Thornton, CO 80241 |

|

| |

(Address of principal executive offices) |

|

| |

(720) 872-5000 |

|

| |

(Registrant’s telephone number, including area code) |

|

Not Applicable

(Former name, former address,

and former fiscal year, if changed since last report.)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common |

|

ASTI |

|

Nasdaq Capital

Market |

Indicate by check mark whether

the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule

12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company,

indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01. Entry Into a Material Definitive Agreement.

Warrant Repurchase Agreements

As previously disclosed,

on December 19, 2022, Ascent Solar Technologies, Inc. (the “Company”) entered into a Securities Purchase Contract (the “Purchase

Contract”) with two institutional investors (the “Investors”). Pursuant to the Purchase Contract, the Company issued

to the Investors certain common stock warrants (the “Warrants”).

The Warrants have certain

“full ratchet” anti-dilution adjustments that are triggered when the Company issues securities with a purchase or conversion,

exercise or exchange price that is less than the exercise price of the Warrants then in effect at any time. Under the full ratchet anti-dilution

adjustments, if the Company issues new securities at a price lower than the then applicable exercise price, (i) the exercise price is

reduced to the lower new issue price and (ii) the number of warrant shares is proportionately increased. The Warrants have been previously

adjusted following past issuances of Company securities. Currently there are 5,596,232 Warrants exercisable at an exercise price of $1.765.

On March 6, 2024 and March

7, 2024, the Company entered into Warrant Repurchase Agreements (the “Repurchase Agreements”), with each of the Investors.

Pursuant to the Repurchase Agreements, if the Company closes a new capital raising transaction with gross proceeds in excess of $5 million

(“Qualified Financing”), the Company will repurchase the Warrants from the Investors for an aggregate purchase price of $3.6

million. Following the delivery of the purchase price to the Investors, the Investors will relinquish all rights, title and interest in

the Warrants and assign the same to the Company, and the Warrants will be cancelled.

So long as the Repurchase

Agreements are in effect, the Investors have agreed not to directly or indirectly sell or assign the Warrants. The Investors retain the

right to exercise the warrants at the current exercise price (currently $1.765 per share) at any time prior to the completion of the Qualified

Financing. In the case of any such exercise, the $3.6 million aggregate repurchase price will be reduced on a pro-rata percentage basis.

If the closing under the

Repurchase Agreements has not occurred by April 12, 2024, then, at the election of either the Company or the Investors, by written notice

to the other, the Repurchase Agreements may be terminated. In the event of any termination of the Repurchase Agreements, the Warrants

shall remain outstanding with all existing terms unchanged.

The Company believes that

repurchasing the Warrants, and thereby avoiding potential future full ratchet adjustments of the Warrants, will bring more certainty to

the Company’s capital structure. The Company believes this certainty will assist the Company in raising additional capital in the

future.

The foregoing description

of the Repurchase Agreements is a summary and is qualified in its entirety by reference to the document, which is attached hereto as Exhibits

10.1 and 10.2.

Item 9.01. Financial Statements and Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| |

|

|

|

ASCENT SOLAR TECHNOLOGIES, INC. |

| |

|

|

|

| March 7, 2024 |

|

|

|

By: |

|

/s/ Jin Jo |

| |

|

|

|

|

|

|

|

Name: Jin Jo |

| |

|

|

|

|

|

|

|

Title: Chief Financial Officer |

Exhibit 10.1

WARRANT REPURCHASE AGREEMENT

This Warrant Repurchase Agreement (the “Agreement”)

is entered into as of the 6th day of March, 2024 by and among Ascent Solar Technologies, Inc., a Delaware corporation (the “Company”),

and the investor signatory hereto (the “Holder”), with reference to the following facts:

A. Prior to

the date hereof, pursuant to that Securities Purchase Contract, dated as of December 19, 2022, by and between the Company and the Holder

(the “Securities Purchase Contract”), the Company issued to the Holder, among other things, a Warrants to Purchase Common

Stock, exercisable as of the date hereof into such aggregate number of shares of Common Stock as set forth on the signature page of the

Holder (without regard to any limitations on exercise set forth therein) (the “Warrants”).

B. The Company

and the Holder desire to (x) have the Company repurchase the Warrants (the “Repurchase”) and (y) cancel the Warrants (the

“Cancellation”).

C. Each of

the Company and the Holder desire to effectuate the Repurchase and the Cancellation on the basis and subject to the terms and conditions

set forth in this Agreement.

D. Capitalized

terms used but not otherwise defined herein shall have the meanings set forth in the Securities Purchase Contract.

NOW, THEREFORE, in consideration of the foregoing premises

and the mutual covenants hereinafter contained, the parties hereto agree as follows:

1. Repurchase.

At the closing hereunder, the Holder hereby agrees to convey, assign and transfer all of the Warrants of the Holder that remain outstanding

as of the closing date to the Company in exchange for the payment by the Company to the Holder of an aggregate purchase price (the “Purchase

Price”) of $1,800,000 for 2,798,116 Warrants in cash. To the extent that the Holder exercises certain Warrants between the date

of this Agreement and the closing hereunder, the aggregate Purchase Price of $1,800,000 will be proportionately reduced to reflect the

lower number of Warrants outstanding as of the closing hereunder.

2. Cancellation.

Upon payment of the Purchase Price, the Holder shall deliver or cause to be delivered to the Company (or its designee) all of the outstanding

Warrants (or affidavit of lost warrants, in form provided upon request by the Company and reasonably acceptable to the Holder) as soon

as commercially practicable following the closing date. Immediately following the delivery of the Purchase Price to the Holder (or its

designee), the Holder shall relinquish all rights, title and interest in the Warrants and assign the same to the Company, and the Warrants

shall be cancelled.

3. Closing.

The closing of the Repurchase and Cancellation hereunder shall occur within three business days following the completion by the Company

of a new capital raising transaction with gross proceeds in excess of $5 million.

4. No Sale

or Assignment of Warrants. So long as this Agreement is still in effect, the Holder agrees not to directly or indirectly sell or assign

the Warrants. So long as the closing under the Agreement occurs in accordance with the terms hereof, no new capital raising transaction

of the Company shall cause any further full ratchet adjustment of the Warrants.

5. Disclosure

of Transaction. The Company shall, on or before 8:30 a.m., New York City time, on or prior to the first business day after the date of

this Agreement, file a Current Report on Form 8-K describing the terms of the transactions contemplated hereby in the form required by

the 1934 Act.

6. Termination.

Notwithstanding anything contained in this Agreement to the contrary, if the closing under this Agreement has not occurred by 5:00 PM

Eastern Time on April 12, 2024, then, at the election of either party by written notice to the other thereafter, this Agreement may be

terminated, shall be null and void ab initio, the Repurchase and the Cancellation shall not occur, and the Warrants shall remain outstanding

as if this Agreement never existed.

[The remainder of the page is intentionally left blank]

IN WITNESS WHEREOF, Holder and the Company have executed

this Agreement as of the date set forth on the first page of this Agreement. This Agreement may be signed in one or more counterparts.

ASCENT SOLAR TECHNOLOGIES, INC.

By: /s/ Paul Warley

Name: Paul Warley

Title: Chief Executive Officer

HOLDER:

By:________________________________

Name:

Title: Authorized Signatory

Number of Warrant Shares issuable upon exercise of the Holder’s Warrants

as of the date hereof (without regard to any limitations on exercise): 2,798,116 as of 3/6/2024.

Exhibit 10.2

WARRANT REPURCHASE AGREEMENT

This Warrant Repurchase Agreement (the “Agreement”)

is entered into as of the 7th day of March, 2024 by and among Ascent Solar Technologies, Inc., a Delaware corporation (the “Company”),

and the investor signatory hereto (the “Holder”), with reference to the following facts:

A. Prior to

the date hereof, pursuant to that Securities Purchase Contract, dated as of December 19, 2022, by and between the Company and the Holder

(the “Securities Purchase Contract”), the Company issued to the Holder, among other things, a Warrants to Purchase Common

Stock, exercisable as of the date hereof into such aggregate number of shares of Common Stock as set forth on the signature page of the

Holder (without regard to any limitations on exercise set forth therein) (the “Warrants”).

B. The Company

and the Holder desire to (x) have the Company repurchase the Warrants (the “Repurchase”) and (y) cancel the Warrants (the

“Cancellation”).

C. Each of

the Company and the Holder desire to effectuate the Repurchase and the Cancellation on the basis and subject to the terms and conditions

set forth in this Agreement.

D. Capitalized

terms used but not otherwise defined herein shall have the meanings set forth in the Securities Purchase Contract.

NOW, THEREFORE, in consideration of the foregoing premises

and the mutual covenants hereinafter contained, the parties hereto agree as follows:

1. Repurchase.

At the closing hereunder, the Holder hereby agrees to convey, assign and transfer all of the Warrants of the Holder that remain outstanding

as of the closing date to the Company in exchange for the payment by the Company to the Holder of an aggregate purchase price (the “Purchase

Price”) of $1,800,000 for 2,798,116 Warrants in cash. To the extent that the Holder exercises certain Warrants between the date

of this Agreement and the closing hereunder, the aggregate Purchase Price of $1,800,000 will be proportionately reduced to reflect the

lower number of Warrants outstanding as of the closing hereunder.

2. Cancellation.

Upon payment of the Purchase Price, the Holder shall deliver or cause to be delivered to the Company (or its designee) all of the outstanding

Warrants (or affidavit of lost warrants, in form provided upon request by the Company and reasonably acceptable to the Holder) as soon

as commercially practicable following the closing date. Immediately following the delivery of the Purchase Price to the Holder (or its

designee), the Holder shall relinquish all rights, title and interest in the Warrants and assign the same to the Company, and the Warrants

shall be cancelled.

3. Closing.

The closing of the Repurchase and Cancellation hereunder shall occur on the same business day of that the Company closes a new capital

raising transaction with gross proceeds in excess of $5 million (a “Qualified Financing”).

4. No Sale

or Assignment of Warrants. So long as this Agreement is still in effect, the Holder agrees not to directly or indirectly sell or assign

the Warrants. So long as the closing under this Agreement occurs in accordance with the terms hereof, no pricing or closing of the Qualified

Financing of the Company shall cause any further full ratchet adjustment of the Warrants under the provisions of the Warrants relating

to Dilutive Issuances.

5. Disclosure

of Transaction. The Company shall, on or before 8:30 a.m., New York City time, on or prior to the first business day after the date of

this Agreement, file a Current Report on Form 8-K describing the terms of the transactions contemplated hereby in the form required by

the 1934 Act.

6. Termination.

Notwithstanding anything contained in this Agreement to the contrary, if the closing under this Agreement has not occurred by 5:00 PM

Eastern Time on April 12, 2024, then, at the election of either party by written notice to the other thereafter, this Agreement may be

terminated. This Agreement may also be terminated, at the election of Holder by written notice to the Company, if the Repurchase is not

completed within the time period specified in Section 3 above. In the event of any termination, this Agreement shall be null and void

ab initio, the Repurchase and the Cancellation shall not occur, and the Warrants shall remain outstanding as if this Agreement never existed.

[The remainder of the page is intentionally left blank]

IN WITNESS WHEREOF, Holder and the Company have executed

this Agreement as of the date set forth on the first page of this Agreement. This Agreement may be signed in one or more counterparts.

ASCENT SOLAR TECHNOLOGIES, INC.

By: /s/ Paul Warley

Name: Paul Warley

Title: Chief Executive Officer

HOLDER:

By:________________________________

Name:

Title: Authorized Signatory

Number of Warrant Shares issuable upon exercise of the Holder’s Warrants

as of the date hereof (without regard to any limitations on exercise): 2,798,116 as of 3/7/2024.

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

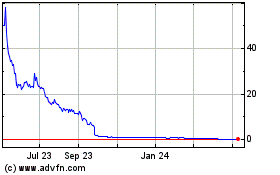

Ascent Solar Technologies (NASDAQ:ASTI)

Historical Stock Chart

From Mar 2024 to Apr 2024

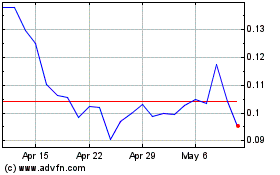

Ascent Solar Technologies (NASDAQ:ASTI)

Historical Stock Chart

From Apr 2023 to Apr 2024