SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

6-K

REPORT

OF FOREIGN PRIVATE ISSUER

PURSUANT

TO RULE 13a-16 OR 15d-163

UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For

the month of December 2023

Alterity

Therapeutics Limited

(Name

of Registrant)

Level 14, 350 Collins Street,

Melbourne, Victoria 3000 Australia

(Address

of Principal Executive Office)

Indicate

by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form

20-F ☒ Form 40-F ☐

This

Form 6-K is being incorporated by reference into our Registration Statement on Form S-8 (Files No. 333-251073, 333-248980

and 333-228671) and our

Registration Statements on Form F-3 (Files No. 333-274816, 333-251647, 333-231417

and 333-250076)

ALTERITY

THERAPEUTICS LIMITED

(a

development stage enterprise)

The

following exhibits are submitted:

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

| |

Alterity Therapeutics Limited |

| |

|

| |

By: |

/s/ Geoffrey P. Kempler |

| |

|

Geoffrey P. Kempler |

| |

|

Chairman |

Date:

December 29, 2023

2

Exhibit 99.1

ALTERITY THERAPEUTICS LIMITED

[ACN 080 699 065]

(“the Company”)

OPTIONS PROSPECTUS

This Prospectus contains the following

offers of securities, the issue of such securities having been approved by shareholders at the general meeting of the Company on 29 December

2023:

| ● | 1,371,428,571 unlisted

options (Short Dated Options) each with an exercise price of A$0.007 (0.7 Australian cents), expiring 31 August 2024 and which,

upon exercise, entitle the holder to one fully paid ordinary share in the capital of the Company (Short Dated Option Offer). |

| ● | 457,142,857 options (Long

Dated Options) each with an exercise price of A$0.01 (1 Australian cent), expiring 31 August 2026 and, upon exercise, entitle the

holder to one fully paid ordinary share in the capital of the Company (Long Dated Option Offer). The Long Dated Options are proposed

to be quoted (listed), subject to meeting the quotation requirements of the ASX. |

The Short Dated Option Offer and Long

Date Option Offer are collectively referred to as the Offers.

The Offers are only made to and able

to be accepted by invitees determined by the Company, noting the Short Dated Options and Long Dated Options are being issued as free-attaching

to fully paid ordinary shares (Shares) under the placement as described further in Section 1.1.

The Offers close at 5pm (Melbourne

time) on 5 January 2024, which date may change without notice.

This document is

important and should be read in its entirety

It is important that you read this Prospectus carefully

before deciding whether to accept the Offers (or either of them) described in this Prospectus. If you do not understand its contents you

should consult your stockbroker, accountant or other professional adviser.

The

securities offered under this Prospectus are considered highly speculative

CORPORATE

DIRECTORY

ALTERITY THERAPEUTICS LIMITED

[ACN 080 699 065]

Directors

Geoffrey Kempler - Non-Executive Chairman

Lawrence Gozlan - Non-Executive Director

Peter Marks - Non-Executive Director

Brian Meltzer - Non-Executive Director

Chief Executive Officer

David Stamler

Chief Financial Officer

Kathryn Andrews^

Company Secretary

Phillip Hains

Registered Office

Level 3, 62 Lygon Street

Carlton Victoria 3053

Tel: +61 3 9824 5254

Share Registrar

Computershare Investor Services Pty Ltd

Yarra Falls, 452 Johnston Street

Abbotsford Victoria 3067

ASX Code

ATH

Web Site

www.alteritytherapeutics.com

To view annual reports, shareholder and company

information, news announcements, background information on the Company’s business and historical information, visit https://alteritytherapeutics.com/.

| ^ | Ms Andrews’ resignation as Chief Financial Officer and

the appointment of the Company Secretary, Mr Phillip Hains both with effect at 31 January 2024 was announced to ASX on 21 December 2023. |

IMPORTANT NOTICES

This prospectus (Prospectus) is dated 29

December 2023. A copy of this Prospectus was lodged with the Australian Securities & Investments Commission (ASIC) on the same

date. Neither ASIC nor ASX Limited (ASX) nor their respective officers take any responsibility as to the contents of this Prospectus.

Subject to the Corporations Act, the ASX Listing

Rules and other applicable laws, the Company reserves the right to close the Offers (or either of them) early, to extend the Closing Date

and/or any other dates (by making an announcement of the extension to ASX), or not to proceed with the Offers (or either of them) described

in this Prospectus.

The Offers are being made under this Prospectus

closes at 5:00pm (Melbourne time) on 5 January 2023, which date may change without notice.

This Prospectus is for an offer of options to

acquire continuously quoted securities (the Long Dated Options) and accordingly is not required by the Corporations Act to contain all

the information normally required to be set out in a document of this type.

This Prospectus contains and applies to the offer

of Short Dated Options and Long Dated Options.

This Prospectus incorporates by reference certain

information contained in documents lodged with ASIC. A document incorporated by reference in this Prospectus in this manner may be obtained

free of charge from the Company during the application period.

The Company has adopted target market determinations

(TMDs) for the Offers. The TMDs are available at the website of the Company, www.alteritytherapeutics.com. By making an application

under either or both of the Offers, an investor warrants that they have read and understood the TMD applicable to that Offer(s) and that

they meet the eligibility criteria of, and fall within the target markets set out in, the TMD.

No person is authorised to give any information

or make any representation in connection with this Prospectus that is not contained in this Prospectus. Any information or representation

not so contained may not be relied on as having been authorised by the Company in connection with the offers of securities.

This Prospectus does not constitute an offer in

any place in which, or to any person to whom, it would not be lawful to make such an offer. The distribution of this Prospectus in jurisdictions

outside Australia may be restricted by law and persons who come into possession of this Prospectus should observe any of those restrictions.

Any failure to comply with the restrictions may constitute a violation of applicable securities law.

No action has been taken to register or qualify

the offer of securities made under this Prospectus, or the securities themselves, or otherwise to permit a public offering of the securities

offered under this Prospectus, in any jurisdiction outside Australia. The securities offered under this Prospectus have not been, and

will not be, registered under the United States Securities Act of 1933 and should not be offered or sold within the USA.

No account has been taken of

particular objectives, financial situation or needs of recipients of this Prospectus. Recipients of this Prospectus should have regard

to their own objectives, financial situation and needs. Recipients of this Prospectus should make their own independent investigation

and assessment of the Company, its business, assets and liabilities, prospects and profits and losses, and risks associated with investing.

Independent expert advice should be sought before any decision is made to apply for securities under this Prospectus.

All monetary amounts in this Prospectus are in

Australian dollars unless otherwise stated.

All dates and times are dates and times in Melbourne,

Victoria, Australia unless otherwise stated.

The securities offered under this Prospectus are

considered highly speculative.

TIMETABLE

|

Lodgement of Prospectus |

29 December 2023 |

| |

|

| Opening date of Offers |

29 December 2023 |

| |

|

| Closing date of the Offers at 5:00pm (Melbourne time) |

5 January 2024 |

| |

|

| Proposed issue date under the Offers |

8 January 2024 |

The above dates should be regarded as indicative

only and may change without notice. All dates and times are Melbourne, Victoria, Australia time. Subject to the Corporations Act 2001

(Cth), the ASX Listing Rules and other applicable laws, the Company reserves the right to change the above dates, close the Offers (or

either of them) before the date stated above, accept late applications under the Offers (or either of them), extend the Closing Date and

subsequent dates or not proceed with the Offers (or either of them). The Company reserves the right to extend the Closing Date by making

an announcement of the extension to ASX. No securities will be issued on the basis of this Prospectus after 29 January 2025, being the

expiry date of this Prospectus.

CONTENTS

| 1. |

Details of the Offers |

8 |

| 2. |

Purpose of the Offers and this Prospectus |

9 |

| 3. |

Financial effect of the Offers |

10 |

| 4. |

Effect on Control and the Capital Structure of the Company |

10 |

| 5. |

Risks |

12 |

| 6. |

Acceptance Instructions |

14 |

| 7. |

Continuous Disclosure Obligations |

15 |

| 8. |

ASX Announcements |

16 |

| 9. |

Terms of securities offered |

17 |

| 10. |

Director’s interests |

20 |

| 11. |

Taxation |

21 |

| 12. |

Overseas Investors |

21 |

| 13. |

Privacy |

22 |

| 14. |

Electronic Prospectus |

22 |

| 15. |

Investment Decisions |

22 |

| 16. |

Future Performance |

22 |

| 17. |

Enquiries |

22 |

KEY INVESTMENT RISKS – SUMMARY

Please read and consider this Prospectus in full

and in conjunction with matters which have or may be referred to in the Company’s ASX announcements before applying for securities

under the Offers (or either of them).

Section 5 of this Prospectus contains an overview

of some of the key risks associated with investment in the Company, including risks associated with the Offers as set out below:

| ● | Value of securities and share market conditions

including liquidity risk. |

| ● | Potential taxation consequences. |

| ● | There being no guarantee that the share price

of the Company will be greater than the exercise price of Long Dated Options prior to the expiry date of Long Dated Options. |

The Company provided detailed disclosure of business

risk factors in its item 3.D of its 2023 Annual Report for the reporting period ended 30 June 2023 that was released to ASX on 31 August

2023. The 2023 Annual Report has been lodged with ASIC and item 3.D of the 2023 Annual Report is incorporated by reference into this Prospectus

in accordance with Section 712 of the Corporations Act. A copy of the 2023 Annual Report including item 3.D is available at www2.asx.com.au

(search code “ATH”) and can be obtained from the Company upon request.

A selection of risk factors as described in item

3.D of the 2023 Annual Report are set out below:

| (a) | The Company has a history of operating losses. |

| (b) | The Company relies on research institutions to conduct its clinical trials and may not be able to secure

and maintain research institutions to conduct future trials. The institutions that the Company works with have their own limits and procedures

that influence or limit the Company’s ability to conduct research and development and conduct of clinical trials. The Company’s

reliance on these research institutions provides it with less control over the timing and cost of clinical trials, clinical study management

personnel and the ability to recruit subjects. |

| (c) | If the Company does not obtain the necessary governmental approvals, it will be unable to develop or commercialise

its pharmaceutical products. |

| (d) | The Company’s success depends upon its ability to protect its intellectual property and its proprietary

technology, to operate without infringing the proprietary rights of third parties and to obtain marketing exclusivity for its products

and technologies. |

| (e) | The Company consider proprietary trade secrets and/or confidential know-how and unpatented know-how to

be important to its business. |

| (f) | The Company’s research and development efforts will be seriously jeopardised if it is unable to

retain key personnel and cultivate key academic and scientific collaborations. |

| (g) | The testing, marketing and sale of human health care products also entails an inherent risk of product

liability. |

| (h) | The biotechnology and pharmaceutical industries are subject to rapid and significant technological change.

The Company’s competitors are numerous and include major pharmaceutical companies, biotechnology firms, universities and other research

institutions. |

Further details of the above risk factors, as

well as information regarding additional business risk factors that may impact upon the Company, are set out in item 3.D of the 2023 Annual

Report as described above.

ABOUT THE OFFERS - SUMMARY

The following summary provides only a limited

overview of the Offers made under this Prospectus. Further details are set out in this Prospectus. Please read and consider this Prospectus

in full before making any decision regarding seeking to accept the Offers (or either of them) or otherwise investing in the Company. For

the purposes of this “About the Offers – Summary”, Placement has the meaning as defined in Section 1.1.

| Topic |

Summary |

For more information see: |

THE OFFERS (GENERAL)

|

| What are the Offers? |

The Offers are offers of securities (options)

as free-attaching to fully paid ordinary shares in the capital of the Company (Shares) issued under the Placement.

The issue of the Short Dated Options and the Long

Dated Options was approved by shareholders at the general meeting of the Company held on 29 December 2023 (Meeting).

|

Sections 1.1 to 1.3

|

| What is the purpose of the Offers? |

The purpose of the Offers is to facilitate the issue of the Short Dated Options and the Long Dated Options as approved by shareholders at the Meeting and, in particular, to facilitate the secondary trading of Shares issued on exercise of Short Dated Options and/or Long Dated Options (if exercised) and the secondary trading of Long Dated Options if quotation (listing) of the Long Dated Options is granted by ASX.

|

Sections 1.1 to 1.3 and 2 |

| Who can apply under the Offers? |

The Offers are only made to and capable of acceptance by the participants in the Placement on the basis of one Short Dated Option for every Share issued under the Placement and one Long Dated Option for every three Shares issued under the Placement.

|

Sections 1.1 to 1.3 and 6 |

SHORT DATED OPTION OFFER

|

| What is the Short Dated Option Offer? |

An offer of an aggregate of 1,371,428,571 Short Dated Options to subscribers for Shares under the Placement on the basis of one Short Dated Option for each Share issued under the Placement.

|

Sections 1.2, 9.1 and 9.4 |

|

What are the terms of the Short Dated Options?

|

Short Dated Options are unlisted and each have

an exercise price of A$0.007 (0.7 Australian cents), expire of 31 August 2024 and, upon exercise, entitle the holder to one Share.

The full terms of Short Dated Options are set

out in Section 9.1. |

Section 9.1 |

LONG DATED OPTION OFFER

|

| What is the Long Dated Option Offer? |

An offer of an aggregate of 457,142,857 Short Dated Options to subscribers for Shares under the Placement on the basis of one Short Dated Option for each Share issued under the Placement.

|

Sections 1.2, 9.2 and 9.4 |

|

What are the terms of the Long Dated Options?

|

Long Dated Options each have an exercise price

of A$0.01 (1 Australian cent), expire of 31 August 2026 and, upon exercise, entitle the holder to one Share. Subject to meeting the quotation

requirements of ASX, Long Dated Options are proposed to be quoted (listed).

The full terms of Long Dated Options are set out

in Section 9.2.

|

Section 9.2 |

| Topic |

Summary |

For more information see: |

|

GENERAL

|

| Are there risks associated with investment in the Company? |

There are risks associated with investment in the Company. These include risks relating to the Short Dated Options, Long Dated Options, risks relating to the Company and risks associated with financial investment generally. Please carefully consider the risks and the information contained in this Prospectus in conjunction with any specific matters which have or may be referred to in the Company’s ASX announcements before deciding to apply for or acquire Short Dated Options and Long Dated Options or otherwise making an investment in the Company.

|

Section 5 |

|

What are the taxation implications of receiving securities?

|

Taxation implications will vary depending upon the specific circumstances of the investor. You should obtain professional advice as to the taxation treatment applicable to you. |

Section 11 |

| Where can I find more information about the Company? |

For more information on the Company please see the Company’s website (www.alteritytherapeutics.com) or refer to the Company’s ASX announcements (available on the ASX’s website www2.asx.com.au, search code “ATH”).

|

Sections 7, 8 and 17 |

| What if I have questions about the Offer or how to apply? |

You should consult your stockbroker, accountant, solicitor or other professional adviser before deciding to apply for Short Dated Options and/or Long Dated Options under the Offers (or either of them). Questions concerning the Offers (or either of them) can be directed to the Company by email to: info@alteritytherapeutics.com.

|

Section 17 |

The Offers are made to offer Short Dated Options

and Long Dated Options to subscribers for Shares in the Placement (defined in Section 1.1) in accordance with the shareholder approval

obtained at the Meeting.

| 1.1 | Background – Placement |

On 22 November 2023, Alterity

Therapeutics Limited [ACN 080 699 065] (the Company) announced it had received binding commitments for a capital raising of A$4.8

million before costs via a two tranche placement (Placement) of Shares at an issue price of A$0.0035 (0.35 Australian cents) per

Share.

The participants in the Placement

were sophisticated, professional and other investors exempt from the disclosure requirements of Ch 6D of the Corporations Act who are

clients of MST Financial Services Pty Ltd or other brokers including institutional investors, or which were identified by the Company

as part of its investor relations program.

The Placement was conducted

over two tranches:

| ● | Tranche one: 362,462,762 Shares under the existing

available placement capacity under Listing Rule 7.1 to raise approximately $1.3 million. Shares under tranche one were issued on 29 November

2023. |

| ● | Tranche two: 1,008,965,809 Shares, the issue

of which was subject to shareholder approval which was obtained at the Meeting. Shares under tranche two are to be issued prior to the

Closing Date. Tranche two also included an issue of Shares (and, consequently, an entitlement to receive free-attaching options as described

below) to related parties (or their nominee(s)). Further details are set out in Section 10.1. |

Every one (1) Share under the

Placement are to be accompanied by one (1) Short Dated Option and every three (3) Shares are to be accompanied by one (1) Long Dated Option.

The issue of Short Dated Options and Long Dated Options as free-attaching to Shares under the Placement was approved by shareholders at

the Meeting.

The purpose of this Prospectus

and the Offers is to facilitate the issue of the Short Dated Options and the Long Dated Options as free-attaching to Shares under the

Placement and as approved by shareholders at the Meeting and, in particular, to facilitate the secondary trading of Shares issued on exercise

of Short Dated Options and/or Long Dated Options (if any) and the secondary trading of Long Dated Options if quotation (listing) is granted.

For further information regarding

the Placement please refer to the announcement on 22 November 2023.

| 1.2 | Short Dated Option Offer |

The Short Dated Option Offer is an offer of an

aggregate of 1,371,428,571 Short Dated Options to subscribers under the Placement on the basis of one (1) Short Dated Option for every

one (1) Share subscribed for and issued under the Placement. Further details with respect to the Placement are set out in Section 1.1.

| 1.3 | Long Dated Option Offer |

The Long Dated Option Offer is an offer of an

aggregate of 457,142,857 Long Dated Options to subscribers under the Placement on the basis of one (1) Long Dated Option for every three

(3) Shares subscribed for and issued under the Placement. Further details with respect to the Placement are set out in Section 1.1.

Short Dated Options

The Short Dated Options will not be quoted (listed).

Nothing set out in this Prospectus is to be construed as stating or implying that the Short Dated Options will be quoted at any particular

time, or at all. It is expressly not stated or implied that permission will be sought or obtained for the official quotation of the Short

Dated Options or that official quotation of the Short Dated Options will be granted within three (3) months (or any other period) of the

date of this Prospectus.

Long Dated Options

The Company proposes seeking

quotation (listing) of Long Dated Options. The Long Dated Options that are issued will be unquoted (unlisted) until such time as the Company

satisfies the quotation requirements of ASX, which will include:

| ● | There being at least 100,000 Long Dated Options

on issue; and |

| ● | The Long Dated Options being held by at least

50 holders with a marketable parcel (being if all options held by the holder are exercised in full, the underlying ordinary shares would

be a parcel of not less than $500 based on the trading price of shares or the exercise price if underlying ordinary shares are unquoted). |

If official quotation of Long

Dated Options is not granted, Long Dated Options will be unlisted securities and will not be tradeable on ASX. The fact that ASX may grant

official quotation of Long Dated Options is not to be taken as an indication of the merits of the Company or the Long Dated Options. The

Company’s Appendix 3B released to ASX on 22 November 2023 in respect of the proposed issue of the Long Dated Options included an

application for quotation if the quotation requirements of ASX are satisfied.

For the avoidance of doubt,

quotation of Long Dated Options is not a condition of the Offers (or either of them).

| 1.5 | Security Purchase Plan |

As announced on 22 November

2023, the Company proposes conducting a security purchase plan to eligible shareholders on the same terms as the Placement to raise up

to $2 million before costs (SPP). The SPP was subject to shareholder approval which was obtained at the Meeting. Offers under the

SPP will be made pursuant to a prospectus that is anticipated to be lodged by the Company in December 2023. The details included in this

Prospectus are indicative and for reference purposes only. Further information can be obtained in the announcement released by the Company

to ASX on 22 November 2023 and will be set out in the transaction-specific prospectus for the SPP anticipated to be lodged with ASIC after

this prospectus is lodged.

The following information in

accordance with Section 734(5) of the Corporations Act:

| (a) | The issuer of securities under the SPP will be the Company. |

| (b) | The Company will release the prospectus for the SPP to ASX (www2.asx.com.au, search code “ATH”). |

| (c) | The disclosure document (prospectus) for the SPP is anticipated to be made available to eligible participants

in January 2024. |

| (d) | A person should consider the prospectus for the SPP in deciding whether to acquire securities under the

SPP. |

| (e) | Anyone who is eligible and wants to acquire securities under the SPP will need to complete make an application

in accordance with the application form that will be in or will accompany a copy of the prospectus for the SPP. |

| (f) | The disclosure document (prospectus) for the SPP, once available, will be sent to eligible shareholders

(being shareholders in the Company with a registered address in Australia or New Zealand at 7.00pm (Melbourne time) on 21 November 2023)

and will be able to be obtained from the Company on request. |

| 2. | Purpose of the Offers and this Prospectus |

The purposes of this Prospectus and the Offers

generally is to facilitate the issue of the Short Dated Options and the Long Dated Options and, in particular, to facilitate the secondary

trading of Shares issued on exercise of Short Dated Options and/or Long Dated Options (if any) and, subject to achieving quotation (listing),

the secondary trading of Long Dated Options on ASX.

The purpose of the Offers and the issue of the

Short Dated Options and Long Dated Option is to reflect the terms of the Placement (being one (1) Short Dated Option for every one (1)

Share under the Placement and one (1) Long Dated Option for every three (3) Shares under the Placement) and to implement the shareholder

approval for the issue of the Short Dated Options and Long Dated Options received at the Meeting.

| 3. | Financial effect of the Offers |

Short Dated Options and Long Dated Options under

the Offers are being issued as free-attaching to Shares under the Placement as described in Section 1.1 and accordingly no funds will

be raised under the Offers.

The anticipated costs of the Offers is set out

in the table below:

|

Particulars |

Amount ($) |

| Legal, printing and postage |

$10,000 |

| ASIC & ASX fees* |

$18,000 |

| TOTAL |

$28,000 |

| * | assumes quotation of the Long Dated Options. |

Noting the above, the Offers are anticipated to

reduce the cash reserves of the Company by approximately $28,000, being the anticipated costs of the Offers and noting no funds are being

raised under the Offers.

| 4. | Effect on Control and the Capital Structure of the Company |

The tables below set out the existing capital

structure of the Company as at the date of this Prospectus and the effect on the Company’s capital structure of the Offers. Except

as otherwise stated, it is assumed that no further securities are issued by the Company other than as provided for under the Offers, and

that no existing or proposed options (including Short Dated Options and/or Long Dated Options) are exercised into Shares. In particular,

this Sections 4.1 and 4.2 do not consider the impact of the SPP on the capital structure of the Company.

SHARES

As noted in Section 1.1, it is proposed

that the Shares forming tranche two of the Placement will be issued prior to the Closing Date. Accordingly, the below table demonstrates

the impact of the issue of Shares forming tranche two of the Placement for indicative purposes. The Offers will not impact share capital.

The potential impact of exercise of Short Dated Options and/or Long Dated Options is set out in Section 4.2.

|

|

Number |

% |

| Existing Shares |

2,802,360,380 |

74% |

| Shares under tranche two of the Placement |

1,008,965,809 |

26% |

| Total |

3,811,326,189 |

100% |

| * | all percentages are subject to rounding |

OPTIONS

The existing and proposed options

of the Company are set out in the table below. All options are presently unlisted however the Company proposes seeking quotation (listing)

of the Long Dated Options. The quotation (listing) of the Long Dated Options is not a condition of the Offers (or either of them):

| Number of options |

Expiry Date |

Exercise price |

| 19,250,000 |

29 November 2026 |

$0.0375 (3.75 cents) |

| 12,000,000 |

31 July 2024 |

$0.07 (7 cents) |

| 11,900,000 |

29 November 2026 |

$0.0238 (2.38 cents) |

| 35,000,000 |

17 September 2025 |

$0.09 (9 cents) |

| 91,392,720 |

06 January 2026 |

$0.032 (3.2 cents) |

| 1,371,428,571 (Short Dated Options) |

31 August 2024 |

$0.007 (0.7 cents) |

| 457,142,857 (Long Dated Options) |

31 August 2026 |

$0.01 (1 cents) |

Noting the Offers relate to

the issue of convertible securities (being Short Dated Options and Long Dated Options) only, the Offers will not (collectively or in isolation)

will not have a material impact on the control (as defined by section 50AA of the Corporations Act) of the Company. No investor or existing

Shareholder will have a voting power greater than 20% as a result of the completion of the Offers (or either of them).

For indicative purposes, the

below tables have been prepared to illustrate the potential dilutive impact of: (a) conversion all of Short Dated Options only; (b) conversion

of all Long Dated Options only; or (c) conversion of all Short Dated Options and Long Dated Options:

TABLE 1: EXERCISE OF ALL SHORT

DATED OPTIONS ONLY

| |

Number |

% |

| Existing Shares |

2,802,360,380 |

54% |

| Shares under tranche two of the Placement |

1,008,965,809 |

20% |

| Total Shares pre Short Dated Option exercise |

3,811,326,189 |

74% |

| Shares issued on exercise of Short Dated Options |

1,371,428,571 |

26% |

| Total Shares post Short Dated Option exercise |

5,182,754,760 |

100% |

TABLE 2: EXERCISE OF ALL LONG

DATED OPTIONS ONLY

| |

Number |

% |

| Existing Shares |

2,802,360,380 |

66% |

| Shares under tranche two of the Placement |

1,008,965,809 |

23% |

| Total Shares pre Long Dated Option exercise |

3,811,326,189 |

89% |

| Shares issued on exercise of Long Dated Options |

457,142,857 |

11% |

| Total Shares post Long Dated Option exercise |

4,268,469,046 |

100% |

TABLE 3: EXERCISE OF ALL SHORT

DATED OPTIONS AND ALL LONG DATED OPTIONS

| |

Number |

% |

| Existing Shares |

2,802,360,380 |

50% |

| Shares under tranche two of the Placement |

1,008,965,809 |

18% |

| Total Shares pre Short Dated Option and Long Dated Option exercise |

3,811,326,189 |

68% |

| Shares issued on exercise of Short Dated Options |

1,371,428,571 |

24% |

| Shares issued on exercise of Long Dated Options |

457,142,857 |

8% |

| Total Shares post Short Dated Option and Long Dated Option exercise |

5,639,897,617 |

100% |

| * | all percentages are subject to rounding |

As noted above, these tables

are provided for indicative purposes. No guarantee is given that a certain number of Short Dated Options and/or Long Dated Options will

be exercised into Shares, if any at all.

| 4.3 | Details of substantial holders |

As at lodgement of the Prospectus,

the Company has received notification of one substantial (5%+) shareholder being the Bank of New York Mellon Corporation and each Group

Entity that together form the BNYMC Group, which holds a relevant interest in 1,588,872,148 Shares (approximately 56.70%) in the Company.

The relevant interest arises from the BNYMC Group having the limited power to dispose of, or control exercise of power to dispose of,

securities deposited with or held by BNYMC (or its custodian or agent) in its capacity as depositary administering an American depository

receipts (ADR) program for the Company. The issue of securities under the Offers (or either of them) will not impact the relevant interest

of the BNYMC Group.

The securities offered under this Prospectus

are considered highly speculative. An investment in the Company carries risk. The Directors strongly recommend potential investors consider

the risk factors described below, together with information contained elsewhere in the Prospectus.

This section identifies circumstances

the Directors regard as risks associated with investment in the Company and which may have a material adverse impact on the financial

performance of the Company if they were to arise.

Specifically:

| ● | the Offers (including

securities under the Offers) are subject to specific risks (refer to Section 5.1); and |

| ● | the business, assets and

operations of the Company are subject to further risk factors. The Company provided detailed disclosure of business risk factors in item

3.D of its 2023 Annual Report for the reporting period ended 30 June 2023 that was released to ASX on 31 August 2023. The 2023 Annual

Report has been lodged with ASIC and item 3.D of 2023 Annual Report is incorporated by reference into this Prospectus in accordance with

Section 712 of the Corporations Act. A copy of item 3.D of the 2023 Annual Report is available at www2.asx.com.au (search code “ATH”)

and can be obtained from the Company upon request. A selection of the risk factors as contained in item 3.D of the 2023 Annual Report

are set out in Section 5.2. |

Where possible, the Directors aims

to manage these risks by carefully planning the Company’s activities and implementing risk control measures. However, some of the

risks identified are highly unpredictable or are out of the control of the Company and the Company is therefore limited to the extent

it can effectively manage them.

These risk factors are not intended

to be an exhaustive list of risks to which the Company is, or will be, exposed.

| 5.1 | Risks associated with the Offers |

| (a) | Value of securities, liquidity and share market conditions |

The market price of the Company’s ordinary

shares are subject to varied and unpredictable influences on the market for equities in general. Market conditions and lack of liquidity

may affect the value of the Company’s ordinary shares regardless of the performance of the Company. No assurance is given that there

will be, or continue to be, an active market for the Shares or if an active market will be established for the Long Dated Options if quoted

(listed). The trading price of Shares may fall as well as rise.

Participation in the Offers (or either of them)

may have taxation consequences depending on the particular circumstances of the recipient. You should seek your own professional advice

before investing in the Company.

| (c) | Exercise price of securities |

There is no guarantee that the share price will

be greater than the exercise price up to the expiry date (31 August 2024 for Short Dated Options and 31 August 2026 for Long Dated Options).

Accordingly, there is a risk that securities will be out of the money during the exercise period, which will affect the value of the securities.

| 5.2 | Company Specific Risks |

As noted above, the below represent a selection

of the risk factors contained in item 3.D of the 2023 Annual Report released to ASX on 31 August 2023 which is available at www2.asx.com.au

(search code “ATH”) and can be obtained from the Company upon request:

| (a) | The Company has a history of operating losses. The Company will need additional funding to complete its

clinical trials and to operate its business; such funding may not be available or, if it is available, such financing is likely to be

dilutive to existing shareholders. |

| (b) | The Company relies on research institutions to conduct its clinical trials and may not be able to secure

and maintain research institutions to conduct future trials. The institutions that the Company works with have their own limits and procedures

that influence or limit the Company’s ability to conduct research and development and conduct of clinical trials. The Company’s

reliance on these research institutions provides it with less control over the timing and cost of clinical trials, clinical study management

personnel and the ability to recruit subjects. |

| (c) | If the Company does not obtain the necessary governmental approvals, it will be unable to develop or commercialise

its pharmaceutical products. The pharmaceutical and biotechnology industries are subject to extensive regulation, and from time to time

legislative bodies and governmental agencies consider changes to such regulations that could have significant impact on industry participants. |

| (d) | The Company’s success depends upon its ability to protect its intellectual property and its proprietary

technology, to operate without infringing the proprietary rights of third parties and to obtain marketing exclusivity for its products

and technologies. Patent matters in biotechnology are highly uncertain and involve complex legal and factual questions. Accordingly, the

availability and breadth of claims allowed in biotechnology and pharmaceutical patents cannot be predicted. |

| (e) | The Company consider proprietary trade secrets and/or confidential know-how and unpatented know-how to

be important to its business. The Company may rely on trade secrets and/or confidential know-how to protect its technology, especially

where patent protection is believed by the Company to be of limited value. However, trade secrets and/or confidential know-how can be

difficult to maintain as confidential. |

| (f) | The Company’s research and development efforts will be seriously jeopardised if it is unable to

retain key personnel and cultivate key academic and scientific collaborations. |

| (g) | The testing, marketing and sale of human health care products also entails an inherent risk of product

liability. The Company may incur substantial liabilities or be required to limit development or commercialisation of its candidate products

if it cannot successfully defend itself against product liability claims. |

| (h) | The biotechnology and pharmaceutical industries are subject to rapid and significant technological change.

The Company’s competitors are numerous and include major pharmaceutical companies, biotechnology firms, universities and other research

institutions. These competitors may develop technologies and products that are more effective than any that the Company is developing,

or which would render its technology and products obsolete or non-competitive. Many of these competitors have greater financial and technical

resistance and manufacturing and marketing capabilities than the Company does. In addition, many of the Company’s competitors have

much more experience than it does in pre-clinical testing and human clinical trials of new or improved drugs, as well as in obtaining

regulatory approvals. |

| 5.3 | Investment Speculative |

The above list of risk factors ought

not to be taken as an exhaustive list of the risks faced by the Company or in connection with an investment in the Company. The above

risk factors, and other risk factors not specifically referred to above, may materially affect the future financial performance of the

Company and the value of the securities offered under this Prospectus. Shares issued on exercise of Short Dated Options and/or Long Dated

Options (if any) carry no guarantee with respect to the payment of dividends, returns of capital or market value. The Company does not

expect to declare any dividends for the foreseeable future.

Potential investors should consider that the investment

in the Company is highly speculative.

| 6. | Acceptance Instructions |

Applications under the Offers (or either of them)

must be made pursuant to the application form provided by the Company for the participation in the Offers (or either of them). The Company

may determine at its absolute discretion whether to accept any or all applications under the Offers (or either of them), including applications

received under the Offers (or either of them) after the Closing Date at its absolute discretion.

This Prospectus does not constitute an offer in

any place in which, or to any person to whom, it would not be lawful to make such an offer. Persons residing in countries outside Australia

should consult their professional advisers as to whether governmental or other consent are required or whether formalities need to be

observed for them to participate in the Offers (or either of them).

No account has been taken of the particular objectives,

financial situation or needs of recipients of this Prospectus. Because of this, recipients of this Prospectus should have regard to their

own objectives, financial situation and needs.

Recipients of this Prospectus should make their

own independent investigations and assessment of the Company, its business, assets and liabilities, prospects and profits and losses,

and the risks associated with investing in the Company. Independent expert advice should be sought before any decision is made to accept

the Offers (or either of them) or otherwise invest in the Company.

If you have any questions about the Offers (or

either of them) please contact the Company at +61 3 8669 1408.

| 7. | Continuous Disclosure Obligations |

This Prospectus is issued by

the Company in accordance with the provisions of the Corporations Act applicable to a prospectus for continuously quoted securities or

securities convertible into continuously quoted securities.

Section 713 of the Corporations

Act enables a company to issue a special prospectus where the securities under that prospectus are continuously quoted securities within

the meaning of the Corporations Act. This generally means that the relevant securities are in a class of securities that were quoted enhanced

disclosure securities at all times during the 3 months before the date of this Prospectus and other requirements relating to the Company

not being subject to various exemptions and orders under the Corporations Act within the last 12 months are met.

In summary, special prospectuses

are required to contain information in relation to the effect of the offer of securities on the company and the rights and liabilities

attaching to the securities. It is not necessary to include general information in relation to all of the assets and liabilities, financial

position, profits and losses or prospects of the issuing company. Accordingly, this Prospectus does not contain the same level of disclosure

as a prospectus of an unlisted company or an initial public offering prospectus.

Having taken such precautions

and having made such enquiries as are reasonable, the Company believes that it has complied with the general and specific requirements

of ASX as applicable from time to time throughout the 12 months before the date of this Prospectus which required the Company to notify

ASX of information about specified events or matters as they arise for the purpose of ASX making that information available to the stock

market conducted by ASX.

For the purpose of satisfying section 713(5) of

the Corporations Act a prospectus must incorporate information that:

| (a) | has been excluded from a continuous disclosure notice in accordance with the ASX Listing Rules; and |

| (b) | is information that investors and their professional advisors would reasonably require for the purpose

of making an informed assessment of: |

| ● | the

assets and liabilities, financial position and performance, profit and losses and prospects of the Company; and |

| ● | the

rights and liabilities attaching to the securities being offered. |

The prospectus must contain this information only

to the extent to which it is reasonable for investors and their professional advisors to expect to find such information in the prospectus.

The Company is not aware of any matters that need to be disclosed under this section of the Corporations Act that have not been previously

disclosed or which have not been set out in this Prospectus.

The Company operates an ongoing business and reports

regularly on its activities. The Company from time to time seeks to engage in discussions on an ongoing basis in respect of potential

opportunities. Funds may be used to fund the costs associated with identifying, investigating and pursuing such opportunities. While the

Company may seek to negotiate such opportunities there is no certainty any such arrangement(s) will be finalised on particular terms,

at a specific time, or at all. The Company will make further announcements in respect of any such opportunities (if any) in accordance

with its continuous disclosure obligations as developments, if any, occur (however no guarantee can be given that such developments, if

any, will occur).

As a disclosing entity under the Corporations

Act, the Company is subject to regular reporting and disclosure obligations. Copies of documents lodged with ASX and ASIC in relation

to the Company may be obtained from or inspected by accessing the respective websites.

Any person may request, and the Company will provide

free of charge, a copy of each of the following documents during the acceptance period of this Prospectus:

| (a) | The annual financial report of the Company for the financial year ended 30 June 2023 (released to ASX

on 31 August 2023), being the most recent annual financial report of the Company before the

lodgement of this Prospectus with ASIC; and |

| (b) | Any continuous disclosure notices given by the Company since the lodgement of the Annual Financial Report

referred to in (b) above before lodgement of this Prospectus. Continuous disclosure notices given by the Company since the lodgement of

the Annual Financial Report to the date of this Prospectus are listed in Section 8 of this Prospectus. |

Such documents are also available online from

the ASX website at www2.asx.com.au, search code “ATH”.

The following announcements (continuous disclosure

notices) have been made by the Company to ASX since lodging its annual financial report for the year ended 30 June 2023 with ASIC:

|

Date |

Headline |

| 29 December 2023 |

Result of Extraordinary General Meeting |

| 29 December 2023 |

Presentation to Extraordinary General Meeting |

| 22 December 2023 |

Change in substantial holding |

| 21 December 2023 |

Notification regarding unquoted securities – ATH |

| 21 December 2023 |

Alterity Appoints Phillip Hains as Chief Financial Officer |

| 18 December 2023 |

Update – Proposed issue of securities - ATH |

| 14 December 2023 |

Change in substantial holding |

| 12 December 2023 |

Change in substantial holding |

| 11 December 2023 |

Grant of Waiver & Addendum - EGM 29 December 2023 |

| 11 December 2023 |

Ceasing to be a substantial holder |

| 11 December 2023 |

Change in substantial holding |

| 8 December 2023 |

Change in substantial holding |

| 8 December 2023 |

Change in substantial holding |

| 7 December 2023 |

Virtual access to Extraordinary General Meeting 29 Dec 2023 |

| 6 December 2023 |

Becoming a substantial holder |

| 4 December 2023 |

Webcast to Discuss ATH434 Efficacy Data in Primate Model |

| 4 December 2023 |

Positive Efficacy Data for ATH434 in a Primate Model of PD |

| 1 December 2023 |

Change in substantial holding |

| 30 November 2023 |

Notice of Extraordinary General Meeting/Proxy Form |

| 30 November 2023 |

Notification of cessation of securities - ATH |

| 29 November 2023 |

Results of Annual General Meeting |

| 29 November 2023 |

Notice Under Section 708A |

| 29 November 2023 |

Application for quotation of securities - ATH |

| 29 November 2023 |

Alterity completes Placement Tranche One raising $1.3M |

| 29 November 2023 |

Chairman’s Address 2023 Annual General Meeting |

| 29 November 2023 |

Presentation to Annual General Meeting |

| 27 November 2023 |

ATH presents Novel Biomarker Data for Evaluation of MSA |

|

Date |

Headline |

| 22 November 2023 |

Proposed issue of securities - ATH |

| 22 November 2023 |

Investor Presentation |

| 22 November 2023 |

Proposed issue of securities - ATH |

| 22 November 2023 |

Proposed issue of securities - ATH |

| 22 November 2023 |

Alterity Therapeutics Raises $4.8M AUD in Placement |

| 20 November 2023 |

Trading Halt |

| 16 November 2023 |

New Data Demonstrating Novel Mechanisms of ATH434 |

| 8 November 2023 |

ATH completes enrolment in ATH434-201 Phase 2 clinical trial |

| 31 October 2023 |

Notice of Annual General Meeting/Proxy Form |

| 30 October 2023 |

Quarterly Activities/Appendix 4C Cash Flow Report |

| 3 October 2023 |

SEC Form F-3 |

| 13 September 2023 |

Notification of cessation of securities - ATH |

| 1 September 2023 |

Alterity Form 20-F and XBRL data filed with SEC |

| 31 August 2023 |

Appendix 4G and Corporate Governance Statement 2023 |

| 31 August 2023 |

Appendix 4E and Annual Report 2023 |

Any person may request, and the Company will provide

free of charge, a copy of any of the above announcements during the application period of this Prospectus.

The Company may make further announcements to

ASX from time to time. Announcements are released by ASX on its website, www2.asx.com.au under the Company’s ASX code “ATH”

and copies of announcements can be obtained from the Company upon request and are available on the Company’s website www.alteritytherapeutics.com.

Prospective investors are advised to refer to ASX’s website for updated releases about events or matters affecting the Company.

In making statements in this Prospectus, it is

noted that the Company is a disclosing entity for the purposes of the Corporations Act and certain matters may reasonably be expected

to be known to investors and professional advisers whom potential investors may consult.

| 9. | Terms of securities offered |

| (a) | Each Option entitles the holder to one fully paid ordinary share in the capital of Alterity Therapeutics

Limited [ABN 37 080 699 065] (the Company) (each a Share). |

| (b) | The Options may be exercised at any time prior to 5.00pm Melbourne time on 31 August 2024 (Expiry Date). |

| (c) | The exercise price of the Options is A$0.007 (0.7 Australian cents) each (Exercise Price). |

| (d) | The Options will not be listed. |

| (e) | The Options are transferable, subject at all times to the requirements of the Australian Corporations

Act 2001 and any other applicable law or regulation. |

| (f) | To exercise the Options, each Option holder must duly complete, execute and deliver to the Company an

exercise notice in the form provided to the Option holder or as otherwise acceptable to the Company (Notice of Exercise). Options

may be exercised by the Option holder in whole or in part by completing the Notice of Exercise (or such other form of written notice of

exercise acceptable to the Company) and delivering it to the Company Secretary at its registered office or to its designated registry

(which may include delivery or giving by electronic means), to be received prior to the Expiry Date. The Notice of Exercise must, among

other things, state the number of Options exercised, the consequent number of Shares to be allotted and the identity of the proposed allottee.

The Notice of Exercise by an Option holder must be accompanied by payment (which may be made by electronic funds transfer by prior arrangement

in writing with the Company or its designated registry) in full for the relevant number of Shares being subscribed, being an amount of

the Exercise Price per Option exercised. |

| (g) | All Shares issued upon the exercise of the Options will rank equally in all respects with the Company’s

then issued Shares. The Company will apply to the Australian Securities Exchange (ASX) for all Shares issued pursuant to the exercise

of the Options to be admitted to quotation. |

| (h) | In the event of a pro rata entitlements issue to the Company’s shareholders, the Exercise Price shall

be reduced in accordance with the formula set out in ASX Listing Rule 6.22.2. |

| (i) | In the event of a bonus issue the number of Shares over which the Option is exercisable shall be increased

by the number of Shares which the Option holder would have received if the Option had been exercised before the record date for the bonus

issue. |

| (j) | In the event of any reorganisation of the capital of the Company (including consolidation, subdivisions,

reduction or return) prior to the Expiry Date the rights of an Option holder will be changed to extent necessary to comply with the Listing

Rules of the ASX applying to a reorganisation of the capital at the time of the reorganisation. |

| (k) | There are no participating rights or entitlements inherent in the Options and an Option holder will not

be entitled to participate in new issues of capital offered to the Company’s shareholders during the term of the Options. However,

the Company will if required by the Listing Rules of ASX send a notice to the Option holder at least 3 business days (or such longer period

as the Listing Rules of ASX require) before the record date of any new issues of capital offered to the Company’s shareholders in

order to give the Option holder the opportunity to exercise their Options prior to the date for determining entitlements to participate

in any such issue. Notice may be sent to the last email address advised by the Option holder. |

| (l) | The Options will not give any right to participate in dividends until Shares are issued pursuant to the

exercise of the relevant Options. |

| (m) | The Options may not be exercised by or on behalf of a person in the United States unless the Options and

the underlying Shares have been registered under the US Securities Act of 1933, as amended, and applicable state securities laws, or exemptions

from such registration requirements are available. |

| (a) | Each Option entitles the holder to one fully paid ordinary share in the capital of Alterity Therapeutics

Limited [ABN 37 080 699 065] (the Company) (each a Share). |

| (b) | The Options may be exercised at any time prior to 5.00pm Melbourne time on 31 August 2026 (Expiry Date). |

| (c) | The exercise price of the Options is A$0.01 (1 Australian cent) each (Exercise Price). |

| (d) | The Company may seek quotation (listing) of the Options, subject to meeting the quotation requirements

of the Australian Securities Exchange (ASX). The Options may accordingly be quoted (listed). |

| (e) | The Options are transferable, subject at all times to the requirements of the Australian Corporations

Act 2001 and any other applicable law or regulation. |

| (f) | To exercise the Options, each Option holder must duly complete, execute and deliver to the Company an

exercise notice in the form provided to the Option holder or as otherwise acceptable to the Company (Notice of Exercise). Options

may be exercised by the Option holder in whole or in part by completing the Notice of Exercise (or such other form of written notice of

exercise acceptable to the Company) and delivering it to the Company Secretary at its registered office or to its designated registry

(which may include delivery or giving by electronic means), to be received prior to the Expiry Date. The Notice of Exercise must, among

other things, state the number of Options exercised, the consequent number of Shares to be allotted and the identity of the proposed allottee.

The Notice of Exercise by an Option holder must be accompanied by payment (which may be made by electronic funds transfer by prior arrangement

in writing with the Company or its designated registry) in full for the relevant number of Shares being subscribed, being an amount of

the Exercise Price per Option exercised. |

| (g) | All Shares issued upon the exercise of the Options will rank equally in all respects with the Company’s

then issued Shares. The Company will apply to the ASX for all Shares issued pursuant to the exercise of the Options to be admitted to

quotation. |

| (h) | In the event of a pro rata entitlements issue to the Company’s shareholders, the Exercise Price shall

be reduced in accordance with the formula set out in ASX Listing Rule 6.22.2. |

| (i) | In the event of a bonus issue the number of Shares over which the Option is exercisable shall be increased

by the number of Shares which the Option holder would have received if the Option had been exercised before the record date for the bonus

issue. |

| (j) | In the event of any reorganisation of the capital of the Company (including consolidation, subdivisions,

reduction or return) prior to the Expiry Date the rights of an Option holder will be changed to extent necessary to comply with the Listing

Rules of the ASX applying to a reorganisation of the capital at the time of the reorganisation. |

| (k) | There are no participating rights or entitlements inherent in the Options and an Option holder will not

be entitled to participate in new issues of capital offered to the Company’s shareholders during the term of the Options. However,

the Company will if required by the Listing Rules of ASX send a notice to the Option holder at least 3 business days (or such longer period

as the Listing Rules of ASX require) before the record date of any new issues of capital offered to the Company’s shareholders in

order to give the Option holder the opportunity to exercise their Options prior to the date for determining entitlements to participate

in any such issue. Notice may be sent to the last email address advised by the Option holder. |

| (l) | The Options will not give any right to participate in dividends until Shares are issued pursuant to the

exercise of the relevant Options. |

| (m) | The Options may not be exercised by or on behalf of a person in the United States unless the Options and

the underlying Shares have been registered under the US Securities Act of 1933, as amended, and applicable state securities laws, or exemptions

from such registration requirements are available. |

| 9.3 | Shares on exercise of Short Dated Options and Long Dated Options |

Shares issued on exercise of Short Dated Options

and/or Long Dated Options will be fully paid ordinary shares in the capital of the Company, which will rank equally with, and will have

the same voting and other rights as existing issued shares of the Company. The rights attaching to the Company’s shares are set out in

the Company’s constitution, the Listing Rules of ASX and the Corporations Act. The Company’s constitution has been lodged with ASIC. The

constitution contains provisions of the kind common for public companies in Australia and are taken to be included in this Prospectus

by operation of Section 712 of the Corporations Act. Any person may request a copy of the constitution during the application period of

the Prospectus, which the Company will provide free of charge.

The Offers and any application concerning the

issue of Short Dated Options and Long Dated Options under this Prospectus, shall be governed and construed in accordance with the laws

of Victoria, Australia.

The Directors’ direct and indirect interests in

securities of the Company as at the date of this Prospectus are set out in the table below:

SHARES & OPTIONS

|

Director/Shareholder

(and/or

associate(s)) |

Existing Shares |

Current Options |

| Number |

% |

|

| Geoffrey Kempler |

18,011,000 |

0.64% |

14,000,000 |

| Lawrence Gozlan |

0 |

0.00% |

7,000,000 |

| Peter Marks |

43,111 |

0.00% |

7,000,000 |

| Brian Meltzer |

326,666 |

0.01% |

7,000,000 |

| TOTAL: |

18,380,777 |

0.66% |

35,000,000 |

At

the Meeting, shareholders approved the participation of Peter Marks, Brian Meltzer and Lawrance Gozlan (and/or their respective nominee(s))

in the Placement as described below:

| (a) | Peter Marks: 7,142,857 Shares together with 7,142,857 Short Dated Options and 2,380,952

Long Dated Options for a subscription amount of $25,000. |

| (b) | Brian Meltzer: 7,142,857 Placement Shares together with 7,142,857 Short Dated Options

and 2,380,952 Long Dated Options for a subscription amount of $25,000. |

| (c) | Lawrence Gozlan: 14,285,714 Placement Shares together with 14,285,714 Short Dated

Options and 4,761,905 Long Dated Options for a subscription amount of $50,000. |

For

indicative purposes, the below table shows the Directors’ direct and indirect interests in securities of the Company assuming the

full subscription by each of Peter Marks, Brian Meltzer and Lawrence Gozlan (and/or their respective nominee(s)) in the Placement as approved

by shareholders and the issue of all Shares under the Placement and all Short Dated Options and Long Dated Options under the Placement:

SHARES & OPTIONS

|

Director/Shareholder

(and/or

associate(s)) |

Shares |

Options |

| Number |

% |

|

| Geoffrey Kempler |

18,011,000 |

0.47% |

14,000,000 |

| Lawrence Gozlan |

14,285,714 |

0.37% |

26,047,619 |

| Peter Marks |

7,185,968 |

0.19% |

16,523,809 |

| Brian Meltzer |

7,469,523 |

0.20% |

16,523,809 |

| TOTAL: |

46,952,205 |

1.23% |

73,095,237 |

Notes

to the above tables:

| (1) | The above does not take into account the issue of any Shares or other securities except as described

above. In particular, the above tables do not take into account the potential issue of Shares on exercise of Short Dated Options and/or

Long Dated Options (if exercised). |

| (2) | All percentages are rounded to two decimal places. |

| 10.2 | Remuneration and Payments to Directors |

Directors are entitled to receive directors’

fees and other remuneration from the Company in relation to services provided to the Company. Details of the cash remuneration paid or

agreed to be paid to the Directors in the two years prior to the lodgement of this Prospectus (excluding GST, if applicable) are as follows:

|

Director |

January 2022 – December 2022 |

January

2023 – December 2023 |

| Geoffrey Kempler |

$388,008 |

$314,425 |

| Lawrence Gozlan |

$70,000 |

$70,000 |

| Peter Marks |

$70,000 |

$70,000 |

| Brian Meltzer |

$69,976 |

$70,563 |

Note to table:

| ● | The remuneration set out above reflects cash

paid to Directors only and includes base salaries paid in connection with director engagements, allowances for travel and compulsory contributions

toward director nominated superannuation funds as required by Australian employment law. |

Except as disclosed in this Prospectus:

| (a) | no person has paid or agreed to pay any amount to any Director or has given or agreed to give any benefit

to any Director, to induce the Director to become, or to qualify as, a Director or otherwise for services rendered by the Director in

connection with the formation or promotion of the Company or the Offers (or either of them). |

| (b) | no Director has, or has had within two years of lodgement of this Prospectus, any interest in: |

| ● | the

formation or promotion of the Company; or |

| ● | any

property acquired or proposed to be acquired by the Company in connection with its formation or promotion of the Offers (or either of

them) or the other offer made under this Prospectus; or |

| ● | the

Offers (or either of them) or the other offer made under this Prospectus. |

Recipients of this Prospectus and the Offers (or

either of them) should seek and obtain their own taxation advice.

This Prospectus and any application form do not

constitute an offer in any jurisdiction in which, or to any persons to whom, it would not be lawful to make such an offer.

This Prospectus does not constitute an offer for

securities in any place where, or to any person whom, it would be unlawful to make such an offer. The distribution of this Prospectus

in jurisdictions outside Australia may be restricted by law, and persons outside Australia who comes into possession of this Prospectus

should seek advice on, and observe any, such restrictions. Any failure to comply with such restrictions may constitute a violation of

applicable securities laws. No action has been taken to register or qualify the securities under this Prospectus or otherwise to permit

a public offering of the securities in any jurisdiction outside Australia. The Company does, however, reserve the right (at its absolute

discretion) to accept an application from a shareholder if it is satisfied that the making and acceptance of the application complies

with the requirements of the relevant jurisdiction.

The Offers (or either of them) have not been,

and will not be, registered under the US Securities Act and has not been made in the United States of America or to persons resident in

the United States of America.

Personal information is collected on application

forms by the Company and the Share Registry for processing applications, maintaining registers of security holders, facilitating distribution

payments and other corporate actions and communications. Acceptances might not be processed efficiently, or at all, if the information

requested is not provided. Personal information about recipients may be disclosed to external service providers such as print or mail

service providers as required or permitted by law. A recipient who would like details of their personal information held by the Company

or its Share Registry, or who would like to correct information that is incorrect or out of date, should contact the Company by email,

by telephone or at the address shown in the Corporate Directory. In accordance with the Corporations Act, recipients may be sent material

(including marketing material) in addition to general corporate communications. Recipients may elect not to receive marketing material

by contacting the Share Registry’s Privacy Officer. Recipients can also request access to, or corrections of, personal information held

by the Company by writing to the Company.

This Prospectus is available in electronic format

via the ASX website, www2.asx.com.au (search code “ATH”) and via the Company’s website at www.alteritytherapeutics.com.

Persons having received this Prospectus in electronic

form may, during the offer period, obtain a paper copy of this Prospectus (free of charge) by contacting the Company by email to info@alteritytherapeutics.com.

Applications under the Offers (or either of them)

may only be made in accordance with the application form which will form part of or will be accompanied by the complete and unaltered

electronic version of this Prospectus. The Corporations Act prohibits any person from passing on to another person an application form

unless it is attached to or accompanied by a hard copy of this Prospectus or by the complete and unaltered electronic version of this

Prospectus.

The Company reserves the right not to accept an

application form from a person if it has reason to believe that when that person was given access to the electronic application form,

it was not provided together with the complete and unaltered electronic version of this Prospectus.

The information in this Prospectus does not constitute

financial product advice. This Prospectus does not take into account the investment objectives, financial situation, tax position and

particular needs of individual investors. Investors should obtain their own independent advice and consider the appropriateness of the

Offers having regard to their own objectives, financial situation, tax position and needs.

Except as required by law, and only then to the

extent so required, neither the Company nor any other person warrants the future performance of the Company, or any return on any investment

made pursuant to this Prospectus. An investment under the Offers (or either of them) should be considered speculative.

If you have any questions regarding the content

of this Prospectus or how to complete the application form, you should contact your stockbroker, accountant or independent professional

financial adviser prior to applying for securities under this prospectus.

If you have any questions regarding the Offers

(or either of them), please contact the Company be email to info@alteritytherapeutics.com.

No person is authorised to give information or

make any representation in connection with this Prospectus which is not contained in this Prospectus. Any such information not so contained

may not be relied on as having been authorised by the Company in connection with this Prospectus.

DIRECTORS’ RESPONSIBILITY

STATEMENT

The Directors of the Company have authorised the lodgement of this

Prospectus with ASIC.

| /s/ Peter Marks |

|

| Peter Marks |

|

| Non-Executive Director |

|

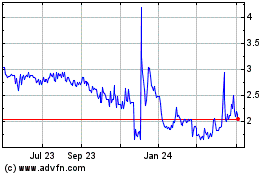

Alterity Therapeutics (NASDAQ:ATHE)

Historical Stock Chart

From Mar 2024 to Apr 2024

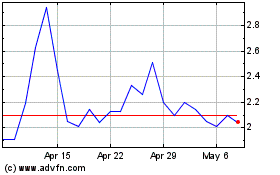

Alterity Therapeutics (NASDAQ:ATHE)

Historical Stock Chart

From Apr 2023 to Apr 2024