false

0001132651

0001132651

2024-05-08

2024-05-08

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

May 8, 2024

Date of Report (Date of Earliest Event Reported)

AMES NATIONAL CORPORATION

(Exact Name of Registrant as Specified in its Charter)

| Iowa |

0-32637 |

42-1039071 |

| (State or Other Jurisdiction of |

(Commission File Number) |

(I.R.S. Employer |

| Incorporation or Organization) |

|

Identification No.) |

405 Fifth Street

Ames, Iowa 50010

(Address of Principal Executive Offices) (Zip Code)

Registrant’s Telephone Number, Including Area Code: (515) 232-6251

NOT APPLICABLE

(Former Name, Former Address and Former Fiscal Year, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| |

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

| |

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

| |

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

| |

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol

|

Name of each exchange on which registered

|

|

Common stock

|

ATLO

|

NASDAQ Capital Market

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b-2 of the Securities Exchange Act of 1934.

Emerging growth company ☐

If an emerging growth company, indicate by checkmark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers

(e) Management Compensation Plan

On May 8, 2024, the Board of Directors (the “Board”) of Ames National Corporation (the “Company”) adopted changes to the semi-annual performance periods used for determining the payment of incentive compensation (in the form of “deferred salary” and “performance awards”) under the Company’s Management Incentive Compensation Plan (the “MIC Plan”) covering certain key officers of the Company and its subsidiary banks (the “Banks”), including the named executive officers as identified in the Company’s proxy statement. The changes will better align the semi-annual performance periods under the MIC Plan with the semi-annual comparative peer group data used in part by the Company and Bank personnel committees in establishing the performance targets for each semi-annual period.

Under the terms of the MIC Plan, (i) the total annual salary of a participating officer is divided between “base salary”, payment of which is not contingent upon the financial performance of the Banks, and “deferred salary”, payment of which is contingent upon the financial performance of the Banks, and (ii) a participating officer becomes eligible to also receive “performance awards” based upon the financial performance of the Banks. Payment of deferred salary and eligibility for performance awards is determined based on Bank performance during two semi-annual performance periods (each, a “Performance Period”), with (i) an officer being eligible to receive payment of some or all of the deferred salary based upon a formula established by the MIC Plan that compares actual Bank performance for the Performance Period against a performance target established for such Performance Period, and (ii) performance awards to be earned when actual Bank performance exceeds the performance target for the Performance Period. Prior to the changes adopted by the Board, the first Performance Period covered the fourth calendar quarter of the prior year and the first calendar quarter of the current year (with earned payments made on June 15), while the second Performance Period covered the second and third calendar quarters of the current year (with earned payments made on December 15). However, the comparative peer group data used to establish the performance target for the first Performance Period covered the prior calendar year, while the comparative peer group data used to establish the performance target for the second Performance Period covered the first and second calendar quarters of the current year, resulting in different periods being used to calculate performance and to generate the comparative peer group data. Under the change adopted to the MIC Plan, the Performance Periods will be aligned with periods covering the comparative peer group data, with the first Performance Period covering the first two calendar quarters of the current year (with earned payments made on December 15), and the second Performance Period covering the third and fourth calendar quarters of the current year (with earned payments made on June 15 of the following year).

Other changes adopted by the Board to the MIC Plan (i) amended the definition of “adjusted net income”, used to calculate the availability of deferred salary and performance awards, to include acquisition adjustments on loans and deposits and any other adjustments that may be recommended by the personnel committees of the Company or the Banks; and (ii) confirmed that the payment of deferred salary and performance awards under the MIC Plan will be subject to the Company’s Clawback Policy to the extent a participating officer qualifies as a “covered executive” for purposes of the Clawback Policy.

Item 8.01 Other Events

On May 8, 2024, the Company announced the declaration of a cash dividend. A copy of the press release dated May 9, 2024 is attached as Exhibit 99.1.

Item 9.01 Financial Statement and Exhibits

| |

(d)

|

The following exhibits are furnished as part of this Report.

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this Report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

AMES NATIONAL CORPORATION

|

|

|

|

|

|

|

|

|

|

|

|

|

Date: May 9, 2024

|

By:

|

/s/ John P. Nelson

|

|

|

|

|

John P. Nelson, Chief Executive Officer and President

|

|

|

|

(Principal Executive Officer)

|

|

Exhibit 10.1

AMES NATIONAL CORPORATION

Ames, Iowa

May 8, 2024

MANAGEMENT INCENTIVE COMPENSATION PLAN

PURPOSE: In the belief that properly motivated and compensated senior officers of Ames National Corporation (the "Company") or its affiliate banks (a "Bank") can be encouraged to produce superior results, this Management Incentive Compensation Plan (the "Plan") outlines a performance formula to guide the Company and Bank Personnel Committees in making their recommendations to the Company Board or the Bank Board, as applicable, with respect to Deferred Salary and Performance Awards to be granted to a limited number of Senior Officer Participants. Capitalized terms used in this Plan, unless defined when first used, shall have the definitions given to such terms in Attachment 1 hereto.

PLAN: A portion of the Annual Salary of each Senior Officer Participant, referred to herein as "Deferred Salary", will be deferred each six months until earned or forfeited based on Bank performance as more fully described in Attachment 2 hereto. The Deferred Salary may be adjusted based on Bank performance. In addition, Performance Awards may be granted to a Senior Officer Participant. Details are outlined in the following attachments:

| |

4.

|

Threshold, Cap and Floor Levels

|

| |

5.

|

Company Senior Officers

|

CLAWBACK POLICY: This Plan, and any Deferred Salary and/or Performance Award paid to a Senior Officer Participant pursuant to the terms of this Plan, shall be subject to the Clawback Policy adopted by the Company Board to the extent that such Senior Officer Participant qualifies as a “Covered Executive” for purposes of the Clawback Policy.

CONCLUSION: While this Plan attempts to capture the significant features bearing on the recommendations which a Committee is called upon to make, it is, however, only a guide and nothing contained herein shall constitute a right or privilege of any Senior Officer Participant or other personnel. Each Committee reserves the right to consider other factors, which it deems pertinent, in making compensation recommendations with respect to the Senior Officer Participants for which it is responsible. Nevertheless, the incentives in this Plan are a strong motivation for the Senior Officer Participants to increase earnings and enhance shareholder value.

Attachment 1

DEFINITIONS

ADJUSTED NET INCOME is determined as follows:

Net Income of a Bank

| Plus |

Provision for credit losses (less negative provisions) |

| Plus |

Off balance sheet provision for credit losses (less negative provisions) |

| Plus |

Recoveries |

| Less |

Charge-offs |

| Plus/Less |

Acquisition adjustments on loans and deposits |

| Plus/Less |

Other adjustments recommended by the Committee |

| = |

Adjusted Net Income |

ADJUSTED R.O.A. is the Adjusted Net Income of a Bank as described above divided by Average Assets of the Bank on an annualized basis. This corresponds to the Adjusted Net Operating Income on the Uniform Bank Performance Report. That report also includes a line reflecting the influence of Sub Chapter S banks.

ANNUAL SALARY means the total salary to be paid to a Senior Officer Participant as divided between base salary and Deferred Salary.

AVERAGE ASSETS are the daily average assets of a Bank for the two calendar quarters.

AWARD PERCENTAGE ALLOCATION is the percentage of the Performance Award to be allocated to a Senior Officer Participant as authorized by the Board on the recommendation of its respective Committee. The Award Percentage Allocation is also used in determining Deferred Salary. The maximum Award Percentage Allocation for any Senior Officer Participant is 40%.

BANK BOARD means the Board of Directors of a Bank.

BANK PERSONNEL COMMITTEE means the Personnel Committee of a Bank Board.

BOARD means either the Company Board with respect to Senior Officer Participants who are employees of the Company or a Bank Board with respect to Senior Officer Participants who are employees of a particular Bank.

COMMITTEE means either the Company Personnel Committee with respect to Senior Officer Participants who are employees of the Company or a Bank Personnel Committee with respect to Senior Officer Participants who are employees of a particular Bank.

COMPANY BOARD means the Board of Directors of the Company.

COMPANY PERSONNEL COMMITTEE means the Personnel Committee of the Company Board.

PERFORMANCE AWARD is the amount to be allocated to the Senior Officer Participants of the Company or a Bank, as applicable, as authorized by the Board on the recommendation of its respective Committee.

SENIOR OFFICER PARTICIPANTS are those key senior officers (designed by each Board based on the recommendation of its respective Committee) who have been given an Award Percentage Allocation and who accept the Deferred Salary arrangement established under this Plan. The Senior Officer Participants at a Bank will normally include senior officers whose decisions directly influence operating results. The Senior Officer Participants at the Company will normally include the Chief Executive Officer and Chief Financial Officer of the Company and other key members of the Company's management team whose decisions directly influence operating results.

Attachment 2

DEFERRED SALARY

A portion of the Annual Salary of each Senior Officer Participant shall be deferred (withheld) until earned or forfeited based on Bank performance. The amount to be deferred for each Senior Officer will be determined semi-annually (i) first, for the six month period from January 1 to June 30 (the “First Period”), and (ii) second, for the six month period from July 1 to December 31 (the “Second Period”, with the First Period and the Second Period each being referred to as a “Period”). The Deferred Salary for each Period will be an amount equal to $100 for each million dollars in Average Assets of the Bank for the Period multiplied by the Award Percentage Allocation established for the Senior Officer Participant for the year. The amount of the Annual Salary and the Award Percentage Allocation for each Senior Officer Participant shall be established by the Board, based on the recommendation of the Committee, prior to the commencement of each calendar year.

|

Example

|

|

Example

|

|

The Average Assets of the Bank for the First Period (six months ending June 30th) is $350 million. The Award Percentage Allocation for the Senior Officer Participant for the year is 20%. The Deferred Salary for the First Period is $100 x 350 x .20 x .50 or $3,500.

|

|

The Average Assets of a Bank for the Second Period (six months ending December 31st) is $100 million. The Award Percentage Allocation for the Senior Officer Participant for the year is 30%. The Deferred Salary for the Second Period is $100 x 100 x .30 x .50 or $1,500.

|

Deferred Salary for each Period will be paid, to the extent earned under the terms of this Plan based on actual Bank performance, (i) on or about December 15 for the First Period, and (ii) on or about June 15 of the following year for the Second Period of the previous year.

Attachment 3

PLAN FORMULA

Each Committee will forward recommendations to its respective Board for payment of Deferred Salaries and Performance Awards to its Senior Officer Participants so that authorized payments may be made on or about June 15 and December 15. The recommendations will be based on Bank performance during the First Period and the Second Period, as applicable. The Plan formula provides for a Performance Award up to 10% of the difference between the actual Adjusted Net Income of a Bank for each Period (not to exceed the Cap or Floor) and the Adjusted Net Income at the Threshold Level R.O.A. If the final amount is positive (i.e., the actual Adjusted Net Income is greater than Adjusted Net Income at the Threshold Level R.O.A.), all Deferred Salary will be earned and a Performance Award will be paid out. If the final amount is negative (i.e. the actual Adjusted Net Income is less than Adjusted Net Income at the Threshold Level R.O.A.), there will be a deduction from the Deferred Salary and no Performance Award will be paid out. The formula is as follows:

| 1. |

Actual Adjusted Net Income for the Period, but not to exceed the Cap or Floor Level

|

|

$ |

|

|

| |

|

|

|

|

|

| 2. |

Adjusted Net Income at the Threshold Level R.O.A. for the Period assuming same amount of Average Assets.

|

|

$ |

|

|

| |

|

|

|

|

|

| 3. |

Subtract the amount on Line 2 from the amount on Line 1.

|

|

$ |

|

|

| |

|

|

|

|

|

| 4. |

The total Performance Award to be allocated to the Senior Officer Participants is 10% of the amount on the Line 3.

|

|

$ |

|

|

The Performance Award to be paid to each Senior Officer Participant is determined by multiplying the total Performance Award (Line 4) by the Award Percentage Allocation established for Senior Officer Participant.

Attachment 4

THRESHOLD, CAP AND FLOOR LEVELS

The report of the Committee to the Board each November shall include a recommendation for the Plan criteria applicable to each Bank for the next calendar year.

| |

1.

|

The Threshold Level R.O.A. will be based upon the Committee’s recommendation from reviewing information in the Uniform Bank Performance Report with emphasis on the Peer Group data on page 1 (Summary Ratios) and the Iowa Average (Summary Ratios). The Adjusted Net Income on page 1, which may be adjusted to reflect the influence of Subchapter S banks, provides a significant Peer Group R.O.A. comparison ratio. The Company and its Banks are expected to achieve results above the Peer Group Adjusted R.O.A.

|

| |

2.

|

The Cap Level or ceiling represents a prudent upper limit that may be exceeded, but no benefit would accrue to the Senior Officer Participants for earnings above the Cap Level.

|

| |

3.

|

The Floor Level will normally have the same deviation below the Threshold Level as the Cap Level is above it.

|

| |

4.

|

The Floor, Threshold and Cap Levels for the Second Period of 2023 (presented as an example) are reflected below and will be reviewed by each Committee for each Period ending June 30th and December 31st.

|

BANK R.O.A. LEVELS

|

Floor Level

|

0.80%

|

|

Threshold Level

|

0.90%

|

|

Cap Level

|

1.45%

|

Attachment 5

COMPANY SENIOR OFFICERS

The calculation for determining Deferred Salary and Performance Awards for the Participating Senior Officers employed by the Company will be similar to that detailed in Attachments 1-4 with the following deviations:

| |

1.

|

The Senior Officer Participant's Deferred Salary for each Period will be $100 per million of total Average Assets of the Banks on an aggregate basis for the Period multiplied by each Senior Officer Participant’s Award Percentage Allocation.

|

| |

2.

|

The Performance Awards will be determined by aggregating the Performance Awards established for each Bank as determined in Attachment 3 multiplied by the Participating Senior Officer's Award Percentage Allocation to establish the amount of the semi-annual Performance Award.

|

Exhibit 99.1

PRESS RELEASE

|

FOR IMMEDIATE RELEASE

|

CONTACT:

|

JOHN P. NELSON

|

| |

|

PRESIDENT

|

| |

|

(515) 232-6251

|

May 9, 2024

AMES NATIONAL CORPORATION DECLARED CASH DIVIDEND

AMES, IOWA – On May 8, 2024, Ames National Corporation (the “Company”) declared a cash dividend of $0.27 per common share. The dividend is payable August 15, 2024, to shareholders of record at the close of business on August 1, 2024.

Ames National Corporation is listed on the NASDAQ Capital Market under the ticker symbol, ATLO. The Company’s affiliate banks include: First National Bank, Ames, Iowa; Boone Bank & Trust Co., Boone, Iowa; State Bank & Trust Co., Nevada, Iowa; Iowa State Savings Bank, Creston, Iowa; Reliance State Bank, Story City, Iowa; and United Bank & Trust Co., Marshalltown, Iowa. Additional information about the Company can be found at www.amesnational.com.

v3.24.1.u1

Document And Entity Information

|

May 08, 2024 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

AMES NATIONAL CORPORATION

|

| Document, Type |

8-K

|

| Document, Period End Date |

May 08, 2024

|

| Entity, Incorporation, State or Country Code |

IA

|

| Entity, File Number |

0-32637

|

| Entity, Tax Identification Number |

42-1039071

|

| Entity, Address, Address Line One |

405 Fifth Street

|

| Entity, Address, City or Town |

Ames

|

| Entity, Address, State or Province |

IA

|

| Entity, Address, Postal Zip Code |

50010

|

| City Area Code |

515

|

| Local Phone Number |

232-6251

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common stock

|

| Trading Symbol |

ATLO

|

| Security Exchange Name |

NASDAQ

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0001132651

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

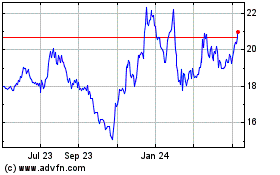

Ames National (NASDAQ:ATLO)

Historical Stock Chart

From Dec 2024 to Jan 2025

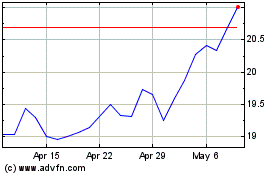

Ames National (NASDAQ:ATLO)

Historical Stock Chart

From Jan 2024 to Jan 2025