As

filed with the Securities and Exchange Commission on August 12, 2024

Registration

Statement No. 333-

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

S-3

REGISTRATION

STATEMENT UNDER THE SECURITIES ACT OF 1933

BONE

BIOLOGICS CORPORATION

(Exact

name of registrant as specified in its charter)

| Delaware |

|

42-1743430 |

(State

or other jurisdiction of

incorporation

or organization) |

|

(I.R.S.

Employer

Identification

Number) |

2

Burlington Woods Drive, Suite 100

Burlington,

MA 01803

(781)

552-4452

(Address,

including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Jeffrey

Frelick

Chief

Executive Officer

Bone

Biologics Corporation

2

Burlington Woods Drive, Suite 100

Burlington,

MA 01803

(781)

552-4452

(Name,

address, including zip code, and telephone number, including area code, of agent for service)

Copies

to:

Alexander

R. McClean, Esq.

Harter

Secrest & Emery LLP

1600

Bausch & Lomb Place

Rochester,

New York 14604

(585)

232-6500

Approximate

date of commencement of proposed sale to the public: From time to time after the effective date of this registration statement.

If

the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check

the following box: ☐

If

any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the

Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following

box: ☒

If

this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the

following box and list the Securities Act registration statement number of the earlier effective registration statement for the same

offering. ☐

If

this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If

this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective

upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ☐

If

this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional

securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting

company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,”

“smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large

accelerated filer |

☐ |

Accelerated

filer |

☐ |

| Non-accelerated

filer |

☒ |

Smaller

reporting company |

☒ |

| |

|

Emerging

growth company |

☐ |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided to Section 7(a)(2)(B) of the Securities Act. ☐

The

registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the

registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective

in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date

as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The

information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration

statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell nor does it seek an

offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT

TO COMPLETION, dated August 12, 2024

PROSPECTUS

BONE

BIOLOGICS CORPORATION

1,617,919

Shares of Common Stock Offered by the Selling

Stockholders

This

prospectus relates to the public offering of up to 1,617,919 shares of common stock, par value $0.001 per share (“common

stock”), of Bone Biologics Corporation by the selling stockholders. Of these shares, 781,251 shares are issuable upon the exercise

of outstanding warrants exercisable for one share of common stock at an exercise price of $2.00 per share and expiring on August 2, 2029

(the “five-year warrants”); 781,251 shares are issuable upon the exercise of outstanding warrants exercisable for

one share of common stock at an exercise price of $2.00 per share and expiring on February 2, 2026 (the “eighteen-month warrants”);

46,875 shares are issuable upon the exercise of outstanding warrants exercisable for one share of common stock at an exercise price of

$3.35 per share and expiring on August 2, 2029; and 8,542 shares are issuable upon the exercise of outstanding warrants exercisable for

one share of common stock at an exercise price of $6.40 per share and expiring on November 16, 2028 (collectively the “warrants”).

The

selling stockholders may sell common stock from time to time in the principal market on which the stock is traded at the prevailing market

price or in negotiated transactions.

We

will not receive any of the proceeds from the sale of common stock by the selling stockholders. We will pay the expenses of registering

these shares.

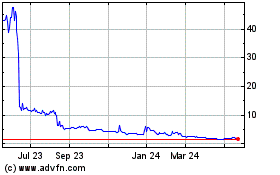

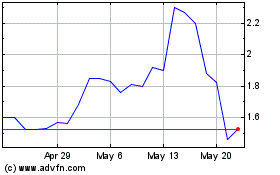

Our

common stock is listed on the Nasdaq Capital Market (“Nasdaq”) under the symbol “BBLG.” The closing price of

our common stock on Nasdaq on August 9, 2024 was $1.69 per share.

Investing

in our securities involves a high degree of risk. See the section entitled “Risk Factors” beginning on page 8 of this prospectus

and in the documents incorporated by reference into this prospectus for a discussion of risks that should be considered in connection

with an investment in our securities.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined

if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The

date of this prospectus is , 2024.

TABLE

OF CONTENTS

ABOUT

THIS PROSPECTUS

We

incorporate by reference important information into this prospectus. You may obtain the information incorporated by reference without

charge by following the instructions under “Where You Can Find More Information.” You should carefully read this prospectus

as well as additional information described under “Information Incorporated by Reference,” before deciding to invest in our

securities.

We

have not authorized anyone to provide you with additional information or information different from that contained or incorporated by

reference in this prospectus filed with the Securities and Exchange Commission (the “SEC”). We take no responsibility for,

and can provide no assurance as to the reliability of, any other information that others may give you. We are offering to sell, and seeking

offers to buy, our securities only in jurisdictions where offers and sales are permitted. The information contained in this prospectus,

or any document incorporated by reference in this prospectus, is accurate only as of the date of those respective documents, regardless

of the time of delivery of this prospectus or any sale of our securities. Our business, financial condition, results of operations and

prospects may have changed since that date.

This

prospectus contains estimates and other statistical data made by independent parties and by us relating to market size and growth and

other data about our industry. We obtained the industry and market data in this prospectus from our own research as well as from industry

and general publications, surveys and studies conducted by third parties. This data involves a number of assumptions and limitations

and contains projections and estimates of the future performance of the industries in which we operate that are subject to a high degree

of uncertainty, including those discussed in “Risk Factors.” We caution you not to give undue weight to such projections,

assumptions and estimates. Further, industry and general publications, studies and surveys generally state that they have been obtained

from sources believed to be reliable, although they do not guarantee the accuracy or completeness of such information. While we believe

that these publications, studies and surveys are reliable, we have not independently verified the data contained in them. In addition,

while we believe that the results and estimates from our internal research are reliable, such results and estimates have not been verified

by any independent source.

We

have not done anything that would permit this offering or the possession or distribution of this prospectus in any jurisdiction where

action for those purposes is required, other than in the United States. Persons outside the United States who come into possession of

this prospectus must inform themselves about, and observe any restrictions relating to, the offering of the securities and the distribution

of this prospectus outside of the United States.

CAUTIONARY

NOTE CONCERNING FORWARD-LOOKING STATEMENTS

This

prospectus and the documents incorporated by reference herein contain forward-looking statements that involve risks and uncertainties.

You should not place undue reliance on these forward-looking statements. All statements other than statements of historical fact contained

in this prospectus and the documents incorporated by reference herein contain are forward-looking statements. The forward-looking statements

in this prospectus and the documents incorporated by reference herein are only predictions. We have based these forward-looking statements

largely on our current expectations and projections about future events and financial trends that we believe may affect our business,

financial condition and results of operations. In some cases, you can identify these forward-looking statements by terms such as “anticipate,”

“believe,” “continue,” “could,” “depend,” “estimate,” “expect,”

“intend,” “may,” “ongoing,” “plan,” “potential,” “predict,” “project,”

“should,” “will,” “would” or the negative of those terms or other similar expressions, although not

all forward-looking statements contain those words. We have based these forward-looking statements on our current expectations and projections

about future events and trends that we believe may affect our financial condition, results of operations, strategy, short- and long-term

business operations and objectives, and financial needs. These forward-looking statements include, but are not limited to, statements

concerning the following:

| |

● |

our

ability to maintain compliance with the Nasdaq listing standards and remain listed on Nasdaq; |

| |

● |

our

projected financial position and estimated cash burn rate; |

| |

● |

our

estimates regarding expenses, future revenues and capital requirements; |

| |

● |

our

ability to continue as a going concern; |

| |

● |

our

need to raise substantial additional capital to fund our operations; |

| |

● |

the

success, cost and timing of our clinical trials; |

| |

● |

our

dependence on third parties in the conduct of our clinical trials; |

| |

● |

our

ability to obtain the necessary regulatory approvals to market and commercialize our product candidates; |

| |

● |

the

ultimate impact of health pandemics or epidemics on our business, our clinical trials, our research programs, healthcare systems

or the global economy as a whole; |

| |

● |

the

potential that results of preclinical and clinical trials indicate our current product candidate or any future product candidates

we may seek to develop are unsafe or ineffective; |

| |

● |

the

results of market research conducted by us or others; |

| |

● |

our

ability to obtain and maintain intellectual property protection for our current product candidates; |

| |

● |

our

ability to protect our intellectual property rights and the potential for us to incur substantial costs from lawsuits to enforce

or protect our intellectual property rights; |

| |

● |

the

possibility that a third party may claim we or our third-party licensors have infringed, misappropriated or otherwise violated their

intellectual property rights and that we may incur substantial costs and be required to devote substantial time defending against

claims against us; |

| |

● |

our

reliance on third-party suppliers and manufacturers; |

| |

● |

the

success of competing therapies and products that are or become available; |

| |

● |

our

ability to expand our organization to accommodate potential growth and our ability to retain and attract key personnel; |

| |

● |

the

potential for us to incur substantial costs resulting from product liability lawsuits against us and the potential for these product

liability lawsuits to cause us to limit our commercialization of our product candidate; |

| |

● |

market

acceptance of our product candidate, the size and growth of the potential markets for our current product candidate and any future

product candidates we may seek to develop, and our ability to serve those markets; |

| |

● |

the

successful development of our commercialization capabilities, including sales and marketing capabilities; |

| |

● |

our

expectation regarding the number of shares outstanding after this offering; |

| |

● |

our

intention to use the net proceeds of this offering to fund clinical trials, maintain and extend our patent portfolio, and for working

capital and other general corporate purposes; and |

| |

● |

pending

the intended uses described herein, our intention to invest the net proceeds of this offering in short-term, investment grade, interest-bearing

securities. |

These

forward-looking statements are subject to a number of risks, uncertainties and assumptions, including the successful development and

commercialization of our product candidates, market acceptance of our product candidates, our financial performance, including our ability

to fund operations, our ability to regain and maintain compliance with Nasdaq’s continued listing requirements, regulatory approval

and regulation of our product candidates, our expected use of proceeds from this offering, and other factors and risks identified from

time to time in our filings with the SEC, including this prospectus and those described in “Risk Factors.” Moreover, we operate

in a very competitive and rapidly changing environment. New risks emerge from time to time. It is not possible for our management to

predict all risks, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors,

may cause actual results to differ materially from those contained in any forward-looking statements we may make. In light of these risks,

uncertainties and assumptions, the forward-looking events and circumstances discussed in this prospectus may not occur and actual results

could differ materially and adversely from those anticipated or implied in the forward-looking statements.

You

should not rely upon forward-looking statements as predictions of future events. Although we believe that the expectations reflected

in the forward-looking statements are reasonable, we cannot guarantee that the future results, levels of activity, performance or events

and circumstances reflected in the forward-looking statements will be achieved or occur. Moreover, except as required by law, neither

we nor any other person assumes responsibility for the accuracy and completeness of the forward-looking statements. We undertake no obligation

to update publicly any forward-looking statements for any reason after the date of this prospectus to conform these statements to actual

results or to changes in our expectations.

You

should read this prospectus and the documents that we reference in this prospectus and have filed with the SEC as exhibits to the registration

statement of which this prospectus is a part with the understanding that our actual future results, levels of activity, performance and

events and circumstances may be materially different from what we expect.

PROSPECTUS

SUMMARY

The

following summary highlights selected information contained or incorporated by reference in this prospectus and does not contain all

of the information that may be important to you and your investment decision. Before investing in our securities, you should carefully

read this entire prospectus, including our consolidated financial statements and the related notes and other documents incorporated by

reference herein, as well as the information under the caption “Risk Factors” herein and under similar headings in the other

documents that are incorporated by reference into this prospectus including documents that are filed after the date hereof. Some of the

statements in this prospectus constitute forward-looking statements that involve risks and uncertainties. See “Cautionary Note

Concerning Forward-Looking Statements.” In this prospectus, unless context requires otherwise, references to “we,”

“us,” “our,” “BBLG” “Bone Biologics,” or the “Company” refer to Bone Biologics

Corporation and its subsidiary on a consolidated basis.

Company

Overview

We

are a medical device company that is currently focused on bone regeneration in spinal fusion using the recombinant human protein known

as NELL-1. NELL-1 in combination with DBM, demineralized bone matrix, is an osteopromotive recombinant protein that provides target specific

control over bone regeneration. The NELL-1 technology platform has been licensed exclusively for worldwide applications to us through

a technology transfer from the UCLA Technology Development Group on behalf of UC Regents (“UCLA TDG”). UCLA TDG and the Company

received guidance from the Food and Drug Administration (“FDA”) that NELL-1/DBM will be classified as a device/drug combination

product that will require an FDA-approved pre-market approval application (“PMA”) before it can be commercialized in the

United States.

We

were founded by University of California professors in collaboration with an Osaka University professor and a University of Southern

California surgeon in 2004 as a privately-held company with proprietary, patented technology that has been validated in sheep and non-human

primate models to facilitate bone growth. We believe our platform technology has application in delivering improved outcomes in the surgical

specialties of spinal, orthopedic, general orthopedic, plastic reconstruction, neurosurgery, interventional radiology, and sports medicine.

Lead product development and clinical studies are targeted on spinal fusion surgery, one of the larger segments in the orthopedic market.

We

are a development stage entity. The production and marketing of our products and ongoing research and development activities are subject

to extensive regulation by numerous governmental authorities in the United States. Prior to marketing in the United States, any combination

product developed by us must undergo rigorous preclinical (animal) and clinical (human) testing and an extensive regulatory approval

process implemented by the FDA under the Federal Food, Drug, and Cosmetic Act. There can be no assurance that we will not encounter problems

in clinical trials that will cause us or the FDA to delay or suspend the clinical trials.

Our

success will depend in part on our ability to obtain patents and product license rights, maintain trade secrets, and operate without

infringing on the proprietary rights of others, both in the United States and other countries. There can be no assurance that patents

issued to or licensed by us will not be challenged, invalidated, rendered unenforceable, or circumvented, or that the rights granted

thereunder will provide proprietary protection or competitive advantages to us.

On June 20, 2024, we announced that the first

patient had been treated in the multicenter, prospective, randomized pilot clinical study of the Company’s NB1 bone graft device.

NB1 is NELL-1 protein combined with demineralized bone matrix (DBM) to provide rapid, specific and guided control over bone regeneration.

This pilot clinical study will evaluate NB1

in 30 adult subjects who undergo transforaminal lumbar interbody fusion (TLIF) to treat degenerative disc disease (DDD) and will evaluate

safety and effectiveness, fusion success, pain, function improvement and adverse events. To be enrolled in the study, patients must have

DDD at one level from L2-S1 and may also have up to Grade 1 spondylolisthesis or Grade 1 retrolisthesis at the involved level. These

two patients were treated in Australia. The study design was previously reviewed and agreed upon by the U.S. Food and Drug Administration’s

Division of Orthopedic Devices in a Pre-submission to support progression to a pivotal clinical trial in the United States.

Product

Candidates

We

have developed a stand-alone platform technology through significant laboratory and small and large animal research over more than ten

years to generate the current applications across broad fields of use. The platform technology is our recombinant human protein, known

as NELL-1, a proprietary skeletal specific growth factor which is a bone void filler. NELL-1 provides regulation over skeletal tissue

formation and stem cell differentiation during bone regeneration. We obtained the platform technology pursuant to an exclusive license

agreement with UCLA TDG which grants us exclusive rights to develop and commercialize NELL-1 for spinal fusion by local administration,

osteoporosis and trauma applications. A major challenge associated with orthopedic surgery is effective bone regeneration, including

challenges related to rapid, uncontrolled bone growth which can cause unsound structure; cysts and less dense bone formation; unwanted

bone formation, and swelling; and intense inflammatory response to current bone regeneration compounds. We believe NELL-1 will address

these unmet clinical challenges for effective bone regeneration, especially in hard healers.

We

are currently focused on bone regeneration in lumbar spinal fusion, in keeping with our exclusive license agreement, using NELL-1 in

combination with DBM, a demineralized bone matrix from Musculoskeletal Transplant Foundation (“MTF”). The NELL-1/DBM medical

device is a combination product which is an osteopromotive recombinant protein that provides target specific control over bone regeneration.

Leveraging the resources of investors and strategic partners, we have successfully surpassed four critical milestones:

| |

● |

Demonstrating

a successful small laboratory scale pilot run for the manufacturing of the recombinant NELL-1 protein in Chinese hamster ovary cells; |

| |

|

|

| |

● |

Validation

of protein dosing and efficacy in established large animal sheep models pilot study; |

| |

|

|

| |

● |

Completed

pivotal animal study; and |

| |

|

|

| |

● |

Initiated

a first-in-man pilot clinical trial in Australia. |

Our

lead product candidate is expected to be purified NELL-1 mixed with 510(k) cleared DBM Demineralized Bone Putty recommended for use in

conjunction with applicable hardware consistent with the indication. The NELL-1/DBM Fusion Device, NB1, will be comprised of a single

dose vial of NELL-1 recombinant protein freeze dried onto DBM. A vial of NELL-1/DBM will be sold in a convenience kit with a diluent

and a syringe of 510(k) cleared demineralized bone (“DBM Putty”) produced by MTF. A delivery device will allow the surgeon

to mix the reconstituted NELL-1 with the appropriate quantity of DBM Putty just prior to implantation.

The

NELL-1/DBM Fusion Device, NB1, is intended for use in lumbar spinal fusion and may have a variety of other spine and orthopedic applications.

While the product is initially targeted at the lumbar spine fusion market, in keeping with our exclusive license agreement, we believe

NELL-1’s novel set of characteristics, target specific mechanism of action, efficacy, safety and affordability position the product

well for application in a variety of procedures including:

| |

Spine

Implants. The global bone graft substitute market presents a $3 billion market opportunity.

While use of the patient’s own bone, also referred to as autograft, to enhance fusion

of vertebral segments remains the optimal use for this type of treatment, complications associated

with use of autograft bone including pain, increased surgical time and infection limit its

use.

|

| |

Non-Union

Trauma Cases. While the majority of fractures heal without the need for osteosynthetic products, bone substitutes are used

in complicated breaks where the bone does not mend naturally. Globally an $8 billion market opportunity, management believes that

NELL-1 technology is expected to perform as well as other growth factors in this market. |

| |

|

| |

Osteoporosis.

Globally an $11.2 billion market opportunity, the medical need to find a solution to counter a decrease in bone mass and density

seen in women most frequently after menopause or a similar effect on astronauts in microgravity environments for an extended period

is a major medical challenge. The systemic use of NELL-1 to stimulate bone regeneration throughout the body thereby increasing bone

density could have a very significant impact on the treatment of osteoporosis. |

UCLA’s

initial research was funded with approximately $18 million in resources from UCLA TDG and government grants. Since licensing the exclusive

worldwide intellectual property rights from UCLA TDG, our continued development has been funded through capital raises. Our research

and development expenses for the years ended December 31, 2023 and 2022 were $6,907,824 and $1,579,298, respectively. We anticipate that

we will require approximately $5 million to complete first-in-man studies, and an estimated additional $24 million in scientific expenses

to achieve FDA approval, if possible, for a spine interbody fusion indication. These amounts are estimates based on data currently available

to us, and are subject to many factors including the various risk factors discussed in the section “Risk Factors”

included in our Form 10-K for the fiscal year ended December 31, 2023 (the “2023 Form 10-K”), which is incorporated herein

by reference.

NELL-1’s

powerful specific bone and cartilage forming properties are derived from the ability of NELL-1 to only target cells that exhibit an activated

“master switch” to develop into bone or cartilage. NELL-1 is a function specific recombinant human protein that has been

proven in laboratory bench models to recapitulate normal human growth and development to provide control over bone and cartilage regeneration.

NELL-1

was isolated in 1996, and the first NELL-1 patent on bone regeneration was filed in 1999. Subsequent patents and continuations in part

describing NELL-1 manufacturing, delivery, and cartilage regeneration were filed to further strengthen the patent portfolio.

We

have completed two preclinical sheep studies that demonstrated our recombinant NELL-1 (“rhNELL-1”) growth factor effectively

promotes bone formation in a phylogenetically advanced spine model. In addition, rhNELL-1 was shown to be well tolerated and there were

no findings of inflammation. Our pivotal sheep study evaluated the effect of rhNELL-1 combined with DBM on lumbar interbody arthrodesis

in an adult ovine model and demonstrated a 37.5% increased frequency of fusion at 26 weeks from the control.

Our

first-in-man pilot clinical study commenced year-end 2023 and will evaluate the safety and effectiveness of NB1 in adult subjects with

spinal degenerative disc disease at one level from L2-S1, who may also have up to Grade 1 spondylolisthesis or Grade 1 retrolisthesis

at the involved level who undergo transforaminal lumbar interbody fusion. The multi-center, prospective, randomized trial consists of

30 patients in Australia, with the primary end-point being fusion success at 12 months and change from baseline in the Oswestry Disability

Index pain score. We expect completion of the trial 12 months following enrollment of the 30th patient. We intend to use the

pilot clinical trial data from Australia to enable a future larger U.S. pivotal clinical study, prior to submission of a PMA to the FDA.

In June 2024, we treated the first two patients in our randomized pilot study of our NB1 bone graft device.

Our

Business Strategy

Our

business plan is to develop our target-specific growth factor for bone regeneration, based on preclinical and clinical data that has

demonstrated increases in the quantity and quality of bone, and a strong safety profile. Our initial focus on lumbar spinal fusion entails

advancing our target-specific growth factor through clinical studies to achieve FDA approval with comparable efficacy and safety to the

gold standard for spine fusion (autografts). Continued capital funding is critical to facilitate the development of our Nell-1 technology

through the clinical regulatory path.

Intellectual

Property Risks

Our

patent portfolio currently consists of five patents which expire between 2024 and 2033. We intend to expand our portfolio through composition

of matter, methods of use and methods of production patent applications, as the opportunity arises through the development of our platform

technology. Our success will depend in part on our ability to obtain patents and product license rights, maintain trade secrets, and

operate without infringing on the proprietary rights of others, both in the United States and other countries. There can be no assurance

that patents issued to or licensed by us will not be challenged, invalidated, rendered unenforceable, or circumvented, or that the rights

granted thereunder will provide proprietary protection or competitive advantages to us. The patent positions of medical device companies

are uncertain and involve complex legal and factual questions. We may incur significant expenses in protecting our intellectual property

and defending or assessing claims with respect to intellectual property owned by others. See “Risk Factors” on page 7 and

other information included or incorporated by reference in this prospectus for a discussion of intellectual property risks to consider

carefully before deciding to invest in our securities.

Our

Management Team

We

have two full-time employees. Jeffrey Frelick has served as our President and Chief Executive Officer since June 2019 and brings more

than 25 years of leadership, operational, and investment experience in the life science industry. Deina Walsh has served as our Chief

Financial Officer since November 2014.

Mr.

Frelick previously served as our Chief Operating Officer from 2015 to June 2019. Prior to this Mr. Frelick spent 15 years on Wall Street

as a sell-side analyst following the med-tech industry at investment banks Canaccord Genuity, ThinkEquity and Lazard. He also previously

worked at Boston Biomedical Consultants where he provided strategic planning assistance, market research data and due diligence for diagnostic

companies. He began his career at Becton Dickinson in sales and sales management positions after gaining technical experience as a laboratory

technologist with Clinical Pathology Facility. Mr. Frelick received a B.S. in Biology from University of Pittsburgh and an M.B.A. from

Suffolk University’s Sawyer Business School.

Ms.

Walsh is a certified public accountant and was owner/founder of DHW CPA, PLLC, a Public Company Accounting Oversight Board (PCAOB) registered

firm. Prior to forming her firm, Ms. Walsh spent 13 years at a public accounting firm where as a partner she was actively responsible

for leading firm audit engagements of publicly held entities in accordance with PCAOB standards and compliance with SEC regulations,

including internal control requirements under Section 404 of the Sarbanes-Oxley Act. Ms. Walsh had a global client base including entities

throughout the United States, Canada and China. These entities encompass a diverse range of industries including manufacturing, wholesale,

life sciences, pharmaceuticals, and technology. Her experience includes work with start-up companies and well-established operating entities.

She has assisted many entities seeking debt and equity capital. Areas of specialty include mergers, acquisitions, reverse mergers, consolidations,

complex equity structures, foreign currency translations and revenue recognition complexities. Ms. Walsh has an Associates of Science

Degree in Business Administration from Monroe Community College and a Bachelor of Science Degree in Accounting from the State University

of New York at Brockport.

We

have relied and plan on continuing to rely on independent organizations, advisors and consultants to perform certain services for us,

including handling substantially all aspects of regulatory approval, clinical management, manufacturing, marketing, and sales. Such services

may not always be available to us on a timely basis or at costs that we can afford. We also have engaged and plan to continue to engage

regulatory consultants to advise us on our dealings with the FDA and other foreign regulatory authorities and have been and will be required

to retain additional consultants and employees.

Our

future performance will depend in part on our ability to successfully integrate newly hired officers into our management team, engage

and retain consultants, and to develop an effective working relationship with our management and consultants. Losing key personnel or

failing to recruit necessary additional personnel would impede our ability to attain our development objectives. Losing key personnel

or failing to recruit necessary additional personnel would impede our ability to attain our development objectives. See “Risk Factors”

on page 7 and other information included or incorporated by reference in this prospectus for a discussion of management risks to consider

carefully before deciding to invest in our securities.

Recent

Developments

August

2024 Warrant Inducement Transaction

On

August 1, 2024, the Company entered into warrant inducement letter agreements with holders of the Company’s warrants to purchase

781,251 shares of common stock issued on March 6, 2024 (the “March 2024 Warrants”). The Company offered, to each warrant

holder who exercised the March 2024 Warrants, the issuance of two additional unregistered common share purchase warrants for each

March 2024 Warrant exercised (each, an “Incentive Warrant”). The Incentive Warrants entitle the holders to purchase an aggregate

of 781,251 shares of common stock of the Company for a period of 18 months from the date of issuance, and warrants exercisable into an

aggregate of 781,251 shares of common stock of the Company for a period of five years from the date of issuance, exercisable immediately,

at a price of $2.00 per share. On August 2, 2024, the Company completed the warrant inducement transaction and received net proceeds

to the Company of approximately $1.7 million.

In

addition, the Company issued warrants to purchase up to an aggregate of 46,875 shares of common stock to the placement agent as compensation.

The warrants issued to the placement agent have substantially the same terms and conditions as the five-year Incentive Warrants, except

the placement agent warrants have an exercise price of $3.35 per share.

Due

to certain beneficial ownership limitations set forth in the March 2024 Warrants, the Company issued the number of shares that would

not cause a holder to exceed such beneficial ownership limitation and agreed to hold such balance of shares of common stock in abeyance.

Of the March 2024 Warrants exercised, an aggregate of 560,251 shares of common stock were held in abeyance. The abeyance

shares will be held until notice is received by the holder that the shares of common stock may be issued in compliance with such

beneficial ownership limitations. Until such time, the abeyance shares are evidenced through the holder’s existing warrants

and will continue to be included in the Company’s table of outstanding warrants. The abeyance shares are not considered issued or outstanding

in our consolidated balance sheets.

As

of August 9, 2024, 264,938 Abeyance Shares

were released and issued.

Going

Concern

We

have a history of operating losses since inception and expect to incur additional near-term losses. As discussed further in “Management’s

Discussion and Analysis - Liquidity and Capital Resources,” included in the 2023 Form 10-K, which is incorporated herein by reference,

our auditor has included a “going concern” explanatory paragraph in its report on our consolidated financial statements for

the fiscal year ended December 31, 2023, expressing substantial doubt about our ability to continue as an ongoing business for the next

twelve months. Our consolidated financial statements do not include any adjustments that may result from the outcome of this uncertainty.

If we cannot secure the financing needed to continue as a viable business, our shareholders may lose some or all of their investment

in us.

Corporate

Information

We

were incorporated under the laws of the State of Delaware on October 18, 2007 as AFH Acquisition X, Inc. Pursuant to a Merger Agreement,

dated September 19, 2014, by and among the Company, its wholly-owned subsidiary, Bone Biologics Acquisition Corp., a Delaware corporation

(“Merger Sub”), and Bone Biologics, Inc., Merger Sub merged with and into Bone Biologics Inc., with Bone Biologics Inc. remaining

as the surviving corporation in the merger. Upon the consummation of the merger, the separate existence of Merger Sub ceased. On September

22, 2014, the Company officially changed its name to “Bone Biologics Corporation” to more accurately reflect the nature of

its business and Bone Biologics, Inc. became a wholly owned subsidiary of the Company. Bone Biologics, Inc. was incorporated in California

on September 9, 2004.

Our

principal executive offices are located at 2 Burlington Woods Drive, Suite 100, Burlington MA 01803 and our telephone number is (781)

552-4452. Our website address is www.bonebiologics.com. The information contained on our website is not incorporated by reference into

this prospectus, and you should not consider any information contained on, or that can be accessed through, our website as part of this

prospectus or in deciding whether to invest in our securities.

THE

OFFERING

| Issuer: |

|

Bone

Biologics Corporation. |

| |

|

|

| Common

stock being offered by us: |

|

1,617,919

shares upon exercise of the warrants. |

| |

|

|

| Common

stock outstanding prior to this offering: |

|

1,801,427

shares. |

| |

|

|

| Common

stock to be outstanding after this offering: |

|

3,419,346

shares (assuming full exercise of the warrants

for cash). |

| |

|

|

| Use

of proceeds: |

|

We

will not receive any of the proceeds from the sale of common stock by the selling stockholders. See “Use of Proceeds.” |

| |

|

|

| Nasdaq

trading symbol: |

|

Our

common stock is listed on the Nasdaq Capital Market under the symbol “BBLG.” |

| |

|

|

| Risk

factors: |

|

The

securities offered by this prospectus are speculative and involve a high degree of risk.

Investors

purchasing securities should not purchase the securities unless they can afford the loss

of their entire investment. See “Risk Factors” beginning on page 7

|

The

discussion above is based on 1,801,427 shares of our common stock outstanding as of August 9, 2024, and excludes the following:

| |

● |

74,151

shares of common stock issuable upon exercise of stock options outstanding at a weighted average exercise price of $107.65 per share. |

| |

|

|

| |

● |

540,023

shares of common stock issuable upon exercise of outstanding common stock warrants with a weighted average exercise price of $48.45

per share. |

| |

|

|

| |

● |

629,489

shares of common stock reserved for future grants pursuant to the Bone Biologics Corporation

2015 Equity Incentive Plan.

|

| |

● |

1,562,502

shares of common stock issuable upon exercise of the five-year and eighteen-month warrants. |

| |

|

|

| |

● |

46,875

shares of common stock issuable upon exercise of the placement agent warrants issued to the placement agent or its designees as compensation

in connection with the inducement transaction. |

RISK

FACTORS

Investing

in our securities involves significant risks. Before you decide whether to purchase any of our securities, you should carefully consider

the risks and uncertainties described below and elsewhere in the prospectus and set forth in Part I, Item 1A under the heading “Risk

Factors” included in our most recent Annual Report on Form 10-K and in other reports we file with the SEC pursuant to the Securities

Exchange Act of 1934, as amended (the “Exchange Act”), which are incorporated by reference into this prospectus. For more

information, please see “Incorporation of Certain Information by Reference” and “Where You Can Find More Information.”

The

risks and uncertainties described in any documents incorporated by reference herein are not the only ones facing us. Additional risks

and uncertainties that we do not presently know about or that we currently believe are not material may also adversely affect our business.

If any of the risks and uncertainties described in this prospectus or the documents incorporated by reference herein actually occur,

our business, financial condition, results of operations and prospects could be adversely affected in a material way. The occurrence

of any of these risks may cause you to lose all or part of your investment in the offered securities.

Because

the shares of common stock that are being registered in this prospectus represent a substantial percentage of our outstanding common

stock, the sale of such securities could cause the market price of our common stock to decline significantly.

This

prospectus relates to the offer and sale from time to time by the selling stockholders of up to 1,617,919 shares of common stock

issuable by us upon exercise of the warrants. The number of shares of common stock that the selling stockholders can sell into the public

markets pursuant to this prospectus represents a significant amount of our outstanding shares of common stock. As of August 9,

2024, there were 1,801,427 shares of common stock outstanding. If all shares being registered hereby were sold, it would comprise approximately

90% of our total shares of common stock outstanding. Given the substantial number of shares of common stock registered pursuant

to this prospectus, the sale of common stock by the selling stockholders, or the public perception that such sales could occur, or that

the selling stockholders intend to sell common stock, could have an adverse impact on the market price of our common stock, even if there

is no relationship between such sales and the performance of our business.

USE

OF PROCEEDS

This

prospectus relates to shares of our common stock that may be offered and sold from time to time by the selling stockholders. We will

not receive any of the proceeds resulting from the sale of common stock by the selling stockholders.

However,

we will receive gross proceeds of approximately $3,336,704 from the cash exercise of the warrants by the selling stockholders,

if any. We intend to use such proceeds to fund clinical trials, maintain and extend our patent portfolio, and for working capital and

general corporate purposes. There is no assurance that the holders of the warrants will elect to exercise any or all of the warrants.

The exercise prices of the warrants offered hereby are $2.00, $3.35, and $6.40 per share. We believe the likelihood that

warrant holders will exercise their warrants, and therefore the amount of cash proceeds that we would receive, is highly dependent upon

the trading price of our common stock. The closing price of our common stock on Nasdaq on August 9, 2024 was $1.69 per

share. If the trading price for our common stock is less than the exercise price of the warrants, we believe holders of the warrants

will be unlikely to exercise their warrants for cash. To the extent that shares of common stock are issued pursuant to the exercise of

warrants on a “cashless basis,” the amount of cash we would receive from the exercise of the warrants will decrease.

SELLING

STOCKHOLDERS

This

prospectus relates to the offering by the selling stockholders of up to 1,617,919 shares of common stock, which are issuable upon

exercise of outstanding warrants.

The

following table sets forth, based on information provided to us by the selling stockholders or known to us, the name of each selling

stockholder, the number of shares offered by each selling stockholder, the number of shares of our common stock beneficially owned by

the selling stockholder before this offering, and the number and percentage of shares of our common stock beneficially owned by the selling

stockholder after the offering. The number of shares owned are those beneficially owned, as determined under the rules of the SEC, and

the information is not necessarily indicative of beneficial ownership for any other purpose. Under these rules, beneficial ownership

includes any shares of common stock as to which a person has sole or shared voting power or investment power and any shares of common

stock which the person has the right to acquire within 60 days through the exercise of any option, warrant or right, through conversion

of any security or pursuant to the automatic termination of a power of attorney or revocation of a trust, discretionary account or similar

arrangement. To our knowledge, except as set forth below, none of the selling stockholders is a broker-dealer or an affiliate of a broker-dealer.

None of the selling stockholders has had any position, office or other material relationship, within the past three years, with us or

with any of our predecessors or affiliates.

We

have assumed all shares of common stock reflected on the table will be sold from time to time in the offering covered by this prospectus.

Because the selling stockholders may offer all or any portion of the shares of common stock listed in the table below, no estimate can

be given as to the amount of those shares of common stock covered by this prospectus that will be held by the selling stockholders upon

the termination of the offering.

| Selling Stockholder | |

Number of

Shares

Beneficially

Owned Before

Offering | | |

Number of

Shares

Offered (1) | | |

Number of

Shares

Beneficially

Owned After

Offering | | |

Percentage of

Shares

Beneficially

Owned After

Offering (2) | |

| Armistice Capital, LLC (3) | |

| 1,367,037

(4) | | |

| 1,171,876 | | |

| 290,000

(5) | | |

| 7.91 | % |

| Intracoastal Capital, LLC (6) | |

| 481,237

(7) | | |

| 390,626 | | |

| 164,450

(8) | | |

| 4.69 | % |

| Noam Rubinstein (9) | |

| 32,222 | | |

| 17,456 | | |

| 14,766 | | |

| * | |

| Craig Schwabe (9) | |

| 3,452 | | |

| 1,870 | | |

| 1,582 | | |

| * | |

| Michael Vasinkevich (9) | |

| 65,595 | | |

| 35,537 | | |

| 30,058 | | |

| * | |

| Charles Worthman (9) | |

| 554 | | |

| 554 | | |

| 469 | | |

| * | |

| * |

Less than 1%. |

| (1) |

Represents

shares issuable upon exercise of outstanding warrants. See “Prospectus Summary — The Offering.” |

| (2) |

Based

on 1,801,427 shares of common stock outstanding as of August 9, 2024, as adjusted to assume the cash exercise of the warrants

and the sale of all shares offered hereby, or a total of 3,363,929 shares. |

| (3) |

The

securities are directly held by Armistice Capital Master Fund Ltd., a Cayman Islands exempted company (the “Master Fund”),

and may be deemed to be beneficially owned by: (i) Armistice Capital, LLC (“Armistice Capital”), as the investment manager

of the Master Fund; and (ii) Steven Boyd, as the Managing Member of Armistice Capital. The warrants are subject to a beneficial ownership

limitation, which such limitation restricts the Selling Stockholder from exercising that portion of the warrants that would result

in the Selling Stockholder and its affiliates owning, after exercise, a number of shares of common stock in excess of the beneficial

ownership limitation. The address of Armistice Capital Master Fund Ltd. is c/o Armistice Capital, LLC, 510 Madison Avenue, 7th Floor,

New York, NY 10022. |

| (4) |

Consists

of 44,000 shares held by Armistice Capital, LLC, 151,161 currently issuable shares held in abeyance, and 1,171,876 shares

underlying the warrants held by the selling stockholders being registered pursuant to this Registration Statement without regard

to any limitations on exercise. Does not include 94,839 shares held in abeyance subject to a beneficial ownership limitation

of 9.99%, and 38,813 shares issuable upon the exercise of presently exercisable warrants subject to a beneficial ownership limitation

of 4.99%, which such limitations restrict the selling stockholder from exercising that portion of the warrants that would result

in the selling stockholder and its affiliates owning, after exercise, a number of shares of common stock in excess of the beneficial

ownership limitation. |

| (5) |

Consists

of 44,000 shares held by Armistice Capital, LLC and 246,000 currently issuable shares held in abeyance. Does not include 38,813 shares issuable upon the exercise

of presently exercisable warrants subject to a beneficial ownership limitation of 4.99%, which such limitations restrict the selling

stockholder from exercising that portion of the warrants that would result in the selling stockholder and its affiliates owning,

after exercise, a number of shares of common stock in excess of the beneficial ownership limitation. |

| (6) |

Mitchell

P. Kopin (“Mr. Kopin”) and Daniel B. Asher (“Mr. Asher”), each of whom are managers of Intracoastal Capital

LLC (“Intracoastal”), have shared voting control and investment discretion over the securities reported herein that are

held by Intracoastal. As a result, each of Mr. Kopin and Mr. Asher may be deemed to have beneficial ownership (as determined under

Section 13(d) of the Exchange Act) of the securities reported herein that are held by Intracoastal. |

| (7) |

Consists

of 78,000 shares held by Intracoastal, 12,611 shares issuable upon the exercise of presently exercisable warrants, and 390,626

shares underlying the warrants held by the selling stockholders being registered pursuant to this Registration Statement without

regard to any limitations on exercise. Does not include 24,526 shares issuable upon the exercise of presently exercisable

warrants subject to a beneficial ownership limitation of 4.99%, and 49,313 shares held in abeyance subject to a beneficial ownership

limitation of 4.99%, which such limitations restrict the selling stockholder from exercising that portion of the warrants or receiving

such shares held in abeyance that would result in the selling stockholder and its affiliates owning, after exercise, a number of

shares of common stock in excess of the beneficial ownership limitation. |

| (8) |

Consists

of 78,000 shares held by Intracoastal, 37,137 shares issuable upon the exercise of presently exercisable warrants, and 49,313 currently

issuable shares held in abeyance. |

| (9) |

Each of Messrs.

Rubinstein, Schwab, Vasinkevich, and Worthman are affiliated with H.C. Wainwright & Co., LLC, a registered broker dealer with

a registered address of H.C. Wainwright & Co., LLC, 430 Park Ave, 3rd Floor, New York, NY 10022, and has sole voting and dispositive

power over the securities held. The number of shares beneficially owned prior to this offering consist of shares of common stock

issuable upon exercise of warrants received as compensation in connection with offerings consummated by us in November 2023, March

2024, and August 2024. The number of shares beneficially owned after this offering consist of shares of common stock issuable upon

exercise of warrants received as compensation in connection with the offering consummated by us in March 2024. Messrs. Rubinstein,

Schwab, Vasinkevich, and Worthman acquired these warrants in the ordinary course of business and, at the time the warrants were acquired,

had no agreement or understanding, directly or indirectly, with any person to distribute such securities. |

PLAN

OF DISTRIBUTION

The

selling stockholders, which as used herein includes donees, pledgees, transferees or other successors-in-interest selling shares of common

stock or interests in shares of common stock received after the date of this prospectus from a selling stockholder as a gift, pledge,

partnership distribution or other transfer, may, from time to time, sell, transfer or otherwise dispose of any or all of their shares

of common stock covered by this prospectus on any stock exchange, market or trading facility on which the shares of common stock are

traded or in private transactions. These dispositions may be at fixed prices, at prevailing market prices at the time of sale, at prices

related to the prevailing market price, at varying prices determined at the time of sale, or at negotiated prices.

The

selling stockholders may use any one or more of the following methods when disposing of the shares of common stock:

| ● | ordinary

brokerage transactions and transactions in which the broker-dealer solicits purchasers; |

| ● | block

trades in which the broker-dealer will attempt to sell the shares as agent, but may position

and resell a portion of the block as principal to facilitate the transaction; |

| ● | purchases

by a broker-dealer as principal and resale by the broker-dealer for its account; |

| ● | an

exchange distribution in accordance with the rules of the applicable exchange; |

| ● | privately

negotiated transactions; |

| ● | short

sales effected after the date the registration statement of which this prospectus is a part

is declared effective by the SEC; |

| ● | through

the writing or settlement of options or other hedging transactions, whether through an options

exchange or otherwise; |

| ● | broker-dealers

may agree with the selling stockholders to sell a specified number of such shares at a stipulated

price per share; |

| ● | the

in-kind distribution of the shares by an investment fund to its limited partners, members

or other equity holders; |

| ● | a

combination of any such methods of sale; and |

| ● | any

other method permitted by applicable law. |

The

selling stockholders may sell all, some or none of the shares of common stock covered by this prospectus. If sold under the registration

statement of which this prospectus forms a part, the shares of common stock will be freely tradeable in the hands of persons other than

our affiliates that acquire such shares.

The

selling stockholders may, from time to time, pledge or grant a security interest in some or all of the shares of common stock owned by

them and, if they default in the performance of their secured obligations, the pledgees or secured parties may offer and sell the shares

of common stock, from time to time, under this prospectus, or under an amendment to this prospectus under Rule 424(b)(3) or other applicable

provision of the Securities Act of 1933, as amended (the “Securities Act”), amending the list of selling stockholders to

include the pledgee, transferee or other successors in interest as a selling stockholder under this prospectus. The selling stockholders

also may transfer the shares of common stock in other circumstances, in which case the transferees, pledgees or other successors in interest

will be the selling beneficial owners for purposes of this prospectus.

In

connection with the sale of our common stock or interests therein, the selling stockholders may enter into hedging transactions with

broker-dealers or other financial institutions, which may in turn engage in short sales of the common stock in the course of hedging

the positions it assumes. To the extent permitted by applicable securities laws, the selling stockholders may also sell shares of our

common stock short and deliver these securities to close out their short positions, or loan or pledge the common stock to broker-dealers

that in turn may sell these securities. The selling stockholders may also enter into option or other transactions with broker-dealers

or other financial institutions or the creation of one or more derivative securities which require the delivery to such broker-dealer

or other financial institution of shares of common stock offered by this prospectus, which shares such broker-dealer or other financial

institution may resell pursuant to this prospectus (as supplemented or amended to reflect such transaction).

The

aggregate proceeds to the selling stockholders from the sale of the common stock offered by the selling stockholders will be the purchase

price of the common stock less discounts or commissions, if any. The selling stockholders reserve the right to accept and, together with

their agents from time to time, to reject, in whole or in part, any proposed purchase of common stock to be made directly or through

agents. We will not receive any of the proceeds from this offering.

The

selling stockholders also may resell all or a portion of the shares of common stock in open market transactions in reliance upon Rule

144 under the Securities Act, provided that the selling stockholders meet the criteria and conforms to the requirements of that rule.

The

selling stockholders and any underwriters, broker-dealers or agents that participate in the sale of the common stock or interests therein

may be “underwriters” within the meaning of Section 2(a)(11) of the Securities Act. Any discounts, commissions, concessions

or profit any selling stockholder earns on any resale of the shares of common stock covered by this prospectus may be underwriting discounts

and commissions under the Securities Act. Selling stockholders who are “underwriters” within the meaning of Section 2(a)(11)

of the Securities Act will be subject to the prospectus delivery requirements of the Securities Act.

To

the extent required, the shares of our common stock to be sold, the names of the selling stockholders, the respective purchase prices

and public offering prices, the names of any agents, dealer or underwriter, any applicable commissions or discounts with respect to a

particular offer will be set forth in an accompanying prospectus supplement or, if appropriate, a post-effective amendment to the registration

statement that includes this prospectus.

In

order to comply with the securities laws of some states, if applicable, the common stock may be sold in these jurisdictions only through

registered or licensed brokers or dealers. In addition, in some states the common stock may not be sold unless it has been registered

or qualified for sale or an exemption from registration or qualification requirements is available and is complied with.

We

have advised the selling stockholders that the anti-manipulation rules of Regulation M under the Exchange Act may apply to sales of shares

in the market and to the activities of the selling stockholders and their affiliates. In addition, to the extent applicable we will make

copies of this prospectus (as it may be supplemented or amended from time to time) available to the selling stockholders for the purpose

of satisfying the prospectus delivery requirements of the Securities Act. The selling stockholders may indemnify any broker-dealer that

participates in transactions involving the sale of the shares against certain liabilities, including liabilities arising under the Securities

Act.

We

have agreed to indemnify the selling stockholders against certain liabilities, including liabilities under the Securities Act and state

securities laws, relating to the registration of the shares offered by this prospectus.

LEGAL

MATTERS

The

validity of the issuance of the common stock offered by us in this offering will be passed upon for us Harter Secrest & Emery LLP,

Rochester, NY.

EXPERTS

The

audited consolidated financial statements of Bone Biologics Corporation as of December 31, 2023 and 2022, and for each of the years then

ended included in our annual report in the 2023 Form 10-K, are incorporated by reference into this prospectus and in the registration

statement and have been so incorporated in reliance upon the report of Weinberg & Company, P.A., an independent registered public

accounting firm (the report on the consolidated financial statements contains an explanatory paragraph regarding our ability to continue

as a going concern), incorporated herein by reference, given on the authority of said firm as experts in auditing and accounting.

INCORPORATION

OF CERTAIN INFORMATION BY REFERENCE

The

SEC allows us to “incorporate by reference” information into this document, which means that we can disclose important information

to you by referring you to another document filed separately with the SEC. The information incorporated by reference is an important

part of this prospectus, and information that we file later with the SEC will automatically update and supersede this information.

We

incorporate by reference the documents listed below and any future filings made with the SEC under Sections 13(a), 13(c), 14, or 15(d)

of the Exchange Act made on or after (i) the date of the initial registration statement and prior to effectiveness of the registration

statement, and (ii) the date of this prospectus and prior to the completion or the termination of the offering of the securities described

in this prospectus (other than information in such filings that was “furnished,” under applicable SEC rules, rather than

“filed”). We incorporate by reference the following documents or information that we have filed with the SEC:

| |

● |

our

Annual Report on Form 10-K for the year ended December 31, 2023, filed with the SEC on February 21, 2024; |

| |

|

|

| |

● |

our

Quarterly Reports on Form 10-Q for the periods ended March 31, 2024, filed with the SEC on May 14, 2024, and June 30, 2024, filed

with the SEC of August 9, 2024; |

| |

|

|

| |

● |

our

Current Reports on Form 8-K filed with the SEC on January 2, 2024, January 10, 2024, January 11, 2024, January 12, 2024, March 1, 2024, March 6, 2024, March 15, 2024, and August 2, 2024; and |

| |

|

|

| |

● |

The

description of the Common Stock incorporated by reference to our Registration Statement on Form 8-A that was filed with the SEC on

October 8, 2021, Exhibit 4.5 to Amendment No. 1 to our Annual Report for the fiscal year ended December 31, 2022 on Form 10-K/A filed

with the SEC on November 20, 2023, and any amendment or report filed for the purpose of updating such description. |

To

obtain copies of these filings, see “Where You Can Find More Information” in this prospectus. Nothing in this prospectus

shall be deemed to incorporate information furnished, but not filed, with the SEC, including pursuant to Item 2.02 or Item 7.01 of Form

8-K and any corresponding information or exhibit furnished under Item 9.01 of Form 8-K.

Information

in this prospectus supersedes related information in the documents listed above and information in subsequently filed documents supersedes

related information in both this prospectus and the incorporated documents.

WHERE

YOU CAN FIND MORE INFORMATION

We

are subject to the periodic reporting requirements of the Exchange Act, and we will file periodic reports, proxy statements and other

information with the SEC. These periodic reports, proxy statements and other information are available at www.sec.gov. We maintain a

website at https://www.bonebiologics.com. We have not incorporated by reference into this prospectus the information contained in, or

that can be accessed through, our website, and you should not consider it to be a part of this prospectus. You may access our Annual

Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and amendments to those reports filed or furnished

pursuant to Section 13(a) or 15(d) of the Exchange Act with the SEC free of charge at our website as soon as reasonably practicable after

such material is electronically filed with, or furnished to, the SEC. You may also request a copy of these filings (other than exhibits

to these documents unless the exhibits are specifically incorporated by reference into these documents or referred to in this prospectus),

at no cost, by writing us at 2 Burlington Woods Drive, Suite 100, Burlington, MA 01803 or contacting us at (781) 552-4452.

We

have filed with the SEC a registration statement under the Securities Act relating to the offering of these securities. The registration

statement, including the attached exhibits, contains additional relevant information about us and the securities. This prospectus does

not contain all of the information set forth in the registration statement. You may review a copy of the registration statement and the

documents incorporated by reference herein through the SEC’s website at www.sec.gov.

BONE

BIOLOGICS CORPORATION

1,617,919

Shares of Common Stock Offered by the Selling

Stockholders

Prospectus

,

2024

PART

II

INFORMATION

NOT REQUIRED IN PROSPECTUS

Item

14. Other Expenses of Issuance and Distribution.

The

following table sets forth all expenses, other than the Placement Agent fees, payable by the registrant in connection with the sale of

the securities being registered. All the amounts shown are estimates except the SEC registration fee.

| | |

Amount to be paid | |

| SEC registration fee | |

$ | 395 | |

| Accounting fees and expenses | |

$ | 5,000 | |

| Legal fees and expenses | |

$ | 10,000 | |

| Total | |

$ | 15,395 | |

Item

15. Indemnification of Directors and Officers.

Section

102 of the Delaware General Corporation Law (“DGCL”) permits a corporation to eliminate the personal liability of directors

of a corporation to the corporation or its stockholders for monetary damages for a breach of fiduciary duty as a director, except where

the director breached his duty of loyalty to us or our stockholders, acted or failed to act (an omission) not in good faith or that involved

intentional misconduct or a knowing violation of law, engaged in intentional misconduct or knowingly violated a law, authorized the payment

of a dividend or approved a stock repurchase in violation of the DGCL, or obtained an improper personal benefit. Our Amended and Restated

Certificate of Incorporation, as amended (“Certificate of Incorporation”) provides that no director of the Company shall

be personally liable to it or its stockholders for monetary damages for any breach of fiduciary duty as a director, notwithstanding any

provision of law imposing such liability, except to the extent that the DGCL prohibits the elimination or limitation of liability of

directors for breaches of fiduciary duty.

Section

145 of the DGCL provides that a corporation has the power to indemnify a director, officer, employee, or agent of the corporation, or

a person serving at the request of the corporation for another corporation, partnership, joint venture, trust or other enterprise in

related capacities against expenses (including attorneys’ fees), judgments, fines and amounts paid in settlement actually and reasonably

incurred by the person in connection with an action, suit or proceeding to which he was or is a party or is threatened to be made a party

to any threatened, ending or completed action, suit or proceeding by reason of such position, if such person acted in good faith and

in a manner he reasonably believed to be in or not opposed to the best interests of the corporation, and, in any criminal action or proceeding,

had no reasonable cause to believe his conduct was unlawful, except that, in the case of actions brought by or in the right of the corporation,

no indemnification shall be made with respect to any claim, issue or matter as to which such person shall have been adjudged to be liable

to the corporation unless and only to the extent that the Court of Chancery or other adjudicating court determines that, despite the

adjudication of liability but in view of all of the circumstances of the case, such person is fairly and reasonably entitled to indemnity

for such expenses which the Court of Chancery or such other court shall deem proper.

Our

Certificate of Incorporation and Amended and Restated Bylaws provide indemnification for our directors and officers to the fullest extent

permitted by the DGCL. We will indemnify each person who was or is a party or threatened to be made a party to any threatened, pending

or completed action, suit or proceeding (other than an action by or in the right of us) by reason of the fact that he or she is or was,

or has agreed to become, a director or officer, or is or was serving, or has agreed to serve, at our request as a director, officer,

partner, employee or trustee of, or in a similar capacity with, another corporation, partnership, joint venture, trust or other enterprise

(all such persons being referred to as an “Indemnitee”), or by reason of any action alleged to have been taken or omitted

in such capacity, against all expenses (including attorneys’ fees), judgments, fines and amounts paid in settlement actually and

reasonably incurred in connection with such action, suit or proceeding and any appeal therefrom, if such Indemnitee acted in good faith

and in a manner he or she reasonably believed to be in, or not opposed to, our best interests, and, with respect to any criminal action

or proceeding, he or she had no reasonable cause to believe his or her conduct was unlawful. Our Certificate of Incorporation and Amended

and Restated Bylaws provide that we will indemnify any Indemnitee who was or is a party to an action or suit by or in the right of us

to procure a judgment in our favor by reason of the fact that the Indemnitee is or was, or has agreed to become, a director or officer,

or is or was serving, or has agreed to serve, at our request as a director, officer, partner, employee or trustee of, or in a similar

capacity with, another corporation, partnership, joint venture, trust or other enterprise, or by reason of any action alleged to have

been taken or omitted in such capacity, against all expenses (including attorneys’ fees) and, to the extent permitted by law, amounts

paid in settlement actually and reasonably incurred in connection with such action, suit or proceeding, and any appeal therefrom, if

the Indemnitee acted in good faith and in a manner he or she reasonably believed to be in, or not opposed to, our best interests, except

that no indemnification shall be made with respect to any claim, issue or matter as to which such person shall have been adjudged to

be liable to us, unless a court determines that, despite such adjudication but in view of all of the circumstances, he or she is entitled

to indemnification of such expenses. Notwithstanding the foregoing, to the extent that any Indemnitee has been successful, on the merits

or otherwise, he or she will be indemnified by us against all expenses (including attorneys’ fees) actually and reasonably incurred

in connection therewith. Expenses must be advanced to an Indemnitee under certain circumstances.

As

of the date of this prospectus, we have entered into separate indemnification agreements with each of our directors and executive officers.

Each indemnification agreement provides, among other things, for indemnification to the fullest extent permitted by law and our Certificate

of Incorporation against any and all expenses, judgments, fines, penalties and amounts paid in settlement of any claim. The indemnification

agreements provide for the advancement or payment of all expenses to the indemnitee and for the reimbursement to us if it is found that

such indemnitee is not entitled to such indemnification. In addition, we have obtained a general liability insurance policy that covers

certain liabilities of directors and officers of our corporation arising out of claims based on acts or omissions in their capacities

as directors or officers.

Item

16. Exhibits.

The

following exhibits to this registration statement included in the Exhibit Index are incorporated by reference.

EXHIBIT

INDEX

*

Filed herewith.

Item

17. Undertakings

The undersigned registrant hereby undertakes:

| (a)(1) |

To file, during

any period in which offers or sales are being made, a post-effective amendment to this registration statement: |

| |

|

| |

(i) |

To include any prospectus

required by Section 10(a)(3) of the Securities Act; |

| |

|

|

| |

(ii) |

To reflect in the prospectus

any facts or events arising after the effective date of the registration statement (or the most recent post-effective amendment thereof)