Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

12 September 2024 - 7:01AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE

13a-16 OR 15d-16 UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of September 2024

Commission File Number 001-39001

Blue Hat Interactive Entertainment Technology

(Translation of registrant’s name into

English)

7th Floor, Building C, No. 1010 Anling Road

Huli District, Xiamen, China 361009

(Address of principal executive office)

Indicate by check mark whether the registrant files

or will file annual reports under cover of Form 20-F or Form 40-F. Form 20-F ☒

Form 40-F ☐

Blue Hat interactive Entertainment Technology, a Cayman

Islands exempted company, (the “Company”) furnishes under the cover of Form 6-K the following:

Exhibit.

SIGNATURES

Pursuant to the requirements of the Securities Exchange

Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: September 11, 2024

| |

BLUE HAT INTERACTIVE ENTERTAINMENT TECHNOLOGY |

| |

|

| |

By: |

/s/ Xiaodong Chen |

| |

|

Name: Xiaodong Chen |

| |

|

Title: Chief Executive Officer |

EXHIBIT 99.1

Blue Hat Announces Receipt of Nasdaq Notification

Regarding Minimum Bid Price Deficiency

Xiamen, China – September 11, 2024: Blue

Hat Interactive Entertainment Technology (“Blue Hat” or the “Company”) (NASDAQ: BHAT), today announced that

on September 6, 2024, it has received a notification letter from The Nasdaq Stock Market LLC (“Nasdaq”) notifying the Company

that it is not in compliance with the minimum bid price requirement from July 25, 2024 through September 5, 2024, as set forth in Nasdaq

Listing Rules 5550(a)(2), which require that the closing bid price for the Company’s ordinary shares listed on Nasdaq be maintained

at a minimum of US$1.00 and failure to meet it for 30 consecutive business days constitutes a compliance deficiency.

The notification has no immediate effect on the listing

of the Company’s ordinary shares on Nasdaq. In accordance with Nasdaq Listing Rule 5810(c)(3)(A), the Company has a period of 180

calendar days from the date of notification, or until March 5, 2025 (the “Compliance Period”), to regain compliance with the

minimum bid price requirement, during which time the Company’s ordinary shares will continue to trade on the Nasdaq Capital Market.

If at any time before the end of the Compliance Period , the bid price of the Company’s ordinary shares closes at or above US$1.00

per share for a minimum of 10 consecutive business days, Nasdaq will provide written notification that the Company has achieved compliance

with the minimum bid price requirement. In the event the Company does not regain compliance by end of the Compliance Period , the Company

may be eligible for additional time to regain compliance, if the company provide written notice of its intention to cure the deficiency

during the second compliance period and is in compliance with the continued listing requirement for market value of publicly held shares

and the initial listing standards for other criteria for the Nasdaq Capital Market, with the exception of the bid price requirement. If

it appears to the staff that the Company will not be able to cure the deficiency, or if the Company is otherwise not eligible, Nasdaq

will provide notice that its securities will be subject to delisting, the Company may appear such determination to a hearing panel. In

addition, if during any compliance period specified in the Nasdaq Listing Rule 5810(c)(3)(A), the Company’s ordinary shares have

a closing bid price of $0.10 or less for ten consecutive trading days, Nasdaq will issue a Staff Delisting Determination under Rule 5810

with respect to the ordinary shares.

The Company intends to monitor the closing bid price

of its ordinary shares during the Compliance Period. In the event the Company is not eligible for additional time to regain compliance

with the Nasdaq requirements at the end of the Compliance Period, the Company’s Board of Directors will consider options that may

be available to achieve compliance.

About Blue Hat

Blue Hat was formerly a provider of communication

services and IDC business, as well as a producer, developer, and operator of AR interactive entertainment games, toys, and educational

materials in China. Leveraging years of technological accumulation and unique patented technology, Blue Hat is expanding its business

to commodity trading, aiming to become a leading intelligent commodity trader worldwide. For more information, please visit the Company’s

investor relations website at http://ir.bluehatgroup.com. The Company routinely provides important information on its website.

Forward-Looking Statements

This release contains forward-looking statements within

the meaning of Section 27A of the Securities Act of 1933, as amended and Section 21E of the Securities Exchange Act of 1934, as amended.

All forward-looking statements are inherently uncertain as they are based on current expectations and assumptions concerning future events

or future performance of the Company. Readers are cautioned not to place undue reliance on these forward-looking statements, which are

only predictions and speak only as of the date hereof. In evaluating such statements, prospective investors should review carefully various

risks and uncertainties identified in this release and matters set in the Company’s SEC filings. These risks and uncertainties could

cause the Company’s actual results to differ materially from those indicated in the forward-looking statements.

Contacts:

Blue Hat Interactive Entertainment Technology

Phone: +86 (592) 228-0010

Email: ir@bluehatgroup.net

-2-

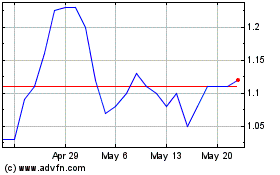

Blue Hat Interactive Ent... (NASDAQ:BHAT)

Historical Stock Chart

From Dec 2024 to Jan 2025

Blue Hat Interactive Ent... (NASDAQ:BHAT)

Historical Stock Chart

From Jan 2024 to Jan 2025