22% Revenue Growth in B2 Cloud Storage, 18%

Revenue Growth Overall in Q4 2024

Q4 Adjusted EBITDA Margin More than Doubled

Year Over Year to 14%

Backblaze, Inc. (Nasdaq: BLZE), the cloud storage innovator

delivering a modern alternative to traditional cloud providers,

today announced results for its fourth quarter and year ended

December 31, 2024.

“Record Q4 sales bookings capped a strong year, validating early

traction in our Go-To-Market transformation," said Gleb Budman, CEO

of Backblaze. "Not only did we increase sales productivity and won

an over $1 million ACV customer in the quarter, we also saw AI

starting to meaningfully contribute to the business, with 3 AI

companies now in our top 10 customers in December 2024."

Fourth Quarter 2024 Financial Highlights:

- Revenue of $33.8 million, an increase of 18% year-over-year

(YoY).

- B2 Cloud Storage revenue was $17.1 million, an increase of 22%

YoY.

- Computer Backup revenue was $16.7 million, an increase of

13%YoY.

- Gross profit of $18.5 million, or 55% of revenue, compared to

$15.1 million or 52% of revenue, in Q4 2023.

- Adjusted gross profit of $26.3 million, or 78% of revenue,

compared to $22.1 million or 77% of revenue in Q4 2023.

- Net loss was $14.4 million compared to a net loss of $12.2

million in Q4 2023.

- Net loss per share was $0.30 for compared to a net loss per

share of $0.32 in Q4 2023.

- Adjusted EBITDA was $4.6 million, or 14% of revenue, compared

to $1.7 million or 6% of revenue in Q4 2023.

- Non-GAAP net loss of $3.0 million compared to non-GAAP net loss

of $5.5 million in 2023.

- Non-GAAP net loss per share of $0.06 compared to a non-GAAP net

loss per share of $0.14 in 2023.

- Cash and short-term investments totaled $54.9 million as of

December 31, 2024.

Full-Year 2024 Financial Highlights:

- Revenue of $127.6 million, an increase of 25% year-over-year

(YoY).

- B2 Cloud Storage revenue was $63.3 million, an increase of 36%

YoY.

- Computer Backup revenue was $64.3 million, an increase of 16%

YoY.

- Gross profit of $69.3 million, or 54% of revenue, compared to

$49.9 million or 49% of revenue, in 2023.

- Adjusted gross profit of $99.2 million, or 78% of revenue,

compared to $76.2 million or 75% of revenue in 2023.

- Net loss was $48.5 million compared to a net loss of $59.7

million in 2023.

- Net loss per share was $1.11 compared to a net loss per share

of $1.66 in 2023.

- Adjusted EBITDA was $13.0 million, or 10% of revenue, compared

to $(3.8) million or (4)% of revenue in 2023.

- Non-GAAP net loss of $17.5 million compared to non-GAAP net

loss of $30.5 million in 2023.

- Non-GAAP net loss per share of $0.40 compared to a non-GAAP net

loss per share of $0.85 in 2023.

- Net cash provided by operating activities during the year ended

December 31, 2024 was $12.5 million, compared to cash used in

operating activities of $7.4 million during the year ended December

31, 2023.

- Adjusted free cash flow during the year ended December 31, 2024

was $(20.1) million, compared to $(43.2) million during the year

ended December 31, 2023.

Fourth Quarter 2024 Operational Highlights:

- Annual recurring revenue (ARR) was $136.7 million, an increase

of 16% YoY.

- B2 Cloud Storage ARR was $70.2 million, an increase of 22%

YoY.

- Computer Backup ARR was $66.5 million, an increase of 11%

YoY.

- Net revenue retention (NRR) rate was 116% compared to 109% in

Q4 2023.

- B2 Cloud Storage NRR was 123% compared to 122% in Q4 2023.

- Computer Backup NRR was 109% compared to 100% in Q4 2023.

- Gross customer retention rate was 90% in Q4 2024 compared to

91% in Q4 2023.

- B2 Cloud Storage gross customer retention rate was 89% in Q4

2024 compared to 90% in Q4 2023.

- Computer Backup gross customer retention rate was 90% in Q4

2024 compared to 91% in Q4 2023.

- Number of customers was 507,647 versus 511,942 in Q4 2023.

- B2 Cloud Storage number of customers was 107,616 versus 97,842

in Q4 2023.

- Computer Backup number of customers was 417,845 versus 431,745

in Q4 2023.

- Total Annual Average Revenue Per Customer (ARPU) was $268

versus $228 in Q4 2023.

- B2 Cloud Storage ARPU was $645 versus $577 in Q4 2023.

- Computer Backup ARPU was $159 versus $140 in Q4 2023.

Recent Business Highlights

- Signed A Deal for Over $1 Million in Annual Contract

Value: An existing customer expanded into a Powered by

Backblaze white label partnership to unlock greater market

opportunities.

- AI Tailwinds Accelerate: 65% more AI customers year over

year drove a nearly 10-fold increase in AI related data, with 3 AI

companies now in our top 10 customers in December 2024.

- B2 Cloud Storage Crossed Over 50% of Company Sales:

Fastest growing offering is now also the dominant part of the

business.

- Executed a Successful Secondary Offering: This

oversubscribed offering reinforces our balance sheet with $37

million in net proceeds.

- Unlocked $8 Million in Annualized Cost Savings:

Increased operating efficiency enables re-investment in sales

capacity.

- Named the 'Easiest to Use' and the 'Fastest Implementation'

Object Storage Solution: G2, a popular software review site,

recognized Backblaze in their Winter 2025 Report.

Financial Outlook:

Based on information available as of the date of this press

release,

For the first quarter of 2025 we expect:

- Revenue between $34.1 million to $34.5 million.

- Adjusted EBITDA margin between 13% to 15%.

- Basic weighted average shares outstanding of 54.0 million to

54.3 million shares.

For full-year 2025 we expect:

- Revenue between $144.0 million to $146.0 million.

- Adjusted EBITDA margin between 16% to 18%.

- For YoY growth in our B2 business, refer to table below:

Q1 2025

Q2 2025

Q3 2025

Q4 2025

21 - 23%

23 - 25%

25-28%

30%+

Conference Call Information:

Backblaze will host a conference call today, February 25, 2025,

at 2:00 p.m. PT (5:00 p.m. ET) to review its financial results.

Attend the webcast here:

https://events.q4inc.com/attendee/327945335 Register to listen by

phone here: https://registrations.events/direct/Q4I489011

Phone registrants will receive dial-in information via

email.

An archive of the webcast will be available shortly after its

completion on the Investor Relations section of the Backblaze

website at https://ir.backblaze.com.

About Backblaze

Backblaze is the cloud storage innovator delivering a modern

alternative to traditional cloud providers. We offer

high-performance, secure cloud object storage that customers use to

develop applications, manage media, secure backups, build AI

workflows, protect from ransomware, and more. Backblaze helps

businesses break free from the walled gardens that traditional

providers lock customers into, enabling customers to use their data

in open cloud workflows with the providers they prefer at a

fraction of the cost. Headquartered in San Mateo, CA, Backblaze

(Nasdaq: BLZE) was founded in 2007 and serves over 500,000

customers in 175 countries around the world. For more information,

please go to www.backblaze.com.

Cautionary Note Regarding Forward-looking Statements

This press release contains forward-looking statements within

the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended, which involve risks and uncertainties. These

forward-looking statements are frequently identified by the use of

forward-looking terminology, including the terms “anticipate,”

“believe,” “continue,” “could,” “estimate,” “expect,” “intend,”

“likely,” “may,” “plan,” “possible,” “potential,” “predict,”

“project,” “should,” “target,” “will,” “would,” or other similar

terms or expressions that relate to our future performance,

expectations, strategy, plans or intentions, and include statements

in the section titled “Financial Outlook.”

Our actual results could differ materially from those stated in

or implied by the forward-looking statements in this press release

due to a number of factors, including but not limited to: the

impact of our go-to-market transformation and ability to attract

and retain customers, including increasingly larger customers; the

continued growth of data stored by our customers; continued growth

of AI related business; realizing the anticipated benefits relating

to cost savings initiatives and the re-investment of savings in

additional sales capacity; market competition, including

competitors that may have greater size, offerings and resources;

effectively managing growth; ability to offer new features and

other offerings on a timely basis, including geographic expansion

in Canada or other jurisdictions, and achieve desired market

adoption; disruption in our service or loss of availability of

customers’ data; cyberattacks; continued growth consistent with

historical levels; the impact of pricing and other product offering

changes; material defects or errors in our software; supply chain

disruption; ability to maintain existing relationships with

partners and to enter into new partnerships; ability to remediate

and prevent material weaknesses in our internal controls over

financial reporting; hiring and retention of key employees; the

impact of war or hostilities, and other significant world or

regional events on our business and the business of our customers,

vendors, supply chain and partners; litigation and other disputes;

the impact of tariffs on other trade restrictions and actions; and

general market, political, economic, and business conditions.

Further information on these and additional risks, uncertainties,

assumptions, and other factors that could cause actual results or

outcomes to differ materially from those included in or implied by

the forward-looking statements contained in this release are

included under the caption “Risk Factors” and elsewhere in our

Quarterly Reports on Form 10-Q and other filings and reports we

make with the SEC from time to time.

The forward-looking statements made in this release reflect our

views as of the date of this press release. We undertake no

obligation to update any forward-looking statements in this press

release, whether as a result of new information, future events or

otherwise.

Non-GAAP Financial Measures

To supplement the financial measures prepared in accordance with

generally accepted accounting principles (GAAP), we use (i)

non-GAAP adjusted gross profit and margin, (ii) adjusted EBITDA and

adjusted EBITDA margin, (iii) non-GAAP net income (loss), and (iv)

adjusted free cash flow and adjusted free cash flow margin. These

non-GAAP financial measures exclude certain items and are not

prepared in accordance with GAAP; therefore, the information is not

necessarily comparable to other companies and should be considered

as a supplement to, not a substitute for, or superior to, the

corresponding measures calculated in accordance with GAAP. We

present these non-GAAP measures because management believes they

are a useful measure of our performance and provide an additional

basis for assessing our operating results. Please see the appendix

attached to this press release for a reconciliation of non-GAAP

adjusted gross margin and adjusted EBITDA margin to the most

directly comparable GAAP financial measures.

A reconciliation of non-GAAP guidance measures to corresponding

GAAP measures is not available on a forward-looking basis without

unreasonable effort due to the uncertainty regarding, and the

potential variability of, expenses and other factors in the future.

For example, stock-based compensation expense-related charges are

impacted by the timing of employee stock transactions, the future

fair market value of our common stock, and our future hiring and

retention needs, all of which are difficult to predict with

reasonable accuracy and subject to constant change.

Adjusted Gross Profit (and Margin)

We believe adjusted gross profit (and margin), when taken

together with our GAAP financial results, provides a meaningful

assessment of our performance and is useful to us for evaluating

our ongoing operations and for internal planning and forecasting

purposes.

We define adjusted gross margin as gross profit, excluding

stock-based compensation expense, depreciation and amortization and

restructuring charges within cost of revenue, as a percentage of

adjusted gross profit to revenue. We exclude stock-based

compensation, which is a non-cash item, and restructuring costs

because we do not consider it indicative of our core operating

performance. We exclude depreciation expense of our property and

equipment and amortization expense of capitalized internal-use

software because these may not reflect current or future cash

spending levels to support our business. We believe adjusted gross

margin provides consistency and comparability with our past

financial performance and facilitates period-to-period comparisons

of operations, as this metric eliminates the effects of

depreciation and amortization.

Adjusted EBITDA and Adjusted EBITDA Margin

We define adjusted EBITDA as net loss adjusted to exclude

depreciation and amortization, stock-based compensation, interest

expense, net, investment income, income tax provision, realized and

unrealized gains and losses on foreign currency transactions,

impairment of long-lived assets, restructuring costs, legal

settlement costs, and other non-recurring charges. Adjusted EBITDA

Margin is defined as Adjusted EBITDA divided by revenues for the

period. We use adjusted EBITDA and Adjusted EBITDA Margin to

evaluate our ongoing operations and for internal planning and

forecasting purposes. We believe that adjusted EBITDA and Adjusted

EBITDA Margin, when taken together with our GAAP financial results,

provides meaningful supplemental information regarding our

operating performance by excluding certain items that may not be

indicative of our business, results of operations, or outlook. We

consider Adjusted EBITDA and Adjusted EBITDA Margin to be important

measures because they help illustrate underlying trends in our

business and our historical operating performance on a more

consistent basis.

Non-GAAP Net Income (Loss)

We define non-GAAP net income (loss) as net income adjusted to

exclude stock-based compensation, realized and unrealized gains and

losses on foreign currency transactions, restructuring costs, legal

settlement costs, and other items we deem non-recurring. We believe

that non-GAAP net income (loss), when taken together with our GAAP

financial results, provides meaningful supplemental information

regarding our operating performance by excluding certain items that

may not be indicative of our business, results of operations, or

outlook.

Adjusted Free Cash Flow and Adjusted Free Cash Flow

Margin

We define adjusted free cash flow as net cash provided by (used

in) operating activities less purchases of property and equipment,

capitalized internal-use software costs, principal payments on

finance leases and lease financing obligations, as reflected in our

consolidated statements of cash flows, and excluding restructuring

costs, legal settlement costs, and other non-recurring charges.

Adjusted free cash flow margin is calculated as adjusted free cash

flow divided by revenue.

Key Business Metrics:

Annual Recurring Revenue (ARR)

We define annual recurring revenue (ARR) as the annualized value

of all Backblaze B2 and Computer Backup arrangements as of the end

of a period. Given the renewable nature of our business, we view

ARR as an important indicator of our financial performance and

operating results, and we believe it is a useful metric for

internal planning and analysis. ARR is calculated based on

multiplying the monthly revenue from all Backblaze B2 and Computer

Backup arrangements, which represent greater than 98% of our

revenue for the periods presented for the last month of a period by

12. Our annual recurring revenue for Computer Backup and B2 Cloud

Storage is calculated in the same manner as our overall annual

recurring revenue based on the revenue from our Computer Backup and

B2 Cloud Storage solutions, respectively.

Net Revenue Retention Rate (NRR)

Our overall net revenue retention rate (NRR) is a trailing

four-quarter average of the recurring revenue from a cohort of

customers in a quarter as compared to the same quarter in the prior

year. We calculate our overall net revenue retention rate for a

quarter by dividing (i) recurring revenue in the current quarter

from any accounts that were active at the end of the same quarter

of the prior year by (ii) recurring revenue in the current

corresponding quarter from those same accounts. Our overall net

revenue retention rate includes any expansion of revenue from

existing customers and is net of revenue contraction and customer

attrition, and excludes revenue from new customers in the current

period. Our net revenue retention rate for Computer Backup and B2

Cloud Storage is calculated in the same manner as our overall net

revenue retention rate based on the revenue from our Computer

Backup and B2 Cloud Storage solutions, respectively.

Gross Customer Retention Rate

We use gross customer retention rate to measure our ability to

retain our customers. Our gross customer retention rate reflects

only customer losses and does not reflect the expansion or

contraction of revenue we earn from our existing customers. We

believe our high gross customer retention rates demonstrate that we

serve a vital service to our customers, as the vast majority of our

customers tend to continue to use our platform from one period to

the next. To calculate our gross customer retention rate, we take

the trailing four-quarter average of the percentage of cohort of

customers who were active at the end of the quarter in the prior

year that are still active at the end of the current quarter. We

calculate our gross customer retention rate for a quarter by

dividing (i) the number of accounts that generated revenue in the

last month of the current quarter that also generated recurring

revenue during the last month of the corresponding quarter in the

prior year, by (ii) the number of accounts that generated recurring

revenue during the last month of the corresponding quarter in the

prior year.

Number of Customers

We define a customer at the end of any period as a distinct

account, as identified by a unique account identifier, that has

paid for our cloud services, which makes up substantially all of

our user base. In Q4 2023, we refined our customer definition to

include end-user customers that purchase through a reseller. This

resulted in no impact to previously reported metrics other than a

1% decrease to the 120% NRR metric reported for Q3 2023.

Annual Average Revenue Per User

We define annual average revenue per user (Annual ARPU) as the

annualized value for the average revenue per customer. Annual ARPU

is calculated by dividing our revenue for the last month of a

period by the total number of customers as of the last day of the

same period, and then multiplying the resulting quotient by 12. Our

annual average revenue per user for Computer Backup and B2 Cloud

Storage is calculated in the same manner based on the revenue and

number of customers from our Computer Backup and B2 Cloud Storage

solutions, respectively.

BACKBLAZE, INC.

CONSOLIDATED BALANCE

SHEETS

(in thousands, except share

and per share data)

December 31,

2024

2023

(unaudited)

Assets

Current assets:

Cash and cash equivalents

$

45,776

$

12,502

Accounts receivable, net

1,831

800

Short-term investments, net

9,139

16,799

Prepaid expenses and other current

assets

9,002

8,413

Total current assets

65,748

38,514

Restricted cash, non-current

—

4,128

Property and equipment, net

42,949

45,600

Operating lease right-of-use assets,

net

15,873

9,980

Capitalized internal-use software, net

41,801

32,521

Other assets

2,187

944

Total assets

$

168,558

$

131,687

Liabilities and Stockholders’

Equity

Current liabilities:

Accounts payable

$

1,459

$

1,973

Accrued expenses and other current

liabilities

7,584

8,768

Finance lease liabilities and lease

financing obligations, current

16,327

18,492

Operating lease liabilities, current

4,026

1,878

Deferred revenue, current

30,407

25,976

Total current liabilities

59,803

57,087

Finance lease liabilities and lease

financing obligations, non-current

13,142

13,310

Operating lease liabilities,

non-current

12,844

8,151

Deferred revenue, non-current

5,147

4,073

Debt facility, non-current

—

4,128

Total liabilities

90,936

86,749

Commitments and contingencies

Stockholders’ Equity

Class A common stock, $0.0001 par value;

113,000,000 shares authorized as of December 31, 2024 and 2023;

53,375,770 and 39,150,610 shares issued and outstanding as of

December 31, 2024 and 2023, respectively.

5

4

Additional paid-in capital

273,602

192,388

Accumulated deficit

(195,985

)

(147,454

)

Total stockholders’ equity

77,622

44,938

Total liabilities and stockholders’

equity

$

168,558

$

131,687

BACKBLAZE, INC.

CONSOLIDATED STATEMENTS OF

OPERATIONS

(in thousands, except share

and per share data)

Three Months Ended December

31,

For the Years Ended December

31,

2024

2023

2024

2023

(unaudited)

(unaudited)

Revenue

$

33,786

$

28,737

$

127,628

$

102,019

Cost of revenue

15,283

13,653

58,285

52,162

Gross profit

18,503

15,084

69,343

49,857

Operating expenses:

Research and development

12,029

9,430

42,098

39,527

Sales and marketing

11,704

10,100

44,440

41,270

General and administrative

8,542

7,179

29,094

26,965

Total operating expenses

32,275

26,709

115,632

107,762

Loss from operations

(13,772

)

(11,625

)

(46,289

)

(57,905

)

Investment income

363

408

1,422

1,984

Interest expense, net

(968

)

(991

)

(3,658

)

(3,792

)

Loss before provision for income taxes

(14,377

)

(12,208

)

(48,525

)

(59,713

)

Income tax provision

—

—

6

—

Net loss and comprehensive loss

$

(14,377

)

$

(12,208

)

$

(48,531

)

$

(59,713

)

Net loss per share attributable to Class A

and Class B common stockholders, basic and diluted

$

(0.30

)

$

(0.32

)

$

(1.11

)

$

(1.66

)

Weighted average shares used in computing

net loss per share attributable to Class A and Class B common

stockholders, basic and diluted(1)

48,212,796

38,254,122

43,543,023

36,011,446

(1) On July 6, 2023, all shares of our

then outstanding Class B common stock were automatically converted

into the same number of Class A common stock, pursuant to the terms

of our Amended and Restated Certificate of Incorporation. No

additional shares of Class B common stock will be issued following

such conversion.

BACKBLAZE, INC.

CONSOLIDATED STATEMENTS OF

CASH FLOWS

(in thousands)

For the Years

Ended December 31,

2024

2023

CASH FLOWS FROM OPERATING

ACTIVITIES

(unaudited)

Net loss

$

(48,531

)

$

(59,713

)

Adjustments to reconcile net loss to net

cash provided by (used in) operating activities:

Net accretion of discount on investment

securities and net realized investment gains

64

417

Noncash lease expense on operating

leases

2,727

2,350

Depreciation and amortization

28,328

24,912

Impairment loss on right-of-use assets

898

—

Stock-based compensation

28,628

25,177

Impairment of capitalized internal-use

software

—

232

Gain on disposal of assets

(154

)

(292

)

Other

345

—

Changes in operating assets and

liabilities:

Accounts receivable

(1,031

)

56

Prepaid expenses and other current

assets

(741

)

(445

)

Other assets

(1,346

)

(389

)

Accounts payable

(547

)

(295

)

Accrued expenses and other current

liabilities

948

(1,422

)

Deferred revenue

5,505

4,526

Operating lease liabilities

(2,588

)

(2,464

)

Net cash provided by (used in) operating

activities

12,505

(7,350

)

CASH FLOWS FROM INVESTING

ACTIVITIES

Purchases of marketable securities

(38,097

)

(26,358

)

Maturities of marketable securities

45,693

67,874

Proceeds from disposal of property and

equipment

455

369

Purchases of property and equipment

(1,711

)

(5,512

)

Capitalized internal-use software

costs

(12,471

)

(14,716

)

Net cash (used in) provided by investing

activities

(6,131

)

21,657

CASH FLOWS FROM FINANCING

ACTIVITIES

Principal payments on finance lease and

lease financing obligations

(19,503

)

(19,510

)

Proceeds from issuance of common stock

upon public offering, net of underwriting discounts and commission

and other offering costs

37,434

—

Payments of offering costs

(383

)

—

Proceeds from debt facility

554

4,273

Repayment of debt facility

(4,682

)

(4,450

)

Proceeds from insurance premium

financing

—

893

Principal payments on insurance premium

financing

(893

)

(1,545

)

Proceeds from lease financing

obligations

—

4,450

Proceeds from exercises of stock

options

7,477

4,708

Proceeds from ESPP

2,768

2,339

Net cash provided by (used in) financing

activities

22,772

(8,842

)

Net increase in cash

29,146

5,465

Cash and cash equivalents and restricted

cash, at beginning of period

16,630

11,165

Cash and cash equivalents, at end of

period

$

45,776

$

16,630

RECONCILIATION OF CASH, CASH

EQUIVALENTS AND RESTRICTED CASH

Cash and cash equivalents

$

45,776

$

12,502

Restricted cash, non-current

—

$

4,128

Total cash and cash equivalents and

restricted cash, non-current

$

45,776

$

16,630

BACKBLAZE, INC.

RECONCILIATION OF GAAP TO

NON-GAAP DATA

(in thousands, except

percentages)

Adjusted Gross Profit and Adjusted

Gross Margin

For the Three Months Ended

December 31,

For the Years Ended

December 31,

2024

2023

2024

2023

(unaudited)

(unaudited)

Gross profit

$

18,503

$

15,084

$

69,343

$

49,857

Adjustments:

Stock-based compensation

398

530

1,616

1,986

Depreciation and amortization

6,917

6,439

27,761

24,330

Restructuring charges

460

—

460

—

Adjusted gross profit

$

26,278

$

22,053

$

99,180

$

76,173

Gross margin

55

%

52

%

54

%

49

%

Adjusted gross margin

78

%

77

%

78

%

75

%

Adjusted EBITDA and Adjusted EBITDA

Margin

For the Three Months Ended

December 31,

For the Years Ended

December 31,

2024

2023

2024

2023

(unaudited)

(unaudited)

Net loss

$

(14,377

)

$

(12,208

)

$

(48,531

)

$

(59,713

)

Adjustments:

Depreciation and amortization

7,060

6,575

28,328

24,912

Stock-based compensation (1)

6,609

6,507

26,104

25,052

Interest expense and investment income

605

583

2,236

1,808

Income tax provision

—

—

6

—

Foreign exchange (gain) loss (2)

(127

)

65

32

123

Non-recurring professional services

—

129

—

411

Restructuring charges (3)

4,861

—

4,861

3,616

Adjusted EBITDA

$

4,631

$

1,651

$

13,036

$

(3,791

)

Adjusted EBITDA Margin

14

%

6

%

10

%

(4

)%

(1) During the three months ended December

31, 2024, $2.5 million of stock-based compensation expense is

classified as restructuring charges in the table above, as it was

incurred as part of our restructuring program. No stock-based

compensation related to restructuring charges was recognized during

the three months ended December 31, 2023. During the years ended

December 31, 2024 and 2023, $2.5 million and $0.1 million,

respectively, of stock-based compensation is classified as

restructuring charges in the table above.

(2) As of December 31, 2024, we included

foreign exchange (gain) loss in its reconciliation of net loss to

Adjusted EBITDA. Adjusted EBITDA and Adjusted EBITDA Margin for the

prior periods presented have been updated to conform with current

presentation.

(3) Restructuring charges represent costs

incurred in connection with our restructuring plans. Costs incurred

in connection with the 2024 Restructuring Plan include: (i) $3.9

million of severance and benefits related to impacted employees,

(ii) $0.9 million related to the expected sublease of a portion of

our corporate headquarters, and (iii) $0.1 million of professional

service fees related to the execution of the 2024 Restructuring

Plan. Costs incurred during the year ended December 31, 2023 relate

to severance and benefits for the employees impacted by the

restructuring plan initiated in Q1 2023.

BACKBLAZE, INC.

SUPPLEMENTAL FINANCIAL

INFORMATION

(in thousands, except share

and per share data)

Non-GAAP Net Loss

For the Three Months Ended

December 31,

For the Years Ended

December 31,

2024

2023

2024

2023

(unaudited)

(unaudited)

Net loss

$

(14,377

)

$

(12,208

)

$

(48,531

)

$

(59,713

)

Adjustments:

Stock-based compensation (1)

6,609

6,507

26,104

25,052

Foreign exchange (gain) loss (2)

(127

)

65

32

123

Non-recurring professional services

—

129

—

411

Restructuring charges (3)

4,861

—

4,861

3,616

Non-GAAP net loss

$

(3,034

)

$

(5,507

)

$

(17,534

)

$

(30,511

)

Non-GAAP net loss per share, basic and

diluted

$

(0.06

)

$

(0.14

)

$

(0.40

)

$

(0.85

)

Weighted average shares used in computing

net loss per share attributable to Class A and Class B common

stockholders, basic and diluted

48,212,796

38,254,122

43,543,023

36,011,446

(1) During the three months ended December

31, 2024, $2.5 million of stock-based compensation expense is

classified as restructuring charges in the table above, as it was

incurred as part of our restructuring program. No stock-based

compensation related to restructuring charges was recognized during

the three months ended December 31, 2023. During the years ended

December 31, 2024 and 2023, $2.5 million and $0.1 million,

respectively, of stock-based compensation is classified as

restructuring charges in the table above.

(2) As of December 31, 2024, we included

foreign exchange loss (gain) in its reconciliation of net loss to

Adjusted EBITDA. Adjusted EBITDA and Adjusted EBITDA Margin for the

prior periods presented have been updated to conform with current

presentation.

(3) Restructuring charges represent costs

incurred in connection with our restructuring plans. Costs incurred

in connection with the 2024 Restructuring Plan include: (i) $3.9

million of severance and benefits related to impacted employees,

(ii) $0.9 million related to the expected sublease of a portion of

our corporate headquarters, and (iii) $0.1 million of professional

service fees related to the execution of the 2024 Restructuring

Plan. Costs incurred during the year ended December 31, 2023 relate

to severance and benefits for the employees impacted by the

restructuring plan initiated in Q1 2023.

Adjusted Free Cash Flow and Adjusted

Free Cash Flow Margin

Three Months Ended December

31,

Year Ended December

31,

2024

2023

2024

2023

(unaudited)

(unaudited)

Net cash provided by (used in) operating

activities

$

2,233

$

3,248

$

12,505

$

(7,350

)

Capital Expenditures (1)

(3,062

)

(4,101

)

(14,182

)

(20,228

)

Principal payments on finance leases and

lease financing obligations

(4,748

)

(4,632

)

(19,503

)

(19,510

)

Non-recurring professional services

—

129

—

411

Cash payments for workforce reduction and

severance charges

1,049

12

1,049

3,491

Adjusted Free Cash Flow

$

(4,528

)

$

(5,344

)

$

(20,131

)

$

(43,186

)

Adjusted Free Cash Flow Margin

(13

)%

(19

)%

(16

)%

(42

)%

(1) Capital expenditures are defined as

cash used for purchases of property and equipment and capitalized

internal-use software costs.

Stock-based Compensation

For the Three Months Ended

December 31,

For the Years Ended

December 31,

2024

2023

2024

2023

(unaudited)

(unaudited)

Cost of revenue

$

689

$

530

$

1,907

$

1,986

Research and development

3,822

2,432

11,277

9,218

Sales and marketing

3,013

2,185

9,505

8,801

General and administrative

1,609

1,360

5,939

5,172

Total stock-based compensation expense

(1)

$

9,133

$

6,507

$

28,628

$

25,177

(1) Stock-based compensation expense

includes restructuring charges of $2.5 million incurred during the

three months and year ended December 31, 2024. Of the $2.5 million

in stock-based compensation restructuring charges incurred, $0.3

million related to cost of revenue, $0.9 million related to

research and development costs, $1.2 million related to sales and

marketing costs, and $0.1 million related to general and

administrative costs. Stock-based compensation restructuring

charges of $0.1 million incurred during the year ended December 31,

2023 were related to sales and marketing and general and

administrative costs.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250225725352/en/

Investors Contact Mimi Kong Senior Director, Investor

Relations and Corporate Development ir@backblaze.com

Press Contact Yev Pusin Sr. Director, Marketing

press@backblaze.com

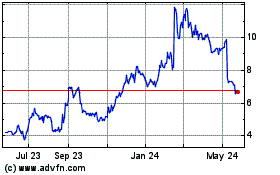

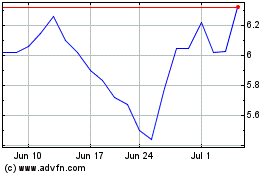

Backblaze (NASDAQ:BLZE)

Historical Stock Chart

From Jan 2025 to Feb 2025

Backblaze (NASDAQ:BLZE)

Historical Stock Chart

From Feb 2024 to Feb 2025