Burning Rock Biotech Limited (NASDAQ: BNR and LSE: BNR, the

“Company” or “Burning Rock”), a company focused on the application

of next generation sequencing (NGS) technology in the field of

precision oncology, today reported financial results for the three

months ended June 30, 2024.

Recent Business Updates

-

Therapy Selection

-

Presented study results on small-cell lung cancer and colorectal

cancer at the ASCO in June 2024. “The efficacy and safety of high

dose Almonertinib in untreated EGFR-mutated NSCLC with brain

metastases, including biomarker analysis” and “Individualized

tumor-informed circulating tumor DNA analysis for molecular

residual disease detection in predicting recurrence and efficacy of

adjuvant chemotherapy in colorectal cancer”.

-

Pharma Services

-

New companion diagnostics (CDx) collaboration announced with Bayer

in China.

Second Quarter 2024 Financial

Results

Total Revenues were RMB135.5 million (US$18.7

million) for the three months ended June 30, 2024, representing a

7.3% decrease from RMB146.3 million for the same period in 2023, as

we transition from central-lab to more in-hospital based testing.

Importantly, in-hospital segment continued its double-digit

growth.

-

Revenue generated from in-hospital business was RMB59.9 million

(US$8.2 million) for the three months ended June 30, 2024,

representing a 11.2% increase from RMB53.8 million for the same

period in 2023, driven by an increase in sales volume.

-

Revenue generated from central laboratory business was RMB48.8

million (US$6.7 million) for the three months ended June 30, 2024,

representing a 26.4% decrease from RMB66.2 million for the same

period in 2023, primarily attributable to a decrease in the number

of tests, as we continued our transition towards in-hospital

testing.

-

Revenue generated from pharma research and development services was

RMB26.9 million (US$3.7 million) for the three months ended June

30, 2024, representing a 2.6% increase from RMB26.2 million for the

same period in 2023, primarily attributable to an increased

development and testing services performed for our pharma

customers.

Cost of revenues was RMB40.1 million (US$5.5

million) for the three months ended June 30, 2024, representing an

12.5% decrease from RMB45.8 million for the same period in 2023,

primarily due to (i) a decrease in cost of central laboratory

business, which was in line with the decrease in revenue generated

from this business; and (ii) a decrease in amortization expense for

all kinds of business.

Gross profit was RMB95.4 million (US$13.1

million) for the three months ended June 30, 2024, representing a

5.0% decrease from RMB100.4 million for the same period in 2023.

Gross margin was 70.4% for the three months ended June 30, 2024,

compared to 68.7% for the same period in 2023. By channel, gross

margin of central laboratory business was 78.8% for the three

months ended June 30, 2024, compared to 78.3% during the same

period in 2023; gross margin of in-hospital business was 73.6% for

the three months ended June 30, 2024, compared to 62.0% during the

same period in 2023, primarily due to a decrease in amortization;

gross margin of pharma research and development services was 48.2%

for the three months ended June 30, 2024, compared to 58.0% during

the same period of 2023, primarily due to a decrease in test volume

of higher margin projects.

Non-GAAP gross profit, which excludes

depreciation and amortization expenses, was RMB101.9 million

(US$14.0 million) for the three months ended June 30, 2024,

representing a 6.8% decrease from RMB109.4 million for the same

period in 2023. Non-GAAP gross margin was 75.2% for the three

months ended June 30, 2024, compared to 74.8% for the same period

in 2023.

Operating expenses were RMB206.7 million

(US$28.4 million) for the three months ended June 30, 2024,

representing a 12.5% decrease from RMB236.1 million for the same

period in 2023. The decrease was primarily driven by budget control

measures and headcount reduction to improve the Company’s operating

efficiency.

-

Research and development expenses were RMB65.0 million (US$8.9

million) for the three months ended June 30, 2024, representing a

32.2% decrease from RMB95.8 million for the same period in 2023,

primarily due to (i) a decrease in staff cost resulted from the

reorganization of our research and development department to

improve operating efficiency; (ii) a decrease in the expenditure

for research projects; and (iii) a decrease in amortized expenses

for office building decoration.

-

Selling and marketing expenses were RMB48.9 million (US$6.7

million) for the three months ended June 30, 2024, representing a

31.0% decrease from RMB70.8 million for the same period in 2023,

primarily due to (i) a decrease in staff cost resulted from the

reorganization of the sales department and improvement in operating

efficiency; (ii) a decrease in conference fee; and (iii) a decrease

in travel expense.

-

General and administrative expenses were RMB92.8 million (US$12.8

million) for the three months ended June 30, 2024, representing a

33.5% increase from RMB69.5 million for the same period in 2023,

primarily due to an increase in amortized expense on share-based

compensation.

Net loss was RMB108.0 million (US$14.9 million)

for the three months ended June 30, 2024, compared to RMB131.2

million for the same period in 2023.

Cash, cash equivalents, restricted cash and

short-term investments were RMB533.0 million (US$73.3 million) as

of June 30, 2024.

About Burning Rock

Burning Rock Biotech Limited (NASDAQ: BNR and

LSE: BNR), whose mission is to guard life via science, focuses on

the application of next generation sequencing (NGS) technology in

the field of precision oncology. Its business consists of i)

NGS-based therapy selection testing for late-stage cancer patients,

and ii) cancer early detection, which has moved beyond

proof-of-concept R&D into the clinical validation stage.

For more information about Burning Rock, please

visit: ir.brbiotech.com.

Safe Harbor Statement

This press release contains forward-looking

statements. These statements constitute “forward-looking”

statements within the meaning of Section 21E of the Securities

Exchange Act of 1934, as amended, and as defined in the U.S.

Private Securities Litigation Reform Act of 1995. These

forward-looking statements can be identified by terminology such as

“will,” “expects,” “anticipates,” “future,” “intends,” “plans,”

“believes,” “estimates,” “target,” “confident” and similar

statements. Burning Rock may also make written or oral

forward-looking statements in its periodic reports to the SEC, in

its annual report to shareholders, in press releases and other

written materials and in oral statements made by its officers,

directors or employees to third parties. Statements that are not

historical facts, including statements about Burning Rock’s beliefs

and expectations, are forward-looking statements. Such statements

are based upon management’s current expectations and current market

and operating conditions, and relate to events that involve known

or unknown risks, uncertainties and other factors, all of which are

difficult to predict and many of which are beyond Burning Rock’s

control. Forward-looking statements involve risks, uncertainties

and other factors that could cause actual results to differ

materially from those contained in any such statements. All

information provided in this press release is as of the date of

this press release, and Burning Rock does not undertake any

obligation to update any forward-looking statement as a result of

new information, future events or otherwise, except as required

under applicable law.

Non-GAAP Measures

In evaluating the business, the Company

considers and uses non-GAAP measures, such as non-GAAP gross profit

and non-GAAP gross margin, as supplemental measures to review and

assess operating performance. The presentation of these non-GAAP

financial measures is not intended to be considered in isolation or

as a substitute for the financial information prepared and

presented in accordance with accounting principles generally

accepted in the United States of America (“U.S. GAAP”). The company

defines non-GAAP gross profit as gross profit excluding

depreciation and amortization. The company defines non-GAAP gross

margin as gross margin excluding depreciation and amortization.

The company presents these non-GAAP financial

measures because they are used by management to evaluate operating

performance and formulate business plans. The company believe

non-GAAP gross profit and non-GAAP gross margin excluding non-cash

impact of depreciation and amortization reflect the company’s

ongoing business operations in a manner that allows more meaningful

period-to-period comparisons.

Contact: IR@brbiotech.com

Selected Operating Data

| |

As of |

|

|

June 30,2023 |

|

September 30, 2023 |

|

December 31, 2023 |

|

March 31, 2024 |

|

June 30, 2024 |

|

| In-hospital

Channel: |

|

|

|

|

|

|

|

|

|

|

| Pipeline partner

hospitals(1) |

30 |

|

29 |

|

28 |

|

28 |

|

29 |

|

| Contracted partner

hospitals(2) |

50 |

|

55 |

|

59 |

|

59 |

|

59 |

|

| Total number of

partner hospitals |

80 |

|

84 |

|

87 |

|

87 |

|

88 |

|

|

(1) |

|

Refers to hospitals that are in the process of establishing

in-hospital laboratories, laboratory equipment procurement or

installation, staff training or pilot testing using the Company’s

products. |

| (2) |

|

Refers to hospitals that have

entered into contracts to purchase the Company’s products for use

on a recurring basis in their respective in-hospital laboratories

the Company helped them establish. Kit revenue is generated from

contracted hospitals. |

Selected Financial Data

| |

For the three

months ended |

| Revenues |

June 30, 2023 |

|

September 30, 2023 |

|

December 31, 2023 |

|

March 31, 2024 |

|

June 30, 2024 |

|

| |

(RMB in thousands) |

| Central laboratory channel |

66,239 |

|

53,481 |

|

51,288 |

|

47,614 |

|

48,773 |

|

| In-hospital channel |

53,835 |

|

54,496 |

|

28,809 |

|

57,387 |

|

59,872 |

|

| Pharma research and development

channel |

26,194 |

|

19,589 |

|

40,988 |

|

20,622 |

|

26,888 |

|

| Total

revenues |

146,268 |

|

127,566 |

|

121,085 |

|

125,623 |

|

135,533 |

|

| |

|

|

|

|

|

|

|

|

| |

For the three

months ended |

| Gross

profit |

June 30, 2023 |

|

September 30, 2023 |

|

December31, 2023 |

|

March 31, 2024 |

|

June 30, 2024 |

|

| |

(RMB in thousands) |

| Central laboratory channel |

51,876 |

|

41,487 |

|

41,886 |

|

37,002 |

|

38,424 |

|

| In-hospital channel |

33,353 |

|

35,459 |

|

12,910 |

|

39,192 |

|

44,058 |

|

| Pharma research and development

channel |

15,193 |

|

8,974 |

|

23,317 |

|

9,500 |

|

12,956 |

|

| Total gross

profit |

100,422 |

|

85,920 |

|

78,113 |

|

85,694 |

|

95,438 |

|

| |

|

|

|

|

|

|

|

|

| |

For the three months

ended |

| Share-based

compensation expenses |

June 30,2023 |

|

September 30, 2023 |

|

December31, 2023 |

|

March 31, 2024 |

|

June 30, 2024 |

|

|

| |

(RMB in

thousands) |

| Cost of revenues |

627 |

|

680 |

|

654 |

|

596 |

|

464 |

|

|

| Research and development

expenses |

15,301 |

|

12,161 |

|

12,401 |

|

12,287 |

|

12,008 |

|

|

| Selling and marketing

expenses |

3,389 |

|

2,848 |

|

1,816 |

|

508 |

|

1,232 |

|

|

| General and administrative

expenses |

18,502 |

|

57,704 |

|

56,472 |

|

55,990 |

|

54,407 |

|

|

| Total share-based

compensation expenses |

37,819 |

|

73,393 |

|

71,343 |

|

69,381 |

|

68,111 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

Burning Rock Biotech Limited

Unaudited Condensed Statements of Comprehensive

Loss (in thousands, except for number of shares and per

share data)

| |

For the three months ended |

|

|

June 30, 2023 |

|

September 30, 2023 |

|

December 31,2023 |

|

March 31, 2024 |

|

June 30, 2024 |

|

June 30, 2024 |

|

| |

RMB |

RMB |

|

RMB |

|

RMB |

|

RMB |

|

US$ |

|

|

Revenues |

146,268 |

|

127,566 |

|

121,085 |

|

125,623 |

|

135,533 |

|

18,650 |

|

| Cost of

revenues |

(45,846) |

|

(41,646) |

|

(42,972) |

|

(39,929) |

|

(40,095) |

|

(5,517) |

|

| Gross

profit |

100,422 |

|

85,920 |

|

78,113 |

|

85,694 |

|

95,438 |

|

13,133 |

|

| Operating

expenses: |

|

|

|

|

|

|

|

| Research and development

expenses |

(95,779) |

|

(83,701) |

|

(73,119) |

|

(65,985) |

|

(64,952) |

|

(8,938) |

|

| Selling and marketing

expenses |

(70,842) |

|

(62,310) |

|

(49,785) |

|

(46,856) |

|

(48,907) |

|

(6,730) |

|

| General and administrative

expenses |

(69,525) |

|

(118,724) |

|

(121,533) |

|

(98,681) |

|

(92,794) |

|

(12,769) |

|

| Total operating

expenses |

(236,146) |

|

(264,735) |

|

(244,437) |

|

(211,522) |

|

(206,653) |

|

(28,437) |

|

| Loss from

operations |

(135,724) |

|

(178,815) |

|

(166,324) |

|

(125,828) |

|

(111,215) |

|

(15,304) |

|

| Interest income |

5,255 |

|

4,018 |

|

5,539 |

|

4,038 |

|

3,187 |

|

439 |

|

| Other income (expense),

net |

(118) |

|

(157) |

|

160 |

|

434 |

|

(82) |

|

(11) |

|

| Foreign exchange (loss) gain,

net |

(210) |

|

423 |

|

(517) |

|

(13) |

|

262 |

|

36 |

|

| Loss before income

tax |

(130,797) |

|

(174,531) |

|

(161,142) |

|

(121,369) |

|

(107,848) |

|

(14,840) |

|

| Income tax expenses |

(445) |

|

(450) |

|

(1,071) |

|

(180) |

|

(190) |

|

(26) |

|

| Net loss |

(131,242) |

|

(174,981) |

|

(162,213) |

|

(121,549) |

|

(108,038) |

|

(14,866) |

|

| Net loss attributable

to Burning Rock Biotech Limited’s shareholders |

(131,242) |

|

(174,981) |

|

(162,213) |

|

(121,549) |

|

(108,038) |

|

(14,866) |

|

| Net loss attributable

to ordinary shareholders |

(131,242) |

|

(174,981) |

|

(162,213) |

|

(121,549) |

|

(108,038) |

|

(14,866) |

|

| Loss per share for class

A and class B ordinary shares: |

|

|

|

|

|

|

|

| Class A ordinary shares - basic

and diluted |

(1.28) |

|

(1.71) |

|

(1.58) |

|

(1.19) |

|

(1.05) |

|

(0.14) |

|

| Class B ordinary shares - basic

and diluted |

(1.28) |

|

(1.71) |

|

(1.58) |

|

(1.19) |

|

(1.05) |

|

(0.14) |

|

| Weighted average shares

outstanding used in loss per share computation: |

|

|

|

|

|

|

|

| Class A ordinary shares - basic

and diluted |

85,151,052 |

|

85,000,869 |

|

85,071,360 |

|

85,219,188 |

|

85,271,858 |

|

85,271,858 |

|

| Class B ordinary shares - basic

and diluted |

17,324,848 |

|

17,324,848 |

|

17,324,848 |

|

17,324,848 |

|

17,324,848 |

|

17,324,848 |

|

| Other comprehensive

income (loss), net of tax of nil: |

|

|

|

|

|

|

|

| Foreign currency translation

adjustments |

14,829 |

|

(1,955) |

|

(3,026) |

|

590 |

|

940 |

|

129 |

|

| Total comprehensive

loss |

(116,413) |

|

(176,936 ) |

|

(165,239) |

|

(120,959 ) |

|

(107,098) |

|

(14,737) |

|

| Total comprehensive loss

attributable to Burning Rock Biotech Limited’s

shareholders |

(116,413) |

|

(176,936) |

|

(165,239) |

|

(120,959 ) |

|

(107,098) |

|

(14,737) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Burning Rock Biotech Limited

Unaudited Condensed Statements of Comprehensive

Loss (in thousands, except for number of shares and per

share data)

| |

For the six months ended |

| |

June 30, 2023 |

|

June 30, 2024 |

|

June 30, 2024 |

|

| |

RMB |

|

RMB |

|

US$ |

|

|

Revenues |

288,784 |

|

261,156 |

|

35,937 |

|

| Cost of

revenues |

(89,590) |

|

(80,024) |

|

(11,012) |

|

| Gross

profit |

199,194 |

|

181,132 |

|

24,925 |

|

| Operating

expenses: |

|

|

|

| Research and development

expenses |

(190,196) |

|

(130,937) |

|

(18,018) |

|

| Selling and marketing

expenses |

(135,616) |

|

(95,763) |

|

(13,177) |

|

| General and administrative

expenses |

(197,564) |

|

(191,475) |

|

(26,349) |

|

| Total operating

expenses |

(523,376) |

|

(418,175) |

|

(57,544) |

|

| Loss from

operations |

(324,182) |

|

(237,043) |

|

(32,619) |

|

| Interest income |

8,399 |

|

7,225 |

|

994 |

|

| Other income, net |

481 |

|

352 |

|

48 |

|

| Foreign exchange loss,

net |

(326) |

|

249 |

|

34 |

|

| Loss before income

tax |

(315,628) |

|

(229,217) |

|

(31,543) |

|

| Income tax expenses |

(867) |

|

(370) |

|

(51) |

|

| Net loss |

(316,495) |

|

(229,587) |

|

(31,594) |

|

| Net loss attributable

to Burning Rock Biotech Limited’s shareholders |

(316,495) |

|

(229,587) |

|

(31,594) |

|

| Net loss attributable

to ordinary shareholders |

(316,495) |

|

(229,587) |

|

(31,594) |

|

| Loss per share for class

A and class B ordinary shares: |

|

|

|

| Class A ordinary shares - basic

and diluted |

(3.09) |

|

(2.24) |

|

(0.31) |

|

| Class B ordinary shares - basic

and diluted |

(3.09) |

|

(2.24) |

|

(0.31) |

|

| Weighted average shares

outstanding used in loss per share computation: |

|

|

|

| Class A ordinary shares - basic

and diluted |

85,108,555 |

|

85,246,969 |

|

85,246,969 |

|

| Class B ordinary shares - basic

and diluted |

17,324,848 |

|

17,324,848 |

|

17,324,848 |

|

| Other comprehensive

income (loss), net of tax of nil: |

|

|

|

| Foreign currency translation

adjustments |

9,170 |

|

1,530 |

|

211 |

|

| Total comprehensive

loss |

(307,325) |

|

(228,057) |

|

(31,383) |

|

| Total comprehensive loss

attributable to Burning Rock Biotech Limited’s

shareholders |

(307,325) |

|

(228,057) |

|

(31,383) |

|

|

|

|

|

|

|

|

|

Burning Rock Biotech

LimitedUnaudited Condensed Consolidated Balance

Sheets(In thousands)

| |

As of |

|

|

December 31, 2023 |

|

June 30,2024 |

|

June 30,2024 |

|

| |

RMB |

|

RMB |

|

US$ |

|

| ASSETS |

|

|

|

|

|

|

| Current

assets: |

|

|

|

|

|

|

| Cash and cash equivalents |

615,096 |

|

532,542 |

|

73,280 |

|

| Restricted cash |

120 |

|

505 |

|

69 |

|

| Accounts receivable, net |

126,858 |

|

153,641 |

|

21,142 |

|

| Contract assets, net |

22,748 |

|

20,018 |

|

2,755 |

|

| Inventories, net |

69,020 |

|

65,805 |

|

9,056 |

|

| Prepayments and other current

assets, net |

50,254 |

|

28,460 |

|

3,916 |

|

| Convertible note

receivable |

- |

|

5,320 |

|

732 |

|

| Total current

assets |

884,096 |

|

806,291 |

|

110,950 |

|

| Non-current

assets: |

|

|

|

|

|

|

| Equity method investment |

337 |

|

247 |

|

34 |

|

| Convertible note

receivable |

5,320 |

|

- |

|

- |

|

| Property and equipment,

net |

131,912 |

|

100,716 |

|

13,860 |

|

| Operating right-of-use

assets |

12,284 |

|

105,429 |

|

14,508 |

|

| Intangible assets, net |

964 |

|

724 |

|

100 |

|

| Other non-current assets |

5,088 |

|

9,976 |

|

1,372 |

|

| Total non-current

assets |

155,905 |

|

217,092 |

|

29,874 |

|

| TOTAL

ASSETS |

1,040,001 |

|

1,023,383 |

|

140,824 |

|

|

|

|

|

|

|

|

|

Burning Rock Biotech

LimitedUnaudited Condensed Consolidated Balance

Sheets (Continued)(in thousands)

| |

As of |

| |

December 31, 2023 |

|

June 30,2024 |

|

June 30,2024 |

|

| |

RMB |

RMB |

US$ |

| LIABILITIES AND

SHAREHOLDERS’ EQUITY |

|

|

|

| Current

liabilities: |

|

|

|

|

Accounts payable |

18,061 |

|

25,870 |

|

3,560 |

|

| Deferred revenue |

130,537 |

|

119,352 |

|

16,423 |

|

| Accrued liabilities and other

current liabilities |

104,935 |

|

86,300 |

|

11,876 |

|

| Customer deposits |

1,197 |

|

1,197 |

|

165 |

|

| Current portion of operating

lease liabilities |

8,634 |

|

26,922 |

|

3,705 |

|

| Total current

liabilities |

263,364 |

|

259,641 |

|

35,729 |

|

| Non-current

liabilities: |

|

|

|

| Non-current portion of

operating lease liabilities |

3,690 |

|

80,988 |

|

11,144 |

|

| Other non-current

liabilities |

4,537 |

|

4,908 |

|

676 |

|

| Total non-current

liabilities |

8,227 |

|

85,896 |

|

11,820 |

|

| TOTAL

LIABILITIES |

271,591 |

|

345,537 |

|

47,549 |

|

| Shareholders’

equity: |

|

|

|

| Class A ordinary shares |

116 |

|

116 |

|

16 |

|

| Class B ordinary shares |

21 |

|

21 |

|

3 |

|

| Additional paid-in

capital |

4,849,337 |

|

4,986,830 |

|

686,211 |

|

| Treasury stock |

(65,896) |

|

(65,896) |

|

(9,068) |

|

| Accumulated deficits |

(3,853,635) |

|

(4,083,222) |

|

(561,870) |

|

| Accumulated other

comprehensive loss |

(161,533) |

|

(160,003) |

|

(22,017) |

|

| Total shareholders’

equity |

768,410 |

|

677,846 |

|

93,275 |

|

| TOTAL LIABILITIES AND

SHAREHOLDERS’ EQUITY |

1,040,001 |

|

1,023,383 |

|

140,824 |

|

|

|

|

|

|

|

|

|

Burning Rock Biotech

LimitedUnaudited Condensed Statements of Cash

Flows(in thousands)

| |

For the three months ended |

|

|

June 30, 2023 |

|

June 30,2024 |

|

June 30,2024 |

|

| |

RMB |

RMB |

US$ |

| Net cash used in operating

activities |

(79,204) |

|

(40,836) |

|

(5,619) |

|

| Net cash used in investing

activities |

(2,928) |

|

(227) |

|

(31) |

|

| Net cash used in financing

activities |

(1,003) |

|

- |

|

- |

|

| Effect of exchange rate on

cash, cash equivalents and restricted cash |

13,271 |

|

1,436 |

|

196 |

|

| Net decrease in cash,

cash equivalents and restricted cash |

(69,864) |

|

(39,627) |

|

(5,454) |

|

| Cash, cash equivalents and

restricted cash at the beginning of period |

803,142 |

|

572,674 |

|

78,803 |

|

| Cash, cash equivalents

and restricted cash at the end of period |

733,278 |

|

533,047 |

|

73,349 |

|

| |

|

| |

For the six months ended |

|

|

June 30,2023 |

|

June 30,2024 |

|

June 30,2024 |

|

| |

RMB |

RMB |

US$ |

|

Net cash used in operating activities |

(192,347) |

|

(81,045) |

|

(11,152) |

|

| Net cash used in investing

activities |

(6,987) |

|

(2,613) |

|

(360) |

|

| Net cash used in financing

activities |

(1,035) |

|

- |

|

- |

|

| Effect of exchange rate on

cash, cash equivalents and restricted cash |

8,379 |

|

1,489 |

|

204 |

|

| Net decrease in cash,

cash equivalents and restricted cash |

(191,990) |

|

(82,169) |

|

(11,308) |

|

| Cash, cash equivalents and

restricted cash at the beginning of period |

925,268 |

|

615,216 |

|

84,657 |

|

| Cash, cash equivalents

and restricted cash at the end of period |

733,278 |

|

533,047 |

|

73,349 |

|

| |

|

Burning Rock Biotech

LimitedReconciliations of GAAP and Non-GAAP

Results

| |

For the three months ended |

|

|

June 30,2023 |

|

September 30, 2023 |

|

December 31, 2023 |

|

March 31,2024 |

|

June 30,2024 |

|

| |

(RMB in thousands) |

| Gross

profit: |

|

|

| Central laboratory channel |

51,876 |

|

41,487 |

|

41,886 |

|

37,002 |

|

38,424 |

|

| In-hospital channel |

33,353 |

|

35,459 |

|

12,910 |

|

39,192 |

|

44,058 |

|

| Pharma research and development

channel |

15,193 |

|

8,974 |

|

23,317 |

|

9,500 |

|

12,956 |

|

| Total gross

profit |

100,422 |

|

85,920 |

|

78,113 |

|

85,694 |

|

95,438 |

|

| Add: depreciation and

amortization: |

|

|

|

|

|

| Central laboratory channel |

2,645 |

|

2,550 |

|

2,414 |

|

1,919 |

|

1,226 |

|

| In-hospital channel |

2,637 |

|

2,751 |

|

2,728 |

|

1,524 |

|

824 |

|

| Pharma research and development

channel |

3,665 |

|

3,863 |

|

3,808 |

|

3,856 |

|

4,417 |

|

| Total depreciation and

amortization included in cost of revenues |

8,947 |

|

9,164 |

|

8,950 |

|

7,299 |

|

6,467 |

|

| Non-GAAP gross

profit: |

|

|

|

|

|

| Central laboratory channel |

54,521 |

|

44,037 |

|

44,300 |

|

38,921 |

|

39,650 |

|

| In-hospital channel |

35,990 |

|

38,210 |

|

15,638 |

|

40,716 |

|

44,882 |

|

| Pharma research and development

channel |

18,858 |

|

12,837 |

|

27,125 |

|

13,356 |

|

17,373 |

|

| Total non-GAAP gross

profit |

109,369 |

|

95,084 |

|

87,063 |

|

92,993 |

|

101,905 |

|

| Non-GAAP gross

margin: |

|

|

|

|

|

| Central laboratory channel |

82.3% |

|

82.3% |

|

86.4% |

|

81.7% |

|

81.3% |

|

| In-hospital channel |

66.9% |

|

70.1% |

|

54.3% |

|

70.9% |

|

75.0% |

|

| Pharma research and development

channel |

72.0% |

|

65.5% |

|

66.2% |

|

64.8% |

|

64.6% |

|

| Total non-GAAP gross

margin |

74.8% |

|

74.5% |

|

71.9% |

|

74.0% |

|

75.2% |

|

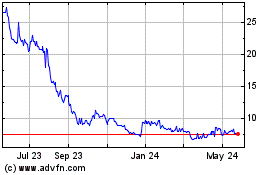

Burning Rock Biotech (NASDAQ:BNR)

Historical Stock Chart

From Oct 2024 to Nov 2024

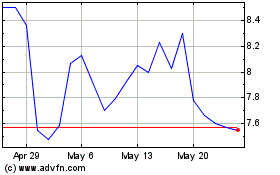

Burning Rock Biotech (NASDAQ:BNR)

Historical Stock Chart

From Nov 2023 to Nov 2024