Bioventus Completes Divestiture of its Advanced Rehabilitation Business to Accelmed Partners

03 January 2025 - 12:00AM

Bioventus Inc. (Nasdaq: BVS) (“Bioventus” or the “Company”), a

global leader in innovations for active healing, announced today

that it has successfully completed the divestiture of its Advanced

Rehabilitation business to Accelmed Partners (“Accelmed”), a

private equity firm focused on acquiring and growing

commercial-stage HealthTech companies. The transaction, announced

on October 1, 2024, enables Bioventus to continue improving its

focus and execution within the Company’s core businesses, while

also delivering approximately $20 million of net closing proceeds

to enhance liquidity.

About Bioventus

Bioventus delivers clinically proven, cost-effective products

that help people heal quickly and safely. Its mission is to make a

difference by helping patients resume and enjoy active lives. The

Innovations for Active Healing from Bioventus include offerings for

Pain Treatments, Restorative Therapies and Surgical Solutions.

Built on a commitment to high quality standards, evidence-based

medicine and strong ethical behavior, Bioventus is a trusted

partner for physicians worldwide. For more information, visit

www.bioventus.com, and follow the Company on LinkedIn and

Twitter. Bioventus and the Bioventus logo are registered trademarks

of Bioventus LLC.

About Accelmed Partners

Accelmed is a U.S.-based private equity firm focused on

acquiring and investing in U.S. commercial stage, lower middle

market HealthTech companies. Since 2009, Accelmed has deployed over

$500 million into companies spanning medical devices, diagnostics,

digital health and technology-enabled healthcare services. Accelmed

seeks to accelerate value and scale innovation across the

HealthTech field by bringing to bear the team’s industry

experience, operational and financial expertise, and strong global

relationships. For more information, please

visit www.accelmed.com.

Forward-Looking Statements

This press release contains forward-looking

statements within the meaning of federal securities laws. Any

statements contained herein that do not relate to matters of

historical fact should be considered forward-looking statements,

including, without limitation, statements concerning the Company’s

future growth, operating margins, market leadership and strategy,

the expected proceeds from the divestiture, and the use of such

proceeds to repay existing debt. In some cases, you can identify

forward-looking statements by terminology such as “aim,”

“anticipate,” “assume,” “believe,” “contemplate,” “continue,”

“could,” “due,” “estimate,” “expect,” “forecast,” “future,” “goal,”

“intend,” “may,” “might,” “objective,” “plan,” “possible,”

“predict,” “project,” “propose,” “potential,” “positioned,” “seek,”

“should,” “strive,” “target,” “will,” “would” and other similar

expressions that are predictions of or indicate future events and

future trends, or the negative of these terms or other comparable

terminology, although not all forward-looking statements contain

these words. Forward-looking statements are inherently subject to

risks and uncertainties, some of which cannot be predicted or

quantified. Factors that could cause actual results to differ

materially from those contemplated herein include, but are not

limited to, our ability to successfully complete the

planned divestiture of the Rehabilitation Business, our

dependence on a limited number of products; our ability to develop,

acquire and commercialize new products, line extensions or expanded

indications; the continued and future acceptance of our existing

portfolio of products and any new products, line extensions or

expanded indications by physicians, patients, third-party payers

and others in the medical community; our ability to achieve and

maintain adequate levels of coverage and/or reimbursement for our

products, the procedures using our products, or any future products

we may seek to commercialize; our ability to recognize the benefits

of our investments; our ability to complete acquisitions or

successfully integrate new businesses, products or technologies in

a cost-effective and non-disruptive manner; competition against

other companies; our ability to continue to research, develop and

manufacture our products if our facilities are damaged or become

inoperable; failure to comply with the extensive government

regulations related to our products and operations; enforcement

actions if we engage in improper claims submission practices or in

improper marketing or promotion of our products; the FDA regulatory

process and our ability to obtain and maintain required regulatory

clearances and approvals; the clinical studies of any of our future

products that do not produce results necessary to support

regulatory clearance or approval in the United States or elsewhere;

we are subject to securities litigation and may be subject to

similar or other litigation in the future, which will require

significant management time and attention, result in significant

legal expenses or costs not covered by our insurers, and may result

in unfavorable outcomes; and the other risks identified in the Risk

Factors section of the Company’s public filings with the Securities

and Exchange Commission (“SEC”), including the Company’s Annual

Report on Form 10-K for the year ended December 31, 2023 and the

quarterly reports on Form 10-Q, and as such factors may be further

updated from time to time in the Company’s other filings with the

SEC, which are accessible on the SEC’s website at www.sec.gov.

Except to the extent required by law, the Company undertakes no

obligation to update or review any estimate, projection, or

forward-looking statement. Actual results may differ materially

from those set forth in the forward-looking statements.

Investor and Media Inquiries:Dave

Crawford919-474-6787dave.crawford@bioventus.com

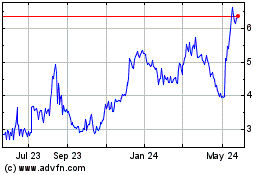

Bioventus (NASDAQ:BVS)

Historical Stock Chart

From Dec 2024 to Jan 2025

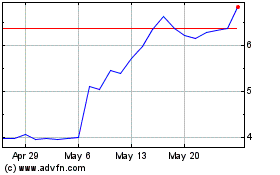

Bioventus (NASDAQ:BVS)

Historical Stock Chart

From Jan 2024 to Jan 2025