Coastal Financial Corporation Prices Public Offering of Common Stock

11 December 2024 - 2:06PM

Coastal Financial Corporation (NASDAQ: CCB) (“Coastal” or the

“Company”), the holding company for Coastal Community Bank (the

“Bank”), today announced the pricing of an underwritten public

offering of 1,200,000 shares of its common stock, no par value per

share (the "Common Stock"), at a price to the public of $71.00 per

share. Coastal also granted the underwriters a 30-day option to

purchase up to an additional 180,000 shares of its Common

Stock sold in this offering at the public offering price, less

underwriting discounts and commissions.

The aggregate gross proceeds of the offering will

be approximately $85.2 million before deducting underwriting

discounts and commissions and estimated offering expenses. Assuming

the underwriters’ option to purchase additional shares is exercised

in full, it is expected the aggregate gross proceeds of the

offering would be approximately $98.0 million before deducting

underwriting discounts and commissions and estimated offering

expenses. The Company intends to use the net proceeds from this

offering for general corporate purposes, including, without

limitation, supporting investment opportunities and the Bank’s

growth. The offering is expected to close on or about December 12,

2024, subject to customary closing conditions.

Keefe, Bruyette & Woods, a Stifel company, is serving as the

lead bookrunning manager, Hovde Group, LLC is serving as a joint

bookrunning manager, and Raymond James & Associates, Inc. and

Stephens Inc. are serving as co-managers for the offering.

The shares of common stock will be issued pursuant to an

effective shelf registration statement on Form S-3 (File No.

333-279879) filed by Coastal with the U.S. Securities and Exchange

Commission (the “SEC”), which was declared effective by the SEC on

June 13, 2024. A preliminary prospectus supplement related to the

offering has been filed with the SEC and a final prospectus

supplement relating to this offering will be filed with the SEC.

Prospective investors should read the preliminary prospectus

supplement, the final prospectus supplement, when available, and

other documents Coastal has filed with the SEC for more complete

information about Coastal and the offering. You may get these

documents for free by visiting EDGAR on the SEC website at

www.sec.gov. Copies of the preliminary prospectus supplement, the

final prospectus supplement, when available, and the accompanying

prospectus relating to this offering may be obtained by contacting

Keefe, Bruyette & Woods, Inc., 787 Seventh Avenue, Fourth

Floor, New York, NY 10019, attention: Equity Capital Markets, or by

calling toll free at (800) 966-1559 or emailing

USCapitalMarkets@kbw.com.

This press release is for informational purposes only and shall

not constitute an offer to sell, or the solicitation of an offer to

buy, the securities, nor shall there be any offer, solicitation, or

sale in any jurisdiction in which such an offer, solicitation or

sale would be unlawful prior to registration or qualification under

the securities laws of any such jurisdiction.

About Coastal Financial Corporation

Coastal Financial Corporation (Nasdaq: CCB) (the “Company”), is

an Everett, Washington based bank holding company whose wholly

owned subsidiaries are Coastal Community Bank (“Bank”) and

Arlington Olympic LLC. The $4.07 billion Bank provides service

through 14 branches in Snohomish, Island, and King Counties, the

Internet and its mobile banking application. The Bank provides

banking as a service to broker-dealers, digital financial service

providers, companies and brands that want to provide financial

services to their customers through the Bank's CCBX segment. Member

FDIC.

Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of

1995. These forward-looking statements reflect our current views

with respect to, among other things, future events and our

financial performance and statements regarding the proposed

offering. Any statements about our management’s expectations,

beliefs, plans, predictions, forecasts, objectives, assumptions or

future events or performance are not historical facts and may be

forward-looking. Words or phrases such as “anticipate,” “believes,”

“can,” “could,” “may,” “predicts,” “potential,” “should,” “will,”

“estimate,” “plans,” “projects,” “continuing,” “ongoing,”

“expects,” “intends” and similar words or phrases are intended to

identify forward-looking statements but are not the exclusive means

of identifying such statements. Any or all of the forward-looking

statements in this press release may turn out to be inaccurate. The

inclusion of or reference to forward-looking information in this

press release should not be regarded as a representation by us or

any other person that the future plans, estimates or expectations

contemplated by us will be achieved. We have based these forward-

looking statements on our current expectations and projections

about future events and financial trends that we believe may affect

our financial condition, results of operations, business strategy,

and financial needs. Our actual results could differ materially

from those anticipated in such forward-looking statements as a

result of risks, uncertainties and assumptions that are difficult

to predict. Factors that could cause actual results to differ

materially from those in the forward-looking statements include,

without limitation, the risks and uncertainties discussed under

“Risk Factors” in our Annual Report on Form 10-K for the most

recent period filed, our Quarterly Report on Form 10-Q for the most

recent quarter, and in any of our other filings with the SEC.

If one or more events related to these or other risks or

uncertainties materialize, or if our underlying assumptions prove

to be incorrect, actual results may differ materially from what we

anticipate. You are cautioned not to place undue reliance on

forward-looking statements. Further, any forward- looking statement

speaks only as of the date on which it is made and we undertake no

obligation to update or revise any forward-looking statement to

reflect events or circumstances after the date on which the

statement is made or to reflect the occurrence of unanticipated

events, except as required by law.

Contact:

Joel

EdwardsCFO425.357.3687Jedwards@coastalbank.com

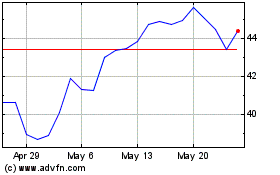

Coastal Financial (NASDAQ:CCB)

Historical Stock Chart

From Dec 2024 to Jan 2025

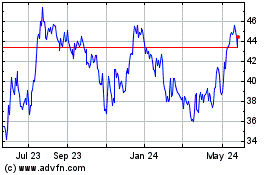

Coastal Financial (NASDAQ:CCB)

Historical Stock Chart

From Jan 2024 to Jan 2025