Constellation to Acquire Calpine in Stock and

Cash

Joins Best-in-Class Customer Platforms,

Providing Opportunities to Better Serve Customers with a Broader

Array of Energy and Sustainability Products

Combines Nation’s Premier Nuclear, Natural Gas

and Geothermal Fleets to Create Cleanest and Most Reliable Energy

Producer, with Coast-to-Coast Presence

Immediately and Highly Accretive to

Constellation’s EPS and Cash Flow with Value Creation for

Constellation Owners

Ownership Commitment from Calpine’s Owners, led

by Energy Capital Partners (ECP), Who Will Receive Stock in the Pro

Forma Company as Consideration

Constellation to Host Conference Call and

Webcast Today at 8:30 a.m. Eastern Time

Constellation (Nasdaq: CEG) and Calpine Corp. today announced

they have entered into a definitive agreement under which

Constellation will acquire Calpine in a cash and stock transaction

valued at an equity purchase price of approximately $16.4 billion,

composed of 50 million shares of Constellation stock and $4.5

billion in cash plus the assumption of approximately $12.7 billion

of Calpine net debt. After accounting for cash that is expected to

be generated by Calpine between signing and the expected closing

date, as well as the value of tax attributes at Calpine, the net

purchase price is $26.6 billion, reflecting an attractive

acquisition multiple of 7.9x 2026 EV/EBITDA.

The agreement creates the nation’s largest clean energy

provider, opening opportunities to serve more customers

coast-to-coast with a broader array of energy and sustainability

products. Already the nation’s largest producer of 24/7

emissions-free electricity, Constellation will add Calpine, the

largest U.S. producer of energy from low-emission natural gas

generation and an expanded renewable energy portfolio, including

the largest geothermal generation operation in the U.S. The

combination also forms the nation’s leading competitive retail

electric supplier, providing 2.5 million customers with a broader

array of customized energy and sustainability solutions and new

product offerings to help them manage energy costs and achieve

their sustainability goals.

“This acquisition will help us better serve our customers across

America, from families to businesses and utilities,” said Joe

Dominguez, president and CEO, Constellation. “By combining

Constellation’s unmatched expertise in zero-emission nuclear energy

with Calpine’s industry-leading, best-in-class, low-carbon natural

gas and geothermal generation fleets, we will be able to offer the

broadest array of energy products and services available in the

industry. Both companies have been at the forefront of America’s

transition to cleaner, more reliable and secure energy, and those

shared values will guide us as we pursue investments in new and

existing clean technologies to meet rising demand. What makes this

combination even more special is it brings together two world-class

teams, with the most talented women and men in the industry, who

share a noble passion for safety, sustainability, operational

excellence and helping America’s families, businesses and

communities thrive and grow. We look forward to welcoming the

Calpine team upon closing of this transaction.”

Calpine’s low-emission natural gas plants will play a key role

in maintaining grid reliability for decades to come as customers

transition to cleaner energy sources. Both companies have been

early investors in carbon sequestration technology to help ensure

America’s abundant natural gas can continue to reliably power

customers. At the same time, Constellation will invest in adding

more zero-emission energy to the grid by extending the life of

existing clean energy sources, exploring new advanced nuclear

projects, investing in renewables and increasing the output of

existing nuclear plants, in addition to restarting the Crane Clean

Energy Center in Pennsylvania.

Andrew Novotny, president and CEO of Calpine, said, “This is an

incredible opportunity to bring together top tier generation

fleets, leading retail customer businesses and the best people in

our industry to help drive a stronger American economy for a

cleaner, healthier and more sustainable future. Together, we will

be better positioned to bring accelerated investment in everything

from zero-emission nuclear to battery storage that will power our

economy in a way that puts people and our environment first. It’s a

win for every American family and business in our newly combined

footprint that wants clean and reliable energy. ECP’s commitment to

these goals over the last seven years was critical to the progress

we have made as a company and to laying a foundation for future

growth.”

Tyler Reeder, president & managing partner of ECP, said,

“Since acquiring Calpine in 2018, we have focused on unlocking

value and driving future potential growth avenues for the business,

which we believe have been recognized through this combination. We

truly cannot thank the Calpine team enough for their partnership

and are excited to support their continued contributions to the

Constellation team. Following the closing of the transaction, we

will remain committed as a shareholder of Constellation, reflecting

our high confidence in the continued value and growth potential

created by this combination.”

The transaction will deliver benefits to Constellation’s owners,

with expected immediate adjusted (non-GAAP) operating earnings per

share (EPS) accretion of more than 20% in 2026 and at least $2 per

share of EPS accretion in future years. The transaction is

projected to add more than $2 billion (non-GAAP) of free cash flow

annually, creating strategic capital and scale to reinvest in the

business. Constellation’s base earnings outlook is expected to

continue growing at a double-digit rate through the decade.

Constellation remains committed to a strong, investment-grade

balance sheet with current ratings expected to be affirmed by

S&P and Moody’s.

Strategic Benefits:

- Creates the cleanest and most reliable generation portfolio

in the U.S., with a diverse, coast-to-coast portfolio of zero- and

low-emission generation assets and expands Constellation’s

footprint in the fastest growing area of demand for power:

Together, Constellation and Calpine will have nearly 60 gigawatts

of capacity from zero- and low-emission sources, including nuclear,

natural gas, geothermal, hydro, wind, solar, cogeneration and

battery storage. The combined company’s footprint will span the

continental U.S. and include a significantly expanded presence in

Texas, the fastest growing market for power demand, as well as

other key strategic states, including California, Delaware, New

York, Pennsylvania and Virginia.

- Combines best-in-class retail and commercial businesses with

a premier customer solutions platform, establishing a

coast-to-coast presence and providing opportunities to serve more

customers with a broader array of energy and sustainability

products to meet increasing demand: The transaction will expand

Constellation’s industry-leading customer solutions business to

position the combined company as the leading U.S. retail

electricity supplier, helping 2.5 million homes and businesses

nationwide achieve their energy and sustainability needs. The

combined company will offer customers a broader array of reliable

energy solutions, including new product offerings that can

integrate nuclear, renewable and natural gas technologies tailored

to customers’ unique needs. Customers also will enjoy more

predictability and competitive prices as a result of the two

companies’ complementary generation assets, load, fuel diversity,

geographies and product offerings.

- Reinforces Constellation’s position as the largest clean

energy producer with the lowest carbon emissions intensity in the

U.S.: Constellation is already the top clean energy producer in

the U.S., providing 10% of the nation’s emissions-free energy.

Joining Calpine with Constellation broadens this position by

increasing Constellation’s renewable portfolio, including the

Geysers facility in Northern California, the largest geothermal

generator in the U.S. The combined company is poised for further

growth, enhanced by its increased scale and cash flow.

- Joins proven, experienced, best-in-class teams with strong

cultures of safety, operating excellence and commitment to serving

customers, communities and the country. Constellation and

Calpine’s people share a passion for powering America’s families

and businesses with energy that is reliable, clean and available

whenever it’s needed. Both companies are innovators recognized

across the industry for operating at the highest levels of safety,

efficiency and reliability, and for offering competitive products

that allow customers to cost-effectively meet their energy needs.

After closing, Calpine CEO Andrew Novotny will bring his decades of

energy expertise and leadership to Constellation and continue to

lead the Calpine business.

- Strengthens shared commitment to supporting clean, healthy

and growing communities through workforce development, philanthropy

and community investment: Together, the combined company will

increase its positive impact, serving as an economic engine for

local communities through jobs, tax payments and other economic

activity. The combined company will continue its commitment to

communities through more than $21.1 million in combined annual

Foundation, corporate and employee philanthropy, in addition to

thousands of employee volunteer hours, with a focus on economically

disadvantaged communities.

Additional Transaction Details

The cash and stock transaction will have a value of

approximately $16.4 billion, composed of 50 million shares of

Constellation stock using the trailing 20-day VWAP of $237.98 and

$4.5 billion in cash plus the assumption of approximately $12.7

billion of Calpine net debt. Constellation expects to fund the cash

portion of the transaction through a combination of cash on hand

and cash flow generated by Calpine in the period between signing

and closing of the transaction (that will be assumed at

closing).

Reflecting their confidence in Constellation’s growth and value

creation through this acquisition, Calpine’s significant

shareholders, including ECP, Canada Pension Plan Investments (CPP

Investments) and Access Industries, have agreed to an 18-month

lock-up with respect to their equity ownership of Constellation

common stock, subject to an agreed upon schedule for potential

sales.

The transaction is expected to close within 12 months of

signing, subject to the satisfaction of customary closing

conditions, including the expiration or termination of the waiting

period pursuant to the Hart-Scott-Rodino Act, and regulatory

approvals from the Federal Energy Regulatory Commission, the

Canadian Competition Bureau, the New York Public Service

Commission, the Public Utility Commission of Texas and other

regulatory agencies.

Following the close of the transaction, Constellation will

continue to be headquartered in Baltimore and will continue to

maintain a significant presence in Houston, where Calpine is

currently headquartered.

Advisors

Lazard is serving as financial advisor to Constellation. J.P.

Morgan Securities LLC is also serving as financial advisor to

Constellation, and Kirkland & Ellis is serving as legal

counsel.

Evercore served as lead financial advisor to Calpine. Morgan

Stanley & Co. LLC, Goldman Sachs & Co. LLC., and Barclays

US are serving as additional financial advisors to Calpine and ECP,

and Latham & Watkins and White & Case are serving as legal

counsel.

Conference Call and Webcast Information

Constellation will host a conference call today, Jan. 10, 2025,

at 8:30 a.m. Eastern Time to discuss this announcement.

The live audio webcast of the conference call, including

presentation slides, will be available at

https://investors.constellationenergy.com.

About Constellation

A Fortune 200 company headquartered in Baltimore, Constellation

Energy Corporation (Nasdaq: CEG) is the nation’s largest producer

of clean, emissions-free energy and a leading supplier of energy

products and services to businesses, homes, community aggregations

and public sector customers across the continental United States,

including three fourths of Fortune 100 companies. With annual

output that is nearly 90% carbon-free, our hydro, wind and solar

facilities paired with the nation’s largest nuclear fleet have the

generating capacity to power the equivalent of 16 million homes,

providing about 10% of the nation’s clean energy. We are further

accelerating the nation’s transition to a carbon-free future by

helping our customers reach their sustainability goals, setting our

own ambitious goal of achieving 100% carbon-free generation by

2040, and by investing in promising emerging technologies to

eliminate carbon emissions across all sectors of the economy.

Follow Constellation on LinkedIn and X.

About Calpine

Calpine Corporation is America’s largest generator of

electricity from natural gas and geothermal resources with

operations in competitive power markets. Our fleet of 79 energy

facilities in operation represents over 27,000 megawatts of

generation capacity. Through wholesale power operations and our

retail businesses, we serve customers in 22 states and Canada. Our

clean, efficient, modern and flexible fleet uses advanced

technologies to generate power in a low-carbon and environmentally

responsible manner. We are uniquely positioned to benefit from the

secular trends affecting our industry, including the abundant and

affordable supply of clean natural gas, environmental regulation,

aging power generation infrastructure and the increasing need for

dispatchable power plants to successfully integrate intermittent

renewables into the grid.

If you would like to learn more about Calpine follow us:

Twitter.com/Calpine or Linkedin.com/Calpine.

About Energy Capital Partners (ECP)

Energy Capital Partners (ECP), founded in 2005, is a leading

equity and credit investor across energy transition,

electrification and decarbonization infrastructure assets. The ECP

team, comprised of 90 people with 800 years of collective industry

experience, deep expertise and extensive relationships, has

consummated more than 100 equity (representing nearly $60 billion

of enterprise value) and over 20 credit transactions since

inception. In 2024, ECP combined with London listed Bridgepoint

Group Plc (LSE: BPT.L) to create a global leader in value added

middle-market investing with a combined $73 billion of assets under

management across private equity, credit and infrastructure. For

more information, visit www.ecpgp.com and www.bridgepoint.eu.

Cautionary Statements Regarding Forward-Looking

Information

This press release contains certain forward-looking statements

within the meaning of the Private Securities Litigation Reform Act

of 1995 that are subject to risks and uncertainties. Words such as

“could,” “may,” “expects,” “anticipates,” “will,” “targets,”

“goals,” “projects,” “intends,” “plans,” “believes,” “seeks,”

“estimates,” “predicts,” and variations on such words, and similar

expressions that reflect Constellation’s and Calpine’s current

views with respect to future events and operational, economic, and

financial performance, are intended to identify such

forward-looking statements. These forward-looking statements

include, but are not limited to, statements regarding the proposed

transaction between Constellation and Calpine, the expected closing

of the proposed transaction and the timing thereof, the financing

of the proposed transaction and the pro forma combined company and

its operations, strategies and plans, enhancements to

investment-grade credit profile, synergies, opportunities and

anticipated future performance and capital structure, and expected

accretion to earnings per share and free cash flow. Information

adjusted for the proposed transaction should not be considered a

forecast of future results. Although Constellation and Calpine

believe these forward-looking statements are reasonable, statements

made regarding future results are not guarantees of future

performance and are subject to numerous assumptions, uncertainties

and risks that are difficult to predict. Forward-looking statements

are based on current expectations, estimates and assumptions that

involve a number of risks and uncertainties that could cause actual

results to differ materially from those projected.

Actual outcomes and results may differ materially from the

results stated or implied in the forward-looking statements

included in this press release due to a number of factors,

including, but not limited to: the occurrence of any event, change

or other circumstances that could give rise to the termination of

the merger agreement; the risk that Constellation or Calpine may be

unable to obtain governmental and regulatory approvals required for

the proposed transaction, or required governmental and regulatory

approvals may delay the proposed transaction or result in the

imposition of conditions that could cause the parties to abandon

the proposed transaction; the risk that the parties may not be able

to satisfy the conditions to the proposed transaction in a timely

manner or at all; the risk that problems may arise in successfully

integrating the businesses of the companies, which may result in

the combined company not operating as effectively and efficiently

as expected; and the risk that the combined company may be unable

to achieve synergies or other anticipated benefits of the proposed

transaction or it may take longer than expected to achieve those

synergies or benefits. Other unpredictable or unknown factors not

discussed in this press release could also have material adverse

effects on forward-looking statements.

The factors that could cause actual results to differ materially

from the forward-looking statements made by Constellation and

Calpine include those factors discussed herein, as well as the

items discussed in (1) Constellation’s 2023 Annual Report on Form

10-K in (a) Part I, ITEM 1A. Risk Factors, (b) Part II, ITEM 7.

Management’s Discussion and Analysis of Financial Condition and

Results of Operations, and (c) Part II, ITEM 8. Financial

Statements and Supplementary Data: Note 19, Commitments and

Contingencies; (2) Constellation’s Third Quarter 2024 Quarterly

Report on Form 10-Q in (a) Part II, ITEM 1A. Risk Factors, (b) Part

I, ITEM 2. Management’s Discussion and Analysis of Financial

Condition and Results of Operations, and (c) Part I, ITEM 1.

Financial Statements: Note 13, Commitments and Contingencies; and

(3) other factors discussed in filings with the SEC by

Constellation. Investors are cautioned not to place undue reliance

on these forward-looking statements, whether written or oral, which

apply only as of the date of this press release. Constellation and

Calpine undertake no obligation to publicly release any revision to

these forward-looking statements to reflect events or circumstances

after the date of this press release.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250109143771/en/

Paul Adams Constellation Communications 667-218-7700

paul.adams@constellation.com

Brett Kerr Calpine External Affairs 713-830-8809

Brett.kerr@calpine.com

ECP FGS Global Nick Rust / Akash Lodh ECP@fgsglobal.com

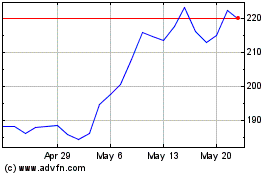

Constellation Energy (NASDAQ:CEG)

Historical Stock Chart

From Dec 2024 to Jan 2025

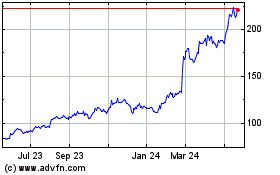

Constellation Energy (NASDAQ:CEG)

Historical Stock Chart

From Jan 2024 to Jan 2025