Cenntro Electric Group Limited Announces Proposed Re-domiciliation to the United States

12 September 2023 - 6:00AM

Business Wire

Cenntro Electric Group Limited (NASDAQ: CENN) (“Cenntro” or “the

Company”), a leading EV technology company with advanced,

market-validated electric commercial vehicles, is pleased to

announce its intention to re-domicile from Australia to the United

States of America ("U.S.") by way of scheme of arrangement

undertaken in accordance with the requirements of the Australian

Corporations Act 2001 (Cth) ("Scheme").

To implement the re-domiciliation, Cenntro has entered into a

scheme implementation agreement dated September 8, 2023 ("Scheme

Implementation Agreement") with Cenntro Inc. (“HoldCo”),

a new U.S. company incorporated in accordance with the laws of

Nevada for the purpose of effecting its re-domiciliation to the

U.S. Pursuant to the terms of the Scheme which HoldCo will acquire

all of the ordinary shares in Cenntro (“Cenntro Shares”) and

eligible holders of Cenntro Shares ("Cenntro Shareholders")

will receive one share of common stock of HoldCo ("HoldCo

Shares") in exchange for each Cenntro Share held by that

Cenntro Shareholder at the record date for the Scheme and

transferred to HoldCo under the Scheme.

The Scheme is subject to court approval in Australia, as well as

approval by Cenntro Shareholders.

If the Scheme is implemented, Cenntro will become a wholly owned

subsidiary of HoldCo. Cenntro will be de-listed from the Nasdaq

Capital Market (“Nasdaq”). HoldCo will apply for HoldCo to

be listed on Nasdaq, effective upon the implementation of the

Scheme.

Reasons for re-domiciliation

After carefully considering the relative merits of the

re-domiciliation, the directors of Cenntro are of the view that the

advantages materially outweigh the disadvantages. In particular,

the board believes that the re-domiciliation would provide the

following potential benefits:

- Position the Cenntro group more appropriately, as its ultimate

holding company will, following implementation of the Scheme, be

domiciled in the U.S. and listed domestically on the Nasdaq;

- Seek to provide the Cenntro group more opportunities to pursue

future corporate development and strategic growth initiatives while

at the same time seeking to reduce the risk of the Cenntro group's

activities being subject to the approval of the Committee on

Foreign Investment in the United States;

- Improve the attractiveness and awareness of Cenntro to a

broader U.S. investor pool that prefer the familiarity of

domestically domiciled companies;

- Better align Cenntro's corporate structure with its business

operations in the U.S., noting the majority of Cenntro's corporate

senior management team are located in the U.S.; and

- Seek to streamline and reduce costs of the Cenntro group,

particularly in respect of compliance and audit costs associated

with being an Australian incorporated public company operating in

both the U.S. and Australia.

Independent Expert

Cenntro has engaged Lonergan Edwards (“Independent

Expert”) to prepare a report for inclusion in the scheme

booklet, stating whether or not in the Independent Expert's opinion

the Scheme is in the best interests of the Cenntro Shareholders

(“Independent Expert's Report”).

Cenntro board unanimously recommends the Scheme

The directors of Cenntro unanimously recommend Cenntro

Shareholders to vote in favor of the Scheme subject to the

Independent Expert concluding that the Scheme is in the best

interests of Cenntro Shareholders, in the absence of a superior

proposal. The directors of Cenntro intend to vote all Cenntro

Shares they hold in favor of the Scheme, subject to the same

qualifications.

Terms of the Schemes

Implementation of the Scheme is subject to a number of

conditions precedent, including:

- Approval by Cenntro Shareholders by the requisite

majorities;

- The Holdco Shares being authorized for listing on Nasdaq;

- The Independent Expert concluding that the Scheme is in the

best interests of Cenntro Shareholders;

- Australian court approval of the Scheme;

- Cenntro receiving all required regulatory approvals for, and no

regulatory intervention preventing, the Scheme;

- Cenntro and HoldCo receiving all relief, waivers, exemptions,

consents or approvals to implement the Scheme; and

- Cenntro and HoldCo entering into binding agreements with each

option holder, warrant holder and note holder to cancel the options

held by such option holders, the warrants held by such warrant

holders and the notes held by such noteholders on conditions that

are acceptable to Cenntro and HoldCo.

A copy of the Scheme Implementation Agreement is attached to

this announcement.

Indicative timetable and next steps

Cenntro Shareholders do not need to take any action at this

time. A scheme booklet containing, among other things, further

information relating to the Scheme, reasons for the directors’

unanimous recommendation, information on the scheme meetings and

the Independent Expert’s Report is expected to be sent to Cenntro

Shareholders in October 2023. Cenntro is targeting implementation

date for the Scheme by December 31, 2023, with the Nasdaq listing

for HoldCo to be completed shortly thereafter. These dates are

indicative only and subject to change.

Cenntro has retained MinterEllison as its Australian legal

advisor, and Ortoli Rosenstadt LLP as its U.S. legal advisor.

About Cenntro Electric Group Ltd.

Cenntro Electric Group Ltd. (or "Cenntro") (NASDAQ: CENN) is a

leading designer and manufacturer of electric commercial vehicles.

Cenntro's purpose-built ECVs are designed to serve a variety of

organizations in support of city services, last-mile delivery, and

other commercial applications. Cenntro plans to lead the

transformation in the automotive industry through scalable,

decentralized production, and smart driving solutions empowered by

the Cenntro iChassis. For more information, please visit Cenntro's

website at: www.cenntroauto.com.

Forward-Looking Statements

This communication contains "forward-looking statements" within

the meaning of the safe harbor provisions of the U.S. Private

Securities Litigation Reform Act of 1995. Forward-looking

statements include all statements that are not historical facts.

Such statements may be, but need not be, identified by words such

as "may,'' "believe,'' "anticipate,'' "could,'' "should,''

"intend,'' "plan,'' "will,'' "aim(s),'' "can,'' "would,''

"expect(s),'' "estimate(s),''"project(s),'' "forecast(s)'',

"positioned,'' "approximately,'' "potential,'' "goal,''

"strategy,'' "outlook'' and similar expressions. Examples of

forward-looking statements include, among other things, statements

regarding assembly and distribution capabilities, decentralized

production, and fully digitalized autonomous driving solutions. All

such forward-looking statements are based on management's current

beliefs, expectations and assumptions, and are subject to risks,

uncertainties and other factors that could cause actual results to

differ materially from the results expressed or implied in this

communication. For additional risks and uncertainties that could

impact Cenntro’s forward-looking statements, please see disclosures

contained in Cenntro's public filings with the SEC, including the

"Risk Factors" in Cenntro's Annual Report on Form 10K/A filed with

the Securities and Exchange Commission on July 6, 2023 and which

may be viewed at www.sec.gov.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230911100170/en/

Investor Relations Contact: Chris Tyson MZ North America

CENN@mzgroup.us 949-491-8235

Company Contact:

PR@cenntroauto.com IR@cenntroauto.com

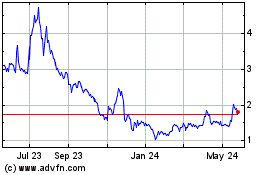

Cenntro (NASDAQ:CENN)

Historical Stock Chart

From Feb 2025 to Mar 2025

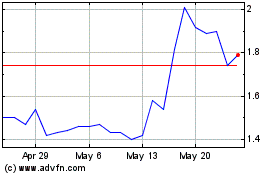

Cenntro (NASDAQ:CENN)

Historical Stock Chart

From Mar 2024 to Mar 2025