0001723089false00017230892025-02-042025-02-04

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

February 4, 2025

Date of Report (Date of earliest event reported)

ChampionX Corporation

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | | | | | | | |

| Delaware | | 001-38441 | | 82-3066826 | |

| (State or other jurisdiction

of incorporation) | | (Commission File Number) | | (I.R.S. Employer Identification No.) | |

2445 Technology Forest Blvd

Building 4, 12th Floor

The Woodlands, Texas 77381

(Address of principal executive offices and zip code)

(281) 403-5772

(Registrant’s telephone number, including area code)

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common stock, $0.01 par value | CHX | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On February 4, 2025, ChampionX Corporation (the "Company") issued a news release announcing its financial results for the quarter and year ended December 31, 2024. A copy of the news release is furnished as Exhibit 99.1 hereto and incorporated herein by reference.

The information furnished pursuant to this Item 2.02 (including Exhibit 99.1) shall not be deemed to be “filed” for the purposes of Section 18 of the Securities and Exchange Act of 1934, as amended, (“Exchange Act”) or otherwise subject to the liabilities of that section, and shall not be deemed to be incorporated by reference into any filing made by ChampionX Corporation under the Exchange Act or the Securities Act of 1933, as amended, regardless of any general incorporation language in any such filing, except as shall be expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | | | | |

| | | ChampionX Corporation | |

| | | | | |

| Date: | February 4, 2025 | | By: | /s/ KENNETH M. FISHER |

| | | | Kenneth M. Fisher |

| | | | Executive Vice President and Chief Financial Officer |

Exhibit 99.1

ChampionX Reports Fourth Quarter and Full Year 2024 Results

•Fourth-quarter revenue of $912.0 million

•Fourth-quarter net income attributable to ChampionX of $82.8 million

•Fourth-quarter adjusted EBITDA of $212.3 million

•Fourth-quarter income before income taxes margin of 13.0%

•Fourth quarter adjusted EBITDA margin of 23.3%

•Fourth-quarter cash from operating activities of $207.3 million and free cash flow of $170.1 million

•Full-year net income attributable to ChampionX of $320.3 million

•Full-year adjusted EBITDA of $784.7 million

•Full-year cash from operating activities of $589.7 million and free cash flow of $460.5 million

THE WOODLANDS, TX, February 4, 2025 -- ChampionX Corporation (NASDAQ: CHX) (“ChampionX” or the “Company”) today announced fourth quarter of 2024 and full year 2024 results. For the fourth quarter of 2024, revenue was $912.0 million, net income attributable to ChampionX was $82.8 million, and adjusted EBITDA was $212.3 million. Income before income taxes margin was 13.0%, and adjusted EBITDA margin was 23.3%. Cash provided by operating activities was $207.3 million, and free cash flow was $170.1 million.

CEO Commentary

“2024 was a year in which we continued to demonstrate the unique nature of ChampionX’s cash flow resiliency, driven by the strength of our high-margin operating model and capital-light portfolio of businesses. We delivered robust adjusted EBITDA margin expansion and generated strong free cash flow. Our differentiated performance is the direct result of our employees around the world remaining committed to serving our customers well and living our continuous improvement culture daily. I am thankful and humbled to lead such a remarkably dedicated team,” ChampionX’s President and Chief Executive Officer Sivasankaran “Soma” Somasundaram said.

“During the fourth quarter of 2024, we generated revenue of $912 million, which increased 1% sequentially, driven by seasonal strength in our Production Chemical Technologies business. Sequential growth in Production Chemical Technologies was offset by typical seasonal declines in our Production & Automation Technologies business into the year-end holidays. For the full year 2024, we generated revenue of $3.6 billion, and we grew our North America revenue by 3% year-over-year, driven by particular strength in the Permian basin. We generated net income attributable to ChampionX of $83 million, income before income taxes margin of 13.0%, and delivered adjusted EBITDA of $212 million, representing a 23.3% adjusted EBITDA margin, our highest level as ChampionX, which speaks to the continued productivity and profitability focus of our team. For the full year 2024, we generated net income attributable to ChampionX of $320 million, income before income taxes margin of 12.2%, a 90 basis point increase over the prior year, and delivered adjusted EBITDA of $785 million, representing a 21.6% adjusted EBITDA margin, an increase of 107 basis points year-over-year.

“We once again demonstrated our strong cash flow profile. Cash flow from operating activities was $207 million during the fourth quarter, which represented 250% of net income attributable to ChampionX, and includes a $48 million tax payment deferred from the fourth quarter of 2024 to the first quarter of 2025. We generated robust free cash flow of $170 million during the fourth quarter, converting 80% of our adjusted EBITDA for the period. Cash flow from operating activities was $590 million for the full year 2024, which represented 184% of net income attributable to ChampionX. For the full year 2024, we generated free cash flow of $460 million and achieved 59% adjusted EBITDA to free cash flow conversion. Our balance sheet and financial position remain strong, ending the year with approximately $1.2 billion of liquidity, including $508 million of cash and $675 million of available capacity on our revolving credit facility.

“As we look ahead to 2025, we expect global oil production to grow, and given our differentiated and resilient production-oriented portfolio, we expect another year of positive performance relative to general oil and gas market activity.”

Agreement to be Acquired by SLB

On April 2, 2024, SLB (NYSE: SLB) and ChampionX jointly announced a definitive Agreement and Plan of Merger (the “Merger Agreement”) for SLB to purchase ChampionX in an all-stock transaction. The transaction was unanimously approved by the ChampionX board of directors and the transaction received the approval of the ChampionX stockholders at a special meeting held on June 18, 2024. The transaction is subject to regulatory approvals and other customary closing conditions.

ChampionX may continue to pay its regular quarterly cash dividends with customary record and payment dates, subject to certain limitations under the Merger Agreement. Given the pending acquisition of ChampionX by SLB, ChampionX has discontinued providing quarterly guidance and will not host a conference call or webcast to discuss its fourth quarter and full year 2024 results.

Production Chemical Technologies

Production Chemical Technologies revenue in the fourth quarter of 2024 was $569.7 million, an increase of $10.1 million, or 2%, sequentially, due to seasonally higher volumes in certain international markets and higher volumes in North America.

Segment operating profit was $103.6 million and adjusted segment EBITDA was $133.5 million. Segment operating profit margin was 18.2%, an increase of 259 basis points, sequentially, and adjusted segment EBITDA margin was 23.4%, an increase of 187 basis points, sequentially, in each case due to volumes and product mix.

Production & Automation Technologies

Production & Automation Technologies revenue in the fourth quarter of 2024 was $269.6 million, a decrease of $6.1 million, or 2%, sequentially, due primarily to seasonality in our North American businesses into the year-end holidays.

Revenue from digital products was $62.3 million in the fourth quarter of 2024, an increase of $4.4 million, or 7.5%, compared to $57.9 million in the third quarter of 2024.

Segment operating profit was $39.0 million, and adjusted segment EBITDA was $70.7 million. Segment operating profit margin was 14.5%, an increase of 210 basis points, sequentially, and adjusted segment EBITDA margin was 26.2%, an increase of 100 basis points, sequentially, in each case due to productivity improvements and product mix.

Drilling Technologies

Drilling Technologies revenue in the fourth quarter of 2024 was $51.9 million, an increase of $0.2 million, or flat, sequentially, in-line with flat sequential U.S. rig count activity.

Segment operating profit was $10.7 million, and adjusted segment EBITDA was $12.3 million. Segment operating profit margin was 20.6%, a decrease of 160 basis points, sequentially, and adjusted segment EBITDA margin was 23.7%, a decrease of 112 basis points, sequentially, in each case due to slightly higher operating costs.

Reservoir Chemical Technologies

Reservoir Chemical Technologies revenue in the fourth quarter of 2024 was $21.9 million, an increase of $1.4 million, or 7%, sequentially, due primarily to higher product volumes.

Segment operating profit was $2.3 million, and adjusted segment EBITDA was $3.8 million. Segment operating profit margin was 10.5%, as compared to 8.2% in the prior quarter, and adjusted segment EBITDA margin was 17.1%, an increase of 106 basis points, sequentially, in each case due to higher product volumes.

Other Business Highlights: Production Chemical Technologies and Reservoir Chemical Technologies

•Chosen by a Canadian operator to be their sole supply partner for production chemical programs to support longer asset life for the customer’s project.

•Awarded SAGD accounts with a Canadian oil sands operator after a well-executed ChampionX pursuit, trial and transition. This success is expected to lead to additional growth opportunities with the customer in 2025.

•Achieved growth with a national oil company in Central Asia through technology and alignment to the customer’s key business drivers. Organized technical workshops and reviews leading to the implementation of a paraffin treatment program with the customer.

•Secured a new contract for the provision of chemical injection skids for Drag Reducing Agents (“DRA”) as part of a new development in Eastern Africa.

•Executed a successful field trial for an innovative AAHI (hydrate inhibitor) with a major operator in Egypt. This strategic initiative is expected to assist the customer with significantly boosting production and enhancing operational efficiency.

•Successfully qualified corrosion inhibitors for an existing gas field in Qatar. This achievement marks a significant step in supporting asset integrity assurance and commitment to delivering reliable solutions to the industry.

•Qualified a new Kinetic Hydrate Inhibitor for a major gas field operated by a major national oil company in the Middle East region. This innovative solution delivers higher value, efficiency, and a lower total cost of operation.

•Instituted notable customer-centric innovations, including the Right Products campaign which delivered 12 new chemistry innovations, the ParaClear(R) program for paraffin remediation, and the full-time Flowback Team with new product lines and digital tools.

•Advanced digital capabilities, including MyAnalytics platform for sales representatives, the Sensor Team for equipment monitoring, and a trial of a Centralized Ordering system to streamline orders.

•Delivered on our first RenewIQ+(R) opportunity, pumping a Reservoir Chemical Technologies chemistry in conjunction with our standard RenewIQ(R) offering.

•Gained significant commercial traction among key customers with Reservoir Chemical Technologies’ new acidizing technology. This innovative system has been evaluated by a major Middle East operator and recognized as one of the top-performing solutions in the market. This milestone underscores our commitment to providing sustainable, high-performance solutions that align with the evolving needs of the industry.

Other Business Highlights: Production & Automation Technologies

•Expanded the portfolio of recently acquired RMSpumptools into North America, delivering new solutions to a major oil company in the Permian basin using permanent magnet motor technology. Additional interest and growth with customers are building into 2025.

•Introduced the SMARTEN™ Lite rod pump controller, which offers an economical automation solution for marginal, low-producing rod pump wells. This new technology was successfully operating on 60 new wells in Q4 2024, helping operators gain 24/7 surveillance and remote control of their rod pump assets with a low-cost edge computing device that requires minimal hardware and setup.

•Continuing to see strong market penetration and interest in Artificial Lift Performance’s Pump Checker software offering. Software license counts have increased by more than 30% since the February 2024 acquisition, with a focused growth on gas lift/plunger lift well applications.

•Successfully added well density to a performance-based integrated production optimization (“IPO”) project recently secured with a customer in the Permian basin, and extended the reach of this holistic solution with an additional customer in the Permian. The IPO solution combines artificial lift, chemicals and chemical injection systems with digital automation, controls, data management, and optimization services to drive incremental production with effective cost management for operators.

•Deployed a large SOOFIE™ continuous emissions monitoring system for an operator in the Middle East. Based on initial results, the customer plans to deploy additional fixed emissions monitoring systems as well as incorporate the ChampionX Aura™ optical gas imaging camera in the field. Our technology was selected based on its proven capabilities and ChampionX collaboration with the field team to assure a steady stream of high-quality data. The SOOFIE continuous monitoring system provides real-time, 24/7 surveillance of methane and other greenhouse gases at oil and gas facilities and landfills.

•Completed installations of ChampionX’s AnX™ coiled rod technology with a Middle East operator. Based on the excellent performance of this corrosion-resistant coiled rod, the customer has ordered product to install in additional wells in 2025. AnX recently won the Gulf Energy Excellence award for Best Production Technology and has demonstrated dramatic run life improvement in highly corrosive applications in multiple geographies around the world.

•Successfully completed the initial installations of a full rod pumping solution on a very challenging application in Colombia. The solution brings together both the downhole rods and pump with ChampionX’s rod lift production optimization software. The customer reports that results are exceeding expectations, with production increasing by 35% while reducing operating costs through optimizing resources required to operate the wells.

•Expanded production optimization software capabilities with customers in Peru and Argentina. Our XSPOC™ software has been implemented across more than 300 wells in Peru and additional licenses are planned in Q1 2025. In Argentina, a customer implemented the software across three fields. By delivering diagnostic insights and actionable recommendations, XSPOC software enables customers to enhance well performance, increase production, and reduce operating costs.

###

About Non-GAAP Measures

In addition to financial results determined in accordance with generally accepted accounting principles in the United States (“GAAP”), this news release presents non-GAAP financial measures. Management believes that adjusted EBITDA, adjusted EBITDA margin, adjusted net income attributable to ChampionX and adjusted diluted earnings per share attributable to ChampionX, provide useful information to investors regarding the Company’s financial condition and results of operations because they reflect the core operating results of our businesses and help facilitate comparisons of operating performance across periods. In addition, free cash flow, free cash flow to adjusted EBITDA ratio, and free cash flow to revenue ratio are used by management to measure our ability to generate positive cash flow for debt reduction and to support our strategic objectives. Although management believes the aforementioned non-GAAP financial measures are good tools for internal use and the investment community in evaluating ChampionX’s overall financial performance, the foregoing non-GAAP financial measures should be considered in addition to, not as a substitute for or superior to, other measures of financial performance prepared in accordance with GAAP. A reconciliation of these non-GAAP measures to the most directly comparable GAAP measures is included in the accompanying financial tables.

About ChampionX

ChampionX is a global leader in chemistry solutions, artificial lift systems, and highly engineered equipment and technologies that help companies drill for and produce oil and gas safely, efficiently, and sustainably around the world. ChampionX’s expertise, innovative products, and digital technologies provide enhanced oil and gas production, transportation, and real-time emissions monitoring throughout the lifecycle of a well. To learn more about ChampionX, visit our website at www.ChampionX.com.

Forward-Looking Statements

This news release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended. Such forward-looking statements include statements relating to the proposed transaction between SLB and ChampionX, including statements regarding the benefits of the transaction and the anticipated timing of the transaction, and information regarding the businesses of SLB and ChampionX, including expectations regarding outlook and all underlying assumptions, SLB’s and ChampionX’s objectives, plans and strategies, information relating to operating trends in markets where SLB and ChampionX operate, statements that contain projections of results of operations or of financial condition and all other statements other than statements of historical fact that address activities, events or developments that SLB or ChampionX intends, expects, projects, believes or anticipates will or may occur in the future. Such statements are based on management’s beliefs and assumptions made based on information currently available to management. All statements in this communication, other than statements of historical fact, are forward-looking statements that may be identified by the use of the words “outlook,” “guidance,” “expects,” “believes,” “anticipates,” “should,” “estimates,” “intends,” “plans,” “seeks,” “targets,” “may,” “can,” “believe,” “predict,” “potential,” “projected,” “projections,” “precursor,” “forecast,” “ambition,” “goal,” “scheduled,” “think,” “could,” “would,” “will,” “see,” “likely,” and other similar expressions or variations, but not all forward-looking statements include such words. These forward-looking statements involve known and unknown risks and uncertainties, and which may cause SLB’s or ChampionX’s actual results and performance to be materially different from those expressed or implied in the forward-looking statements. Factors and risks that may impact future results and performance include, but are not limited to those factors and risks described in Part I, “Item 1. Business”, “Item 1A. Risk Factors”, and “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations” in SLB’s Annual Report on Form 10-K for the year ended December 31, 2023, as filed with the Securities and Exchange Commission (the “SEC”) on January 24, 2024 and Part 1, Item 1A, “Risk Factors” in ChampionX’s Annual Report on Form 10-K for the year ended December 31, 2023 filed with the SEC on February 6, 2024, and each of their respective, subsequent Quarterly Reports on Form 10-Q and Current Reports on Form 8-K. These include, but are not limited to, and in each case as a possible result of the proposed transaction on

each of SLB and ChampionX: the ultimate outcome of the proposed transaction between SLB and ChampionX, including the effect of the announcement of the proposed transaction; the ability to operate the SLB and ChampionX respective businesses, including business disruptions; difficulties in retaining and hiring key personnel and employees; the ability to maintain favorable business relationships with customers, suppliers and other business partners; the terms and timing of the proposed transaction; the occurrence of any event, change or other circumstance that could give rise to the termination of the proposed transaction; the anticipated or actual tax treatment of the proposed transaction; the ability to satisfy closing conditions to the completion of the proposed transaction (including the adoption of the merger agreement in respect of the proposed transaction by ChampionX stockholders); other risks related to the completion of the proposed transaction and actions related thereto; the ability of SLB and ChampionX to integrate the business successfully and to achieve anticipated synergies and value creation from the proposed transaction; changes in demand for SLB’s or ChampionX’s products and services; global market, political and economic conditions, including in the countries in which SLB and ChampionX operate; the ability to secure government regulatory approvals on the terms expected, at all or in a timely manner; the extent of growth of the oilfield services market generally, including for chemical solutions in production and midstream operations; the global macro-economic environment, including headwinds caused by inflation, rising interest rates, unfavorable currency exchange rates, and potential recessionary or depressionary conditions; the impact of shifts in prices or margins of the products that SLB or ChampionX sells or services that SLB or ChampionX provides, including due to a shift towards lower margin products or services; cyber-attacks, information security and data privacy; the impact of public health crises, such as pandemics (including COVID-19) and epidemics and any related company or government policies and actions to protect the health and safety of individuals or government policies or actions to maintain the functioning of national or global economies and markets; trends in crude oil and natural gas prices, including trends in chemical solutions across the oil and natural gas industries, that may affect the drilling and production activity, profitability and financial stability of SLB’s and ChampionX’s customers and therefore the demand for, and profitability of, their products and services; litigation and regulatory proceedings, including any proceedings that may be instituted against SLB or ChampionX related to the proposed transaction; failure to effectively and timely address energy transitions that could adversely affect the businesses of SLB or ChampionX, results of operations, and cash flows of SLB or ChampionX; and disruptions of SLB’s or ChampionX’s information technology systems.

These risks, as well as other risks related to the proposed transaction, are included in the Form S-4 and proxy statement/prospectus that was filed with the SEC in connection with the proposed transaction. While the list of factors presented here is, and the list of factors presented in the registration statement on Form S-4 are, considered representative, no such list should be considered to be a complete statement of all potential risks and uncertainties. For additional information about other factors that could cause actual results to differ materially from those described in the forward-looking statements, please refer to SLB’s and ChampionX’s respective periodic reports and other filings with the SEC, including the risk factors identified in SLB’s and ChampionX’s Annual Reports on Form 10-K, respectively, and SLB’s and ChampionX’s subsequent Quarterly Reports on Form 10-Q. The forward-looking statements included in this communication are made only as of the date hereof. Neither SLB nor ChampionX undertakes any obligation to update any forward-looking statements to reflect subsequent events or circumstances, except as required by law.

Investor Contact: Byron Pope

byron.pope@championx.com

281-602-0094

Media Contact: John Breed

john.breed@championx.com

281-403-5751

CHAMPIONX CORPORATION

CONDENSED CONSOLIDATED STATEMENTS OF INCOME

(UNAUDITED)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Years Ended |

| | Dec 31, | | Sep 30, | | Dec 31, | | December 31, |

| (in thousands, except per share amounts) | 2024 | | 2024 | | 2023 | | 2024 | | 2023 |

| Revenue | $ | 912,037 | | | $ | 906,533 | | | $ | 943,555 | | | $ | 3,633,983 | | | $ | 3,758,285 | |

| Cost of goods and services | 600,154 | | | 608,764 | | | 661,337 | | | 2,445,281 | | | 2,618,646 | |

| Gross profit | 311,883 | | | 297,769 | | | 282,218 | | | 1,188,702 | | | 1,139,639 | |

| Selling, general and administrative expense | 184,722 | | | 180,501 | | | 147,415 | | | 720,632 | | | 633,032 | |

| | | | | | | | | |

| (Gain) loss on sale-leaseback transaction and disposal group | — | | | 57 | | | — | | | (29,826) | | | 12,965 | |

| Interest expense, net | 12,375 | | | 14,137 | | | 13,808 | | | 55,868 | | | 54,562 | |

| Foreign currency transaction losses (gains), net | 1,697 | | | 3,505 | | | 14,651 | | | 2,490 | | | 36,334 | |

| Other income, net | (5,026) | | | (2,176) | | | (7,584) | | | (3,337) | | | (21,078) | |

| Income before income taxes | 118,115 | | | 101,745 | | | 113,928 | | | 442,875 | | | 423,824 | |

| Provision for income taxes | 33,204 | | | 28,078 | | | 35,771 | | | 115,746 | | | 105,105 | |

| Net income | 84,911 | | | 73,667 | | | 78,157 | | | 327,129 | | | 318,719 | |

| Net income attributable to noncontrolling interest | 2,145 | | | 1,659 | | | 959 | | | 6,863 | | | 4,481 | |

| Net income attributable to ChampionX | $ | 82,766 | | | $ | 72,008 | | | $ | 77,198 | | | $ | 320,266 | | | $ | 314,238 | |

| | | | | | | | | |

| Earnings per share attributable to ChampionX: | | | | | | | | | |

| Basic | $ | 0.43 | | | $ | 0.38 | | | $ | 0.40 | | | $ | 1.68 | | | $ | 1.60 | |

| Diluted | $ | 0.43 | | | $ | 0.37 | | | $ | 0.39 | | | $ | 1.65 | | | $ | 1.57 | |

| | | | | | | | | |

| Weighted-average shares outstanding: | | | | | | | | | |

| Basic | 190,586 | | | 190,496 | | | 193,191 | | | 190,578 | | | 196,083 | |

| Diluted | 193,487 | | | 193,362 | | | 196,649 | | | 193,643 | | | 199,906 | |

CHAMPIONX CORPORATION

CONDENSED CONSOLIDATED BALANCE SHEETS

(UNAUDITED)

| | | | | | | | | | | |

| December 31, |

| (in thousands) | 2024 | | 2023 |

| Assets | | | |

| Current Assets: | | | |

| Cash and cash equivalents | $ | 507,681 | | | $ | 288,557 | |

| | | |

| Receivables, net | 466,782 | | | 534,534 | |

| Inventories, net | 496,831 | | | 521,549 | |

| | | |

| Prepaid expenses and other current assets | 92,603 | | | 80,777 | |

| Total current assets | 1,563,897 | | | 1,425,417 | |

| | | |

| Property, plant and equipment, net | 755,422 | | | 773,552 | |

| Goodwill | 718,944 | | | 669,064 | |

| Intangible assets, net | 258,614 | | | 243,553 | |

| Other non-current assets | 173,375 | | | 130,116 | |

| Total assets | $ | 3,470,252 | | | $ | 3,241,702 | |

| | | |

| Liabilities | | | |

| Current portion of long-term debt | $ | 6,203 | | | $ | 6,203 | |

| Accounts payable | 455,531 | | | 451,680 | |

| Other current liabilities | 324,138 | | | 324,866 | |

| Total current liabilities | 785,872 | | | 782,749 | |

| | | |

| Long-term debt | 591,453 | | | 594,283 | |

| Other long-term liabilities | 261,749 | | | 203,639 | |

| Stockholders’ equity: | | | |

| ChampionX stockholders’ equity | 1,846,437 | | | 1,676,622 | |

| Noncontrolling interest | (15,259) | | | (15,591) | |

| Total liabilities and equity | $ | 3,470,252 | | | $ | 3,241,702 | |

CHAMPIONX CORPORATION

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(UNAUDITED)

| | | | | | | | | | | |

| | Years Ended December 31, |

| (in thousands) | 2024 | | 2023 |

| Cash flows from operating activities: | | | |

| Net income | $ | 327,129 | | | $ | 318,719 | |

| Depreciation and amortization | 245,825 | | | 235,936 | |

| (Gain) loss on sale-leaseback transaction and disposal group | (29,826) | | | 12,965 | |

| | | |

| | | |

| Loss on Argentina Blue Chip Swap transaction | 7,086 | | | — | |

| Deferred income taxes | (22,873) | | | (22,272) | |

| (Gain) on disposal of fixed assets | (443) | | | (1,046) | |

| Receivables | 76,569 | | | 70,021 | |

| Inventories | (8,924) | | | 18,753 | |

| Accounts payable | (399) | | | (53,891) | |

| Other assets | (15,152) | | | 20,395 | |

| Leased assets | (33,767) | | | (51,247) | |

| Other operating items, net | 44,456 | | | (8,062) | |

| Net cash provided by operating activities | 589,681 | | | 540,271 | |

| | | |

| Cash flows from investing activities: | | | |

| Capital expenditures | (141,310) | | | (142,324) | |

| | | |

| Proceeds from sale of fixed assets | 12,113 | | | 14,545 | |

| Proceeds from sale-leaseback transaction | 44,292 | | | — | |

| Purchase of investments | (31,526) | | | — | |

| Sale of investments | 24,358 | | | — | |

| Acquisitions, net of cash acquired | (123,269) | | | — | |

| Net cash used for investing activities | (215,342) | | | (127,779) | |

| | | |

| Cash flows from financing activities: | | | |

| Proceeds from long-term debt | — | | | 15,500 | |

| Repayment of long-term debt | (6,203) | | | (45,176) | |

| | | |

| Repurchases of common stock | (49,399) | | | (277,575) | |

| Dividends paid | (70,531) | | | (64,980) | |

| Other | (24,324) | | | (934) | |

| Net cash used for financing activities | (150,457) | | | (373,165) | |

| | | |

| Effect of exchange rate changes on cash and cash equivalents | (4,758) | | | (957) | |

| | | |

| Net increase in cash and cash equivalents | 219,124 | | | 38,370 | |

| Cash and cash equivalents at beginning of period | 288,557 | | | 250,187 | |

| Cash and cash equivalents at end of period | $ | 507,681 | | | $ | 288,557 | |

CHAMPIONX CORPORATION

BUSINESS SEGMENT DATA

(UNAUDITED)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | Years Ended |

| Dec 31, | | Sep 30, | | Dec 31, | | December 31, |

| (in thousands) | 2024 | | 2024 | | 2023 | | 2024 | | 2023 |

| Segment revenue: | | | | | | | | | |

| Production Chemical Technologies | $ | 569,662 | | | $ | 559,539 | | | $ | 634,137 | | | $ | 2,288,886 | | | $ | 2,404,377 | |

| Production & Automation Technologies | 269,568 | | | 275,700 | | | 241,294 | | | 1,042,369 | | | 1,003,146 | |

| Drilling Technologies | 51,942 | | | 51,792 | | | 46,821 | | | 211,828 | | | 215,721 | |

| Reservoir Chemical Technologies | 21,937 | | | 20,531 | | | 21,402 | | | 94,296 | | | 96,154 | |

| Corporate and other | (1,072) | | | (1,029) | | | (99) | | | (3,396) | | | 38,887 | |

| Total revenue | $ | 912,037 | | | $ | 906,533 | | | $ | 943,555 | | | $ | 3,633,983 | | | $ | 3,758,285 | |

| | | | | | | | | |

| Income (loss) before income taxes: | | | | | | | | |

| Segment operating profit (loss): | | | | | | | | | |

| Production Chemical Technologies | $ | 103,567 | | | $ | 87,260 | | | $ | 102,179 | | | $ | 364,047 | | | $ | 350,216 | |

| Production & Automation Technologies | 39,027 | | | 34,136 | | | 22,110 | | | 123,840 | | | 118,409 | |

| Drilling Technologies | 10,703 | | | 11,501 | | | 8,679 | | | 78,469 | | | 45,481 | |

| Reservoir Chemical Technologies | 2,294 | | | 1,675 | | | 3,907 | | | 12,078 | | | 10,541 | |

| Total segment operating profit | 155,591 | | | 134,572 | | | 136,875 | | | 578,434 | | | 524,647 | |

| Corporate and other | 25,101 | | | 18,690 | | | 9,139 | | | 79,691 | | | 46,261 | |

| Interest expense, net | 12,375 | | | 14,137 | | | 13,808 | | | 55,868 | | | 54,562 | |

| Income before income taxes | $ | 118,115 | | | $ | 101,745 | | | $ | 113,928 | | | $ | 442,875 | | | $ | 423,824 | |

| | | | | | | | | |

| Operating profit margin / income (loss) before income taxes margin: | | | | | | | | | |

| Production Chemical Technologies | 18.2 | % | | 15.6 | % | | 16.1 | % | | 15.9 | % | | 14.6 | % |

| Production & Automation Technologies | 14.5 | % | | 12.4 | % | | 9.2 | % | | 11.9 | % | | 11.8 | % |

| Drilling Technologies | 20.6 | % | | 22.2 | % | | 18.5 | % | | 37.0 | % | | 21.1 | % |

| Reservoir Chemical Technologies | 10.5 | % | | 8.2 | % | | 18.3 | % | | 12.8 | % | | 11.0 | % |

| ChampionX Consolidated | 13.0 | % | | 11.2 | % | | 12.1 | % | | 12.2 | % | | 11.3 | % |

| | | | | | | | | |

| Adjusted EBITDA | | | | | | | | | |

| Production Chemical Technologies | $ | 133,475 | | | $ | 120,622 | | | $ | 139,107 | | | $ | 489,549 | | | $ | 506,991 | |

| Production & Automation Technologies | 70,739 | | | 69,604 | | | 52,800 | | | 259,531 | | | 232,672 | |

| Drilling Technologies | 12,321 | | | 12,867 | | | 10,361 | | | 54,411 | | | 51,986 | |

| Reservoir Chemical Technologies | 3,751 | | | 3,292 | | | 5,501 | | | 18,343 | | | 18,498 | |

| Corporate and other | (8,021) | | | (8,873) | | | (9,624) | | | (37,112) | | | (38,926) | |

| Adjusted EBITDA | $ | 212,265 | | | $ | 197,512 | | | $ | 198,145 | | | $ | 784,722 | | | $ | 771,221 | |

| | | | | | | | | |

| Adjusted EBITDA margin | | | | | | | | | |

| Production Chemical Technologies | 23.4 | % | | 21.6 | % | | 21.9 | % | | 21.4 | % | | 21.1 | % |

| Production & Automation Technologies | 26.2 | % | | 25.2 | % | | 21.9 | % | | 24.9 | % | | 23.2 | % |

| Drilling Technologies | 23.7 | % | | 24.8 | % | | 22.1 | % | | 25.7 | % | | 24.1 | % |

| Reservoir Chemical Technologies | 17.1 | % | | 16.0 | % | | 25.7 | % | | 19.5 | % | | 19.2 | % |

| ChampionX Consolidated | 23.3 | % | | 21.8 | % | | 21.0 | % | | 21.6 | % | | 20.5 | % |

CHAMPIONX CORPORATION

RECONCILIATIONS OF GAAP TO NON-GAAP FINANCIAL MEASURES

(UNAUDITED)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | Years Ended |

| Dec 31, | | Sep 30, | | Dec 31, | | December 31, |

| (in thousands) | 2024 | | 2024 | | 2023 | | 2024 | | 2023 |

| Net income attributable to ChampionX | $ | 82,766 | | | $ | 72,008 | | | $ | 77,198 | | | $ | 320,266 | | | $ | 314,238 | |

| Pre-tax adjustments: | | | | | | | | | |

(Gain) loss on sale-leaseback transaction and disposal group (1) | — | | | 57 | | | — | | | (29,826) | | | 12,965 | |

Russia sanctions compliance and impacts (2) | 73 | | | 109 | | | 160 | | | 366 | | | 1,209 | |

| | | | | | | | | |

| | | | | | | | | |

| Restructuring and other related charges | 2,704 | | | 5,317 | | | 2,407 | | | 17,657 | | | 13,387 | |

Merger transaction costs (3) | 14,434 | | | 8,312 | | | — | | | 37,805 | | | 245 | |

Acquisition costs and related adjustments (4) | 75 | | | 753 | | | (6,817) | | | 2,634 | | | (12,670) | |

| Intellectual property defense | 158 | | | 69 | | | 638 | | | 1,537 | | | 1,545 | |

Merger-related indemnification responsibility (5) | 100 | | | — | | | — | | | 100 | | | 722 | |

| | | | | | | | | |

| Tulsa, Oklahoma storm damage | — | | | — | | | 660 | | | 305 | | | 3,162 | |

| Foreign currency transaction losses, net | 1,697 | | | 3,505 | | | 14,651 | | | 2,490 | | | 36,334 | |

| Loss on Argentina Blue Chip Swap transaction | — | | | — | | | — | | | 7,086 | | | — | |

| Tax impact of adjustments | (5,565) | | | (4,259) | | | (2,600) | | | (10,480) | | | (12,650) | |

| Adjusted net income attributable to ChampionX | 96,442 | | | 85,871 | | | 86,297 | | | 349,940 | | | 358,487 | |

| Tax impact of adjustments | 5,565 | | | 4,259 | | | 2,600 | | | 10,480 | | | 12,650 | |

| Net income attributable to noncontrolling interest | 2,145 | | | 1,659 | | | 959 | | | 6,863 | | | 4,481 | |

| Depreciation and amortization | 62,534 | | | 63,508 | | | 58,710 | | | 245,825 | | | 235,936 | |

| Provision for income taxes | 33,204 | | | 28,078 | | | 35,771 | | | 115,746 | | | 105,105 | |

| Interest expense, net | 12,375 | | | 14,137 | | | 13,808 | | | 55,868 | | | 54,562 | |

| Adjusted EBITDA | $ | 212,265 | | | $ | 197,512 | | | $ | 198,145 | | | $ | 784,722 | | | $ | 771,221 | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

_______________________

(1) Amounts represents the and the gain on the sale and leaseback of certain buildings and land during 2024. For the year ended December 31, 2023, the loss recorded to properly adjust the carrying value of our Chemical Technologies operations in Russia to the lower of carrying value or fair value less costs to sell .

(2) Includes charges incurred related to legal and professional fees to comply with, as well as additional foreign currency exchange losses associated with, the sanctions imposed in Russia.

(3) Includes costs incurred during 2024 in relation to the Merger Agreement with Schlumberger Limited, including third party legal and professional fees.

(4) Includes costs incurred for the acquisition of businesses and revenue associated with the amortization of a liability established as part of the merger transaction with Ecolab Inc. (“Ecolab”) to acquire the Chemical Technologies business, representing unfavorable terms under the Cross Supply Agreement, as well as costs incurred for the acquisition of businesses. During the fourth quarter of 2023, we recorded a fair value adjustment to contingent consideration on a prior acquisition as well as the settlement of an item pursuant to the tax matters agreement with Ecolab.

(5) Expense related to the June 3, 2020 merger transaction with Ecolab in which we acquired the Chemical Technologies business.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | Years Ended |

| Dec 31, | | Sep 30, | | Dec 31, | | December 31, |

| (in thousands) | 2024 | | 2024 | | 2023 | | 2024 | | 2023 |

| Diluted earnings per share attributable to ChampionX | $ | 0.43 | | | $ | 0.37 | | | $ | 0.39 | | | $ | 1.65 | | | $ | 1.57 | |

| Per share adjustments: | | | | | | | | | |

| (Gain) loss on sale-leaseback transaction and disposal group | — | | | — | | | — | | | (0.15) | | | 0.06 | |

| Russia sanctions compliance and impacts | — | | | — | | | — | | | — | | | — | |

| | | | | | | | | |

| | | | | | | | | |

| Restructuring and other related charges | 0.01 | | | 0.03 | | | 0.01 | | | 0.09 | | | 0.07 | |

| Merger transaction costs | 0.07 | | | 0.04 | | | — | | | 0.20 | | | — | |

| Acquisition costs and related adjustments | — | | | — | | | (0.03) | | | 0.01 | | | (0.06) | |

| Intellectual property defense | — | | | — | | | — | | | 0.01 | | | 0.01 | |

| Merger-related indemnification responsibility | — | | | — | | | — | | | — | | | — | |

| | | | | | | | | |

| Tulsa, Oklahoma storm damage | — | | | — | | | 0.01 | | | — | | | 0.02 | |

| Foreign currency transaction losses | 0.01 | | | 0.02 | | | 0.07 | | | 0.01 | | | 0.18 | |

| Loss on Argentina Blue Chip Swap transaction | — | | | — | | | — | | | 0.04 | | | — | |

| Tax impact of adjustments | (0.02) | | | (0.02) | | | (0.01) | | | (0.05) | | | (0.06) | |

| Adjusted diluted earnings per share attributable to ChampionX | $ | 0.50 | | | $ | 0.44 | | | $ | 0.44 | | | $ | 1.81 | | | $ | 1.79 | |

CHAMPIONX CORPORATION

RECONCILIATIONS OF GAAP TO NON-GAAP FINANCIAL MEASURES

(UNAUDITED)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Years Ended |

| Dec 31, | | Sep 30, | | Dec 31, | | December 31, |

| (in thousands) | 2024 | | 2024 | | 2023 | | 2024 | | 2023 |

| Production Chemical Technologies | | | | | | | | | |

| Segment operating profit | $ | 103,567 | | | $ | 87,260 | | | $ | 102,179 | | | $ | 364,047 | | | $ | 350,216 | |

| Non-GAAP adjustments | 2,251 | | | 7,073 | | | 11,194 | | | 19,108 | | | 51,717 | |

| Depreciation and amortization | 27,657 | | | 26,289 | | | 25,734 | | | 106,394 | | | 105,058 | |

| Segment adjusted EBITDA | $ | 133,475 | | | $ | 120,622 | | | $ | 139,107 | | | $ | 489,549 | | | $ | 506,991 | |

| | | | | | | | | |

| Production & Automation Technologies | | | | | | | | | |

| Segment operating profit | $ | 39,027 | | | $ | 34,136 | | | $ | 22,110 | | | $ | 123,840 | | | $ | 118,409 | |

| Non-GAAP adjustments | 75 | | | 1,656 | | | 1,231 | | | 9,807 | | | 5,246 | |

| Depreciation and amortization | 31,637 | | | 33,812 | | | 29,459 | | | 125,884 | | | 109,017 | |

| Segment adjusted EBITDA | $ | 70,739 | | | $ | 69,604 | | | $ | 52,800 | | | $ | 259,531 | | | $ | 232,672 | |

| | | | | | | | | |

| Drilling Technologies | | | | | | | | | |

| Segment operating profit | $ | 10,703 | | | $ | 11,501 | | | $ | 8,679 | | | $ | 78,469 | | | $ | 45,481 | |

| Non-GAAP adjustments | 306 | | | 54 | | | 109 | | | (29,523) | | | 313 | |

| Depreciation and amortization | 1,312 | | | 1,312 | | | 1,573 | | | 5,465 | | | 6,192 | |

| Segment adjusted EBITDA | $ | 12,321 | | | $ | 12,867 | | | $ | 10,361 | | | $ | 54,411 | | | $ | 51,986 | |

| | | | | | | | | |

| Reservoir Chemical Technologies | | | | | | | | | |

| Segment operating profit | $ | 2,294 | | | $ | 1,675 | | | $ | 3,907 | | | $ | 12,078 | | | $ | 10,541 | |

| Non-GAAP adjustments | 39 | | | 3 | | | 4 | | | 69 | | | 1,486 | |

| Depreciation and amortization | 1,418 | | | 1,614 | | | 1,590 | | | 6,196 | | | 6,471 | |

| Segment adjusted EBITDA | $ | 3,751 | | | $ | 3,292 | | | $ | 5,501 | | | $ | 18,343 | | | $ | 18,498 | |

| | | | | | | | | |

| Corporate and other | | | | | | | | | |

| Segment operating profit | $ | (37,476) | | | $ | (32,827) | | | $ | (22,947) | | | $ | (135,559) | | | $ | (100,823) | |

| Non-GAAP adjustments | 16,570 | | | 9,336 | | | (839) | | | 40,693 | | | (1,863) | |

| Depreciation and amortization | 510 | | | 481 | | | 354 | | | 1,886 | | | 9,198 | |

| Interest expense, net | 12,375 | | | 14,137 | | | 13,808 | | | 55,868 | | | 54,562 | |

| Segment adjusted EBITDA | $ | (8,021) | | | $ | (8,873) | | | $ | (9,624) | | | $ | (37,112) | | | $ | (38,926) | |

Free Cash Flow

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | Years Ended |

| Dec 31, | | Sep 30, | | Dec 31, | | December 31, |

| (in thousands) | 2024 | | 2024 | | 2023 | | 2024 | | 2023 |

| Free Cash Flow | | | | | | | | | |

| Cash provided by operating activities | $ | 207,250 | | | $ | 141,298 | | | $ | 168,953 | | | $ | 589,681 | | | $ | 540,271 | |

| Less: Capital expenditures, net of proceeds from sale of fixed assets | (37,117) | | | (33,248) | | | (29,142) | | | (129,197) | | | (127,779) | |

| Free cash flow | $ | 170,133 | | | $ | 108,050 | | | $ | 139,811 | | | $ | 460,484 | | | $ | 412,492 | |

| | | | | | | | | |

| Cash From Operating Activities to Revenue Ratio | | | | | | | | | |

| Cash provided by operating activities | $ | 207,250 | | | $ | 141,298 | | | $ | 168,953 | | | $ | 589,681 | | | $ | 540,271 | |

| Revenue | $ | 912,037 | | | $ | 906,533 | | | $ | 943,555 | | | $ | 3,633,983 | | | $ | 3,758,285 | |

| | | | | | | | | |

| Cash from operating activities to revenue ratio | 23 | % | | 16 | % | | 18 | % | | 16 | % | | 14 | % |

| | | | | | | | | |

| Free Cash Flow to Revenue Ratio | | | | | | | | | |

| Free cash flow | $ | 170,133 | | | $ | 108,050 | | | $ | 139,811 | | | $ | 460,484 | | | $ | 412,492 | |

| Revenue | $ | 912,037 | | | $ | 906,533 | | | $ | 943,555 | | | $ | 3,633,983 | | | $ | 3,758,285 | |

| | | | | | | | | |

| Free cash flow to revenue ratio | 19 | % | | 12 | % | | 15 | % | | 13 | % | | 11 | % |

| | | | | | | | | |

| Free Cash Flow to Adjusted EBITDA Ratio | | | | | | | | | |

| Free cash flow | $ | 170,133 | | | $ | 108,050 | | | $ | 139,811 | | | $ | 460,484 | | | $ | 412,492 | |

| Adjusted EBITDA | $ | 212,265 | | | $ | 197,512 | | | $ | 198,145 | | | $ | 784,722 | | | $ | 771,221 | |

| | | | | | | | | |

| Free cash flow to adjusted EBITDA ratio | 80 | % | | 55 | % | | 71 | % | | 59 | % | | 53 | % |

v3.25.0.1

Document and Entity Information Document

|

Feb. 04, 2025 |

| Entity Information [Line Items] |

|

| Document Type |

8-K

|

| Document Period End Date |

Feb. 04, 2025

|

| Entity Registrant Name |

ChampionX Corporation

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-38441

|

| Entity Tax Identification Number |

82-3066826

|

| Entity Address, Address Line One |

2445 Technology Forest Blvd

|

| Entity Address, Address Line Two |

Building 4, 12th Floor

|

| Entity Address, City or Town |

The Woodlands

|

| Entity Address, State or Province |

TX

|

| Entity Address, Postal Zip Code |

77381

|

| City Area Code |

(281)

|

| Local Phone Number |

403-5772

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common stock, $0.01 par value

|

| Trading Symbol |

CHX

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001723089

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

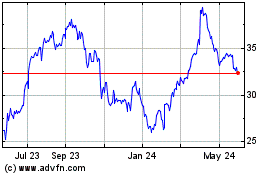

ChampionX (NASDAQ:CHX)

Historical Stock Chart

From Jan 2025 to Feb 2025

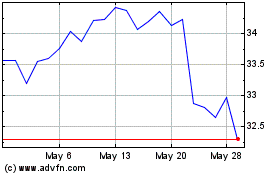

ChampionX (NASDAQ:CHX)

Historical Stock Chart

From Feb 2024 to Feb 2025