Revere Medical Enters into Agreement to Acquire

CareMax’s Management Services Organization

Agreement in Principle Reached with “Stalking

Horse” for Core Centers’ Assets

Sale Transactions to be Implemented Through an

Expedited Prearranged Chapter 11 Plan Supported by 100% of

CareMax’s Secured Lenders

CareMax Secures $30.5 Million in Debtor in

Possession Financing to Support Operations and Continuing Provision

of Healthcare Services Throughout Restructuring Process

CareMax, Inc. (NASDAQ: CMAX; CMAXW) (“CareMax” or the

“Company”), a leading technology-enabled value-based care delivery

system, today announced it has entered into an agreement to sell

its management services organization and also announced a sale

process for the Company’s core centers’ assets (collectively, the

“Sale Transactions”). The Sale Transactions will be implemented

pursuant to a prearranged chapter 11 plan supported and funded by

100 percent of CareMax’s current secured lenders (the “Prearranged

Plan”).

CareMax has entered into an agreement with an affiliate of

Revere Medical (formerly known as Rural Health Group), pursuant to

which Revere Medical will acquire the Medicare Shared Savings

Program portion of the Company’s management services organization

(the “MSO Business”) that supports care provided to approximately

80,000 Medicare beneficiaries. The sale of the MSO Business is

anticipated to be consummated simultaneously with the consummation

of CareMax’s Prearranged Plan. The Company intends to wind down the

ACO REACH and Medicare Advantage portions of its management

services organization.

CareMax also announced that it has reached an agreement in

principle on a “stalking horse” agreement with a third-party buyer

for the Company’s operating clinic business (the “Core Centers’

Assets”). The closing of this sale is also anticipated to be

consummated simultaneously with the consummation of CareMax’s

Prearranged Plan. The Company intends to disclose the proposed

terms of the stalking horse agreement and the potential purchaser

in the coming days, when and if an agreement is finalized.

The stalking horse bid will be subject to an auction and, if an

agreement with the stalking horse bidder is not finalized in the

coming days, CareMax’s current secured lenders – who have been

providing capital to the business for the past four months – will

credit bid for the Core Centers Assets. The sale process is

intended to ensure patient and doctor continuity and CareMax’s

secured lenders are committed to supporting the business throughout

this process.

To facilitate the foregoing, CareMax has initiated prearranged

voluntary chapter 11 proceedings in the U.S. Bankruptcy Court for

the Northern District of Texas (the "Court"). CareMax has also

filed customary motions with the Court, seeking authorization to

maintain business-as-usual operations, including by:

- Continuing operations to ensure patients at its clinics

continue to receive high-quality, value-based healthcare;

- Paying associated wages, including for its doctors and nurses,

without interruption; and

- Paying the existing pre-petition claims of certain vendors that

are critical to the health and safety of CareMax’s patients and

critical to the operation of the Company's medical centers.

These motions, once approved, will help facilitate a smooth

transition into the restructuring process and ensure the Company's

medical centers and physicians can continue providing uninterrupted

service to patients.

Simultaneously, CareMax entered into a restructuring support

agreement (the "RSA") with lenders holding 100 percent of the

Company’s secured debt obligations. The RSA provides for, among

other things, the lenders’ support for the Sale Transactions and

the Prearranged Plan and the lenders’ agreement to provide CareMax

with a $30.5 million debtor in possession financing facility to

support CareMax’s operations through confirmation of the

Prearranged Plan (the “DIP Financing”).

The Prearranged Plan, the Sale Transactions, the RSA, and the

DIP Financing are subject to Court approval, as well as customary

regulatory approval and closing conditions. CareMax anticipates

that the Sale Transactions and Prearranged Plan will be consummated

in early 2025.

CareMax will continue to operate and maintain its commitment to

providing high-quality patient care and services. The DIP Financing

is expected to provide sufficient liquidity to support the

Company's ongoing operations throughout the restructuring

process.

Carlos de Solo, Chief Executive Officer of CareMax, commented,

“After a careful review of the Company’s strategic alternatives, we

have determined that the transactions announced today are our best

opportunity to protect the long-term value of the CareMax assets

and ensure our patients, providers, and health plans can continue

to rely on the comprehensive, coordinated care we provide. We are

deeply appreciative of the outstanding team members across CareMax,

whose hard work and commitment to our partners is resolute.”

Additional information regarding the Company’s court-supervised

process, court filings, and information about the claims process

can be found at https://cases.stretto.com/CareMax, a website

administered by CareMax’s claims agent, Stretto, Inc. Information

is also available by calling (855.314.3709) (Toll-Free) and

(657.660.3550) (International).

Additional information regarding the Prearranged Plan, Sale

Transactions, the RSA, and the DIP Financing, and the impact of the

foregoing on the Company’s securityholders, can be found in a

Current Report on Form 8-K to be filed with the U.S. Securities and

Exchange Commission.

Advisors

Sidley Austin LLP is serving as legal counsel to CareMax.

Alvarez & Marsal North America, LLC is serving as financial

advisor to CareMax. Piper Sandler & Co. is serving as

investment banker to CareMax. Ropes & Gray LLP is serving as

legal counsel and Guggenheim Securities, LLC is serving as

financial advisor and investment banker to the current secured

lenders.

About CareMax

Founded in 2011, CareMax is a value-based care delivery system

that utilizes a proprietary technology-enabled platform and

multi-specialty, whole person health model to deliver

comprehensive, preventative and coordinated care for its members.

CareMax operates 46 clinical centers and employs approximately

1,100 employees who serve approximately 260,000 patients across all

business lines. Through CareMax’s fully-integrated, Five-Star

Quality rated health and wellness centers, CareMax is redefining

healthcare across the country by reducing costs, improving overall

outcomes and promoting health equity for seniors.

Learn more at www.caremax.com.

About Revere Medical / Rural Healthcare Group

Rural Healthcare Group is now Revere Medical. Revere Medical is

headquartered in Nashville, Tennessee and operates an employed

medical group and provider network across six states. More

information on Revere Medical can be found here:

www.reveremedical.com

Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of Section 27A of the Securities Act of 1933, as

amended, Section 21E of the Securities Exchange Act of 1934, as

amended, and the Private Securities Litigation Reform Act of 1995,

as amended. These forward-looking statements include statements

regarding the process and potential outcomes and timing of the

Company’s chapter 11 proceedings, the Company’s expectations

regarding the Prearranged Plan, the Sale Transactions and the DIP

Financing and the Court’s approval thereof, the Company’s

expectations regarding reaching an agreement to sell the Core

Centers’ Assets, the Company’s ability to continue to operate as

usual during the chapter 11 proceedings and the Company's ability

to pay for continuing obligations. Words such as "anticipate,"

"believe," "budget," "contemplate," "continue," "could,"

"envision," "estimate," "expect," "guidance," "indicate," "intend,"

"may," "might," "plan," "possibly," "potential," "predict,"

"probably," "pro forma," "project," "seek," "should," "target," or

"will," or the negative or other variations thereof, and similar

words or phrases or comparable terminology, are intended to

identify forward-looking statements. These forward-looking

statements reflect the Company’s expectations, plans or forecasts

of future events and views as of the date of this press release.

These forward-looking statements are not guarantees of future

performance, conditions or results, and involve a number of known

and unknown risks, uncertainties, assumptions and other important

factors, many of which are outside the Company’s control, that

could cause actual results or outcomes to differ materially from

those discussed in the forward-looking statements.

Important risks and uncertainties that could cause the Company's

actual results and financial condition to differ materially from

those indicated in forward-looking statements include, among

others, the Company's future capital requirements and sources and

uses of cash, including funds to satisfy its liquidity needs; the

Company's ability to fund its planned operations and its ability to

continue as a going concern; the adverse impact of the chapter 11

proceedings on the Company's business, financial condition, and

results of operations; the Company's ability to maintain

relationships with patients, employees, doctors, health plans and

other key payers and other third parties as a result of the chapter

11 proceedings; the effects of the chapter 11 proceedings on the

Company and the interests of various constituents, including

holders of the Company's common stock; the Company's ability to

obtain court approvals with respect to motions filed or other

requests made to the Court throughout the course of the chapter 11

proceedings; risk associated with third-party motions in the

chapter 11 cases; and the other risks and uncertainties described

from time to time in the Company's filings with the United States

Securities and Exchange Commission (the “SEC”). For a detailed

discussion of the risk factors that could affect the Company's

actual results, please refer to the risk factors identified in the

Company's reports filed with the SEC. All information provided in

this press release is as of the date hereof, and the Company

undertakes no duty to update or revise this information unless

required by law, and forward-looking statements should not be

relied upon as representing the Company’s assessments as of any

date subsequent to the date of this press release.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241117000726/en/

Investor Relations / Media Jude Gorman / Clayton Erwin /

Olivia Sherman Collected Strategies

CareMax-CS@collectedstrategies.com

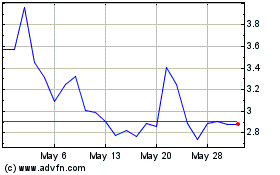

CareMax (NASDAQ:CMAX)

Historical Stock Chart

From Dec 2024 to Jan 2025

CareMax (NASDAQ:CMAX)

Historical Stock Chart

From Jan 2024 to Jan 2025