LSE Suitors Likely to Face Antitrust Hurdles

02 March 2016 - 7:54AM

Dow Jones News

By Shayndi Raice, Tim Cave and James Rundle

The most coveted asset owned by the London Stock Exchange Group

PLC could also be what brings down any deal to buy it.

A potential bidding war for LSE emerged Tuesday between

Intercontinental Exchange Inc., CME Group Inc. and Deutsche Börse

AG. Analysts agree that any of the three buyers would have to

persuade authorities that a combination of their clearinghouse

businesses with LSE's can pass antitrust muster.

LSE's clearinghouse business, LCH.Clearnet, is the dominant

clearinghouse for interest-rate swap derivatives globally and the

part rivals want most.

Clearinghouses are supposed to help prevent a marketwide

collapse by ensuring that trading partners get paid even if one of

them defaults.

ICE said Tuesday it was considering bidding for the U.K.

exchange, a week after Germany's Deutsche Börse said it was

pursuing a merger with LSE. CME Group is also considering a bid,

according to a person familiar with the matter.

European regulators have traditionally been concerned about an

exchange becoming too large in any of its business lines, for fear

that pushes up fees for customers. Trade clearing businesses are

also systemically important, meaning regulators will carefully

assess one party amassing too much power or housing too much

risk.

Both Deutsche Börse and ICE own derivatives clearinghouses. But

Deutsche Börse's focuses on listed products, while LSE's focus is

on over-the-counter swaps. ICE's European clearing operation, ICE

Clear Europe, is dominant in credit, energy and commodity

derivatives, which also includes financial futures, after its

purchase of NYSE Euronext's Liffe exchange.

CME in the U.S. accounts for around 40% of swaps clearing, with

the remainder processed by LCH. CME has made a push into Europe in

recent years with the opening of a derivatives exchange, CME Europe

in 2014, and a clearinghouse in 2011.

Because of the overlap, some analysts believe problems could

arise with any bidder.

"On the clearing side, any combinations with the LSE would, I

believe, gather some close scrutiny," said Richard Repetto, an

analyst with Sandler O'Neill + Partners LP.

But from a political perspective, a deal with Deutsche Börse and

LSE could appease European regulators who want an exchange

powerhouse in Europe.

Another political plus for a German and U.K. tie-up is that it

would create the largest equity market operator in Europe,

unseating Bats Europe, which leads exchanges by value traded. Bats'

market share of EU equity trading by value was 21.19% in February,

while the LSE's was 17.69%, and Deutsche Börse's 9.5%, according to

figures from Bats.

Since the financial crisis, regulators have promoted clearing in

derivatives markets, particularly in interest rate swaps, since it

is designed to reduce the risk of defaulting on a trade. Some

analysts believe the deal could give regulators an opportunity to

push ICE to provide open access, allowing market participants and

rivals access to its index, data, clearing and other products

through commercial partnerships.

The European Commission blocked a deal between Deutsche Börse

and NYSE Euronext in 2012 over concerns it would create a

quasimonopoly in European derivatives traded on exchanges.

But Spencer Mindlin, an analyst with Aite Group, thinks the

industry may now have enough competition to warrant some

consolidation.

"There are plenty of competitors, he said. "That competition

didn't necessarily exist five or 10 years ago."

Write to Shayndi Raice at shayndi.raice@wsj.com

(END) Dow Jones Newswires

March 01, 2016 15:39 ET (20:39 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

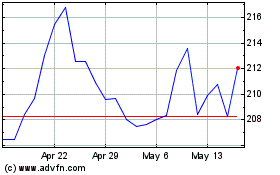

CME (NASDAQ:CME)

Historical Stock Chart

From Sep 2024 to Oct 2024

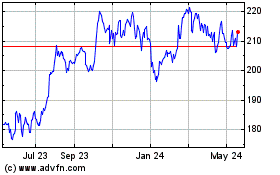

CME (NASDAQ:CME)

Historical Stock Chart

From Oct 2023 to Oct 2024