Centogene N.V. (Nasdaq: CNTG) (“we” or the “Company”), the

essential life science partner for data-driven answers in rare and

neurodegenerative diseases, today announced financial results for

the fiscal year ended December 31, 2023, and provided a business

update.

“In 2023, we focused on strategic growth – strengthening our

Diagnostic portfolio and introducing new data and wet lab solutions

to accelerate drug discovery, development, and commercialization

for Pharma. We expanded our partnership model with a joint venture

in Saudi Arabia, securing a $30 million investment and additional

milestone payments. However, delays in Pharma program timelines

impacted our 2023 revenue. Looking ahead to 2024, our Diagnostics

business is expected to maintain steady growth in line with

industry standards, and our Pharma orderbook is on a record

trajectory – with momentum expected to compound each quarter.”

Kim Stratton continued, “We are excited to be engaged in

discussions with multiple potential strategic partners and to have

deepened our relationship with Lifera over the past months. With

this progress at the forefront, CENTOGENE is positioned for growth

and a path towards profitability. We expect to see 2024 annual

revenue growth between 10-15%.”

Full Year

2023 Financial

Highlights

- Total revenues increased by

2% to €48.5 million in FY2023, compared to €47.5 million in

FY2022

- Diagnostics segment revenues

increased by 8% in 2023 to €33.7 million, primarily related to an

increase of 11% in revenues for CentoXome® (CENTOGENE’s proprietary

Whole Exome Sequencing) and CentoGenome® (CENTOGENE’s proprietary

Whole Genome Sequencing). Achieved upselling 47% of CentoXome® and

CentoGenome® orders to MOx (CENTOGENE’s portfolio of multiomic

testing solutions) in FY2023

- Pharma segment revenues of

€14.8 million, reflecting a decrease of 8%, primarily driven by a

lag in Pharma program timelines in H2 2023

- Overall gross profit margin of

36% of revenues or €17.2 million in FY2023, compared to 42% of

revenues or €19.8 million in FY2022

- Net loss position increased by 12.2%

at €35.8 million in FY2023 compared to a net loss of €31.9 million

in FY2022

- Total segment adjusted EBITDA was at

€11.1 million in FY2023, compared to €13.2 million in FY2022. This

decrease was mainly driven by the lag in pharma revenues, as well

as the increase in cost of sales and selling expenses

- Cash and cash equivalents

were €19.1 million as of December 31, 2023, compared to €35.9

million for the period ended December 31, 2022

“We are focused on streamlining processes and strengthening our

financial position to enable us to execute on our leading rare and

neurodegenerative disease business and sustainable long-term value

creation,” said Miguel Coego, Chief Financial Officer at CENTOGENE.

“Looking ahead, we will remain prudent with our capital allocation

– serving as a key driver to our goal of hitting EBITDA breakeven

by the end of this year and our path to cash profitability. We

believe this will enable us to advance our strategic alternatives

process to unlock value for our patients, physicians, pharma

partners, and CENTOGENE stakeholders.”

Recent Business Highlights

Corporate

- Announced strategic collaboration

with Lifera, a biopharmaceutical company wholly-owned by the PIF,

with the formation of a joint venture (JV), Lifera Omics, to

increase local and regional access and rapid delivery of

world-class genomic and multiomic testing to patients in Saudi

Arabia and countries of the Gulf Cooperation Council (GCC). Under

the terms of the collaboration, CENTOGENE received a $30 million

mandatory convertible loan from Lifera, as well as milestone

payments

- Secured an additional approximately

$20 million proceeds from Lifera via the sale of $15 million in

CENTOGENE’s accounts receivables (AR) in Saudi Arabia at face value

with no recourse. Additionally, Lifera purchased 16% of CENTOGENE’s

stake into their JV at a value of approximately $5 million with

CENTOGENE maintaining 4% ownership in the JV with the option to

repurchase the previous ownership on substantially the same terms

in the next 6-24 months. CENTOGENE to remain active in Lifera

Omics’ operations to deliver genomic and multiomic testing

- Initiated strategic alternatives

process focused on sustainable long-term value creation for the

benefit of its stakeholders

- Expanded the CENTOGENE Biodatabank

to over 850,000 patients, over 70% of whom are of non- European

descent, approximately 30,000 active physicians, and more than 85

million unique variants thanks to the increasing number of

CentoXome® and CentoGenome® analyses, which contain significantly

more variants than more targeted diagnostic tests

- Authored over 30 peer-reviewed

scientific publications in FY2023, reaching a milestone of over 300

publications in the Company’s history. The research unlocked

insights into Parkinson’s disease, Gaucher disease, Niemann-Pick

type C1 disease, hereditary angioedema, autosomal recessive spastic

paraplegia, colorectal carcinomas, renal hypouricemia, CLN6

disease, ELOVL4-related autosomal recessive neuro-ichthyosis,

CFTR-related disease, TOR1A-related disorders, as well as a range

of variants associated with epilepsy, genetic cancers, metabolic

disorders, developmental disorders, and other rare and

neurodegenerative diseases

Pharma

- Led 48 collaborations with 34

different pharmaceutical partners in FY2023. Of these 48

collaborations, 12 were with new partners. Starting off Q1 2024,

the Company has formed collaborations with eight new partners

- Extended Takeda partnership to March

2026 to continue providing access to genetic testing for patients

with lysosomal storage disorders

- Announced research project with The

Michael J. Fox Foundation to validate the genetic risk factors of

Parkinson’s disease using multiomics

- Reached initial recruitment and

genetic testing milestone in the observational EFRONT Study, being

conducted to advance the genetic understanding of frontotemporal

dementia (FTD)

- Leading, alongside Denali

Therapeutics, the ROPAD Study, the world’s largest observational

study on Parkinson’s disease genetics with over 15,000 enrolled

patients to date. Patients enrolled in ROPAD and identified with

LRRK2 genetic variations may be eligible for participation in

ongoing interventional clinical studies

Diagnostics

- Strong test requests of approximately

81,500 test requests for FY2023, representing an increase of

approximately 18% as compared to approximately 57,100 in the prior

year

- Strengthened Diagnostics Sales team

and expanded direct footprint distribution network in targeted

geographic areas, such as Canada, Colombia, Italy, Spain, and

Portugal

- Expanded MOx, the Company’s

multiomic diagnostic portfolio, now incorporating cutting-edge

transcriptomic analysis. CENTOGENE’s MOx 2.0 is a single-step

multiomic solution that combines DNA sequencing, biochemical

testing, and now RNA sequencing to provide physicians with the most

comprehensive testing capability

- Launched NEW CentoGenome®, the

world's most comprehensive Whole Genome Sequencing tool for

diagnosis of rare and neurodegenerative diseases, which now detects

Copy Number Variations associated with spinal muscular atrophy, as

well as complex disease-causing variants associated with Gaucher

disease and susceptibility to GBA1-related Parkinson's disease

- Launched CENTOGENE’s FilterTool to

fuel rapid, reliable analysis for diagnosis and research of rare

genetic diseases by significantly reducing time- and

resource-intensive processes – enabling users to display, filter,

select, and classify variants. Seamlessly integrating with

CentoCloud®, CENTOGENE’s CE-marked Software as a Service (SaaS)

bioinformatics pipeline, FilterTool is one of the first

applications to receive CE mark under new In Vitro Diagnostic

Regulation (IVDR) from the European Parliament

- Launched together with TWIST

Bioscience three Next Generation Sequencing target enrichment

panels, Twist Alliance CNTG Exome, Twist Alliance CNTG Rare Disease

Panel, and Twist Alliance CNTG Hereditary Oncology Panel, to

support rare disease and hereditary cancer research and support

diagnostics

- Integrated Illumina’s new NovaSeq X

Plus Sequencer into the Company’s state-of-the-art, CAP/CLIA

accredited laboratory in Rostock, Germany, to further optimize

throughput, scale, and cost efficiencies

- Published research in Science in

collaboration with the Laboratory of Human Genetics of Infectious

Diseases at Institut Imagine on human pre-T cell receptor alpha

(pre-TCRα) deficiency and its effect on human immunity

- Published study in the European

Journal of Human Genetics revealing unique genetic variants in

world's largest Niemann-Pick type C1 disease cohort

- Published the discovery of a new

form of early-onset dystonia and parkinsonism in the context of

neurodevelopmental abnormalities associated to the gene called

ACBD6 (Acyl-CoA Binding Domain Containing 6) as part of an

international team of researchers. The landmark study’s findings

have been published in Brain

- Published a study in the Diagnostics

journal establishing lyso-Gb1 (glucosylsphingosine) as a predictive

biomarker

2024 Revenue

Guidance

The Company expects revenue growth to be between 10-15% in

FY2024 compared to FY2023.

Update on Process to Review Strategic

Alternatives

On February 28, 2024, we announced a process to explore

strategic alternatives, including the sale of the Company,

divestitures of asset, licensing/partnership transactions, and/or

additional financing. We engaged an investment banker firm to

advise us in connection with this process. We are currently in

active discussions with several interested parties, which could

result in a near-term transaction by July 15, 2024. We do not

expect to disclose developments unless and until our board of

directors has concluded that disclosure is appropriate or required.

There can be no assurance that our strategic review process will

result in any transaction or other strategic outcome. We do not

intend to disclose further developments on this strategic review

process unless and until we determine that such disclosure is

appropriate or necessary.

About CENTOGENE

CENTOGENE’s mission is to provide data-driven, life-changing

answers to patients, physicians, and pharma companies for rare and

neurodegenerative diseases. We integrate multiomic technologies

with the CENTOGENE Biodatabank – providing dimensional analysis to

guide the next generation of precision medicine. Our unique

approach enables rapid and reliable diagnosis for patients,

supports a more precise physician understanding of disease states,

and accelerates and de-risks targeted pharma drug discovery,

development, and commercialization.

Since our founding in 2006, CENTOGENE has been offering rapid

and reliable diagnosis – building a network of approximately 30,000

active physicians. Our ISO, CAP, and CLIA certified multiomic

reference laboratories in Germany utilize Phenomic, Genomic,

Transcriptomic, Epigenomic, Proteomic, and Metabolomic datasets.

This data is captured in our CENTOGENE Biodatabank, with over

850,000 patients represented from over 120 highly diverse

countries, over 70% of whom are of non-European descent. To date,

the CENTOGENE Biodatabank has contributed to generating novel

insights for more than 300 peer-reviewed publications.

By translating our data and expertise into tangible insights, we

have supported over 50 collaborations with pharma partners.

Together, we accelerate and de-risk drug discovery, development,

and commercialization in target and drug screening, clinical

development, market access and expansion, as well as offering

CENTOGENE Biodata Licenses and Insight Reports to enable a world

healed of all rare and neurodegenerative diseases.

To discover more about our products, pipeline, and

patient-driven purpose, visit www.centogene.com and follow us on

LinkedIn.

Forward-Looking Statements

This press release contains “forward-looking statements” within

the meaning of the U.S. federal securities laws. Statements

contained herein that are not clearly historical in nature are

forward-looking, and the words “anticipate,” “believe,”

“continues,” “expect,” “estimate,” “intend,” “project,” “plan,” “is

designed to,” “potential,” “predict,” “objective” and similar

expressions and future or conditional verbs such as “will,”

“would,” “should,” “could,” “might,” “can,” and “may,” or the

negative of these are generally intended to identify

forward-looking statements. Such forward-looking statements involve

known and unknown risks, uncertainties, and other important factors

that may cause CENTOGENE’s actual results, performance, or

achievements to be materially different from any future results,

performance, or achievements expressed or implied by the forward-

looking statements. Such risks and uncertainties include, among

others, our ability to achieve the revenue levels set forth in our

guidance, negative economic and geopolitical conditions and

instability and volatility in the worldwide financial markets,

possible changes in current and proposed legislation, regulations

and governmental policies, pressures from increasing competition

and consolidation in our industry, the expense and uncertainty of

regulatory approval, including from the U.S. Food and Drug

Administration, our reliance on third parties and collaboration

partners, including our ability to manage growth, our ability to

execute our business plan and strategy, including to enter into new

client relationships, our ability to execute on our announced

strategic alternatives process, our dependency on the rare disease

industry, our ability to manage international expansion, our

reliance on key personnel, our reliance on intellectual property

protection, fluctuations of our operating results due to the effect

of exchange rates, our ability to streamline cash usage, our

continued ongoing compliance with covenants linked to financial

instruments, including timing requirements with respect to our

strategic alternatives process, our requirement for additional

financing, and our ability to continue as a going concern, or other

factors. For further information on the risks and uncertainties

that could cause actual results to differ from those expressed in

these forward-looking statements, as well as risks relating to

CENTOGENE’s business in general, see CENTOGENE’s risk factors set

forth in CENTOGENE’s Form 20-F filed on May 15, 2024, with the

Securities and Exchange Commission (the “SEC”) and subsequent

filings with the SEC. Any forward-looking statements contained in

this press release speak only as of the date hereof, and CENTOGENE

specifically disclaims any obligation to update any forward-looking

statement, whether as a result of new information, future events,

or otherwise.

Non-IFRS Measures

This document may contain summarized, non-audited, or non-GAAP

financial information. The information contained herein should

therefore be considered as a whole and in conjunction with all the

public information regarding the Company available, including any

other documents released by the Company that may contain more

detailed information. Adjusted EBITDA, adjusted EBITDA as a

percentage of sales, working capital as a percentage of sales,

adjusted EBITDA margin, working capital, adjusted net profit,

adjusted profit per share, adjusted gross debt, and net cash/debt

are non-IFRS financial metrics that management uses in its decision

making. CENTOGENE has included these financial metrics to provide

supplemental measures of its performance. The Company believes

these metrics are important and useful to investors because they

eliminate items that have less bearing on the Company’s current and

future operating performance and highlight trends in its core

business that may not otherwise be apparent when relying solely on

IFRS financial measures.

CONTACT

CENTOGENE

Melissa HallCorporate Communications Press@centogene.com

Lennart StreibelInvestor Relations

IR@centogene.com

|

|

|

Centogene N.V.Consolidated statements of

comprehensive loss for the years ended December 31, 2023,

2022 and 2021(in EUR k) |

|

|

|

|

|

Note |

|

2023 |

|

|

2022 |

|

|

2021 |

|

| |

|

|

|

|

|

|

|

|

|

Revenue |

|

7.2 |

|

48,536 |

|

|

47,473 |

|

|

42,234 |

|

| Cost of

sales |

|

|

|

31,287 |

|

|

27,712 |

|

|

28,735 |

|

|

Gross profit |

|

|

|

17,249 |

|

|

19,761 |

|

|

13,499 |

|

| Research

and development expenses |

|

|

|

12,361 |

|

|

17,488 |

|

|

19,297 |

|

| General

administrative expenses |

|

|

|

32,588 |

|

|

32,587 |

|

|

43,480 |

|

| Selling

expenses |

|

|

|

12,564 |

|

|

9,924 |

|

|

9,326 |

|

|

Impairment of financial assets |

|

|

|

812 |

|

|

— |

|

|

827 |

|

| Gain on

reversal of financial asset impairment |

|

|

|

— |

|

|

432 |

|

|

— |

|

| Other

operating income |

|

8.1 |

|

11,848 |

|

|

3,774 |

|

|

2,894 |

|

| Other

operating expenses |

|

8.2 |

|

431 |

|

|

741 |

|

|

86 |

|

|

Operating loss |

|

|

|

(29,659 |

) |

|

(36,773 |

) |

|

(56,623 |

) |

| Losses from investments

accounted for by the Equity method |

|

15 |

|

(302 |

) |

|

— |

|

|

— |

|

|

Gains/(losses) on changes in fair value of warrants |

|

8.3 |

|

(159 |

) |

|

2,574 |

|

|

— |

|

| Interest

and similar income |

|

|

|

3,293 |

|

|

512 |

|

|

3 |

|

| Interest

and similar expenses |

|

|

|

8,418 |

|

|

4,909 |

|

|

802 |

|

|

Financial costs, net |

|

8.3 |

|

(5,284 |

) |

|

(1,823 |

) |

|

(799 |

) |

|

Loss before taxes from continuing operations |

|

|

|

(35,245 |

) |

|

(38,596 |

) |

|

(57,422 |

) |

| Income

taxes expenses |

|

10 |

|

287 |

|

|

107 |

|

|

(70 |

) |

|

Loss for the year from continuing operations |

|

|

|

(35,532 |

) |

|

(38,703 |

) |

|

(57,352 |

) |

| Net

income from discontinued operations, net of tax |

|

9 |

|

— |

|

|

6,862 |

|

|

11,106 |

|

|

Loss for the period |

|

|

|

(35,532 |

) |

|

(31,841 |

) |

|

(46,246 |

) |

| Other

comprehensive income/(loss), all attributable to equity holders of

the parent |

|

|

|

(271 |

) |

|

(76 |

) |

|

543 |

|

|

Total comprehensive loss |

|

|

|

(35,803 |

) |

|

(31,917 |

) |

|

(45,703 |

) |

|

Attributable to: |

|

|

|

|

|

— |

|

|

— |

|

| Equity

holders of the parent |

|

|

|

(35,803 |

) |

|

(31,917 |

) |

|

(45,801 |

) |

|

Non‑controlling interests from continuing operations |

|

25 |

|

— |

|

|

— |

|

|

98 |

|

|

Non‑controlling interests from discontinued operations |

|

|

|

— |

|

|

— |

|

|

— |

|

|

|

|

|

|

(35,803 |

) |

|

(31,917 |

) |

|

(45,703 |

) |

|

Net loss per share - Basic and diluted from (in

EUR) |

|

|

|

|

|

|

|

|

|

Continuing operations |

|

11 |

|

(1.27 |

) |

|

(1.45 |

) |

|

(2.53 |

) |

| Loss

attributable to parent |

|

11 |

|

(1.27 |

) |

|

(1.19 |

) |

|

(2.04 |

) |

| |

|

|

|

|

|

|

|

|

|

The accompanying notes form an integral part of these consolidated

financial statements |

|

|

|

Centogene N.V.Consolidated statements of

financial position as of December 31, 2023 and

2022(in EUR k) |

|

|

|

Assets |

|

Note |

|

Dec 31, 2023 |

|

|

Dec 31, 2022 |

|

| |

|

|

|

|

|

|

|

|

| Non‑current

assets |

|

|

|

|

|

|

|

|

|

Intangible assets |

|

12 |

|

6,850 |

|

|

7,400 |

|

|

Property, plant and equipment |

|

13 |

|

5,643 |

|

|

6,808 |

|

|

Right-of-use assets |

|

14 |

|

13,635 |

|

|

15,351 |

|

|

Investment in Joint Venture |

|

15 |

|

2,784 |

|

|

— |

|

|

Derivative assets |

|

23.1 |

|

799 |

|

|

510 |

|

|

Other assets |

|

17 |

|

3,425 |

|

|

2,911 |

|

| |

|

|

|

33,136 |

|

|

32,980 |

|

| Current

assets |

|

|

|

|

|

|

|

|

|

Inventories |

|

16 |

|

2,463 |

|

|

1,819 |

|

|

Trade receivables and contract assets |

|

17 |

|

19,415 |

|

|

16,548 |

|

|

Other assets |

|

17 |

|

3,042 |

|

|

5,514 |

|

|

Cash and cash equivalents |

|

18 |

|

19,099 |

|

|

35,951 |

|

| |

|

|

|

44,019 |

|

|

59,832 |

|

| |

|

|

|

77,155 |

|

|

92,812 |

|

| |

|

|

|

|

|

|

|

Equity and liabilities |

|

Note |

|

Dec 31, 2023 |

|

Dec 31, 2022 |

| |

|

|

|

|

|

|

| Equity |

|

|

|

|

|

|

|

Issued capital |

|

19 |

|

3,478 |

|

|

3,307 |

|

|

Capital reserve |

|

19 |

|

148,308 |

|

|

145,369 |

|

|

Accumulated deficit and other reserves |

|

|

|

(177,068 |

) |

|

(141,265 |

) |

|

Non‑controlling interests |

|

|

|

— |

|

|

— |

|

| |

|

|

|

(25,282 |

) |

|

7,411 |

|

| Non‑current

liabilities |

|

|

|

|

|

|

|

Non‑current loans |

|

21.1 |

|

39,880 |

|

|

40,051 |

|

|

Lease liabilities |

|

21.1 |

|

12,399 |

|

|

13,125 |

|

|

Deferred tax liabilities |

|

10 |

|

407 |

|

|

35 |

|

|

Government grants |

|

21.2 |

|

5,701 |

|

|

6,687 |

|

|

Derivative liabilities |

|

21.2, 23 |

|

242 |

|

|

376 |

|

|

Warrant liability |

|

21.2, 23 |

|

394 |

|

|

260 |

|

|

Other liabilities |

|

21.2, 22 |

|

48 |

|

|

202 |

|

| |

|

|

|

59,071 |

|

|

60,736 |

|

| Current

liabilities |

|

|

|

|

|

|

|

Government grants |

|

21.2 |

|

984 |

|

|

1,263 |

|

|

Current loans |

|

21.1 |

|

25,882 |

|

|

4,635 |

|

|

Lease liabilities |

|

21.1 |

|

2,178 |

|

|

2,311 |

|

|

Liabilities from income taxes |

|

|

|

87 |

|

|

89 |

|

|

Trade payables |

|

21.2 |

|

5,628 |

|

|

6,317 |

|

|

Other liabilities |

|

21.2, 22 |

|

8,607 |

|

|

10,050 |

|

| |

|

|

|

43,366 |

|

|

24,665 |

|

| |

|

|

|

77,155 |

|

|

92,812 |

|

|

|

|

The accompanying notes form an integral part of these consolidated

financial statements |

|

|

|

Centogene N.V.Consolidated statements of

cash flows for the years ended December 31, 2023, 2022

and 2021(in EUR k) |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

Note |

|

2023 |

|

|

2022 |

|

|

2021 |

|

| Operating

activities |

|

|

|

|

|

|

|

|

| Loss before taxes from

continuing operations |

|

|

|

(35,245 |

) |

|

(38,596 |

) |

|

(57,422 |

) |

| Income before taxes from

discontinued operations |

|

9 |

|

— |

|

|

6,875 |

|

|

11,152 |

|

| Loss before taxes |

|

|

|

(35,245 |

) |

|

(31,721 |

) |

|

(46,270 |

) |

| Adjustments to

reconcile earnings to cash flow from operating

activities |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Amortization (including impairments) and depreciation |

|

12,13,14 |

|

7,610 |

|

|

10,378 |

|

|

19,974 |

|

|

Government grant depreciation |

|

|

|

(1,265 |

) |

|

— |

|

|

— |

|

|

Inventory write-off |

|

16 |

|

226 |

|

|

— |

|

|

1,795 |

|

|

Interest income |

|

8.3 |

|

(209 |

) |

|

— |

|

|

(3 |

) |

|

Interest expense |

|

8.3 |

|

8,201 |

|

|

4,909 |

|

|

851 |

|

|

Gain on the disposal of property, plant and equipment |

|

|

|

(56 |

) |

|

(754 |

) |

|

(18 |

) |

|

Gain on the sales of IP to Joint Venture |

|

8.1 |

|

(7,549 |

) |

|

— |

|

|

— |

|

|

Expected credit loss allowances on trade receivables and contract

assets |

|

23.2 |

|

761 |

|

|

— |

|

|

827 |

|

|

Share‑based payment expenses |

|

22 |

|

2,929 |

|

|

(16 |

) |

|

8,035 |

|

|

Tax Expense |

|

|

|

— |

|

|

(89 |

) |

|

— |

|

|

Profit or loss from financial instruments FV adjustments |

|

8.3 |

|

(263 |

) |

|

(2,574 |

) |

|

— |

|

|

Loss from Joint Venture equity method |

|

15 |

|

302 |

|

|

— |

|

|

— |

|

|

Other non‑cash items |

|

|

|

(34 |

) |

|

(1,430 |

) |

|

(821 |

) |

|

Net foreign exchange differences |

|

|

|

(2,438 |

) |

|

963 |

|

|

— |

|

|

Interest received |

|

|

|

209 |

|

|

— |

|

|

— |

|

| Changes in operating

assets and liabilities: |

|

|

|

|

|

|

|

|

|

Inventories |

|

16 |

|

(870 |

) |

|

2,050 |

|

|

5,741 |

|

|

Trade receivables and contract assets |

|

17 |

|

(3,628 |

) |

|

6,914 |

|

|

4,855 |

|

|

Other assets |

|

17 |

|

1,858 |

|

|

- |

|

|

1,828 |

|

|

Trade payables |

|

21.2 |

|

(689 |

) |

|

(4,935 |

) |

|

(20,484 |

) |

|

Other liabilities |

|

|

|

(1,599 |

) |

|

(10,182 |

) |

|

1,952 |

|

|

|

|

|

|

|

|

|

|

|

| Thereof cash flow (used in)

continuing operating activities |

|

|

|

(31,749 |

) |

|

(35,497 |

) |

|

(42,635 |

) |

| Thereof cash flow from

discontinued operating activities |

|

|

|

— |

|

|

9,009 |

|

|

20,897 |

|

| Cash flow (used

in)/from operating activities |

|

|

|

(31,749 |

) |

|

(26,488 |

) |

|

(21,739 |

) |

| |

|

|

|

|

|

|

|

|

| Investing

activities |

|

|

|

|

|

|

|

|

| Cash paid for investments in

intangible assets |

|

12 |

|

(2,239 |

) |

|

(1,727 |

) |

|

(2,787 |

) |

| Cash paid for investments in

property, plant and equipment |

|

13 |

|

(40 |

) |

|

(367 |

) |

|

(2,915 |

) |

| Cash paid for investment in

Joint Venture |

|

15 |

|

(4,973 |

) |

|

— |

|

|

— |

|

| Grants received for investment

in property, plant and equipment |

|

21.2 |

|

— |

|

|

506 |

|

|

168 |

|

| Cash received from the

disposals of property, plant and equipment |

|

|

|

93 |

|

|

855 |

|

|

171 |

|

| Cash received from sale of IP

to Joint Venture |

|

15 |

|

9,436 |

|

|

— |

|

|

— |

|

| Interest received |

|

|

|

— |

|

|

— |

|

|

3 |

|

| |

|

|

|

|

|

|

|

|

| Thereof cash flow from/(used

in) in continuing investing activities |

|

|

|

2,277 |

|

|

(1,553 |

) |

|

(2,494 |

) |

| Thereof cash flow from/(used

in) discontinued investing activities |

|

|

|

— |

|

|

820 |

|

|

(2,866 |

) |

| Cash flow used in

investing activities |

|

|

|

2,277 |

|

|

(733 |

) |

|

(5,360 |

) |

| |

|

|

|

|

|

|

|

|

| Financing

activities |

|

|

|

|

|

|

|

|

| Cash received from the

issuance of shares |

|

19 |

|

— |

|

|

12,140 |

|

|

— |

|

| Cash received from issuance of

warrants |

|

|

|

— |

|

|

2,833 |

|

|

— |

|

| Cash paid for acquisition of

non-wholly owned subsidiary |

|

|

|

— |

|

|

(1 |

) |

|

— |

|

| Cash received from loans |

|

21, 23.2 |

|

25,500 |

|

|

40,568 |

|

|

1,772 |

|

| Cash repayments of loans |

|

21, 23.2 |

|

(3,374 |

) |

|

— |

|

|

(464 |

) |

| Cash repayments of lease

liabilities |

|

21, 23.2 |

|

(3,095 |

) |

|

(4,314 |

) |

|

(4,244 |

) |

| Interest paid |

|

8.3 |

|

(5,987 |

) |

|

(4,909 |

) |

|

(267 |

) |

| |

|

|

|

|

|

|

|

|

| Thereof net cash flow

from/(used in) continuing financing activities |

|

|

|

13,044 |

|

|

46,798 |

|

|

(2,403 |

) |

| Thereof net cash flow used in

discontinued financing activities |

|

|

|

— |

|

|

(481 |

) |

|

(800 |

) |

| Cash flow from

financing activities |

|

|

|

13,044 |

|

|

46,317 |

|

|

(3,203 |

) |

| |

|

|

|

|

|

|

|

|

| Changes in cash and cash

equivalents |

|

|

|

(16,428 |

) |

|

19,096 |

|

|

(30,302 |

) |

| Cash and cash equivalents at

the beginning of the period |

|

|

|

35,951 |

|

|

17,818 |

|

|

48,156 |

|

| Effect of movements in

exchange rates on cash held |

|

|

|

(424 |

) |

|

(963 |

) |

|

(36 |

) |

| Cash and cash equivalents at

the end of the period |

|

|

|

19,099 |

|

|

35,951 |

|

|

17,818 |

|

| |

|

The accompanying notes form an integral part of these consolidated

financial statements |

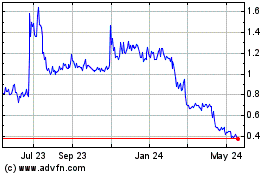

Centogene NV (NASDAQ:CNTG)

Historical Stock Chart

From Dec 2024 to Jan 2025

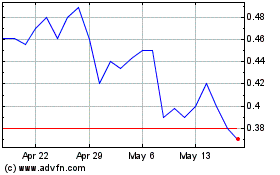

Centogene NV (NASDAQ:CNTG)

Historical Stock Chart

From Jan 2024 to Jan 2025