false000031754000003175402025-02-202025-02-20

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 20, 2025

COCA-COLA CONSOLIDATED, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 0-9286 | | 56-0950585 |

(State or other jurisdiction

of incorporation) | | (Commission

File Number) | | (IRS Employer

Identification No.) |

| | | | |

4100 Coca-Cola Plaza Charlotte, NC | | | | 28211 |

| (Address of principal executive offices) | | | | (Zip Code) |

Registrant’s telephone number, including area code: (980) 392-8298

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, par value $1.00 per share | COKE | The Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On February 20, 2025, Coca-Cola Consolidated, Inc. (the “Company”) issued a news release reporting its financial results for the fourth quarter and the fiscal year ended December 31, 2024. A copy of the news release is furnished as Exhibit 99.1 hereto and is incorporated herein by reference.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | | | | | | | |

| Exhibit No. | | Description | | Incorporated by Reference or

Filed/Furnished Herewith |

| 99.1 | | | | Furnished herewith. |

| 104 | | Cover Page Interactive Data File – the cover page interactive data file does not appear in the Interactive Data File because its XBRL tags are embedded within the Inline XBRL document. | | Filed herewith. |

The information in this Current Report on Form 8-K, including Exhibit 99.1 attached hereto, is being furnished and shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed to be incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in any such filing.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | |

| | COCA-COLA CONSOLIDATED, INC. |

| | | | |

Date: February 20, 2025 | | By: | /s/ F. Scott Anthony | |

| | | F. Scott Anthony

Executive Vice President and Chief Financial Officer |

Coca-Cola Consolidated Reports

Fourth Quarter and Fiscal Year 2024 Results

■Fourth quarter of 2024 net sales increased 7% versus the fourth quarter of 2023.

■Gross profit in the fourth quarter of 2024 was $698 million, an increase of 9% versus the fourth quarter of 2023. Gross margin in the fourth quarter of 2024 improved by 70 basis points(a) to 40%.

■Income from operations for the fourth quarter of 2024 was $219 million, an increase of $40 million, or 23%, versus the fourth quarter of 2023. For fiscal year 2024, income from operations increased $86 million to $920 million.

Key Results

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Fourth Quarter | | | | Fiscal Year | | |

| (in millions) | | 2024 | | 2023 | | Change | | 2024 | | 2023 | | Change |

Volume(1) | | 89.7 | | 88.5 | | 1.3% | | 353.1 | | 355.4 | | (0.6)% |

| Net sales | | $1,746.5 | | $1,631.0 | | 7.1% | | $6,899.7 | | $6,653.9 | | 3.7% |

| Gross profit | | $697.9 | | $641.5 | | 8.8% | | $2,753.2 | | $2,598.7 | | 5.9% |

| Gross margin | | 40.0 | % | | 39.3 | % | | | | 39.9 | % | | 39.1 | % | | |

| Income from operations | | $218.7 | | $178.5 | | 22.6% | | $920.4 | | $834.5 | | 10.3% |

| Operating margin | | 12.5 | % | | 10.9 | % | | | | 13.3 | % | | 12.5 | % | | |

| | | | | | | | | | | | |

| Beverage Sales | | Fourth Quarter | | | | Fiscal Year | | |

| (in millions) | | 2024 | | 2023 | | Change | | 2024 | | 2023 | | Change |

| Sparkling bottle/can | | $1,083.5 | | $1,006.1 | | 7.7% | | $4,106.1 | | $3,892.1 | | 5.5% |

| Still bottle/can | | $531.3 | | $488.6 | | 8.7% | | $2,227.2 | | $2,149.6 | | 3.6% |

(1) Volume is measured on a standard physical case basis and is used to standardize differing package configurations delivered via direct store delivery (“DSD”).

Fourth Quarter and Fiscal Year 2024 Review

CHARLOTTE, February 20, 2025 – Coca‑Cola Consolidated, Inc. (NASDAQ: COKE) today reported operating results for the fourth quarter and the fiscal year ended December 31, 2024.

“We are very pleased with our solid operating and financial performance in 2024 and thankful for the unwavering commitment of our 17,000 teammates who contributed to this success,” said J. Frank Harrison, III, Chairman and Chief Executive Officer. “Our financial performance has enabled us to reinvest in our business for long-term growth while returning substantial cash to our stockholders. During 2024, we invested over $370 million in capital expenditures, repurchased approximately $626 million of our Common Stock and increased our annualized regular dividend to $10 per share.”

Net sales increased 7.1% to $1.7 billion in the fourth quarter of 2024 and increased 3.7% to $6.9 billion in fiscal year 2024. Sparkling and Still net sales increased 7.7% and 8.7%, respectively, compared to the fourth quarter of 2023. Net sales in the fourth quarter of 2024 were positively impacted by two additional selling days as compared to the fourth quarter of 2023, which accounted for approximately $40 million of net sales or 2.5% of growth in the quarter. The net sales improvement was driven by the continued strength in Sparkling volume growth and pricing actions taken during 2024. Sales to our large retail customers, including club and value stores, outpaced other selling channels as consumer demand for multi-serve, value-oriented packages remained strong.

Volume was up 1.3% in the fourth quarter of 2024 and down 0.6% in fiscal year 2024. On a comparable(b) basis, volume decreased 0.9% as compared to the fourth quarter of 2023. Fourth quarter 2024 comparable(b) performance included an increase in Sparkling category volume of 0.8% and a decline in Still category volume of 6.4%. Our Sparkling brands continue to reflect the strength of our Zero calorie brands and positive customer response to our large variety of package offerings.

In the second quarter of 2024, we shifted the distribution of casepack Dasani water sold in Walmart stores to a non-DSD method of distribution. As a result, these cases are not included in our 2024 reported case volume. The impact of this distribution change reduced our reported case volume by 1.3% during the fourth quarter of 2024 and 0.8% during fiscal year 2024.

Gross profit in the fourth quarter of 2024 was $697.9 million, an increase of $56.4 million, or 8.8%, while gross margin improved 70 basis points to 40.0%. Pricing actions taken during the first quarter of 2024 along with stable commodity prices contributed to the overall improvement in gross margin. Additionally, our product mix shifted towards Sparkling beverages, which typically carry higher gross margins, during the fourth quarter of 2024. Gross profit in fiscal year 2024 was $2.8 billion, an increase of $154.5 million, or 5.9%.

“Our income from operations grew over 10% in 2024, and we achieved EBITDA(b) of over $1.1 billion with an EBITDA margin(b) of 16.2% - the highest level in decades,” said Dave Katz, President and Chief Operating Officer. “As we look to 2025, we are encouraged by the continued strong performance of our Sparkling brands and the robust commercial plans in place to strengthen the performance of our Still portfolio. While 2025 will likely be a year of slower financial growth, we believe our operating plans will deliver another solid year of margin performance and cash generation.”

Selling, delivery and administrative (“SD&A”) expenses in the fourth quarter of 2024 increased $16.1 million, or 3.5%. The increase in quarterly SD&A expenses was primarily driven by an increase in labor costs. SD&A expenses in fiscal year 2024 increased $68.6 million, or 3.9%. SD&A expenses as a percentage of net sales in fiscal year 2024 increased 10 basis points to 26.6% as compared to fiscal year 2023.

Income from operations in the fourth quarter of 2024 was $218.7 million, compared to $178.5 million in the fourth quarter of 2023, an increase of 22.6%. Income from operations in the fourth quarter of 2024 was positively impacted by two additional selling days as compared to the fourth quarter of 2023, which accounted for approximately $10 million of income from operations. For fiscal year 2024, income from operations increased $85.9 million to $920.4 million, an increase of 10.3%. Operating margin for fiscal year 2024 was 13.3% as compared to 12.5% for fiscal year 2023, an increase of 80 basis points.

Net income in the fourth quarter of 2024 was $178.9 million, compared to $75.8 million in the fourth quarter of 2023, an increase of $103.1 million. On an adjusted(b) basis, net income in the fourth quarter of 2024 was $156.7 million, compared to $125.5 million in the fourth quarter of 2023, an increase of $31.1 million. Net income for the fourth quarter of 2024 benefited from routine, non-cash fair value adjustments to our acquisition related contingent consideration liability, driven primarily by an increase to the discount rate used to compute the fair value of the liability.

Net income in fiscal year 2024 was $633.1 million, compared to $408.4 million in fiscal year 2023, an increase of $224.8 million. On an adjusted(b) basis, net income in fiscal year 2024 was $678.6 million, compared to $613.8 million in fiscal year 2023, an increase of $64.7 million. Net income for fiscal year 2023 was adversely impacted by the settlement of our primary pension plan benefit liabilities during fiscal year 2023, which resulted in a non-cash charge of $112.8 million. Income tax expense for fiscal year 2024 was $223.5 million, compared to $149.1 million for fiscal year 2023, resulting in an effective income tax rate of 26.1% and 26.7% for fiscal year 2024 and 2023, respectively.

Cash flows from operations for fiscal year 2024 were $876.4 million, compared to $810.7 million for fiscal year 2023. Cash flows from operations reflected our strong operating performance during fiscal year 2024. In fiscal year 2024, we invested $371 million in capital expenditures as we continue to enhance our supply chain and invest for future growth. In fiscal year 2025, we expect capital expenditures to be approximately $300 million.

(a) All comparisons are to the corresponding period in the prior year unless specified otherwise.

(b) The discussion of the operating results for the fourth quarter and the fiscal year ended December 31, 2024 includes selected non-GAAP financial information, such as “comparable” and “adjusted” results, EBITDA and EBITDA margin. The schedules in this news release reconcile such non-GAAP financial measures to the most directly comparable GAAP financial measures.

| | | | | | | | |

| CONTACTS: | | |

| Brian K. Little (Media) | | Scott Anthony (Investors) |

| Vice President, Corporate Communications Officer | | Executive Vice President & Chief Financial Officer |

| (980) 378-5537 | | (704) 557-4633 |

| Brian.Little@cokeconsolidated.com | | Scott.Anthony@cokeconsolidated.com |

About Coca-Cola Consolidated, Inc.

Headquartered in Charlotte, N.C., Coca‑Cola Consolidated (NASDAQ: COKE) is the largest Coca‑Cola bottler in the United States. We make, sell and distribute beverages of The Coca‑Cola Company and other partner companies in more than 300 brands and flavors across 14 states and the District of Columbia, to approximately 60 million consumers. For over 122 years, we have been deeply committed to the consumers, customers and communities we serve and passionate about the broad portfolio of beverages and services we offer. Our Purpose is to honor God in all we do, to serve others, to pursue excellence and to grow profitably.

More information about the Company is available at www.cokeconsolidated.com. Follow Coca‑Cola Consolidated on Facebook, X, Instagram and LinkedIn.

Cautionary Note Regarding Forward-Looking Statements

Certain statements contained in this news release are “forward-looking statements” subject to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 that involve risks and uncertainties which we expect will or may occur in the future and may impact our business, financial condition and results of operations. The words “anticipate,” “believe,” “expect,” “intend,” “project,” “may,” “will,” “should,” “could” and similar expressions are intended to identify those forward-looking statements. These forward-looking statements reflect the Company’s best judgment based on current information, and, although we base these statements on circumstances that we believe to be reasonable when made, there can be no assurance that future events will not affect the accuracy of such forward-looking information. As such, the forward-looking statements are not guarantees of future performance, and actual results may vary materially from the projected results and expectations discussed in this news release. Factors that might cause the Company’s actual results to differ materially from those anticipated in forward-looking statements include, but are not limited to: increased costs (including due to inflation) or disruption, unavailability or shortages of raw materials, fuel and other supplies; the reliance on purchased finished products from external sources; changes in public and consumer perception and preferences, including concerns related to product safety and sustainability, artificial ingredients, brand reputation and obesity; changes in government regulations related to nonalcoholic beverages, including regulations related to obesity, public health, artificial ingredients, recycling, sustainability and product safety; decreases from historic levels of marketing funding support provided to us by The Coca‑Cola Company and other beverage companies; material changes in the performance requirements for marketing funding support or our inability to meet such requirements; decreases from historic levels of advertising, marketing and product innovation spending by The Coca‑Cola Company and other beverage companies, or advertising campaigns that are negatively perceived by the public; any failure of the several Coca‑Cola system governance entities of which we are a participant to function efficiently or in our best interest and any failure or delay of ours to receive anticipated benefits from these governance entities; provisions in our beverage distribution and manufacturing agreements with The Coca‑Cola Company that could delay or prevent a change in control of us or a sale of our Coca‑Cola distribution or manufacturing businesses; the concentration of our capital stock ownership; our inability to meet requirements under our beverage distribution and manufacturing agreements; changes in the inputs used to calculate our acquisition related contingent consideration liability; technology failures or cyberattacks on our information technology systems or our effective response to technology failures or cyberattacks on our third-party service providers’, business partners’, customers’, suppliers’ or other third parties’ information technology systems; unfavorable changes in the general economy; changes in trade policies, including the imposition of, or increase in, tariffs on imported goods; the concentration risks among our customers and suppliers; lower than expected net pricing of our products resulting from continued and increased customer and competitor consolidations and marketplace competition; the effect of changes in our level of debt, borrowing costs and credit ratings on our access to capital and credit markets, operating flexibility and ability to obtain additional financing to fund future needs; the failure to attract, train and retain qualified employees while controlling labor costs and other labor issues; the failure to maintain productive relationships with our employees covered by collective bargaining agreements, including failing to renegotiate collective bargaining agreements; changes in accounting standards; our use of estimates and assumptions; changes in tax laws, disagreements with tax authorities or additional tax liabilities; changes in legal contingencies; natural disasters, changing weather patterns and unfavorable weather; and climate change or legislative or regulatory responses to such change. These and other factors are discussed in the Company’s regulatory filings with the United States Securities and Exchange Commission, including those in “Item 1A. Risk Factors” of the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2023. The forward-looking statements contained in this news release speak only as of this date, and the Company does not assume any obligation to update them, except as may be required by applicable law.

###

| | | | | | | | |

| | FINANCIAL STATEMENTS

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(UNAUDITED) |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Fourth Quarter | | Fiscal Year |

| (in thousands, except per share data) | | 2024 | | 2023 | | 2024 | | 2023 |

| Net sales | | $ | 1,746,495 | | | $ | 1,630,956 | | | $ | 6,899,716 | | | $ | 6,653,858 | |

| Cost of sales | | 1,048,621 | | | 989,478 | | | 4,146,537 | | | 4,055,147 | |

| Gross profit | | 697,874 | | | 641,478 | | | 2,753,179 | | | 2,598,711 | |

| Selling, delivery and administrative expenses | | 479,125 | | | 463,011 | | | 1,832,829 | | | 1,764,260 | |

| Income from operations | | 218,749 | | | 178,467 | | | 920,350 | | | 834,451 | |

| Interest expense (income), net | | 3,997 | | | (3,684) | | | 1,848 | | | (918) | |

| | | | | | | | |

| Other (income) expense, net | | (31,279) | | | 73,908 | | | 61,848 | | | 165,092 | |

| Pension plan settlement expense | | — | | | (4,300) | | | — | | | 112,796 | |

| Income before taxes | | 246,031 | | | 112,543 | | | 856,654 | | | 557,481 | |

| Income tax expense | | 67,083 | | | 36,707 | | | 223,529 | | | 149,106 | |

| Net income | | $ | 178,948 | | | $ | 75,836 | | | $ | 633,125 | | | $ | 408,375 | |

| | | | | | | | |

| Basic net income per share: | | | | | | | | |

| Common Stock | | $ | 20.48 | | | $ | 8.09 | | | $ | 70.10 | | | $ | 43.56 | |

| Weighted average number of Common Stock shares outstanding | | 7,733 | | | 8,369 | | | 8,035 | | | 8,369 | |

| | | | | | | | |

| Class B Common Stock | | $ | 20.47 | | | $ | 8.09 | | | $ | 69.50 | | | $ | 43.56 | |

| Weighted average number of Class B Common Stock shares outstanding | | 1,005 | | | 1,005 | | | 1,005 | | | 1,005 | |

| | | | | | | | |

| Diluted net income per share: | | | | | | | | |

| Common Stock | | $ | 20.46 | | | $ | 8.08 | | | $ | 69.94 | | | $ | 43.48 | |

| Weighted average number of Common Stock shares outstanding – assuming dilution | | 8,745 | | | 9,384 | | | 9,053 | | | 9,392 | |

| | | | | | | | |

| Class B Common Stock | | $ | 20.44 | | | $ | 8.08 | | | $ | 69.17 | | | $ | 43.40 | |

| Weighted average number of Class B Common Stock shares outstanding – assuming dilution | | 1,012 | | | 1,015 | | | 1,018 | | | 1,023 | |

| | | | | | | | |

| | FINANCIAL STATEMENTS

CONDENSED CONSOLIDATED BALANCE SHEETS

(UNAUDITED) |

| | | | | | | | | | | | | | |

| (in thousands) | | December 31, 2024 | | December 31, 2023 |

| ASSETS | | | | |

| Current Assets: | | | | |

| Cash and cash equivalents | | $ | 1,135,824 | | | $ | 635,269 | |

| Short-term investments | | 301,210 | | | — | |

| Trade accounts receivable, net | | 552,979 | | | 539,873 | |

| Other accounts receivable | | 130,563 | | | 119,469 | |

| Inventories | | 330,395 | | | 321,932 | |

| Prepaid expenses and other current assets | | 96,331 | | | 88,585 | |

| Total current assets | | 2,547,302 | | | 1,705,128 | |

| Property, plant and equipment, net | | 1,505,267 | | | 1,320,563 | |

| Right-of-use assets - operating leases | | 112,351 | | | 122,708 | |

| Leased property under financing leases, net | | 3,138 | | | 4,785 | |

| Other assets | | 181,048 | | | 145,213 | |

| Goodwill | | 165,903 | | | 165,903 | |

| Other identifiable intangible assets, net | | 798,130 | | | 824,642 | |

| Total assets | | $ | 5,313,139 | | | $ | 4,288,942 | |

| | | | |

| LIABILITIES AND EQUITY | | | | |

| Current Liabilities: | | | | |

| Current portion of debt | | $ | 349,699 | | | $ | — | |

| Current portion of obligations under operating leases | | 23,257 | | | 26,194 | |

| Current portion of obligations under financing leases | | 2,685 | | | 2,487 | |

| Dividends payable | | — | | | 154,666 | |

| Accounts payable and accrued expenses | | 937,528 | | | 907,987 | |

| Total current liabilities | | 1,313,169 | | | 1,091,334 | |

| Deferred income taxes | | 132,941 | | | 128,435 | |

| Pension and postretirement benefit obligations and other liabilities | | 918,061 | | | 927,113 | |

| Noncurrent portion of obligations under operating leases | | 92,362 | | | 102,271 | |

| Noncurrent portion of obligations under financing leases | | 2,346 | | | 5,032 | |

| Long-term debt | | 1,436,649 | | | 599,159 | |

| Total liabilities | | 3,895,528 | | | 2,853,344 | |

| | | | |

| Equity: | | | | |

| Stockholders’ equity | | 1,417,611 | | | 1,435,598 | |

| Total liabilities and equity | | $ | 5,313,139 | | | $ | 4,288,942 | |

| | | | | | | | |

| | FINANCIAL STATEMENTS

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(UNAUDITED) |

| | | | | | | | | | | | | | |

| | Fiscal Year |

| (in thousands) | | 2024 | | 2023 |

| Cash Flows from Operating Activities: | | | | |

| Net income | | $ | 633,125 | | | $ | 408,375 | |

| Depreciation expense, amortization of intangible assets and deferred proceeds, net | | 193,791 | | | 176,966 | |

| Fair value adjustment of acquisition related contingent consideration | | 59,166 | | | 159,354 | |

| Deferred income taxes | | 2,529 | | | (49,021) | |

| Pension plan settlement expense | | — | | | 112,796 | |

| Change in current assets and current liabilities | | (3,774) | | | 29,138 | |

| Change in noncurrent assets and noncurrent liabilities | | (13,958) | | | (35,090) | |

| Other | | 5,478 | | | 8,172 | |

| Net cash provided by operating activities | | $ | 876,357 | | | $ | 810,690 | |

| | | | |

| Cash Flows from Investing Activities: | | | | |

| Additions to property, plant and equipment | | $ | (371,015) | | | $ | (282,304) | |

| Purchases and disposals of short-term investments | | (296,035) | | | — | |

| Other | | (15,151) | | | (13,046) | |

| Net cash used in investing activities | | $ | (682,201) | | | $ | (295,350) | |

| | | | |

| Cash Flows from Financing Activities: | | | | |

| Proceeds from bond issuance | | $ | 1,200,000 | | | $ | — | |

| Payments related to share repurchases | | (625,654) | | | — | |

| Cash dividends paid | | (185,635) | | | (46,868) | |

| Payments of acquisition related contingent consideration | | (64,312) | | | (28,208) | |

| Debt issuance fees | | (15,512) | | | (340) | |

| Other | | (2,488) | | | (2,303) | |

| Net cash provided by (used in) financing activities | | $ | 306,399 | | | $ | (77,719) | |

| | | | |

| Net increase in cash during period | | $ | 500,555 | | | $ | 437,621 | |

| Cash at beginning of period | | 635,269 | | | 197,648 | |

| Cash at end of period | | $ | 1,135,824 | | | $ | 635,269 | |

| | | | | | | | |

| | COMPARABLE AND NON-GAAP FINANCIAL MEASURES(c) The following tables reconcile reported results (GAAP) to comparable and adjusted results (non-GAAP): |

Results for the fourth quarter of 2024 include two additional selling days compared to the fourth quarter of 2023. Results for fiscal year 2024 include one additional selling day compared to fiscal year 2023. For comparison purposes, the estimated impact of the additional selling day(s) in the fourth quarter of 2024 and fiscal year 2024 have been excluded from our comparable(b) volume results.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Fourth Quarter | | | | Fiscal Year | | |

| (in millions) | | 2024 | | 2023 | | Change | | 2024 | | 2023 | | Change |

| Volume | | 89.7 | | | 88.5 | | | 1.3 | % | | 353.1 | | | 355.4 | | | (0.6) | % |

| Volume related to extra day(s) in fiscal period | | (1.9) | | | — | | | | | (1.0) | | | — | | | |

| Comparable volume | | 87.8 | | | 88.5 | | | (0.9) | % | | 352.1 | | | 355.4 | | | (0.9) | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Fourth Quarter 2024 |

| (in thousands, except per share data) | | Gross profit | | SD&A expenses | | Income from operations | | Income before taxes | | Net income | | Basic net income per share |

| Reported results (GAAP) | | $ | 697,874 | | | $ | 479,125 | | | $ | 218,749 | | | $ | 246,031 | | | $ | 178,948 | | | $ | 20.48 | |

| Fair value adjustment of acquisition related contingent consideration | | — | | | — | | | — | | | (31,711) | | | (23,937) | | | (2.56) | |

| Fair value adjustments for commodity derivative instruments | | 2,073 | | | (127) | | | 2,200 | | | 2,200 | | | 1,656 | | | 0.19 | |

| Total reconciling items | | 2,073 | | | (127) | | | 2,200 | | | (29,511) | | | (22,281) | | | (2.37) | |

| Adjusted results (non-GAAP) | | $ | 699,947 | | | $ | 478,998 | | | $ | 220,949 | | | $ | 216,520 | | | $ | 156,667 | | | $ | 18.11 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Adjusted % Change vs. Fourth Quarter 2023 | | 9.6 | % | | 3.5 | % | | 25.7 | % | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Fourth Quarter 2023 |

| (in thousands, except per share data) | | Gross profit | | SD&A expenses | | Income from operations | | Income before taxes | | Net income | | Basic net income per share |

| Reported results (GAAP) | | $ | 641,478 | | | $ | 463,011 | | | $ | 178,467 | | | $ | 112,543 | | | $ | 75,836 | | | $ | 8.09 | |

| Fair value adjustment of acquisition related contingent consideration | | — | | | — | | | — | | | 73,316 | | | 55,047 | | | 5.87 | |

| Fair value adjustments for commodity derivative instruments | | (2,737) | | | (70) | | | (2,667) | | | (2,667) | | | (2,009) | | | (0.21) | |

| Pension plan settlement expense | | — | | | — | | | — | | | (4,300) | | | (3,350) | | | (0.36) | |

| Total reconciling items | | (2,737) | | | (70) | | | (2,667) | | | 66,349 | | | 49,688 | | | 5.30 | |

| Adjusted results (non-GAAP) | | $ | 638,741 | | | $ | 462,941 | | | $ | 175,800 | | | $ | 178,892 | | | $ | 125,524 | | | $ | 13.39 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Fiscal Year 2024 |

| (in thousands, except per share data) | | Gross profit | | SD&A expenses | | Income from operations | | Income before taxes | | Net income | | Basic net income per share |

| Reported results (GAAP) | | $ | 2,753,179 | | | $ | 1,832,829 | | | $ | 920,350 | | $ | 856,654 | | | $ | 633,125 | | | $ | 70.10 | |

| Fair value adjustment of acquisition related contingent consideration | | — | | | — | | | — | | 59,166 | | | 44,493 | | | 4.92 | |

| Fair value adjustments for commodity derivative instruments | | 728 | | | (547) | | | 1,275 | | 1,275 | | | 959 | | | 0.11 | |

| Total reconciling items | | 728 | | | (547) | | | 1,275 | | 60,441 | | | 45,452 | | | 5.03 | |

| Adjusted results (non-GAAP) | | $ | 2,753,907 | | | $ | 1,832,282 | | | $ | 921,625 | | $ | 917,095 | | | $ | 678,577 | | | $ | 75.13 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Adjusted % Change vs. Fiscal Year 2023 | | 6.0 | % | | 4.0 | % | | 10.3 | % | | | | | | |

| | | | | | | | |

| (in thousands) | | Fiscal Year 2024 |

| Net income as reported (GAAP) | | $ | 633,125 | |

| Fair value adjustments for commodity derivative instruments | | 1,275 | |

| Interest expense, net | | 1,848 | |

| Other expense, net | | 61,848 | |

| Income tax expense | | 223,529 | |

| Depreciation expense, amortization of intangible assets and deferred proceeds, net | | 193,791 | |

| EBITDA (non-GAAP) | | $ | 1,115,416 | |

EBITDA margin(d) | | 16.2% |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Fiscal Year 2023 |

| (in thousands, except per share data) | | Gross profit | | SD&A expenses | | Income from operations | | Income before taxes | | Net income | | Basic net income per share |

| Reported results (GAAP) | | $ | 2,598,711 | | | $ | 1,764,260 | | | $ | 834,451 | | | $ | 557,481 | | | $ | 408,375 | | | $ | 43.56 | |

| Fair value adjustment of acquisition related contingent consideration | | — | | | — | | | — | | | 159,354 | | | 119,834 | | | 12.78 | |

| Fair value adjustments for commodity derivative instruments | | (1,220) | | | (2,281) | | | 1,061 | | | 1,061 | | | 798 | | | 0.09 | |

| Pension plan settlement expense | | — | | | — | | | — | | | 112,796 | | | 84,823 | | | 9.05 | |

| Total reconciling items | | (1,220) | | | (2,281) | | | 1,061 | | | 273,211 | | | 205,455 | | | 21.92 | |

| Adjusted results (non-GAAP) | | $ | 2,597,491 | | | $ | 1,761,979 | | | $ | 835,512 | | | $ | 830,692 | | | $ | 613,830 | | | $ | 65.48 | |

(c) The Company reports its financial results in accordance with accounting principles generally accepted in the United States (“GAAP”). However, management believes that certain non-GAAP financial measures provide users of the financial statements with additional, meaningful financial information that should be considered, in addition to the measures reported in accordance with GAAP, when assessing the Company’s ongoing performance. Management also uses these non-GAAP financial measures in making financial, operating and planning decisions and in evaluating the Company’s performance. Non-GAAP financial measures should be viewed in addition to, and not as an alternative for, the Company’s reported results prepared in accordance with GAAP. The Company’s non-GAAP financial information does not represent a comprehensive basis of accounting.

(d) EBITDA margin is calculated as EBITDA divided by net sales.

v3.25.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

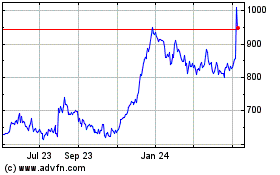

Coca Cola Consolidated (NASDAQ:COKE)

Historical Stock Chart

From Jan 2025 to Feb 2025

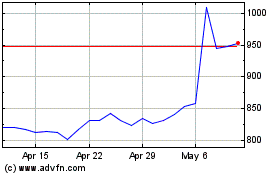

Coca Cola Consolidated (NASDAQ:COKE)

Historical Stock Chart

From Feb 2024 to Feb 2025