Collegium Pharmaceutical, Inc. (Nasdaq: COLL) today announced its

2025 full-year financial guidance and provided a business update.

“In 2024, we executed on our priorities of

maximizing the pain portfolio and strategically deploying capital,

delivering record financial results and closing the acquisition of

Ironshore,” said Vikram Karnani, President and Chief Executive

Officer of Collegium. “Looking ahead to 2025 and beyond, Collegium

will embark upon a new phase of growth. Jornay PM, as a highly

differentiated product to treat ADHD, is positioned to be our lead

growth driver, and our focus will be on commercial expansion. We

are committed to maximizing and delivering strong performance

across our entire portfolio as we build a leading, diversified

biopharmaceutical company serving people living with serious

medical conditions.”

“Our 2025 financial guidance reflects expected

significant top- and bottom-line growth driven by the addition of

Jornay PM and continued performance from our pain portfolio. We

expect Jornay PM net revenue in 2025 to be in excess of $135

million,” said Colleen Tupper, Chief Financial Officer of

Collegium. “We plan to make targeted investments in Jornay PM

throughout 2025, which we expect will accelerate growth in the

near-term, while creating significant momentum in 2026 and beyond.

In addition, we will continue to strategically deploy capital in a

disciplined manner to create long-term value for our

shareholders.”

Recent Business Highlights

- Completed integration of Ironshore Therapeutics Inc.

(Ironshore), and accelerated growth in Jornay PM average weekly

prescriptions during the 2024 back-to-school season.

- In November 2024, Vikram Karnani joined Collegium as President

and Chief Executive Officer and was appointed to the Board of

Directors.

- In 2024, repurchased $60 million in shares under the $150

million share repurchase program authorized by Collegium’s Board of

Directors in January 2024, including $25 million repurchased in the

fourth quarter of 2024 and $35 million repurchased through an

accelerated share repurchase program in May 2024.

Financial Guidance for 2025

- Product revenues, net are expected

in the range of $735 million to $750 million.

- Adjusted EBITDA (excluding

stock-based compensation) is expected in the range of $435 million

to $450 million.

- Adjusted operating expenses

(excluding stock-based compensation) are expected in the range of

$220 million to $230 million.

* Non-GAAP financial measure. Please refer to the “Non-GAAP

Financial Measures” section for details regarding these

measures.

About Collegium Pharmaceutical,

Inc.

Collegium is building a leading, diversified

biopharmaceutical company committed to improving the lives of

people living with serious medical conditions. The Company has a

leading portfolio of responsible pain management medications and

recently acquired Jornay PM, a treatment for ADHD, establishing a

presence in neuropsychiatry. Collegium’s strategy includes growing

its commercial portfolio, with Jornay PM as the lead growth driver,

and deploying capital in a disciplined manner. Collegium’s

headquarters are located in Stoughton, Massachusetts. For more

information, please visit the Company’s website

at www.collegiumpharma.com.

Non-GAAP Financial Measures

We have included information about certain

non-GAAP financial measures in this press release. We use these

non-GAAP financial measures to understand, manage and evaluate our

business as we believe they provide additional information on the

performance of our business. We believe that the presentation of

these non-GAAP financial measures, taken in conjunction with our

results under GAAP, provide analysts, investors, lenders and other

third parties insight into our view and assessment of our ongoing

operating performance. In addition, we believe that the

presentation of these non-GAAP financial measures, when viewed with

our results under GAAP and the accompanying reconciliations, where

applicable, provide supplementary information that may be useful to

analysts, investors, lenders, and other third parties in assessing

our performance and results from period to period. We report these

non-GAAP financial measures to portray the results of our

operations prior to considering certain income statement elements.

These non-GAAP financial measures should be considered in addition

to, and not as a substitute for, or superior to, net income or

other financial measures calculated in accordance with GAAP.

In this press release we discuss the following

financial measures that are not calculated in accordance with

GAAP.

Adjusted EBITDA

Adjusted EBITDA is a non-GAAP financial measure

that represents GAAP net income (loss) adjusted to exclude interest

expense, interest income, the benefit from or provision for income

taxes, depreciation, amortization, stock-based compensation, and

other adjustments to reflect changes that occur in our business but

do not represent ongoing operations. Adjusted EBITDA, as used by

us, may be calculated differently from, and therefore may not be

comparable to, similarly titled measures used by other

companies.

There are several limitations related to the use

of adjusted EBITDA rather than net income (loss), which is the

nearest GAAP equivalent, such as:

- adjusted EBITDA excludes

depreciation and amortization, and, although these are non-cash

expenses, the assets being depreciated or amortized may have to be

replaced in the future, the cash requirements for which are not

reflected in adjusted EBITDA;

- we exclude stock-based compensation

expense from adjusted EBITDA although (a) it has been, and will

continue to be for the foreseeable future, a significant recurring

expense for our business and an important part of our compensation

strategy and (b) if we did not pay out a portion of our

compensation in the form of stock-based compensation, the cash

salary expense included in operating expenses would be higher,

which would affect our cash position;

- adjusted EBITDA does not reflect

changes in, or cash requirements for, working capital needs;

- adjusted EBITDA does not reflect

the benefit from or provision for income taxes or the cash

requirements to pay taxes;

- adjusted EBITDA does not reflect

historical cash expenditures or future requirements for capital

expenditures or contractual commitments;

- we exclude impairment expenses from

adjusted EBITDA and, although these are non-cash expenses, the

asset being impaired may have to be replaced in the future, the

cash requirements for which are not reflected in adjusted

EBITDA;

- we exclude restructuring expenses

from adjusted EBITDA. Restructuring expenses primarily include

employee severance and contract termination costs that are not

related to acquisitions. The amount and/or frequency of these

restructuring expenses are not part of our underlying

business;

- we exclude litigation settlements

from adjusted EBITDA, as well as any applicable income items or

credit adjustments due to subsequent changes in estimates. This

does not include our legal fees to defend claims, which are

expensed as incurred;

- we exclude acquisition related

expenses as the amount and/or frequency of these expenses are not

part of our underlying business. Acquisition related expenses

include transaction costs, which primarily consist of financial

advisory, banking, legal, and regulatory fees, and other consulting

fees, incurred to complete an acquisition, employee related

expenses (severance cost and benefits) for terminated employees

after the acquisition, and miscellaneous other acquisition related

expenses incurred;

- we exclude recognition of the

step-up basis in inventory from acquisitions (i.e., the adjustment

to record inventory from historic cost to fair value at

acquisition) as the adjustment does not reflect the ongoing expense

associated with sale of our products as part of our underlying

business

- we exclude losses on

extinguishments of debt as these expenses are episodic in nature

and do not directly correlate to the cost of operating our business

on an ongoing basis; and

- we exclude other expenses, from

time to time, that are episodic in nature and do not directly

correlate to the cost of operating our business on an ongoing

basis.

Adjusted Operating Expenses

Adjusted operating expenses is a non-GAAP

financial measure that represents GAAP operating expenses adjusted

to exclude stock-based compensation expense, and other adjustments

to reflect changes that occur in our business but do not represent

ongoing operations.

We have not provided a reconciliation of our

full-year 2025 guidance for adjusted EBITDA or adjusted operating

expenses to the most directly comparable forward-looking GAAP

measures, in reliance on the unreasonable efforts exception

provided

under Item 10(e)(1)(i)(B) of Regulation S-K,

because we are unable to predict, without unreasonable efforts, the

timing and amount of items that would be included in such a

reconciliation, including, but not limited to, stock-based

compensation expense, acquisition related expense and litigation

settlements. These items are uncertain and depend on various

factors that are outside of the Company’s control or cannot be

reasonably predicted. While we are unable to address the probable

significance of these items, they could have a material impact on

GAAP net income and operating expenses for the guidance period. A

reconciliation of adjusted EBITDA or adjusted operating expenses

would imply a degree of precision and certainty as to these future

items that does not exist and could be confusing to investors.

Forward-Looking Statements

This press release contains forward-looking

statements within the meaning of The Private Securities Litigation

Reform Act of 1995. We may, in some cases, use terms such as

"predicts," "forecasts," "believes," "potential," "proposed,"

"continue," "estimates," "anticipates," "expects," "plans,"

"intends," "may," "could," "might," "should" or other words that

convey uncertainty of future events or outcomes to identify these

forward-looking statements. Examples of forward-looking statements

contained in this press release include, among others, statements

related to our full-year 2025 financial guidance, including

projected product revenue, adjusted operating expenses and adjusted

EBITDA, current and future market opportunities for our products

and our assumptions related thereto, expectations (financial or

otherwise) and intentions, and other statements that are not

historical facts. Such statements are subject to numerous important

factors, risks and uncertainties that may cause actual events or

results, performance, or achievements to differ materially from the

Company's current expectations, including risks relating to, among

others: unknown liabilities; risks related to future opportunities

and plans for our products, including uncertainty of the expected

financial performance of such products; our ability to

commercialize and grow sales of our products; our ability to

successfully integrate the operations of Ironshore into our

organization, and realize the anticipated benefits associated with

the acquisition; our ability to manage our relationships with

licensors; the success of competing products that are or become

available; our ability to maintain regulatory approval of our

products, and any related restrictions, limitations, and/or

warnings in the label of our products; the size of the markets for

our products, and our ability to service those markets; our ability

to obtain reimbursement and third-party payor contracts for our

products; the rate and degree of market acceptance of our products;

the costs of commercialization activities, including marketing,

sales and distribution; changing market conditions for our

products; the outcome of any patent infringement or other

litigation that may be brought by or against us; the outcome of any

governmental investigation related to our business; our ability to

secure adequate supplies of active pharmaceutical ingredient for

each of our products and manufacture adequate supplies of

commercially saleable inventory; our ability to obtain funding for

our operations and business development; regulatory developments in

the U.S.; our expectations regarding our ability to obtain and

maintain sufficient intellectual property protection for our

products; our ability to comply with stringent U.S. and

foreign government regulation in the manufacture of pharmaceutical

products, including U.S. Drug Enforcement Agency, or DEA,

compliance; our customer concentration; and the accuracy of our

estimates regarding expenses, revenue, capital requirements and

need for additional financing. These and other risks are described

under the heading "Risk Factors" in our Annual Reports on Form 10-K

and Quarterly Reports on Form 10-Q and other filings with

the SEC. Any forward-looking statements that we make in this

press release speak only as of the date of this press release. We

assume no obligation to update our forward-looking statements

whether as a result of new information, future events or otherwise,

after the date of this press release.

Investor Contact:Argot

Partnersir@collegiumpharma.com

Media Contact:Cheryl

WheelerHead of Corporate

Communicationscommunications@collegiumpharma.com

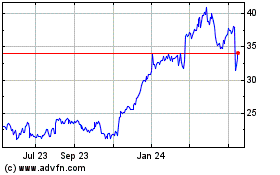

Collegium Pharmaceutical (NASDAQ:COLL)

Historical Stock Chart

From Dec 2024 to Jan 2025

Collegium Pharmaceutical (NASDAQ:COLL)

Historical Stock Chart

From Jan 2024 to Jan 2025