Core Scientific Falls After Filing for Bankruptcy

21 December 2022 - 10:51PM

Dow Jones News

By Will Feuer

Shares of Core Scientific Inc., which went public last year

through a merger with a special-purpose acquisition company,

declined after the cryptocurrency mining company filed for chapter

11 bankruptcy protection.

The stock, already down 98% this year, fell another 15% to 18

cents a share in premarket trading on Wednesday.

The company said earlier Wednesday that it would continue to

operate its self-mining cryptocurrency and hosting operations. Core

Scientific said these operations are cash-flow positive on a

debt-free basis.

The prolonged decline of the value of bitcoin as well as surging

electricity costs pushed the company into bankruptcy, Core

Scientific said. Certain hosting customers also failed to honor

their payment obligations.

Last week, shares of Core Scientific popped after one of its

largest creditors, B. Riley Financial Inc., offered the company

fresh financing to stave off bankruptcy. B. Riley last week wrote

an open letter to the firm suggesting that it was willing to give

Core Scientific $40 million immediately, and an additional $32

million following stipulations that included the price of bitcoin

rising above $18,500.

Bitcoin recently traded at about $16,868 a coin, about 65% lower

since the start of the year.

Core Scientific had agreed in July 2021 to merge with Power

& Digital Infrastructure Acquisition Corp., a SPAC, in a deal

the companies valued at about $4.3 billion.

Write to Will Feuer at Will.Feuer@wsj.com

(END) Dow Jones Newswires

December 21, 2022 06:36 ET (11:36 GMT)

Copyright (c) 2022 Dow Jones & Company, Inc.

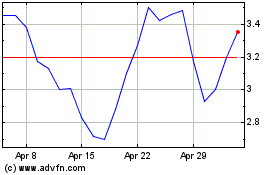

Core Scientific (NASDAQ:CORZ)

Historical Stock Chart

From Mar 2024 to Apr 2024

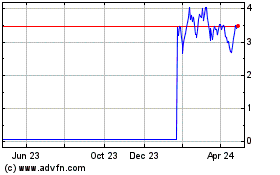

Core Scientific (NASDAQ:CORZ)

Historical Stock Chart

From Apr 2023 to Apr 2024