- Operated approximately 218,000 owned and hosted bitcoin

miners

- Produced 1,027 self-mined bitcoin and an estimated 354 bitcoin

from hosted miners in January

- Expanded self-mining energized hash rate by 1.7 EH/s with new

miner deployments

- Improved self-mining fleet energy efficiency by five percent,

to 26.44 Joules per Terahash (J/TH)

Core Scientific, Inc. (Nasdaq: CORZ, CORZW, CORZZ)

("Core Scientific" or “the Company”), a leader in bitcoin mining

and infrastructure for high-value compute, today released

production and operations updates for January 2024.

“Core Scientific produced 13,762 bitcoin in 2023, more than any

other listed company in North America and providing strong momentum

as we entered into 2024,” said Adam Sullivan, Core Scientific’s

Chief Executive Officer. “In January we relisted on Nasdaq with a

strengthened balance sheet, a pathway to reduce leverage further

and a pragmatic growth plan for an additional 72 megawatts of

infrastructure at our existing Texas sites this year.”

“Our ongoing deployment of new, more efficient miners in January

not only increased our energized hash rate, but also improved our

fleet efficiency. Along with multiple additional initiatives well

underway, we believe improving our fleet efficiency helps to

position us more favorably for the upcoming halving,” Mr. Sullivan

added.

Key Metrics Summary

Metric

January

2024

December

2023

Self-Mining Bitcoin Produced1

1,027

1,177

Hosting Bitcoin Produced2

354

449

Average Self-Mined Bitcoin

Produced/Day

33.1

38.0

Self-Mining Energized Hash rate3

18.6

16.9

Hosting Energized Hash rate4

6.2

6.3

Total Energized Hash rate

24.8

23.2

Bitcoin Sold

1,114

1,211

Bitcoin Sales Proceeds ($USD)

Appx. $47.8 million

Appx. $51.2 million

Average Self-Mining Fleet Efficiency

(J/TH)5

26.44

27.94

Data Centers

As of month-end, the Company operated approximately 218,000

bitcoin miners for both self-mining and hosting, representing a

total energized hash rate of 24.8 EH/s at its data centers in

Georgia, Kentucky, North Carolina, North Dakota and Texas.

Self-Mining

Core Scientific produced 1,027 bitcoin in January from its owned

fleet of miners. As of month end, the Company operated

approximately 167,000 owned bitcoin miners, accounting for

approximately 77% of its total number of miners and representing a

total energized hash rate of 18.6 EH/s.

Hosting Services

In addition to its self-mining fleet, Core Scientific provided

data center hosting services, technology and operating support for

approximately 51,000 hosted, customer-owned bitcoin miners,

representing approximately 23% of the bitcoin miners operating in

the Company’s data centers as of January 31. Customer-owned bitcoin

miners produced approximately 354 bitcoin in January, including

bitcoin rewards paid to the Company pursuant to proceeds sharing

agreements.

Grid Support

The Company reduced the consumption of power at its data centers

on several occasions in January, delivering 18,487 megawatt hours

to local grid partners. By supporting the grid in such a fashion,

Core Scientific helps grid operators keep power flowing to their

customers when temperatures rise and air conditioning use

increases, and when temperatures drop and heating use increases.

Core Scientific works with utility companies and the communities in

which it operates to enhance electrical grid stability.

New Miner Deployments

The Company completed the deployment of 28,400 new Bitmain S19j

XP miners procured from Bitmain under a contract announced on

September 21, 2023. The new miners are rated to operate at between

141 and 151 Terahash (“TH”) and an average of approximately 22

J/TH, increasing energized hash rate while also helping to improve

the efficiency of the Company’s self-mining fleet. Core Scientific

expects to deploy an additional 12,600 Bitmain S21 miners by the

end of July 2024, representing 2.5 EH/s in energized hash rate and

operating at 17.5 J/TH.

Shareholder Inquiries

The following reflects questions received from shareholders

regarding Core Scientific’s listing on the Nasdaq Global Select

Market on January 24, 2024, with responses and references provided

by the Company:

The Company issued the following securities as part of its

emergence and listing:

Security

Type

CUSIP

No.

Ticker

New Common Stock

21874A 106

CORZ

Tranche 1 Warrants

21874A 114

CORZW

Tranche 2 Warrants

21874A 130

CORZZ

New Convertible Notes

21874A AB2

N/A

New Secured Notes

21874A AA4

N/A

Contingent Value Rights

21874A 122

N/A

Core Scientific published an Emergence Update presentation on

January 22, 2024, providing information of interest to shareholders

and noteholders. Answers to the following questions can be found

below or on the presentation slide numbers referenced below:

No.

Question

Response

1

What is the duration and exercise

price of the new warrants?

Tranche 1 warrants: 3 years, $6.71 Tranche

2 warrants: 5 years, $8.72 See slide #20 of January 22, 2024

Emergence Update Slides

2

What is the Company’s capital

structure as of the listing date?

See slide #9 of January 22, 2024 Emergence

Update Slides

3

How many shares of new stock have

been issued?

The Company issued 184,998,580 shares of

New Common Stock

4

How do I contact

Computershare?

+1-800-564-6253

5

What should I have received if I

held my old Core Scientific shares as of the effective date?

See slide #19 and #20 of January 22, 2024

Emergence Update Slides

ABOUT CORE SCIENTIFIC

Core Scientific is one of the largest bitcoin miners and hosting

solutions providers for bitcoin mining in North America.

Transforming energy into high value compute with superior

efficiency at scale, Core Scientific has designed, developed and

operated high-power infrastructure for digital asset mining in

North America since 2017. The Company’s dedicated technology team

develops and delivers a full suite of proprietary hardware and

software solutions for infrastructure, energy and fleet management

to increase operating efficiency, productivity and capability. Core

Scientific’s data centers are located in Georgia, Kentucky, North

Carolina, North Dakota and Texas. To learn more, visit

http://www.corescientific.com.

FORWARD LOOKING STATEMENTS AND EXPLANATORY NOTES

This press release includes “forward-looking statements” within

the meaning of the Private Securities Litigation Reform Act of

1995. Forward-looking statements may be identified by the use of

words such as “estimate,” “plan,” “project,” “forecast,” “intend,”

“will,” “expect,” “anticipate,” “believe,” “seek,” “target” or

other similar expressions that predict or indicate future events or

trends or that are not statements of historical matters. The

Company’s actual results may differ materially from those

anticipated in these forward-looking statements as a result of

certain risks and other factors, which could include, but are not

limited to, the following: risks and uncertainties relating to the

Company’s ability to achieve significant cash flows from

operations; the effects of the emergence from the Company’s chapter

11 cases on the Company’s liquidity, results of operations and

business; the trading price and volatility of the Company’s common

stock; the comparability of the Company’s post-emergence financial

results to its historical results and the projections filed with

the bankruptcy court in the Company’s chapter 11 cases; changes in

the Company’s business strategy and performance, including as a

result of changes to the Company’s board of directors or

management; the possibility that the Company may be unable to

achieve its business and strategic goals; the Company’s

post-bankruptcy capital structure; attraction and retention of key

personnel; the Company’s ability to achieve expected benefits from

restructuring activities; restrictions on the Company’s operations

contained in the agreements governing the Company’s indebtedness;

the Company’s ability to generate sufficient cash to reduce its

indebtedness and its potential need and ability to incur further

indebtedness; the impact of the halving event; actions taken by

third parties, including the Company’s creditors and other

stakeholders, as well as other risk factors set forth in the

Company’s Annual Report on Form 10-K and Quarterly Reports on Form

10-Q filed with the Securities and Exchange Commission. These

statements are provided for illustrative purposes only and are

based on various assumptions, whether or not identified in this

press release, and on the current expectations of the Company’s

management. These forward-looking statements are not intended to

serve, and must not be relied on by any investor, as a guarantee,

an assurance, a prediction or a definitive statement of fact or

probability. Actual events and circumstances are difficult or

impossible to predict and will differ from assumptions. Many actual

events and circumstances are beyond the control of the Company.

These forward-looking statements are subject to a number of risks

and uncertainties, including those identified in the Company’s

reports filed with the U.S. Securities & Exchange Commission,

and if any of these risks materialize or our assumptions prove

incorrect, actual results could differ materially from the results

implied by these forward-looking statements. Accordingly, undue

reliance should not be placed upon the forward-looking

statements.

Please follow us on:

https://www.linkedin.com/company/corescientific/

https://twitter.com/core_scientific

1 Self-Mining Bitcoin Produced represents bitcoin

rewards produced by bitcoin miners owned and operated by Core

Scientific 2 Hosting Bitcoin Produced represents

estimated bitcoin rewards produced by hosted customer-owned miners

operated by Core Scientific, including bitcoin rewards paid to the

Company pursuant to proceeds sharing agreements 3 Self-Mining

Energized Hash Rate represents the total rated capacity of all

Company-owned bitcoin miners installed and operating in Core

Scientific’s data centers 4 Hosting Energized Hash Rate

represents the total rated capacity of all hosted bitcoin miners

owned by customers, installed and operating in Core Scientific’s

data centers 5 Average Self-Mining Fleet Efficiency (J/TH)

represents the weighted average power consumption in Joules per

terahash based on the rated efficiency and capacity of each model

of miner operating in Core Scientific’s owned self-mining fleet

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240205442857/en/

Investors: ir@corescientific.com Media:

press@corescientific.com

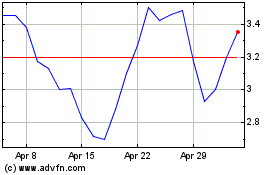

Core Scientific (NASDAQ:CORZ)

Historical Stock Chart

From Mar 2024 to Apr 2024

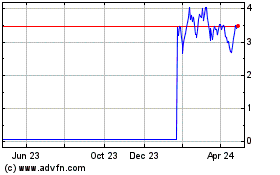

Core Scientific (NASDAQ:CORZ)

Historical Stock Chart

From Apr 2023 to Apr 2024