0001447362FALSE00014473622025-02-272025-02-27

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 27, 2025

Castle Biosciences, Inc.

(Exact name of registrant as specified in its charter) | | | | | | | | | | | | | | |

| | | | | |

| Delaware | | 001-38984 | | 77-0701774 |

(state or other jurisdiction

of incorporation) | | (Commission

File Number) | | (I.R.S. Employer

Identification No.) |

| | | | | | | | | | | | | | |

| 505 S. Friendswood Drive, Suite 401 Friendswood, Texas | | 77546 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (866) 788-9007

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

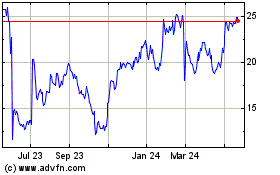

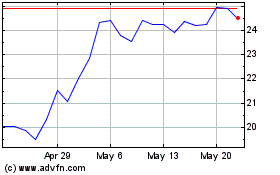

| Common Stock, $0.001 par value per share | | CSTL | | The Nasdaq Global Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b–2 of the Securities Exchange Act of 1934 (§ 240.12b–2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On February 27, 2025, Castle Biosciences, Inc. (the “Company”) issued a press release announcing its financial results for the fourth quarter and year ended December 31, 2024. A copy of the press release is attached hereto as Exhibit 99.1 and incorporated herein by reference.

The information contained or incorporated in this Current Report on Form 8-K, including Exhibit 99.1, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed to be incorporated by reference into any filing under the Exchange Act or the Securities Act of 1933, as amended (the “Securities Act”), except as expressly set forth by specific reference in such filing to this Current Report on Form 8-K.

Item 7.01 Regulation FD Disclosure.

On February 27, 2025, the Company made available the slide presentations attached hereto as Exhibit 99.2 and Exhibit 99.3. Information from these slide presentations may also be used by the management of the Company in future meetings regarding the Company.

The information contained or incorporated in this Item 7.01 of this Current Report on Form 8-K, including Exhibit 99.2 and Exhibit 99.3, shall not be deemed “filed” for purposes of Section 18 of the Exchange Act or otherwise subject to the liabilities of that section, nor shall it be deemed to be incorporated by reference into any filing under the Exchange Act or the Securities Act except as expressly set forth by specific reference in such filing to this Current Report on Form 8-K.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits. | | | | | | | | |

| Exhibit | | |

| Number | | Description |

| 99.1 | | |

| 99.2 | | |

| 99.3 | | |

| 104 | | Inline XBRL for the cover page of this Current Report on Form 8-K. |

| | |

| SIGNATURES |

|

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | | | | | | | | |

| CASTLE BIOSCIENCES, INC. |

| | | |

| | | |

| By: | /s/ Frank Stokes | |

| | Frank Stokes | |

| | Chief Financial Officer | |

Date: February 27, 2025 | | | |

Exhibit 99.1

Castle Biosciences Reports Fourth Quarter and Full-Year 2024 Results

Full-year 2024 revenue of $332 million, an increase of 51% compared to 2023 and above previously reported guidance

Delivered 96,071 total test reports in 2024, an increase of 36% compared to 2023

Year-end 2024 cash, cash equivalents and marketable investment securities of $293 million, a $50 million increase compared to 2023

Anticipate generating between $280-295 million in total revenue in 2025

Conference call and webcast today at 4:30 p.m. ET

FRIENDSWOOD, Texas - Feb. 27, 2025--Castle Biosciences, Inc. (Nasdaq: CSTL), a company improving health through innovative tests that guide patient care, today announced its financial results for the fourth quarter and year ended December 31, 2024.

“Castle delivered an outstanding fourth quarter that rounded out an exceptional 2024, including 51% revenue growth and 36% test report volume growth compared to 2023,” said Derek Maetzold, president and chief executive officer of Castle Biosciences. “I am incredibly proud of our team's hard work in achieving these results, including achieving our previously provided 2025 revenue guidance range one year ahead of expectations.

“We are extremely pleased with the progress we made across our initiatives in 2024 in the areas of our core growth drivers, including a 17% increase in our dermatologic test reports (DecisionDx®-Melanoma and DecisionDx®-SCC combined) and a 130% increase in our TissueCypher® Barrett’s Esophagus test reports, over 2023. We believe this was driven largely by the clinical value of our tests, strong execution on our commercial strategy and expansion of our clinical evidence base.

“Building on our momentum and successes, we expect to continue to focus on delivering operational excellence. Further, sound capital allocation remains a priority, including pursuing strategic opportunities, aimed at driving stockholder value in 2025 and beyond.”

Twelve Months Ended December 31, 2024, Financial and Operational Highlights

•Revenues were $332.1 million, a 51% increase compared to $219.8 million in 2023.

•Adjusted Revenues, which exclude the effects of revenue adjustments related to tests delivered in prior periods, were $333.8 million, a 49% increase compared to $224.3 million in 2023.

•Delivered 96,071 total test reports in 2024, an increase of 36% compared to 70,429 in 2023:

◦DecisionDx-Melanoma test reports delivered in 2024 were 36,008, compared to 33,330 in 2023.

◦DecisionDx-SCC test reports delivered in 2024 were 16,348, compared to 11,442 in 2023.

◦MyPath® Melanoma test reports delivered in 2024 were 3,909, compared to 3,962 MyPath Melanoma and DiffDx®-Melanoma aggregate test reports in 2023.

◦TissueCypher Barrett’s Esophagus test reports delivered in 2024 were 20,956, compared to 9,100 in 2023.

◦IDgenetix® test reports delivered in 2024 were 17,151, compared to 10,921 in 2023.

◦DecisionDx®-UM test reports delivered in 2024 were 1,699, compared to 1,674 in 2023.

•Gross margin for 2024 was 79%, and Adjusted Gross Margin was 82%, compared to 75% and 80% respectively for the same periods in 2023.

•Net cash provided by operations was $64.9 million, compared to net cash used in operations of $5.6 million in 2023.

•Net income for 2024, which includes non-cash stock-based compensation expense of $50.3 million, was $18.2 million, compared to a net loss of $57.5 million in 2023.

•Adjusted EBITDA for 2024 was $75.0 million, compared to $(4.4) million in 2023.

Cash, Cash Equivalents and Marketable Investment Securities

As of December 31, 2024, the Company’s cash, cash equivalents and marketable investment securities totaled $293.1 million.

Fourth Quarter Ended December 31, 2024, Financial and Operational Highlights

•Revenues were $86.3 million, a 31% increase compared to $66.1 million during the same period in 2023.

•Adjusted Revenues, which exclude the effects of revenue adjustments related to tests delivered in prior periods, were $85.8 million, a 22% increase compared to $70.2 million for the same period in 2023.

•Delivered 24,071 total test reports, an increase of 19% compared to 20,284 in the same period of 2023:

◦DecisionDx-Melanoma test reports delivered in the quarter were 8,672, compared to 8,591 in the fourth quarter of 2023.

◦DecisionDx-SCC test reports delivered in the quarter were 4,299, compared to 3,530 in the fourth quarter of 2023.

◦MyPath Melanoma test reports delivered in the quarter were 879, compared to 1,018 in the fourth quarter of 2023.

◦TissueCypher Barrett’s Esophagus test reports delivered in the quarter were 6,672, compared to 3,441 in the fourth quarter of 2023.

◦IDgenetix test reports delivered in the quarter were 3,125, compared to 3,299 in the fourth quarter of 2023. In late 2024, the Company made modifications to its promotional investments for IDgenetix, shifting resources to inside sales and non-personal promotion.

◦DecisionDx-UM test reports delivered in the quarter were 424, compared to 405 in the fourth quarter of 2023.

•Gross margin was 76%, and Adjusted Gross Margin was 81%, compared to 78% and 82% respectively for the same periods in 2023.

•Net cash provided by operations was $24.4 million, compared to $18.6 million for the same period in 2023.

•Net income, which includes non-cash stock-based compensation expense of $11.4 million, was $9.6 million, compared to a net loss of $2.6 million for the same period in 2023.

•Adjusted EBITDA was $21.3 million, compared to $9.4 million for the same period in 2023.

2025 Outlook

The Company anticipates generating between $280-295 million in total revenue in 2025.

Fourth Quarter and Recent Accomplishments and Highlights

Dermatology

•DecisionDx-Melanoma: Findings from a prospective, multicenter study demonstrating the significant impact of the DecisionDx-Melanoma test on sentinel lymph node biopsy (SLNB) decision-making for patients with melanoma were recently published in the World Journal of Surgical Oncology; further; no patient with a DecisionDx-Melanoma-predicted risk of SLN positivity of less than 5% who decided to have an SLNB procedure had a positive node.

•DecisionDx-Melanoma: The Company announced the publication of a new independent meta-analysis in Cancers assessing the efficacy of its DecisionDx-Melanoma test in predicting melanoma patient outcomes. The article, titled “The Prognostic Value of the 31-Gene Expression Profile Test in Cutaneous Melanoma: A Systematic Review and Meta-Analysis,” concluded that DecisionDx-Melanoma consistently provides improved risk stratification over staging alone to inform personalized management strategies for patients with cutaneous melanoma (CM). This recently published meta-analysis encompassed 13 peer-reviewed publications involving thousands of patients and affirmed the powerful risk stratification provided by DecisionDx-Melanoma and its potential to significantly improve care for patients with CM. See the Company’s news release from Dec. 12, 2024, for more information.

•DecisionDx-Melanoma: The Company announced the latest data from a prospective, multicenter study exploring the impact of integrating DecisionDx-Melanoma test results into SLNB decision-making for patients recently diagnosed with melanoma. The updated findings demonstrated the power of the test’s results to accurately identify patients with a low risk of metastasis who can safely forgo SLNB, thereby reducing unnecessary SLNB procedures and the associated costs and risks of complications that accompany them. The data was presented in a poster and oral presentation at The European Congress on Dermato-Oncology (Dermato-Onco2024) recently held in Vienna, Austria. See the Company’s news release from Nov. 6, 2024, for more information.

•DecisionDx-SCC: The Company announced that its poster on DecisionDx-SCC was selected as a “Late Breakers” top five finalist for the Akamai Award, recognizing the best posters at Maui Derm Hawaii 2025. Specifically, the poster shared new data from a study involving Castle’s largest cohort of patients with cutaneous squamous cell carcinoma (SCC) to date (n=1,408). This study demonstrated improved risk stratification of patients with SCC tumors located on the head or neck when the test’s results are combined with Brigham and Women’s Hospital (BWH) staging. See the Company’s news release from Jan. 17, 2025, for more information.

Gastroenterology

•The Company announced that it received assay approval from the New York State Department of Health (NYSDOH) for its TissueCypher Barrett’s Esophagus (BE) test. With this approval, all of the tests in Castle’s dermatology, gastroenterology and ophthalmology portfolios, as well as its clinical laboratories in Phoenix and Pittsburgh, are now approved by the state of New York. See the Company’s news release from Jan. 6, 2025, for more information.

Corporate

•The Company announced that it was named a Houston Top Workplace for 2024 by the Houston Chronicle. This was the fourth consecutive year the Company was ranked among the Houston metro area’s top workplaces. Castle also earned three Culture Excellence awards in the areas of Employee Appreciation, Employee Well-Being and Professional Development. See the Company’s news release from Nov. 19, 2024, for more information.

Conference Call and Webcast Details

Castle Biosciences will hold a conference call on Thursday, Feb. 27, 2025, at 4:30 p.m. Eastern time to discuss its fourth quarter and full-year 2024 results and provide a corporate update.

A live webcast of the conference call can be accessed here: https://events.q4inc.com/attendee/686536610 or via the webcast link on the Investor Relations page of the Company’s website, https://ir.castlebiosciences.com/overview/default.aspx. Please access the webcast at least 10 minutes before the conference call start time. An archive of the webcast will be available on the Company’s website until March 20, 2025.

To access the live conference call via phone, please dial 833 470 1428 from the United States, or +1 404 975 4839 internationally, at least 10 minutes prior to the start of the call, using the conference ID 944585.

There will be a brief Question & Answer session following management commentary.

Use of Non-GAAP Financial Measures (UNAUDITED)

In this release, we use the metrics of Adjusted Revenues, Adjusted Gross Margin and Adjusted EBITDA, which are non-GAAP financial measures and are not calculated in accordance with generally accepted accounting principles in the United States (GAAP). Adjusted Revenues and Adjusted Gross Margin reflect adjustments to GAAP net revenues to exclude net positive and/or net negative revenue adjustments recorded in the current period associated with changes in estimated variable consideration related to test reports delivered in previous periods. Adjusted Gross Margin further excludes acquisition-related intangible asset amortization. Adjusted EBITDA excludes from net loss: interest income, interest expense, income tax expense (benefit), depreciation and amortization expense, stock-based compensation expense and change in fair value of trading securities.

We use Adjusted Revenues, Adjusted Gross Margin and Adjusted EBITDA internally because we believe these metrics provide useful supplemental information in assessing our revenue and operating performance reported in accordance with GAAP, respectively. We believe that Adjusted Revenues, when used in conjunction with our

test report volume information, facilitates investors’ analysis of our current-period revenue performance and average selling price performance by excluding the effects of revenue adjustments related to test reports delivered in prior periods, since these adjustments may not be indicative of the current or future performance of our business. We believe that providing Adjusted Revenues may also help facilitate comparisons to our historical periods. Adjusted Gross Margin is calculated using Adjusted Revenues and therefore excludes the impact of revenue adjustments related to test reports delivered in prior periods, which we believe is useful to investors as described above. We further exclude acquisition-related intangible asset amortization in the calculation of Adjusted Gross Margin. We believe that excluding acquisition-related intangible asset amortization may facilitate gross margin comparisons to historical periods and may be useful in assessing current-period performance without regard to the historical accounting valuations of intangible assets, which are applicable only to tests we acquired rather than internally developed. We believe Adjusted EBITDA may enhance an evaluation of our operating performance because it excludes the impact of prior decisions made about capital investment, financing, investing and certain expenses we believe are not indicative of our ongoing performance. However, these non-GAAP financial measures may be different from non-GAAP financial measures used by other companies, even when the same or similarly titled terms are used to identify such measures, limiting their usefulness for comparative purposes.

These non-GAAP financial measures are not meant to be considered in isolation or used as substitutes for net revenues, gross margin or net loss reported in accordance with GAAP; should be considered in conjunction with our financial information presented in accordance with GAAP; have no standardized meaning prescribed by GAAP; are unaudited; and are not prepared under any comprehensive set of accounting rules or principles. In addition, from time to time in the future, there may be other items that we may exclude for purposes of these non-GAAP financial measures, and we may in the future cease to exclude items that we have historically excluded for purposes of these non-GAAP financial measures. Likewise, we may determine to modify the nature of adjustments to arrive at these non-GAAP financial measures. Because of the non-standardized definitions of non-GAAP financial measures, the non-GAAP financial measure as used by us in this press release and the accompanying reconciliation tables have limits in their usefulness to investors and may be calculated differently from, and therefore may not be directly comparable to, similarly titled measures used by other companies. Accordingly, investors should not place undue reliance on non-GAAP financial measures. Reconciliations of these non-GAAP financial measures to the most directly comparable GAAP financial measures are presented in the tables at the end of this release.

About Castle Biosciences

Castle Biosciences (Nasdaq: CSTL) is a leading diagnostics company improving health through innovative tests that guide patient care. The Company aims to transform disease management by keeping people first: patients, clinicians, employees and investors.

Castle’s current portfolio consists of tests for skin cancers, Barrett’s esophagus, mental health conditions and uveal melanoma. Additionally, the Company has active research and development programs for tests in these and other diseases with high clinical need, including its test in development to help guide systemic therapy selection for patients with moderate-to-severe atopic dermatitis seeking biologic treatment. To learn more, please visit www.CastleBiosciences.com and connect with us on LinkedIn, Facebook, X and Instagram.

DecisionDx-Melanoma, DecisionDx-CMSeq, i31-SLNB, i31-ROR, DecisionDx-SCC, MyPath Melanoma, DiffDx-Melanoma, TissueCypher, IDgenetix, DecisionDx-UM, DecisionDx-PRAME and DecisionDx-UMSeq are trademarks of Castle Biosciences, Inc.

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, which are subject to the “safe harbor” created by those sections. These forward-looking statements include, but are not limited to, statements concerning our expectations regarding: our 2025 total revenue guidance of $280-295 million; the impact of non-coverage by Medicare of our DecisionDx-SCC test; our business strategy, including our capital allocation and pursuit of strategic opportunities; the impact of modifications to promotional investments for IDgenetix; the ability of DecisionDx-Melanoma to (i) provide improved risk stratification over staging alone to inform personalized management strategies and significantly improve care for patients with CM and (ii) reduce unnecessary SLNB procedures and the associated costs and risks of complications that accompany them; the

ability of DecisionDx-SCC to improve risk stratification of patients with SCC tumors located on the head or neck when the test’s results are combined with BWH staging; and the growing recognition among clinicians of the value of TissueCypher. The words “anticipate,” “can,” “could,” “expect,” “goal,” “may,” “plan” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. We may not actually achieve the plans, intentions, or expectations disclosed in our forward-looking statements and you should not place undue reliance on our forward-looking statements. Actual results or events could differ materially from the plans, intentions and expectations disclosed in the forward-looking statements that we make. These forward-looking statements involve risks and uncertainties that could cause our actual results to differ materially from those in the forward-looking statements, including, without limitation: our assumptions or expectations regarding continued reimbursement for our products and subsequent coverage decisions; Novitas’ local coverage determination signifying non-coverage by Medicare of our DecisionDx-SCC test; our estimated total addressable markets for our products and product candidates; the expenses, capital requirements and potential needs for additional financing; the anticipated cost, timing and success of our product candidates; our plans to research, develop and commercialize new tests; our ability to successfully integrate new businesses, assets, products or technologies acquired through acquisitions; the effects of macroeconomic events and conditions, including inflation and monetary supply shifts, labor shortages, liquidity concerns at, and failures of, banks and other financial institutions or other disruptions in the banking system or financing markets, recession risks, international tariffs, supply chain disruptions, outbreaks of contagious diseases and geopolitical events (such as the ongoing Israel-Hamas War and Ukraine-Russia conflict), among others, on our business and our efforts to address its impact on our business; the possibility that subsequent study or trial results and findings may contradict earlier study or trial results and findings or may not support the results discussed in this press release, including with respect to the tests discussed in this press release; our planned installation of additional equipment and supporting technology infrastructures and implementation of certain process efficiencies may not enable us to increase the future scalability of our TissueCypher Test; the possibility that the actual application of our tests may not provide the aforementioned benefits to patients; the possibility that our newer gastroenterology and mental health franchises may not contribute to the achievement of our long-term financial targets as anticipated; and the risks set forth under the heading “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2024, each filed or to be filed with the SEC, and in our other filings with the SEC. The forward-looking statements are applicable only as of the date on which they are made, and we do not assume any obligation to update any forward-looking statements, except as may be required by law.

Investor Relations Contact:

Camilla Zuckero

czuckero@castlebiosciences.com

281-906-3868

Media Contact:

Allison Marshall

amarshall@castlebiosciences.com

###

CASTLE BIOSCIENCES, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(in thousands, except per share data)

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

December 31, | | Twelve Months Ended

December 31, |

| 2024 | | 2023 | | | | 2024 | | 2023 | | |

| (unaudited) | | (unaudited) | | | | | | | | |

| NET REVENUES | $ | 86,311 | | | $ | 66,120 | | | | | $ | 332,069 | | | $ | 219,788 | | | |

| OPERATING EXPENSES AND OTHER OPERATING INCOME | | | | | | | | | | | |

| Cost of sales (exclusive of amortization of acquired intangible assets) | 16,183 | | | 12,423 | | | | | 60,205 | | | 44,982 | | | |

| Research and development | 11,773 | | | 12,994 | | | | | 52,041 | | | 53,618 | | | |

| Selling, general and administrative | 49,965 | | | 44,090 | | | | | 200,047 | | | 180,152 | | | |

| Amortization of acquired intangible assets | 4,340 | | | 2,271 | | | | | 11,106 | | | 9,013 | | | |

| | | | | | | | | | | |

| Total operating expenses, net | 82,261 | | | 71,778 | | | | | 323,399 | | | 287,765 | | | |

| Operating income (loss) | 4,050 | | | (5,658) | | | | | 8,670 | | | (67,977) | | | |

| Interest income | 3,372 | | | 3,119 | | | | | 12,916 | | | 10,623 | | | |

| Changes in fair value of trading securities | 555 | | | — | | | | | 555 | | | — | | | |

| Interest expense | (92) | | | (2) | | | | | (577) | | | (11) | | | |

| Income (loss) before income taxes | 7,885 | | | (2,541) | | | | | 21,564 | | | (57,365) | | | |

| Income tax (benefit) expense | (1,705) | | | 39 | | | | | 3,319 | | | 101 | | | |

| Net income (loss) | $ | 9,590 | | | $ | (2,580) | | | | | $ | 18,245 | | | $ | (57,466) | | | |

| | | | | | | | | | | |

| Earnings (loss) per share: | | | | | | | | | | | |

| Basic | $ | 0.34 | | | $ | (0.10) | | | | | $ | 0.66 | | | $ | (2.14) | | | |

| Diluted | $ | 0.32 | | | $ | (0.10) | | | | | $ | 0.62 | | | $ | (2.14) | | | |

| | | | | | | | | | | |

| Weighted-average shares outstanding: | | | | | | | | | | | |

| Basic | 28,126 | | | 27,030 | | | | | 27,776 | | | 26,802 | | | |

| Diluted | 30,200 | | | 27,030 | | | | | 29,255 | | | 26,802 | | | |

Stock-Based Compensation Expense

Stock-based compensation expense is included in the condensed consolidated statements of operations as follows (in thousands):

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

December 31, | | Twelve Months Ended

December 31, |

| 2024 | | 2023 | | | | 2024 | | 2023 | | |

| (unaudited) | | (unaudited) | | | | | | | | |

| Cost of sales (exclusive of amortization of acquired intangible assets) | $ | 1,350 | | | $ | 1,219 | | | | | $ | 5,529 | | | $ | 4,938 | | | |

| Research and development | 1,987 | | | 2,364 | | | | | 9,598 | | | 10,119 | | | |

| Selling, general and administrative | 8,102 | | | 8,219 | | | | | 35,193 | | | 36,162 | | | |

| Total stock-based compensation expense | $ | 11,439 | | | $ | 11,802 | | | | | $ | 50,320 | | | $ | 51,219 | | | |

CASTLE BIOSCIENCES, INC.

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE LOSS

(in thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

December 31, | | Twelve Months Ended

December 31, |

| 2024 | | 2023 | | | | 2024 | | 2023 | | |

| (unaudited) | | (unaudited) | | | | | | | | |

| Net income (loss) | $ | 9,590 | | | $ | (2,580) | | | | | $ | 18,245 | | | $ | (57,466) | | | |

| Other comprehensive (loss) income: | | | | | | | | | | | |

| Net unrealized (loss) gain on debt securities held as available-for-sale | (243) | | | 207 | | | | | 94 | | | 517 | | | |

| Comprehensive income (loss) | $ | 9,347 | | | $ | (2,373) | | | | | $ | 18,339 | | | $ | (56,949) | | | |

CASTLE BIOSCIENCES, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(in thousands) | | | | | | | | | | | |

| |

| December 31, 2024 | | December 31, 2023 |

| ASSETS | | | |

| Current Assets | | | |

| Cash and cash equivalents | $ | 119,709 | | | $ | 98,841 | |

| Marketable investment securities | 173,421 | | | 144,258 | |

| Accounts receivable, net | 51,218 | | | 38,302 | |

| Inventory | 8,135 | | | 7,942 | |

| Prepaid expenses and other current assets | 7,671 | | | 6,292 | |

| Total current assets | 360,154 | | | 295,635 | |

| Long-term accounts receivable, net | 918 | | | 1,191 | |

| Property and equipment, net | 51,122 | | | 25,433 | |

| Operating lease assets | 11,584 | | | 12,306 | |

| Goodwill and other intangible assets, net | 106,229 | | | 117,335 | |

| Other assets – long-term | 1,228 | | | 1,440 | |

| Total assets | $ | 531,235 | | | $ | 453,340 | |

| | | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | | | |

| Current Liabilities | | | |

| Accounts payable | $ | 6,901 | | | $ | 10,268 | |

| Accrued compensation | 32,555 | | | 28,945 | |

| Operating lease liabilities | 1,665 | | | 1,137 | |

| Current portion of long-term debt | 278 | | | — | |

| Other accrued and current liabilities | 7,993 | | | 7,317 | |

| Total current liabilities | 49,392 | | | 47,667 | |

| Long term debt | 9,745 | | | — | |

| Noncurrent operating lease liabilities | 14,345 | | | 14,173 | |

| Noncurrent finance lease liabilities | 311 | | | 25 | |

| Deferred tax liability | 1,607 | | | 206 | |

| Total liabilities | 75,400 | | | 62,071 | |

| | | |

| Stockholders’ Equity | | | |

| Common stock | 28 | | | 27 | |

| Additional paid-in capital | 655,703 | | | 609,477 | |

| Accumulated deficit | (200,126) | | | (218,371) | |

| Accumulated other comprehensive income | 230 | | | 136 | |

| Total stockholders’ equity | 455,835 | | | 391,269 | |

| Total liabilities and stockholders’ equity | $ | 531,235 | | | $ | 453,340 | |

CASTLE BIOSCIENCES, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (Continued)

(in thousands)

| | | | | | | | | | | | | |

| Twelve Months Ended

December 31, |

| 2024 | | 2023 | | |

| OPERATING ACTIVITIES | | | | | |

| Net income (loss) | $ | 18,245 | | | $ | (57,466) | | | |

| Adjustments to reconcile net income (loss) to net cash provided by (used in) operating activities: | | | | | |

| Depreciation and amortization | 15,997 | | | 12,330 | | | |

| Stock-based compensation expense | 50,320 | | | 51,219 | | | |

| | | | | |

| Change in fair value of trading securities | (555) | | | — | | | |

| Deferred income taxes | 1,401 | | | (223) | | | |

| Accretion of discounts on marketable investment securities | (6,685) | | | (5,491) | | | |

| Other | 268 | | | 635 | | | |

| Change in operating assets and liabilities: | | | | | |

| Accounts receivable | (12,643) | | | (14,930) | | | |

| Prepaid expenses and other current assets | (1,142) | | | (435) | | | |

| Inventory | (193) | | | (3,962) | | | |

| Operating lease assets | 1,322 | | | (258) | | | |

| Other assets | 262 | | | (330) | | | |

| Accounts payable | (4,372) | | | 5,707 | | | |

| Operating lease liabilities | (1,289) | | | 852 | | | |

| Accrued compensation | 3,610 | | | 4,587 | | | |

| Other accrued and current liabilities | 320 | | | 2,139 | | | |

| Net cash provided by (used in) operating activities | 64,866 | | | (5,626) | | | |

| | | | | |

| INVESTING ACTIVITIES | | | | | |

| Purchases of marketable investment securities | (205,729) | | | (189,075) | | | |

| Proceeds from maturities of marketable investment securities | 183,900 | | | 186,500 | | | |

| Purchases of property and equipment | (28,326) | | | (13,621) | | | |

| Proceeds from sale of property and equipment | 18 | | | 13 | | | |

| | | | | |

| | | | | |

| Net cash used in investing activities | (50,137) | | | (16,183) | | | |

| | | | | |

| FINANCING ACTIVITIES | | | | | |

| Proceeds from exercise of common stock options | 2,017 | | | 269 | | | |

| Payment of employees’ taxes on vested restricted stock units | (8,762) | | | (5,134) | | | |

| Proceeds from contributions to the employee stock purchase plan | 2,981 | | | 2,709 | | | |

| Repayment of principal portion of finance lease liabilities | (97) | | | (142) | | | |

| | | | | |

| Proceeds from issuance of term debt | 10,000 | | | — | | | |

| Net cash provided by (used in) financing activities | 6,139 | | | (2,298) | | | |

| | | | | |

| NET CHANGE IN CASH AND CASH EQUIVALENTS | 20,868 | | | (24,107) | | | |

| Beginning of year | 98,841 | | | 122,948 | | | |

| End of year | $ | 119,709 | | | $ | 98,841 | | | |

| | | | | |

| | | | | |

| | | | | |

CASTLE BIOSCIENCES, INC.

Reconciliation of Non-GAAP Financial Measures (UNAUDITED)

The table below presents the reconciliation of adjusted revenues and adjusted gross margin, which are non-GAAP financial measures. See "Use of Non-GAAP Financial Measures (UNAUDITED)" above for further information regarding the Company's use of non-GAAP financial measures.

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

December 31, | | Twelve Months Ended

December 31, |

| 2024 | | 2023 | | | | 2024 | | 2023 | | |

| (in thousands) | | | | | | | | | | | |

| Adjusted revenues | | | | | | | | | | | |

| Net revenues (GAAP) | $ | 86,311 | | $ | 66,120 | | | | $ | 332,069 | | $ | 219,788 | | |

| Revenue associated with test reports delivered in prior periods | (491) | | 4,086 | | | | 1,751 | | 4,476 | | |

| Adjusted revenues (Non-GAAP) | $ | 85,820 | | $ | 70,206 | | | | $ | 333,820 | | $ | 224,264 | | |

| | | | | | | | | | | |

| Adjusted gross margin | | | | | | | | | | | |

Gross margin (GAAP)1 | $ | 65,788 | | $ | 51,426 | | | | $ | 260,758 | | $ | 165,793 | | |

| Amortization of acquired intangible assets | 4,340 | | 2,271 | | | | 11,106 | | 9,013 | | |

| Revenue associated with test reports delivered in prior periods | (491) | | 4,086 | | | | 1,751 | | 4,476 | | |

| Adjusted gross margin (Non-GAAP) | $ | 69,637 | | $ | 57,783 | | | | $ | 273,615 | | $ | 179,282 | | |

| | | | | | | | | | | |

Gross margin percentage (GAAP)2 | 76.2 | % | | 77.8 | % | | | | 78.5 | % | | 75.4 | % | | |

Adjusted gross margin percentage (Non-GAAP)3 | 81.1 | % | | 82.3 | % | | | | 82.0 | % | | 79.9 | % | | |

1.Calculated as net revenues (GAAP) less the sum of cost of sales (exclusive of amortization of acquired intangible assets) and amortization of acquired intangible assets.

2.Calculated as gross margin (GAAP) divided by net revenues (GAAP).

3.Calculated as adjusted gross margin (Non-GAAP) divided by adjusted revenues (Non-GAAP).

The table below presents the reconciliation of adjusted EBITDA, which is a non-GAAP financial measure. See "Use of Non-GAAP Financial Measures (UNAUDITED)" above for further information regarding the Company's use of non-GAAP financial measures.

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

December 31, | | Twelve Months Ended

December 31, |

| 2024 | | 2023 | | | | 2024 | | 2023 | | |

| (in thousands) | | | | | | | | | | | |

| Adjusted EBITDA | | | | | | | | | | | |

| Net income (loss) | $ | 9,590 | | | $ | (2,580) | | | | | $ | 18,245 | | | $ | (57,466) | | | |

| Interest income | (3,372) | | | (3,119) | | | | | (12,916) | | | (10,623) | | | |

| Interest expense | 92 | | | 2 | | | | | 577 | | | 11 | | | |

| Income tax (benefit) expense | (1,705) | | | 39 | | | | | 3,319 | | | 101 | | | |

| Depreciation and amortization expense | 5,768 | | | 3,224 | | | | | 15,997 | | | 12,330 | | | |

| Stock-based compensation expense | 11,439 | | | 11,802 | | | | | 50,320 | | | 51,219 | | | |

| Changes in fair value of trading securities | (555) | | | — | | | | | (555) | | | — | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Adjusted EBITDA (Non-GAAP) | $ | 21,257 | | | $ | 9,368 | | | | | $ | 74,987 | | | $ | (4,428) | | | |

©2025 Castle Biosciences 1 Empowering people, informing care decisions Fourth Quarter 2024 February 27, 2025

©2025 Castle Biosciences 2 Disclaimers Forward-Looking Statements This presentation contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, which are subject to the “safe harbor” created by those sections. These forward-looking statements include, but are not limited to, statements concerning: our positioning for continued growth and value creation; our estimated U.S. total addressable market for our commercially available tests; our ongoing studies generating data and their impact on driving adoption of our tests; study observations and interpretations of study data, including conclusions about the benefits and impact of our tests on treatment decisions and patient outcomes; our ability to advance penetration of our tests with clinicians and payers; our ability to carry out our commercial strategies; our ability to be net operating cash flow positive by the end of 2025; our future approach to capital allocation; our expected launch of our pipeline expansion by the end of 2025; and the timing and achievement of program milestones. The words “anticipates,” “can,” “could,” “estimates,” “expects,” “may,” “potential,” “target” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. We may not actually achieve the plans, intentions, or expectations disclosed in our forward-looking statements and you should not place undue reliance on our forward-looking statements. Actual results or events could differ materially from the plans, intentions and expectations disclosed in the forward-looking statements that we make. These forward-looking statements involve risks and uncertainties that could cause our actual results to differ materially from those in the forward-looking statements, including, without limitation: our estimates and assumptions underlying our estimated U.S. total addressable market for our commercially available tests; our assumptions or expectations regarding continued reimbursement for our products and subsequent coverage decisions; Novitas’ local coverage determination signifying non-coverage by Medicare of our DecisionDx-SCC test; our estimated total addressable markets for our products and product candidates; the expenses, capital requirements and potential needs for additional financing, the anticipated cost, timing and success of our product candidates; our plans to research, develop and commercialize new tests; our ability to successfully integrate new businesses, assets, products or technologies acquired through acquisitions; the effects of macroeconomic events and conditions, including inflation and monetary supply shifts, tariffs and disruptions to trade, labor shortages, liquidity concerns at, and failures of, banks and other financial institutions or other disruptions in the banking system or financing markets and recession risks, supply chain disruptions, outbreaks of contagious diseases and geopolitical events (such as the ongoing Israel-Hamas War and Ukraine-Russia conflict), among others, on our business and our efforts to address its impact on our business; the possibility that subsequent study or trial results and findings may contradict earlier study or trial results and findings or may not support the results discussed in this presentation, including with respect to the diagnostic and prognostic tests discussed in this presentation; our planned installation of additional equipment and supporting technology infrastructures and implementation of certain process efficiencies may not enable us to increase the future scalability of our TissueCypher Test; the possibility that actual application of our tests may not provide the anticipated benefits to patients; the possibility that our newer gastroenterology and mental health franchises may not contribute to the achievement of our long-term financial targets as anticipated; and the risks set forth under the heading “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2024, filed or to be filed with the SEC, and in our other filings with the SEC. The forward-looking statements are applicable only as of the date on which they are made, and we do not assume any obligation to update any forward-looking statements, except as may be required by law.

©2025 Castle Biosciences 3 Disclaimers Financial Information; Non-GAAP Financial Measures In this presentation, we use the metrics of Adjusted Revenues, Adjusted Gross Margin and Adjusted EBITDA, which are non-GAAP financial measures and are not calculated in accordance with generally accepted accounting principles in the United States (GAAP). Adjusted Revenues and Adjusted Gross Margin reflect adjustments to GAAP net revenues to exclude net positive and/or net negative revenue adjustments recorded in the current period associated with changes in estimated variable consideration related to test reports delivered in previous periods. Adjusted Gross Margin further excludes acquisition-related intangible asset amortization. Adjusted EBITDA excludes from net income (loss): interest income, interest expense, income tax expense (benefit), depreciation and amortization expense, stock-based compensation expense and change in fair value of trading securities. We use Adjusted Revenues, Adjusted Gross Margin and Adjusted EBITDA internally because we believe these metrics provide useful supplemental information in assessing our revenue and operating performance reported in accordance with GAAP, respectively. We believe that Adjusted Revenues, when used in conjunction with our test report volume information, facilitates investors’ analysis of our current-period revenue performance and average selling price performance by excluding the effects of revenue adjustments related to test reports delivered in prior periods, since these adjustments may not be indicative of the current or future performance of our business. We believe that providing Adjusted Revenues may also help facilitate comparisons to our historical periods. Adjusted Gross Margin is calculated using Adjusted Revenues and therefore excludes the impact of revenue adjustments related to test reports delivered in prior periods, which we believe is useful to investors as described above. We further exclude acquisition-related intangible asset amortization in the calculation of Adjusted Gross Margin. We believe that excluding acquisition-related intangible asset amortization may facilitate gross margin comparisons to historical periods and may be useful in assessing current-period performance without regard to the historical accounting valuations of intangible assets, which are applicable only to tests we acquired rather than internally developed. We believe Adjusted EBITDA may enhance an evaluation of our operating performance because it excludes the impact of prior decisions made about capital investment, financing, investing and certain expenses we believe are not indicative of our ongoing performance. However, these non-GAAP financial measures may be different from non-GAAP financial measures used by other companies, even when the same or similarly titled terms are used to identify such measures, limiting their usefulness for comparative purposes. These non-GAAP financial measures are not meant to be considered in isolation or used as substitutes for net revenues, gross margin, or net income (loss) reported in accordance with GAAP; should be considered in conjunction with our financial information presented in accordance with GAAP; have no standardized meaning prescribed by GAAP; are unaudited; and are not prepared under any comprehensive set of accounting rules or principles. In addition, from time to time in the future, there may be other items that we may exclude for purposes of these non- GAAP financial measures, and we may in the future cease to exclude items that we have historically excluded for purposes of these non-GAAP financial measures. Likewise, we may determine to modify the nature of adjustments to arrive at these non-GAAP financial measures. Because of the non-standardized definitions of non-GAAP financial measures, the non-GAAP financial measure as used by us in this press release and the accompanying reconciliation tables have limits in their usefulness to investors and may be calculated differently from, and therefore may not be directly comparable to, similarly titled measures used by other companies. Accordingly, investors should not place undue reliance on non-GAAP financial measures. Reconciliations of these non-GAAP financial measures to the most directly comparable GAAP financial measures are presented in the tables at the end of this presentation. Industry and Market Data This presentation includes certain information and statistics obtained from third-party sources. The Company has not independently verified the accuracy or completeness of any such third- party information.

©2025 Castle Biosciences 4 Registered Trademarks DecisionDx-Melanoma, DecisionDx-CMSeq, i31-SLNB, i31-ROR, DecisionDx-SCC, MyPath Melanoma, DiffDx- Melanoma, TissueCypher, IDgenetix, DecisionDx-UM, DecisionDx-PRAME and DecisionDx-UMSeq are trademarks of Castle Biosciences, Inc.

©2025 Castle Biosciences 5 Proven strategy designed to drive value creation for our stakeholders FOCUS on best/first-in-class tests with high, unmet clinical need and significant market opportunity BUILD robust clinical evidence PENETRATE target markets to further test adoption by clinicians and payers

©2025 Castle Biosciences 6 Key 2024 and recent results 1 TissueCypher Barrett’s Esophagus test surpassed 25,000 test reports delivered since the Company’s acquisition of the test at the end of 2021 4 Gross Margin for 2024 was 79%, and Adjusted Gross Margin was 82%, compared to 75% and 80% respectively in 2023 5 Net cash provided by operations in 2024 was $64.9 million, compared to $5.6 million net cash used in operations in 2023 6 Delivered strong 2024 results, highlighted by year-over-year growth in our total test report volume (+36%) and revenue (+51%) As of Dec. 31, 2024, cash, cash equivalents and marketable investment securities totaled $293.1 million 7 Adjusted EBITDA for 2024 was $75.0 million, compared to $(4.4) million in 2023 Findings from a prospective, multicenter study demonstrating the significant impact of the DecisionDx-Melanoma test on sentinel lymph node biopsy (SLNB) decision-making for patients with melanoma were published in the World Journal of Surgical Oncology, further no patient with a DecisionDx-Melanoma-predicted risk of SLN positivity of less than 5% who decided to have an SLNB procedure had a positive node 2 3 Adjusted Gross Margin and Adjusted EBITDA are non-GAAP measures. See non-GAAP reconciliations at the end of this presentation for a reconciliation of Adjusted Gross Margin and Adjusted EBITDA to their most closely comparable GAAP measures.

©2025 Castle Biosciences 7 Data from the DecisionDx-Melanoma prospective, multicenter CONNECTION study was successful at predicting which patients with T1 tumors have a low risk of SLN positivity DecisionDx-Melanoma correctly identified a population of patients with very low risk of SLN positivity who could have avoided a sentinel lymph node biopsy If DecisionDx-Melanoma was used in these patients to direct SLNB decisions, there could have been a 64% reduction in SLNB surgical procedures DecisionDx-Melanoma Predicted <5% Risk Group DecisionDx-Melanoma Predicted ≥5% Risk Group T1 1.6% 5.7% SLN positivity rates among those with T1 tumors Marks, The i31-GEP identifies patients with T1 cutaneous melanoma who can safely avoid sentinel lymph node biopsy: Results from a prospective, multicenter study. Video abstract presented at: 2024 American Society for Dermatologic Surgery (ASDS) Annual Meeting; SLN(B)=sentinel lymph node (biopsy) BUILD

©2025 Castle Biosciences 8 Patients with low-risk DecisionDx-Melanoma test results who did not undergo SLNB have high recurrence-free survival (RFS) (three-year recurrence free survival rate of 99.5%) 3-year RFS (95% CI) Recurrence, % (n/N) 99.5% (98.7-100%) 0.5% (2/367) <5% risk of SLN positivity by i31-GEP who did not undergo SLNB RFS in patients with <5% risk (DecisionDx- Melanoma) who did not undergo SLNB BUILD S u rv iv al P ro b ab ili ty Time (years) Marks, The i31-GEP identifies patients with T1 cutaneous melanoma who can safely avoid sentinel lymph node biopsy: Results from a prospective, multicenter study. Video abstract presented at: 2024 American Society for Dermatologic Surgery (ASDS) Annual Meeting; SLN(B)=sentinel lymph node (biopsy)

©2025 Castle Biosciences 9 Evidence from prospective studies supporting DecisionDx-Melanoma demonstrates: DecisionDx- Melanoma low-risk, Class 1A patients who forego an SLNB have high recurrence-free survival DecisionDx- Melanoma low-risk test results are associated with very low SLNB positive outcomes Physicians are using DecisionDx-Melanoma to inform clinical decisions about sentinel lymph node biopsy (SLNB) and performing fewer SLNBs Guenther, JM, et al. Society of Surgical Oncology SSO 2024 Annual Meeting. Ann Surg Oncol 31 (Suppl 1), S32 (2024). Yamamoto et al. CMRO. 2023. Guenther et al. World J. Surg. Oncol. 2025 1 2 3 BUILD

©2025 Castle Biosciences 10 DecisionDx-SCC Has Consistently Demonstrated High Value Patients in Guiding SCC Treatment Pathways DecisionDx-SCC launched commercially 2020 2021 2022 2023 2024 Number of peer-reviewed publications 1 2 4 5 4 Somani et al. – Integrating DecisionDx-SCC to guide ART decisions for SCC patients could result in substantial Medicare healthcare savings of up to ~$972 million annually. Moody et al. – Study demonstrated that ART selection based upon clinicopathologic factors and vague guideline recommendations is inconsistent and integration of DecisionDx-SCC improves identification of patients who are likely or unlikely to benefit from ART. 2019 SCC=cutaneous squamous cell carcinoma, ART=adjuvant radiation therapy, NCCN=National Comprehensive Cancer Network, BWH=Brigham and Women’s Hospital, AJCC8=American Joint Committee on Cancer 8th Edition Gopal et al. – Multi-disciplinary expert consensus guidelines show integration of DecisionDx-SCC testing and AJCC8 staging within NCCN guidelines to improve precision in ART recommendations based on which patients are at the highest risk for metastasis and most likely to benefit from treatment. Wysong et al. – Study of 897 patients analyzed the independent performance of DecisionDx-SCC from risk factors and staging systems and demonstrated significantly improved predictive accuracy when test results were integrated with NCCN guidelines and AJCC8 and BWH staging to guide risk-appropriate treatment pathway decisions. Arron et al. – Largest study ever published to evaluate use of ART in SCC. Propensity matched study design demonstrated that DecisionDx- SCC predicted which high risk SCC patients would likely benefit and which would not. Ruiz et al. – Second largest study ever published to evaluate use of ART in SCC. As with the prior Arron study, this study also demonstrated that DecisionDx-SCC predicted which high risk SCC patients would likely benefit and which would not. 6 Study Demonstrating Risk Stratification Value in High-Risk SCC Studies Demonstrating Predictive Value of ART in High-Risk SCC Consensus guideline study Study Demonstrating Significant Direct Cost Savings to Medicare BUILD

©2025 Castle Biosciences 11 Drive robust test report volume and revenue growth $53.3 $59.3 $68.8 $65.1 $63.8 $12.8 $13.6 $18.2 $20.7 $22.5 Q4 2023 Q1 2024 Q2 2024 Q3 2024 Q4 2024 Dermatologic Non-Dermatologic $66.1 $87.0 $73.0 $85.8 $86.3 NET REVENUE BY QUARTER ($M) Q4 2023 Q1 2024 Q2 2024 Q3 2024 Q4 2024 DecisionDx-UM MyPath Melanoma IDgenetix TissueCypher DecisionDx-SCC DecisionDx-Melanoma TOTAL TEST VOLUME BY QUARTER 1. Consists of DecisionDx-Melanoma, DecisionDx-SCC and our Diagnostic Gene Expression Profile offering (MyPath Melanoma and DiffDx-Melanoma) 2. Consists of TissueCypher Barrett’s Esophagus Test, DecisionDx-UM and IDgenetix 3. Q4 2024 volume reflects typical seasonality, with the fourth quarter historically having the fewest work days compared to the other three quarters, and specifically Q4 2024 had two less working days than Q3 2024; further, the overlap of Christmas and Hanukkah led to additional dermatology practice closures 4. In late 2024, we revised our commercial strategy for our IDgenetix test, reallocating resources to inside sales and non-personal promotions 1 2 20,284 20,888 25,102 26,010 24,0713,4

©2025 Castle Biosciences 12 Maintain strong Adjusted Gross Margin 82.3% 80.5% 83.2% 81.9% 81.1% Q4 2023 Q1 2024 Q2 2024 Q3 2024 Q4 2024 ADJUSTED GROSS MARGIN BY QUARTER1,2 $12.4 $13.9 $14.5 $15.6 $16.2 $13.0 $13.8 $14.1 $12.3 $11.8 $44.1 $48.5 $51.1 $50.5 $50.0 $2.3 $4.3 Q4 2023 Q1 2024 Q2 2024 Q3 2024 Q4 2024 Cost of Sales R&D SG&A Amortization of acquired intangible assets OPERATING EXPENSES BY QUARTER ($M)3 1. Adjusted Gross Margin is a non-GAAP measure. See Non-GAAP reconciliations at the end of this presentation for a reconciliation of Adjusted Gross Margin to its most closely comparable GAAP measure. 2. Calculated as Adjusted Gross Margin (Non-GAAP) divided by Adjusted Revenues (Non-GAAP) 3. Total operating expenses, including cost of sales $2.2 $2.2 $2.3

©2025 Castle Biosciences 13 Improving operating cash flow and Adjusted EBITDA $18.6 $(6.8) $24.0 $23.3 $24.4 Q4 2023 Q1 2024 Q2 2024 Q3 2024 Q4 2024 OPERATING CASH FLOW BY QUARTER ($M) 1. As of December 31, 2024; includes Cash, Cash Equivalents & Marketable Investment Securities 2. Net cash used in operating activities in Q1 2024 includes payout of annual bonuses as well as certain healthcare benefit contributions 3. Adjusted EBITDA is a non-GAAP measure. See non-GAAP reconciliations at the end of this presentation for a reconciliation of Adjusted EBITDA to its most closely comparable GAAP measure 4. Adjusted EBITDA excludes from net income (loss), interest income, interest expense, income tax expense (benefit), depreciation and amortization expense, stock-based compensation expense and change in fair value of trading securities $9.4 $10.5 $21.5 $21.6 $21.3 Q4 2023 Q1 2024 Q2 2024 Q3 2024 Q4 2024 ADJUSTED EBITDA BY QUARTER ($M)3,4 Cash position of ~$293M1 supports growth initiatives

©2025 Castle Biosciences 14 Appendix

©2025 Castle Biosciences 15 DecisionDx-Melanoma DERMATOLOGY Provides comprehensive, personalized, genomic tumor information to guide management for patients with cutaneous melanoma demonstrated change in management for 1 of 2 patients tested3 ~191,800 patients with a clinical DecisionDx- Melanoma order from ~14,900 clinicians4 50% Clinical Validity, Utility and Demonstrated Patient Outcomes Demonstrated clinical validity, utility and impact, backed by 53 peer-reviewed publications, including two publications (Bailey et al. 2023 and Dhillon et al. 2023) demonstrating an association with testing and improved patient outcomes SLNB Guidance and Patient Outcomes1,2 DecisionDx-Melanoma successfully identified patients with T1 tumors with a low risk of SLN positivity who can safely forego SLNB while maintaining high survival rates in a prospective multicenter study and can reduce SLNB- associated complications and healthcare costs. 1. Marks, The i31-GEP identifies patients with T1 cutaneous melanoma who can safely avoid sentinel lymph node biopsy: Results from a prospective, multicenter study. Video abstract presented at: 2024 American Society for Dermatologic Surgery (ASDS) Annual Meeting; 2. Guenther JM, et al. Patients who forego sentinel lymph node biopsy after 31-GEP testing are not harmed: A prospective, multicenter analysis. Poster presented at: 20th European Association of Dermato-Oncology (EADO) Congress; 3. Dillon et al. 2022; 4. Data as of December 31, 2024 SLN(B)=sentinel lymph node (biopsy)

©2025 Castle Biosciences 16 DecisionDx-SCC DERMATOLOGY Identifies the risk of metastasis in patients with squamous cell carcinoma (SCC) and one or more risk factors Clinical Validity and Utility Demonstrated validity, utility and impact, backed by 22 peer-reviewed publications, including data showing that DecisionDx- SCC can significantly impact patient management plans in a risk-appropriate manner within established guidelines Real-World Use Framework Study in Clinical, Cosmetic and Investigational Dermatology highlights a clinician-derived, real-world algorithm that provides a framework to incorporate DecisionDx-SCC test results into clinical practice within NCCN guidelines recommendations net annual Medicare savings that could be realized by using DecisionDx-SCC to guide adjuvant radiation therapy decisions2 ~200,000 ~78% Up to ~$972M patients diagnosed annually with SCC and classified as high risk in the U.S. of clinicians ordering DecisionDx-SCC also ordered DecisionDx- Melanoma1 1. 12-months ended December 31, 2024; 2. Somani et al. 2024

©2025 Castle Biosciences 17 MyPath Melanoma DERMATOLOGY Aids in the diagnosis and management for patients with ambiguous melanocytic lesions Clinical Validity and Utility Demonstrated validity, utility and impact, backed by 20 peer-reviewed publications demonstrating the performance and utility of the test in providing objective information to aid in diagnosis in ambiguous melanocytic lesions Guideline Support • National Comprehensive Cancer Network guidelines for cutaneous melanoma in the principles for molecular testing • American Society of Dermatopathology in the Appropriate Use Criteria for ancillary diagnostic testing • American Academy of Dermatology guidelines of care for the management of primary cutaneous melanoma peer-reviewed publications ~300,000 patients each year present with a diagnostically ambiguous lesion ~50,000 lesions tested clinically1 20 1. as of December 31, 2024

©2025 Castle Biosciences 18 TissueCypher GASTROENTEROLOGY A leading risk-stratification test designed to predict risk of progression to esophageal cancer in patients with Barrett’s esophagus Clinical Validity and Utility Demonstrated validity, utility and impact, backed by 16 peer-reviewed publications demonstrating the ability and performance of the test in risk-stratifying patients with Barrett’s esophagus to guide risk- appropriate treatment decisions Recognition from AGA 2024 Clinical Practice Guideline acknowledges that individuals who may be at increased risk of progression to esophageal cancer might be identified using tissue-based biomarkers, particularly TissueCypher 2022 Recognized in the Clinical Practice Update on New Technology and Innovation for Surveillance and Screening in Barrett’s Esophagus as a tool that may be used by physicians to risk stratify non-dysplastic patients ~415,000 patients receiving upper GI endoscopies per year who meet intended use criteria for TissueCypher 1 in 40 patients progress to esophageal cancer within 5 years (among BE patients)1 16 peer-reviewed publications 1. Shaheen et al. Gastroenterology 2000

©2025 Castle Biosciences 19 IDgenetix MENTAL HEALTH Advanced pharmacogenomic (PGx) test designed to guide medication selection and management for patients with neuropsychiatric conditions, such as depression and anxiety Advanced PGx • Demonstrated clinical validity, utility and impact, backed by 19 peer-reviewed publications • Eliminate trial and error prescribing • Received 2024 MedTech Breakthrough Award for “Best Overall Mental Health Solution” Easy to Use • 10 mental health and pain conditions in one report • Collection of DNA sample via simple cheek swab • 3-5 days to receive test report on average • Specialized sales and medical science liaison support improved chance of remission of depression symptoms vs. control1 3 in 1 test • drug-gene interactions • drug-drug interactions • lifestyle factors 2X >2.5X improved chance of medication response vs. control1 1. Bradley, et al. 2018

©2025 Castle Biosciences 20 DecisionDx-UM OPHTHALMOLOGY The standard of care for evaluating metastatic risk in uveal melanoma Standard of Care • Utilized in approximately 80% of newly diagnosed patients • Favorable reimbursement profile – covered by Medicare and more than 100 private insurers • Included in NCCN Guidelines and considered standard of care peer-reviewed publications ~8 in 10 ~2,000 27 patients diagnosed in the U.S. annually patients diagnosed with UM in the U.S. receive the test as part of their diagnostic workup Clinical Validity and Utility Demonstrated validity, utility and impact, backed by 27 peer-reviewed publications, which included more than 5,000 patients, representing the largest body of evidence for a molecular prognostic test in this field Data as of December 31, 2024

©2025 Castle Biosciences 21 Atopic Dermatitis Gene Expression Profile Test PIPELINE Test currently in development for use in patients diagnosed with moderate-to-severe atopic dermatitis (AD) who are seeking systemic treatment • Pipeline test has shown potential to identify the class of therapy to which a patient with AD is more likely to respond as indicated by an improvement in Eczema Area and Severity Index (EASI) score at three months • Data from our ongoing validation study for our pipeline test suggests we may be able to improve the standard-of-care ‘trial-and-error’ treatment approach by identifying patients who are more likely to achieve a greater response to a specific class of therapy based on identification of the immune pathway that is driving their AD • Q423: early discovery data presented • Q424: progress update • Assuming successful validation: expect launch by the end of 2025 Anticipated Program Milestones 1. Data as of December 31, 2024; 2. consists of patients with moderate-to-severe disease 39 Active sites1 >1,100 Patients enrolled1,2 Atopic Dermatitis Pipeline Program

©2025 Castle Biosciences 22 Reconciliation of Non-GAAP Financial Measures (Unaudited) The tables below presents the reconciliation of adjusted revenues and adjusted gross margin, which are non-GAAP financial measures. See "Use of Non-GAAP Financial Measures (UNAUDITED)" above for further information regarding the Company's use of non-GAAP financial measures. (In thousands) Three months ended Twelve months ended Dec. 31, 2024 Dec. 31, 2023 Dec. 31, 2024 Dec. 31, 2023 Adjusted Revenues Net revenues (GAAP) $ 86,311 $ 66,120 $332,069 $219,788 Revenue associated with test reports delivered in prior periods (491) 4,086 1,751 4,476 Adjusted Revenues (Non-GAAP) $ 85,820 $ 70,206 $333,820 $224,264 Adjusted Gross Margin Gross margin (GAAP)1 $ 65,788 $ 51,426 $260,758 $165,793 Amortization of acquired intangible assets 4,340 2,271 11,106 9,013 Revenue associated with test reports delivered in prior periods (491) 4,086 1,751 4,476 Adjusted Gross Margin (Non-GAAP) $ 69,637 $ 57,783 $273,615 $179,282 Gross margin percentage (GAAP) 2 76.2% 77.8% 78.5% 75.4% Adjusted Gross Margin percentage (Non-GAAP) 3 81.1% 82.3% 82.0% 79.9% 1. Calculated as net revenues (GAAP) less the sum of cost of sales (exclusive of amortization of acquired intangible assets) and amortization of acquired intangible assets. 2. Calculated as gross margin (GAAP) divided by net revenues (GAAP). 3. Calculated as adjusted gross margin (Non-GAAP) divided by adjusted revenues (Non-GAAP).

©2025 Castle Biosciences 23 Reconciliation of Non-GAAP Financial Measures (Unaudited) The table below presents the reconciliation of adjusted EBITDA, which is a non-GAAP financial measure. See disclaimer slide for further information regarding the Company’s use of non-GAAP financial measures. (In thousands) Three months ended Twelve months ended Dec. 31, 2024 Dec. 31, 2023 Dec. 31, 2024 Dec. 31, 2023 Adjusted EBITDA Net income (loss) $9,590 $(2,580) $ 18,245 $ (57,466) Interest income (3,372) (3,119) (12,916) (10,623) Interest expense 92 2 577 11 Income tax (benefit) expense (1,705) 39 3,319 101 Depreciation and amortization expense 5,768 3,224 15,997 12,330 Stock-based compensation expense 11,439 11,802 50,320 51,219 Changes in fair value of trading securities (555) — (555) — Adjusted EBITDA (Non-GAAP) $21,257 $9,368 $74,987 $(4,428)

©2025 Castle Biosciences 24 Reconciliation of Non-GAAP Financial Measures (Unaudited) The tables below present the reconciliation of Adjusted Revenues and Adjusted Gross Margin, which are non-GAAP financial measures. See disclaimer slide for further information regarding the Company’s use of non-GAAP financial measures. (In thousands) Three months ended Dec. 31, 2024 Sep. 30, 2024 Jun. 30, 2024 Mar. 31, 2024 Dec. 31, 2023 Adjusted Revenues Net revenues (GAAP) $86,311 $85,782 $87,002 $72,974 $66,120 Revenue associated with test reports delivered in prior periods (491) 552 (363) (1,656) 4,086 Adjusted Revenues (Non-GAAP) $85,820 $86,334 $86,639 $71,318 $70,206 Adjusted Gross Margin Gross margin (GAAP)1 $65,788 $67,901 $70,236 $56,833 $51,426 Amortization of acquired intangible assets 4,340 2,272 2,247 2,247 2,271 Revenue associated with test reports delivered in prior periods (491) 552 (363) (1,656) 4,086 Adjusted Gross Margin (Non-GAAP) $69,637 $70,725 $72,120 $57,424 $57,783 Gross margin percentage (GAAP) 2 76.2% 79.2% 80.7% 77.9% 77.8% Adjusted Gross Margin percentage (Non-GAAP) 3 81.1% 81.9% 83.2% 80.5% 82.3%

©2025 Castle Biosciences 25 Reconciliation of Non-GAAP Financial Measures (Unaudited) The table below presents the reconciliation of Adjusted EBITDA, which is a non-GAAP financial measure. See disclaimer slide for further information regarding the Company’s use of non-GAAP financial measures. (In thousands) Three months ended Dec. 31, 2024 Sep. 30, 2024 Jun. 30, 2024 Mar. 31, 2024 Dec. 31, 2023 Adjusted EBITDA Net income (loss) $9,590 $2,269 $8,920 $(2,534) $(2,580) Interest income (3,372) (3,404) (3,144) (2,996) (3,119) Interest expense 92 201 270 14 2 Income tax (benefit) expense (1,705) 6,013 (1,034) 45 39 Depreciation and amortization expense 5,768 3,541 3,348 3,340 3,224 Stock-based compensation expense 11,439 13,027 13,179 12,675 11,802 Changes in fair value of trading securities (555) — — — — Adjusted EBITDA (Non-GAAP) $21,257 $21,647 $21,539 $10,544 $9,368

©2025 Castle Biosciences 26 Thank You

©2025 Castle Biosciences 1 Empowering people, informing care decisions February 2025

©2025 Castle Biosciences 2 Disclaimers Forward-Looking Statements This presentation contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, which are subject to the “safe harbor” created by those sections. These forward-looking statements include, but are not limited to, statements concerning: our positioning for continued growth and value creation; our estimated U.S. total addressable market for our commercially available tests; our ongoing studies generating data and their impact on driving adoption of our tests; study observations and interpretations of study data, including conclusions about the benefits and impact of our tests on treatment decisions and patient outcomes; our ability to advance penetration of our tests with clinicians and payers; our ability to carry out our commercial strategies; our ability to be net operating cash flow positive by the end of 2025; our future approach to capital allocation; our expected launch of our pipeline expansion by the end of 2025; and the timing and achievement of program milestones. The words “anticipates,” “can,” “could,” “estimates,” “expects,” “may,” “potential,” “target” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. We may not actually achieve the plans, intentions, or expectations disclosed in our forward-looking statements and you should not place undue reliance on our forward-looking statements. Actual results or events could differ materially from the plans, intentions and expectations disclosed in the forward-looking statements that we make. These forward-looking statements involve risks and uncertainties that could cause our actual results to differ materially from those in the forward-looking statements, including, without limitation: our estimates and assumptions underlying our estimated U.S. total addressable market for our commercially available tests; our assumptions or expectations regarding continued reimbursement for our products and subsequent coverage decisions; Novitas’ local coverage determination signifying non-coverage by Medicare of our DecisionDx-SCC test; our estimated total addressable markets for our products and product candidates; the expenses, capital requirements and potential needs for additional financing, the anticipated cost, timing and success of our product candidates; our plans to research, develop and commercialize new tests; our ability to successfully integrate new businesses, assets, products or technologies acquired through acquisitions; the effects of macroeconomic events and conditions, including inflation and monetary supply shifts, tariffs and disruptions to trade, labor shortages, liquidity concerns at, and failures of, banks and other financial institutions or other disruptions in the banking system or financing markets and recession risks, supply chain disruptions, outbreaks of contagious diseases and geopolitical events (such as the ongoing Israel-Hamas War and Ukraine-Russia conflict), among others, on our business and our efforts to address its impact on our business; the possibility that subsequent study or trial results and findings may contradict earlier study or trial results and findings or may not support the results discussed in this presentation, including with respect to the diagnostic and prognostic tests discussed in this presentation; our planned installation of additional equipment and supporting technology infrastructures and implementation of certain process efficiencies may not enable us to increase the future scalability of our TissueCypher Test; the possibility that actual application of our tests may not provide the anticipated benefits to patients; the possibility that our newer gastroenterology and mental health franchises may not contribute to the achievement of our long-term financial targets as anticipated; and the risks set forth under the heading “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2024, filed or to be filed with the SEC, and in our other filings with the SEC. The forward-looking statements are applicable only as of the date on which they are made, and we do not assume any obligation to update any forward-looking statements, except as may be required by law.

©2025 Castle Biosciences 3 Disclaimers Financial Information; Non-GAAP Financial Measures In this presentation, we use the metrics of Adjusted Revenues, Adjusted Gross Margin and Adjusted EBITDA, which are non-GAAP financial measures and are not calculated in accordance with generally accepted accounting principles in the United States (GAAP). Adjusted Revenues and Adjusted Gross Margin reflect adjustments to GAAP net revenues to exclude net positive and/or net negative revenue adjustments recorded in the current period associated with changes in estimated variable consideration related to test reports delivered in previous periods. Adjusted Gross Margin further excludes acquisition-related intangible asset amortization. Adjusted EBITDA excludes from net income (loss): interest income, interest expense, income tax expense (benefit), depreciation and amortization expense, stock-based compensation expense and change in fair value of trading securities. We use Adjusted Revenues, Adjusted Gross Margin and Adjusted EBITDA internally because we believe these metrics provide useful supplemental information in assessing our revenue and operating performance reported in accordance with GAAP, respectively. We believe that Adjusted Revenues, when used in conjunction with our test report volume information, facilitates investors’ analysis of our current-period revenue performance and average selling price performance by excluding the effects of revenue adjustments related to test reports delivered in prior periods, since these adjustments may not be indicative of the current or future performance of our business. We believe that providing Adjusted Revenues may also help facilitate comparisons to our historical periods. Adjusted Gross Margin is calculated using Adjusted Revenues and therefore excludes the impact of revenue adjustments related to test reports delivered in prior periods, which we believe is useful to investors as described above. We further exclude acquisition-related intangible asset amortization in the calculation of Adjusted Gross Margin. We believe that excluding acquisition-related intangible asset amortization may facilitate gross margin comparisons to historical periods and may be useful in assessing current-period performance without regard to the historical accounting valuations of intangible assets, which are applicable only to tests we acquired rather than internally developed. We believe Adjusted EBITDA may enhance an evaluation of our operating performance because it excludes the impact of prior decisions made about capital investment, financing, investing and certain expenses we believe are not indicative of our ongoing performance. However, these non-GAAP financial measures may be different from non-GAAP financial measures used by other companies, even when the same or similarly titled terms are used to identify such measures, limiting their usefulness for comparative purposes. These non-GAAP financial measures are not meant to be considered in isolation or used as substitutes for net revenues, gross margin, or net income (loss) reported in accordance with GAAP; should be considered in conjunction with our financial information presented in accordance with GAAP; have no standardized meaning prescribed by GAAP; are unaudited; and are not prepared under any comprehensive set of accounting rules or principles. In addition, from time to time in the future, there may be other items that we may exclude for purposes of these non- GAAP financial measures, and we may in the future cease to exclude items that we have historically excluded for purposes of these non-GAAP financial measures. Likewise, we may determine to modify the nature of adjustments to arrive at these non-GAAP financial measures. Because of the non-standardized definitions of non-GAAP financial measures, the non-GAAP financial measure as used by us in this press release and the accompanying reconciliation tables have limits in their usefulness to investors and may be calculated differently from, and therefore may not be directly comparable to, similarly titled measures used by other companies. Accordingly, investors should not place undue reliance on non-GAAP financial measures. Reconciliations of these non-GAAP financial measures to the most directly comparable GAAP financial measures are presented in the tables at the end of this presentation. Industry and Market Data This presentation includes certain information and statistics obtained from third-party sources. The Company has not independently verified the accuracy or completeness of any such third- party information.

©2025 Castle Biosciences 4 Registered Trademarks DecisionDx-Melanoma, DecisionDx-CMSeq, i31-SLNB, i31-ROR, DecisionDx-SCC, MyPath Melanoma, DiffDx- Melanoma, TissueCypher, IDgenetix, DecisionDx-UM, DecisionDx-PRAME and DecisionDx-UMSeq are trademarks of Castle Biosciences, Inc.

©2025 Castle Biosciences 5 Improving health through innovative tests that guide patient care OUR MISSION Transforming disease management by keeping people first: patients, clinicians, employees, and investors OUR VISION

©2025 Castle Biosciences 6 Answering Clinical Questions To Guide Care Along The Patient Journey Our focus is on diagnostic support, risk stratification and therapy selection/response areas of the patient care continuum Dermatology Ophthalmology Gastroenterology Mental Health Diagnostic Support Risk Stratification Therapy Selection/ Response PATIENT CARE JOURNEY Atopic Dermatitis Pipeline Test

©2025 Castle Biosciences 7 Proven strategy designed to drive value creation for our stakeholders FOCUS on best/first-in-class tests with high, unmet clinical need and significant market opportunity BUILD robust clinical evidence PENETRATE target markets to further test adoption by clinicians and payers