EUROPE MARKETS: Trade Talks Trap Europe Markets In Their Gravitational Field

13 May 2019 - 8:12PM

Dow Jones News

By Dave Morris

After European stocks defied gravity Friday, U.S.-China trade

tensions caught up with them to drag equities lower.

How did markets perform?

The Stoxx 600 dropped 0.6% to 375.1. It had climbed 0.3%

Friday.

Germany's DAX (DAX) took the brunt of the trade-related declines

(Germany is a key trading partner of China's), falling 0.8% and

wiping out Friday's 0.7% gain.

The U.K.'s FTSE 100 was flat at 7,206.6, after edging down 0.1%

Friday.

The pound was up 0.2% to $1.3021. On Friday it edged up

0.1%.

France's CAC 40 declined 0.6% to 5,297.2 after rising 0.3%

Friday.

Italy's FTSE MIB dipped 0.7% to 20,735.9. On Friday it was up

0.3%.

What's moving the markets?

Given that talks in Washington, D.C. failed to prevent tariffs

being imposed on Chinese goods by the U.S., Friday's positive

market session was surprising. Today's declines are less

surprising.

The big story Monday remains trade talks, which despite ending

Friday saw plenty of sabers being rattled in the media over the

weekend.

Chinese Vice Premier Liu He told Xinhua

(http://www.xinhuanet.com/english/2019-05/11/c_138051337.htm) that

cooperation is the right choice, and that casually accusing one

side of "backtracking" during negotiations was irresponsible. The

dig at U.S. President Donald Trump and his team, who have accused

China of changing its stance midway through the negotiations, came

as Trump economic adviser Larry Kudlow broke from the president in

admitting that tariffs would hurt both sides.

The talks are expected to resume, though no timetable has been

set.

Jasper Lawler, head of research at London Capital Group, said:

"The base case scenario is that a deal will still be achieved, it

is just going to take a lot longer than the market had been pricing

in over recent months."

Brexit talks between the U.K.'s ruling Conservative Party and

the opposition Labour Party were looking fragile as The Times

reported a potential cabinet revolt

(https://www.thetimes.co.uk/edition/news/pull-plug-on-brexit-talks-with-labour-theresa-may-urged-mtv5nzcfw).

The paper said Tuesday's cabinet meeting would see ministers

pushing for a series of so-called indicative votes in Parliament

rather than continuing talks with Labour, which some view as

politically toxic.

Which stocks are active?

Vodafone Group PLC (VOD.LN) shares slumped 3.6% on reports that

it was planning to cut its dividend. According to the Sunday Times,

(https://www.thetimes.co.uk/edition/business/vodafone-ready-to-slash-dividend-to-pay-for-5g-g6d59xtxl)

the telecommunications company will announce at its first quarter

earnings Tuesday that it needs the funds to pay for investments in

5G network space in Italy and Germany.

Thyssenkrupp AG (TKA.XE) snapped back 6.5% after rising

dramatically Friday on news that the German industrial firm had

abandoned its plan to split itself in two because of concerns among

both regulators and investors. Reports indicate the company is now

planning an initial public offering (IPO) of its elevators

business, as well as 6,000 job cuts. Shares had jumped more than

20% Friday.

Centrica PLC (CNA.LN) shares were up 1.9% as investors rewarded

the energy utility for not delivering results as bad as had been

expected. The company formerly known as British Gas warned that

headwinds ranging from the U.K. government's energy price cap to

warmer than normal temperatures had dampened its first quarter, and

that they were weighing on its full year outlook.

Russ Mould, investment director at AJ Bell, said: "British Gas

used to be a trusted brand--now its reputation has been tarnished

by talk of substandard customer service and expensive bills.

"With so much choice in the energy market, Centrica cannot

afford to fail on service and cost which means it is going to have

to reinvent itself."

(END) Dow Jones Newswires

May 13, 2019 05:57 ET (09:57 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

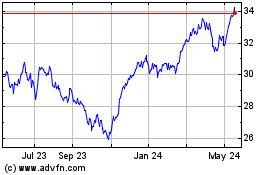

Global X Funds Global X ... (NASDAQ:DAX)

Historical Stock Chart

From Nov 2024 to Dec 2024

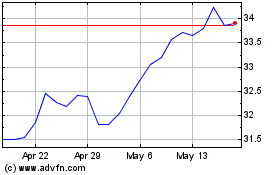

Global X Funds Global X ... (NASDAQ:DAX)

Historical Stock Chart

From Dec 2023 to Dec 2024