Euronet (or the “Company”) (NASDAQ: EEFT), a global leader in

payments processing and cross-border transactions, today announced

fourth quarter and full year 2024 financial

results.

Euronet reports the following

consolidated results for the fourth quarter 2024 compared with the

same period of 2023:

- Revenues of $1,047.3 million, a 9% increase from $957.7 million

(10% increase on a constant currency1 basis).

- Operating income of $122.7 million, a 26% increase from $97.4

million (27% increase on a constant currency basis).

- Adjusted operating income2 of $122.7 million, a 23% increase

from $99.9 million (24% increase on a constant currency

basis).

- Adjusted EBITDA3 of $165.8 million, a 12% increase from $147.6

million (13% increase on a constant currency basis).

- Net income attributable to Euronet of $45.2 million, or $0.98

diluted earnings per share, compared with $69.3 million, or $1.43

diluted earnings per share.

- Adjusted earnings per share4 of $2.08, a 10% increase from

$1.88.

- Euronet's cash and cash equivalents were $1,278.8 million and

ATM cash was $643.8 million, totaling $1,922.6 million as of

December 31, 2024, and availability under its revolving credit

facilities was approximately $1,335 million.

Euronet reports the following consolidated results

for the full year 2024 compared with the same period

of 2023:

- Revenues of $3,989.8 million, an 8% increase from $3,688.0

million (9% increase on a constant currency basis).

- Operating income of $503.2 million, a 16% increase from $432.6

million (18% increase on a constant currency basis).

- Adjusted operating income of $502.8 million, a 16% increase

from $432.1 million (18% increase on a constant currency

basis).

- Adjusted EBITDA of $678.5 million, a 10% increase from $618.7

million (11% increase on a constant currency basis).

- Net income attributable to Euronet of $306.0 million, or $6.45

diluted earnings per share, compared with $279.7 million, or $5.50

diluted earnings per share.

- Adjusted earnings per share of $8.61, a 15% increase from

$7.46.

See the reconciliation of non-GAAP items in the

attached financial schedules.

"I am pleased we delivered 15% growth in

Adjusted EPS for the full year -- at the top end of our range,

driven by strong performance in all three segments. As we

entered 2024, we told shareholders that we expected our Adjusted

EPS to grow between 10% and 15%, and we would be driving to go

through the range. Throughout the year our results increasingly

demonstrated that it was likely we would perform at the upper end

of that range. Now with these very good fourth quarter

results, you can see we performed at the top of the range and even

ahead of our historical 10- and 20-year CAGR rates. I would

like to also point out that our 2024 adjusted EPS of $8.61 was

adversely impacted by significant increases in interest and

tax expense, but also benefited from share repurchases. With

interest, taxes and share repurchases netting each other, you can

see that the 15% increase in adjusted EPS was driven by the 16%

increase in operating income made possible by strong revenue

growth, scale and cost management. For the fourth

quarter we delivered record adjusted EPS of $2.08, a 10%

year-over-year increase as well as double-digit growth in operating

income and adjusted EBITDA," stated Michael J. Brown,

Euronet's Chairman and Chief Executive Officer. "EFT delivered

double-digit growth across all metrics driven by international

travel, growth in merchant acquiring business, fee increase

opportunities, and expansion into new markets. Money Transfer

produced strong fourth quarter results across all metrics

including a 33% growth in digital transactions. In epay, our

core business delivered strong results from continued digital

branded payments and mobile growth.”

Adjusted operating income and adjusted EBITDA

were adjusted for non-cash purchase accounting adjustments in the

EFT Segment during the fourth quarter and full-year of 2023

and the full year of 2024 and a non-cash gain in the full year

2023.

Taking into consideration recent trends in the

business and the global economy, the Company anticipates its

2025 adjusted EPS will grow 12% to 16% year-over-year,

consistent with its 10 and 20 year compounded annualized growth

rates. This outlook does not include any changes that may

develop in foreign exchange rates, interest rates or other

unforeseen factors.

Segment and Other Results

The EFT Processing Segment

reports the following results for the fourth quarter 2024 compared

with the same period or date in 2023:

- Revenues of $265.6 million, a 12% increase from $237.9 million

(13% increase on a constant currency basis).

- Operating income of $37.3 million, a 46% increase from $25.5

million (48% increase on a constant currency basis).

- Adjusted operating income of $37.3 million, a 33% increase from

$28.0 million (35% increase on a constant currency basis).

- Adjusted EBITDA of $61.7 million, an 18% increase from $52.2

million (19% increase on a constant currency basis).

- Transactions of 3,203 million, a 35% increase from 2,369

million.

- Total of 55,248 installed ATMs as of December 31, 2024, a 5%

increase from 52,652 at December 31, 2023. Operated 49,945 active

ATMs as of December 31, 2024, a 6% increase from 47,303 as of

December 31, 2023.

The EFT Processing

Segment reports the following results for

the full year 2024 compared with the same period

in 2023:

- Revenues of $1,161.2 million, a 10% increase from $1,058.3

million (10% increase on a constant currency basis).

- Operating income of $256.0 million, a 24% increase from $206.3

million (25% increase on a constant currency basis).

- Adjusted operating income of $255.6 million, a 24% increase

from $205.8 million (25% increase on a constant currency

basis).

- Adjusted EBITDA of $353.5 million, an 18% increase from $300.4

million (19% increase on a constant currency basis).

- Transactions of 11,424 million, a 35% increase from 8,473

million.

Revenue, operating income, and adjusted EBITDA growth for both

the fourth quarter and full year 2024 was driven by

continued growth in transactions in nearly all markets, new market

expansion, fee increase opportunities, cost management and growth

in the merchant acquiring business with adjusted EBITDA doubling in

the last two years.

The EFT Segment's total

installed ATMs at December 31, 2024 grew

5% over December 31, 2023 ATMs due to the net

addition of 1,729 Euronet-owned ATMs, 773 new outsourcing

ATMs and the addition of 94 low-margin ATMs in

India. The difference between installed and active

ATMs relates to ATMs that have been seasonally

deactivated.

The epay Segment reports

the following results for the fourth

quarter 2024 compared with the same period or date

in 2023:

- Revenues of $342.2 million, an 8% increase from $316.7 million

(10% increase on a constant currency basis).

- Operating income of $48.0 million, a 10% increase from $43.6

million (12% increase on a constant currency basis).

- Adjusted EBITDA of $49.9 million, a 10% increase from $45.4

million (12% increase on a constant currency basis).

- Transactions of 1,185 million, a 31% increase from 906

million.

- POS terminals of approximately 777,000 as of December 31, 2024,

a 5% decrease from approximately 821,000.

- Retailer locations of approximately 362,000 as of December 31,

2024, a 3% increase from approximately 352,000.

The epay Segment reports the

following results for the full year 2024 compared

with the same period in 2023:

- Revenues of $1,150.5 million, a 6% increase from $1,082.4

million (7% increase on a constant currency basis).

- Operating income of $129.9 million, a 3% increase from $126.2

million (4% increase on a constant currency basis).

- Adjusted EBITDA of $137.2 million, a 3% increase from $133.1

million (4% increase on a constant currency basis).

- Transactions of 4,374 million, a 15% increase from 3,789

million.

Fourth quarter and full year 2024

constant currency revenue, operating income and adjusted

EBITDA growth was driven by continued expansion of digital branded

payment and mobile sales.

The Money Transfer Segment

reports the following results for the fourth quarter 2024 compared

with the same period or date in 2023:

- Revenues of $441.9 million, a 9% increase from $405.1 million

(9% increase on a constant currency basis).

- Operating income of $58.4 million, a 13% increase from $51.9

million (12% increase on a constant currency basis).

- Adjusted EBITDA of $64.4 million, a 9% increase from $59.3

million (9% increase on a constant currency basis).

- Total transactions of 46.9 million, an 11% increase from 42.4

million.

- Network locations of approximately 607,000 as of December 31,

2024, a 5% increase from approximately 580,000.

The Money Transfer

Segment reports the following

results for the full year 2024 compared with the

same period in 2023:

- Revenues of $1,686.5 million, an 8% increase from $1,555.2

million (9% increase on a constant currency basis).

- Operating income of $201.0 million, an 8% increase from $185.4

million (9% increase on a constant currency basis).

- Adjusted EBITDA of $227.0 million, a 5% increase from $216.4

million (5% increase on a constant currency basis).

- Total transactions of 176.9 million, a 9% increase from 161.7

million.

Fourth quarter constant currency revenue,

operating income and adjusted EBITDA growth was the result of

14% growth in U.S.-outbound transactions, 11% growth in

international-originated money transfers and 8% growth in xe

transactions, partially offset by a 14% decline in the

intra-U.S. business. These transaction growth rates include

33% growth in direct-to-consumer digital transactions.

Full year 2024 constant currency revenue,

operating income, and adjusted EBITDA growth was the result of

12% growth in U.S.-outbound transactions, 11% growth in

international-originated money transfers and 16% growth in xe

transactions, partially offset by a 14% decline in the

intra-U.S. business. These transaction growth rates include

28% growth in direct-to-consumer digital transactions.

Corporate and Other reports

$21.0 million of expense for the fourth

quarter 2024 compared with $23.6 million for

the fourth quarter 2023. For the full year 2024,

Corporate and Other reports $83.7 million of expense compared

with $85.3 million for the full year 2023. The decrease

in corporate expenses for both the fourth quarter and full year

2024 is largely the result of a decrease in long-term compensation

expenses based on lower share value.

Balance Sheet and Financial

PositionUnrestricted cash and cash equivalents on hand

were $1,278.8 million as of December 31, 2024,

compared to $1,524.1 million as of September 30, 2024. The net

decrease in unrestricted cash and cash equivalents during the

quarter is mainly due to working capital

fluctuations, repayment of short-term borrowings, $50

million in share repurchases, partially offset by cash generated

from operations. Total indebtedness was

$1,949.8 million as of December 31, 2024, compared

to $2,278.8 million as of September 30, 2024. The decrease in debt

was largely due to repayment of short-term borrowings. Availability

under the Company's revolving credit facility was approximately

$1,335 million as of December 31, 2024. The increase in

availability of the revolving credit facility was primarily

the result of an increase and extension of our credit facility in

December 2024 from $1.25 billion to $1.90 billion.

Non-GAAP MeasuresIn addition to

the results presented in accordance with U.S. GAAP, the Company

presents non-GAAP financial measures, such as constant currency

financial measures, adjusted operating income, adjusted EBITDA, and

adjusted earnings per share. These measures should be used in

addition to, and not a substitute for, revenues, net income and

earnings per share computed in accordance with U.S. GAAP. We

believe that these non-GAAP measures provide useful information to

investors regarding the Company's performance and overall results

of operations. These non-GAAP measures are also an integral part of

the Company's internal reporting and performance assessment for

executives and senior management. The non-GAAP measures used by the

Company may not be comparable to similarly titled non-GAAP measures

used by other companies. The attached schedules provide a full

reconciliation of these non-GAAP financial measures to their most

directly comparable U.S. GAAP financial measure.

The Company does not provide a reconciliation of

its forward-looking non-GAAP measures to GAAP due to the inherent

difficulty in forecasting and quantifying certain amounts that are

necessary for GAAP and the related GAAP and non-GAAP

reconciliation, including adjustments that would be necessary for

foreign currency exchange rate fluctuations and other charges

reflected in the Company's reconciliation of historic numbers,

the amount of which, based on historical experience, could be

significant.

(1) Constant currency financial measures are

computed as if foreign currency exchange rates did not change from

the prior period. This information is provided to illustrate the

impact of changes in foreign currency exchange rates on the

Company's results when compared to the prior period.

(2) Adjusted operating income is defined as

operating income excluding, to the extent incurred in the

period, non-cash gains and non-cash purchase accounting

adjustments. Adjusted operating income represents a performance

measure and is not intended to represent a liquidity measure.

(3) Adjusted EBITDA is defined as net

income excluding, to the extent incurred in the period, interest

expense, income tax expense, depreciation, amortization,

share-based compensation, non-cash gains, non-cash purchase

accounting adjustments and other non-operating or non-recurring

items that are considered expenses or income under U.S. GAAP.

Adjusted EBITDA represents a performance measure and is not

intended to represent a liquidity measure.

(4) Adjusted earnings per share is defined

as diluted U.S. GAAP earnings per share excluding, to the extent

incurred in the period, the tax-effected impacts of: a)

foreign currency exchange gains or losses, b) share-based

compensation, c) acquired intangible asset amortization, d)

non-cash income tax expense, e) non-cash gains and non-cash

purchase accounting adjustments, f) other non-operating or

non-recurring items and g) dilutive shares relate to the Company's

convertible bonds. Adjusted earnings per share represents a

performance measure and is not intended to represent a liquidity

measure.

Conference Call and Slide

PresentationEuronet Worldwide will host an analyst

conference call on February 13, 2025, at 9:00 a.m. Eastern

Time to discuss these results. The call may also include discussion

of Company developments on the Company's operations,

forward-looking information, and other material information about

business and financial matters. To listen to the call via telephone

please register at Euronet Worldwide Fourth Quarter 2024 Earnings

Call. The conference call will also be available via webcast at

http://ir.euronetworldwide.com. Participants should register at

least five minutes prior to the scheduled start time of the event.

A slideshow will be included in the webcast.

A webcast replay will be available beginning

approximately one hour after the event at

http://ir.euronetworldwide.com and will remain available for one

year.

About Euronet Worldwide, Inc.A

global leader in payments processing and cross-border

transactions, Euronet moves money in all the ways consumers

and businesses depend upon. This includes money transfers,

credit/debit processing, ATMs, point-of-sale services, branded

payments, currency exchange and more. With products and services in

more than 200 countries and territories provided through its own

brand and branded business segments, Euronet and its

financial technologies and networks make participation in the

global economy easier, faster and more secure for everyone.

Starting in Central Europe in 1994,

Euronet now supports an extensive global real-time

digital and cash payments network that includes 55,248 installed

ATMs, approximately 1,160,000 EFT point-of-sale terminals and a

growing portfolio of outsourced debit and credit card services

which are under management in 67 countries; card software

solutions; a prepaid processing network of approximately 777,000

point-of-sale terminals at approximately 362,000 retailer locations

in 64 countries; and a global money transfer network of

approximately 607,000 locations serving 197 countries and

territories with digital connections to 4.1 billion bank accounts

and 3.1 billion digital wallet accounts. Euronet serves

clients from its corporate headquarters

in Leawood, Kansas, USA, and 67 worldwide offices. For

more information, please visit the Company's website

at www.euronetworldwide.com.

Statements contained in this news release that

concern Euronet's or its management's intentions, expectations, or

predictions of future performance, are forward-looking statements.

Euronet's actual results may vary materially from those anticipated

in such forward-looking statements as a result of a number of

factors, including: conditions in world financial markets and

general economic conditions, including impacts from the

COVID-19 or other pandemics; inflation; military conflicts in

the Ukraine and the Middle East, and the related economic

sanctions; our ability to successfully integrate any acquired

operations; economic conditions in specific countries and regions;

technological developments affecting the market for our products

and services; our ability to successfully introduce new products

and services; foreign currency exchange rate fluctuations; the

effects of any breach of our computer systems or those of our

customers or vendors, including our financial processing networks

or those of other third parties; interruptions in any of our

systems or those of our vendors or other third parties;

our ability to renew existing contracts at profitable rates;

changes in fees payable for transactions performed for cards

bearing international logos or over switching networks such as card

transactions on ATMs; our ability to comply with increasingly

stringent regulatory requirements, including anti-money laundering,

anti-terrorism, anti-bribery, consumer and data protection and

privacy; changes in laws and regulations affecting our business,

including tax and immigration laws and any laws regulating

payments, including dynamic currency conversion transactions;

changes in our relationships with, or in fees charged by, our

business partners; competition; the outcome of claims and other

loss contingencies affecting Euronet; the cost of borrowing

(including fluctuations in interest rates), availability of credit

and terms of and compliance with debt covenants; and renewal of

sources of funding as they expire and the availability of

replacement funding. These risks and other risks are described in

the Company's filings with the Securities and Exchange Commission,

including our Annual Report on Form 10-K, Quarterly Reports on Form

10-Q and Current Reports on Form 8-K. Copies of these filings may

be obtained via the SEC's Edgar website or by contacting the

Company. Any forward-looking statements made in this release speak

only as of the date of this release. Except as may be required

by law, Euronet does not intend to update these

forward-looking statements and undertakes no duty to any person to

provide any such update under any circumstances. The Company

regularly posts important information to the investor relations

section of its website.

|

EURONET WORLDWIDE, INC. |

|

Condensed Consolidated Balance Sheets |

|

(in millions) |

|

|

|

|

|

|

|

As of |

|

|

|

|

December 31, |

|

As of |

|

|

2024 |

|

December 31, |

|

|

(unaudited) |

|

2023 |

|

ASSETS |

|

|

|

|

Current assets: |

|

|

|

|

Cash and cash equivalents |

$ |

1,278.8 |

|

$ |

1,254.2 |

|

ATM cash |

643.8 |

|

525.2 |

|

Restricted cash |

9.2 |

|

15.2 |

|

Settlement assets |

1,522.7 |

|

1,681.5 |

|

Trade accounts receivable, net |

284.9 |

|

370.6 |

|

Prepaid expenses and other current assets |

297.1 |

|

316.0 |

|

Total current assets |

4,036.5 |

|

4,162.7 |

|

|

|

|

|

|

Property and equipment, net |

329.7 |

|

332.1 |

|

Right of use lease asset, net |

132.1 |

|

142.6 |

|

Goodwill and acquired intangible assets, net |

1,048.1 |

|

1,015.1 |

|

Other assets, net |

288.1 |

|

241.9 |

|

|

|

|

|

|

Total assets |

$ |

5,834.5 |

|

$ |

5,894.4 |

|

|

|

|

|

|

LIABILITIES AND EQUITY |

|

|

|

|

Current liabilities: |

|

|

|

|

Settlement obligations |

$ |

1,522.7 |

|

$ |

1,681.5 |

|

Accounts payable and other current liabilities |

841.0 |

|

816.9 |

|

Current portion of operating lease liabilities |

48.3 |

|

50.3 |

|

Short-term debt obligations |

814.0 |

|

151.9 |

|

Total current liabilities |

3,226.0 |

|

2,700.6 |

|

|

|

|

|

|

Debt obligations, net of current portion |

1,134.4 |

|

1,715.4 |

|

Operating lease liabilities, net of current portion |

87.4 |

|

95.8 |

|

Capital lease obligations, net of current portion |

1.4 |

|

2.3 |

|

Deferred income taxes |

71.8 |

|

47.0 |

|

Other long-term liabilities |

84.3 |

|

83.6 |

|

Total liabilities |

4,605.3 |

|

4,644.7 |

|

Equity |

1,229.2 |

|

1,249.7 |

|

|

|

|

|

|

Total liabilities and equity |

$ |

5,834.5 |

|

$ |

5,894.4 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EURONET WORLDWIDE, INC. |

|

Consolidated Statements of Operations |

|

(unaudited - in millions, except share and per share

data) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Year Ended |

|

|

Three Months Ended |

|

|

|

December 31, |

|

|

December 31, |

|

|

|

2024 |

|

|

|

|

2023 |

|

|

2024 |

|

2023 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenues |

$ |

3,989.8 |

|

|

|

$ |

3,688.0 |

|

|

$ |

1,047.3 |

|

|

|

$ |

957.7 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

Direct operating costs |

|

2,389.3 |

|

|

|

|

2,222.8 |

|

|

640.8 |

|

|

|

596.4 |

|

|

Salaries and benefits |

|

650.2 |

|

|

|

|

602.9 |

|

|

167.9 |

|

|

|

158.0 |

|

|

Selling, general and administrative |

|

315.3 |

|

|

|

|

296.8 |

|

|

83.4 |

|

|

|

72.4 |

|

|

Depreciation and amortization |

|

131.8 |

|

|

|

|

132.9 |

|

|

32.5 |

|

|

|

33.5 |

|

|

Total operating expenses |

|

3,486.6 |

|

|

|

|

3,255.4 |

|

|

924.6 |

|

|

|

860.3 |

|

|

Operating income |

|

503.2 |

|

|

|

|

432.6 |

|

|

122.7 |

|

|

|

97.4 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other income (expense): |

|

|

|

|

|

|

|

|

|

|

|

|

Interest income |

|

23.8 |

|

|

|

|

15.2 |

|

|

5.7 |

|

|

|

5.1 |

|

|

Interest expense |

|

(80.5 |

) |

|

|

|

(55.6 |

) |

|

(21.3 |

) |

|

|

(16.5 |

) |

|

Foreign currency exchange (loss) gain |

|

(19.1 |

) |

|

|

|

8.0 |

|

|

(35.5 |

) |

|

|

11.6 |

|

|

Other income |

|

21.5 |

|

|

|

|

0.2 |

|

|

4.3 |

|

|

|

0.3 |

|

|

Total other (expense) income, net |

|

(54.3 |

) |

|

|

|

(32.2 |

) |

|

(46.8 |

) |

|

|

0.5 |

|

|

Income before income taxes |

|

448.9 |

|

|

|

|

400.4 |

|

|

75.9 |

|

|

|

97.9 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income tax expense |

|

(142.6 |

) |

|

|

|

(120.9 |

) |

|

(30.6 |

) |

|

|

(28.4 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income |

|

306.3 |

|

|

|

|

279.5 |

|

|

45.3 |

|

|

|

69.5 |

|

|

Net (income) loss attributable to non-controlling interests |

|

(0.3 |

) |

|

|

|

0.2 |

|

|

(0.1 |

) |

|

|

(0.2 |

) |

|

Net income attributable to Euronet Worldwide, Inc. |

$ |

306.0 |

|

|

|

$ |

279.7 |

|

|

$ |

45.2 |

|

|

|

$ |

69.3 |

|

|

Add: Interest expense from assumed conversion of convertible notes,

net of tax |

|

4.2 |

|

|

|

|

4.2 |

|

|

|

0.9 |

|

|

|

|

1.0 |

|

|

Net income for diluted earnings per share calculation |

$ |

310.2 |

|

|

|

$ |

283.9 |

|

|

$ |

46.1 |

|

|

|

$ |

70.3 |

|

|

Earnings per share attributable to Euronet |

|

|

|

|

|

|

|

|

|

|

|

|

Worldwide, Inc. stockholders - diluted |

$ |

6.45 |

|

|

|

$ |

5.50 |

|

|

$ |

0.98 |

|

|

|

$ |

1.43 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Diluted weighted average shares outstanding |

|

48,082,766 |

|

|

|

|

51,599,633 |

|

|

47,050,602 |

|

|

|

49,066,284 |

|

|

EURONET WORLDWIDE, INC. |

|

Reconciliation of Net Income to Operating Income (Expense),

Adjusted Operating Income (Expense) and Adjusted

EBITDA |

|

(unaudited - in millions) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended December 31, 2024 |

|

|

|

|

|

|

|

|

|

|

|

|

|

EFT Processing |

|

epay |

|

Money Transfer |

|

Corporate Services |

|

Consolidated |

|

|

|

|

|

|

|

|

|

|

|

| Net

income |

|

|

|

|

|

|

|

|

$ |

45.3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Add: Income tax expense |

|

|

|

|

|

|

|

|

30.6 |

|

|

Add: Total other expense, net |

|

|

|

|

|

|

|

|

46.8 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating income (expense) |

$ |

37.3 |

|

|

$ |

48.0 |

|

|

$ |

58.4 |

|

|

$ |

(21.0 |

) |

|

|

$ |

122.7 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Add: Depreciation and amortization |

24.4 |

|

|

1.9 |

|

|

6.0 |

|

|

0.2 |

|

|

|

32.5 |

|

|

Add: Share-based compensation |

— |

|

|

— |

|

|

— |

|

|

10.6 |

|

|

|

10.6 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Earnings before interest, taxes, depreciation, amortization,

share-based compensation (Adjusted EBITDA) (1) |

$ |

61.7 |

|

|

$ |

49.9 |

|

|

$ |

64.4 |

|

|

$ |

(10.2 |

) |

|

|

$ |

165.8 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended December 31, 2023 |

|

|

|

|

|

|

|

|

|

|

|

|

|

EFT Processing |

|

epay |

|

Money Transfer |

|

Corporate Services |

|

Consolidated |

|

|

|

|

|

|

|

|

|

|

|

| Net

income |

|

|

|

|

|

|

|

|

$ |

69.5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Add: Income tax expense |

|

|

|

|

|

|

|

|

28.4 |

|

|

Less: Total other income, net |

|

|

|

|

|

|

|

|

(0.5 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

Operating income (expense) |

$ |

25.5 |

|

|

$ |

43.6 |

|

|

$ |

51.9 |

|

|

$ |

(23.6 |

|

) |

|

$ |

97.4 |

|

|

Add: non-cash purchase accounting expense adjustment |

|

2.5 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

2.5 |

|

|

Adjusted operating income (expense) (1) |

|

28.0 |

|

|

|

43.6 |

|

|

|

51.9 |

|

|

|

(23.6 |

|

) |

|

|

99.9 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Add: Depreciation and amortization |

24.2 |

|

|

1.8 |

|

|

7.4 |

|

|

0.1 |

|

|

|

33.5 |

|

|

Add: Share-based compensation |

— |

|

|

— |

|

|

— |

|

|

14.2 |

|

|

|

14.2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Earnings before interest, taxes, depreciation, amortization,

non-cash purchase accounting expense adjustment

and share-based compensation (Adjusted EBITDA) (1) |

$ |

52.2 |

|

|

$ |

45.4 |

|

|

$ |

59.3 |

|

|

$ |

(9.3 |

|

) |

|

$ |

147.6 |

|

(1) Adjusted operating income (expense) and

Adjusted EBITDA are non-GAAP measures that should be considered in

addition to, and not a substitute for, net income computed in

accordance with U.S. GAAP.

|

EURONET WORLDWIDE, INC. |

|

Reconciliation of Net Income to Operating Income (Expense),

Adjusted Operating Income (Expense) and Adjusted

EBITDA |

|

(unaudited - in millions) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Twelve months ended December 31,

2024 |

|

|

|

|

|

|

|

|

|

|

|

|

|

EFT Processing |

|

epay |

|

Money Transfer |

|

Corporate Services |

|

Consolidated |

|

|

|

|

|

|

|

|

|

|

|

| Net

income |

|

|

|

|

|

|

|

|

$ |

306.3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Add: Income tax expense |

|

|

|

|

|

|

|

|

142.6 |

|

|

Add: Total other expense, net |

|

|

|

|

|

|

|

|

54.3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating income (expense) |

$ |

256.0 |

|

|

$ |

129.9 |

|

|

$ |

201.0 |

|

|

$ |

(83.7 |

) |

|

$ |

503.2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Less: Non-cash purchase accounting income adjustment |

(0.4 |

) |

|

— |

|

|

— |

|

|

— |

|

|

(0.4 |

) |

|

Adjusted operating income (expense) (1) |

255.6 |

|

|

129.9 |

|

|

201.0 |

|

|

(83.7 |

) |

|

502.8 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Add: Depreciation and amortization |

97.9 |

|

|

7.3 |

|

|

26.0 |

|

|

0.6 |

|

|

131.8 |

|

|

Add: Share-based compensation |

— |

|

|

— |

|

|

— |

|

|

43.9 |

|

|

43.9 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Earnings before interest, taxes, depreciation, amortization,

non-cash purchase accounting income adjustment and share-based

compensation (Adjusted EBITDA) (1) |

$ |

353.5 |

|

|

$ |

137.2 |

|

|

$ |

227.0 |

|

|

$ |

(39.2 |

) |

|

$ |

678.5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Twelve months ended December 31,

2023 |

|

|

|

|

|

|

|

|

|

|

|

|

|

EFT Processing |

|

epay |

|

Money Transfer |

|

Corporate Services |

|

Consolidated |

|

|

|

|

|

|

|

|

|

|

|

| Net

income |

|

|

|

|

|

|

|

|

$ |

279.5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Add: Income tax expense |

|

|

|

|

|

|

|

|

120.9 |

|

|

Add: Total other expense, net |

|

|

|

|

|

|

|

|

32.2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating income (expense) |

$ |

206.3 |

|

|

$ |

126.2 |

|

|

$ |

185.4 |

|

|

$ |

(85.3 |

) |

|

$ |

432.6 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Add: Non-cash purchase accounting expense adjustment |

2.5 |

|

|

— |

|

|

— |

|

|

— |

|

|

2.5 |

|

|

Less: Non-cash gain |

(3.0 |

) |

|

— |

|

|

— |

|

|

— |

|

|

(3.0 |

) |

|

Adjusted operating income (expense) (1) |

205.8 |

|

|

126.2 |

|

|

185.4 |

|

|

(85.3 |

) |

|

432.1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Add: Depreciation and amortization |

94.6 |

|

|

6.9 |

|

|

31.0 |

|

|

0.4 |

|

|

132.9 |

|

|

Add: Share-based compensation |

— |

|

|

— |

|

|

— |

|

|

53.7 |

|

|

53.7 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Earnings before interest, taxes, depreciation, amortization,

non-cash purchase accounting expense adjustment, non-cash gain

and share-based compensation (Adjusted

EBITDA) (1) |

$ |

300.4 |

|

|

$ |

133.1 |

|

|

$ |

216.4 |

|

|

$ |

(31.2 |

) |

|

$ |

618.7 |

|

(1) Adjusted operating income (expense)

and Adjusted EBITDA are non-GAAP measures that should be

considered in addition to, and not a substitute for, net income

computed in accordance with U.S. GAAP.

|

EURONET WORLDWIDE, INC. |

|

Reconciliation of Adjusted Earnings per Share |

|

(unaudited - in millions, except share and per share

data) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Year Ended |

|

Three Months Ended |

|

|

December 31, |

|

December 31, |

|

|

|

2024 |

|

|

|

|

2023 |

|

|

|

2024 |

|

|

|

|

2023 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net

income attributable to Euronet Worldwide, Inc. |

$ |

306.0 |

|

|

|

$ |

279.7 |

|

|

$ |

45.2 |

|

|

|

$ |

69.3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Foreign currency exchange loss (gain) |

|

19.1 |

|

|

|

|

(8.0 |

) |

|

|

35.5 |

|

|

|

|

(11.6 |

) |

|

Intangible asset amortization(1) |

|

21.7 |

|

|

|

|

24.4 |

|

|

|

4.7 |

|

|

|

|

5.4 |

|

|

Share-based compensation(2) |

|

43.9 |

|

|

|

|

53.7 |

|

|

|

10.6 |

|

|

|

|

14.2 |

|

|

Non-cash gain(3) |

|

— |

|

|

|

|

(3.0 |

) |

|

|

— |

|

|

|

|

— |

|

|

Non-cash purchase accounting (income) expense adjustment(4) |

|

(0.4 |

) |

|

|

|

2.5 |

|

|

|

— |

|

|

|

|

2.5 |

|

|

Income tax effect of above adjustments(5) |

|

13.2 |

|

|

|

|

(3.0 |

) |

|

|

3.2 |

|

|

|

|

1.2 |

|

|

Non-cash investment gain(6) |

|

(20.3 |

) |

|

|

|

— |

|

|

|

(3.5 |

) |

|

|

|

— |

|

|

Non-cash GAAP tax expense (benefit)(7) |

|

9.9 |

|

|

|

|

19.7 |

|

|

|

(3.1 |

) |

|

|

|

6.4 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted earnings(8) |

$ |

393.1 |

|

|

|

$ |

366.0 |

|

|

$ |

92.6 |

|

|

|

$ |

87.4 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted earnings per share - diluted(8) |

$ |

8.61 |

|

|

|

$ |

7.46 |

|

|

$ |

2.08 |

|

|

|

$ |

1.88 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Diluted weighted average shares outstanding (GAAP) |

|

48,082,766 |

|

|

|

|

51,599,633 |

|

|

|

47,050,602 |

|

|

|

|

49,066,284 |

|

|

Effect of adjusted EPS dilution of convertible notes |

|

(2,781,818 |

) |

|

|

|

(2,781,818 |

) |

|

|

(2,781,818 |

) |

|

|

|

(2,781,818 |

) |

|

Effect of unrecognized share-based compensation on diluted shares

outstanding |

|

369,573 |

|

|

|

|

230,000 |

|

|

|

295,559 |

|

|

|

|

158,030 |

|

|

Adjusted diluted weighted average shares outstanding |

|

45,670,521 |

|

|

|

|

49,047,815 |

|

|

|

44,564,343 |

|

|

|

|

46,442,496 |

|

(1) Intangible asset amortization of $4.7

million and $5.4 million are included in

depreciation and amortization expense of $32.5 million

and $ 33.5 million for both the three months ended

December 31, 2024 and December 31, 2023, in the consolidated

statements of operations. Intangible asset amortization

of $21.7 million and $24.4 million are

included in depreciation and amortization expense of $131.8

million and $132.9 million for

the twelve months ended December 31, 2024 and

December 31, 2023, respectively, in the consolidated statements of

operations.

(2) Share-based compensation of $10.6 million

and $14.2 million are included in salaries and benefits expense of

$167.9 million and $158.0 million for the three months ended

December 31, 2024 and December 31, 2023, respectively, in the

consolidated statements of operations. Share-based

compensation of $43.9 million and $53.7

million are included in salaries and benefits expense of

$650.2 million and $602.9 million for

the twelve months ended December 31, 2024 and

December 31, 2023, respectively, in the consolidated statements of

operations.

(3) A non-cash gain of $3.0 million is

included in operating income for the twelve months ended December

31, 2023, in the consolidated statements of

operations.

(4) Non-cash purchase accounting

(income)/expense adjustment of respectively ($0.4) million and $2.5

million is included in operating income for the twelve months ended

December 31, 2024 and December 31, 2023 in the consolidated

statement of operations.

(5) Adjustment is the aggregate U.S. GAAP

income tax effect on the preceding adjustments determined by

applying the applicable statutory U.S. federal, state and/or

foreign income tax rates.

(6) Non-cash investment gain of

respectively $3.5 million and $20.3 million for the

three and twelve months ended December 31,

2024 is included in other income in the consolidated

statement of operations.

(7) Adjustment is the non-cash GAAP tax impact

recognized on certain items such as the utilization of certain

material net deferred tax assets and amortization of

indefinite-lived intangible assets.

(8) Adjusted earnings and adjusted earnings

per share are non-GAAP measures that should be considered in

addition to, and not as a substitute for, net income and earnings

per share computed in accordance with U.S. GAAP.

Contact:

Euronet Worldwide, Inc.

Stephanie Taylor

+1-913-327-4200

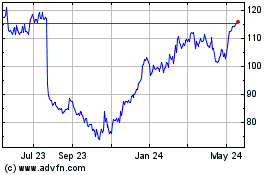

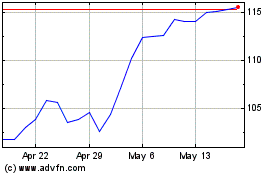

Euronet Worldwide (NASDAQ:EEFT)

Historical Stock Chart

From Jan 2025 to Feb 2025

Euronet Worldwide (NASDAQ:EEFT)

Historical Stock Chart

From Feb 2024 to Feb 2025