false

0001682639

0001682639

2024-08-30

2024-08-30

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13

or 15(d)

of the Securities Exchange

Act of 1934

Date of Report (Date

of earliest event reported): August 30, 2024

EYENOVIA, INC.

(Exact Name of Registrant

as Specified in its Charter)

| Delaware |

|

001-38365 |

|

47-1178401 |

(State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

295 Madison Avenue, Suite 2400, New York, NY

10017

(Address of Principal Executive Offices, and

Zip Code)

(833) 393-6684

Registrant’s Telephone Number, Including

Area Code

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨ Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement communications pursuant to Rule 13e-4(c) under

the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section

12(b) of the Act:

| (Title of each class) |

|

(Trading

Symbol) |

|

(Name of each exchange

on which registered) |

| Common stock, par value $0.0001 per share |

|

EYEN |

|

The Nasdaq Stock Market

(Nasdaq Capital Market) |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities

Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging

growth company ¨

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 5.02 |

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers. |

Retirement of John Gandolfo as Chief Financial

Officer

Effective August 30, 2024, John Gandolfo

retired from his positions as Chief Financial Officer, Treasurer and Secretary of Eyenovia, Inc. (the “Company”). To

help ensure a smooth transition of his responsibilities to his successor, Mr. Gandolfo will serve as an employee of the Company until

November 30, 2024, and will continue to be compensated for his services pursuant to the Employment Agreement dated February 15,

2019, as amended on March 10, 2022.

Appointment of Andrew D. Jones as Chief Financial

Officer

Also, effective August 30, 2024, the Board

of Directors of the Company (the “Board”) appointed Andrew D. Jones to the positions of Chief Financial Officer, Treasurer

and Secretary of the Company.

Mr. Jones (age 54) served as the Chief Executive

Officer and Treasurer of NovaBay Pharmaceuticals, Inc. (NYSE: NBY; “NovaBay”), an ophthalmic commercial stage company,

from May 2020 to February 2023. Prior to joining NovaBay, Mr. Jones served as the Vice President of Finance of MyoScience, Inc.,

a commercial stage company that produced pain management devices, from July 2017 until its acquisition by Pacira BioSciences, Inc.

(Nasdaq: PCRX) in August 2019, during which time he was responsible for all financial, accounting, investor relations and risk management

functions as well as leading debt and equity fundraising. Mr. Jones previously served as Controller for various public and private

life sciences companies including Armetheon, Inc. (May 2015 to July 2017), Asante Solutions, Inc. (October 2014

to May 2015) and Genelabs Technologies, Inc. (then, Nasdaq: GNLB) (2005 to 2009) and began his career with PricewaterhouseCoopers.

Mr. Jones received a B.S. degree in Business Administration from the University of Washington in Seattle.

There are no arrangements or understandings between

Mr. Jones and any other persons pursuant to which he was appointed as Chief Financial Officer, Treasurer and Secretary of the Company,

and there is no family relationship between Mr. Jones and any director or executive officer of the Company. There are no transactions

between the Company and Mr. Jones that are disclosable pursuant to Item 404(a) of Regulation S-K.

In connection with his appointment as Chief Financial

Officer, Treasurer and Secretary, Mr. Jones entered into an executive employment agreement with the Company (the “Employment

Agreement”). Pursuant to the Employment Agreement, the Company will pay Mr. Jones an initial salary of $440,000. Mr. Jones

will be eligible for a cash bonus based on performance metrics to be determined by the Compensation Committee of the Board, with an initial

target of 40% of his annual base salary. Mr. Jones will also receive an inducement equity award consisting of options to purchase

200,000 shares of the Company’s common stock, which will vest in four equal installments on the first, second, third and fourth

anniversaries of the grant date, subject to Mr. Jones’ continued service to the Company on the applicable vesting dates. The

stock options will be granted in accordance with Nasdaq Listing Rule 5635(c)(4).

Mr. Jones’ employment is “at

will” and has no set term. If Mr. Jones’ employment is terminated by the Company without cause or if he suffers an Involuntary

Termination (as defined in the Employment Agreement; such a termination, a “qualifying termination”), Mr. Jones will

be entitled to receive (i) 12 months of his then-current annual base salary, less applicable withholdings and (ii) continuation

of up to 12 months of group health insurance benefits for Mr. Jones, his spouse and his dependents. In the event of a qualifying

termination within 12 months following any change in control of the Company, Mr. Jones would be eligible for similar benefits.

The foregoing description of the Employment Agreement

does not purport to be complete and is qualified in its entirety by the full text of the Employment Agreement, a copy of which is attached

as Exhibit 10.1 to this Current Report on Form 8-K and incorporated herein by reference.

| Item 7.01 |

Regulation FD Disclosure. |

On September 3, 2024, the Company issued

a press release announcing the resignation of Mr. Gandolfo from his position as Chief Financial Officer and the appointment of Mr. Jones

as Chief Financial Officer. A copy of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

The information in this Item 7.01, including Exhibit 99.1

attached hereto, is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange

Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed

incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth

by specific reference in such a filing.

| Item 9.01 |

Financial Statements and Exhibits. |

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

EYENOVIA, INC. |

| |

|

|

| Dated: September 3, 2024 |

By: |

/s/ Michael Rowe |

| |

|

Michael Rowe |

| |

|

Chief Executive Officer |

Exhibit 10.1

EXECUTIVE EMPLOYMENT AGREEMENT

THIS EXECUTIVE EMPLOYMENT AGREEMENT (the “Agreement”)

is made and effective this 30th day of August 2024 (the “Effective Date”), by and between Eyenovia, Inc., a Delaware

corporation (the “Company”), and Andrew D. Jones, an individual resident of California (“Executive”).

The Company and Executive are herein referred to each as a “Party” and together as the “Parties”.

WITNESSETH:

WHEREAS, the Parties wish to enter into this

Agreement to set forth the terms and conditions of Executive’s employment as the Company’s Chief Financial Officer; and

WHEREAS, in addition to and as an express condition

of this Agreement, Executive is executing concurrently herewith an At-Will Employment, Confidentiality, and Invention Assignment Agreement

(the “Confidentiality Agreement”), a copy of which is attached hereto as Exhibit A.

NOW, THEREFORE, in consideration of the mutual

promises herein contained, and other good and valuable consideration, including the employment of Executive by the Company and the compensation

received by Executive from the Company from time to time, the receipt and sufficiency of which are hereby acknowledged, the Parties, intending

to be legally bound, hereby agree as follows:

1. EMPLOYMENT;

TERM. The Company hereby agrees to employ Executive, and Executive hereby accepts such employment upon the terms and conditions hereinafter

set forth and as set forth the Confidentiality Agreement (Exhibit A). The term of Executive’s employment hereunder will commence

as of the Effective Date and will continue until terminated by either Party (the “Term”).

2. AT

WILL EMPLOYMENT. Executive’s employment with the Company is “at will,” and, subject to the terms and conditions

hereof, such employment may be terminated by Executive or the Company at any time, for any or no cause or reason. Upon the termination

of Executive’s employment by either Party, for any reason, neither Executive nor the Company shall have any further obligation or

liability under this Agreement to the other, except as expressly set out herein, as set forth in any equity agreement and the continuing

obligations set forth in the Confidentiality Agreement (Exhibit A).

3. POSITION

AND DUTIES. During the Term, Executive will be engaged as Chief Financial Officer of the Company reporting to the Company’s

Chief Executive Officer (the “CEO”), and his authority, duties and responsibilities will be commensurate in all material

respects with the authority, duties and responsibilities for such a position and such other duties and responsibilities as reasonably

determined by the CEO in his sole discretion. This position is exempt from the overtime payment provisions of the Fair Labor Standards

Act and the California Labor Code.

4. SERVICE.

Executive shall use his best efforts to at all times fulfill his duties and responsibilities in a reasonable and appropriate manner in

compliance with the Company’s policies and practices and the laws and regulations that apply to the Company’s operation and

administration. Executive shall devote his full business time and attention and best efforts to the business and affairs of the Company

and shall not be engaged in or employed by any other business enterprise without the express written approval of the Company, which approval

shall not be unreasonably withheld. This Section 4 shall not be construed as preventing Executive from:

a) Investing

his assets in a manner not prohibited by the Confidentiality Agreement, and in such form or manner as shall not impair his ability to

fulfill his duties and responsibilities under this Agreement;

b) Serving

on no more than one (1) board of directors of any company with approval of the CEO, with any additional directorships requiring the approval

of the Board of Directors of the Company (the “Board”), subject to the prohibitions set forth in the Confidentiality

Agreement and provided that it shall not impair his ability to fulfill his duties and responsibilities under this Agreement; or

c) Engaging

in religious, charitable or other community or non-profit activities that do not impair his ability to fulfill his duties and responsibilities

under this Agreement.

5. COMPENSATION.

During the Term of this Agreement, Executive’s compensation shall be determined and paid as follows.

(a) BASE

SALARY. Executive shall receive as compensation a base salary at the rate of no less than Four Hundred Forty Thousand Dollars ($440,000)

per year (the “Base Salary”), minus any federal, state and local payroll taxes and other withholdings legally required

or properly requested by Executive, paid semi-monthly on the Company’s regularly scheduled paydays in accordance with the Company’s

regular payroll practices and procedures.

(b) BONUS.

Executive shall be eligible to receive an annual cash bonus (the “Bonus”) in a target amount determined by the Board

or its Compensation Committee, based upon the Company’s and Executive’s meeting pre-established annual individual and Company

objectives as set out and approved by the Board or its Compensation Committee. Executive’s initial target Bonus opportunity is forty

percent (40%) of Executive’s Base Salary. Any bonus for 2024 will be prorated based on the number of months Executive is employed

by the Company in 2024. Annual performance objectives will be determined by the Compensation Committee by the end of the 1st quarter of

each calendar year. The amount of Executive’s Bonus shall be determined based upon Executive’s meeting these annual objectives.

Any such Bonus compensation will be paid (minus applicable withholdings) by March 15 of the calendar year following the calendar year

to which it relates. The payment of any Bonus shall be subject to Executive’s continued employment with the Company through the

end of the calendar year to which the annual objectives relate. Any dispute as to whether Executive has met the objectives shall be determined

by the Compensation Committee in the exercise of its sole discretion, with Executive having the right to request that the Board review

and confirm or reject such determination.

(c) EQUITY.

Subject to and upon approval by the Board, the Company will grant to Executive an equity award consisting of a stock option to purchase

two hundred thousand (200,000) shares of the Company’s outstanding common stock (the “Equity Award”) with a purchase

price equal to the fair market value of such common stock on the date of grant, as determined by the Board. Subject to Executive’s

continued service with the Company through each applicable date, (i) 1/4th of the shares subject to the Equity Award on the date of grant

will vest on the first anniversary of the vesting commencement date and (ii) 1/4th of the shares subject to the Equity Award on the date

of grant will vest each anniversary thereafter over the remaining three years, so that all of the shares subject to the Equity Award on

the date of grant will be vested on the four-year anniversary of the vesting commencement date. The Equity Award will be granted pursuant

to and subject to the terms and conditions of the Company’s 2018 Omnibus Stock Incentive Plan, or such other type of plan as is

in effect at that time (the “Plan”) and will be further subject to the terms of an equity agreement as approved by

the Board or its Compensation Committee, both the Plan and the equity agreement control in the event of any conflict with this Agreement.

The Equity Award will be granted only if Executive is employed by the Company on the date of approval by the Board.

(d) BENEFITS.

Executive will be eligible (subject to applicable eligibility requirements) to receive such other benefits as are provided from time to

time to other executive employees of the Company, including group health insurance and vacation, in accordance with the Company’s

policies and procedures and the applicable plan documents for such benefits. All such benefits are subject to change by the Company to

the extent permitted by applicable law without prior notice to or consent of Executive.

(e) BUSINESS

EXPENSES. Company shall reimburse Executive for all reasonable travel and other business expenses incurred by him in the performance

of his duties and responsibilities, subject to such reasonable requirements with respect to substantiation and documentation in accordance

with the Company’s established policies and procedures. Any taxable reimbursement due under the terms of this Agreement shall be

paid no later than December 31 of the year after the year in which the expense is incurred and shall comply with Treasury Regulation §

1.409A-3(i)(1)(iv).

6. PAYMENTS

ON TERMINATION.

(a) SEVERANCE.

If Executive’s employment is terminated by the Company without “Cause” (as such term is defined in the Plan) or Executive

suffers an Involuntary Termination (as defined below), provided such termination is a “separation from service” within the

meaning of Treasury Regulation § 1.409A-1(h), and provided further that Executive has signed (and not revoked) a full general release

of all claims in a form reasonably satisfactory to the Company within thirty (30) days of such termination (or such greater time period

as required by applicable law for consideration of an employee waiver), Executive will be entitled to receive (i) severance in a total

amount equal to twelve (12) months of his then-current Base Salary, less applicable withholdings (the “Severance”)

and (ii) subject to Section 6(d), if Executive properly and timely elects to continue group health insurance benefits under COBRA, reimbursement

for his and his spouse and dependents’ applicable COBRA premiums (x) for a period of twelve (12) months, (y) until Executive becomes

eligible for comparable insurance benefits from another employer (of which Executive shall promptly notify the Company), or (z) the date

Executive’s COBRA continuation coverage terminates, whichever is earlier. The Severance will be paid over a twelve (12) month period

in equal installments on the Company’s regular payroll schedule beginning on the first pay period following the 45th day following

Executive’s last day of employment.

(b) CHANGE

IN CONTROL SEVERANCE. If, within twelve (12) months following any “Corporate Transaction” (as such term is defined in

the Plan), Executive’s employment is terminated by the Company without “Cause” (as such term is defined in the Plan)

or Executive suffers an Involuntary Termination (as defined below), provided such termination is a “separation from service”

within the meaning of Treasury Regulation § 1.409A-1(h), and provided further that Executive has signed (and not revoked) a full

general release of all claims in a form reasonably satisfactory to the Company within thirty (30) days of such termination (or such greater

time period as required by applicable law for consideration of an employee waiver), Executive will be entitled to receive, in lieu of

the Severance described in Subsection (a) above, (i) severance in a total amount equal to twelve (12) months of his then-current Base

Salary, less applicable withholdings (the “Change in Control Severance”) and (ii) subject to Section 6(d), if Executive

properly and timely elects to continue group health insurance benefits under COBRA, reimbursement for his and his spouse and dependents’

applicable COBRA premiums (x) for a period of twelve (12) months, (y) until Executive becomes eligible for comparable insurance benefits

from another employer (of which Executive shall promptly notify the Company), or (z) the date Executive’s COBRA continuation coverage

terminates, whichever is earlier. The Change in Control Severance will be paid over a twelve (12) month period in equal installments on

the Company’s regular payroll schedule beginning on the first pay period following the 45th day following Executive’s last

day of employment.

(c) INVOLUNTARY

TERMINATION. For purposes of this Agreement, “Involuntary Termination” means the occurrence of any of the following

without the written consent of Executive: (i) a material diminution in Executive’s Base Salary, Bonus target or benefits (other

than a material diminution that is applicable to all similarly situated employees and executives of the Company in connection with an

across-the-board cost savings strategy); (ii) a material diminution in Executive’s authority, duties or responsibilities; (iii)

a material diminution in the level of Executive’s reporting structure, including a requirement that Executive report to a corporate

officer or employee instead of reporting directly to the CEO; or (iv) any other action or inaction that constitutes a material breach

by the Company of this Agreement. An Involuntary Termination shall be effectuated by Executive’s giving the Company written notice

of the termination within ninety (90) days of the initial existence of the circumstances alleged to be the grounds for Involuntary Termination,

setting forth such circumstances in reasonable detail. The Company shall have sixty (60) days following the receipt of such notification

to cure the specific circumstances that constitute grounds for Involuntary Termination. Executive must terminate employment with the Company

within thirty (30) days of the expiration of such cure period. In the event the Company cures, grounds for Involuntary Termination shall

not be deemed to exist with respect to the specific circumstances set forth in the written notice. Notwithstanding the foregoing, any

reasonable actions taken by the Company to accommodate a disability of Executive or pursuant to the Family and Medical Leave Act or comparable

state leave law shall not constitute an Involuntary Termination for purposes of this Agreement. The foregoing definition of Involuntary

Termination is intended to comply with the safe harbor provisions set forth in Treasury Regulation Section § 1.409A-1(n)(2)(ii) and

shall be interpreted consistently therewith.

(d) COMPLIANCE

WITH AFFORDABLE CARE ACT. Notwithstanding the foregoing, if at any time the Company determines in its reasonable discretion that the

payment of any COBRA premiums would result in a violation of the nondiscrimination rules of Section 105(h)(2) of the Internal Revenue

Code of 1986, as amended, or any statute or regulation of similar effect (including but not limited to the 2010 Patient Protection and

Affordable Care Act, as amended by the 2010 Health Care and Education Reconciliation Act), then in lieu of providing the COBRA premiums,

the Company will instead pay Executive a fully taxable cash payment equal to the COBRA premiums for the remainder of the designated period,

subject to applicable tax withholdings.

(e) REMEDIES

UPON BREACH. If Executive is entitled to receive the Severance or the Change in Control Severance but materially violates any provisions

of this Agreement, the Confidentiality Agreement or any other agreement entered into by Executive and the Company, in addition to and

not in limitation of any other remedies available to the Company, the Company will be entitled to immediately stop paying any further

installments of the Severance or Change in Control Severance and recover any Severance or Change in Control Severance already paid.

7. ARBITRATION.

In the event of any controversy, dispute or claim relating to or arising out of Executive’s employment relationship with the Company,

this Agreement, the Confidentiality Agreement, or the termination of Executive’s employment with the Company for any reason (including,

but not limited to, any claims of breach of contract, defamation, wrongful termination or age, sex, sexual orientation, race, color, national

origin, ancestry, marital status, religious creed, physical or mental disability or medical condition or other discrimination, retaliation

or harassment), the Parties agree that all such disputes shall be exclusively and fully resolved by confidential, binding arbitration,

as set forth in the Confidentiality Agreement.

8. EXCISE

TAXES. In the event that the payments and benefits provided for in this Agreement or otherwise payable to Executive in connection

with a Corporate Transaction (a) constitute “parachute payments” within the meaning of Section 280G of the Internal Revenue

Code of 1986, as amended (the “Code”) and (b) but for this Section 8, would be subject to the excise tax imposed by

Section 4999 of the Code, then, such payments and benefits shall be either (x) delivered in full, or (y) delivered as to such lesser extent

which would result in no portion of such payments and benefits being subject to excise tax under Section 4999 of the Code, whichever of

the foregoing amounts, taking into account the applicable federal, state, local, and foreign income taxes and the excise tax imposed by

Section 4999 of the Code, results in the receipt by Executive on an after-tax basis, of the greatest amount of benefits under this Agreement,

notwithstanding that all or some portion of such benefits may be taxable under Section 4999 of the Code. In the event Executive’s

payments and benefits are delivered to a lesser extent pursuant to the foregoing clause (y), such payments and benefits shall be reduced

in the following order, in each case, in reverse chronological order beginning with the severance and other benefits that are to be paid

the further in time from consummation of the transaction that is subject to Section 280G of the Code: (A) cash payments not subject to

Section 409A of the Code; (B) cash payments subject to Section 409A of the Code; (C) equity-based payments and acceleration; and (D) non-cash

forms of benefits. Unless the Company and Executive otherwise agree in writing, any determination required under this Section 8 shall

be made in writing by an accounting firm selected by the Company (the “Accountant”), whose determination shall be conclusive

and binding upon Executive and the Company for all purposes. For purposes of making the calculations required by this Section 8, the Accountant

may make reasonable assumptions and approximations concerning applicable taxes and may rely on reasonable, good faith interpretations

concerning the application of Sections 280G and 4999 of the Code. The Company and Executive will furnish to the Accountant such information

and documents as the Accountant may reasonably request in order to make a determination under this Section. The Company shall bear all

costs the Accountant may reasonably incur in connection with any calculations contemplated by this Section 8.

9. Withholding

and SECTION 409A. All amounts paid under this Agreement shall be paid less all applicable tax withholdings and any other

withholdings required by law or authorized by Executive. The Parties intend that the provisions of this Agreement comply with or be exempt

from Section 409A of the Code and the regulations thereunder (collectively, “Section 409A”) and all provisions of this

Agreement shall be construed in a manner consistent with the requirements for avoiding taxes or penalties under Section 409A. Any payments

made pursuant to this Agreement that satisfy the requirements to be either separation pay due to an involuntary separation from service

within the meaning of Treas. Reg. § 1.409A-1(b)(9)(iii) or a short-term deferral within the meaning of Treas. Reg. § 1.409A-1(b)(4)

shall, to the maximum extent possible, not be treated as deferred compensation subject to Section 409A. Notwithstanding the foregoing,

nothing in this Agreement shall be interpreted or construed to transfer any liability for any tax (including a tax or penalty due as a

result of a failure to comply with Section 409A) from Executive to the Company or to any other individual or entity. To the extent necessary

to avoid adverse tax consequences under Section 409A, a termination of employment shall not be deemed to have occurred for purposes of

any provision of this Agreement providing for the payment of any amounts or benefits upon or following a termination of employment unless

such termination also constitutes a “separation from service” within the meaning of Section 409A and, for purposes of any

such provision of this Agreement, references to a “termination,” “termination of employment,” “separation

of service,” or like terms shall mean “separation from service.” Each installment payment required under this Agreement

shall be considered a separate payment for purposes of Section 409A. If, upon separation from service, Executive is a “specified

employee” within the meaning of Section 409A, any payment under this Agreement that is subject to Section 409A and would otherwise

be paid within six months after Executive’s separation from service will instead be paid in the seventh month following Executive’s

separation from service (to the extent required by Section 409A(a)(2)(B)(i)).

10. NOTICES.

Any notice required to be given pursuant to this Agreement must be in writing and will be deemed effectively given to the other Party

on (i) the date it is actually delivered by personal delivery of such notice in person; (ii) one day after deposit in the custody of a

reputable overnight courier service (such as FedEx); or (iii) three days after its deposit in the custody of the U.S. mail, certified

or registered postage prepaid, return receipt requested; in the case of Executive, to his address shown on the Company’s records,

as updated by Executive from time-to-time, and in the case of the Company, to its principal office address.

11. WAIVER.

No waiver of any provision of this Agreement shall be valid unless the same is in writing and signed by the Party against whom such waiver

is sought to be enforced. Failure to insist upon strict compliance with any of the terms, covenants or conditions hereof shall not be

deemed a waiver of such terms, covenants or conditions, nor shall any waiver or relinquishment of any right or power granted hereunder

at any particular time be deemed a waiver or relinquishment of such rights or power at any other time or times.

12. SEVERABILITY.

In the event that any provision (or part thereof) of this Agreement is found by a court, arbitrator, or other tribunal having competent

jurisdiction to be illegal, invalid, or unenforceable, then such provision (or part thereof) shall not be voided, but shall be recast

so as to be enforced to the maximum extent permissible under applicable law while taking into account the original intent and effect of

the provision, and the remainder of this Agreement shall remain in full force and effect. Any prohibition or unenforceability of any provision

(or part thereof) of this Agreement in any jurisdiction shall not invalidate or render unenforceable such provisions (or portion thereof)

in any other jurisdiction.

13. GOVERNING

LAW. This Agreement shall be governed by and construed according to the laws of the State of California, without reference to the

choice of law or conflict of law provisions of such laws.

14. BENEFIT.

This Agreement shall be binding upon and shall inure to the benefit of each of the Parties hereto, and to their respective heirs, representatives,

successors and permitted assigns. Executive may not assign any of his rights or delegate any of his duties under this Agreement.

15. ENTIRE

AGREEMENT. This Agreement, and the Confidentiality Agreement (Exhibit A), contain the entire agreement and understanding by and between

the Company and Executive with respect to the terms described therein, and any representations, promises, agreements or understandings,

written or oral, not therein contained shall be of no force or effect. This Agreement supersedes and replaces in its entirety any and

all agreements between Executive and the Company with respect to the subject matter hereof. No change or modification hereof shall be

valid or binding unless the same is in writing and signed by the Parties hereto.

16. CAPTIONS.

The captions in this Agreement are for convenience only and in no way define, bind or describe the scope or intent of this Agreement.

[Signature page follows.]

SIGNATURE PAGE TO

EXECUTIVE EMPLOYMENT AGREEMENT

IN WITNESS WHEREOF, the Parties have executed this

Executive Employment Agreement effective as of the day and year first above written.

| EYENOVIA, INC. |

| |

|

| By: |

/s/ Michael Rowe |

|

| |

|

|

| Name: |

Michael Rowe |

|

| |

|

|

| Title: |

CEO |

|

| EXECUTIVE |

| |

| /s/ Andrew D. Jones |

(SEAL) |

| |

|

| Andrew D. Jones |

Exhibit A: Confidentiality Agreement

Exhibit 99.1

Eyenovia Announces Appointment of Experienced

Finance and Accounting Executive Andrew Jones as

Chief Financial Officer

Current CFO, John Gandolfo, to remain with the

Company through November as part of planned retirement transition

NEW YORK— September 3, 2024—Eyenovia, Inc. (NASDAQ:

EYEN), a commercial-stage ophthalmic company with two FDA-approved products and a late-stage asset in pediatric progressive myopia, today

announced the appointment of experienced finance and accounting executive Andrew Jones as Chief Financial Officer. Mr. Jones brings

to the Eyenovia team more than 30 years of diverse finance and accounting leadership experience spanning therapeutics and medical technology/devices,

most recently serving as Chief Financial Officer of NovaBay Pharmaceuticals, Inc., a publicly traded, commercial stage ophthalmic

company. Eyenovia’s current CFO, John Gandolfo, is retiring and will remain with the Company through November to help ensure

a smooth transition.

“We are very pleased to welcome Andrew to the Eyenovia team and

believe that his diverse and relevant experience is a perfect fit for our Company at this crucial stage,” stated Michael Rowe, Chief

Executive Officer of Eyenovia. “As we approach a critical data readout for MicroPine later this year, the U.S. launch of clobetasol,

as well as the continued commercial ramp of Mydcombi, we will rely on Andrew’s track record of success – in both operations

as well as capital raising – to ensure that we are best positioned for long-term success.”

“Additionally, on behalf of the entire Eyenovia team, I

would like to thank John Gandolfo for his many contributions since joining the Company in 2017. We have made tremendous progress during

that time, and I wish him well in his retirement.”

“Eyenovia’s commercial strategy is rapidly advancing, with

two FDA-approved products and a third in late Phase 3 development, in addition to several collaboration agreements that have the potential

to further advance and expand the use of its already proven Optejet technology to address additional large market ophthalmic indications,”

stated Mr. Andrew Jones. “With many opportunities to drive long-term growth and value creation, I am excited to join the

Eyenovia team as it works to be a leader in the development of highly differentiated topical ophthalmic medications.”

Prior to joining Eyenovia, Mr. Jones served as the Chief Financial

Officer and Treasurer of NovaBay Pharmaceuticals during a successful period of commercial growth and cost reductions. Prior to joining

NovaBay, he served as Vice President of Finance at MyoScience, Inc., a company that successfully developed and commercialized a pain

management device through its acquisition by Pacira BioSciences, Inc. Mr. Jones previously served as Controller for various

public and private life sciences companies including Armetheon, Inc., Asante Solutions, Inc. and Genelabs Technologies, Inc.,

and began his career with PricewaterhouseCoopers. Mr. Jones received a B.S. degree in Business Administration from the University

of Washington in Seattle.

Nasdaq Rule 5635(c)(4) Notice

In connection with the commencement of his employment,

Mr. Jones was awarded an inducement grant of an option to purchase 200,000 shares of the Company’s common stock at an exercise

price equal to the closing price per share of the Company’s common stock on the grant date, August 30, 2024. Such option is

subject to a four-year vesting schedule, with 25% of the shares subject to the option vesting on the first anniversary of the grant date

and the balance of the shares to vest in equal annual installments over Mr. Jones' subsequent three years of continuous service to

the Company thereafter. The Compensation Committee of Eyenovia's Board of Directors approved the award as an inducement material to Mr. Jones'

employment in accordance with Nasdaq Listing Rule 5635(c)(4).

About Eyenovia, Inc.

Eyenovia, Inc. (NASDAQ:

EYEN) is a commercial-stage ophthalmic pharmaceutical technology company developing a pipeline of microdose array print therapeutics.

Eyenovia is currently focused on the commercialization of MYDCOMBI® for mydriasis, clobetasol propionate ophthalmic suspension, 0.05%

for post-surgical pain and inflammation, as well as the ongoing late-stage development of medications in the Optejet device for pediatric

progressive myopia as well as out-licensing for additional indications. For more information, visit Eyenovia.com.

The Eyenovia Corporate

Information slide deck may be found at ir.eyenovia.com/events-and-presentations.

PLEASE GO TO MYDCOMBI.COM FOR

IMPORTANT SAFETY INFORMATION for MYDCOMBI™ (tropicamide and phenylephrine hydrochloride ophthalmic spray) 1%/2.5%

PLEASE GO TO CLOBETASOLBID.COM FOR

IMPORTANT SAFETY INFORMATION for Clobetasol Proprionate Ophthalmic Suspension 0.05%

Forward-Looking Statements

Except

for historical information, all the statements, expectations and assumptions contained in this press release are forward-looking

statements. Forward-looking statements include, but are not limited to, statements that express our intentions, beliefs, expectations,

strategies, predictions or any other statements relating to our future activities or other future events or conditions, including estimated

market opportunities for our product candidates and platform technology, and the timing for availability and sales growth of our approved

products. These statements are based on current expectations, estimates and projections about our business based, in part, on assumptions

made by management. These statements are not guarantees of future performance and involve risks, uncertainties and assumptions that are

difficult to predict. Therefore, actual outcomes and results may, and in some cases are likely to, differ materially from what is expressed

or forecasted in the forward-looking statements due to numerous factors discussed from time to time in documents which we file with the U.S.

Securities and Exchange Commission.

In addition, such statements could be affected

by risks and uncertainties related to, among other things: risks of our clinical trials, including, but not limited to, the costs, design,

initiation and enrollment, timing, progress and results of such trials; the timing of, and our ability to submit applications for, obtaining

and maintaining regulatory approvals for our products and product candidates; the potential advantages of our products, product candidates

and platform technology; the rate and degree of market acceptance and clinical utility of our products and product candidates; our estimates

regarding the potential market opportunity for our products and product candidates; reliance on third parties to develop and commercialize

our products and product candidates; the ability of us and our partners to timely develop, implement and maintain manufacturing, commercialization

and marketing capabilities and strategies for our products and product candidates; intellectual property risks; changes in legal, regulatory,

legislative and geopolitical environments in the markets in which we operate and the impact of these changes on our ability to obtain

regulatory approval for our products and product candidates; and our competitive position.

Any forward-looking statements speak only as of

the date on which they are made, and except as may be required under applicable securities laws, Eyenovia does not undertake

any obligation to update any forward-looking statements.

Eyenovia Contact:

Eyenovia, Inc.

Andy Jones

Chief Financial Officer

ajones@eyenovia.com

Eyenovia Investor Contact:

Eric Ribner

LifeSci Advisors, LLC

eric@lifesciadvisors.com

(646) 751-4363

Eyenovia Media Contact:

Eyenovia, Inc.

Norbert Lowe

Vice President, Commercial Operations

nlowe@eyenovia.com

v3.24.2.u1

Cover

|

Aug. 30, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Aug. 30, 2024

|

| Entity File Number |

001-38365

|

| Entity Registrant Name |

EYENOVIA, INC.

|

| Entity Central Index Key |

0001682639

|

| Entity Tax Identification Number |

47-1178401

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

295 Madison Avenue

|

| Entity Address, Address Line Two |

Suite 2400

|

| Entity Address, City or Town |

New York

|

| Entity Address, State or Province |

NY

|

| Entity Address, Postal Zip Code |

10017

|

| City Area Code |

833

|

| Local Phone Number |

393-6684

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common stock, par value $0.0001 per share

|

| Trading Symbol |

EYEN

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

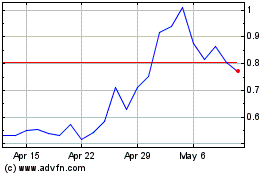

Eyenovia (NASDAQ:EYEN)

Historical Stock Chart

From Oct 2024 to Nov 2024

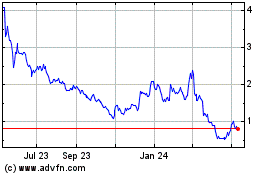

Eyenovia (NASDAQ:EYEN)

Historical Stock Chart

From Nov 2023 to Nov 2024