Filed

Pursuant to Rule 433 of the Securities Act of 1933

Issuer

Free Writing Prospectus dated December 19, 2024

Relating

to Preliminary Prospectus dated November 20, 2024

Registration

No. 333-275761

EzFill

Holdings, Inc.

Free

Writing Prospectus

We

have filed a registration statement (including a preliminary prospectus) (File No. 333-275761) with the SEC for the offering to which

this communication relates. The registration statement has not yet become effective. Before you invest, you should read the preliminary

prospectus in that registration statement (including the risk factors described therein) and other documents that we have filed with

the SEC for more complete information about us and this offering. You may access these documents for free by visiting EDGAR on the SEC

Website at http://www.sec.gov. The preliminary prospectus was filed November 20, 2024 and is available on the SEC website at http://www.sec.gov.

Alternatively, EzFill Holdings, Inc. and any underwriter or dealer participating in the offering will arrange to send you the prospectus

if you request it by calling ThinkEquity at (877) 436-3673 or by email at prospecdtus@think-equity.com or standard mail at ThinkEquity,

Attn: Prospectus Department, 17 State Street 41st Floor, New York, New York 10004. The recent registration statement (including

the most recent prospectus) can be accessed through the following link:

https://www.sec.gov/ix?doc=/Archives/edgar/data/1817004/000149315224046904/forms-1a.htm

Form

CRS/Reg BI Disclaimer:

ThinkEquity

is registered with the Securities and Exchange Commission (SEC) as a broker-dealer and is a member of the Financial Industry Regulatory

Authority (FINRA) and the Securities Investor Protection Corporation (SIPC). Brokerage and investment advisory services and fees differ

and it is important for you to understand these differences. Free and simple tools are available to research firms and financial professionals

at Investor.gov/CRS, which also provides educational materials about broker-dealers, investment advisers, and investing. When we provide

you with a recommendation, we have to act in your best interest and not put our interest ahead of yours. At the same time, the way we

make money creates a conflict with your interests. Please strive to understand and ask us about these conflicts because they can affect

the recommendations we provide you. There are many risks involved with investing. For ThinkEquity customers and clients, please see our

Regulation Best Interest Relationship Guide on the Form CRS Reg BI page on our website at https://www.think-equity.com/. Please

also carefully review and verify the accuracy of the information you provide us on account applications, subscription documents and others.

Forward Looking Statement

This document contains forward-looking statements.

In addition, from time to time, we or our representatives may make forward-looking statements orally or in writing. We base these forward-looking

statements on our expectations and projections about future events, which we derive from the information currently available to us. Such

forward-looking statements relate to future events or our future performance, including: our financial performance and projections; our

growth in revenue and earnings; and our business prospects and opportunities. You can identify forward-looking statements by those that

are not historical in nature, particularly those that use terminology such as “may,” “should,” “expects,”

“anticipates,” “contemplates,” “estimates,” “believes,” “plans,” “projected,”

“predicts,” “potential,” or “hopes” or the negative of these or similar terms. Factors that may cause

actual results to differ materially from current expectations include, among other things, those listed under the heading “Risk

Factors” and elsewhere in the registration statement that we have filed with the U.S. Securities and Exchange Commission. Forward-looking

statements are only predictions. The forward-looking events discussed in this document and other statements made from time to time by

us or our representatives, may not occur, and actual events and results may differ materially and are subject to risks, uncertainties

and assumptions about us. We are not obligated to publicly update or revise any forward-looking statement, whether as a result of uncertainties

and assumptions, the forward-looking events discussed in this document and other statements made from time to time by us or our representatives

might not occur. Past performance is not indicative of future results. There is now guarantee that any specific outcome will be achieved.

Investments may be speculative, illiquid and there is a total risk of loss.

Mobile

Fueling Vendor Agreement, dated as of December 14, 2024

On

December 14, 2024, EzFill Holdings, Inc., a Delaware corporation (the “Company”) and Amazon Logistics, Inc., a Delaware

corporation (“Amazon”) entered into a Mobile Fueling Vendor Agreement (the “Agreement”) in respect of certain

mobile fueling products and services to be provided by the Company to Amazon. Such products and services will include, but not be limited

to, (i) the Company’s on-site fueling services for fleet vehicles for both overnight and daytime fueling services to certain vehicles

identified by Amazon stored at certain Amazon delivery locations and other off-site locations designed by Amazon, and (ii) a designated

account management team available to assist Amazon during normal business hours and that will respond to escalations, questions and other

support needed on a timely basis.

The

Agreement provides for certain service level agreements in connection with establishing a process to review the deployment plan as set

forth therein on at least a monthly basis to track progress and align on any required adjustments. Further, the Agreement provides for

certain representations, covenants and indemnification provisions that are customary for these types of transactions.

The

term of the Agreement commences as of the Effective Date (as defined in the Agreement) and, unless earlier terminated as provided thereunder,

will continue for three (3) years (the “Initial Term”). Following the Initial Term, Amazon has the unilateral right to extend

the Agreement for up to two (2) additional one-year terms by providing sixty (60) days’ notice to the Company of its intent to

extend the Agreement.

Letter

of Understanding, dated as of December 12, 2024

On

December 12, 2024, EzFill Holdings, Inc., a Delaware corporation (the “Company”) and Shell Retail and Convenience

Operations LLC d/b/a Shell TapUp and d/b/a Instafuel, a Delaware limited liability company (“Shell”),

entered into a Letter of Understanding (the “LOU”) in respect of the purchase and sale of seventy-eight (78) trucks and

certain above ground tanks for a total purchase price of $5,345,077 plus applicable taxes. The LOU provides for the Company to pay Shell

a seven percent (7%) non-refundable down payment by December 16, 2024, with the remaining balance due by December 26, 2024. The

LOU provides the Company with option of removing up to eight (8) trucks from the schedule of transferred assets, based on the results

of its inspections of the trucks, with the final purchase price being updated accordingly.

The LOU provides for certain representations, covenants and indemnification

obligations that are customary for these types of transactions. The Company expects the transactions contemplated by the LOU to close

by December 26, 2024.

Past

performance is not indicative of further results. There is no guarantee that any specific objective will be achieved. Investments may

be illiquid, highly speculative and there is a risk of the total loss of your investment. Please see full disclosure at the beginning.

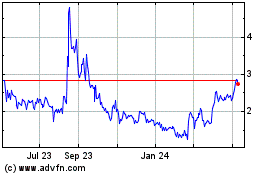

EzFill (NASDAQ:EZFL)

Historical Stock Chart

From Nov 2024 to Dec 2024

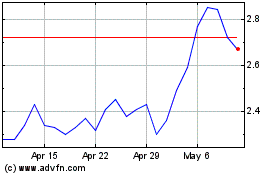

EzFill (NASDAQ:EZFL)

Historical Stock Chart

From Dec 2023 to Dec 2024