false000092129900009212992024-02-262024-02-26

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): February 26, 2024 |

FIBROGEN, INC.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

001-36740 |

77-0357827 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

409 Illinois Street |

|

San Francisco, California |

|

94158 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: 415 978-1200 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock, $0.01 par value |

|

FGEN |

|

The Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On February 26, 2024, FibroGen, Inc. (“FibroGen”) issued a press release announcing financial results for the quarter and the year ended December 31, 2023. A copy of such press release is furnished as Exhibit 99.1 to this report and is incorporated herein by reference.

The information in this Item 2.02, including Exhibit 99.1, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that Section or Sections 11 and 12(a)(2) of the Securities Act of 1933, as amended. The information contained in this Item 2.02, in Exhibit 99.1 shall not be incorporated by reference into any filing with the U.S. Securities and Exchange Commission made by FibroGen, whether made before or after the date hereof, regardless of any general incorporation language in such filing.

Item 9.01 Financial Statements and Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

|

|

|

|

FIBROGEN, INC. |

|

|

|

|

Date: |

February 26, 2024 |

By: |

/s/ Juan Graham |

|

|

|

Juan Graham

Senior Vice President and Chief Financial Officer |

Exhibit 99.1

FibroGen Reports Fourth Quarter and Full Year 2023 Financial Results

•Topline data from two pivotal pamrevlumab pancreatic cancer trials anticipated in 2Q 2024

•Additional data from Phase 1 monotherapy study of FG-3246 in metastatic castration-resistant prostate cancer (mCRPC) expected in 1Q 2024

•FibroGen regains rights to roxadustat from AstraZeneca in the United States and other AstraZeneca territories, except China and South Korea

•FY 2023 total net revenue of $147.8 million, an increase of 5% year over year

•Robust roxadustat volume growth of 41% in China in FY 2023 compared to FY 2022

•Successful execution of cost reduction plan; $248.1 million in cash provides cash runway into 2026

SAN FRANCISCO, February 26, 2024 (GLOBE NEWSWIRE) -- FibroGen, Inc. (NASDAQ: FGEN) today reported financial results for the fourth quarter and full year 2023 and provided an update on the company’s recent developments.

“We are extremely excited about the company’s prospects in 2024,” said Thane Wettig, Chief Executive Officer, FibroGen. “In this year alone, we will obtain data read-outs from our two late-stage pancreatic cancer trials, start a Phase 2 metastatic castration-resistant prostate cancer trial, file an immuno-oncology IND, and potentially receive approval for roxadustat in chemotherapy-induced anemia in China. Furthermore, the continued strength of our China business, accelerated realization of our corporate cost reduction program, and our strong balance sheet provide us a cash runway into 2026. These unique and exciting programs, combined with the quality of our talented colleagues, provide a strong foundation to create significant value for shareholders relative to our current valuation.”

Upcoming Milestones:

Pamrevlumab

•Topline data from the PanCAN Precision PromiseSM Phase 2/3 study of pamrevlumab in metastatic pancreatic cancer expected in 2Q 2024.

•Topline data from the LAPIS Phase 3 study of pamrevlumab in locally advanced unresectable pancreatic cancer (LAPC) expected in 2Q 2024.

Roxadustat

•Expect approval decision for roxadustat in chemotherapy-induced anemia (CIA) in China in mid-2024. If approved, FibroGen will receive a $10M milestone payment from AstraZeneca.

Oncology Pipeline

•Additional data from Phase 1 monotherapy study of FG-3246 in metastatic castration-resistant prostate cancer (mCRPC) expected in 1Q 2024.

•Anticipate the initiation of a Phase 2 study of FG-3246 in mCRPC in 2H 2024.

•Anticipate the filing of two INDs: FG-3165 (anti-Gal9 antibody) in 1Q 2024 and FG-3175 (anti-CCR8 antibody) in 2025.

Recent Developments and Key Highlights of 2023:

Pamrevlumab

•Announced graduation and completion of the pamrevlumab arm in Precision PromiseSM, Pancreatic Cancer Action Network’s Phase 2/3 adaptive platform trial for metastatic pancreatic cancer.

oPamrevlumab, in Stage 1 of the trial, achieved a protocol pre-specified ≥ 35% predictive probability of success for the primary endpoint of overall survival at the completion of the trial.

Roxadustat

•Regained all rights to roxadustat from AstraZeneca in the United States and other AstraZeneca territories, except China and South Korea.

•Presented data from Phase 3 MATTERHORN study of roxadustat in patients with anemia of lower risk transfusion-dependent myelodysplastic syndromes at American Society of Hematology Annual Meeting.

Corporate

•Thane Wettig appointed Chief Executive Officer.

•Successful execution of cost reduction plan, resulting in a reduction of total annualized expenses of $120 million.

China:

•Fourth quarter FibroGen’s net product revenue under U.S. GAAP from the sale of roxadustat in China was $23.5 million compared to $23.4 million in the fourth quarter of 2022.

•Full year 2023 FibroGen’s net product revenue under U.S. GAAP from the sale of roxadustat in China was $100.9 million compared to $82.9 million in the full year 2022, an increase of 22%.

•Fourth quarter total roxadustat net sales in China1 by FibroGen and the distribution entity jointly owned by FibroGen and AstraZeneca (JDE) was $66.5 million, compared to $53.1 million in the fourth quarter of 2022, an increase of 25%.

•Full year 2023 total roxadustat net sales in China1 by FibroGen and the JDE was $284.1 million, compared to $208.8 million in the full year 2022, an increase of 36%, driven by over 41% growth in volume.

•Roxadustat continues to be the number one brand based on value share in the anemia of CKD market in China and has secured renewal on the National Reimbursement Drug List.

•For 2024, we anticipate FibroGen’s full year net product revenue under U.S. GAAP to range between $120 million to $135 million, representing full year roxadustat net sales in China1 by FibroGen and the JDE to range between $300 million to $340 million.

Financial:

•Total revenue for the fourth quarter of 2023 was $27.1 million, as compared to $34.4 million for the fourth quarter of 2022. Reduction primarily driven by the change in net product revenue assumptions under U.S. GAAP and drug product revenue shipment timing.

•Total revenue for full year 2023 was $147.8 million as compared to $140.7 million in 2022.

•Net loss for the fourth quarter of 2023 was $56.2 million, or $0.57 net loss per basic and diluted share, compared to a net loss of $66.2 million, or $0.70 net loss per basic and diluted share one year ago.

•Net loss for the year was $284.2 million, or $2.92 net loss per basic and diluted share, compared to a net loss of $293.7 million, or $3.14 net loss per basic and diluted share one year ago.

•At December 31, 2023, FibroGen had $248.1 million in cash - defined as cash, cash equivalents, investments, and accounts receivable.

•We expect our cash, cash equivalents, investments, and accounts receivable to be sufficient to fund our operating plans into 2026.

Conference Call and Webcast Details

FibroGen will host a conference call and webcast today, Monday, February 26, 2024, at 5:00 PM Eastern Time to discuss financial results and provide a business update. Interested parties may access a live audio webcast of the conference call via the “Investor Relations” page of the Company’s website at www.fibrogen.com. To access the call by phone, please go to this link (registration link), and you will be provided with dial in details. To avoid delays, we encourage participants to dial into the conference call fifteen minutes ahead of the scheduled start time. A replay of the webcast will also be available for a limited time at the following link (webcast replay).

_________________________________

1 Total roxadustat net sales in China includes sales made by the distribution entity as well as FibroGen China’s direct sales, each to its own distributors. The distribution entity jointly owned by AstraZeneca and FibroGen is not consolidated into FibroGen’s financial statements.

About Pamrevlumab

Pamrevlumab is a potential first-in-class antibody being developed by FibroGen to inhibit the activity of connective tissue growth factor (CTGF). Pamrevlumab is in Phase 3 clinical development for the treatment of locally advanced unresectable pancreatic cancer (LAPC) and in Phase 2/3 for the treatment of metastatic pancreatic cancer. The U.S. Food and Drug Administration has granted Orphan Drug Designation, and Fast Track designation to pamrevlumab for the treatment of patients with LAPC. Pamrevlumab has demonstrated a safety and tolerability profile that has supported ongoing clinical investigation in LAPC and metastatic pancreatic cancer. Pamrevlumab is an investigational drug and not approved for marketing by any regulatory authority. For information about our pamrevlumab studies please visit www.clinicaltrials.gov.

About Roxadustat

Roxadustat, an oral medication, is the first in a new class of medicines comprising HIF-PH inhibitors that promote erythropoiesis, or red blood cell production, through increased endogenous production of erythropoietin, improved iron absorption and mobilization, and downregulation of hepcidin. Roxadustat is in clinical development for chemotherapy-induced anemia (CIA) and a Supplemental New Drug Application (sNDA) has been accepted by the China Health Authority.

Roxadustat is approved in China, Europe, Japan, and numerous other countries for the treatment of anemia of CKD in adult patients on dialysis (DD) and not on dialysis (NDD). Several other licensing applications for roxadustat have been submitted by partners, Astellas and AstraZeneca, to regulatory authorities across the globe, and are currently under review. Astellas and FibroGen are collaborating on the development and commercialization of roxadustat for the potential treatment of anemia in territories including Japan, Europe, Turkey, Russia, and the Commonwealth of Independent States, the Middle East, and South Africa. AstraZeneca and FibroGen continue to collaborate on the development and commercialization of roxadustat in China.

About FibroGen

FibroGen, Inc. is a biopharmaceutical company focused on accelerating the development of novel therapies at the frontiers of cancer biology. Pamrevlumab, an anti-CTGF fully human monoclonal antibody, is in clinical development for the treatment of metastatic pancreatic cancer and locally advanced unresectable pancreatic cancer (LAPC). Roxadustat (爱瑞卓®, EVRENZOTM) is currently approved in China, Europe, Japan, and numerous other countries for the treatment of anemia in chronic kidney disease (CKD) patients on dialysis and not on dialysis. Roxadustat is in clinical development for chemotherapy-induced anemia (CIA) and a Supplemental New Drug Application (sNDA) has been accepted for review by the China Health Authority. FibroGen recently expanded its research and development portfolio to include antibody-drug conjugate (ADC) and immuno-oncology product candidates for the treatment of solid tumors. For more information, please visit www.fibrogen.com.

Forward-Looking Statements

This release contains forward-looking statements regarding FibroGen’s strategy, future plans and prospects, including statements regarding the development and commercialization of roxadustat, including its commercial potential, and the potential safety and efficacy profile of roxadustat. These forward-looking statements include but are not limited to statements about FibroGen’s plans and objectives and typically are identified by use of terms such as “may,” “will”, “should,” “on track,” “could,” “expect,” “plan,” “anticipate,” “believe,” “estimate,” “predict,” “potential,” “continue” and similar words, although some forward-looking statements are expressed differently. FibroGen’s actual results may differ materially from those indicated in these forward-looking statements due to risks and uncertainties related to the continued progress and timing of its various programs, including the enrollment and results from ongoing and potential future clinical trials, and other matters that are described in FibroGen’s Annual Report on Form 10-K for the fiscal year ended December 31, 2023 as filed with the Securities and Exchange Commission (SEC), including the risk factors set forth therein. Investors are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this release, and FibroGen undertakes no obligation to update any forward-looking statement in this press release, except as required by law.

# # #

Condensed Consolidated Balance Sheets

(In thousands)

|

|

|

|

|

|

|

|

|

December 31, 2023 |

|

|

December 31, 2022 |

|

|

(Unaudited) |

|

|

(1) |

|

Assets |

|

|

|

|

|

Current assets: |

|

|

|

|

|

Cash and cash equivalents |

$ |

113,688 |

|

|

$ |

155,700 |

|

Short-term investments |

|

121,898 |

|

|

|

266,308 |

|

Accounts receivable, net |

|

12,553 |

|

|

|

16,299 |

|

Inventory |

|

41,565 |

|

|

|

40,436 |

|

Prepaid expenses and other current assets |

|

41,855 |

|

|

|

14,083 |

|

Total current assets |

|

331,559 |

|

|

|

492,826 |

|

|

|

|

|

|

|

Restricted time deposits |

|

1,658 |

|

|

|

2,072 |

|

Long-term investments |

|

— |

|

|

|

4,348 |

|

Property and equipment, net |

|

13,126 |

|

|

|

20,605 |

|

Equity method investment in unconsolidated variable interest entity |

|

5,290 |

|

|

|

5,061 |

|

Operating lease right-of-use assets |

|

68,093 |

|

|

|

79,893 |

|

Other assets |

|

3,803 |

|

|

|

5,282 |

|

Total assets |

$ |

423,529 |

|

|

$ |

610,087 |

|

|

|

|

|

|

|

Liabilities, stockholders’ equity and non-controlling interests |

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

Accounts payable |

$ |

17,960 |

|

|

$ |

30,758 |

|

Accrued and other liabilities |

|

172,891 |

|

|

|

219,773 |

|

Deferred revenue |

|

12,740 |

|

|

|

12,739 |

|

Operating lease liabilities, current |

|

14,077 |

|

|

|

10,292 |

|

Total current liabilities |

|

217,668 |

|

|

|

273,562 |

|

|

|

|

|

|

|

Product development obligations |

|

17,763 |

|

|

|

16,917 |

|

Deferred revenue, net of current |

|

157,555 |

|

|

|

185,722 |

|

Operating lease liabilities, non-current |

|

66,537 |

|

|

|

79,593 |

|

Senior secured term loan facilities, non-current |

|

71,934 |

|

|

|

— |

|

Liability related to sale of future revenues, non-current |

|

51,413 |

|

|

|

49,333 |

|

Other long-term liabilities |

|

2,858 |

|

|

|

6,440 |

|

Total liabilities |

|

585,728 |

|

|

|

611,567 |

|

|

|

|

|

|

|

Redeemable non-controlling interests |

|

21,480 |

|

|

|

— |

|

Total stockholders’ deficit attributable to FibroGen |

|

(204,166 |

) |

|

|

(21,447 |

) |

Nonredeemable non-controlling interests |

|

20,487 |

|

|

|

19,967 |

|

Total deficit |

|

(183,679 |

) |

|

|

(1,480 |

) |

Total liabilities, redeemable non-controlling interests and deficit |

$ |

423,529 |

|

|

$ |

610,087 |

|

(1)The condensed consolidated balance sheet amounts at December 31, 2022 are derived from audited financial statements.

Condensed Consolidated Statements of Operations

(In thousands, except per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended December 31, |

|

|

Years Ended December 31, |

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

|

(Unaudited) |

|

|

(Unaudited) |

|

|

(1) |

|

Revenue: |

|

|

|

|

|

|

|

|

|

|

|

License revenue |

$ |

— |

|

|

$ |

— |

|

|

$ |

9,649 |

|

|

$ |

22,590 |

|

Development and other revenue |

|

2,575 |

|

|

|

4,517 |

|

|

|

18,401 |

|

|

|

24,189 |

|

Product revenue, net |

|

23,510 |

|

|

|

23,374 |

|

|

|

100,949 |

|

|

|

82,869 |

|

Drug product revenue, net |

|

1,052 |

|

|

|

6,476 |

|

|

|

18,753 |

|

|

|

11,086 |

|

Total revenue |

|

27,137 |

|

|

|

34,367 |

|

|

|

147,752 |

|

|

|

140,734 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating costs and expenses: |

|

|

|

|

|

|

|

|

|

|

|

Cost of goods sold |

|

5,406 |

|

|

|

4,924 |

|

|

|

18,848 |

|

|

|

20,280 |

|

Research and development |

|

51,702 |

|

|

|

61,628 |

|

|

|

282,861 |

|

|

|

296,791 |

|

Selling, general and administrative |

|

24,224 |

|

|

|

33,966 |

|

|

|

115,252 |

|

|

|

124,688 |

|

Restructuring charge |

|

— |

|

|

|

— |

|

|

|

12,606 |

|

|

|

— |

|

Total operating costs and expenses |

|

81,332 |

|

|

|

100,518 |

|

|

|

429,567 |

|

|

|

441,759 |

|

Loss from operations |

|

(54,195 |

) |

|

|

(66,151 |

) |

|

|

(281,815 |

) |

|

|

(301,025 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

Interest and other, net: |

|

|

|

|

|

|

|

|

|

|

|

Interest expense |

|

(5,068 |

) |

|

|

(1,119 |

) |

|

|

(15,532 |

) |

|

|

(1,440 |

) |

Interest income and other income (expenses), net |

|

2,496 |

|

|

|

923 |

|

|

|

10,480 |

|

|

|

7,596 |

|

Total interest and other, net |

|

(2,572 |

) |

|

|

(196 |

) |

|

|

(5,052 |

) |

|

|

6,156 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss before income taxes |

|

(56,767 |

) |

|

|

(66,347 |

) |

|

|

(286,867 |

) |

|

|

(294,869 |

) |

Provision for (benefit from) income taxes |

|

80 |

|

|

|

108 |

|

|

|

3 |

|

|

|

358 |

|

Investment income in unconsolidated

variable interest entity |

|

615 |

|

|

|

280 |

|

|

|

2,638 |

|

|

|

1,573 |

|

Net loss |

$ |

(56,232 |

) |

|

$ |

(66,175 |

) |

|

$ |

(284,232 |

) |

|

$ |

(293,654 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

Net loss per share - basic and diluted |

$ |

(0.57 |

) |

|

$ |

(0.70 |

) |

|

$ |

(2.92 |

) |

|

$ |

(3.14 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average number of common shares used to

calculate net loss per share - basic and diluted |

|

98,496 |

|

|

|

94,032 |

|

|

|

97,303 |

|

|

|

93,582 |

|

(1)The condensed consolidated statement of operations amounts for the year ended December 31, 2022 are derived from audited financial statements.

# # #

Contacts:

FibroGen, Inc.

Investors:

David DeLucia, CFA

Vice President of Corporate FP&A / Investor Relations

ir@fibrogen.com

Media:

Meichiel Keenan

Director, Investor Relations and Corporate Communications

media@fibrogen.com

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

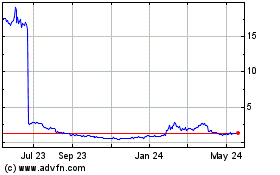

FibroGen (NASDAQ:FGEN)

Historical Stock Chart

From Mar 2024 to Apr 2024

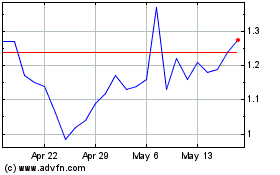

FibroGen (NASDAQ:FGEN)

Historical Stock Chart

From Apr 2023 to Apr 2024