Greater Bay Bancorp (Nasdaq:GBBK), a $7.4 billion in assets

financial services holding company, today announced results for the

fourth quarter and year ended December 31, 2006. For the fourth

quarter of 2006, the Company�s net income was $18.8 million, or

$0.33 per diluted common share, compared to $27.5 million, or $0.48

per diluted common share, for the fourth quarter of 2005, and $18.5

million, or $0.32 per diluted common share, for the third quarter

of 2006. For the year ended December 31, 2006, net income was $89.6

million, or $1.60 per diluted common share, compared to $97.2

million, or $1.64 per diluted common share for the year ended

December 31, 2005. Operating results for the quarter included the

recognition of severance expenses totaling $2.2 million which were

associated with reduction in workforce actions taken as part of the

Company�s previously outlined cost control initiatives. The results

also included a mark-to-market decline of $1.5 million in the value

of the Company�s equity investment portfolio. For the fourth

quarter of 2006, the Company�s return on average common equity,

annualized, was 10.03% compared to 16.25% for the fourth quarter of

2005, and 10.15% for the third quarter of 2006. Return on average

common equity for the year ended December 31, 2006 was 12.57%

compared to 14.55% in 2005. Return on average assets, annualized,

for the fourth quarter of 2006 was 1.00% compared to 1.53% for the

fourth quarter of 2005, and 1.00% for the third quarter of 2006.

Return on average assets for the year ended December 31, 2006 was

1.24% compared to 1.37% in 2005. �We are pleased with the continued

progress achieved during the quarter,� stated Byron A. Scordelis,

President and Chief Executive Officer of Greater Bay Bancorp.

�Against a cyclical market backdrop of continued margin pressure,

we achieved healthy growth in our core deposit base, and posted

solid growth in both our community banking and specialty finance

loan portfolios. Key credit metrics remained strong, and we made

tangible progress in our sustained expense control initiatives.�

Net Interest Income and Margin Net interest income for the fourth

quarter of 2006 decreased to $63.9 million from $67.7 million in

the fourth quarter of 2005, and increased from $63.8 million in the

third quarter of 2006. Net interest income for the year ended

December 31, 2006 decreased to $260.4 million from $267.2 million

in 2005. The net interest margin (on a fully tax-equivalent basis)

for the fourth quarter of 2006 was 3.91%, compared to 4.36% for the

fourth quarter of 2005 and 3.97% for the third quarter of 2006. The

net interest margin (on a fully tax-equivalent basis) for the year

ended December 31, 2006 was 4.13% compared to 4.34% in 2005.

�Margin contraction was principally due to a continued, though

noticeably slowed, narrowing of deposit spreads,� stated James S.

Westfall, Executive Vice President and Chief Financial Officer.

�Movement in asset yields and other funding costs were fairly

balanced during the quarter,� he added. Non-Interest Income

Non-interest income for the fourth quarter of 2006 decreased to

$51.6 million compared to $53.0 million in the fourth quarter of

2005. This reduction was primarily attributable to a $2.8 million

decline in equity investment mark-to-market income, partially

offset by a $1.7 million increase in insurance commissions and

fees. Non-interest income for the fourth quarter of 2006 decreased

by $3.9 million compared to the third quarter of 2006. This

reduction was primarily attributable to a $3.0 million reduction in

insurance commissions and fees reflecting normal fourth quarter

seasonality and a $1.5 million decline in equity investment

mark-to-market income. Non-interest income for the year ended

December 31, 2006 increased to $222.6 million from $211.9 million

in 2005. This change was primarily attributable to an increase in

insurance brokerage commissions and fees of $10.9 million,

including $10.2 million related to Lucini / Parish which was

acquired May 1, 2005. Non-interest income as a percentage of total

revenues for the fourth quarter of 2006 was 44.7%, compared to

43.9% for the fourth quarter of 2005 and 46.5% for the third

quarter of 2006. Non-interest income as a percentage of total

revenues for the year ended December 31, 2006 was 46.1%, compared

to 44.2% for 2005. �We continue to be very encouraged by the

performance of ABD,� commented Mr. Scordelis. �ABD achieved solid

quarterly revenue growth compared to the same period last year in

spite of on-going premium softening, and its net full-year inflow

of new business remained positive. ABD also undertook explicit cost

control measures aimed at expanding its future operating margin.�

Operating Expenses Operating expenses for the fourth quarter of

2006 increased to $88.0 million from $86.4 million in the fourth

quarter of 2005. This increase was primarily attributable to an

increase in compensation and benefits of $3.8 million, inclusive of

severance expenses of $2.2 million. Partially offsetting this

increase was a reduction of $1.3 million in legal and professional

costs. Operating expenses for the fourth quarter of 2006 decreased

to $88.0 million from $91.1 million in the third quarter of 2006.

This reduction was primarily attributable to a decrease of $1.1

million in legal and professional costs and a decrease of $3.2

million in other expenses due to the write-off of the unamortized

debt issuance costs related to the August redemption of a trust

preferred security. These decreases were partially offset by an

increase in severance expense of $1.2 million. Operating expenses

for the year ended December 31, 2006 increased to $352.6 million

from $336.1 million in 2005. This increase was primarily

attributable to an increase of $15.6 million in compensation and

benefits , including $5.6 million related to the full-year effect

of ABD�s May 2005 acquisition of Lucini/Parish, $3.0 million

related to the opening of three new ABD offices, $1.9 million in

severance expenses related to our 2006 expense reduction

initiatives and $1.5 million related to the change in accounting

for option compensation beginning in 2006. These increases were

partially offset by a $1.4 million reduction in legal and

professional costs that primarily reflect lower Sarbanes-Oxley

compliance expenses. �We completed a staffing reduction of

approximately four percent during the quarter and commenced the

planned consolidation of a significant portion of our

administrative and service functions into a single lower cost

facility that will occur in the second half of 2007,� stated Mr.

Scordelis. �We also remain focused on technology enhancements and

other procurement efficiencies with the dual objectives of

promoting revenue growth and containing operating expenses.� Income

Taxes The Company�s effective tax rate was 35.7% for 2006 compared

to 37.8% in 2005. The decrease reflects an increased proportion of

tax-exempt income, tax credits from investments in low income

housing investments and higher California net interest deductions

for enterprise zone loans. Credit Quality Overview Net loan

charge-offs in the fourth quarter of 2006 were $3.2 million, or

0.26% of average loans, annualized, compared to $1.2 million, or

0.10% of average loans, annualized, for the fourth quarter of 2005

and $0.2 million, or 0.02% of average loans, for the third quarter

of 2006. Net loan charge-offs for the year ended December 31, 2006

were $6.1 million, or 0.13% of average loans, compared to $11.3

million, or 0.24% of average loans in 2005. Provision for credit

losses was a negative $0.4 million for the fourth quarter of 2006,

compared to a negative $10.5 million for the fourth quarter of

2005, and a negative of $0.4 million for the third quarter of 2006.

The provision for the year ended December 31, 2006 was a negative

$8.7 million, compared to a negative $13.3 million in 2005.

Non-performing assets were $30.2 million at December 31, 2006,

compared to $71.7 million at December 31, 2005 and $29.7 million at

September 30, 2006. The ratio of non-performing assets to total

assets was 0.41% at December 31, 2006, compared to 1.01% at

December 31, 2005 and 0.40% at September 30, 2006. The ratio of

non-accrual loans to total loans was 0.61% at December 31, 2006,

compared to 1.50% at December 31, 2005 and 0.60% at September 30,

2006. Allowance for loan and lease losses was $68.0 million, or

1.39% of total loans, at December 31, 2006, compared to $82.2

million, or 1.74% of total loans, at December 31, 2005 and $71.3

million, or 1.48% of total loans, at September 30, 2006. Balance

Sheet At December 31, 2006, total assets were $7.4 billion, total

net loans and leases were $4.9 billion, total securities were $1.5

billion, and total deposits were $5.3 billion. Total loans and

leases, net of deferred costs and fees, were $4.9 billion at

December 31, 2006, which represents an increase of $177.9 million,

or 3.8%, compared to December 31, 2005. This growth reflects an

increase of $193.5 million in commercial loans and leases, $85.0

million in real estate construction and land loans, and $13.4

million in residential mortgages. These increases were partially

offset by a decline of $46.2 million in commercial term real estate

loans, $40.5 million in consumer and other loans, and $29.4 million

in real estate other loans. Total loans and leases, net of deferred

costs and fees, increased by $69.6 million from September 30, 2006

to December 31, 2006, representing an annualized growth rate of

5.7% for the quarter. This growth reflects an increase of $109.3

million in commercial loans and leases, and $10.2 million in real

estate other, partially offset by decreases of $23.5 million in

construction and land loans, $19.5 million in commercial term real

estate loans, and $10.4 million in consumer and other loans. �We

are encouraged by the continued growth in our loan portfolio,�

stated Mr. Scordelis. �Of most significance, and consistent with

our previously stated strategic intent, commercial loans in our

community banking business grew at an annualized rate of more than

30% and our specialty finance business posted another quarter of

double digit growth. Looking to 2007, we expect our Matsco division

to surpass $1.0 billion in outstandings during the first quarter of

2007, and we currently foresee the potential for an increasing

level of commercial construction lending opportunities as 2007

progresses, which may mitigate a current market-driven slowing of

residential construction activity.� Securities totaled $1.5 billion

as of December 31, 2006, compared to $1.5 billion at December 31,

2005 and $1.6 billion at September 30, 2006. Total deposits at

December 31, 2006 were $5.3 billion, which represents an increase

of $198.6 million, or 3.9%, compared to December 31, 2005, and an

increase of $198.1 million representing an annualized growth rate

of 15.5% compared to September 30, 2006. Core deposits (excluding

institutional and brokered deposits) at December 31, 2006 were $4.3

billion, which represents a decrease of $310.0 million, or 6.8%,

compared to December 31, 2005, and an increase of $157.9 million

representing an annualized growth rate of 15.3% compared to

September 30, 2006. �Meaningful deposit balance growth during the

quarter represents a marked reversal of the trend in recent

periods,� commented Mr. Scordelis. �Core demand and time deposits

had solid growth, while money market balances stabilized during the

quarter. Acknowledging the potential for further near-term balance

volatility as clients respond to the prevailing interest rate

cycle, we continue to focus on account growth and optimization of

overall balance levels, mix, and funding costs.� Capital Overview

The capital ratios of Greater Bay Bancorp and its subsidiary bank

continue to exceed minimum well-capitalized guidelines established

by bank regulatory agencies. The Company�s common equity to assets

ratio was 9.99% at December 31, 2006, compared to 9.45% at December

31, 2005 and 9.99% at September 30, 2006. The Company�s tangible

common equity to tangible assets ratio was 6.32% at December 31,

2006, compared to 5.56% at December 31, 2005 and 6.32% at September

30, 2006. Other Matters In September 2006, the SEC staff issued

Staff Accounting Bulletin (SAB) No. 108, �Considering the Effects

of Prior Year Misstatements when Quantifying Misstatements in

Current Year Financial Statements�. The Company adopted SAB 108 as

of December 31, 2006 by initially applying the provisions of SAB

108 using the cumulative effect transition method in connection

with the finalization of our financial statements for the year

ended December 31, 2006. As a result of adopting SAB 108, the

Company�s total shareholders� equity as of January 1, 2006, was

reduced by $1.9 million comprised of a decrease in retained

earnings of $5.3 million and an increase in common stock of $3.4

million. Additionally, the Company increased net income reported in

the first and second quarters of 2006 by $0.3 million and $1.0

million, respectively which had the effect of increasing reported

net income for the year ended December 31, 2006 by $1.3 million.

Outlook for 2007 Our full year guidance for 2007 is as follows:

Core Loan Growth � we expect core loan portfolio growth in the high

single digits. Core Deposit Growth � we expect core deposit growth

in the low single digits. Credit Quality � we expect full year net

charge-offs to range from 25 basis points to 35 basis points of

average loans outstanding. Net Interest Margin � we expect the full

year margin level to fluctuate in the 3.80% to 3.90% range.

Conference Call The Company will broadcast its earnings conference

call live via the Internet at 8:00 a.m. PST on Thursday, February

1. Participants may access this conference call through the

company's website at http://www.gbbk.com, under the "Investor Info"

link, or through http://www.earnings.com. You should go to either

of these websites 15 minutes prior to the start of the call, as it

may be necessary to download audio software to hear the conference

call. A replay of the conference call will be available on the

websites. A telephone replay will also be available beginning at

11:00 a.m. PST on February 1 through 9:00 p.m. PST on February 8,

2007, by dialing 800-642-1687 or 706-645-9291 and providing

Conference ID 7182532. About Greater Bay Bancorp Greater Bay

Bancorp, a diversified financial services holding company, provides

community banking services in the Greater San Francisco Bay Area

through Greater Bay Bank, N.A.�s community banking organization,

including Bank of Petaluma, Coast Commercial Bank, Golden Gate

Bank, Mid-Peninsula Bank, Mt. Diablo National Bank, Peninsula Bank

of Commerce and Santa Clara Valley National Bank. Nationally,

Greater Bay Bancorp provides specialized leasing and loan services

through its specialty finance group, which includes Matsco, Greater

Bay Business Funding and Greater Bay Capital. ABD Insurance and

Financial Services, the Company�s insurance brokerage subsidiary,

provides commercial insurance brokerage, employee benefits

consulting and risk management solutions to business clients

throughout the United States. Safe Harbor Certain matters discussed

in this press release constitute forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of

1995. These forward looking statements relate to the Company�s

current expectations regarding future operating results, net

interest margin, net loan charge-offs, asset quality, level of loan

loss reserves, growth in loans and deposits, and the strength of

the local economy. These forward looking statements are subject to

certain risks and uncertainties that could cause the actual

results, performance or achievements to differ materially from

those expressed, suggested or implied by the forward looking

statements. These risks and uncertainties include, but are not

limited to: (1) the impact of changes in interest rates, a decline

in economic conditions at the local, national and international

levels and increased competition among financial service providers

on the Company�s results of operations and the quality of the

Company�s earning assets; (2) government regulation, including

ABD�s receipt of requests for information from state insurance

commissioners and subpoenas from state attorneys general related to

the ongoing insurance industry-wide investigations into contingent

commissions and override payments; and (3) the other risks set

forth in the Company�s reports filed with the Securities and

Exchange Commission, including its Annual Report on Form 10-K for

the year ended December 31, 2005. Greater Bay does not undertake,

and specifically disclaims, any obligation to update any

forward-looking statements to reflect occurrences or unanticipated

events or circumstances after the date of such statements. For

additional information and press releases about Greater Bay

Bancorp, visit the Company�s website at http://www.gbbk.com.

GREATER BAY BANCORP December 31, 2006 - FINANCIAL SUMMARY

(UNAUDITED) (Dollars and shares in 000's, except per share data) �

� � � � � � � � � � SELECTED QUARTERLY CONSOLIDATED OPERATING DATA:

� � Restated(7) Fourth Third Second First Fourth Quarter Quarter

Quarter Quarter Quarter 2006� 2006� � 2006� 2006� � 2005� Interest

income $ 116,308� $ 113,916� $ 108,321� $ 104,015� $ 102,225�

Interest expense 52,419� 50,142� � 42,487� 37,134� � 34,478� Net

interest income before reversal of provision for credit losses

63,889� 63,774� 65,834� 66,881� 67,747� Reversal of provision for

credit losses (384) (443) � (1,886) (6,004) � (10,491) Net interest

income after reversal of provision for credit losses 64,273�

64,217� 67,720� 72,885� 78,238� � Non-interest income: Insurance

commissions and fees 38,730� 41,757� 40,235� 44,600� 37,071� Rental

revenue on operating leases 4,490� 4,632� 4,790� 4,950� 4,906�

Service charges and other fees 2,324� 2,363� 2,368� 2,540� 2,533�

Loan and international banking fees 1,980� 1,960� 1,718� 1,795�

1,919� Income on bank owned life insurance 2,003� 2,038� 1,922�

1,911� 1,869� Trust fees 1,138� 1,059� 1,127� 1,055� 1,101�

Gains/(losses) on sale of loans -� (14) -� -� 172� Security gains,

net -� 40� 5� 168� -� Other income 908� 1,617� � 4,605� 1,747� �

3,438� Total non-interest income 51,573� 55,452� 56,770� 58,766�

53,009� � Operating expenses: Compensation and benefits 55,279�

52,548� 50,906� 57,556� 51,455� Occupancy and equipment 11,457�

11,896� 11,192� 11,322� 11,285� Legal costs and other professional

fees 3,950� 5,074� 3,884� 3,753� 5,295� Depreciation - operating

leases 3,503� 3,665� 3,917� 4,003� 4,013� Amortization of

intangibles 1,507� 1,678� 1,689� 1,640� 1,835� Other expenses

12,281� 16,220� � 11,387� 12,271� � 12,476� Total operating

expenses 87,977� 91,081� 82,975� 90,545� 86,359� � Income before

provision for income taxes and cumulative effect of accounting

change 27,869� 28,588� 41,515� 41,106� 44,888� Provision for income

taxes 9,091� 10,076� � 15,423� 15,006� � 17,433� Income before

cumulative effect of accounting change 18,778� 18,512� 26,092�

26,100� 27,455� Cumulative effect of accounting change, net of tax

(1) -� -� � -� 130� � -� Net income $ 18,778� $ 18,512� � $ 26,092�

$ 26,230� � $ 27,455� � � � � � � � � � � � � � EARNINGS PER SHARE

DATA: Net Income per common share before cumulative effect of

accounting change (2) Basic $ 0.34� $ 0.33� $ 0.48� $ 0.49� $ 0.51�

Diluted $ 0.33� $ 0.32� $ 0.47� $ 0.46� $ 0.48� � Net Income per

common share after cumulative effect of accounting change (2) Basic

$ 0.34� $ 0.33� $ 0.48� $ 0.49� $ 0.51� Diluted $ 0.33� $ 0.32� $

0.47� $ 0.46� $ 0.48� � Weighted average common shares outstanding

50,478� 50,423� 50,188� 49,802� 50,251� Weighted average common

& potential common shares outstanding 51,180� 51,366� 51,173�

52,727� 53,370� � GAAP ratios Return on quarterly average assets,

annualized 1.00% 1.00% 1.47% 1.49% 1.53% Return on quarterly

average common shareholders' equity, annualized 10.03% 10.15%

14.85% 15.62% 16.25% Return on quarterly average total equity,

annualized 8.81% 8.89% 12.95% 13.56% 14.09% Net interest margin,

annualized (3) 3.91% 3.97% 4.26% 4.37% 4.36% Operating expense

ratio, annualized (4) 4.71% 4.92% 4.66% 5.15% 4.81% Efficiency

ratio (5) 76.20% 76.39% 67.68% 72.06% 71.52% � NON-GAAP ratios

Efficiency ratio (excluding ABD & other ABD expenses paid by

holding company) (6) 67.08% 69.63% 58.27% 66.35% 62.31% � � � � �

(1) Effective January 1, 2006, the Company adopted SFAS No.123

(revised 2004), Share-Based Payment ("SFAS 123R"), as a result of

which the Company recognized a one-time cumulative adjustment, to

record an estimate of future forfeitures on outstanding equity

based awards for which compensation expense had been recognized

prior to adoption. � � � (2) The following table provides a

reconciliation of income available to common shareholders.

Additionally, the Company's outstanding convertible preferred stock

was antidilutive for all periods presented. � � Income before

cumulative effect of accounting change as reported $ 18,778� $

18,512� $ 26,092� $ 26,100� $ 27,455� Less: dividends on

convertible preferred stock (1,832) (1,832) � (1,822) (1,832) �

(1,825) Income available to common shareholders before cumulative

effect of accounting change 16,946� 16,680� 24,270� 24,268� 25,630�

Add: CODES interest and other related income/(loss), net of taxes

-� -� � -� 59� � (99) Income available to common shareholders

before cumulative effect of accounting change 16,946� 16,680�

24,270� 24,327� 25,531� Cumulative effect of accounting change, net

of tax -� -� � -� 130� � -� Income available to common shareholders

after cumulative effect of accounting change $ 16,946� $ 16,680� �

$ 24,270� $ 24,457� � $ 25,531� � Weighted average common shares

outstanding 50,478� 50,423� 50,188� 49,802� 50,251� Weighted

average potential common shares: Stock options 702� 943� 985� 946�

939� CODES due 2024 -� -� � -� 1,979� � 2,180� Total weighted

average common & potential common shares outstanding 51,180�

51,366� � 51,173� 52,727� � 53,370� � (3) Net interest income (on a

tax equivalent basis) for the period, annualized and divided by

average quarterly interest earning assets for the period. � (4)

Total operating expenses for the period, annualized and divided by

average quarterly assets. (5) Total operating expenses divided by

total revenue (the sum of net interest income and non-interest

income, excluding provision for credit losses). � (6) Total

operating expenses less ABD operating expenses divided by total

revenue less ABD revenue. The following table provides the

information for calculating the efficiency ratio excluding ABD: �

Revenue (excluding ABD) $ 75,911� $ 77,083� $ 82,180� $ 80,546� $

83,614� Operating expenses (excluding ABD & other ABD expenses

paid by holding company) $ 50,924� $ 53,670� $ 47,888� $ 53,441� $

52,102� (7) Restated to reflect adoption of SEC Staff Accounting

Bulletin No. 108 effective January 1, 2006, and reflects the

reversal of expenses recorded during Q1 and Q2 to correct for

immaterial errors related to periods prior to 2006. The pre tax

amounts reversed were $0.6 million and $1.5 million for Q1 and Q2

respectively. � � GREATER BAY BANCORP December 31, 2006 - FINANCIAL

SUMMARY (UNAUDITED) (Dollars and shares in 000's, except per share

data) � � � � � � � SELECTED QUARTERLY CONSOLIDATED OPERATING DATA:

� Twelve Months EndedDecember 31, 2006� 2005� Interest income $

442,560� $ 390,783� Interest expense 182,182� 123,573� Net interest

income before reversal of provision for credit losses 260,378�

267,210� Reversal of provision for credit losses (8,717) (13,269)

Net interest income after reversal of provision for credit losses

269,095� 280,479� � Non-interest income: Insurance commissions and

fees 165,322� 154,390� Rental revenue on operating leases 18,862�

18,302� Service charges and other fees 9,595� 10,448� Loan and

international banking fees 7,453� 7,708� Income on bank owned life

insurance 7,874� 7,547� Trust fees 4,379� 4,301� Gains/(losses) on

sale of loans (14) 478� Security gains, net 213� 342� Other income

8,877� 8,416� Total non-interest income 222,561� 211,932� �

Operating expenses: Compensation and benefits 216,289� 200,657�

Occupancy and equipment 45,867� 44,123� Legal costs and other

professional fees 16,661� 18,015� Depreciation - operating leases

15,088� 15,226� Amortization of intangibles 6,514� 7,876� Other

expenses 52,159� 50,164� Total operating expenses 352,578� 336,061�

� Income before provision for income taxes and cumulative effect of

accounting change 139,078� 156,350� Provision for income taxes

49,596� 59,123� Income before cumulative effect of accounting

change 89,482� 97,227� Cumulative effect of accounting change, net

of tax (1) 130� -� Net income $ 89,612� $ 97,227� � � � � � � � �

EARNINGS PER SHARE DATA: Net Income per common share before

cumulative effect of accounting change (2) Basic $ 1.64� $ 1.77�

Diluted $ 1.60� $ 1.64� � Net Income per common share after

cumulative effect of accounting change (2) Basic $ 1.64� $ 1.77�

Diluted $ 1.60� $ 1.64� � Weighted average common shares

outstanding 50,221� 50,730� Weighted average common & potential

common shares outstanding 51,530� 55,058� � GAAP ratios Return on

YTD average assets, annualized 1.24% 1.37% Return on YTD common

shareholders' equity, annualized 12.57% 14.55% Return on YTD

average total equity, annualized 10.98% 12.59% Net interest margin,

annualized (3) 4.13% 4.34% Operating expense ratio, annualized (4)

4.86% 4.74% Efficiency ratio (5) 73.01% 70.14% � NON-GAAP ratios

Efficiency Ratio (excluding ABD & other ABD expenses paid by

holding company) (6) 65.22% 62.47% � � � � � (1) Effective January

1, 2006, the Company adopted SFAS No.123 (revised 2004),

Share-Based Payment ("SFAS 123R"), as a result of which the Company

recognized a one-time which the Company recognized a one-time

cumulative adjustment, to record an estimate of future forfeitures

on outstanding equity based awards for which compensation expense

had been recognized prior to adoption. � � � (2) The following

table provides a reconciliation of income available to common

shareholders before and after cumulative effect of accounting

change. Additionally, the Company's outstanding convertible

preferred stock was antidilutive for all periods presented. � �

Income before cumulative effect of accounting change as reported $

89,482� $ 97,227� Less: dividends on convertible preferred stock

(7,318) (7,340) Net Income available to common shareholders before

cumulative effect of accounting change 82,164� 89,887� Add: CODES

interest and other related income/(loss), net of taxes 59� 267�

Income available to common shareholders before cumulative effect of

accounting change 82,223� 90,154� Cumulative effect of accounting

change, net of tax 130� -� Income available to common shareholders

after cumulative effect of accounting change $ 82,353� $ 90,154� �

� Weighted average common shares outstanding 50,221� 50,730�

Weighted average potential common shares: Stock options 821� 1,017�

CODES due 2024 488� 3,302� CODES due 2022 -� 9� Total weighted

average common & potential common shares outstanding 51,530�

55,058� � (3) Net interest income (on a tax equivalent basis) for

the period divided by YTD average interest earning assets for the

period. (4) Total operating expenses for the period divided by YTD

average assets. (5) Total operating expenses divided by total

revenue (the sum of net interest income and non-interest income,

excluding provision for credit losses). (6) Total operating

expenses less ABD operating expenses divided by total revenue less

ABD revenue. The following table provides the information for

calculating the efficiency ratio excluding ABD: � Revenue

(Excluding ABD) $ 315,720� $ 323,344� Operating Expenses (Excluding

ABD & other ABD expenses paid by holding company) $ 205,923� $

202,006� GREATER BAY BANCORP December 31, 2006 - FINANCIAL SUMMARY

(UNAUDITED) (Dollars in 000's) � � � � � � � � � � � � SELECTED

CONSOLIDATED FINANCIAL CONDITION DATA AND RATIOS: � � Restated(5)

Dec 31 Sep 30 Jun 30 Mar 31 Dec 31 2006� � 2006� 2006� 2006� �

2005� Cash and cash equivalents $ 170,365� $ 160,572� $ 198,716� $

167,203� $ 152,153� Fed funds sold -� -� 36,000� -� -� Securities

1,543,097� 1,572,109� 1,565,732� 1,468,123� 1,493,584� Loans and

leases: Commercial (1) 2,245,549� 2,136,235� 2,072,334� 2,046,402�

2,052,049� Term real estate - commer-cial 1,403,631� � 1,423,090�

1,394,518� 1,439,416� � 1,449,818� Total commer-cial (1) 3,649,180�

3,559,325� 3,466,852� 3,485,818� 3,501,867� Real estate

construc-tion and land 729,871� 753,416� 762,409� 688,086� 644,883�

Residen-tial mortgage 279,615� 277,038� 275,332� 271,658� 266,263�

Real estate other 173,271� 163,077� 164,133� 180,409� 202,675�

Consumer and other (1) 68,698� 79,131� 101,821� 100,468� 109,168�

Deferred costs and fees, net (1) 5,206� � 4,278� 4,066� 3,285� �

3,113� Total loans and leases, net of deferred costs and fees (1)

4,905,841� 4,836,265� 4,774,613� 4,729,724� 4,727,969� Allowance

for loan and lease losses (68,025) � (71,323) (71,689) (74,568) �

(82,159) Total loans and leases, net 4,837,816� 4,764,942�

4,702,924� 4,655,156� 4,645,810� Goodwill 246,016� 242,687�

243,343� 242,728� 243,289� Other intangible assets 42,978� 44,515�

46,227� 48,005� 49,741� Other assets 530,862� � 554,985� 583,167�

533,366� � 536,392� Total assets $ 7,371,134� � $ 7,339,810� $

7,376,109� $ 7,114,581� � $ 7,120,969� � Deposits: Demand,

non-interest-bearing $ 1,028,245� $ 980,050� $ 1,015,734� $

1,004,575� $ 1,093,157� MMDA, NOW and savings 2,614,349� 2,613,387�

2,734,656� 2,957,354� 3,000,647� Time deposits, $100,000 and over

892,048� 784,557� 776,712� 782,891� 741,682� Other time deposits

722,541� � 681,104� 495,131� 363,941� � 223,053� Total deposits

5,257,183� � 5,059,098� 5,022,233� 5,108,761� � 5,058,539� Other

borrowings 825,837� 994,044� 970,390� 750,248� 797,802�

Subordinated debt 180,929� 180,929� 287,631� 210,311� 210,311�

Other liabilities 254,812� � 256,545� 268,899� 240,008� � 265,607�

Total lia-bilities 6,518,761� � 6,490,616� 6,549,153� 6,309,328� �

6,332,259� � Minority interest: Preferred stock of real estate

investment trust subsidiaries 12,861� 12,821� 12,780� 12,739�

12,699� � Convertible preferred stock 103,094� 103,094� 103,096�

103,097� 103,387� Common share-holders' equity 736,418� � 733,279�

711,080� 689,417� � 672,624� Total equity 839,512� 836,373�

814,176� 792,514� 776,011� � � � � � � � Total liabilities and

total equity $ 7,371,134� � $ 7,339,810� $ 7,376,109� $ 7,114,581�

� $ 7,120,969� � � � � � � � � � � � RATIOS: � Loan growth, current

quarter to prior year quarter 3.76% 3.19% 0.72% 4.93% 5.34% Loan

growth, current quarter to prior quarter, annualized 5.71% 5.12%

3.81% 0.15% 3.49% Loan growth, YTD 3.76% 3.06% 1.99% 0.15% 5.34% �

Core loan growth, current quarter to prior year quarter (2) 4.45%

3.90% 1.32% 1.39% 0.57% Core loan growth, current quarter to prior

quarter, annualized (2) 6.41% 5.91% 4.47% 0.66% 4.30% Core loan

growth, YTD (2) 4.45% 3.73% 2.58% 0.66% 0.57% � Deposit growth,

current quarter to prior year quarter 3.93% 0.87% 2.93% 2.26%

-0.87% Deposit growth, current quarter to prior quarter, annualized

15.53% 2.91% -6.79% 4.03% 3.41% Deposit growth, YTD 3.93% 0.01%

-1.45% 4.03% -0.87% � Core deposit growth, current quarter to prior

year quarter (3) -6.79% -10.48% -6.63% -5.78% -5.03% Core deposit

growth, current quarter to prior quarter, annualized (3) 15.29%

-14.43% -19.72% -8.31% -1.02% Core deposit growth, YTD (3) -6.79%

-13.71% -13.84% -8.31% -5.03% � Revenue growth, current quarter to

prior year quarter (4) -4.38% -2.66% 2.46% 8.10% 7.03% Revenue

growth, current quarter to prior quarter, annualized (4) -12.53%

-10.93% -9.71% 16.43% -5.60% � Net interest income growth, current

quarter to prior year quarter -5.69% -6.21% 0.63% 1.27% -0.52% Net

interest income growth, current quarter to prior quarter,

annualized 0.72% -12.41% -6.28% -5.18% -1.45% � � � � � (1) In Q3

2006, $15.4 million of deferred costs and fees on leases were

reclassified from commercial loans and consumer and other loans

into net deferred costs and fees. Prior period presentation has

been changed to conform to current period presentation. � (2) Core

loans calculated as total loans less purchased residential mortgage

loans. � (3) Core deposits calculated as total deposits less

institutional and brokered time deposits. � (4) Revenue is the sum

of net interest income before reversal of provision for credit

losses and total non-interest income. � (5) Restated to reflect

adoption of SEC Staff Accounting Bulletin No. 108 effective January

1, 2006, including an adjustment to common shareholders' equity of

$1.9 million as of January 1, 2006. GREATER BAY BANCORP December

31, 2006 - FINANCIAL SUMMARY (UNAUDITED) (Dollars in 000's) � � � �

� � � � � � � � SELECTED AVERAGE BALANCE SHEET AND YIELD DATA: �

Three months ended December 31, 2006 September 30, 2006 Average

Average Average Yield / Average Yield / Tax-Equivalent Basis (1)

Balance (2) � Interest � Rate Balance (2) � Interest � Rate �

INTEREST-EARNING ASSETS: Fed funds sold $ 83,034� $ 1,098� 5.24% $

33,141� $ 432� 5.18% Securities: Taxable 1,493,073� 17,358� 4.61%

1,509,123� 17,537� 4.61% Tax-exempt (1) 92,347� 1,595� 6.85%

91,142� 1,590� 6.92% Other short-term (3) 9,643� 90� 3.69% 9,993�

83� 3.29% Loans & leases (4) 4,850,605� 96,673� 7.91%

4,785,791� 94,781� 7.86% Total interest-earning assets 6,528,702�

116,814� 7.10% 6,429,190� 114,423� 7.06% Noninterest-earning assets

885,204� -� 911,348� -� Total assets $7,413,906� 116,814� $

7,340,538� 114,423� INTEREST-BEARING LIABILITIES: Deposits: MMDA,

NOW and Savings $2,611,369� 17,545� 2.67% $ 2,719,915� 17,036�

2.48% Time deposits over $100,000 827,608� 10,312� 4.94% 787,289�

9,506� 4.79% Other time deposits 727,388� 8,895� 4.85% 595,200�

6,973� 4.65% Total interest-bearing deposits 4,166,365� 36,752�

3.50% 4,102,404� 33,515� 3.24% Short-term borrowings 393,702�

4,873� 4.91% 299,675� 3,674� 4.86% CODES -� -� 0.00% -� -� 0.00%

Subordinated debt 180,929� 3,768� 8.26% 251,677� 5,355� 8.44% Other

long-term borrowings 526,025� 7,026� 5.30% 579,694� 7,598� 5.20%

Total interest-bearing liabilities 5,267,021� 52,419� 3.95%

5,233,450� 50,142� 3.80% Noninterest-bearing deposits 1,021,175�

993,457� Other noninterest-bearing liabilities 267,007� 274,367�

Minority Interest: Preferred stock of real estate investment trust

subsidiaries 12,837� 12,796� Shareholders' equity 845,866� �

826,468� � Total share-holders' equity and liabilities $7,413,906�

52,419� $ 7,340,538� 50,142� � Net interest income, on a

tax-equivalent basis (1) 64,395� 64,281� � Net interest margin (5)

3.91% 3.97% � Reconciliation to reported net interest income: �

Adjustment for tax-equivalent basis (506) (507) � Net interest

income, as reported $ 63,889� $ 63,774� � � (1) Income from

tax-exempt securities issued by state and local governments or

authorities, is adjusted by an increment that equates tax-exempt

income to tax equivalent basis (assuming a 35% federal income tax

rate). (2) Nonaccrual loans are included in the average balance.

(3) Includes average interest-earning deposits in other financial

institutions. (4) Amortization of deferred costs and fees, net,

resulted in an increase of interest income on loans by $674,000 and

$364,000, for the three months ended December 31, 2006 and

September 30, 2006, respectively. (5) Net interest margin during

the period equals (a) the difference between tax-equivalent

interest income on interest-earning assets and the interest expense

on interest-bearing liabilities, divided by (b) average

interest-earning assets for the period, annualized. GREATER BAY

BANCORP December 31, 2006 - FINANCIAL SUMMARY (UNAUDITED) (Dollars

in 000's) � SELECTED AVERAGE BALANCE SHEET AND YIELD DATA: � Three

months ended December 31, 2006 December 31, 2005 Average Average

Average Yield / Average Yield / Tax-Equivalent Basis (1) Balance

(2) � Interest � Rate Balance (2) � Interest � Rate �

INTEREST-EARNING ASSETS: Fed funds sold $ 83,034� $ 1,098� 5.24% $

74,740� $ 716� 3.80% Securities: Taxable 1,493,073� 17,358� 4.61%

1,374,102� 14,862� 4.29% Tax-exempt (1) 92,347� 1,595� 6.85%

80,793� 1,476� 7.25% Other short-term (3) 9,643� 90� 3.69% 11,245�

45� 1.58% Loans and leases (4) 4,850,605� 96,673� 7.91% 4,673,852�

85,611� 7.27% Total interest-earning assets 6,528,702� 116,814�

7.10% 6,214,732� 102,710� 6.56% Noninterest-earning assets 885,204�

-� 905,369� -� Total assets $ 7,413,906� 116,814� $ 7,120,101�

102,710� INTEREST-BEARING LIABILITIES: Deposits: MMDA, NOW and

Savings $ 2,611,369� 17,545� 2.67% $ 3,111,275� 14,841� 1.89% Time

deposits over $100,000 827,608� 10,312� 4.94% 741,859� 6,466� 3.46%

Other time deposits 727,388� 8,895� 4.85% 194,054� 1,375� 2.81%

Total interest-bearing deposits 4,166,365� 36,752� 3.50% 4,047,188�

22,682� 2.22% Short-term borrowings 393,702� 4,873� 4.91% 171,801�

1,870� 4.32% CODES -� -� 0.00% 87,500� 117� 0.53% Subordinated debt

180,929� 3,768� 8.26% 210,311� 4,504� 8.50% Other long-term

borrowings 526,025� 7,026� 5.30% 456,962� 5,305� 4.61% Total

interest-bearing liabilities 5,267,021� 52,419� 3.95% 4,973,762�

34,478� 2.75% Noninterest-bearing deposits 1,021,175� 1,086,424�

Other noninterest-bearing liabilities 267,007� 274,391� Minority

Interest: Preferred stock of real estate investment trust

subsidiaries 12,837� 12,674� Shareholders' equity 845,866� �

772,848� � Total share-holders' equity and liabilities $ 7,413,906�

52,419� $ 7,120,101� 34,478� � Net interest income, on a

tax-equivalent basis (1) 64,395� 68,232� � Net interest margin (5)

3.91% 4.36% � Reconciliation to reported net interest income: �

Adjustment for tax-equivalent basis (506) (485) � Net interest

income, as reported $ 63,889� $ 67,747� � � (1) Income from

tax-exempt securities issued by state and local governments or

authorities, is adjusted by an increment that equates tax-exempt

income to tax equivalent basis (assuming a 35% federal income tax

rate). (2) Nonaccrual loans are included in the average balance.

(3) Includes average interest-earning deposits in other financial

institutions. (4) Amortization of deferred costs and fees, net,

resulted in an increase of interest income on loans by $674,000 and

$580,000 for the three months ended December 31, 2006 and December

31, 2005, respectively. (5) Net interest margin during the period

equals (a) the difference between tax-equivalent interest income on

interest-earning assets and the interest expense on

interest-bearing liabilities, divided by (b) average

interest-earning assets for the period, annualized. GREATER BAY

BANCORP December 31, 2006 - FINANCIAL SUMMARY (UNAUDITED) (Dollars

in 000's) � � SELECTED AVERAGE BALANCE SHEET AND YIELD DATA: �

Twelve months ended December 31, 2006 December 31, 2005 Average

Average Average Yield / Average Yield / Tax-Equivalent Basis (1)

Balance (2) � Interest � Rate Balance (2) Interest � Rate �

INTEREST-EARNING ASSETS: Fed funds sold $ 34,991� $ 1,790� 5.12% $

47,555� $ 1,505� 3.16% Securities: Taxable 1,465,664� 66,549� 4.54%

1,453,524� 62,042� 4.27% Tax-exempt (1) 88,137� 6,220� 7.06%

83,201� 5,949� 7.15% Other short-term (3) 9,687� 254� 2.62% 8,906�

155� 1.74% Loans and leases (4) 4,758,571� 369,747� 7.77%

4,604,690� 323,098� 7.02% Total interest-earning assets 6,357,050�

444,560� 6.99% 6,197,876� 392,749� 6.34% Noninterest-earning assets

898,487� -� 891,721� -� Total assets $ 7,255,537� 444,560� $

7,089,597� 392,749� INTEREST-BEARING LIA-BILITIES: Deposits: MMDA,

NOW and Savings $ 2,771,143� 63,747� 2.30% $ 3,125,467� 54,437�

1.74% Time deposits over $100,000 788,086� 35,606� 4.52% 682,213�

19,640� 2.88% Other time deposits 501,082� 22,616� 4.51% 162,352�

4,001� 2.46% Total interest-bearing deposits 4,060,311� 121,969�

3.00% 3,970,032� 78,078� 1.97% Short-term borrowings 311,321�

14,477� 4.65% 297,561� 10,741� 3.61% CODES 18,518� 101� 0.55%

137,585� 749� 0.54% Subordinated debt 216,933� 18,547� 8.55%

210,311� 17,639� 8.39% Other long-term borrowings 532,155� 27,088�

5.09% 333,454� 16,366� 4.91% Total interest-bearing lia-bilities

5,139,238� 182,182� 3.54% 4,948,943� 123,573� 2.50%

Noninterest-bearing deposits 1,017,381� 1,088,927� Other

noninterest-bearing liabilities 269,846� 267,019� Minority

Interest: Preferred stock of real estate investment trust

subsidiaries 12,776� 12,618� Shareholders' equity 816,296� �

772,090� � Total share-holders' equity and lia-bilities $

7,255,537� 182,182� $ 7,089,597� 123,573� � Net interest income, on

a tax-equivalent basis (1) 262,378� 269,176� � Net interest margin

(5) 4.13% 4.34% � Reconcilia-tion to reported net interest income:

� Adjustment for tax-equivalent basis (2,000) (1,966) � Net

interest income, as reported $ 260,378� $ 267,210� � � (1) Income

from tax-exempt securities issued by state and local governments or

authorities, is adjusted by an increment that equates tax-exempt

income to tax equivalent basis (assuming a 35% federal income tax

rate). (2) Nonaccrual loans are included in the average balance.

(3) Includes average interest-earning deposits in other financial

institutions. (4) Amortization of deferred costs and fees, net,

resulted in an increase of interest income on loans by $1,885,000

and $1,418,000 for the twelve months ended December 31, 2006 and

December 31, 2005, respectively. (5) Net interest margin during the

period equals (a) the difference between tax-equivalent interest

income on interest-earning assets and the interest expense on

interest-bearing liabilities, divided by (b) average

interest-earning assets for the period, annualized. GREATER BAY

BANCORP December 31, 2006 - FINANCIAL SUMMARY (UNAUDITED) (Dollars

and shares in 000's, except per share data) � SELECTED CONSOLIDATED

CREDIT QUALITY DATA: � Dec 31 Sep 30 Jun 30 Mar 31 Dec 31 � � � �

2006� 2006� 2006� 2006� 2005� � Nonperforming assets (1)

Commercial: Matsco/GBC $ 7,583� $ 8,323� $ 7,257� $ 8,011� $ 8,883�

SBA 5,576� 2,881� 4,536� 3,627� 6,497� Other 8,486� 6,458� 4,775�

9,184� 9,142� Total commercial 21,645� 17,662� 16,568� 20,822�

24,522� Real estate: Commercial 7,173� 10,939� 14,763� 8,203�

8,434� Construction and land 930� 323� 323� 3,242� 323� Other -� -�

3� 7� 33,312� Total real estate 8,103� 11,262� 15,089� 11,452�

42,069� Consumer and other 117� 139� 611� 718� 4,503� Total

nonaccrual loans 29,865� 29,063� 32,268� 32,992� 71,094� OREO -� -�

-� -� -� Other nonperforming assets 382� 603� 361� 438� 631� Total

non-performing assets (1) $ 30,247� $ 29,666� $ 32,629� $ 33,430� $

71,725� � Net loan charge-offs (recoveries) (2) $ 3,192� $ 223� $

2,662� $ 43� $ 1,207� � Ratio of allowance for loan and lease

losses to: End of period loans 1.39% 1.48% 1.50% 1.58% 1.74% Total

nonaccrual loans 227.77% 245.41% 222.17% 226.02% 115.56% � Ratio of

reversal of provision for credit losses to average loans,

annualized -0.03% -0.04% -0.16% -0.52% -0.89% � Total nonaccrual

loans to total loans 0.61% 0.60% 0.68% 0.70% 1.50% Total

nonperforming assets to total assets 0.41% 0.40% 0.44% 0.47% 1.01%

� Ratio of quarterly net loan charge-offs to average loans,

annualized 0.26% 0.02% 0.23% 0.00% 0.10% Ratio of YTD net loan

charge-offs to YTD average loans 0.13% 0.08% 0.12% 0.00% 0.24% � �

� � � (1) Nonperforming assets include nonaccrual loans and leases,

other real estate owned and other nonperforming assets. (2) Net

loan charge-offs are loan charge-offs net of recoveries. Q3 2006

includes an insurance recovery of $1.6 million related to

previously charged off loans and leases. � � � � � � � � � � � � �

� � � � � � � � SELECTED QUARTERLY CAPITAL RATIOS AND DATA: � Dec

31 Sep 30 Jun 30 Mar 31 Dec 31 � � � � 2006� 2006� 2006� 2006�

2005� � Tier 1 leverage ratio 10.63% 10.63% 12.07% 10.77% 10.41%

Tier 1 risk-based capital ratio 12.26% 12.15% 13.49% 12.48% 12.01%

Total risk-based capital ratio 13.47% 13.40% 14.93% 13.73% 13.26%

Total equity to assets ratio 11.39% 11.40% 11.04% 11.14% 10.90%

Common equity to assets ratio 9.99% 9.99% 9.64% 9.69% 9.45% � Tier

I capital $ 755,860� $ 748,071� $ 824,154� $ 734,692� $ 708,563�

Total risk-based capital $ 830,461� $ 825,036� $ 911,802� $

808,436� $ 782,525� Risk weighted assets $ 6,166,011� $ 6,155,489�

$ 6,108,101� $ 5,889,032� $ 5,900,425� � NON-GAAP RATIOS (1): �

Tangible common equity to tangible assets - end of period (2) 6.32%

6.32% 5.95% 5.84% 5.56% Tangible common book value per common share

- end of period (3) $ 8.78� $ 8.74� $ 8.28� $ 7.93� $ 7.61� �

Common book value per common share - end of period (4) $ 14.46� $

14.36� $ 13.97� $ 13.71� $ 13.48� Total common shares outstanding -

end of period 50,938� 51,047� 50,917� 50,288� 49,906� � � � � � (1)

The following table provides a reconciliation of common equity to

tangible common equity and total assets to tangible assets: �

Common shareholders' equity $ 736,418� $ 733,279� $ 711,080� $

689,417� $ 672,624� Less: goodwill and other Intangible assets

(288,994) (287,202) (289,570) (290,733) (293,030) Tangible common

equity $ 447,424� $ 446,077� $ 421,510� $ 398,684� $ 379,594� �

Total assets $ 7,371,134� $ 7,339,810� $ 7,376,109� $ 7,114,581� $

7,120,969� Less: goodwill and other intangible assets (288,994)

(287,202) (289,570) (290,733) (293,030) Tangible assets $

7,082,140� $ 7,052,608� $ 7,086,539� $ 6,823,848� $ 6,827,939� �

(2) Computed as common shareholders' equity, less goodwill and

other intangible assets divided by tangible assets. (3)Computed as

common shareholders' equity, less goodwill and other intangible

assets divided by total common shares outstanding - end of period.

(4)Computed as common shareholders' equity divided by common shares

outstanding - end of period.

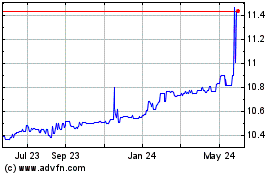

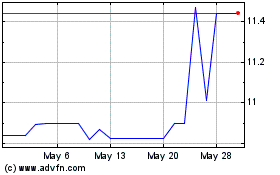

Global Blockchain Acquis... (NASDAQ:GBBK)

Historical Stock Chart

From Dec 2024 to Jan 2025

Global Blockchain Acquis... (NASDAQ:GBBK)

Historical Stock Chart

From Jan 2024 to Jan 2025