Form SC 13D - General statement of acquisition of beneficial ownership

08 September 2023 - 5:14AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

DC 20549

SCHEDULE

13D

THE SECURITIES EXCHANGE ACT OF 1934

(Amendment No.)*

| Groupon, Inc. |

| (Name of Issuer) |

| Common Stock, par value $0.0001 per share |

| (Title of Class of Securities) |

|

Theodore Woo

Windward Management LP

1691 Michigan Ave.

Miami Beach, FL 33139

Telephone Number +1 786-206-3126 |

|

(Name, Address and Telephone Number of Person Authorized

to Receive

Notices and Communications) |

| September 7, 2023 |

| (Date of Event Which Requires Filing of this Statement) |

| If the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of ss.240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box [X]. |

| |

|

| * The remainder of this cover page shall be filled out for a reporting person's initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover page. |

| 1. |

NAME OF REPORTING PERSONS |

|

| |

I.R.S. IDENTIFICATION NOS. OF ABOVE PERSONS (ENTITIES ONLY) |

|

| |

|

|

| |

Windward Management LP |

|

| 2. |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) [_]

(b) [_] |

| 5. |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) OR 2(e) |

[_] |

| 6. |

CITIZENSHIP OR PLACE OF ORGANIZATION |

|

| |

|

|

| |

Delaware |

|

| NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON |

| 8. |

SHARED VOTING POWER |

|

| |

|

|

| |

2,777,400 |

|

| 9. |

SOLE DISPOSITIVE POWER |

| |

|

|

| |

0 |

|

| 10. |

SHARED DISPOSITIVE POWER |

|

| |

|

|

| |

2,777,400 |

|

| 11. |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

|

| |

|

|

| |

2,777,400 |

|

| 12. |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

[_] |

| 13. |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

|

| |

|

|

| |

8.9% |

|

| 14. |

TYPE OF REPORTING PERSON |

|

| |

|

|

| |

PN |

|

| |

|

|

| 1. |

NAME OF REPORTING PERSONS |

|

| |

I.R.S. IDENTIFICATION NOS. OF ABOVE PERSONS (ENTITIES ONLY) |

|

| |

|

|

| |

Windward Management LLC |

|

| 2. |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) [_]

(b) [_] |

| 5. |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) OR 2(e) |

[_] |

| 6. |

CITIZENSHIP OR PLACE OF ORGANIZATION |

|

| |

|

|

| |

Delaware |

|

| NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON |

| 8. |

SHARED VOTING POWER |

|

| |

|

|

| |

2,777,400 |

|

| 9. |

SOLE DISPOSITIVE POWER |

| |

|

|

| |

0 |

|

| 10. |

SHARED DISPOSITIVE POWER |

|

| |

|

|

| |

2,777,400 |

|

| 11. |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

|

| |

|

|

| |

2,777,400 |

|

| 12. |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

[_] |

| 13. |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

|

| |

|

|

| |

8.9% |

|

| 14. |

TYPE OF REPORTING PERSON |

|

| |

|

|

| |

OO |

|

| |

|

|

| 1. |

NAME OF REPORTING PERSONS |

|

| |

I.R.S. IDENTIFICATION NOS. OF ABOVE PERSONS (ENTITIES ONLY) |

|

| |

|

|

| |

Marc Chalfin |

|

| 2. |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) [_]

(b) [_] |

| 5. |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) OR 2(e) |

[_] |

| 6. |

CITIZENSHIP OR PLACE OF ORGANIZATION |

|

| |

|

|

| |

United States of America |

|

| NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON |

| 8. |

SHARED VOTING POWER |

|

| |

|

|

| |

2,777,400 |

|

| 9. |

SOLE DISPOSITIVE POWER |

| |

|

|

| |

0 |

|

| 10. |

SHARED DISPOSITIVE POWER |

|

| |

|

|

| |

2,777,400 |

|

| 11. |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

|

| |

|

|

| |

2,777,400 |

|

| 12. |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

[_] |

| 13. |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

|

| |

|

|

| |

8.9% |

|

| 14. |

TYPE OF REPORTING PERSON |

|

| |

|

|

| |

IN |

|

| |

|

|

| 1. |

NAME OF REPORTING PERSONS |

|

| |

I.R.S. IDENTIFICATION NOS. OF ABOVE PERSONS (ENTITIES ONLY) |

|

| |

|

|

| |

Windward Management Partners Master Fund, Ltd. |

|

| 2. |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) [_]

(b) [_] |

| 5. |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) OR 2(e) |

[_] |

| 6. |

CITIZENSHIP OR PLACE OF ORGANIZATION |

|

| |

|

|

| |

Cayman Islands |

|

| NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON |

| 8. |

SHARED VOTING POWER |

|

| |

|

|

| |

962,425 |

|

| 9. |

SOLE DISPOSITIVE POWER |

| |

|

|

| |

0 |

|

| 10. |

SHARED DISPOSITIVE POWER |

|

| |

|

|

| |

962,425 |

|

| 11. |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

|

| |

|

|

| |

962,425 |

|

| 12. |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

[_] |

| 13. |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

|

| |

|

|

| |

3.1% |

|

| 14. |

TYPE OF REPORTING PERSON |

|

| |

|

|

| |

OO |

|

| |

|

|

| Item 1. |

Security and Issuer. |

|

| |

The name of the issuer is Groupon, Inc., a Delaware corporation (the "Issuer"). The address of the Issuer's principal executive offices is 600 W Chicago Avenue, Suite 400, Chicago, Illinois 60654. This Schedule 13D relates to the Issuer's Common Stock, par value $0.0001 per share (the "Shares"). |

|

| |

|

|

| |

|

|

| Item 2. |

Identity and Background. |

|

| |

(a), (f) |

This Schedule 13D is being filed jointly by Windward Management LP, a Delaware limited partnership (“Windward”), Windward Management LLC, a Delaware limited liability company and the general partner of Windward (the “General Partner”), Windward Management Partners Master Fund, Ltd., a Cayman Islands exempted company (the “Fund”), and Marc Chalfin, a United States Citizen (collectively, the "Reporting Persons"). |

|

| |

|

|

|

| |

(b) |

The principal business address for the Reporting Persons is 1691 Michigan Ave., Miami Beach, FL 33139. |

|

| |

|

|

|

| |

(c) |

Mr. Chalfin is the Managing Member of the General Partner. The principal business of Windward is serving as an investment adviser to its clients. Windward is the investment manager to the Fund. The principal business of the Fund is purchasing, holding and selling securities for investment purposes. |

|

| |

|

|

|

| |

(d), (e) |

During the last five years, none of the Reporting Persons has been (a) convicted in a criminal proceeding (excluding traffic violations or similar misdemeanors) or (b) a party to a civil proceeding of a judicial or administrative body of competent jurisdiction and as a result of such proceeding was or is subject to a judgment, decree or final order enjoining future violations of, or prohibiting or mandating activities subject to, federal or state securities laws or finding any violation with respect to such laws. The Reporting Persons disclaim membership in a group. |

|

| |

|

|

|

| |

|

|

| Item 3. |

Source and Amount of Funds or Other Consideration. |

|

| |

|

|

| |

The funds for the purchase of the Shares by the Fund came from the working capital of the Fund and other clients of Windward, over which the Reporting Persons, through their roles described above in Item 2(c), exercise investment discretion. No borrowed funds were used to purchase the Shares, other than borrowed funds used for working capital purposes in the ordinary course of business. |

|

| |

|

|

| Item 4. |

Purpose of Transaction. |

|

| |

|

|

| |

The Reporting Persons have acquired their Shares of

the Issuer for investment.

The Reporting Persons will have conversations with

members of the Issuer’s management and board of directors. Windward has sent the letter attached hereto as Exhibit C to Dusan Senkypyl,

the Issuer’s Chief Executive Officer, expressing conviction in the Issuer’s recovery and explaining how the Issuer is significantly

undervalued.

No Reporting Person has any present plan or proposal

which would relate to or would result in any of the matters set forth in subparagraphs (a)- (j) of Item 4 of Schedule 13D. The Reporting

Persons may in the future take one or more of the actions described in subsections (a) through (j) of Item 4 of Schedule 13D and may discuss

such actions with the Issuer's management and the board of directors, other stockholders of the Issuer, and other interested parties.

The Reporting Persons intend to review their investments

in the Issuer on a continuing basis. Depending on various factors, including, without limitation, the Issuer's financial position and

strategic direction, the outcome of the discussions and actions referenced above, actions taken by the Issuer's board of directors, price

levels of the Shares, other investment opportunities available to the Reporting Persons, conditions in the securities market and general

economic and industry conditions, the Reporting Persons may in the future take actions with respect to its investment position in the

Issuer as it deems appropriate, including, without limitation, purchasing additional Shares or selling some or all of its Shares, and/or

engaging in hedging or similar transactions with respect to the Shares.

None of the information or language contained in this

filing is intended as investment advice. Opinions and forward-looking statements of the author should be independently substantiated prior

to any investment.

|

|

| |

|

|

| Item 5. |

Interest in Securities of the Issuer. |

|

| |

|

|

| |

(a) - (e) |

As of the date hereof, Windward, the General Partner

and Mr. Chalfin may be deemed to be the beneficial owners of 2,777,400 Shares, constituting 8.9% of the Shares, based upon 31,248,618*

Shares outstanding.

As of the date hereof, the Fund may be deemed to be

the beneficial owner of 962,425 Shares, constituting 3.1% of the Shares, based upon 31,248,618* Shares outstanding.

Windward has the sole power to vote or direct the

vote of 0 Shares; has the shared power to vote or direct the vote of 2,777,400 Shares; has the sole power to dispose or direct the disposition

of 0 Shares; and has the shared power to dispose or direct the disposition of 2,777,400 Shares.

The General Partner has the sole power to vote or

direct the vote of 0 Shares; has the shared power to vote or direct the vote of 2,777,400 Shares; has the sole power to dispose or direct

the disposition of 0 Shares; and has the shared power to dispose or direct the disposition of 2,777,400 Shares.

Mr. Chalfin has the sole power to vote or direct the

vote of 0 Shares; has the shared power to vote or direct the vote of 2,777,400 Shares; has the sole power to dispose or direct the disposition

of 0 Shares; and has the shared power to dispose or direct the disposition of 2,777,400 Shares.

The Fund has the sole power to vote or direct the

vote of 0 Shares; has the shared power to vote or direct the vote of 962,425 Shares; has the sole power to dispose or direct the disposition

of 0 Shares; and has the shared power to dispose or direct the disposition of 962,425 Shares.

The transactions by the Reporting Persons in the Shares

during the past sixty days are set forth in Exhibit B.

*This outstanding Shares figure reflects the number

of outstanding Shares at August 3, 2023, as reported in the Form 10-Q filed by the Issuer on August 9, 2023. |

|

| |

|

|

|

| Item 6. |

Contracts, Arrangements, Understandings or Relationships with Respect to Securities of the Issuer. |

|

| |

|

|

| |

The Reporting Persons’ beneficial ownership reported herein includes 2,304,400 shares that may be acquired through the exercise of exchange traded call options with varying expiration dates and strike prices. |

|

| |

|

|

| Item 7. |

Material to be Filed as Exhibits. |

|

| |

Exhibit A: Joint Filing Agreement

Exhibit B: Schedule of Transactions in Shares

Exhibit C: Letter to Issuer |

| |

|

|

SIGNATURE

After reasonable inquiry and to the best of my knowledge

and belief, I certify that the information set forth in this statement is true, complete and correct.

| |

Windward Management LP*

By: Windward Management LLC, its general partner

/s/ Marc Chalfin |

| |

By: Marc Chalfin

Title: Managing Member |

| |

|

| |

Windward Management LLC*

/s/ Marc Chalfin |

| |

By: Marc Chalfin

Title: Managing Member |

| |

|

| |

Windward Management Partners Master Fund, Ltd.

/s/ Marc Chalfin |

| |

By: Marc Chalfin

Title: Authorized Signatory |

| |

|

| |

Marc Chalfin* |

| |

|

| |

/s/ Marc Chalfin |

| |

|

* This reporting person disclaims beneficial ownership

of these reported securities except to the extent of its pecuniary interest therein, and this report shall not be deemed an admission

that any such person is the beneficial owner of these securities for purposes of Section 16 of the U.S. Securities Exchange Act of 1934,

as amended, or for any other purpose.

Attention: Intentional misstatements or omissions of fact constitute Federal

criminal violations (see 18 U.S.C. 1001).

Exhibit A

AGREEMENT

The undersigned agree that this

Schedule 13D, dated September 7, 2023, relating to the Common Stock, par value $0.0001 per share of Groupon, Inc. shall be filed on behalf

of the undersigned.

| |

Windward Management LP

By: Windward Management LLC, its general partner

/s/ Marc Chalfin |

| |

By: Marc Chalfin

Title: Managing Member |

| |

Windward Management LLC

/s/ Marc Chalfin |

| |

By: Marc Chalfin

Title: Managing Member |

| |

|

| |

Windward Management Partners Master Fund, Ltd.

/s/ Marc Chalfin |

| |

By: Marc Chalfin

Title: Authorized Signatory |

| |

|

| |

Marc Chalfin |

| |

|

| |

/s/ Marc Chalfin |

| |

|

Exhibit B

SCHEDULE OF TRANSACTIONS IN SHARES

| Date |

Class/Security |

Action |

Quantity |

Average Price |

| 07/12/2023 |

GRPN US 01/19/24 C20 |

COVER |

3,000.00 |

0.6000 |

| 07/18/2023 |

GRPN US 10/20/23 C9 |

BUY |

2,300.00 |

1.2500 |

| 07/18/2023 |

GRPN US 08/18/23 C5 |

SELL |

1,310.00 |

2.2000 |

| 07/19/2023 |

GRPN US 08/18/23 C5 |

SELL |

1,000.00 |

2.9500 |

| 07/20/2023 |

GRPN US 01/19/24 C5 |

SELL |

500.00 |

3.3759 |

| 07/20/2023 |

GRPN US 10/20/23 C14 |

BUY |

3,000.00 |

0.7044 |

| 07/21/2023 |

GRPN US 01/19/24 C10 |

BUY |

300.00 |

1.5000 |

| 07/21/2023 |

GRPN US 10/20/23 C12 |

BUY |

1,000.00 |

0.7500 |

| 07/26/2023 |

GRPN US 10/20/23 C14 |

SELL |

100.00 |

0.6825 |

| 07/26/2023 |

GRPN US 11/17/23 C12 |

BUY |

100.00 |

1.2125 |

| 07/27/2023 |

GRPN US 10/20/23 C14 |

SELL |

1,400.00 |

0.7912 |

| 07/27/2023 |

GRPN US 11/17/23 C12 |

BUY |

1,400.00 |

1.4412 |

| 07/28/2023 |

GRPN US 08/18/23 C5 |

SELL |

595.00 |

3.2225 |

| 07/28/2023 |

GRPN US 11/17/23 C15 |

BUY |

978.00 |

0.9561 |

| 07/31/2023 |

GRPN US 11/17/23 C12 |

BUY |

1,153.00 |

1.3637 |

| 07/31/2023 |

GRPN US 10/20/23 C14 |

SELL |

1,153.00 |

0.7637 |

| 07/31/2023 |

GRPN US 10/20/23 C9 |

BUY |

1.00 |

1.6500 |

| 08/01/2023 |

GRPN US 01/19/24 C18 |

BUY |

2,000.00 |

1.0124 |

| 08/01/2023 |

GRPN US 10/20/23 C14 |

SELL |

100.00 |

0.6718 |

| 08/01/2023 |

GRPN US 11/17/23 C15 |

BUY |

522.00 |

0.9453 |

| 08/01/2023 |

GRPN US 01/19/24 C32 |

SHORT |

2,000.00 |

0.3432 |

| 08/01/2023 |

GRPN US 11/17/23 C12 |

BUY |

100.00 |

1.2718 |

| 08/02/2023 |

GRPN US 10/20/23 C14 |

SELL |

247.00 |

0.6781 |

| 08/02/2023 |

GRPN US 11/17/23 C12 |

BUY |

247.00 |

1.2976 |

| 08/04/2023 |

GRPN US 09/15/23 C9 |

BUY |

500.00 |

1.3000 |

| 08/04/2023 |

GRPN US 11/17/23 C12 |

BUY |

500.00 |

1.4500 |

| 08/04/2023 |

GRPN US 08/18/23 C5 |

SELL |

405.00 |

3.0000 |

| 08/07/2023 |

GRPN US 09/15/23 C8 |

BUY |

475.00 |

1.2200 |

| 08/07/2023 |

GRPN US 01/19/24 C10 |

BUY |

350.00 |

2.0000 |

| 08/09/2023 |

GRPN US 08/18/23 C11 |

SELL |

25.00 |

0.4000 |

| 08/09/2023 |

GRPN US 10/20/23 C12 |

BUY |

1,500.00 |

1.2549 |

| 08/09/2023 |

GRPN US 01/19/24 C5 |

SELL |

1.00 |

4.4000 |

| 08/09/2023 |

GRPN US 10/20/23 C6 |

SELL |

2,000.00 |

3.2216 |

| 08/09/2023 |

COMMON STOCK |

SELL |

9,098.00 |

8.5124 |

| 08/09/2023 |

COMMON STOCK |

SELL |

2,036.00 |

8.6219 |

| 08/09/2023 |

GRPN US 01/19/24 C8 |

SELL |

302.00 |

3.1047 |

| 08/09/2023 |

GRPN US 11/17/23 C15 |

SELL |

1,500.00 |

1.1057 |

| 08/09/2023 |

GRPN US 09/15/23 C11 |

BUY |

3,000.00 |

0.8808 |

| 08/10/2023 |

GRPN US 10/20/23 C12 |

SELL |

2,500.00 |

0.6700 |

| Date |

Class/Security |

Action |

Quantity |

Average Price |

| 08/10/2023 |

GRPN US 01/19/24 C8 |

SELL |

399.00 |

2.4573 |

| 08/10/2023 |

COMMON STOCK |

BUY |

1,500.00 |

7.9853 |

| 08/10/2023 |

GRPN US 11/17/23 C12 |

BUY |

2,500.00 |

1.1200 |

| 08/10/2023 |

GRPN US 10/20/23 C9 |

SELL |

215.00 |

1.2616 |

| 08/10/2023 |

GRPN US 09/15/23 C9 |

SELL |

500.00 |

0.8000 |

| 08/10/2023 |

GRPN US 09/15/23 C8 |

SELL |

81.00 |

1.1500 |

| 08/11/2023 |

GRPN US 10/20/23 C9 |

SELL |

2,086.00 |

1.9360 |

| 08/11/2023 |

GRPN US 09/15/23 C8 |

SELL |

394.00 |

1.5269 |

| 08/11/2023 |

GRPN US 01/19/24 C10 |

SELL |

252.00 |

2.9000 |

| 08/11/2023 |

GRPN US 10/20/23 C6 |

SELL |

1,002.00 |

3.8048 |

| 08/11/2023 |

COMMON STOCK |

SELL |

60,000.00 |

9.3298 |

| 08/11/2023 |

GRPN US 09/15/23 C11 |

SELL |

1,500.00 |

0.7433 |

| 08/15/2023 |

GRPN US 01/19/24 C32 |

COVER |

2,000.00 |

0.5000 |

| 08/22/2023 |

COMMON STOCK |

BUY |

9,400.00 |

10.1357 |

| 08/29/2023 |

COMMON STOCK |

BUY |

35,000.00 |

11.7025 |

| 08/30/2023 |

GRPN US 09/15/23 P12 |

SHORT |

317.00 |

1.2554 |

| 08/30/2023 |

COMMON STOCK |

BUY |

4,936.00 |

11.5768 |

| 08/30/2023 |

GRPN US 11/17/23 C20 |

BUY |

1,000.00 |

0.9998 |

| 08/30/2023 |

COMMON STOCK |

BUY |

24,100.00 |

11.6679 |

| 08/30/2023 |

COMMON STOCK |

BUY |

25,000.00 |

11.5819 |

| 08/30/2023 |

COMMON STOCK |

SELL |

809.00 |

11.8104 |

| 08/31/2023 |

COMMON STOCK |

BUY |

41,700.00 |

11.5113 |

| 08/31/2023 |

GRPN US 11/17/23 C20 |

BUY |

1,000.00 |

1.0000 |

| 08/31/2023 |

GRPN US 10/20/23 C6 |

BUY |

1.00 |

6.5000 |

| 08/31/2023 |

COMMON STOCK |

SELL |

21,500.00 |

12.0642 |

| 08/31/2023 |

GRPN US 09/15/23 C11 |

SELL |

1,500.00 |

1.5709 |

| 08/31/2023 |

GRPN US 01/19/24 C10 |

BUY |

1.00 |

4.9000 |

| 08/31/2023 |

GRPN US 11/17/23 C15 |

BUY |

2,000.00 |

1.9687 |

| 09/01/2023 |

COMMON STOCK |

BUY |

8,000.00 |

11.8011 |

| 09/05/2023 |

GRPN US 10/20/23 C15 |

BUY |

1,500.00 |

0.7783 |

| 09/05/2023 |

COMMON STOCK |

BUY |

10,000.00 |

11.0516 |

| 09/05/2023 |

COMMON STOCK |

BUY |

50,000.00 |

11.0372 |

| 09/06/2023 |

COMMON STOCK |

BUY |

12,675.00 |

11.0324 |

| 09/06/2023 |

COMMON STOCK |

BUY |

26,000.00 |

10.9740 |

| 09/07/2023 |

GRPN US 10/20/23 C15 |

BUY |

1,000.00 |

0.6500 |

| 09/07/2023 |

COMMON STOCK |

BUY |

10,000.00 |

10.7956 |

| 09/07/2023 |

COMMON STOCK |

BUY |

25,000.00 |

10.7136 |

Exhibit C

LETTER TO ISSUER

Dusan Senkypyl

Chief Executive Officer

dsenkypl@groupon.com

Dear Dusan,

I have very much enjoyed our conversations

over the last several months and appreciate your initiative, on behalf of shareholders including myself, to help turn the ship around

at Groupon. As long term deep fundamental investors, we are highly cognizant that turnarounds take time with bumps along the way. That

being said, our diligence suggests that the opportunity here is vast and not even remotely understood by the market. There have been quite

a few mis-steps by prior management and in spite of a legacy bloated cost structure and a company that was mired in a “blasé-faire”

culture, the company managed to survive in spite of itself, a testament to the quality of the core business. We are extremely supportive

and appreciative of your efforts thus far and believe, based on our numerous conversations and your swift actions to date, that our interests

are aligned. In fact, we are quite impressed with the green shoots we are already witnessing, both in the reported financials and what

we observe in our due diligence, which will hopefully foreshadow what is to come. Given our large investment in the company, we thought

it made sense to file a 13D so that we could engage in a more comprehensive manner with the company and provide some input should you

find it helpful.

Windward’s Investment in Groupon

At Windward, our strategy is to scour the investment

universe for companies that are undergoing transitory profit pressures, causing them to be disregarded by the investment herd, thereby

jettisoning them to the bottom of the proverbial investment barrel. These situations allow us the opportunity to accumulate positions

at what we believe to be both trough profits and multiples at the cusp of inflecting. Windward employs rigorous qualitative & quantitative

research to provide a nuanced view of key performance indicators and unit economics, enabling us to have a differentiated and convicted

view. This research enables us to “skate to the puck” on material & extremely variant changes in the “investment

winds”, which we believe will not only abate, but significantly inflect in a highly positive manner in the near future, causing

asymmetric and potentially explosive returns in the investment over a defined catalyst path. Our conviction is measured not only by our

degree of variance in our profit estimates from both the Buy and Sell Side, but the proximity of the impending fundamental inflection.

In our opinion, what makes an investment extremely exciting is when these fundamental profit tailwinds are augmented by events such as

management change, non-core asset sales, & large stock buybacks. While this generally is enough to get us to max position size, what

makes an investment truly unique is when we can foresee inflections across all 3 financial statements occurring at once, as exemplified

in our investment case for Groupon.

Despite the fact that our average cost is $6.42,

our conviction level is higher, as we file today at $11, given we continue to build evidence that our thesis is correct and the catalyst

path grows more imminent. Below, we will delineate our investment case for $55 or 5x from here over the next 12 months. Given the

asymmetric upside we see over a relatively short period of time, we have structured our position with both stock and options. Our options

positions, many of which are in the money, form the majority of our 8.9% position in the company. These calls are high delta and longer-term

options, allowing us to pick up more leverage should we recognize the explosive upside we envision playing out.

Groupon Thesis – Counter cyclical

recession investment play, borne out of the Global Financial Crisis (during that time was the fastest growing company in North America).

Company has suffered headwind upon headwind and has been left for dead, trading as if bankruptcy is imminent. To the untrained eye, this

screens as a do not touch & melting ice cube short, hence the top 25 Short Interest % of Float, hovering at what we estimate to be

~40% of the “tradeable float”. This set up has allowed us to accumulate a position at an implied negative Enterprise Value,

which we believe will become apparent in the next few months as the company rapidly transitions from a “going concern” to

one with excess cash that will likely seek to buyback significantly undervalued shares ($245M buyback authorization or 74% of market cap)

at the same time revenues and EBITDA materially inflects, in a closely held shareholder base with significant short interest.

Macro & Self-inflicted headwinds, set

to become tailwinds – Groupon is primarily a discount site that takes a spread for lead generation to local merchants for selling

deals to its 13.6M active local user base globally. This is a high quality business with high margins and negative working capital, when

run efficiently. Given the shutdown of services in early Covid and the resulting dearth of service workers, coupled with a once in a generation

inflationary price taking environment, only exacerbated by sky high demand for participating in a services starved world, I’m not

sure any other public business I have come across suffered a greater 1- 2 punch over the last several years. This fact pattern coupled

with a potential impending recession augmented by the massively shrinking US consumer balance sheet could be one of the better headwind

to tailwind stories we will ever see. It is our contention that a company which hadn’t seen revenue growth in almost 10 years is

on the cusp of several years of +double digit growth just to get back to normalized revenues of a paltry 50% of 2019 levels!

| · | Prior to Covid, Groupon had been considered a melting ice cube in Ecom land for ~5 years, with revenues

declining ~MSD p/a after experiencing explosive growth from its inception until 2014; Despite this, Gross Profit $ hung in pretty consistently

at $1.2B per annum from 2015-2019 |

| · | The business got absolutely annihilated during COVID with GP$ -50% as services came to a screeching halt |

| o | Nail salons, massage parlors, restaurants, bowling alleys etc. |

| · | Stock ran to $60 March of 2021 as a COVID recovery play, given folks thought the company would recover

half of the losses and get EBITDA back to $175M or implying 10x recovered EBITDA |

| o | Service workers didn’t come back, they were too busy trading crypto, collecting stimulus and day

trading stocks, thus many service businesses were severely under-staffed |

| o | Further exacerbating issues, massive supply chain disruptions coupled with massive stimulus, created a

transitory euphoria around pricing and lack of discounting I have not seen in my 44 years on this planet |

| o | These two factors severely crimped demand for merchants to discount product to drive demand, given they

had a massive supply imbalance and were looking to take price rather than reduce it |

| · | This led to a series of bad guides under prior management teams who have consistently under-performed

and caused the stock to trade into no man’s land |

| o | To put it in perspective, the prior management team up until Dec of 2022 believed this company would generate

100M of Free Cash Flow (FCF) THIS YEAR! |

| · | This macroeconomic backdrop, coupled with some missteps from prior management, including poor alignment

of sales compensation to inventory generation, bad marketing decisions and lack of focus led to Gross Profit $’s declining to an

initial soft guide in 2023 of $425M or a paltry 35% of 2019 levels! |

| · | It is our contention that under the leadership of new management controlled by Pale Fire (activist who

owns 22% of company –interests aligned section) that there is a lot of low hanging fruit against artificially depressed easy compares

that should allow revenues to start accelerating towards 50%+ of 2019 levels |

| · | Management has commented that sales commission $’s exceeded Gross profit $’s generated from

poor inventory deals under prior regime due to a mismatch of incentives and supply/demand alignment |

| o | We liken the prior inventory situation to selling parkas in Miami in the summer and bathing suits in Buffalo

in the winter – demand and supply were severely out of whack |

| · | New management has quickly re-aligned the salesforce and changed incentives to match bottoms up demand

driven by regional CEO’s evaluation of analytics, instead of letting rogue sales people drive the bus to collect negative ROI commissions

checks |

| · | Company is now heavily leveraging AI to seamlessly generate improved lower cost local inventory |

| · | Management has started rolling out improvements in top markets and is already seeing a significant improvement

in performance, with some markets back to 70% of pre-covid levels |

| o | As management rolls out to rest of markets and turns marketing back up to 25% of Gross Profit, we should

see a marked acceleration against artificially depressed compares, especially given the return of service workers and macro backdrop whereby

bowling lanes, for example, now need to drive traffic rather than have demand exceeding supply |

| · | Based on our in-depth research and nuanced understanding of comparisons, it is our belief that Groupon

will return to growth by Q4 & likely is already flirting with it this quarter against expectations of -LDD% y/y |

Mis-modeling & the imminent simultaneous

inflection across all 3 of the Financial Statements – It is our contention that the company is on the cusp of a massive inflection

across all 3 of the financial statements simultaneously, which should drive a “powder kegged” re-rating in the shares over

the next several months

| · | The impending inflection in revenues at the same time the company benefits from a $250M cost restructuring,

which is just hitting its stride, will result in a material re-rating of EBITDA, more than doubling against street expectations;

We believe it will become apparent this coming quarter that the company will do ~$80M+ of EBITDA ‘23 & ~$150M+ ‘24 against

consensus of $40M & $74M respectively |

| · | Given the company does not provide formal guidance, there is some confusion around the trajectory of profits

this year. Additionally, new management’s conservative posture, given prior management’s mis-steps, is taking the stance of

under-promising and over-delivering as has been evident the last 2 quarters since Dusan has taken over as CEO |

| o | The company came in at high end of EBITDA in Q1 despite a massive top line miss |

| o | In Q2 the company hit our EBITDA estimate which was double consensus expectations |

| · | During the Q1 call, management gave, in our opinion, conservative guidance that the rate of revenue decline

would be similar in 2Q vs 1Q and has kept a similar tone around conservatism in H2 despite beating their 2Q guide by 500bps; It is our

contention that 2H revs will be flat to + and that coupled with lower 2H SGA, given trajectory of cost cutting, will lead to back half

EBITDA of $70M vs $10M in 1H Roughly half comes from lower SGA with the other half coming from increased GP$ on stabilization of revs

y/y.. This all includes marketing increasing to 25% of GP$ |

| · | For ’24 the company will benefit from the annualization of $30M of the already announced cost cuts

and it’s our contention there is likely more wood to chop on OPEX side (some of which will be reinvested); Furthermore, the company

has guided to a return to growth starting in Q1 and given the tailwinds we have delineated, we think 10% top line growth is conservative |

| o | To put this in perspective, if the company were to return to just 50% of 2019 levels, they would generate

200M+ of EBITDA |

Balance sheet inflection – While

the inflection in revenue and EBITDA is powerful, we think the impending inflection in the balance sheet perhaps dwarfs this in the short

term. Currently the capital structure is $225M in converts due in ’26 and a $75M revolver against $118M in cash

| · | Company has publicly delineated 2.3% stake in Sum up and its intention to monetize that, it’s

wholly owned stake in Giftcloud and goal to monetize some of its Intellectual Property |

| o | We believe stake in sum up is worth $150M+ and that there is real demand despite it being a less liquid

VC investment. We estimate other assets are worth $50M cumulatively. |

| o | Unique ownership structure with Sumup founders owning 70% of equity and historical raises being debt driven,

coupled with an already discounted raise last year during nadir of stock market in June at $8.5B valuation Vs. rumors at $22B imply stake

could be worth $200M+ |

| o | It is our view that these “late inning” sales, of which management disclosed they have already

received several offers, per the last conference call, would be a massive springboard as this would allow them to immediately pay down

their covenant heavy revolver and leave the company in a position of net cash right as the cash flow is also significantly inflecting,

enabling them to commence their $245M buyback (74% of current market cap, we assume they use only $90M) |

Cash Flow inflection – Over the

last 2 quarters, the company has burned $130M of cash flow, causing cash to decline from $248M to $118M. This coupled with the going concern

language, stemming from a last minute amendment to the revolver during height of regional banking crisis, unfortunately coinciding with

trough EBITDA/Cash burn & further exacerbated by commentary about potential for a dilutive equity raise has spooked the market and

thus created the unique opportunity

| · | Given our nuanced understanding of working capital, we are very comfortable that these 1x working capital

headwinds, which constitute $112/$130M burn will not only abate, but will soon turn to tailwinds |

| · | $25m of burn was operating lease liabilities – 1x step down due to termination of HQ and LT lease

liability |

| · | Accrued expenses are 30m drain and have gone from $260M Pre covid to $119M currently, we believe both

accrued and operating lease liability are both in the late innings of cash outflow |

| · | Merchant payables, which represents the money owed to vendors at the time services are rendered is -$48M

YTD & is the biggest concern to the market; However their tunnel vision on past results, given the cash drain from $540M Pre-Covid

to $178M currently, causes the market to miss the opportunity ahead for significant cash generation, which will completely dispel the

bear case as revenue growth inflects + |

| o | Payables have been steadily declining as revenue has taken a leg down to 35% of ’19 levels. However,

there is also a seasonal component to this as Q4 payables are a big generator of cash and Q1 sees a large drawdown. 1H was disproportionately

affected given seasonal drawdown coupled with -20% y/y rev declines, we will see this reverse significantly in Q4 |

| o | It is our contention that as revenues flat-line and start to grow in 2H that perversely not only do Merchant

payables cease being a cash headwind, but in fact will become a massive tailwind & we could see upwards of $100M of cash infusion

over the next year as payables were as high as $270M in Q4 2021, approximating a similar revenue base we estimate in ’24 |

| · | Free Cash Flow will be significantly + in 2H – Management has given soft guidance that Free Cash

Flow will be less negative in Q3 & + in Q4. It is our belief based on detailed analysis of working capital and + inflecting EBITDA

that Q3 could be flat and that GRPN will be +FCF from here on out; Furthermore, Q4 will be a significant cash generating quarter as the

company benefits form both EBITDA leverage & negative seasonal working capital leading to 2H FCF that could exceed $75M. We estimate

’24 FCF 100M+ |

Incentives aligned – Pale Fire

largest owner/activist (owns 22% of GRPN at $19) recently took control of board and fired ineffective prior CEO and took over as CEO/CFO

| · | Very sharp entrepreneur / VC CIO – created $1B of wealth for themselves over last 5 years (sold

and turned around several global ECOM and fintech companies) |

| · | Turned around Groupon of Eastern Europe called Slevomat – plan to institute similar playbook at

Groupon |

| · | Stepped down as CIO of Pale Fire $1B in AUM & foregoing salary, in exchange for 3.5M shares or 10%

of company fully diluted at $6 |

| · | Former Founder Lefkofsky owns 13%; Between the two, ~45% will be closely held should stock exceed $6 |

| o | Dusan has already decided to exercise his first tranche of options, signaling he believes the company

is significantly undervalued, given he had to come out of pocket to do so |

Valuation & Target Price

| · | It is our contention that the stock is worth $55+ or 5x where it currently trades. We believe that as

we skate forward to The Fall of ’24 it will be apparent that the company will do $200M+ of EBITDA in ’25 |

| · | 8x $200M of EBITDA assuming only 10% share buyback/4M shares at $22 (100% up from current levels) over

the next 12 months results in $55, even after accounting for dilution from Dusan’s options grant |

| · | To put in perspective, when GRPN hit $60 in June of ‘21, the stock was discounting 10x 175M of EBITDA,

but this was on an OPEX base $250M higher. Top line recovery needs to be far less to achieve same EBITDA |

| · | If we are correct in our assumptions across all the financial statements, GRPN will have $100M+ of net

cash pro forma after buyback exiting ’24 and could likely buy back significantly more stock than we model

|

| · | Given stock hasn’t had any real revenue growth during the last 8 years, we wouldn’t be surprised

to see the multiple expand to 10x EBITDA, if they could see multiple consecutive quarters of top line growth. If Groupon could return

to 60% of 2019 levels, a number that wouldn’t be shocking to us, the company would generate upwards of $300M of EBITDA and the stock

could flirt with triple digits in our Bull case |

In closing, we look forward to working constructively

with management to ensure Groupon achieves the value we believe is embedded within the company.

Sincerely,

/s/ Marc Chalfin

Marc Chalfin

CIO Windward Management LP

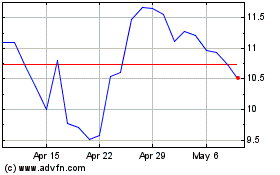

Groupon (NASDAQ:GRPN)

Historical Stock Chart

From Apr 2024 to May 2024

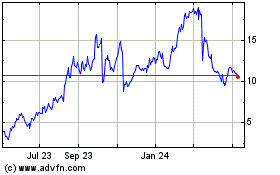

Groupon (NASDAQ:GRPN)

Historical Stock Chart

From May 2023 to May 2024