Territorial Bancorp Inc. (NASDAQ: TBNK) (“Territorial” or the

“Company”) today announced it is mailing a letter to Territorial

shareholders in connection with the Company’s upcoming Special

Meeting of Stockholders (the “Special Meeting”) to vote on the

proposed merger with Hope Bancorp, Inc. (NASDAQ: HOPE) (“Hope

Bancorp”) and related proposals. The Special Meeting is scheduled

for November 6, 2024 at 8:30 a.m., Hawai‘i Time. Territorial

shareholders of record as of August 14, 2024 are entitled to vote

at or before the meeting. Other important information related to

the Special Meeting can be found at

www.TerritorialandHopeCombination.com.

Highlights from the letter being mailed today include:

- Hope Bancorp Merger Provides Territorial Shareholders

with Significant Value and Substantial Upside Opportunity.

The merger is a 100% tax free, stock-for-stock transaction under

which Territorial shareholders will receive 0.8048 shares of Hope

Bancorp common stock for each share of Territorial common stock

they own. This per share consideration represents an approximate

25% premium to Territorial’s closing stock price just prior to the

merger announcement. Additionally, Territorial shareholders will

benefit from the considerable upside value of the stronger combined

company as well as $10.5 million of incremental value from annual

merger enabled cost savings and synergies, and Hope Bancorp’s

dividend, which is more than 1,000% higher than Territorial’s

standalone quarterly dividend.

- As a Result of Merger, Territorial Shareholders Will be

Investors in a Larger, More Diversified Regional Bank with Exciting

Growth Opportunities. The combined company will have

increased resources and expanded growth investment opportunities as

well as a more resilient business that is better able to navigate

market cycles.

- Merger Preserves Territorial’s Unwavering Commitment to

Hawai‘i and Provides Benefits to Customers, Employees and

Communities. Local branch and all other operations will

continue to be led by local teams with customers able to rely on

the same people they know and respect. Employees will continue to

receive competitive compensation and benefits with new career

opportunities. Hope Bancorp has committed to building on

Territorial’s more than 100-year legacy of supporting Territorial’s

local communities.

- Blue Hill’s Preliminary Indication of Interest is

Illusory, Non-Binding and Highly Conditional. Blue Hill

does not have committed financing, and its suggested transaction is

dependent on numerous conditions, including its ability to overcome

significant regulatory hurdles in a regulatory process that Blue

Hill has not yet started. Blue Hill is a newly created entity and

appears to lack M&A and regulatory experience with transactions

of this size and complexity.

- Blue Hill Exposes Territorial Shareholders to

Significant Risk and Uncertainty. Under Blue Hill’s Preliminary

Indication of Interest, Territorial’s Stock Could be Worth

Substantially Less Than it Is Today. In addition to

significant challenges in gaining regulatory approvals, a leading

proxy solicitation firm has stated that it is highly unlikely that

Blue Hill can meet its required tender threshold given the

composition of Territorial’s shareholder base. If Blue Hill does

not acquire 100% of outstanding Territorial shares, Territorial’s

shareholders could be left with an illiquid, stub minority

investment in a controlled company. Territorial would face the

declining performance and limited growth prospects that it does

today as a small, monoline one- to four- family loan focused bank

with limited scale.

- Blue Hill Is Unlikely to Deliver Its Claimed Benefits

to Hawaiʻi. Rather, Blue Hill’s Transaction Could be Detrimental

to Hawaiʻi, Jobs and Communities. In press reports and

elsewhere, Blue Hill repeatedly emphasizes “local management,” but

none of its named principals appear to primarily reside in Hawaiʻi,

according to public information. Blue Hill’s registered business

address appears to be a residential home in Hudson, New York. There

would likely need to be significant job cuts and reduced

investments in areas such as technology in order for Blue Hill to

reach its stated financial targets after it took control of

Territorial.

The Territorial Board of Directors unanimously recommends that

shareholders vote FOR the Hope Bancorp merger and related proposals

TODAY.

The full text of the letter being mailed to shareholders

follows:

Dear Fellow Territorial Bancorp Shareholders,

As previously announced, Territorial Bancorp has entered into a

definitive agreement to merge with Hope Bancorp. This transaction

delivers significant value to Territorial shareholders and provides

you with the opportunity to benefit from the substantial upside

opportunities of a larger, more diversified regional bank.

On November 6, 2024, Territorial will hold a Special Meeting of

Stockholders (the “Special Meeting”) to vote on this transaction.

How you vote will influence the value of your Territorial

investment.The Board unanimously

recommends that Territorial shareholders vote FOR the Hope Bancorp

merger and related proposals.

Compelling Value for Territorial

Shareholders

The merger is structured as a 100% tax free, stock-for-stock

transaction under which Territorial shareholders will receive

0.8048 shares of Hope Bancorp common stock for each share of

Territorial common stock they own. This per share consideration

represents:

- ~ 25% premium1 to

Territorial’s closing stock price just prior to the merger

announcement

- Strong implied transaction multiples across

all relevant metrics, including earnings per share and adjusted

tangible book value per share

Opportunity to Participate in Future

Growth and Value Creation

The all-stock consideration in the merger will allow Territorial

shareholders to participate in the considerable strategic,

operating and financial benefits we anticipate unlocking through

the combination:

- Larger, more diversified footprint, expanding

our opportunities and reducing our risks

- Solid financial position and greater

access to capital, enabling the combined company to

capture its many new growth opportunities and invest in new

technology and solutions to continue expanding our portfolio and

penetrating our markets

- 1,000%+ increase to Territorial’s standalone

dividend, increasing from $0.01 per share to $0.11 per share3

- $10.5 million of incremental value from annual

merger enabled cost savings and synergies

- Immediate accretion at close, tapping into

Hope Bancorp’s double-digit percentage EPS growth v. Territorial’s

losses as a standalone company

The transaction with Hope Bancorp will vault Territorial into a

new class of banking institutions. With a broader footprint

and diverse revenue streams, we will become part of a significantly

more resilient business better able to navigate market environments

to drive growth and shareholder value.

Preserves Territorial’s Unwavering

Commitment to Hawai‘i Market

Territorial has been part of the fabric of our local communities

across Hawai‘i for more than 100 years, and with this transaction –

local leadership, local operations, local relationships, all remain

in place.

|

Territorial Savings Bank |

Employees |

Customers |

Communities |

- Continuing to operate under Territorial name

|

- Continued strong local workforce

- Retaining all customer-facing branch staff to ensure

relationship continuity for customers

- Competitive compensation, benefits

- New career advancement opportunities

|

- Access to expanded array of banking products & services

- Benefits from enhanced technology platforms for improved

customer experiences

- Additional choices for customers

- Continued reliance on teams at local branches

|

- Shared cultural values that emphasize volunteerism

and active engagement with local communities

- Ongoing commitment to Territorial’s legacy of community

support and investment

|

Blue Hill’s Unsolicited Preliminary

Indication of Interest is Not in the Best Interest of Territorial

Shareholders, Customers, Employees or Communities in

Hawaiʻi

After our definitive merger agreement with Hope Bancorp was

reached and announced, Blue Hill Advisors LLC (“Blue Hill”) – a

recently formed entity with only three disclosed investors –

delivered its self-labeled “preliminary indication of interest” to

acquire Territorial Bancorp for $12.50 per share in cash through a

tender offer, with the potential option for holders of up to 30% of

Territorial shares to remain investors in the Company.

In consultation with its legal and financial advisors, the

Territorial Board carefully considered the Blue Hill preliminary

indication of interest on multiple occasions. The Board unanimously

determined to reject the preliminary indication of interest because

the Board does not believe that it is a superior proposal, or

likely to lead to a superior proposal, as defined by the terms of

the Hope Bancorp merger agreement. We firmly believe that our

merger with Hope Bancorp remains in the best interest of

Territorial shareholders.

Blue Hill’s Non-Binding, Preliminary

Indication of Interest is Highly Conditional

- No committed financing to purchase Territorial

- Requires side agreements with undisclosed terms to be

negotiated and signed by numerous unidentified investors

- Subject to an undefined due diligence process

- Dependent on overcoming significant hurdles in a regulatory

process that Blue Hill has not yet started and would be

challenging

Blue Hill’s Cloak of Secrecy and

Anonymity Creates Substantial Regulatory Risk and Uncertainty for

Territorial Shareholders

We find it difficult to believe that either federal or Hawaiʻi

regulators would allow Blue Hill to purchase Territorial based on

the following:

- No evidence that Blue Hill, its named principals nor its

undisclosed investors have obtained – or even tried to obtain –

regulatory approval for a transaction of this size and complexity

based on information it has provided to Territorial

- Blue Hill says it will immediately reconstitute the Territorial

Board after it gains control of the Company, but has not disclosed

the names of its new directors or the individuals who will replace

Territorial’s current management

- Blue Hill has not shared any detailed business plan, including

specifics on Board, management, strategy, resources, capital

planning, policies and procedures if it were to gain control of

Territorial – all of which are required in the regulatory

process

- Blue Hill was only established in February of 2023

- According to public sources, Blue Hill’s registered business

address appears to be a residential home in Hudson, New York

Even if Blue Hill were to gain regulatory approval, its

ability to complete a tender offer is highly unlikely.

Based on advice from a leading proxy solicitation firm whose

principals have overseen hundreds of tender offers over the past

40+ years, it is highly unlikely that Blue Hill could achieve its

required 70% tender threshold given the composition of

Territorial’s shareholder base. Abandonment of the Hope Bancorp

merger and the failure of the Blue Hill transaction to materialize

would leave Territorial significantly weakened in the aftermath of

two failed deals with significant standalone business risks.

Under Blue Hill’s Preliminary Indication

of Interest, Territorial’s Stock – and the Value of Your Investment

– Could be Worth Substantially Less Than It Is Today

If Blue Hill is unable to complete a 100% tender, the remaining

Territorial shareholders would be left with an illiquid, stub

minority investment in a controlled company. Blue Hill’s

undisclosed investors – who would control the Company – have

provided no assurance that they would serve all shareholders’

interests and have not defined a governance structure that ensures

they do.

As a standalone company, Territorial would face the same

business and value downside risks that Territorial faces today as a

small, monoline one- to four- family loan focused bank with limited

scale.

Unlike the Hope Bancorp stock-based transaction, Blue Hill’s

cash-based transaction creates immediate tax consequences, which

could leave Territorial shareholders with less – in some cases

substantially less – than the $12.50 per share consideration.

Blue Hill is Not Positioned to Deliver

Its Claimed Benefits to Hawaiʻi. Rather, Blue Hill’s Transaction

Could be Detrimental to Hawaiʻi, Jobs and Communities

In press reports and elsewhere, Blue Hill repeatedly emphasizes

“local management,” but:

- None of Blue Hill’s named principals appear to

primarily reside in Hawaiʻi, according to public information.

- Blue Hill is not based in Hawaiʻi. Blue Hill’s

registered business address4 appears to be a residential home in

Hudson, New York, which is also for rent5 on apartments.com.

- Blue Hill has provided no assurances as to

whether it would reduce employment levels, change employee

compensation or benefits, or reduce investments in communities

after it gains control of Territorial.

- In order for Blue Hill to reach its targeted 55% efficiency

ratio, there would likely need to be significant job

cuts and reduced investments in areas

such as technology.

Protect Your Territorial Investment and

Ensure You Have the Opportunity to Realize the Upside Value Created

by the Territorial + Hope Bancorp Combination by Voting

FOR the Merger Today

We are on a path to complete our merger with Hope Bancorp by the

end of 2024. The Hope Bancorp merger will create a stronger, more

diversified regional bank with an expanded footprint and

diversified offerings to drive future growth. The merger will

provide Territorial shareholders with compelling value and the

opportunity to participate in the considerable upside of our

combined business, and it will enable Territorial to build on our

more than 100-year legacy of supporting our local Hawai‘i

communities.

We urge you to consider the concrete and compelling

opportunities that the Hope Bancorp merger will create and not be

distracted and deceived by Blue Hill’s illusory, non-binding,

highly conditional preliminary indication of interest.

The Territorial Board of Directors unanimously recommends that

you vote FOR the Hope Bancorp merger and related proposals TODAY.

You can vote by internet, telephone or mail.

On behalf of the Territorial Board of Directors and management

team, thank you for your continued support of Territorial

Bancorp.

Allan S. Kitagawa Chairman of the Board, President and Chief

Executive Officer

|

Your Vote Is Important, No Matter How Many or How Few

Shares You Own! |

|

Please take a moment to vote FOR the proposals set forth on the

enclosed proxy card — by Internet, telephone toll-free or by

signing, dating and returning the enclosed proxy card or voting

instruction form. Vote well in advance of the Special Meeting on

November 6, 2024 at 8:30 a.m. Hawaiʻi Time.If you have questions

about how to vote your shares, please contact: |

|

Laurel Hill Advisory GroupCall toll-free: (888)

742-1305Banks and brokers should call: (516) 933-3100 |

| |

About Us

Territorial Bancorp Inc., headquartered in Honolulu, Hawaiʻi, is

the stock holding company for Territorial Savings Bank. Territorial

Savings Bank is a state-chartered savings bank which was originally

chartered in 1921 by the Territory of Hawaiʻi. Territorial Savings

Bank conducts business from its headquarters in Honolulu, Hawaiʻi,

and has 28 branch offices in the state of Hawaiʻi. For additional

information, please visit https://www.tsbHawaiʻi.bank.

Forward-Looking Statements

This communication contains certain statements regarding future

events or the future financial performance of Territorial Bancorp

Inc. (“Territorial”) and its proposed merger with Hope Bancorp,

Inc. (“Hope Bancorp”) that constitute forward-looking statements

within the meaning of the Private Securities Litigation Reform Act

of 1995. These forward-looking statements relate to, among other

things, expectations regarding the combined company’s deposit base,

diversification of the loan portfolio as well as overall risk

diversification, capital to support growth, strengthened

opportunities, enhanced value, geographic expansion, and statements

about the proposed transaction being immediately accretive.

Forward-looking statements include, but are not limited to,

statements preceded by, followed by or that include the words

“will,” “believes,” “expects,” “anticipates,” “intends,” “plans,”

“estimates,” “outlook,” or similar expressions. These statements

are subject to risks and uncertainties. Hope Bancorp’s actual

results, performance or achievements may differ materially from the

results, performance or achievements expressed or implied in any

forward-looking statements. The closing of the proposed transaction

is subject to regulatory approvals, the approval of Territorial

Bancorp stockholders, and other customary closing conditions. There

is no assurance that such conditions will be met or that the

proposed merger will be consummated within the expected time frame,

or at all. If the transaction is consummated, factors that may

cause actual outcomes to differ from what is expressed or

forecasted in these forward-looking statements include, among

things: difficulties and delays in integrating Hope Bancorp and

Territorial and achieving anticipated synergies, cost savings and

other financial benefits from the transaction; higher than

anticipated transaction costs; deposit attrition, operating costs,

customer loss and business disruption following the merger,

including difficulties in maintaining relationships with employees

and customers; and inability to obtain required governmental

approvals of the merger on its proposed terms and expected time

frames, or without regulatory constraints that may limit growth.

Other risks and uncertainties include, but are not limited to:

possible further deterioration in economic conditions in Hope

Bancorp’s or Territorial’s areas of operation or elsewhere;

interest rate risk associated with volatile interest rates and

related asset-liability matching risk; liquidity risks; risk of

significant non-earning assets, and net credit losses that could

occur, particularly in times of weak economic conditions or times

of rising interest rates; the failure of or changes to assumptions

and estimates underlying Hope Bancorp’s or Territorial’s allowances

for credit losses; potential increases in deposit insurance

assessments and regulatory risks associated with current and future

regulations; the outcome of any legal proceedings that may be

instituted against Hope Bancorp or Territorial; the risk that any

announcements relating to the proposed transaction could have

adverse effects on the market price of the common stock of either

or both Hope Bancorp and Territorial; and diversion of management’s

attention from ongoing business operations and opportunities. For

additional information concerning these and other risk factors, see

Hope Bancorp’s and Territorial’s most recent Annual Reports on Form

10-K and other filings with the U.S. Securities and Exchange

Commission (the “SEC”). These forward-looking statements are made

only as of the date of this presentation and are not guarantees of

future results, performance or outcomes. Hope Bancorp and

Territorial do not undertake, and specifically disclaim any

obligation, to update any forward-looking statements to reflect the

occurrence of events or circumstances after the date of such

statements except as required by law.

Additional Information about the Merger with Hope

Bancorp and Where to Find It

In connection with the proposed merger with Hope Bancorp, Hope

Bancorp has filed with the SEC a Registration Statement on Form

S-4, containing the Proxy Statement/Prospectus, which has been

mailed or otherwise delivered to Territorial’s stockholders on or

about August 29, 2024, as supplemented September 12, 2024. Hope

Bancorp and Territorial may file additional relevant materials with

the SEC. INVESTORS AND STOCKHOLDERS ARE URGED TO READ THE PROXY

STATEMENT/PROSPECTUS, AND ANY OTHER RELEVANT DOCUMENTS THAT ARE

FILED OR FURNISHED OR WILL BE FILED OR FURNISHED WITH THE SEC, AS

WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THOSE DOCUMENTS, CAREFULLY

AND IN THEIR ENTIRETY BECAUSE THEY CONTAIN OR WILL CONTAIN

IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION AND RELATED

MATTERS. You may obtain any of the documents filed with or

furnished to the SEC by Hope Bancorp or Territorial at no cost from

the SEC’s website at www.sec.gov.

Investor / Media Contact:

Walter IdaSVP, Director of Investor

Relations808-946-1400walter.ida@territorialsavings.net

_____________________________________1 Based on Territorial and

Hope Bancorp’s closing prices as of Apr 26, 2024 (day before merger

announcement)2 Hope Bancorp recently closed its branch purchase

& assumption agreement for the sale of its two branches in

Virginia3 Based on 0.8048 fixed exchange ratio and Hope Bancorp’s

$0.14 current per share dividend4 Per the LLC entity information

filed with New York State5

https://www.apartments.com/286-blue-hill-rd-hudson-ny/y5jxrls/

A photo accompanying this announcement is available

at:https://www.globenewswire.com/NewsRoom/AttachmentNg/163aeb3e-6965-40d9-884c-04b67906b0b4

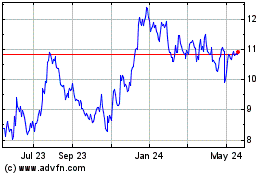

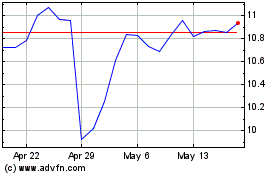

Hope Bancorp (NASDAQ:HOPE)

Historical Stock Chart

From Oct 2024 to Nov 2024

Hope Bancorp (NASDAQ:HOPE)

Historical Stock Chart

From Nov 2023 to Nov 2024