Third Quarter 2023 and Recent Selected Highlights:

- Record revenues of $34.3 million, an increase of 50% over $22.8

million in the prior-year quarter and an increase of 2% over $33.5

million in the sequential quarter.

- GAAP net loss of $(4.4 million).

- Adjusted EBITDA of $9.2 million, an increase of 270% over $2.5

million in the prior‑year quarter.

- GAAP gross margin was flat at 71%, year-over-year.

- Core gross margin improved to 78% over the prior year’s

72%.

- Cash and cash equivalents of $65.6 million as of September 30,

2023.

- Harrow Completes Transfer of NDAs and Launches FLAREX®,

NATACYN®, TOBRADEX® ST, VERKAZIA®, and ZERVIATE® in the U.S.

Harrow (Nasdaq: HROW), a leading U.S. eyecare pharmaceutical

company, announced results for the third quarter and nine months

ended September 30, 2023. The Company also posted its third quarter

Letter to Stockholders and corporate presentation to the

“Investors” section of its website, harrow.com. The Company

encourages all Harrow stockholders to review these documents, which

provide additional details concerning the historical quarterly

period as well as the future expectations for the business.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20231113816178/en/

Commenting on Harrow’s third quarter results, Mark L. Baum, CEO

of Harrow, said, “During the third quarter, we produced record

revenues, a 50% increase over prior‑year revenues. However,

operationally, the third quarter was a mixed bag, with some areas

performing exceptionally well, like our launch of IHEEZO, and some

areas underperforming, such as our Fab Five products and our

compounding business.

“The 50% year-over-year increase in revenues was primarily a

result of increases in branded pharmaceutical products (BPPS),

buoyed by performance from IHEEZO® that exceeded our internal

expectations. Strategic amendments to the IHEEZO launch led to a

substantial ramp in unit demand in September, a trend that

continued into the fourth quarter. We are hearing from eyecare

professionals that they are very happy with IHEEZO’s clinical

benefits, and we are seeing sizable orders and re-orders from

high-volume users as well as many new accounts. While it’s still

early in the launch and we have a lot of additional work to do, we

are bullish about what we see for IHEEZO in 2024 and beyond.

“During the third quarter, we strategically focused our

commercial team’s efforts on IHEEZO, delaying implementation of

marketing and sales detailing efforts for four of the “Fab Five”

products we had acquired earlier in the year and for which the New

Drug Applications (NDAs) had recently transferred. We have now

implemented those strategies and initial prescription data is

encouraging. We estimate that we are approximately three months

behind our revenue forecasts for these products.

“Our compounding business underperformed during the period as we

made investments in compliance and operations. We are confident

that the solutions already implemented or planned for our

compounding business will prove effective and restore the business

to its historical growth trajectory during the first quarter of

2024.

“Because we are a few months behind our internal targets – for

the aggregate business – we are adjusting our previously issued

2023 financial guidance to revenues of $129 million to $136 million

and Adjusted EBITDA of $36 million to $41 million. In addition, we

are outlining our expectations for 2024, which include revenues of

more than $180 million, excluding contributions from TRIESENCE. In

summary, 2023, to date, has been a transformational year – and we

believe that, because of the strategic actions that we have taken

in 2023, we are positioned well for another record-breaking year in

2024.”

Third quarter 2023 figures of merit:

For the Three Months Ended

September 30,

For the Nine Months Ended

September 30,

2023

2022

2023

2022

Net revenues

$

34,265,000

$

22,823,000

$

93,838,000

$

68,266,000

Gross margin

71

%

71

%

70

%

72

%

Core gross margin(1)

78

%

72

%

77

%

73

%

Net loss

(4,391,000

)

(6,464,000

)

(15,263,000

)

(15,141,000

)

Core net loss(1)

(2,960,000

)

(1,531,000

)

(4,519,000

)

(564,000

)

Adjusted EBITDA(1)

9,209,000

2,483,000

25,556,000

11,928,000

Basic and diluted net loss per share

(0.13

)

(0.24

)

(0.48

)

(0.55

)

Core diluted net loss per share(1)

(0.09

)

(0.06

)

(0.14

)

(0.02

)

(1)

Core gross margin, core net loss, core

diluted net loss per share (collectively, “Core Results”), and

Adjusted EBITDA are non‑GAAP measures. For additional information,

including a reconciliation of such Core Results and Adjusted EBITDA

to the most directly comparable measures presented in accordance

with GAAP, see the explanation of non-GAAP measures and

reconciliation tables in the financial tables section.

Conference Call and Webcast

The Company’s management team will host a conference call and

live webcast today at 4:45 p.m. Eastern Time to discuss the third

quarter 2023 results and provide a business update. To participate

in the call, see details below:

Conference Call Details:

Date:

Monday, November 13, 2023

Time:

4:45 p.m. Eastern time

Participant Dial-in:

1-833-953-2434 (U.S.) 1-412-317-5763

(International)

Replay Dial-in (Passcode

7225453):

(telephonic replay through November 20,

2023)

1-877-344-7529 (U.S.) 1-412-317-0088

(International)

Webcast: (online replay through

November 13, 2024)

harrow.com

About Harrow

Harrow, Inc. (Nasdaq: HROW) is a leading eyecare pharmaceutical

company engaged in the discovery, development, and

commercialization of innovative ophthalmic pharmaceutical products

for the U.S. market. Harrow helps U.S. eyecare professionals

preserve the gift of sight by making its comprehensive portfolio of

prescription and non-prescription pharmaceutical products

accessible and affordable to millions of Americans each year. For

more information about Harrow, please visit harrow.com.

Forward-Looking Statements

This press release contains “forward-looking statements” within

the meaning of the U.S. Private Securities Litigation Reform Act of

1995. Any statements in this release that are not historical facts

may be considered such “forward-looking statements.”

Forward-looking statements are based on management's current

expectations and are subject to risks and uncertainties which may

cause results to differ materially and adversely from the

statements contained herein. Some of the potential risks and

uncertainties that could cause actual results to differ from those

predicted include, among others, risks related to: liquidity or

results of operations; our ability to successfully implement our

business plan, develop and commercialize our products, product

candidates and proprietary formulations in a timely manner or at

all, identify and acquire additional products, manage our pharmacy

operations, service our debt, obtain financing necessary to operate

our business, recruit and retain qualified personnel, manage any

growth we may experience and successfully realize the benefits of

our previous acquisitions and any other acquisitions and

collaborative arrangements we may pursue; competition from

pharmaceutical companies, outsourcing facilities and pharmacies;

general economic and business conditions, including inflation and

supply chain challenges; regulatory and legal risks and

uncertainties related to our pharmacy operations and the pharmacy

and pharmaceutical business in general; physician interest in and

market acceptance of our current and any future formulations and

compounding pharmacies generally. These and additional risks and

uncertainties are more fully described in Harrow’s filings with the

Securities and Exchange Commission, including its Annual Report on

Form 10-K and its Quarterly Reports on Form 10-Q. Such documents

may be read free of charge on the SEC's web site at sec.gov. Undue

reliance should not be placed on forward-looking statements, which

speak only as of the date they are made. Except as required by law,

Harrow undertakes no obligation to update any forward-looking

statements to reflect new information, events, or circumstances

after the date they are made, or to reflect the occurrence of

unanticipated events.

HARROW, INC.

CONDENSED CONSOLIDATED BALANCE

SHEETS

September 30,

2023

December 31, 2022

(unaudited)

ASSETS

Cash and cash equivalents

$

65,610,000

$

96,270,000

All other current assets

44,668,000

21,990,000

Total current assets

110,278,000

118,260,000

All other assets

175,787,000

39,118,000

TOTAL ASSETS

$

286,065,000

$

157,378,000

LIABILITIES AND STOCKHOLDERS'

EQUITY

Current liabilities

$

19,029,000

$

18,632,000

Loans payable, net of unamortized debt

discount

182,186,000

104,174,000

All other liabilities

9,448,000

7,332,000

TOTAL LIABILITIES

210,663,000

130,138,000

TOTAL STOCKHOLDERS' EQUITY

75,402,000

27,240,000

TOTAL LIABILITIES AND STOCKHOLDERS'

EQUITY

$

286,065,000

$

157,378,000

HARROW, INC.

UNAUDITED CONDENSED

CONSOLIDATED STATEMENTS OF OPERATIONS

For the Three Months Ended

September 30,

For the Nine Months Ended

September 30,

2023

2022

2023

2022

Net revenues

$

34,265,000

$

22,823,000

$

93,838,000

$

68,266,000

Cost of sales

10,067,000

6,721,000

28,338,000

19,218,000

Gross profit

24,198,000

16,102,000

65,500,000

49,048,000

Selling, general and administrative

21,033,000

15,421,000

56,878,000

43,004,000

Research and development

1,421,000

775,000

3,316,000

2,347,000

Total operating expenses

22,454,000

16,196,000

60,194,000

45,351,000

Income (loss) from operations

1,744,000

(94,000

)

5,306,000

3,697,000

Total other expense, net

4,596,000

6,335,000

19,333,000

18,763,000

Income tax expense

1,539,000

35,000

1,236,000

75,000

Net loss attributable to Harrow,

Inc.

$

(4,391,000

)

$

(6,464,000

)

$

(15,263,000

)

$

(15,141,000

)

Net loss per share of common stock,

basic and diluted

$

(0.13

)

$

(0.24

)

$

(0.48

)

$

(0.55

)

HARROW, INC.

UNAUDITED CONDENSED

CONSOLIDATED STATEMENTS OF CASH FLOWS

For the Nine Months Ended

September 30,

2023

2022

Net cash (used in) provided by:

Operating activities

$

(4,856,000

)

$

5,417,000

Investing activities

(152,350,000

)

(1,738,000

)

Financing activities

126,546,000

(887,000

)

Net change in cash and cash

equivalents

(30,660,000

)

2,792,000

Cash and cash equivalents at beginning of

the period

96,270,000

42,167,000

Cash and cash equivalents at end of the

period

$

65,610,000

$

44,959,000

Non-GAAP Financial Measures

In addition to the Company’s results of operations determined in

accordance with U.S. generally accepted accounting principles

(GAAP), which are presented and discussed above, management also

utilizes Adjusted EBITDA and Core Results, unaudited financial

measures that are not calculated in accordance with GAAP, to

evaluate the Company’s financial results and performance and to

plan and forecast future periods. Adjusted EBITDA and Core Results

are considered “non‑GAAP” financial measures within the meaning of

Regulation G promulgated by the SEC. Management believes that these

non-GAAP financial measures reflect an additional way of viewing

aspects of the Company’s operations that, when viewed with GAAP

results, provide a more complete understanding of the Company’s

results of operations and the factors and trends affecting its

business. Management believes Adjusted EBITDA and Core Results

provide meaningful supplemental information regarding the Company’s

performance because (i) they allow for greater transparency with

respect to key metrics used by management in its financial and

operational decision-making; (ii) they exclude the impact of

non-cash or, when specified, non-recurring items that are not

directly attributable to the Company’s core operating performance

and that may obscure trends in the Company’s core operating

performance; and (iii) they are used by institutional investors and

the analyst community to help analyze the Company’s results.

However, Adjusted EBITDA, Core Results, and any other non-GAAP

financial measures should be considered as a supplement to, and not

as a substitute for, or superior to, the corresponding measures

calculated in accordance with GAAP. Further, non‑GAAP financial

measures used by the Company and the way they are calculated may

differ from the non-GAAP financial measures or the calculations of

the same non‑GAAP financial measures used by other companies,

including the Company’s competitors.

Adjusted EBITDA

The Company defines Adjusted EBITDA as net loss, excluding the

effects of stock‑based compensation and expenses, interest, taxes,

depreciation, amortization, investment (income) loss, net, and, if

any and when specified, other non-recurring income or expense

items. Management believes that the most directly comparable GAAP

financial measure to Adjusted EBITDA is net loss. Adjusted EBITDA

has limitations and should not be considered as an alternative to

gross profit or net loss as a measure of operating performance or

to net cash provided by (used in) operating, investing, or

financing activities as a measure of ability to meet cash

needs.

The following is a reconciliation of Adjusted EBITDA, a non-GAAP

measure, to the most comparable GAAP measure, net loss, for the

three and nine months ended September 30, 2023, and for the same

periods in 2022:

HARROW, INC.

RECONCILIATION OF NET LOSS TO

ADJUSTED EBITDA

For the Three Months Ended

September 30,

For the Nine Months Ended

September 30,

2023

2022

2023

2022

GAAP net loss

$

(4,391,000

)

$

(6,464,000

)

$

(15,263,000

)

$

(15,141,000

)

Stock-based compensation and expenses

4,476,000

1,932,000

11,521,000

5,941,000

Interest expense, net

5,749,000

1,800,000

16,200,000

5,386,000

Income tax expense

1,539,000

35,000

1,236,000

75,000

Depreciation

405,000

247,000

1,095,000

1,090,000

Amortization of intangible assets

2,584,000

398,000

7,634,000

1,200,000

Investment (income) loss, net

(1,348,000

)

4,535,000

(2,676,000

)

13,377,000

Other expense, net

195,000

-

5,809,000

(1)

-

Adjusted EBITDA

$

9,209,000

$

2,483,000

$

25,556,000

$

11,928,000

(1)

Includes $5,465,000 for the loss on

extinguishment of debt.

Core Results

Harrow Core Results, including core gross margin, core net

(loss) income, core operating income, core basic and diluted loss

per share, and core operating margin, exclude (1) all amortization

and impairment charges of intangible assets, excluding software

development costs, (2) net gains and losses on investments and

equity securities, including equity method gains and losses and

equity valued at fair value through profit and loss (“FVPL”), and

preferred stock dividends, and (3) gains/losses on forgiveness of

debt. In other periods, Core Results may also exclude fair value

adjustments of financial assets in the form of options to acquire a

company carried at FVPL, obligations related to product recalls,

certain acquisition‑related items, restructuring charges/releases

and associated items, related legal items, gains/losses on early

extinguishment of debt or debt modifications, impairments of

property, plant and equipment and software, as well as income and

expense items that management deems exceptional and that are or are

expected to accumulate within the year to be over a $100,000

threshold.

The following is a reconciliation of Core Results, non-GAAP

measures, to the most comparable GAAP measures for the three and

nine months ended September 30, 2023, and for the same periods in

2022:

For the Three Months Ended

September 30, 2023

GAAP Results

Amortization of Certain

Intangible Assets

Investment

Gains

Other Items

Core Results

Gross profit

$

24,198,000

$

2,480,000

$

-

$

-

$

26,678,000

Gross margin

71

%

78

%

Operating income

1,744,000

2,584,000

-

-

4,328,000

(Loss) income before taxes

(2,852,000

)

2,584,000

(1,348,000

)

195,000

(1,421,000

)

Tax expense

(1,539,000

)

-

-

-

(1,539,000

)

Net (loss) income

(4,391,000

)

2,584,000

(1,348,000

)

195,000

(2,960,000

)

Basic and diluted loss per share

($)(1)

(0.13

)

(0.09

)

Weighted average number of shares of

common stock outstanding, basic and diluted

34,255,197

34,255,197

For the Nine Months Ended

September 30, 2023

GAAP Results

Amortization of Certain

Intangible Assets

Investment

Gains

Other Items

Core Results

Gross profit

$

65,500,000

$

7,174,000

$

-

$

-

$

72,674,000

Gross margin

70

%

77

%

Operating income

5,306,000

7,634,000

-

-

12,940,000

(Loss) income before taxes

(14,027,000

)

7,634,000

(2,676,000

)

5,786,000

(3,283,000

)

Tax expense

(1,236,000

)

-

-

-

(1,236,000

)

Net (loss) income

(15,263,000

)

7,634,000

(2,676,000

)

5,786,000

(4,519,000

)

Basic and diluted loss per share

($)(1)

(0.48

)

(0.14

)

Weighted average number of shares of

common stock outstanding, basic and diluted

31,689,947

31,689,947

For the Three Months Ended

September 30, 2022

GAAP Results

Amortization of Certain

Intangible Assets

Investment

Losses

Core Results

Gross profit

$

16,102,000

$

341,000

$

-

$

16,443,000

Gross margin

71

%

72

%

Operating (loss) income

(94,000

)

398,000

-

304,000

(Loss) income before taxes

(6,429,000

)

398,000

4,535,000

(1,496,000

)

Tax expense

(35,000

)

-

-

(35,000

)

Net (loss) income

(6,464,000

)

398,000

4,535,000

(1,531,000

)

Basic and diluted loss per share

($)(1)

(0.24

)

(0.06

)

Weighted average number of shares of

common stock outstanding, basic and diluted

27,349,642

27,349,642

For the Nine Months Ended

September 30, 2022

GAAP Results

Amortization of Certain

Intangible Assets

Investment

Losses

Core Results

Gross profit

$

49,048,000

$

1,023,000

$

-

$

50,071,000

Gross margin

72

%

73

%

Operating income

3,697,000

1,200,000

-

4,897,000

(Loss) Income before taxes

(15,066,000

)

1,200,000

13,377,000

(489,000

)

Tax expense

(75,000

)

-

-

(75,000

)

Net (loss) income

(15,141,000

)

1,200,000

13,377,000

(564,000

)

Basic and diluted loss per share

($)(1)

(0.55

)

(0.02

)

Weighted average number of shares of

common stock outstanding, basic and diluted

27,293,756

27,293,756

(1)

Core basic and diluted loss per share is

calculated using the weighted-average number of shares of common

stock outstanding during the period. Core basic and diluted loss

per share also contemplates dilutive shares associated with

equity-based awards as described in Note 2 and elsewhere in the

Condensed Consolidated Financial Statements included in the

Company’s Quarterly Report on Form 10-Q for the quarter ended

September 30, 2023.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20231113816178/en/

Jamie Webb, Director of Communications and Investor Relations

jwebb@harrowinc.com 615-733-4737

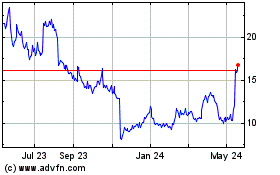

Harrow (NASDAQ:HROW)

Historical Stock Chart

From Dec 2024 to Jan 2025

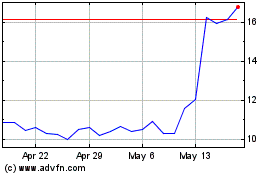

Harrow (NASDAQ:HROW)

Historical Stock Chart

From Jan 2024 to Jan 2025