0001800227FALSE00018002272025-02-112025-02-11

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 11, 2025

IAC Inc.

(Exact name of registrant as specified in charter)

| | | | | | | | |

| Delaware | 001-39356 | 84-3727412 |

(State or other jurisdiction

of incorporation) | (Commission

File Number) | (IRS Employer

Identification No.) |

| | | | | | | | | | | | | | |

| 555 West 18th Street, | New York, | NY | | 10011 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant's telephone number, including area code: (212) 314-7300

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

| | | | | | | | | | | | | | |

| Securities registered pursuant to Section 12(b) of the Act: |

| Title of each class | | Trading Symbol(s) | | Name of exchange on which registered |

| Common Stock, par value $0.0001 | | IAC | | The Nasdaq Stock Market LLC |

| | | (Nasdaq Global Select Market) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

Item 7.01. Regulation FD Disclosure.

On February 11, 2025, the Registrant announced that it had released its results for the year ended December 31, 2024. The full text of the related press release, which is posted on the “Investor Relations” section of the Registrant’s website at http://ir.iac.com/quarterly-results and appears in Exhibit 99.1 hereto, is incorporated herein by reference.

Exhibit 99.1 is being furnished under both Item 2.02 “Results of Operations and Financial Condition” and Item 7.01 “Regulation FD Disclosure.”

Item 9.01. Financial Statements and Exhibits

Exhibits.

| | | | | |

Exhibit

Number | Description |

| Press Release of IAC Inc., dated February 11, 2025. |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| IAC Inc. |

| |

| By: | | /s/ KENDALL HANDLER |

| Name: | | Kendall Handler |

| Title: | | Executive Vice President, Chief Legal Officer & Secretary |

Date: February 11, 2025

IAC REPORTS Q4 2024

•IAC Board of Directors approved plan to spin off Angi

•Dotdash Meredith Digital revenue growth of 10%

drives full year Digital revenue to over $1 billion

•Total IAC Q4 operating income of $51 million and Q4 Adjusted EBITDA of $142 million

NEW YORK— February 11, 2025—IAC (NASDAQ: IAC) released its fourth quarter results today and separately posted a letter to shareholders from Joey Levin, Chief Executive Officer of IAC, on the Investor Relations section of its website at ir.iac.com. A letter to Angi shareholders was also posted from Jeffrey Kip, the Chief Executive Officer of Angi Inc.

| | | | | | | | | | | | | | | | | | | | |

| IAC SUMMARY RESULTS |

| ($ in millions except per share amounts) |

| | | | | | |

| Q4 2024 | | Q4 2023 | | Growth | |

| | | | | | |

| Revenue | $ | 989.3 | | | $ | 1,058.0 | | | -6 | % | |

| Operating income (loss) | 50.6 | | | (37.0) | | | NM | |

| Unrealized (loss) gain on investment in MGM Resorts International | (287.4) | | | 512.6 | | | NM | |

| Net (loss) earnings | (199.0) | | | 327.8 | | | NM | |

| Diluted loss (earnings) per share | (2.39) | | | 3.70 | | | NM | |

| Adjusted EBITDA | 142.0 | | | 156.8 | | | -9 | % | |

See reconciliations of GAAP to non-GAAP measures beginning on page 15. |

•IAC announced on January 13, 2025:

◦The IAC Board of Directors approved a plan to spin off IAC’s full stake in Angi Inc. to IAC shareholders. The transaction is expected to close in the first half of 2025, but no sooner than March 31, 2025.

◦Joey Levin will step down from his role as IAC CEO and become an advisor to the Company, with the transition expected to occur upon the completion of the spin-off. Concurrent with IAC’s announcement, Angi Inc. announced its appointment of Mr. Levin as Executive Chairman of Angi Inc., effective upon his departure from IAC.

•Dotdash Meredith Digital revenue increased 10% to $311 million, the fourth consecutive quarter of double-digit growth, and Print revenue increased 10% to $218 million.

◦Operating income was $87 million and Adjusted EBITDA was $130 million, both negatively impacted by $13 million of severance primarily related to headcount reductions intended to better align resources with strategic initiatives.

◦Excluding the $13 million of severance, full year 2024 operating income would have been $120 million and Adjusted EBITDA would have been $308 million.

◦On November 26, 2024, Dotdash Meredith repriced $1.18 billion of Term B loans under its credit agreement, reducing borrowing costs by 60 basis points.

◦As of December 31, 2024, Dotdash Meredith’s net consolidated leverage ratio under the terms of its credit agreement declined below 4.0x, which provides IAC with increased financial flexibility.

•Angi Inc. Operating income decreased $5 million to $2 million and Adjusted EBITDA decreased 23% to $32 million driven primarily by the recovery in Q4 2023 of $11 million for previously incurred legal fees.

◦Full year 2024 operating income increased $48 million to $22 million and full year 2024 Adjusted EBITDA increased 23% to $145 million.

•As of Q4 2024, Care.com is reported as a separate reportable segment (previously included in Emerging & Other).

◦Revenue increased 3% to $94 million driven by 18% Enterprise growth.

◦Full year 2024 operating income was $34 million and Adjusted EBITDA was $45 million.

•On January 20, 2025, IAC amended and renewed its existing services agreement with Google, under which businesses within its Search segment generate revenue, extending the term until March 31, 2026.

•For the year ended December 31, 2024, net cash provided by operating activities increased $165 million to $355 million. Free Cash Flow increased $241 million to $289 million.

•See the FY 2025 outlook detail and Q1 2025 outlook commentary on page 14.

DISCUSSION OF FINANCIAL AND OPERATING RESULTS

| | | | | | | | | | | | | | | | | |

| ($ in millions, rounding differences may occur) | Q4 2024 | | Q4 2023 | | Growth |

| Revenue | | | | | |

| Dotdash Meredith | $ | 522.1 | | | $ | 475.9 | | | 10 | % |

| Angi Inc. | 267.9 | | | 300.4 | | | -11 | % |

| Care.com | 93.7 | | | 91.3 | | | 3 | % |

| Search | 89.2 | | | 133.5 | | | -33 | % |

| Emerging & Other | 16.6 | | | 59.1 | | | -72 | % |

| Intersegment eliminations | (0.1) | | | (2.2) | | | -97 | % |

| Total Revenue | $ | 989.3 | | | $ | 1,058.0 | | | -6 | % |

| Operating income (loss) | | | | | |

| Dotdash Meredith | $ | 87.3 | | | $ | (18.1) | | | NM |

| Angi Inc. | 2.2 | | | 7.6 | | | -72 | % |

| Care.com | 4.6 | | | 5.3 | | | -13 | % |

| Search | 6.0 | | | 7.5 | | | -19 | % |

| Emerging & Other | (7.2) | | | (1.1) | | | -568 | % |

| Corporate | (42.3) | | | (38.2) | | | -11 | % |

| Total Operating income (loss) | $ | 50.6 | | | $ | (37.0) | | | NM |

| Adjusted EBITDA | | | | | |

| Dotdash Meredith | $ | 130.1 | | | $ | 123.5 | | | 5 | % |

| Angi Inc. | 31.8 | | | 41.4 | | | -23 | % |

| Care.com | 7.9 | | | 8.6 | | | -8 | % |

| Search | 6.0 | | | 7.5 | | | -19 | % |

| Emerging & Other | (6.7) | | | (0.4) | | | 1756 | % |

| Corporate | (27.1) | | | (23.8) | | | 14 | % |

| Total Adjusted EBITDA | $ | 142.0 | | | $ | 156.8 | | | -9 | % |

Dotdash Meredith

Revenue

| | | | | | | | | | | | | | | | | |

| ($ in millions, rounding differences may occur) | Q4 2024 | | Q4 2023 | | Growth |

| Revenue | | | | | |

| Digital | $ | 310.6 | | | $ | 283.6 | | | 10 | % |

| Print | 217.9 | | | 198.4 | | | 10 | % |

| Intersegment eliminations | (6.5) | | | (6.2) | | | 5 | % |

| Total | $ | 522.1 | | | $ | 475.9 | | | 10 | % |

•Revenue of $522.1 million increased 10% year-over-year reflecting:

◦10% Digital revenue growth (fourth consecutive quarter of double-digit growth) reflecting:

▪Performance marketing revenue increasing 22% year-over-year driven by 39% affiliate commerce growth, partially offset by revenue declines from services, concentrated primarily in the Finance category

▪Advertising revenue increasing 3%, driven by:

•Higher premium advertising revenue due primarily to the Technology and Health and Pharmaceuticals categories

•Higher programmatic advertising revenue due to higher programmatic rates and 3% growth in Core Sessions

▪Licensing and other revenue increasing 19% due primarily to the addition of OpenAI (partnership began in May 2024) and improved performance from content syndication partners

◦10% Print revenue growth driven by higher revenue from a legacy agency business due to political advertising spend on third-party publisher platforms, as well as the timing of shipments related to certain annual publications (Q4 2024 vs. Q3 in 2023), partially offset by the ongoing migration of audience and advertising spend from print to digital

Operating Income (Loss) and Adjusted EBITDA

| | | | | | | | | | | | | | | | | |

| ($ in millions, rounding differences may occur) | Q4 2024 | | Q4 2023 | | Growth |

| Operating income (loss) | | | | | |

| Digital | $ | 90.3 | | | $ | (6.3) | | | NM |

| Print | 16.6 | | | 1.2 | | | 1284 | % |

| Other | (19.6) | | | (13.0) | | | -51 | % |

| Total | $ | 87.3 | | | $ | (18.1) | | | NM |

| Adjusted EBITDA | | | | | |

| Digital | $ | 122.6 | | | $ | 115.9 | | | 6 | % |

| Print | 23.0 | | | 16.2 | | | 42 | % |

| Other | (15.5) | | | (8.6) | | | 80 | % |

| Total | $ | 130.1 | | | $ | 123.5 | | | 5 | % |

•Operating income of $87.3 million increased $105.4 million reflecting:

◦Digital operating income increased $96.6 million to $90.3 million reflecting:

▪$86.8 million lower amortization of intangibles due, in part, to the inclusion in the prior year of a $79.9 million indefinite-lived intangible asset impairment

▪Adjusted EBITDA growth of 6% to $122.6 million due to higher revenue, partially offset by higher compensation costs (including $4.0 million of severance-related costs) and higher online marketing spend

◦Print operating income increased $15.4 million to $16.6 million reflecting:

▪Adjusted EBITDA increasing 42% to $23.0 million due to revenue growth, partially offset by $6.4 million in severance-related costs

▪$6.3 million lower amortization of intangibles and $2.2 million lower depreciation

◦Other operating loss increased $6.6 million to $19.6 million driven by the Adjusted EBITDA loss increasing $6.9 million to $15.5 million due primarily to higher compensation expense, including $2.5 million of severance-related costs, and the benefit of non-income tax items in Q4 2023

Angi Inc.

Please refer to the Angi Inc. Q4 2024 earnings release for further detail.

Care.com

•Revenue increased 3% to $93.7 million reflecting:

◦An 18% increase at Enterprise primarily driven by an increase in back-up care utilization

◦A 10% decrease at Consumer driven by lower subscriptions on the Care.com platform

•Operating income of $4.6 million decreased 13% driven by Adjusted EBITDA declining 8% to $7.9 million due primarily to $9.3 million in net legal accruals related to the resolution of certain legal matters, partially offset by higher revenue and lower sales and marketing expense

Search

•Revenue decreased 33% to $89.2 million reflecting:

◦A 35% decrease at Ask Media Group due to a reduction in traffic acquisition costs driving fewer visitors to ad-supported search and content websites

◦A 23% decrease at Desktop (legacy desktop search software business)

•Operating income of $6.0 million reflecting Adjusted EBITDA decreasing $1.4 million to $6.0 million due primarily to lower revenue, partially offset by lower traffic acquisition costs and lower compensation costs

Emerging & Other

•Revenue decreased 72% to $16.6 million reflecting:

◦The sale of Mosaic Group on February 15, 2024 ($37.5 million included in Q4 2023)

◦The sale of Roofing on November 1, 2023 ($6.3 million included in Q4 2023)

◦2% declines from Vivian Health

◦71% growth from The Daily Beast

•Operating loss increased $6.1 million to $7.2 million driven by the Adjusted EBITDA loss increasing $6.4 million to $6.7 million reflecting:

▪Mosaic Group profits of $6.6 million in Q4 2023

▪Higher legal fees

▪Lower losses at The Daily Beast

Corporate

Operating loss increased $4.1 million to $42.3 million due primarily to $3.3 million higher Adjusted EBITDA losses driven predominantly by $3.3 million of transaction-related costs related to the proposed spin-off of Angi Inc. and higher professional fees, partially offset by lower compensation costs.

Investment in MGM

IAC holds 64.7 million shares of MGM Resorts International (“MGM”), which were purchased for $1.3 billion, and were worth $2.2 billion as of February 7. 2025. Net earnings (loss) and diluted earnings (loss) per share reflect changes in MGM’s share price as unrealized gains and losses and, as a result, can be very volatile, which reduces their ability to be effective measures to assess operating performance.

Income Taxes

The Company recorded an income tax benefit of $63.3 million in Q4 2024 for an effective tax rate of 24%, which was higher than the statutory rate due primarily to state taxes. In Q4 2023, the Company recorded an income tax provision of $112.5 million for an effective tax rate of 26%, which was higher than the statutory rate due primarily to state taxes and an unbenefited capital loss.

Free Cash Flow

For the twelve months ended December 31, 2024, net cash provided by operating activities was $354.5 million, a $165.0 million increase year-over-year. Free Cash Flow increased $240.8 million to $289.0 million due primarily to favorable working capital, lower capital expenditures ($80.3 million in 2023 for the purchase of the land under IAC’s headquarters building) and higher Adjusted EBITDA.

| | | | | | | | | | | |

| Twelve Months Ended December 31, |

| ($ in millions, rounding differences may occur) | 2024 | | 2023 |

| Net cash provided by operating activities | $ | 354.5 | | | $ | 189.5 | |

| Capital expenditures | (65.5) | | | (141.4) | |

| Free cash flow | $ | 289.0 | | | $ | 48.2 | |

CONFERENCE CALL

IAC and Angi Inc. will host a conference call to answer questions regarding their fourth quarter results on Wednesday, February 12, 2025, at 8:30 a.m. Eastern Time. This conference call will include the disclosure of certain information, including forward-looking information, which may be material to an investor’s understanding of IAC and Angi Inc.’s business. The conference call will be open to the public at ir.iac.com or ir.angi.com.

LIQUIDITY AND CAPITAL RESOURCES

As of December 31, 2024:

•IAC had 86.3 million shares of common stock and Class B common stock outstanding.

•The Company had $1.8 billion in cash and cash equivalents of which IAC held $1.1 billion, Angi Inc. held $416 million and Dotdash Meredith, Inc. held $250 million.

•The Company had $2.0 billion in long-term debt, of which Dotdash Meredith Inc. held $1.5 billion and ANGI Group, LLC (a subsidiary of Angi Inc.) held $500.0 million.

•IAC’s economic interest in Angi Inc. was 85.3% and IAC’s voting interest was 98.3%. IAC held 424.6 million shares of Angi Inc.

•IAC owned 64.7 million shares of MGM.

On November 26, 2024, Dotdash Meredith repriced $1.18 billion of Term B loans and amended its existing credit agreement to reduce borrowing costs by 60 basis points.

As of December 31, 2024, Dotdash Meredith’s net consolidated leverage ratio under the terms of its credit agreement declined below 4.0x, which provides IAC with increased financial flexibility.

Dotdash Meredith Inc. has a $150 million revolving credit facility, which had no borrowings outstanding as of December 31, 2024 and currently has no borrowings outstanding.

As of December 31, 2024:

•IAC had 3.7 million shares remaining in its stock repurchase authorization.

•Angi, Inc. had 23.1 million shares remaining in its stock repurchase authorization.

Pursuant to these authorizations, share repurchases may be made over an indefinite period of time in the open market and in privately negotiated transactions, depending on those factors management deems relevant at any particular time, including, without limitation, market conditions, price and future outlook.

OPERATING METRICS

($ in millions; rounding differences may occur)

| | | | | | | | | | | | | | | | | |

| Q4 2024 | | Q4 2023 | | Growth |

| | | | | |

| Dotdash Meredith | | | | | |

| Revenue | | | | | |

| Advertising revenue | $ | 191.8 | | | $ | 185.5 | | | 3 | % |

| Performance marketing revenue | 86.5 | | | 71.1 | | | 22 | % |

| Licensing and other revenue | 32.3 | | | 27.0 | | | 19 | % |

| Total Digital Revenue | 310.6 | | | 283.6 | | | 10 | % |

| Print Revenue | 217.9 | | | 198.4 | | | 10 | % |

| Intersegment eliminations | (6.5) | | | (6.2) | | | 5 | % |

| Total Revenue | $ | 522.1 | | | $ | 475.9 | | | 10 | % |

| | | | | |

| Digital metrics | | | | | |

| | | | | |

| Total Sessions (in millions) | 2,666 | | | 2,789 | | | -4 | % |

| Core Sessions (in millions) | 2,327 | | | 2,255 | | | 3 | % |

| | | | | |

| Angi Inc. | | | | | |

| Revenue | | | | | |

| Ads and Leads | $ | 214.5 | | | $ | 246.9 | | | -13 | % |

| Services | 24.8 | | | 26.1 | | | -5 | % |

| Total Domestic | 239.2 | | | 273.1 | | | -12 | % |

| International | 28.6 | | | 27.4 | | | 5 | % |

| Total Revenue | $ | 267.9 | | | $ | 300.4 | | | -11 | % |

| | | | | |

| Metrics | | | | | |

| | | | | |

| Service Requests (in thousands) | 3,629 | | | 4,324 | | | -16 | % |

| Monetized Transactions (in thousands) | 5,255 | | | 5,500 | | | -4 | % |

| Monetized Transactions per Service Request | 1.45 | | 1.27 | | 14 | % |

| Transacting Professionals (in thousands) | 168 | | | 196 | | | -14 | % |

| | | | | |

| Care.com | | | | | |

| Revenue | | | | | |

| Consumer | $ | 45.0 | | | $ | 50.0 | | | -10 | % |

| Enterprise | 48.6 | | | 41.3 | | | 18 | % |

| Total Revenue | $ | 93.7 | | | $ | 91.3 | | | 3 | % |

| | | | | |

| Search | | | | | |

| Revenue | | | | | |

| Ask Media Group | $ | 74.0 | | | $ | 113.9 | | | -35 | % |

| Desktop | 15.2 | | | 19.6 | | | -23 | % |

| Total Revenue | $ | 89.2 | | | $ | 133.5 | | | -33 | % |

| | | | | |

See metric definitions on page 19

DILUTIVE SECURITIES

IAC has various dilutive securities. The table below details these securities as well as potential dilution at various stock prices (shares in millions; rounding differences may occur).

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Shares | | Avg Exercise Price | | As of 02/07/25 | Dilution at: |

| | | | | | | | | |

| Share Price | | | | | $ | 41.60 | | $ | 45.00 | | $ | 50.00 | | $ | 55.00 | | $ | 60.00 | |

| | | | | | | | | |

Absolute Shares as of 02/07/25 | 83.3 | | | | | 83.3 | | 83.3 | | 83.3 | | 83.3 | | 83.3 | |

| | | | | | | | | |

| RSUs and non-publicly traded subsidiary denominated equity awards | 3.0 | | | | | 0.8 | | 0.8 | | 0.7 | | 0.7 | | 0.7 | |

| Options | 2.4 | | | $ | 14.25 | | | 0.4 | | 0.4 | | 0.5 | | 0.5 | | 0.5 | |

| Total Dilution | | | | | 1.2 | | 1.2 | | 1.2 | | 1.2 | | 1.2 | |

| % Dilution | | | | | 1.5 | % | 1.4 | % | 1.4 | % | 1.4 | % | 1.4 | % |

| Total Diluted Shares Outstanding | | | | | 84.5 | | 84.5 | | 84.5 | | 84.5 | | 84.4 | |

The dilutive securities presentation is calculated using the methods and assumptions described below, which are different from those used for GAAP dilution, which is calculated based on the treasury stock method.

The Company currently settles all equity awards on a net basis; therefore, the dilutive effect is presented as the net number of shares expected to be issued upon vesting or exercise, and in the case of options, assuming no proceeds are received by the Company. Any required withholding taxes are paid in cash by the Company on behalf of the employees. In addition, the estimated income tax benefit from the tax deduction received upon the vesting or exercise of these awards is assumed to be used to repurchase IAC shares. Assuming all awards were exercised or vested on February 7, 2025, withholding taxes paid by the Company on behalf of the employees upon net settlement would have been $95.1 million (of which approximately 75% would be payable for awards currently vested and those vesting on or before December 31, 2025), assuming a stock price of $41.60 and a 50% withholding rate. The table above assumes no change in the fair value estimate of the non-publicly traded subsidiary denominated equity awards from the values used at December 31, 2024. The number of shares ultimately needed to settle these awards and the cash withholding tax obligation may vary significantly as a result of the determination of the fair value of the relevant subsidiaries. In addition, the number of shares required to settle these awards will be impacted by movement in the stock price of IAC.

IAC Restricted Stock

On January 13, 2025, IAC and Mr. Levin entered into an Employment Transition Agreement (the “Transition Agreement”), pursuant to which the 3 million shares of IAC restricted stock granted to Mr. Levin in November 2020 were forfeited. In accordance with the terms of the Transition Agreement, the Company transferred 5.0 million Class B common shares of Angi Inc. held by the Company and paid $9.3 million to satisfy applicable tax withholding obligations.

As of February 7, 2025, IAC’s economic interest in Angi Inc. was 84.2% and IAC’s voting interest was 98.1%. IAC held 419.6 million shares of Angi, Inc.

Angi Inc. Equity Awards and the Treatment of the Related Dilutive Effect

Certain Angi Inc. equity awards can be settled in shares of either IAC or Angi Inc. common stock at IAC’s election. IAC is expected to settle certain vested Angi Inc. subsidiary denominated equity awards in shares of IAC common stock in March 2025 and the dilution from these awards is included in the calculation above; the dilution related to the remaining unvested awards is excluded from the calculation above. Upon settlement by IAC, Angi Inc. is obligated to reimburse IAC for the cost of those shares by issuing shares of Angi Inc. common stock to IAC.

GAAP FINANCIAL STATEMENTS

IAC CONSOLIDATED STATEMENT OF OPERATIONS (UNAUDITED)

($ in thousands except per share data)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Twelve Months Ended December 31, |

| | 2024 | | 2023 | | 2024 | | 2023 |

| | |

| Revenue | $ | 989,307 | | | $ | 1,058,034 | | | $ | 3,807,233 | | | $ | 4,365,235 | |

| Operating costs and expenses: | | | | | | | |

| Cost of revenue (exclusive of depreciation shown separately below) | 262,712 | | | 304,894 | | | 1,059,990 | | | 1,343,254 | |

| Selling and marketing expense | 320,837 | | | 351,623 | | | 1,338,732 | | | 1,576,229 | |

| General and administrative expense | 209,733 | | | 190,209 | | | 817,658 | | | 891,958 | |

| Product development expense | 80,267 | | | 83,592 | | | 323,687 | | | 334,491 | |

| Depreciation | 30,424 | | | 38,865 | | | 126,890 | | | 175,096 | |

| Amortization of intangibles | 34,713 | | | 125,808 | | | 144,506 | | | 295,970 | |

| Goodwill impairment | — | | | — | | | — | | | 9,000 | |

| Total operating costs and expenses | 938,686 | | | 1,094,991 | | | 3,811,463 | | | 4,625,998 | |

| Operating income (loss) | 50,621 | | | (36,957) | | | (4,230) | | | (260,763) | |

| Interest expense | (36,954) | | | (40,226) | | | (155,888) | | | (157,632) | |

| Unrealized (loss) gain on investment in MGM Resorts International | (287,373) | | | 512,611 | | | (649,178) | | | 721,668 | |

| Other income, net | 11,036 | | | 3,673 | | | 116,897 | | | 63,862 | |

| (Loss) earnings before income taxes | (262,670) | | | 439,101 | | | (692,399) | | | 367,135 | |

| Income tax benefit (provision) | 63,280 | | | (112,451) | | | 159,069 | | | (108,818) | |

| Net (loss) earnings | (199,390) | | | 326,650 | | | (533,330) | | | 258,317 | |

| Net loss (earnings) attributable to noncontrolling interests | 413 | | | 1,100 | | | (6,567) | | | 7,625 | |

| Net (loss) earnings attributable to IAC shareholders | $ | (198,977) | | | $ | 327,750 | | | $ | (539,897) | | | $ | 265,942 | |

| | | | | | | |

| Per share information attributable to IAC common stock and Class B common stock shareholders: |

| Basic (loss) earnings per share | $ | (2.39) | | | $ | 3.82 | | | $ | (6.49) | | | $ | 3.07 | |

| Diluted (loss) earnings per share | $ | (2.39) | | | $ | 3.70 | | | $ | (6.49) | | | $ | 2.97 | |

| | | | | | | |

| Stock-based compensation expense by function: | | | | | | | |

| Cost of revenue | $ | 462 | | | $ | 508 | | | $ | 2,219 | | | $ | 1,613 | |

| Selling and marketing expense | 1,785 | | | 2,315 | | | 7,241 | | | 8,808 | |

| General and administrative expense | 21,718 | | | 23,773 | | | 93,524 | | | 93,506 | |

| Product development expense | 2,321 | | | 2,489 | | | 9,539 | | | 13,254 | |

| Total stock-based compensation expense | $ | 26,286 | | | $ | 29,085 | | | $ | 112,523 | | | $ | 117,181 | |

IAC CONSOLIDATED BALANCE SHEET (UNAUDITED)

($ in thousands)

| | | | | | | | | | | |

| December 31, |

| 2024 | | 2023 |

| |

| ASSETS | | | |

| Cash and cash equivalents | $ | 1,798,170 | | | $ | 1,297,445 | |

| | | |

| Marketable securities | — | | | 148,998 | |

| Accounts receivable, net | 519,690 | | | 536,650 | |

| | | |

| Other current assets | 167,175 | | | 257,499 | |

| Total current assets | 2,485,035 | | | 2,240,592 | |

| | | |

| Buildings, land, capitalized software, equipment and leasehold improvements, net | 392,761 | | | 455,281 | |

| Goodwill | 2,877,078 | | | 3,024,266 | |

| Intangible assets, net of accumulated amortization | 722,135 | | | 874,705 | |

| Investment in MGM Resorts International | 2,242,672 | | | 2,891,850 | |

| Long-term investments | 438,534 | | | 411,216 | |

| Other non-current assets | 388,945 | | | 473,267 | |

| TOTAL ASSETS | $ | 9,547,160 | | | $ | 10,371,177 | |

| | | |

| LIABILITIES AND SHAREHOLDERS' EQUITY | | | |

| LIABILITIES: | | | |

| Current portion of long-term debt | $ | 35,000 | | | $ | 30,000 | |

| Accounts payable, trade | 71,991 | | | 105,514 | |

| Deferred revenue | 98,568 | | | 143,449 | |

| Accrued expenses and other current liabilities | 680,633 | | | 671,527 | |

| Total current liabilities | 886,192 | | | 950,490 | |

| | | |

| Long-term debt, net | 1,931,847 | | | 1,993,154 | |

| Deferred income taxes | 13,867 | | | 164,612 | |

| Other long-term liabilities | 410,866 | | | 474,540 | |

| | | |

| Redeemable noncontrolling interests | 25,415 | | | 33,378 | |

| | | |

| Commitments and contingencies | | | |

| | | |

| SHAREHOLDERS' EQUITY: | | | |

| Common stock, $0.0001 par value | 8 | | | 8 | |

| Class B common stock, $0.0001 par value | 1 | | | 1 | |

| Additional paid-in capital | 6,380,700 | | | 6,340,312 | |

| (Accumulated deficit) retained earnings | (538,974) | | | 923 | |

| Accumulated other comprehensive loss | (11,396) | | | (10,942) | |

| Treasury Stock | (252,441) | | | (252,441) | |

| Total IAC shareholders' equity | 5,577,898 | | | 6,077,861 | |

| Noncontrolling interests | 701,075 | | | 677,142 | |

| Total shareholders' equity | 6,278,973 | | | 6,755,003 | |

| TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY | $ | 9,547,160 | | | $ | 10,371,177 | |

IAC CONSOLIDATED STATEMENT OF CASH FLOWS (UNAUDITED)

($ in thousands) | | | | | | | | | | | |

| Twelve Months Ended December 31, |

| | 2024 | | 2023 |

| | |

| Cash flows from operating activities: | | | |

| Net (loss) earnings | $ | (533,330) | | | $ | 258,317 | |

| Adjustments to reconcile net (loss) earnings to net cash provided by operating activities: | | | |

| Unrealized loss (gain) on investment in MGM Resorts International | 649,178 | | | (721,668) | |

| Amortization of intangibles | 144,506 | | | 295,970 | |

| Depreciation | 126,890 | | | 175,096 | |

| Stock-based compensation expense | 112,523 | | | 117,181 | |

| Provision for credit losses | 61,949 | | | 87,729 | |

| Non-cash lease expense (including right-of-use asset impairments) | 54,050 | | | 101,695 | |

| Deferred income taxes | (181,037) | | | 88,792 | |

| Unrealized (increase) decrease in the estimated fair value of a warrant | (20,393) | | | (2,832) | |

| (Gains) losses on sales of businesses and investments in equity securities (including downward and upward adjustments), net | (10,493) | | | 19,346 | |

| Pension and post-retirement benefit (credit) cost | (5,453) | | | 76 | |

| Goodwill impairment | — | | | 9,000 | |

| Other adjustments, net | (1,521) | | | (12,315) | |

| Changes in assets and liabilities, net of effects of dispositions: | | | |

| Accounts receivable | (51,783) | | | (37,296) | |

| Other assets | 103,861 | | | 11,281 | |

| Operating lease liabilities | (69,783) | | | (74,256) | |

| Accounts payable and other liabilities | (9,333) | | | (120,259) | |

| Income taxes payable and receivable | (2,780) | | | 2,884 | |

| Deferred revenue | (12,533) | | | (9,213) | |

| Net cash provided by operating activities | 354,518 | | | 189,528 | |

| Cash flows from investing activities: | | | |

| Capital expenditures | (65,506) | | | (141,364) | |

| Net proceeds from sales of fixed assets | 12,832 | | | 29,805 | |

| Proceeds from maturities of marketable debt securities | 375,000 | | | 550,000 | |

| | | |

| Purchases of marketable debt securities | (221,788) | | | (455,413) | |

| Net proceeds from the sales of businesses and investments | 177,163 | | | 11,861 | |

| Purchase of retirement investment fund | (15,968) | | | — | |

| Proceeds from the sale of retirement investment fund | 2,326 | | | — | |

| | | |

| Net collections of notes receivable | 11,834 | | | 11,297 | |

| Purchases of investments | (53) | | | (103,555) | |

| Other, net | 985 | | | 9,902 | |

| Net cash provided by (used in) investing activities | 276,825 | | | (87,467) | |

| Cash flows from financing activities: | | | |

| Principal payments on Dotdash Meredith Term Loans | (67,964) | | | (30,000) | |

| Proceeds from the issuance of Dotdash Meredith Term Loan B-1 | 7,964 | | | — | |

| | | |

| | | |

| | | |

| | | |

| | | |

| Proceeds from the exercise of IAC stock options | — | | | 130 | |

| Withholding taxes paid on behalf of IAC employees on net settled stock-based awards | (14,976) | | | (10,587) | |

| Withholding taxes paid on behalf of Angi Inc. employees on net settled stock-based awards | (7,578) | | | (5,994) | |

| Purchases of Angi Inc. treasury stock | (28,605) | | | (10,932) | |

| Purchases of IAC treasury stock | — | | | (165,622) | |

| Purchase of noncontrolling interests | (16,019) | | | — | |

| | | |

| Other, net | (1,921) | | | (8) | |

| Net cash used in financing activities | (129,099) | | | (223,013) | |

| Total cash provided by (used in) | 502,244 | | | (120,952) | |

| Effect of exchange rate changes on cash and cash equivalents and restricted cash | (1,230) | | | 1,124 | |

| Net increase (decrease) in cash and cash equivalents and restricted cash | 501,014 | | | (119,828) | |

| Cash and cash equivalents and restricted cash at beginning of period | 1,306,241 | | | 1,426,069 | |

| Cash and cash equivalents and restricted cash at end of period | $ | 1,807,255 | | | $ | 1,306,241 | |

FULL YEAR 2025 OUTLOOK

Please find below our full year 2025 outlook. We confront investment choices every day, and as stewards of capital, will deviate from this outlook when we have attractive opportunities that drive long-term value at the expense of short-term results. And of course, sometimes we’ll simply be wrong about the future. Amply warned, here’s our current outlook:

| | | | | |

| |

| ($ in millions) | FY 2025 Outlook |

| | |

| Adjusted EBITDA | |

| Dotdash Meredith (a) | $330-$350 |

| Angi Inc. | 135-150 |

| Care.com | 45-55 |

| Search | 10-15 |

| Emerging & Other | (25-15) |

| Corporate | (150-130) |

| Total | $345-$425 |

| |

| Stock-based compensation expense (b) | (45-35) |

| Depreciation | (120-110) |

| Amortization of intangibles | (100-90) |

| Total Operating income | $80-$190 |

(a) Excludes approximately $36 million non-cash gain from a lease termination in Q1 2025.

(b) FY 2025 stock-based compensation expense reflects the net reduction in Q1 2025 of approximately $45 million of stock-based compensation expense due to the provisions of the Employment Transition Agreement between IAC and Mr. Levin, entered into on January 13, 2025.

Additional Q1/FY 2025 Observations

•Dotdash Meredith – In Q1 we expect Digital revenue growth in the high-single digits and total Adjusted EBITDA between $40-$45 million (excluding approximately $36 million non-cash gain from a lease termination). For the full year, we expect continued 10% Digital revenue growth.

•Angi Inc. – In Q1 we expect revenue declines in the low 20%’s year-over-year (and then to improve each quarter sequentially) and Adjusted EBITDA over $20 million.

•Care.com – In Q1we expect mid-single digit revenue declines and Adjusted EBITDA around $10 million.

•Search – In Q1 we expect revenue of $70-$80 million and Adjusted EBITDA of $2-$3 million.

•Emerging & Other – In Q1 we expect revenue around $15 million and Adjusted EBITDA losses between $5-$10 million. FY 2025 includes certain non-recurring expenses for legacy businesses.

•Corporate – 2025 FY Adjusted EBITDA losses reflect several non-recurring expenses including professional fees, primarily related to shareholder litigation arising out of the Match Group separation, restructuring costs, including costs specific to Joey Levin’s departure from IAC, and Angi Inc. spin-off costs. Most of these non-recurring expenses are concentrated in Q1 2025.

RECONCILIATIONS OF GAAP TO NON-GAAP MEASURES

($ in millions; rounding differences may occur)

IAC RECONCILIATION OF OPERATING INCOME (LOSS) TO ADJUSTED EBITDA

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| For the three months ended December 31, 2024 |

| Operating Income (Loss) | | Stock-based

Compensation

Expense | | Depreciation | | Amortization

of Intangibles | | | | | | Adjusted

EBITDA |

| Dotdash Meredith | | | | | | | | | | | | | |

| Digital | $ | 90.3 | | | $ | 2.3 | | | $ | 3.7 | | | $ | 26.2 | | | | | | | $ | 122.6 | |

| Print | 16.6 | | | 0.4 | | | 1.5 | | | 4.6 | | | | | | | 23.0 | |

| Other | (19.6) | | | 3.3 | | | 0.8 | | | — | | | | | | | (15.5) | |

| Total Dotdash Meredith | 87.3 | | | 6.0 | | | 6.0 | | | 30.8 | | | | | | | 130.1 | |

| Angi Inc. | | | | | | | | | | | | | |

| Ads and Leads | 28.7 | | | 2.1 | | | 17.1 | | | — | | | | | | | 47.9 | |

| Services | (7.1) | | | 0.6 | | | 2.5 | | | 2.6 | | | | | | | (1.4) | |

| Other | (18.8) | | | 3.6 | | | — | | | — | | | | | | | (15.2) | |

| International | (0.6) | | | 0.3 | | | 0.8 | | | — | | | | | | | 0.5 | |

| Total Angi Inc. | 2.2 | | | 6.7 | | | 20.3 | | | 2.6 | | | | | | | 31.8 | |

| Care.com | 4.6 | | | — | | | 2.0 | | 1.3 | | | | | | | 7.9 | |

| Search | 6.0 | | | — | | | — | | | — | | | | | | | 6.0 | |

| Emerging & Other | (7.2) | | | 0.5 | | | — | | | — | | | | | | | (6.7) | |

| Corporate | (42.3) | | | 13.2 | | | 2.0 | | | — | | | | | | | (27.1) | |

| Total | $ | 50.6 | | | $ | 26.3 | | | $ | 30.4 | | | $ | 34.7 | | | | | | | $ | 142.0 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| For the three months ended December 31, 2023 |

| Operating (Loss) Income | | Stock-based

Compensation

Expense | | Depreciation | | Amortization

of Intangibles | | | | | | Adjusted

EBITDA |

| Dotdash Meredith | | | | | | | | | | | | | |

| Digital | $ | (6.3) | | | $ | 2.1 | | | $ | 7.0 | | | $ | 113.0 | | | | | | | $ | 115.9 | |

| Print | 1.2 | | | 0.4 | | | 3.7 | | | 10.9 | | | | | | | 16.2 | |

| Other | (13.0) | | | 3.9 | | | 0.6 | | | — | | | | | | | (8.6) | |

| Total Dotdash Meredith | (18.1) | | | 6.4 | | | 11.3 | | | 123.9 | | | | | | | 123.5 | |

| Angi Inc. | | | | | | | | | | | | | |

| Ads and Leads | 23.7 | | | 6.3 | | | 17.2 | | | — | | | | | | | 47.2 | |

| Services | (1.9) | | | 1.1 | | | 5.9 | | | — | | | | | | | 5.1 | |

| Other | (15.0) | | | 2.3 | | | — | | | — | | | | | | | (12.7) | |

| International | 0.9 | | | 0.1 | | | 0.8 | | | — | | | | | | | 1.8 | |

| Total Angi Inc. | 7.6 | | | 9.8 | | | 23.9 | | | — | | | | | | | 41.4 | |

| Care.com | 5.3 | | | — | | | 1.4 | | | 1.9 | | | | | | | 8.6 | |

| Search | 7.5 | | | — | | | — | | | — | | | | | | | 7.5 | |

| Emerging & Other | (1.1) | | | 0.5 | | | 0.2 | | | — | | | | | | | (0.4) | |

| Corporate | (38.2) | | | 12.3 | | | 2.0 | | | — | | | | | | | (23.8) | |

| Total | $ | (37.0) | | | $ | 29.1 | | | $ | 38.9 | | | $ | 125.8 | | | | | | | $ | 156.8 | |

IAC RECONCILIATION OF OPERATING INCOME (LOSS) TO ADJUSTED EBITDA (continued)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| For the twelve months ended December 31, 2024 |

| Operating Income (Loss) | | Stock-based

Compensation

Expense | | Depreciation | | Amortization

of Intangibles | | | | | | Adjusted

EBITDA |

| Dotdash Meredith | | | | | | | | | | | | | |

| Digital | $ | 146.8 | | | $ | 10.1 | | | $ | 15.9 | | | $ | 116.5 | | | | | | | $ | 289.4 | |

| Print | 24.6 | | | 2.0 | | | 7.3 | | | 19.9 | | | | | | | 53.8 | |

| Other | (64.6) | | | 13.7 | | | 3.1 | | | — | | | | | | | (47.8) | |

| Total Dotdash Meredith | 106.9 | | | 25.8 | | | 26.3 | | | 136.4 | | | | | | | 295.4 | |

| Angi Inc. | | | | | | | | | | | | | |

| Ads and Leads | 94.4 | | | 20.4 | | | 65.5 | | | — | | | | | | | 180.3 | |

| Services | (19.4) | | | 3.8 | | | 17.5 | | | 2.6 | | | | | | | 4.5 | |

| Other | (64.8) | | | 9.4 | | | — | | | — | | | | | | | (55.4) | |

| International | 11.7 | | | 1.1 | | | 3.1 | | | — | | | | | | | 16.0 | |

| Total Angi Inc. | 21.9 | | | 34.8 | | | 86.1 | | | 2.6 | | | | | | | 145.3 | |

| Care.com | 33.7 | | | — | | | 6.0 | | | 5.5 | | | | | | | 45.2 | |

| Search | 17.4 | | | — | | | 0.1 | | | — | | | | | | | 17.5 | |

| Emerging & Other | (37.7) | | | 1.6 | | | 0.1 | | | — | | | | | | | (36.0) | |

| Corporate | (146.4) | | | 50.3 | | | 8.4 | | | — | | | | | | | (87.7) | |

| Total | $ | (4.2) | | | $ | 112.5 | | | $ | 126.9 | | | $ | 144.5 | | | | | | | $ | 379.7 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| For the twelve months ended December 31, 2023 |

| Operating (Loss) Income | | Stock-based

Compensation

Expense | | Depreciation | | Amortization

of Intangibles | | | | Goodwill impairment | | Adjusted

EBITDA |

| Dotdash Meredith | | | | | | | | | | | | | |

| Digital | $ | (16.7) | | | $ | 8.2 | | | $ | 24.8 | | | $ | 226.7 | | | | | $ | — | | | $ | 243.0 | |

| Print | (3.5) | | | 1.4 | | | 13.3 | | | 53.0 | | | | | — | | | 64.2 | |

| Other | (130.6) | | | 14.0 | | | 32.2 | | | — | | | | | — | | | (84.4) | |

| Total Dotdash Meredith | (150.7) | | | 23.5 | | | 70.3 | | | 279.7 | | | | | — | | | 222.8 | |

| Angi Inc. | | | | | | | | | | | | | |

| Ads and Leads | 50.0 | | | 23.1 | | | 66.2 | | | 8.0 | | | | | — | | | 147.4 | |

| Services | (23.4) | | | 7.6 | | | 24.0 | | | — | | | | | — | | | 8.1 | |

| Other | (61.4) | | | 11.3 | | | — | | | — | | | | | — | | | (50.1) | |

| International | 8.3 | | | 1.4 | | | 3.4 | | | — | | | | | — | | | 13.1 | |

| Total Angi Inc. | (26.5) | | | 43.4 | | | 93.6 | | | 8.0 | | | | | — | | | 118.5 | |

| Care.com | 45.2 | | | — | | | 3.2 | | | 7.8 | | | | | — | | | 56.2 | |

| Search | 44.2 | | | — | | | 0.1 | | | — | | | | | — | | | 44.3 | |

| Emerging & Other | (26.4) | | | 1.8 | | | 0.8 | | | 0.5 | | | | | 9.0 | | | (14.4) | |

| Corporate | (146.5) | | | 48.5 | | | 7.2 | | | — | | | | | — | | | (90.9) | |

| Total | $ | (260.8) | | | $ | 117.2 | | | $ | 175.1 | | | $ | 296.0 | | | | | $ | 9.0 | | | $ | 336.5 | |

DOTDASH MEREDITH RECONCILIATION OF OPERATING INCOME TO ADJUSTED EBITDA EXCLUDING Q4 2024 SEVERANCE

| | | | | | | | |

| Twelve Months Ended December 31, |

| ($ in millions) | 2024 | |

| | |

| Operating income | $ | 106.9 | | |

| Q4 2024 severance | 13.0 | | |

| Operating income excl. Q4 2024 severance | $ | 119.9 | | |

| Amortization of intangibles | 136.4 | | |

| Depreciation | 26.3 | | |

| Stock-based compensation expense | 25.8 | |

| Adjusted EBITDA excl. Q4 2024 severance | $ | 308.4 | | |

Q1 2025 OPERATING INCOME (LOSS) TO ADJUSTED EBITDA RECONCILIATION

| | | | | | | | | | | | | | | | | |

| Q1 2025 Outlook |

| ($ in millions) | Dotdash Meredith | Angi Inc. (a) | Care.com | Search | Emerging & Other |

| | |

| Operating income (loss) | $4-$14 | $0 | $8 | $2-$3 | ($11-$6) |

| Depreciation | 6 | | 25-20 | 1 | | — | | — | |

| Stock-based compensation expense | 5 | (5)-0 | — | | — | | 1 |

| Amortization of intangibles | 25-20 | — | | 1 | | — | | — | |

| Adjusted EBITDA | $40-$45 | Over $20 | $10 | $2-$3 | ($10-$5) |

(a) Stock-based compensation expense reflects the reversal in Q1 2025 of approximately $10 million of previously recognized stock-based compensation expense in connection with the Employment Transition Agreement, entered into on January 13, 2025 between IAC and Mr. Levin. The expense was previously recognized from October 10, 2022 through April 8, 2024 when Mr. Levin served as CEO of Angi Inc.

PRINCIPLES OF FINANCIAL REPORTING

IAC reports Adjusted EBITDA and Free Cash Flow, which are supplemental measures to U.S. generally accepted accounting principles (“GAAP”). Adjusted EBITDA is considered our primary segment measure of profitability and is one of the metrics, along with Free Cash Flow, by which we evaluate the performance of our businesses and our internal budgets are based and may also impact management compensation. We believe that investors should have access to, and we are obligated to provide, the same set of tools that we use in analyzing our results. These non-GAAP measures should be considered in addition to results prepared in accordance with GAAP, but should not be considered a substitute for or superior to GAAP results. IAC endeavors to compensate for the limitations of the non-GAAP measures presented by providing the comparable GAAP measures with equal or greater prominence and descriptions of the reconciling items, including quantifying such items, to derive the non-GAAP measures. We encourage investors to examine the reconciling adjustments between the GAAP and non-GAAP measures, which are included in this release. Interim results are not necessarily indicative of the results that may be expected for a full year.

Definitions of Non-GAAP Measures

Adjusted Earnings Before Interest, Taxes, Depreciation and Amortization (Adjusted EBITDA) is defined as operating income excluding: (1) stock-based compensation expense; (2) depreciation; and (3) acquisition-related items consisting of (i) amortization of intangible assets and impairments of goodwill and intangible assets, if applicable, and (ii) gains and losses recognized on changes in the fair value of contingent consideration arrangements, if applicable. We believe this measure is useful for analysts and investors as this measure allows a more meaningful comparison between our performance and that of our competitors. Adjusted EBITDA has certain limitations because it excludes the impact of these expenses.

Free Cash Flow is defined as net cash provided by operating activities, less capital expenditures. We believe Free Cash Flow is useful to analysts and investors because it represents the cash that our operating businesses generate, before taking into account non-operational cash movements. Free Cash Flow has certain limitations in that it does not represent the total increase or decrease in the cash balance for the period, nor does it represent the residual cash flow for discretionary expenditures. For example, it does not take into account stock repurchases. Therefore, we think it is important to evaluate Free Cash Flow along with our consolidated statement of cash flows.

Non-Cash Expenses That Are Excluded from Adjusted EBITDA

Stock-based compensation expense consists of expense associated with awards that were granted under various IAC stock and annual incentive plans and expense related to awards issued by certain subsidiaries of the Company. These expenses are not paid in cash, and we view the economic costs of stock-based awards to be the dilution to our share base; we also include the related shares in our fully diluted shares outstanding for GAAP earnings per share using the treasury stock method. The Company is currently settling all stock-based awards on a net basis; IAC remits the required tax-withholding amounts for net-settled awards from its current funds.

Please see page 10 for a summary of our dilutive securities, including stock-based awards as of February 7, 2025, and a description of the calculation methodology.

Depreciation is a non-cash expense relating to our buildings, capitalized software, equipment and leasehold improvements and is computed using the straight-line method to allocate the cost of depreciable assets to operations over their estimated useful lives, or, in the case of leasehold improvements, the lease term, if shorter.

Amortization of intangible assets and impairments of goodwill and intangible assets are non-cash expenses related primarily to acquisitions. At the time of an acquisition, the identifiable definite-lived intangible assets of the acquired company, such as advertiser relationships, technology, licensee relationships, trade names, content, customer lists and user base, and professional relationships, are valued and amortized over their estimated lives. Value is also assigned to acquired indefinite-lived intangible assets, which comprise trade names and trademarks, and goodwill that are not subject to amortization. An impairment is recorded when the carrying value of an intangible asset or goodwill exceeds its fair value. We believe that intangible assets represent costs incurred by the acquired company to build value prior to acquisition and the related amortization and impairments of intangible assets or goodwill, if applicable, are not ongoing costs of doing business.

Gains and losses recognized on changes in the fair value of contingent consideration arrangements are accounting adjustments to report liabilities for the portion of the purchase price of acquisitions, if applicable, that is contingent upon the financial performance and/or operating targets of the acquired company at fair value that are recognized in “General and administrative expense” in the statement of operations. These adjustments can be highly variable and are excluded from our assessment of performance because they are considered non-operational in nature and, therefore, are not indicative of current or future performance or the ongoing cost of doing business.

Metric Definitions

Dotdash Meredith

Digital Revenue – Includes Advertising revenue, Performance Marketing revenue and Licensing and Other revenue.

(a) Advertising revenue – primarily includes revenue generated from display advertisements sold both directly through our sales team and via programmatic exchanges.

(b) Performance Marketing revenue – primarily includes revenue generated through affiliate commerce, affinity marketing channels, and performance marketing commissions. Affiliate commerce commission revenue is generated when Dotdash Meredith refers users to commerce partner websites resulting in a purchase or transaction. Affinity marketing programs market and place magazine subscriptions for both Dotdash Meredith and third-party publisher titles. Performance marketing commissions are generated on a cost-per-click or cost-per-action basis.

(c) Licensing and Other revenue – primarily includes revenue generated through brand and content licensing and similar agreements. Brand licensing generates royalties from multiple long-term trademark licensing agreements with retailers, manufacturers, publishers and service providers. Content licensing royalties are earned from our relationship with Apple News+ as well as other content use and distribution relationships, including utilization in large-language models and other artificial intelligence-related activities.

Print Revenue – Primarily includes subscription, advertising, newsstand and performance marketing revenue.

Total Sessions – Represents unique visits to all sites that are part of Dotdash Meredith’s network and sourced from Google Analytics.

Core Sessions – Represents a subset of Total Sessions that comprises unique visits to Dotdash Meredith’s most significant (in terms of investment) owned and operated sites as follows:

| | | | | | | | |

| People | InStyle | Simply Recipes |

| allrecipes | FOOD & WINE | Serious Eats |

| Investopedia | Martha Stewart | EatingWell |

| Better Homes & Gardens | BYRDIE | Parents |

| Verywell Health | REAL SIMPLE | Verywell Mind |

| The Spruce | Southern Living | Health |

| TRAVEL + LEISURE | | |

Angi Inc.

Ads and Leads Revenue - Primarily comprises domestic revenue from consumer connection revenue for consumer matches, revenue from professionals under contract for advertising and membership subscription revenue from professionals and consumers.

Services Revenue –Primarily comprises domestic revenue from pre-priced offerings by which the consumer requests services through an Angi Inc. platform and Angi Inc. connects them with a professional to perform the service.

International Revenue – Primarily comprises revenue generated within the International segment (consisting of businesses in Europe and Canada), including consumer connection revenue for consumer matches and membership subscription revenue from professionals.

Other – Reflects costs for corporate initiatives, shared costs, such as executive and public company costs, and other expenses not allocated to the operating segments.

Service Requests - Reflects (i) fully completed and submitted domestic service requests for connections with Ads and Leads professionals, (ii) contacts to Ads and Leads professionals generated via the professional directory from unique users in unique categories (such that multiple contacts from the same user in the same category in the same day are counted as one Service Request) and (iii) requests to book Services jobs in the period.

Monetized Transactions – Reflects (i) Service Requests that are matched to a paying Ads and Leads professional in the period and (ii) completed and in-process Services jobs in the period; a single Service Request can result in multiple monetized transactions.

Monetized Transactions per Service Request – Monetized Transactions divided by Service Requests.

Transacting Professionals (formerly known as Transacting Service Professionals) – The number of (i) Ads and Leads professionals that paid for consumer matches or advertising and (ii) Services professionals that performed a Services job, during the most recent quarter.

Care.com

Consumer Revenue - Consists of revenue primarily generated through subscription fees from families and caregivers, both domestically and internationally, for its suite of products and services. Consumer also includes revenue generated through the Company’s comprehensive household payroll and tax support services (HomePay) as well as through contracts with businesses that advertise through its platform.

Enterprise Revenue - Consists of revenue primarily generated through annual contracts with businesses (employers or re-sellers) who provide access to Care.com’s suite of products and services as an employee benefit.

Search

Ask Media Group Revenue - Consists of revenue generated from advertising principally through the display of paid listings in response to search queries, as well as from display advertisements appearing alongside content on its various websites, and, to a lesser extent, affiliate commerce commission revenue.

Desktop Revenue - Consists of revenue generated by applications distributed through both business-to-business partnerships and direct-to-consumer marketing.

OTHER INFORMATION

Safe Harbor Statement Under the Private Securities Litigation Reform Act of 1995

This press release and the IAC and Angi Inc. conference call, which will be held at 8:30 a.m. Eastern Time on Wednesday, February 12, 2025, may contain "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. The use of words such as "anticipates," "estimates," "expects," "plans" and "believes," among others, generally identify forward-looking statements. These forward-looking statements include, among others, statements relating to: the future financial performance of IAC and its businesses, business prospects and strategy, the contemplated Angi Inc. spin-off and anticipated benefits, the reorganization of IAC’s leadership, anticipated trends and prospects in the industries in which IAC’s businesses operate and other similar matters. Actual results could differ materially from those contained in these forward-looking statements for a variety of reasons, including, among others: (i) our ability to market our products and services in a successful and cost-effective manner, (ii) the display prominence of links to websites offering our products and services in search results, (iii) changes in our relationship with (or policies implemented by) Google, (iv) our ability to compete with generative artificial intelligence technology and the related disruption to marketing technologies, (v) the failure or delay of the markets and industries in which our businesses operate to migrate online and the continued growth and acceptance of online products and services as effective alternatives to traditional products and services, (vi) our continued ability to develop and monetize versions of our products and services for mobile and other digital devices, (vii) unstable market and economic conditions (particularly those that adversely impact advertising spending levels and consumer confidence and spending behavior), either generally and/or in any of the markets in which our businesses operate, as well as geopolitical conflicts, (viii) the ability of our Digital business to successfully expand the digital reach of our portfolio of publishing brands, (ix) our continued ability to market, distribute and monetize our products and services through search engines, digital app stores, advertising networks and social media platforms, (x) risks related to our Print business (declining revenue, increased paper and postage costs, reliance on a single supplier to print our magazines and potential increases in pension plan obligations), (xi) our ability to establish and maintain relationships with quality and trustworthy professionals and caregivers, (xii) the ability of Angi Inc. to expand its pre-priced offerings, while balancing the overall mix of service requests and directory services on Angi platforms, (xiii) the ability of Angi Inc. to continue to generate leads for professionals given changing requirements applicable to certain communications with consumers, (xiv) our ability to access, collect, use and protect the personal data of our users and subscribers, (xv) our ability to engage directly with users, subscribers, consumers, professionals and caregivers on a timely basis, (xvi) the ability of our Chairman and Senior Executive, certain members of his family and our Chief Executive Officer to exercise significant influence over the composition of our board of directors, matters subject to stockholder approval and our operations, (xvii) risks related to our liquidity and indebtedness (the impact of our indebtedness on our ability to operate our business, our ability to generate sufficient cash to service our indebtedness and interest rate risk), (xviii) our inability to freely access the cash of Dotdash Meredith and /or Angi Inc. and their respective subsidiaries, (xix) dilution with respect to investments in IAC and Angi Inc., (xx) our ability to compete, (xxi) our ability to build, maintain and/or enhance our various brands, (xxii) our ability to protect our systems, technology and infrastructure from cyberattacks (including cyberattacks experienced by third parties with whom we do business), (xxiii) the occurrence of data security breaches and/or fraud, (xxiv) increased liabilities and costs related to the processing, storage, use and disclosure of personal and confidential user information, (xxv) the integrity, quality, efficiency and scalability of our systems, technology and infrastructure (and those of third parties with whom we do business), (xxvi) changes in key personnel and risks related to leadership transitions, (xxvii) risks related to the proposed spin-off of IAC’s ownership in Angi Inc. and (xxviii) changes to our capital deployment strategy. Certain of these and other risks and uncertainties are described in IAC’s filings with the Securities and Exchange Commission (the “SEC”), including the most recent Annual Report on Form 10-K filed with the SEC on February 29, 2024, and subsequent reports that IAC files with the SEC. Other unknown or unpredictable factors that could also adversely affect IAC's business, financial condition and results of operations may arise from time to time. It is not possible for our management to predict all risks, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those expressed in any forward-looking statements we may make. Except as required by law, we undertake no obligation to update any forward-looking statements to reflect events or circumstances after the date of such statements. You should, therefore, not rely on these forward-looking statements as representing our views as of any date subsequent to the date of this press release.

About IAC

IAC (NASDAQ: IAC) builds companies. We are guided by curiosity, a questioning of the status quo, and a desire to invent or acquire new products and brands. From the single seed that started as IAC over two decades ago have emerged 11 public companies and generations of exceptional leaders. We will always evolve, but our basic principles of financially-disciplined opportunism will never change. IAC is today comprised of category-leading businesses including Angi Inc. (NASDAQ: ANGI), Dotdash Meredith and Care.com, among many others ranging from early stage to established businesses. IAC is headquartered in New York City with business locations worldwide.

Contact Us

IAC/Angi Inc. Investor Relations

Mark Schneider

(212) 314-7400

IAC Corporate Communications

Valerie Combs

(212) 314-7251

IAC

555 West 18th Street, New York, NY 10011 (212) 314-7300 http://iac.com

v3.25.0.1

Cover

|

Feb. 11, 2025 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Feb. 11, 2025

|

| Entity Registrant Name |

IAC Inc.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-39356

|

| Entity Tax Identification Number |

84-3727412

|

| Entity Address, Address Line One |

555 West 18th Street,

|

| Entity Address, City or Town |

New York,

|

| Entity Address, State or Province |

NY

|

| Entity Address, Postal Zip Code |

10011

|

| City Area Code |

212

|

| Local Phone Number |

314-7300

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.0001

|

| Trading Symbol |

IAC

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001800227

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

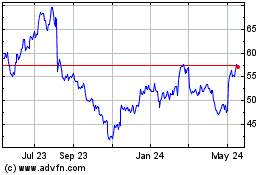

IAC (NASDAQ:IAC)

Historical Stock Chart

From Jan 2025 to Feb 2025

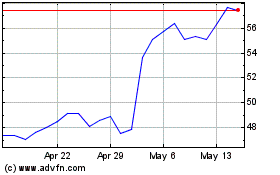

IAC (NASDAQ:IAC)

Historical Stock Chart

From Feb 2024 to Feb 2025