Interactive Brokers Group Reports Brokerage Metrics and Other Financial Information for December 2024, includes Reg.-NMS Execution Statistics

03 January 2025 - 4:40AM

Business Wire

Interactive Brokers Group, Inc. (Nasdaq: IBKR) an automated

global electronic broker, today reported its Electronic Brokerage

monthly performance metrics for December.

Brokerage highlights for the month included:

- 3.267 million Daily Average Revenue Trades (DARTs)1, 66% higher

than prior year and 1% lower than prior month.

- Ending client equity of $568.2 billion, 33% higher than prior

year and 1% lower than prior month.

- Ending client margin loan balances of $64.2 billion, 45% higher

than prior year and 7% higher than prior month.

- Ending client credit balances of $119.7 billion, including $4.9

billion in insured bank deposit sweeps2, 15% higher than prior year

and 1% higher than prior month.

- 3.34 million client accounts, 30% higher than prior year and 3%

higher than prior month.

- 219 annualized average cleared DARTs1 per client account.

- Average commission per cleared Commissionable Order4 of $2.58

including exchange, clearing and regulatory fees. Key

products:

December 2024 Average

Average Commission per

Order Size

Cleared Commissionable

Order

Stocks 862 shares

$1.84

Equity Options 6.6 contracts

$3.82

Futures 3.1 contracts

$4.56

Futures include options on futures. We estimate exchange,

clearing and regulatory fees to be 57% of the futures

commissions.

Other financial information for Interactive Brokers

Group:

- Mark to market on U.S. government securities portfolio4 was a

gain of $0.3 million for the quarter, and a gain of $1.8 million

for the year ended December 31st.

- GLOBAL5: The value of the GLOBAL, reported in U.S. dollars,

decreased by 0.58% in December and decreased by 1.45% for the year

ended December 31st.

In the interest of transparency, we quantify our IBKR PRO

clients’ all-in cost of trade execution below.

For the full multimedia release with graph see link:

https://www.interactivebrokers.com/MonthlyMetrics

- Average U.S. Reg-NMS stock trade was $18,726 in December

(dividing 2c by 1a in table below).

- In December, IBKR PRO clients’ total cost of executing and

clearing U.S. Reg.-NMS stocks through IB was about 5.7 basis points

of trade money6, as, measured against a daily VWAP7 benchmark (4.1

basis points net cost for the rolling twelve months).

IBKR PRO Clients' Reg.-NMS Stock Trading Expense Detail

All amounts are in millions, except %

Previous

Jan

'24

Feb

'24

Mar

'24

Apr

'24

May

'24

Jun

'24

Jul

'24

Aug

'24

Sep

'24

Oct

'24

Nov

'24

Dec

'24

12

Months

#1a - Number of orders Buys

6.79

7.24

8.51

8.36

8.80

8.07

10.09

9.84

8.38

10.93

11.40

13.32

111.73

Sells

4.92

5.38

6.23

6.21

6.67

5.83

7.55

7.53

6.54

8.33

8.62

9.66

83.47

Total

11.71

12.62

14.74

14.57

15.47

13.90

17.64

17.37

14.92

19.26

20.02

22.98

195.20

#1b - Number of shares purchased or sold Shares

bought

2,639

2,636

3,432

3,387

4,712

3,305

3,855

4,154

3,614

4,645

4,744

5,517

46,640

Shares sold

2,551

2,499

3,189

3,190

4,374

3,100

3,767

3,960

3,436

4,390

4,497

5,232

44,184

Total

5,189

5,135

6,621

6,577

9,087

6,405

7,622

8,114

7,050

9,035

9,241

10,749

90,824

#2 - Trade money including price, commissions and

fees 2a Buy money

$133,951

$148,224

$165,938

$161,619

$170,762

$151,903

$189,920

$182,908

$155,758

$190,627

$204,300

$214,806

$2,070,716

2b Sell money

$131,649

$143,433

$163,285

$165,541

$169,343

$147,514

$191,745

$186,274

$154,825

$188,444

$201,932

$215,520

$2,059,505

2c Total

$265,601

$291,657

$329,223

$327,160

$340,105

$299,417

$381,664

$369,182

$310,583

$379,071

$406,232

$430,326

$4,130,220

#3 - Trade value at Daily VWAP 3a Buy value

$133,917

$148,162

$165,825

$161,534

$170,686

$151,684

$189,851

$182,849

$155,692

$190,537

$204,249

$214,660

$2,069,645

3b Sell value

$131,705

$143,451

$163,313

$165,602

$169,379

$147,417

$191,812

$186,440

$154,890

$188,493

$201,995

$215,621

$2,060,117

3c Total

$265,622

$291,612

$329,138

$327,135

$340,066

$299,101

$381,663

$369,289

$310,582

$379,030

$406,243

$430,281

$4,129,762

#4 - Total trade expense, including commissions and fees,

relative to Daily VWAP 4a Buys (2a-3a)

$34.2

$62.5

$113.3

$85.1

$75.4

$219.1

$68.8

$58.6

$66.6

$90.7

$51.4

$145.7

$1,071.2

4b Sells (3b-2b)

$55.2

$18.0

$28.0

$60.7

$36.0

($97.1)

$67.5

$166.0

$65.7

$49.6

$62.3

$100.9

$612.9

4c Total trade expense

$89.4

$80.5

$141.3

$145.8

$111.4

$122.0

$136.3

$224.6

$132.3

$140.3

$113.8

$246.6

$1,684.1

Trade expense as percentage of trade money

4c/2c

0.034%

0.028%

0.043%

0.045%

0.033%

0.041%

0.036%

0.061%

0.043%

0.037%

0.028%

0.057%

0.041%

#5 - Trade expense categories 5a Total commissions

& fees

$23.4

$23.7

$29.2

$28.8

$36.1

$30.4

$37.1

$38.1

$33.2

$41.9

$43.5

$47.4

$412.8

5b Execution cost (4c-5a)

$66.0

$56.7

$112.1

$117.0

$75.4

$91.6

$99.2

$186.5

$99.1

$98.4

$70.3

$199.2

$1,271.5

#6 - Trade expense categories as percentage of trade

money Total commissions & fees (5a/2c)

0.009%

0.009%

0.009%

0.009%

0.011%

0.010%

0.010%

0.010%

0.011%

0.011%

0.011%

0.011%

0.010%

Execution cost (5b/2c)

0.025%

0.019%

0.034%

0.036%

0.022%

0.031%

0.026%

0.051%

0.032%

0.026%

0.017%

0.046%

0.031%

Net Expense to IB Clients

0.034%

0.028%

0.043%

0.045%

0.033%

0.041%

0.036%

0.061%

0.043%

0.037%

0.028%

0.057%

0.041%

The above illustrates that the rolling twelve months’ average

all-in cost of an IBKR PRO client U.S. Reg.-NMS stock trade was 4.1

basis points.

________________ Note 1: Daily Average Revenue Trades

(DARTs) – customer orders divided by the number of trading days in

the period.

Note 2: FDIC insured client bank deposit sweep program

balances with participating banks. These deposits are not reported

in the Company’s statement of financial condition.

Note 3: Commissionable Order – a customer order that

generates commissions.

Note 4: Mark to market gains and losses on investments in

U.S. government securities and associated hedges are included in

Other Income. In the general course of business, we hold these

investments to maturity. As a result, accumulated mark to market

gains or losses should converge to zero at maturity. Accounting

conventions require broker-dealers, unlike banks, to mark all

investments to market.

Note 5: In connection with our currency diversification

strategy, we have determined to base our net worth in GLOBALs, a

basket of 10 major currencies in which we hold our equity. The

total effect of the currency diversification strategy is reported

in Comprehensive Income and the components are reported in (1)

Other Income and (2) Other Comprehensive Income (“OCI”) on the

balance sheet. The effect of the GLOBAL on our comprehensive income

can be estimated by multiplying the total equity for the period by

the change in the U.S. dollar value of the GLOBAL during the same

period.

Note 6: Trade money is the total amount of money clients

spent or received, including all commissions and fees.

Note 7: Consistent with the clients’ trading activity,

the computed VWAP benchmark includes extended trading hours.

_________________ More information, including historical results

for each of the above metrics, can be found on the investor

relations page of the Company’s corporate web site,

www.interactivebrokers.com/ir.

About Interactive Brokers Group, Inc.: Interactive

Brokers Group affiliates provide automated trade execution and

custody of securities, commodities, foreign exchange, and forecast

contracts around the clock on over 150 markets in numerous

countries and currencies, from a single unified platform to clients

worldwide. We serve individual investors, hedge funds, proprietary

trading groups, financial advisors and introducing brokers. Our

four decades of focus on technology and automation has enabled us

to equip our clients with a uniquely sophisticated platform to

manage their investment portfolios. We strive to provide our

clients with advantageous execution prices and trading, risk and

portfolio management tools, research facilities and investment

products, all at low or no cost, positioning them to achieve

superior returns on investments. Interactive Brokers has

consistently earned recognition as a top broker, garnering multiple

awards and accolades from respected industry sources such as

Barron’s, Investopedia, Stockbrokers.com, and many others.

Cautionary Note Regarding Forward-Looking Statements: The

foregoing information contains certain forward-looking statements

that reflect the company's current views with respect to certain

current and future events and financial performance. These

forward-looking statements are and will be, as the case may be,

subject to many risks, uncertainties and factors relating to the

company's operations and business environment which may cause the

company's actual results to be materially different from any future

results, expressed or implied, in these forward-looking statements.

Any forward-looking statements in this release are based upon

information available to the company on the date of this release.

The company does not undertake to publicly update or revise its

forward-looking statements even if experience or future changes

make it clear that any statements expressed or implied therein will

not be realized. Additional information on risk factors that could

potentially affect the company's financial results may be found in

the company's filings with the Securities and Exchange

Commission.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250102088736/en/

Contacts for Interactive Brokers Group, Inc.:

media@ibkr.com.

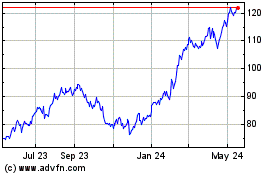

Interactive Brokers (NASDAQ:IBKR)

Historical Stock Chart

From Dec 2024 to Jan 2025

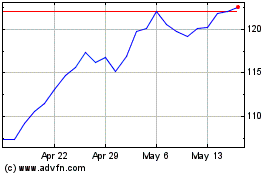

Interactive Brokers (NASDAQ:IBKR)

Historical Stock Chart

From Jan 2024 to Jan 2025