ICOP Digital, Inc. (NASDAQ: ICOP), an industry-leading company

engaged in advancing digital surveillance technology solutions,

announced today its financial and operational results for the three

months ended September 30, 2010. The Company will host a conference

call today at 4:15 PM EST to discuss the results, and plans to file

its 10-Q on Friday, November 12, 2010. The call can be accessed

through the Company's website, www.ICOP.com. The live audio

presentation can be accessed by dialing toll free at 877-315-9024.

Key Operational

Highlights

- ICOP recorded the second highest revenues in more than 12

months, for the third quarter of 2010.

- Domestic sales increased 18% over the same nine (9) month

period in 2009.

- The Company recently participated in the 117th Annual

International Association of Chiefs of Police (IACP) Conference in

Orlando, Florida where new products and features were showcased

including a .0004 lux night vision camera, ICOP's "DP2 Integration"

product, to manage backend video for legacy units (vendor no longer

in business), new industry-leading high-speed wireless upload

capabilities and solid state hard drives.

- ICOP received an initial order to deploy ICOP Model 20/20-W®

mobile video systems to 11 Air Force Bases in the Southern US,

stretching from Arizona to Florida.

- Purchasing contracts were announced for the State of Montana,

and a cooperative purchasing contract in New Jersey.

- The Company announced an initial order for 104 ICOP Model

20/20-W systems from the US Department of Homeland Security that

have been deployed at all land-based points of entry on the

Southwest border between the United States and Mexico, including at

the US Border Patrol driver training school for use in training

pursuit officers.

- In July, ICOP was notified by The Nasdaq Stock Market LLC that

the Company met the requirements of the March 24, 2010 decision of

the Listing Qualifications Panel of The NASDAQ Stock Market LLC

(the "Panel"), and that the Panel has determined to continue the

listing of the Company's securities on The NASDAQ Stock

Market.

- As a result of the resignation of one of the independent

directors on September 23, 2010, the Company needs to appoint one

additional independent director no later than our 2011 shareholder

meeting in order to comply with NASDAQ Listing rules. The Company

is interviewing candidates and expects to meet this schedule.

- On November 1, 2010, the Company agreed to settle the

litigation brought against it by two institutional investors. The

terms of the non- cash settlement include the surrender of the

investors' Series 1 Warrants, the Company's issuance of an

aggregate of 600,000 shares of unregistered common stock to the

investors, and a mutual release of all claims. The common stock is

being issued in reliance on the exemption from registration in

Section 3(a)(10) of the Securities Act. The settlement is subject

to the approval of the Court. A $1 million non-cash settlement

expense was recorded in the third quarter of 2010.

Financial highlights for

the three months ended September 30, 2010:

- Revenues increased to $2.6 million, a 31% increase compared to

third quarter revenues of $1.9 million reported in 2009.

- Gross margin for the third quarter of 2010 was 42.3%, compared

to 39.7%, for the same period in 2009, primarily due to higher cost

of goods sold for 2009 due to our summer special program which

offered promotional items that were expensed to cost of goods

sold.

- Operating expenses in the third quarter 2010 totaled $1.9

million compared to $2.1 million for 2009, a decrease of 10%. The

decrease is mainly due to the decline in depreciation, stock based

compensation and promotional expenses. Overall operating expenses

as a percentage of sales decreased from 110.4% in 2009 to 75.4% for

the three months ended September 30, 2010.

- Operating loss for the three month period year over year

increased $557 thousand, approximately 40%, primarily due to the $1

million recorded for potential non-cash settlement in the Financing

Transaction Litigation.

Financial highlights for

the nine months ended September 30, 2010:

- Revenues increased to $6.3 million, a 9% increase compared to

$5.8 million reported in 2009.

- Gross margin for 2010 was 42.1%, compared to 46.8%, for the

same period in 2009, primarily due to higher cost of goods sold for

2010 which is attributable to increased sales for certain products

having a lower margin. The decline is also due to higher margins in

2009 for certain markets along with the result of the cost of

inventory being higher in 2010 as a result of unfavorable foreign

currency movements in the U.S. Dollar compared to the Japanese

Yen.

- Operating expenses were $6.3 million and $6.4 million for the

nine months ended September 30, 2010 and 2009, respectively, a

decrease of $91 thousand (1%). Overall operating expenses as a

percentage of sales decreased from 110.0% in 2009 to 99.9% for the

nine months ended September 30, 2010. This decrease is mainly due

to lower stock based compensation, research and development, and

depreciation expense offset by increased travel costs. The increase

in travel costs is attributed to trade events, activities relating

to a recently formed client services team and greater focus on

direct sales.

- Operating loss for the nine month period year over year

increased $1.1 million, approximately 30%, primarily due to the $1

million recorded for potential non-cash settlement in the Financing

Transaction Litigation.

On September 30, 2010, we had $192 thousand in cash, $2.2

million in accounts receivable, $2.5 million in inventory, $410

thousand in prepaid expenses and other current assets and $2.9

million in current liabilities, for a net working capital of $2.4

million.

About ICOP Digital, Inc.

ICOP Digital, Inc. (NASDAQ: ICOP) is a leading provider of

mobile video solutions (i.e. in-car video) for Law Enforcement,

Military, and Homeland Security markets, worldwide. ICOP solutions

help the public and private sectors mitigate risks, reduce losses,

and improve security through the live streaming, capture and secure

management of high quality video and audio. www.ICOP.com

ICOP Digital, Inc.

Condensed Balance Sheets - Unaudited

September 30, December 31,

2010 2009

------------- -------------

Assets

Current assets:

Cash and cash equivalents $ 191,778 $ 1,171,943

Accounts receivable, net of allowances of

$100,457 at September 30, 2010

and December 31, 2009 2,210,761 2,009,591

Inventory, at lower of cost or market 2,502,183 2,094,168

Prepaid Expenses 112,086 98,351

Other Assets 297,820 1,759,004

------------- -------------

Total current assets 5,314,628 7,133,057

Property and equipment, net of accumulated

depreciation $1,614,010 and $1,411,988 at

September 30, 2010 and December 31, 2009,

respectively 1,242,093 1,463,765

Other assets:

Deferred patent costs 102,362 95,906

Investment, at cost 25,000 25,000

Security deposit 17,500 18,258

------------- -------------

Total other assets 144,862 139,164

------------- -------------

Total assets $ 6,701,583 $ 8,735,986

============= =============

Liabilities and Shareholders' Equity

Current liabilities:

Accounts payable $ 400,311 $ 370,998

Accrued liabilities 524,396 476,761

Notes payable 479,985 629,985

Due to factor 1,269,588 686,965

Unearned revenue - current portion 256,807 233,175

------------- -------------

Total current liabilities 2,931,087 2,397,884

Other liabilities:

Unearned revenue - long term portion 382,420 420,009

Contingency 1,038,000 -

Shareholders' equity:

Preferred stock, no par value; 5,000,000

shares authorized, no shares issued

and outstanding at September 30, 2010 and

December 31, 2009 - -

Common stock, no par value; 50,000,000

shares authorized, 2,722,795 and 2,360,294

issued and outstanding at September 30,

2010 and December 31, 2009, respectively 37,755,171 36,469,313

Accumulated other comprehensive income 3,465 3,465

Retained deficit (35,408,560) (30,554,685)

------------- -------------

Total shareholders' equity 2,350,076 5,918,093

------------- -------------

Total liabilities and shareholders' equity $ 6,701,583 $ 8,735,986

============= =============

ICOP Digital, Inc.

Condensed Statement of Operations - Unaudited

Three Months Ended Nine Months Ended

September 30, September 30,

------------------------ ------------------------

2010 2009 2010 2009

----------- ----------- ----------- -----------

Sales, net of returns

and allowances $ 2,555,114 $ 1,945,231 $ 6,291,336 $ 5,795,227

Cost of sales 1,475,112 1,173,137 3,644,259 3,084,130

----------- ----------- ----------- -----------

Gross profit 1,080,002 772,094 2,647,077 2,711,097

Operating expenses:

Selling, general and

administrative 1,724,032 1,950,190 5,729,731 5,776,993

Research and

development 203,714 196,641 553,443 597,539

----------- ----------- ----------- -----------

Total operating

expenses 1,927,746 2,146,831 6,283,174 6,374,532

----------- ----------- ----------- -----------

Operating loss (847,744) (1,374,737) (3,636,097) (3,663,435)

Other income (expense):

Contingency settlement (1,038,000) - (1,038,000) -

Gain on derecognition

of liabilities - - - 52,765

Gain/(Loss) on

disposal of property

and equipment (2,875) 4,537 (2,472) (2,109)

Interest income 18 25 65 61

Loss on extended

warranties - (599) - (1,944)

Interest expense (70,666) (43,555) (184,300) (140,908)

Other income 1,400 13,878 6,929 22,574

----------- ----------- ----------- -----------

Loss before income

taxes (1,957,867) (1,400,451) (4,853,875) (3,732,996)

Income tax provision - - - -

----------- ----------- ----------- -----------

Net Loss $(1,957,867) $(1,400,451) $(4,853,875) $(3,732,996)

=========== =========== =========== ===========

Basic and diluted net

loss per share $ (0.83) $ (0.85) $ (1.81) $ (3.35)

=========== =========== =========== ===========

Basic and diluted

weighted average

common shares

outstanding 2,362,180 1,641,430 2,674,941 1,114,656

Forward-Looking Statements

This document contains forward-looking statements. You should

not rely on forward-looking statements because they are subject to

uncertainties and factors relating to our operations and business

environment, all of which are difficult to predict and many of

which are beyond our control. The Company may experience

significant fluctuations in future operating results due to a

number of economic, competitive, and other factors, including,

among other things, our ability to continue as a going concern, our

history of losses and negative cash flow, our need for additional

capital to acquire inventory, support operations, and capitalize on

opportunities and our reliance on third-party manufacturers and

suppliers, government agency budgetary and political constraints,

new or increased competition, changes in market demand, and the

performance or reliability of our products. This, plus other

uncertainties and factors described in our most-recent annual

report and our most-recent prospectus filed with the Securities and

Exchange Commission, could materially affect the Company and our

operations. These documents are available electronically without

charge at www.sec.gov.

Add to Digg Bookmark with del.icio.us Add to Newsvine

For more information, contact: Melissa K. Owen Dir. of

Communications 16801 West 116th Street Lenexa, KS 66219 USA Phone:

(913) 338-5550 Fax: (913) 312-0264 Email Contact www.ICOP.com For

Investor Relations: DC Consulting, LLC Daniel Conway Chief

Executive Officer Phone: (407) 792-3332 Email Contact Email

Contact

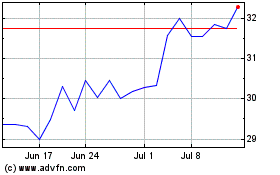

iShares Copper and Metal... (NASDAQ:ICOP)

Historical Stock Chart

From Jan 2025 to Feb 2025

iShares Copper and Metal... (NASDAQ:ICOP)

Historical Stock Chart

From Feb 2024 to Feb 2025