As filed with the Securities and Exchange

Commission on December 4, 2024

Registration No. 333-282310

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM S-3/A

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

T Stamp Inc.

(Exact name of registrant as specified in its charter)

| Delaware |

813777260 |

| (State or other jurisdiction of |

(IRS Employer |

| incorporation or organization) |

Identification Number) |

3017 Bolling Way NE,

Floor 2,

Atlanta, Georgia,

30305, USA

(404) 806-9906

(Address, including zip code, and telephone number,

including area code, of registrant’s principal executive offices)

Gareth Genner

c/o T Stamp Inc.

3017 Bolling Way NE,

Floor 2,

Atlanta, Georgia,

30305, USA

(404) 806-9906

(Name, address, including zip code, and telephone

number, including area code, of agent for service)

With a copy to:

CrowdCheck Law LLP

700 12th Street NW,

Suite 700

Washington, DC 20005

Approximate

date of commencement of proposed sale to the public: From time to time after the effective date of this registration statement.

If

the only securities being registered on this form are being offered pursuant to dividend or interest reinvestment plans, please check

the following box. ¨

If

any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under

the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the

following box. x

If

this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please

check the following box and list the Securities Act registration statement number of the earlier effective registration statement for

the same offering. ¨

If

this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and

list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If

this form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective

upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ¨

If

this form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional

securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ¨

Indicate by check mark whether

the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging

growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting

company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ¨ |

|

Accelerated

filer ¨ |

| Non-accelerated filer x |

|

Smaller reporting company

x |

| |

|

Emerging growth company

x |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act.¨

The registrant hereby

amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file

a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of

the Securities Act, or until this registration statement shall become effective on such date as the Securities and Exchange Commission,

acting pursuant to such Section 8(a), may determine.

The information contained in this

prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities

and Exchange Commission is effective. This prospectus is not an offer to sell these securities and offers to buy these securities are

not being solicited in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED

DECEMBER 4, 2024

PRELIMINARY PROSPECTUS

T Stamp Inc.

Up to 12,410,858 Shares of Class A

Common Stock Issuable Upon The Exercise of Warrants

This prospectus relates

to the resale from time to time of up to an aggregate of 12,410,858 shares of our Class A Common Stock, par value $0.01 per share

(the “Warrant Shares”), comprised of (i) 2,864,798 shares issuable upon the exercise of certain common

stock purchase warrants (the “Private Placement Warrants”); and (ii) 9,546,060

shares issuable upon the exercise of certain common stock purchase warrants (the “New Warrants”), each of which

were sold to a certain investor (the “Selling Stockholder”) in a private placement offering consummated

on September 3, 2024. We refer to the Private Placement Warrants and New Warrants herein collectively as the “Warrants”).

We are registering these Warrant Shares as required by the Securities Purchase Agreement (the “SPA”) (with

respect to the shares issuable upon exercise of the Private Placement Warrants) and Warrant Exercise Agreement (the “WEA”)

(with respect to the shares issuable upon the exercise of the New Warrants), each of which we entered into with the Selling Stockholder

on September 3, 2024. The Selling Stockholder may offer and sell the Warrant Shares in public or private transactions, or both.

These sales may occur at fixed prices, at market prices prevailing at the time of sale, at prices related to the prevailing market price,

or at negotiated prices.

As provided by Rule 416

of the Securities Act of 1933, as amended, this prospectus also covers any additional shares of Class A Common Stock that may become

issuable upon any anti-dilution adjustment pursuant to the terms of the Warrants issued to the Selling Stockholder by reason of stock

splits, stock dividends, and other events described therein.

The Selling Stockholder

may sell all or a portion of Warrant Shares through underwriters, broker-dealers, or agents, who may receive compensation in the form

of discounts, concessions, or commissions from the Selling Stockholder, the purchasers of the Warrant Shares, or both. See “Plan

of Distribution” for a more complete description of the ways in which the Warrant Shares may be sold. We will not receive any of

the proceeds from the sale of any of the 12,410,858 Warrant Shares by the Selling Stockholder. However, upon exercise of the Warrants

for cash, the Selling Stockholder would pay us an exercise price of $0.3223 per Warrant Share, subject to any adjustment pursuant to

the terms of the Warrants, or an aggregate of approximately $4,000,342 if the Warrants are exercised in full for cash. The Warrants are

also exercisable on a cashless basis under certain circumstances, and if the Warrants are exercised on a cashless basis, we would not

receive any cash payment from the Selling Stockholder upon any such exercise of the Warrants. We have agreed to bear the expenses (other

than underwriting discounts, commissions, or agent’s commissions and legal expenses of the Selling Stockholder) in connection with

the registration of the Warrant Shares being offered under this prospectus by the Selling Stockholder.

We will pay the expenses

of registering the Warrant Shares, but all selling and other expenses incurred by the Selling Stockholder will be paid by the Selling

Stockholder. See “Plan of Distribution” for further details.

This prospectus provides you with a general description

of the securities that may be resold by the Selling Stockholder. In certain circumstances, we may provide a prospectus supplement that

will contain specific information about the terms of a particular offering by the Selling Stockholder. Such supplements may also add,

update or change information contained in this prospectus. You should carefully read this prospectus and the applicable prospectus supplement

before you invest in any of our securities.

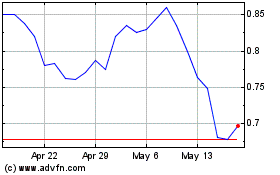

Our Class A Common Stock is listed on

the Nasdaq Capital Market under the symbol “IDAI.” On December 3, 2024, the last reported sale price of our Class A

Common Stock on the Nasdaq Capital Market was $0.613 per share.

As of December 3, 2024, the aggregate

market value of our outstanding Class A Common Stock held by non-affiliates was approximately $10.88 million based on 17,748,632

shares of Class A Common Stock held by non-affiliates on such date, and based on the last reported sale price of our Class A

Common Stock on the Nasdaq Capital Market on such date of $0.613 per share. As of the date of this prospectus, we have sold $460,229.80

worth of securities on September 3, 2024 pursuant to General Instruction I.B.6 of Form S-3 during the prior 12-calendar month

period ending on, and including, the date of this prospectus.

We are an “emerging growth company,”

as defined in Section 2(a) of the Securities Act of 1933, as amended (the “Securities Act”), and are

subject to reduced public company reporting requirements.

INVESTING IN OUR SECURITIES INVOLVES A HIGH

DEGREE OF RISK. SEE “RISK FACTORS” ON PAGE 10 OF THIS PROSPECTUS AND ANY SIMILAR SECTION CONTAINED IN THE APPLICABLE PROSPECTUS

SUPPLEMENT CONCERNING FACTORS YOU SHOULD CONSIDER BEFORE INVESTING IN OUR SECURITIES.

Neither the Securities and Exchange Commission

nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete.

Any representation to the contrary is a criminal offense.

The date of this prospectus is ,

2024.

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS

This prospectus provides you with a general description

of the Class A Common Stock (or Warrant Shares) that may be resold by the Selling Stockholder, which is not meant to be a complete

description of the Class A Common Stock.

To the extent required by applicable law, each

time the Selling Stockholder sells securities, we will provide you with this prospectus and, to the extent required, a prospectus supplement

that will contain more information about the specific terms of the offering. We may also authorize one or more free writing prospectuses

to be provided to you that may contain material information relating to these offerings. The prospectus supplement may also add, update

or change information contained in this prospectus with respect to that offering. If there is any inconsistency between the information

in this prospectus and the applicable prospectus supplement, you should rely on the prospectus supplement. Before purchasing any securities,

you should carefully read both this prospectus and the applicable prospectus supplement, together with the additional information described

under the headings “Where You Can Find More Information” and “Incorporation of Certain Information by Reference.”

We have not authorized anyone to provide you with

any information or to make any representations other than those contained in this prospectus, any applicable prospectus supplement or

any free writing prospectuses prepared by or on behalf of us or to which we have referred you. We take no responsibility for and can provide

no assurance as to the reliability of any other information that others may give you. You should assume that the information appearing

in this prospectus and the applicable prospectus supplement to this prospectus is accurate as of the date on its respective cover, and

that any information incorporated by reference is accurate only as of the date of the document incorporated by reference, unless we indicate

otherwise. Our business, financial condition, results of operations and prospects may have changed since those dates.

Unless the context requires otherwise, references

in this prospectus to the “Company,” “T Stamp”, “Trust Stamp”,

“we,” “us” and “our” refer to T Stamp Inc., a Delaware corporation,

and its consolidated subsidiaries.

PROSPECTUS SUMMARY

This summary highlights selected information

appearing elsewhere in this prospectus or incorporated by reference in this prospectus and does not contain all of the information that

you need to consider in making your investment decision. You should carefully read the entire prospectus, the applicable prospectus supplement

and any related free writing prospectus, including the risks of investing in our securities discussed under the heading “Risk Factors”

contained in the applicable prospectus supplement and any related free writing prospectus, and under similar headings in the other documents

that are incorporated by reference into this prospectus. You should also carefully read the information incorporated by reference into

this prospectus, including our financial statements, and the exhibits to the registration statement of which this prospectus is a part.

Overview

Trust Stamp was incorporated

under the laws of the State of Delaware on April 11, 2016 as “T Stamp Inc.” T Stamp Inc. and its subsidiaries primarily

develop proprietary artificial intelligence-powered solutions, researching and leveraging machine learning artificial intelligence, including

computer vision, cryptography, and data mining, to process and protect data and deliver insightful outputs that identify and defend against

fraud, protect sensitive user information, facilitate automated processes, and extend the reach of digital services through global accessibility.

We utilize the power and agility of technologies such as GPU processing, edge computing, neural networks, and large language models to

process and protect data faster and more effectively than historically possible to deliver results at a disruptively low cost for usage

across multiple industries.

Our team has substantial

expertise in the creation and development of AI-enabled software products. We license our technology and expertise in numerous fields,

with an increasing emphasis on addressing diverse markets through established partners who will integrate our technology into field-specific

applications.

Over the last six

months, the Company has undertaken a multi-pronged process to position itself better to leverage the growing opportunities offered by

the expanded use and acceptance of AI technologies. This process has included:

| i. | Reducing the size of the non-production-focused

executive and consulting teams to reduce overhead for the 2025 calendar year. |

| ii. | Releasing sales staff that did not

meet their targets. |

| iii. | Negotiating the sale of certain

assets that have resulted in continuous operating losses to raise operating capital and eliminate

the cash flow deficits associated with the asset, allowing for sharpened focus on and investment

in products with the best promise for profitable revenue generation. |

| iv. | Negotiating a services contract to

offset the cost of the technical team members while maintaining significant R&D and product

development capabilities. |

| v. | Refocusing go-to-market strategies

on joint ventures with proven industry partners with access to target markets. |

Markets

Trust Stamp has evaluated

the market potential for its services in part by reviewing the following reports, articles, and data sources, none of which were commissioned

by the Company, and none of which are to be incorporated by reference:

Data Security and

Fraud

| |

· |

According to the “2021 Year End Report: Data Breach QuickView” published

by Flashpoint, 4,145 publicly disclosed breaches exposed over 22 billion records in 2022. |

| |

· |

The cumulative merchant losses to online payment fraud between 2023 and 2027 will exceed $343 billion globally according to a 2022 report titled “Fighting Online Payment Fraud in 2022 & Beyond” published by Juniper Research. |

Financial and societal

inclusion

| |

· |

According to the “Global Findex Database 2021,” published by the World Bank, 1.4 billion people

were unbanked as of 2021.. |

| |

· |

131 million small and medium-sized enterprises in emerging markets lack access to finance, limiting their ability to grow and thrive (UNSGSA Financial Inclusion Webpage, Accessed March 2023) |

| |

· |

The global market for Microfinance is estimated at $157 Billion in the year 2020, and is projected to reach $342 billion by 2026 according to the 2022 report titled “Microfinance - Global Market Trajectory & Analytics” published by Global Industry Analysts, Inc. |

Trust Stamp’s biometric

authentication, liveness detection, and information tokenization enable individuals to verify and establish their identities using data

derived from biometrics. While individuals in this market lack traditional means of identity verification, Trust Stamp provides a means

to authenticate identity that preserves an individual’s privacy and control over that identity.

Alternatives to

Detention (“ATD”)

| |

· |

The ATD market includes Federal, State, and Municipal agencies for both criminal justice and immigration purposes. Trust Stamp addresses the ATD market with applications built on Trust Stamp’s privacy-preserving solutions allowing individuals to comply with ATD requirements using ethical and humane technology methodologies. Trust Stamp has developed innovative patented technologies for use in the ATD market encompassing biometrics, geolocation, and tokenization as well as a proprietary, tamper-resistant, battery-free “Tap-In-Band” that can complement or replace biometric check-in requirements and provide a lower-cost and more humane alternative to traditional “ankle bracelet” technology. |

Other Markets

The Company is developing

products and working with partners and industry organizations in other sectors that offer significant market opportunities and has entered

into go-to-market or licensing agreements, including global data location services, healthcare, IoT, automotive dealer services,

and computer vision for UAV operations. We anticipate licensing our technology in numerous fields, typically through established partners

who will integrate our technology into field-specific applications.

Principal Products

and Services

We adhere to the best

practices outlined in the National Institute of Standards and Technology (“NIST”) and International Organization for Standardization

(“ISO”) frameworks, and our policies and procedures in managing personally identifiable information (“PII”) comply

with General Data Protection Regulation (“GDPR”) requirements wherever such requirements are applicable.

Key Customers

The Company’s

initial business consisted of developing proprietary privacy-first identity solutions and implementing them through custom applications

built and maintained for a few key customers. In 2022, the Company added to its product offerings a modular and highly scalable SaaS

model with low-code or no implementation (“the Orchestration Layer”).

Recent Developments

Results of

Stockholder Special Meeting

On November 18, 2024, the Company held a Special Meeting of Stockholders

(the “Special Meeting”) to consider and vote upon:

| · | Proposal 1:

Ratification of the approval of that certain Securities Purchase Agreement dated July 13,

2024 between our Company and DQI Holdings, Inc. (the “July DQI SPA”)

and all transactions contemplated thereunder, including, but not limited to, the sale of

4,597,701 shares of our Class A Common Stock, par value $0.01 per share to DQI as required

by and in accordance with Nasdaq Listing Rule 5635(d)); and |

| · | Proposal 2: Ratification

of the approval of the issuance of the Private Placement Warrants issued to the Selling Stockholder

pursuant the SPA as required by and in accordance with Nasdaq Listing Rule 5635(d)); |

| · | Proposal 3: Approval

of the issuance of the New Warrants issued to the Selling Stockholder pursuant to the WEA

as required by and in accordance with Nasdaq Listing Rule 5635(d)); and |

| · | Proposal 4: Approval

a reverse stock split of our Common Stock at a ratio of not less than 1-for-5 and not more

than 1-for-50, with such ratio to be determined by the Board of Directors on or prior to

December 31, 2024, in its sole discretion, and which would be effected by filing a Certificate

of Amendment to the Company's Third Amended and Restated Certificate of Incorporation with

the State of Delaware (collectively, the “Reverse Split ”). |

At the Special Meeting, 44% of our Common Stock entitled to vote

at the Special Meeting were represented in person or by proxy at the Special Meeting. Based on the results of the vote, the stockholders

voted to approve Proposals 1, 2, 3 and 4.The number of votes cast for or withheld from the approval is also set forth below. The voting

results disclosed below are final.

| Proposal | |

Number of

Shares Voted

For | | |

Number of

Shares Voted

Against | | |

Number of

Shares

Abstained | | |

Percentage of

Shares Voted

“For” of Shares

Voted | |

| Ratify,

by a vote of all the stockholders, the approval of the July DQI SPA and all transactions contemplated thereunder, including, but

not limited to, the sale of 4,597,701 shares of our Class A Common Stock to DQI as required by and in accordance with Nasdaq Listing

Rule 5635(d)) (“Proposal 1”) | |

| 8,045,514 | | |

| 223,000 | | |

| 15,537 | | |

| 97 | % |

| Ratify, by

a vote of all the stockholders, the issuance of the Private Placement Warrants and the issuance of up to 2,864,798 shares from the

exercise of the Private Placement Warrants issued as part of the Armistice SPA, in accordance with Nasdaq Listing Rule 5635(d)) (“Proposal

2”); | |

| 7,984,668 | | |

| 295,174 | | |

| 4,209 | | |

| 96 | % |

| Approve the

issuance of the New Warrants and the issuance of up to 9,546,060 shares of our Common Stock upon the exercise of the New Warrants

issued to Armistice pursuant to the WEA as required by and in accordance with Nasdaq Listing Rule 5635(d)) (“Proposal 3”) | |

| 7,982,414 | | |

| 297,956 | | |

| 3,681 | | |

| 96 | % |

| Approve a

reverse stock split of our Common Stock at a ratio of not less than 1-for-5 and not more than 1-for-50, with such ratio to be determined

by the Board of Directors on or prior to December 31, 2024, in its sole discretion (“Proposal 4”) | |

| 7,929,963 | | |

| 344,738 | | |

| 9,350 | | |

| 96 | % |

Election of New Board Member

On November 2, 2024, the Board of Directors of the Company elected

Andrew Scott Francis, the current Chief Technology Officer of the Company, to the Board of Directors, effective immediately, to fill

a vacancy on the Board of Directors left from the resignation of Joshua Allen from the Company's Board of Directors on September 26,

2024. Andrew Scott Francis will be a member of the “Class III” directors of the Company.

Securities Purchase Agreement

and Registration Rights Agreement with DQI Holdings, Inc.

On October 27, 2024, the Company entered into a Securities Purchase

Agreement the (“DQI SPA”) with DQI Holdings, Inc. (“DQI”). Pursuant to the terms

of the DQI SPA, the Company agreed to sell, and DQI agreed to purchase from, at the closing of the DQI SPA and upon the terms and subject

to the conditions set forth in the DQI SPA, 1,363,636.36 shares of Class A Common Stock, par value $0.01 of the Company at $0.22 per

share, subject to adjustment in certain circumstances. On October 28, 2024, the Closing of the DQI SPA occurred, and the Company awarded

1,363,636.36 shares of Class A Common Stock to DQI (the “DQI Shares”) in exchange for a cash payment of $300,000.

The closing of the DQI SPA was subject to a number of customary closing conditions, including, but not limited to, the Company’s

entry into a Registration Rights Agreement, the execution of which were conditions to the closing of the DQI SPA.

The DQI Shares were not registered under the Securities Act and

were offered pursuant to an exemption from the registration requirements of the Securities Act provided under Section 4(a)(2) of the

Securities Act and/or Rule 506 of Regulation D promulgated under the Securities Act.

The foregoing description of the DQI SPA does not purport to be

complete and is qualified in its entirety by reference to the full text of the DQI SPA, a copy of which is incorporated by reference

as Exhibit 10.29 to this registration statement.

Pursuant to the DQI SPA, the Company also entered into a registration

rights agreement (the “DQI Registration Rights Agreement”) with DQI on October 27, 2024, pursuant to which

the Company must file a registration statement on Form S-3 (or, if the Company is ineligible to use a Form S-3, another appropriate form)

with the SEC to register for resale by DQI of the DQI Shares, with such registration statement becoming effective 5 days after the date

the stockholders of the Company ratify, by vote, the approval of that certain Securities Purchase Agreement dated July 13, 2024 between

the Company and DQI and all transactions contemplated thereunder, including, but not limited to, the sale of 4,597,701 shares of our

Class A Common Stock to DQI. However, following comments received from SEC staff, it was determined to wait until after the stockholder

approval for filing of such registration statement.

The foregoing summary of the DQI Registration Rights Agreement

is not complete, and is qualified by reference to a copy of the DQI Registration Rights Agreement, a copy of which is included as Exhibit

10.30 to this registration statement.

Securities

Purchase Agreement for Pre-Funded Warrants and Private Placement Warrants

On September 3, 2024, the Company

entered into a securities purchase agreement (the “SPA”) with the Selling Stockholder, pursuant to which the

Company agreed to issue and sell to the investor (i) in a registered direct offering Pre-Funded Warrants (the "Pre-Funded

Warrants") to purchase 1,432,399 shares of the Company's Class A Common Stock and (ii) in a concurrent private

placement, common stock purchase warrants (the “Private Placement Warrants”), exercisable for an aggregate

of up to 2,864,798 shares of Class A Common Stock, at an exercise price of $0.3223 per share of Class A Common Stock. The offering

price per Pre-Funded Warrant is $0.3213.

The securities to be

issued in the registered direct offering were offered pursuant to the Company’s shelf registration statement on Form S-3 (File

333-271091) (the “Shelf Registration Statement”), initially filed by the Company with the Securities and Exchange

Commission (the “SEC”) under the Securities Act of 1933, as amended (the “Securities Act”),

on April 3, 2023 and declared effective on April 12, 2023. The Pre-Funded Warrants are exercisable upon issuance and will remain

exercisable until all of the Pre-Funded Warrants are exercised in full.

The Private Placement

Warrants (and the shares of Class A Common Stock issuable upon the exercise of the Private Placement Warrants) were not registered

under the Securities Act, and were offered pursuant to an exemption from the registration requirements of the Securities Act provided

under Section 4(a)(2) of the Securities Act and/or Rule 506 of Regulation D promulgated

under the Securities Act.

Pursuant to the SPA,

the Company agreed to hold an annual or special meeting of its stockholders within sixty (60) days following the closing date of the SPA

for the purpose of obtaining shareholder approval of the SPA and transactions contemplated thereunder (including, but not limited to,

the issuance of the Pre-Funded Warrants, Private Placement Warrants, and shares issuable upon the exercise of the Pre-Funded Warrants

and Private Placement Warrants) as may be required by the applicable rules and regulations of the Nasdaq Stock Market (“Shareholder

Approval”). If the Company does not obtain Shareholder Approval at the first meeting, the Company must call a meeting

every ninety (90) days thereafter to seek Shareholder Approval until the earlier of the date on which Shareholder Approval is obtained

or the warrants are no longer outstanding.

The Private Placement

Warrants are immediately exercisable upon the date Shareholder Approval is received, and will expire five years thereafter, and in certain

circumstances may be exercised on a cashless basis. If we fail for any reason to deliver shares

of Class A Common Stock upon the valid exercise of the Private Placement Warrants, subject to our receipt of a valid exercise notice

and the aggregate exercise price, by the time period set forth in the Private Placement Warrants, we are required to pay the applicable

holder, in cash, as liquidated damages as set forth in the Private Placement Warrants. The Pre-Funded Warrants and Private Placement Warrants

also include customary buy-in rights in the event we fail to deliver shares of common stock upon exercise thereof within the time periods

set forth in the Pre-Funded Warrants and Private Placement Warrants.

On September 3,

2024, the Company closed the registered direct offering and the private placement offering (collectively, the “Offering”),

raising gross proceeds of approximately $2.0 million before deducting placement agent fees and other offering expenses payable by the

Company. In the event that all Private Placement Warrants are exercised for cash, the Company will receive additional gross proceeds

of approximately $3.076 million. The Company’s primary use of the net proceeds was to fund the termination of its transaction documents

with HCM Management Foundation (“HCM”) pursuant to that certain Termination and Release Agreement between the

Company and HCM also dated September 3, 2024 (filed herewith as Exhibit 10.25) under which the

transaction entered into between the Company and HCM as described in the Form 8-K filed by the Company on April 4, 2024 was terminated.

The balance of the proceeds is being used for working capital, capital expenditures and other general corporate purposes.

Pursuant to the terms

of the SPA, the Company is required within 30 days of September 3, 2024 to file a registration statement on Form S-1 or other

appropriate form if the Company is not then S-1 eligible registering the resale of the shares of Class A Common Stock issued and

issuable upon the exercise of the Private Placement Warrants. The Company is required to use commercially reasonable efforts to cause

such registration to become effective within 91 days of the closing date of the Offering, and to keep the registration statement effective

at all times until no investor owns any Private Placement Warrants or shares issuable upon exercise thereof.

Pursuant to the terms

of the SPA, from September 3, 2024 until 45 days thereafter, subject to certain exceptions, we may not issue, enter into any agreement

to issue or announce the issuance or proposed issuance of any shares of common stock or common stock equivalents, or file any registration

statement or any amendment or supplement thereto, other than a prospectus supplement for the Shelf Registration Statement. In addition,

from September 3, 2024 until 45 days thereafter, we are prohibited from effecting or entering into an agreement to effect any issuance

of common stock or common stock equivalents involving a variable rate transaction (as defined in the SPA).

On November 18, 2024,

Shareholder Approval was obtained.

Placement Agency Agreement

Also in connection with the Offering, on

September 3, 2024, the Company entered into a placement agency agreement (the “Placement Agency Agreement”)

with Maxim Group LLC (the “Placement Agent”). Pursuant to the terms of the Placement Agency Agreement, the

Placement Agent agreed to use its reasonable best efforts to arrange for the sale of the Shares, Pre-Funded Warrants, and Private Placement

Warrants. The Company will pay the Placement Agent a cash fee equal to 6.0% of the gross proceeds generated from such sales and will

reimburse the Placement Agent for certain of its expenses in an aggregate amount up to $45,000.

The Placement Agency

Agreement contains customary representations, warranties and agreements by the Company, customary conditions to closing, indemnification

obligations of the Company and the Placement Agent, including for liabilities under the Securities Act, other obligations of the parties,

and termination provisions.

In addition, pursuant

to certain “lock-up” agreements (each, a “Lock-Up Agreement”) that were required to be entered into

as a condition to the closing of the SPA, our officers and directors have agreed, for a period of 60 days from September 3, 2024,

not to engage in any of the following, whether directly or indirectly, without the consent of the purchaser under the SPA: offer to sell,

sell, contract to sell pledge, grant, lend, or otherwise transfer or dispose of our common stock or any securities convertible into or

exercisable or exchangeable for Class A Common Stock (the “Lock-Up Securities”); enter into any swap or

other arrangement that transfers to another, in whole or in part, any of the economic consequences of ownership of the Lock-Up Securities;

make any demand for or exercise any right or cause to be filed a registration statement, including any amendments thereto, with respect

to the registration of any Lock-Up Securities; enter into any transaction, swap, hedge, or other arrangement relating to any Lock-Up Securities

subject to customary exceptions; or publicly disclose the intention to do any of the foregoing.

The foregoing does not purport to be a complete

description of each of the Pre-Funded Warrants, the Private Placement Warrants, the SPA, and Lock-Up Agreement and is qualified in its

entirety by reference to the full text of each of such document, which are filed as Exhibits 4.12, 4.13, and 10.23, and 10.26, respectively,

to this registration statement on Form S-3 and are incorporated herein by reference.

Warrant Exercise Agreement

On September 3,

2024, the Company entered into a warrant exercise agreement (the “WEA”) with the Selling Stockholder, pursuant

to which the Selling Stockholder agreed to exercise (the “Exercise”)

(i) all of the warrants issued to the Selling Stockholder on June 5,

2023, as subsequently amended on December 20, 2023, which are exercisable for 1,173,030 shares of the Company’s Class A

Common Stock, par value $0.01 per share (“Class A Common Stock”) with a current exercise price of $1.34

per share (the “June 2023 Warrants”) and (ii) all of the warrants issued to the Selling Stockholder

on December 20, 2023, which are exercisable for 3,600,000 shares of Class A Common Stock, with a current exercise price of $1.34

per share (the “December 2023 Warrants” and collectively with the June 2023, the “Existing

Warrants”). In consideration for the immediate exercise of 4,773,000 of the Existing

Warrants for cash, the Company agreed to reduce the exercise price of all of the Existing Warrants, including any unexercised portion

thereof, to $0.3223 per share, which was equal to the most recent closing price of the Company’s Class A Common Stock on The

Nasdaq Stock Market prior to the execution of the WEA. In addition, in consideration for such Exercise, the Selling Stockholder received

new unregistered warrants to purchase up to an aggregate of 9,546,060 shares of Class A Common Stock, equal to 200% of the shares

of Class A Common Stock issued in connection with the Exercise, with an exercise price of $0.3223 per share (the “New

Warrants”) in a private placement pursuant to Section 4(a)(2) of

the Securities Act

The New Warrants will

have substantially the same terms as the June 2023 Warrants (which were described in the Company’s Current Report on Form 8-K

filed with the SEC on June 5, 2023), except that the New Warrants will not become exercisable until such time as the Company has

received stockholder approval with respect to the issuance of shares of Class A Common Stock underlying the New Warrants and will

remain exercisable for five (5) years from the stockholder approval. The Company agreed to hold a stockholder meeting for this purpose

no later than the 90th calendar date following the entry into the WEA. The Company agreed to file a resale registration statement on Form S-3

within 30 days of September 3, 2024 with respect to the New Warrants and the shares of Class A Common Stock issuable upon exercise

of the New Warrants. The Existing Warrants and the New Warrants each include a beneficial ownership limitation that prevents the Selling

Stockholder from owning more than 9.99%, with respect to the Existing Warrants, and 4.99%, with respect to the New Warrants, of the Company’s

outstanding Class A Common Stock at any time.

Additionally,

pursuant to the WEA, from September 3, 2024 until the 60th day thereafter, the Company

is prohibited from effecting or entering into an agreement to effect any issuance by the Company of any common stock of the Company or

any common stock equivalents (or a combination of units thereof) involving a Variable Rate Transaction. “Variable Rate Transaction”

means a transaction in which the Company (i) issues or sells any debt or equity securities that are convertible into, exchangeable

or exercisable for, or include the right to receive, additional shares of the Company’s common stock either (A) at a conversion

price, exercise price or exchange rate or other price that is based upon, and/or varies with, the trading prices of or quotations for

the shares of the Company’s common stock at any time after the initial issuance of such debt or equity securities or (B) with

a conversion, exercise or exchange price that is subject to being reset at some future date after the initial issuance of such debt or

equity security or upon the occurrence of specified or contingent events directly or indirectly related to the business of the Company

or the market for the Company’s common stock or (ii) enters into, or effects a transaction under, any agreement, including,

but not limited to, an equity line of credit or an “at-the-market offering”, whereby the Company may issue securities at a

future determined price, regardless of whether shares pursuant to such agreement have actually been issued and regardless of whether such

agreement is subsequently canceled. The Selling Stockholder will be entitled to obtain injunctive relief against the Company to preclude

any such issuance, which remedy shall be in addition to any right to collect damages.

The

gross proceeds to the Company from the Exercise was approximately $1.538 million, prior to deducting warrant inducement agent fees and

estimated offering expenses. These funds supplement the funds received as discussed above under “Securities Purchase Agreement”,

in which the Company’s primary use of the net proceeds was to fund the termination of its transaction documents with HCM Management

Foundation with the balance being used for working capital, capital expenditures and other general corporate purposes.

Maxim Group LLC (“Maxim”)

acted as the exclusive warrant inducement agent and financial advisor to the Company for the Exercise. The Company agreed to pay Maxim

an aggregate cash fee equal to 6.0% of the gross proceeds received by the Company from the Exercise.

The resales of the shares

of Class A Common Stock underlying the Existing Warrants have been registered pursuant to a registration statement on Form S-1

(File No. 333-274160) with respect to the June 2023 Warrants, and pursuant to a registration statement on Form S-3 (File

No. 333-277151) with respect to the December 2023 Warrants (collectively, the “Registration Statements”).

The Registration Statements are currently effective for the resale of the shares of Class A Common Stock issuable upon the exercise

of the Existing Warrants.

The foregoing descriptions of the WEA

and the New Warrants and are not complete and are qualified in their entirety by reference to the full text of the form of WEA and the

form of the New Warrants, copies of which are filed hereto as Exhibits 10.24 and 4.14, respectively, to this registration statement on

Form S-3 of which this prospectus forms a part.

As of December 2,

2024, the Selling Stockholder has not exercised the New Warrants. All 9,546,060 of the New Warrants remain outstanding as of December 2,

2024.

Corporate Information

Trust Stamp was incorporated under the laws of

the State of Delaware on April 11, 2016 as “T Stamp Inc.” Our principal executive offices are located at 3017 Bolling

Way NE, Floor 2, Atlanta, GA 30305, and our telephone number is (404) 806-9906. Our website address is www.truststamp.ai.

None of the information contained on, or that may be accessed through, our website is a prospectus or constitutes part of, or is otherwise

incorporated into this prospectus.

The Offering

| Issuer |

T Stamp Inc., a Delaware corporation |

| |

|

Securities Offered by

the Selling Stockholder |

Up to 12,410,858 shares

of Class A Common Stock issuable upon exercise of the Warrants |

Shares of Class A

Common Stock

Outstanding Prior to

this Offering (as of

December 3, 2024): |

23,145,179

(1) |

| |

|

Shares of Class A

Common Stock

Outstanding

Assuming Exercise of

All Warrants: |

35,556,037 (2) |

| |

|

| Use of Proceeds |

We will not receive any proceeds from the sale of our Class A Common Stock offered by the Selling Stockholder under this prospectus. However, in the case of Warrants being exercised by the Selling Stockholder for cash, the Selling Stockholder would pay us an exercise price of $0.3223 per share of Class A Common Stock, subject to any adjustment pursuant to the terms of the Warrants, or an aggregate of approximately $4,000,342 if the Warrants are exercised in full for cash. The Warrants are also exercisable on a cashless basis, and if the Warrants are exercised on a cashless basis, we would not receive any cash payment from the Selling Stockholder upon any such exercise of the Warrants. |

| |

|

| Risk Factors |

Investing in our securities involves a high degree of risk. See “Risk Factors” beginning on page 10 of this prospectus, and any other risk factors described in a prospectus supplement and in the documents incorporated herein and therein by reference, for a discussion of certain factors that you should carefully consider before deciding to invest in our securities. |

| |

|

Nasdaq Capital

Market Trading

Symbol |

IDAI |

| (1) |

The above discussion

is based on 23,145,179 shares of Class A Common Stock outstanding as of December 3, 2024, but excludes up to 7,915,143

shares of Class A Common Stock acquirable within 60 days of December 3, 2024 from the conversion, vesting, and/or exercise of

outstanding restricted stock units, stock options, warrants, and stock grants. |

| (2) |

Assumes the issuance

of 12,410,858 shares of Class A Common Stock underlying the Warrants upon full exercise by the Selling Stockholder. |

RISK FACTORS

Investing

in our securities involves a high degree of risk. Before deciding whether to invest in our securities, you should consider carefully

the risks and uncertainties described under the heading “Risk Factors” contained in the applicable prospectus supplement

and any related free writing prospectus, and discussed under the section entitled “Risk Factors” contained in our Annual

Report on Form 10-K for the fiscal year ended December 31, 2023, which

is incorporated by reference into this prospectus in their entirety, together with other information in this prospectus, the documents

incorporated by reference and any free writing prospectus that we may authorize for use in connection with this offering. The risks described

in these documents are not the only ones we face, but those that we consider to be material. There may be other unknown or unpredictable

economic, business, competitive, regulatory or other factors that could have material adverse effects on our future results. Past financial

performance may not be a reliable indicator of future performance, and historical trends should not be used to anticipate results or

trends in future periods. If any of these risks actually occurs, our business, financial condition, results of operations or cash flow

could be seriously harmed. This could cause the trading price of our securities to decline, resulting in a loss of all or part of your

investment. Please also carefully read the section below entitled “Special Note Regarding Forward-Looking Statements.”

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus, each prospectus supplement and

the information incorporated by reference in this prospectus and each prospectus supplement contain “forward-looking statements”

within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”) and

Section 21E of the Securities and Exchange Act of 1934, as amended (the “Exchange Act”), that involve risks

and uncertainties, as well as assumptions that, if they never materialize or prove incorrect, could cause our results to differ materially

and adversely from those expressed or implied by such forward-looking statements. Forward-looking statements may include, but are not

limited to, statements relating to our outlook or expectations for earnings, revenues, expenses, asset quality or other future financial

or business performance, strategies, expectations or business prospects, or the impact of legal, regulatory or supervisory matters on

our business, results of operations, or financial condition. Specifically, forward-looking statements may include statements relating

to our future business prospects, revenue, income, and financial condition.

Forward-looking statements can be identified by

the use of words such as “estimate,” “plan,” “project,” “forecast,” “intend,”

“expect,” “anticipate,” “believe,” “seek,” “target,” or similar expressions.

Forward-looking statements reflect our judgment based on currently available information and involve a number of risks and uncertainties

that could cause actual results to differ materially from those described in the forward-looking statements.

Important factors could cause actual results to

differ materially from our expectations include, but are not limited to:

| |

· |

adverse economic conditions; |

| |

· |

general decreases in demand for our products and services; |

| |

· |

changes in timing of introducing new products into the market; |

| |

· |

intense competition (including entry of new competitors), including among competitors with substantially greater resources than us; |

| |

· |

revenues and net income lower than anticipated; |

| |

· |

becoming delisted from Nasdaq; |

| |

· |

the possible fluctuation and volatility of operating results and financial conditions; |

| |

· |

the impact of legal, regulatory, or supervisory matters on our business, results of operations, or financial condition; |

| |

· |

inability to carry out our marketing and sales plans; and |

| |

· |

the loss of key employees and executives. |

Forward-looking statements are based on assumptions

we have made in light of our industry experience and our perceptions of historical trends, current conditions, expected future developments

and other factors we believe are appropriate under the circumstances. You are cautioned that these statements are not guarantees of performance

or results. They involve risks, uncertainties (many of which are beyond our control) and assumptions. Although we believe that these forward-looking

statements are based on reasonable assumptions, you should be aware that many factors could affect our actual operating and financial

performance and cause our performance to differ materially from the performance anticipated in the forward-looking statements. We discuss

in greater detail many of these risks in the applicable prospectus supplement, in any free writing prospectuses we may authorize for use

in connection with a specific offering, in our most recent annual report on Form 10-K, as well as any amendments thereto, and in

our subsequent filings with the SEC, which are incorporated by reference into this prospectus in their entirety.

Unless required by law, we undertake no obligation

to update or revise any forward-looking statements to reflect new information or future events or developments. Thus, you should not assume

that actual events are bearing out as expressed or implied in such forward-looking statements. You should read this prospectus, any applicable

prospectus supplement, together with the documents we have filed with the SEC that are incorporated by reference and any free writing

prospectus that we may authorize for use in connection with this offering completely and with the understanding that our actual future

results may be materially different from what we expect. We qualify all of the forward-looking statements in the foregoing documents by

these cautionary statements.

USE OF PROCEEDS

We will not receive any proceeds from the sale

of the Warrant Shares covered by this prospectus and any accompanying prospectus supplement. All proceeds from the sale of the Warrant

Shares will be for the account of the Selling Stockholder. However, we will receive the proceeds of any cash exercise of the Warrants.

We intend to use the net proceeds from any cash exercise of the Warrants for general corporate purposes, which includes working capital,

business and product development, potential acquisitions, retirement of debt and other business opportunities. The timing and amount of

our actual expenditures will be based on many factors; therefore, unless otherwise indicated in the prospectus supplement, our management

will have broad discretion to allocate the net proceeds of our offerings.

We will bear all other costs, fees and expenses

incurred in effecting the registration of the offering and sale of the Warrant Shares covered by this prospectus and any accompanying

prospectus supplement, including, without limitation, all registration and filing fees, Nasdaq listing fees and fees and expenses of our

counsel and our accountants, in accordance with the terms of the SPA and WEA. The Selling Stockholder will pay any discounts, commissions,

and fees of underwriters, selling brokers, dealer managers or similar securities industry professionals incurred by the Selling Stockholder

in disposing of the Warrant Shares covered by this prospectus.

THE SELLING STOCKHOLDER

The shares of Class A

Common Stock (or Warrant Shares) being offered by the Selling Stockholder are those issuable to the Selling Stockholder upon exercise

of the Warrants. For additional information regarding the issuance of the Warrants, see “Recent Developments” further above

in this prospectus. We are registering the shares of Class A Common Stock issuable upon exercise of the Warrants in order to permit

the Selling Stockholder to offer the shares for resale from time to time.

In

September 2022, April 2023, June 2023, and September 2024, the Selling Stockholder and the Company engaged in transactions

whereby, pursuant to the terms of Securities Purchase Agreements dated September 11, 2022, April 14, 2023, June 5, 2023,

and September 3, 2024, respectively, the Company sold the Selling Stockholder a number of shares of Class A Common Stock and

warrants to purchase shares of Class A Common Stock in various private placement transactions, and subsequently filed registration

statements on Form S-1 that were declared effective in January 2023 (File No. 333-267668), August 2023 (File No. 333-272343),

and September 2023 (File No. 333-274160), respectively, to register for resale by the Selling Stockholder those shares, as well

as the shares issuable upon the exercise of the warrants sold to this investor in those transactions (with the exception of the September 2024

transactions, whereby the Company sold the Selling Stockholder pre-funded warrants in a registered

direct pursuant to the Company’s shelf registration statement on Form S-3 (File 333-271091) declared effective on April 12,

2023.

Additionally,

in December 2023, the Selling Stockholder the Company entered into a warrant exercise agreement, whereby the Selling Stockholder

agreed to exercise certain warrants previously issued to the Selling Stockholder in

exchange for the Company (i) reducing the exercise price of all those warrants; and (ii) issuing

the Selling Stockholder new unregistered warrants to purchase up to an aggregate of 3,600,000 shares of Class A Common Stock, with

an exercise price of $1.34 per share in a private placement pursuant to Section 4(a)(2) of the Securities Act. The Company

subsequently filed resale registration statement on Form S-3 with respect to the 3,600,000 shares of Class A Common Stock issuable

upon exercise of those warrants, which was declared effective on April 23, 2024 (File No. 333-277151).

Apart from these previous transactions, and the transactions described in this prospectus relating to the SPA and WEA, the Selling Stockholder

has not had any material relationship with the Company within the past three years.

The table below lists beneficial ownership information

of the Selling Stockholder as of the date of this prospectus, as well as the expected beneficial ownership of the Selling Stockholder

after the conclusion of this offering.

In accordance with the terms of the SPA and WEA with the Selling Stockholder, this prospectus generally

covers the resale of the maximum number of shares of Class A Common Stock issuable upon exercise of the Warrants, determined as if the

outstanding Warrants were exercised in full as of the trading day immediately preceding the date this registration statement was initially

filed with the SEC, each as of the trading day immediately preceding the applicable date of determination and all subject to adjustment

as provided in the SPA and WEA, without regard to any limitations on the exercise of the Warrants. The fourth column assumes the sale

of all the shares offered by the Selling Stockholder pursuant to this prospectus.

Under

the terms of the Private Placement Warrants, the Selling Stockholder may not exercise the Private Placement Warrants to the extent such

exercise would cause the Selling Stockholder, together with its affiliates and attribution parties, to beneficially own a number of shares

of Class A Common Stock which would exceed 4.99% (or, at the option of the Selling Stockholder upon 61 days’ notice to the

Company subject to the terms of the Private Placement Warrants, up to 9.99%), as applicable of our then outstanding Class A Common

Stock following such exercise, excluding for purposes of such determination shares of Class A Common Stock issuable upon exercise

of such Warrants which have not been exercised. The New Warrants are subject to a 9.99% beneficial ownership limitation, which

prohibits the Selling Stockholder from exercising any portion of the New Warrants if, following such exercise, the Selling Stockholder’s

ownership of our Class A Common Stock would exceed 9.99%. The number of shares in the table do not reflect this limitation. The Selling

Stockholder may sell all, some or none of the Warrant Shares in this offering. See “Plan of Distribution.”

| | |

Number of shares of |

| |

Maximum Number of shares | |

Number of shares of |

| Name of Selling | |

Class A Common

Stock Owned |

| |

of Class A Common

Stock to be Sold | |

Class A

Common Stock |

| Stockholder | |

Prior to Offering |

| |

Pursuant to this prospectus | |

Owned After Offering |

| Armistice Capital, LLC | |

12,410,858 |

(1) | |

12,410,858(2) | |

—(3) |

| (1) |

Consists of 12,410,858

shares of Class A Common Stock underlying the Warrants. |

| (2) |

The securities to be

sold pursuant to this prospectus include 12,410,858 shares of Class A Common Stock that may be exercised pursuant to the Warrants,

all of which are directly held by Armistice Capital Master Fund Ltd. (the “Master Fund”), a Cayman Islands

exempted company, and may be deemed to be indirectly beneficially owned by Armistice Capital, LLC (the “Selling Stockholder”),

as the investment manager of the Master Fund; and (ii) Steven Boyd, as the Managing Member of the Selling Stockholder. The Private

Placement Warrants are subject to a 4.99% beneficial ownership limitation, which prohibits the Selling Stockholder from exercising

any portion of the Private Placement Warrants if, following such exercise, the Selling Stockholder’s ownership of our Class A

Common Stock would exceed the applicable ownership limitation. This beneficial ownership limitation may be increased up to 9.99%

at the option of the Selling Stockholder upon 61 days’ notice to the Company subject to the terms of the Private Placement

Warrants. The New Warrants are subject to a 9.99% beneficial ownership limitation, which prohibits the Selling Stockholder from exercising

any portion of the New Warrants if, following such exercise, the Selling Stockholder’s ownership of our Class A Common

Stock would exceed 9.99%. The address of the Selling Stockholder is c/o Armistice Capital, LLC, 510 Madison Avenue, 7th Floor, New

York, NY 10022. |

| (3) |

Assumes the sale of all shares offered by the Selling Stockholder pursuant to this prospectus. |

SECURITIES BEING REGISTERED AND DESCRIPTION

OF CAPITAL STOCK

We are registering for

resale by the Selling Stockholder from time to time of up to an aggregate of 12,410,858 shares of Class A Common Stock issuable upon

the exercise of the Warrants sold to the Selling Stockholder in a private placement offering consummated on September 3, 2024.

General

The authorized capital stock of the Company consists

of Common Stock, par value $0.01 per share. The total number of authorized shares of Common Stock of Trust Stamp is 50,000,000, all of

which are designated as Class A Common Stock.

The following summary description of our capital

stock is based on the provisions of our Third Amended & Restated Certificate of Incorporation, our amended and restated bylaws

and the applicable provisions of the Delaware General Corporation Law (the “DGCL”). This description is not

complete and is subject to, and qualified in its entirety by reference to our Third Amended & Restated Certificate of Incorporation

(our “A&R Certificate of Incorporation”) and our amended and restated bylaws (our “Bylaws”),

each of which is incorporated by reference as an exhibit to the registration statement of which this prospectus forms a part, and the

DGCL. You should read our A&R Certificate of Incorporation our Bylaws and the applicable provisions of the DGCL for a complete statement

of the provisions described below and for other provisions that may be important to you. For information on how to obtain copies of our

A&R Certificate of Incorporation and our Bylaws, see “Where You Can Find Additional Information.”

Common Stock

Pursuant to the Company’s A&R Certificate

of Incorporation, the Board of Directors of the Company has the right to designate shares of the Company’s Common Stock as either

Class A or Class B Common Stock. As of the date of this prospectus, all shares of Common Stock of the Company have been designated

as Class A Common Stock, and there is no issued (or designated) Class B Common Stock. The rights and preferences of each of

the Class A and Class B classes of Common Stock are summarized below.

Class A Common Stock

Voting Rights

Holders of shares of Class A Common Stock

are entitled to one vote for each on all matters submitted to a vote of the shareholders, including the election of directors.

Dividend Rights

Holders of each class of Common Stock are entitled

to receive dividends, as may be declared from time to time by the Board of Directors out of legally available funds as detailed in our

A&R Certificate of Incorporation. The Company has never declared or paid cash dividends on any of its capital stock and currently

does not anticipate paying any cash dividends after this offering or in the foreseeable future.

Liquidation Rights

In the event of a voluntary or involuntary liquidation,

dissolution, or winding up of the Company, the holders of Class A Common Stock are entitled to share ratably in the net assets legally

available for distribution to shareholders after the payment of all debts and other liabilities of the Company.

Exchange Rights

A holder of shares of Class A Common Stock

shares that is a bank, savings association, or a holding company (or an affiliate thereof) may at any time choose to exchange all or any

portion of shares of Class A Common Stock it holds for shares of Class B Common Stock. In the event of such an election, each

Class A share for which the holder makes such election shall be exchanged for a Class B share on a one-for-one basis without

the payment of any additional consideration. In the event of such an election, the Company will take all necessary corporate actions to

affect such exchange, the holder will surrender its certificate or certificates representing the shares of Class A Common Stock for

which it made such election, and such Shares of Class A Common Stock shall be cancelled.

Transfer Rights

There are no restrictions on the transfer of shares

of Class A Common Stock of the Company.

Class B Common Stock

The rights and preferences of the Company’s

Class B Common Stock are identical to those of the Class A Common Stock of the Company, except for as described below.

Voting Rights

Holders of shares of Class B Common Stock

have no voting rights with respect to such shares; provided that the holders of Class B Common Stock shall be entitled to vote (one

vote for each Class B share held) to the same extent that the holders of Shares of Class A Common Stock would be entitled to

vote on matters as to which non-voting equity interests are permitted to vote pursuant to 12 C.F.R. § 225.2(q)(2) (or a successor

provision thereto).

Transfer Rights

In the event a holder of shares of Class B

Common Stock transfers all or any portion of his or her shares of Class B Common Stock to a “Permitted Transferee” (as

defined below), such Permitted Transferee will be entitled to elect to exchange all or any portion of such Shares of Class B Common

Stock for Shares of Class A Common Stock on a one-for-one basis without the payment of any additional consideration. No fractional

shares may be so exchanged. In the event of such an election, the Company will take all necessary corporate actions to effect such exchange,

the holder will surrender its certificate or certificates representing the Shares of Class B Common Stock for which it made such

election, and such Shares of Class B Common Stock shall be cancelled. A “Permitted Transferee” is a person or entity

who acquires Shares of Class B Common Stock from a bank, savings association, or a holding company (or an affiliate thereof) in any

of the following transfers:

| |

(i) |

A widespread public distribution; |

| |

(ii) |

A private placement in which no one party acquires the right to purchase 2% or more of any class of voting securities of the Company |

| |

(iii) |

An assignment to a single party (e.g. a broker or investment banker) for the purpose of conducting widespread public distribution on behalf of a bank, savings association, or a holding company (or an affiliate thereof) and its transferees (other than transferees that are Permitted Transferees); or |

| |

(iv) |

To a party who would control more than 50% of the voting securities of the Company without giving effect to the Shares of Class B Common Stock transferred by a bank, savings association, or a holding company (or an affiliate thereof) and its transferees (other than transferees that are Permitted Transferees). |

Warrants

The Company has various warrants outstanding

that are exercisable for shares of its Class A Common Stock. See (i) the Company’s Annual Report on

Form 10-K for the year ended December 31, 2023 filed with the SEC on April 1, 2024; (ii) the Company’s Registration

Statement on Form S-3 filed with the SEC on April 11, 2024; (iii) the Company’s Registration Statement on Form S-3/A

filed with the SEC on April 15, 2024; (iv) the Company’s Quarterly Report on Form 10-Q for the three months ended

March 31, 2024 filed with the SEC on May 16, 2024; and (v) the Company’s Quarterly Report on Form 10-Q for

the three and six months ended June 30, 2024 filed with the SEC on August 13, 2024; (vi) the Company’s Current Report

on Form 8-K filed with the SEC on September 5, 2024, and Form 8-K/A filed on September 13, 2024; (vii) the Company’s

Current Report on Form 8-K filed with the SEC on September 13, 2024 for information on the outstanding warrants of the Company; and (viii)

the Company’s Quarterly Report on Form 10-Q for the three and nine months ended September 30, 2024 filed with the SEC

on November 15, 2024 (including the amendment to this Quarterly Report on Form 10-Q/A filed with the SEC on November 21, 2024 to correct

an error in the original report).

Anti-Takeover Effects of Our Certificate of Incorporation and Bylaws

Our A&R Certificate of Incorporation and Bylaws

contain certain provisions that could have the effect of delaying, deferring or discouraging another party from acquiring control of us.

These provisions, which are summarized below, could discourage takeovers, coercive or otherwise. These provisions are also designed, in

part, to encourage persons seeking to acquire control of us to negotiate first with our Board of Directors. We believe that the benefits

of increased protection of our potential ability to negotiate with an unfriendly or unsolicited acquirer outweigh the disadvantages of

discouraging a proposal to acquire us.

Authorized but Unissued Capital Stock

We have authorized but unissued shares of Common

Stock, and our Board of Directors may authorize the issuance of one or more series of preferred stock without stockholder approval. These

shares could be used by our Board of Directors to make it more difficult or to discourage an attempt to obtain control of us through a

merger, tender offer, proxy contest or otherwise.

Limits on Stockholder Action to Call a Special Meeting

Our Bylaws provide that special meetings of the

stockholders may be called only by our Board of Directors. A stockholder may not call a special meeting, which may delay the ability of

our stockholders to force consideration of a proposal or for holders controlling a majority of our capital stock to take any action, including

the removal of directors.

Our

A&R Certificate of Incorporation authorizes our Board of Directors to fill vacancies or newly created directorships.

If there is a vacancy on our Board of Directors,

the majority of the directors then in office may elect a successor to fill any vacancies or newly created directorships. This may also

discourage or deter a potential acquirer from conducting a solicitation of proxies to elect their own slate of directors or otherwise

attempt to obtain control of our Company.

Classified Board

of Directors

The A&R Certificate

of Incorporation provides for a classified board of directors of the Company, with the board divided into three classes. Class I

will hold office for a term expiring at the 2023 annual meeting of stockholders; Class II will hold office initially for a term expiring

at the 2024 annual meeting of stockholders; and Class III will hold office initially for a term expiring at the 2025 annual meeting

of stockholders. At each annual meeting following this initial classification and election, the successors to the class of directors whose

terms expire at that meeting would be elected for a term of office to expire at the third succeeding annual meeting after their election

and until their successors have been duly elected and qualified.

The Class I directors

were elected at the 2023 annual meeting for a term of office for a term expiring at the 2026 annual meeting.

PLAN OF DISTRIBUTION

The Selling Stockholder, which as used herein

includes certain donees, pledgees, transferees, or other successors-in-interest selling Warrant Shares or interests in Warrant Shares

received after the date of this prospectus from the Selling Stockholder as a gift, pledge, partnership distribution or other transfer,

may, from time to time, sell, transfer or otherwise dispose of any or all of their Warrant Shares on any stock exchange, market or trading

facility on which the shares are traded or in private transactions. These dispositions may be at fixed prices, at prevailing market prices

at the time of sale, at prices related to the prevailing market price, at varying prices determined at the time of sale, or at negotiated

prices.

The Selling Stockholder may use any one or more

of the following methods when disposing of shares or interests therein:

| |

· |

ordinary brokerage transactions and transactions in which the broker-dealer solicits purchasers; |

| |

· |

block trades in which the broker-dealer will attempt to sell the shares as agent, but may position and resell a portion of the block as principal to facilitate the transaction; |

| |

· |

purchases by a broker-dealer as principal and resale by the broker-dealer for its account; |

| |

· |

an exchange distribution in accordance with the rules of the applicable exchange; |

| |

· |

privately negotiated transactions; |

| |

· |

short sales effected after the date the registration statement of which this prospectus is a part is declared effective by the SEC; |

| |

· |

through the writing or settlement of options or other hedging transactions, whether through an options exchange or otherwise; |

| |

· |

broker-dealers may agree with the Selling Stockholder to sell a specified number of such shares at a stipulated price per share; |

| |

· |

a combination of any such methods of sale; and |

| |

· |

any other method permitted by applicable law. |

The Selling Stockholder may transfer the Warrant

Shares in other circumstances, in which case the transferees, pledgees, or other successors in interest will be the selling beneficial

owners for purposes of this prospectus.

In connection with the sale of our Class A

Common Stock or interests therein, the Selling Stockholder may enter into hedging transactions with broker-dealers or other financial

institutions, which may in turn engage in short sales of the Class A Common Stock in the course of hedging the positions they assume.

The Selling Stockholder may also sell shares of our Class A Common Stock short and deliver these securities to close out its short

positions, or loan or pledge the Class A Common Stock to broker-dealers that in turn may sell these securities. The Selling Stockholder

may also enter into option or other transactions with broker-dealers or other financial institutions or the creation of one or more derivative

securities which require the delivery to such broker-dealer or other financial institution of shares offered by this prospectus, which

shares such broker-dealer or other financial institution may resell pursuant to this prospectus (as supplemented or amended to reflect

such transaction).

The aggregate proceeds to the Selling Stockholder

from the sale of the Warrant Shares offered by them will be the sale price of the Warrant Shares less discounts or commissions, if any.

The Selling Stockholder reserves the right to accept and, together with its agents from time to time, to reject, in whole or in part,

any proposed purchase of Warrant Shares to be made directly or through agents. We will not receive any of the proceeds from this offering.

The Selling Stockholder also may resell all or

a portion of the shares in open market transactions in reliance upon Rule 144 under the Securities Act of 1933, provided that it

meets the criteria and conforms to the requirements of that rule.

The Selling Stockholder and any underwriters,

broker-dealers or agents that participate in the sale of the Class A Common Stock or interests therein may be “underwriters”

within the meaning of Section 2(11) of the Securities Act. Any discounts, commissions, concessions, or profit they earn on any resale

of the shares may be underwriting discounts and commissions under the Securities Act. If any of the Selling Stockholder is an “underwriter”

within the meaning of Section 2(11) of the Securities Act, it will be subject to the prospectus delivery requirements of the Securities

Act.

To the extent required, the shares of our Class A

Common Stock to be sold, the names of the Selling Stockholder, the respective purchase prices and public offering prices, the names of

any agents, dealer, or underwriter, any applicable commissions or discounts with respect to a particular offer will be set forth in an

accompanying prospectus supplement or, if appropriate, a post-effective amendment to the registration statement that includes this prospectus.

In order to comply with the securities laws of

some states, if applicable, the Warrant Shares may be sold in these jurisdictions only through registered or licensed brokers or dealers.

In addition, in some states the Warrant Shares may not be sold unless it has been registered or qualified for sale or an exemption from

registration or qualification requirements is available and is complied with.

We have advised the Selling Stockholder that the

anti-manipulation rules of Regulation M under the Exchange Act may apply to sales of shares in the market and to the activities of

the Selling Stockholder and their affiliates. In addition, to the extent applicable we will make copies of this prospectus (as it may

be supplemented or amended from time to time) available to the Selling Stockholder for the purpose of satisfying the prospectus delivery

requirements of the Securities Act. The Selling Stockholder may indemnify any broker-dealer that participates in transactions involving

the sale of the shares against certain liabilities, including liabilities arising under the Securities Act.

We have agreed to indemnify the Selling Stockholder

against liabilities, including liabilities under the Securities Act and the Exchange Act, relating to the registration of the shares offered

by this prospectus.

We have agreed with the Selling Stockholder to

keep the registration statement of which this prospectus constitutes a part effective at all times until no Selling Stockholder owns any

Warrants or Warrant Shares.

Our Class A Common Stock is listed on the

Nasdaq Capital Market under the symbol “IDAI.”

LEGAL MATTERS

The validity of the securities being offered hereby

will be passed upon for us by CrowdCheck Law, LLP. Additional legal matters may be passed upon for us or any underwriters, dealers or