false000104089600010408962024-05-132024-05-13

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (date of earliest event reported): May 13, 2024

Intellicheck, Inc.

(Exact name of registrant as specified in charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-15465 | | 11-3234779 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

| | | | | | | | |

200 Broadhollow Road, Suite 207, Melville, NY | | 11747 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (516) 992-1900

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A2. below):

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, $.001 par value | | IDN | | The NASDAQ Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 2.02. Results of Operations and Financial Condition

On May 13, 2024, Intellicheck, Inc. (the “Company”) issued a press release containing its results of operations for the first quarter ended March 31, 2024. A copy of the press release is attached to this Current Report on Form 8-K as Exhibit 99.1.

The information in this Report, including the exhibit, shall not be deemed to be “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that Section. It shall not be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such a filing.

Item 9.01. Exhibits.

(99) Exhibits

| | | | | | | | |

| Exhibit | | Description |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| Dated: May 13, 2024 | INTELLICHECK, INC. |

| |

| By: | /s/ Jeffrey Ishmael |

| Name: | Jeffrey Ishmael |

| Title: | Chief Financial Officer and Chief Operating Officer |

Exhibit Index

| | | | | | | | |

| Exhibit | | Description |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

Intellicheck Announces Record First Quarter 2024 Financial Results

Total Revenues Grew 10% Year Over Year

Continued Net Income and EBITDA Improvements

MELVILLE, NY – May 13, 2024 - Intellicheck, Inc. (Nasdaq: IDN), an industry-leading identity company delivering on-demand digital and physical identity validation solutions, today announced its financial results for the first quarter ended March 31, 2024. Total revenue for the first quarter ended March 31, 2024 grew 10% to $4,680,000 compared to $4,254,000 in the same period of 2023. SaaS revenue grew 9% and totaled $4,609,000 compared to $4,228,000 in the same period of 2023.

“Unrelenting incidents of identity theft and fraud have led to a significant new focus on security and growing consumer concerns. Not only must every business have the advanced technology in place to protect their bottom line, but they must be responsive to the clear message from consumers. They want better protection, they do not want to be burdened with time consuming, arduous processes to get that protection, and they will take their business elsewhere if they do not get what they want in a user-friendly process. As we continue to expand our presence within existing markets and enter new ones, our strategic focus is in on the path forward. We intend to continue to capitalize on the demand for consumer-engaging solutions with our distinctive, affordable technology that is hardware agnostic and features rapid, frictionless, and accurate identity verification that has no need for additional hardware and differentiates Intellicheck from other would-be solution providers,“ said Intellicheck CEO Bryan Lewis.

Gross profit as a percentage of revenues was 90.7%, in line with expectations, for the three months ended March 31, 2024 compared to 92.2% in the same period in 2023.

Operating expenses for the three months ended March 31, 2024, which consist of selling, general and administrative expenses and research and development expenses, decreased 10% to $4,768,000 for the first quarter of 2024 compared to $5,303,000 for the same period of 2023. Included within operating expenses for the first quarters of 2024 and 2023 were $344,000 and $682,000, respectively, of non-cash equity compensation expense.

Net loss for the three months ended March 31, 2024 improved by $945,000 to ($442,000) or ($0.02) per diluted share compared to net loss of ($1,387,000) or ($0.07) per diluted share for the same period in 2023.

Adjusted EBITDA (earnings before interest and other income, provision for income taxes, sales tax accruals, depreciation, amortization, stock-based compensation expense and certain non-recurring charges) improved by $441,000 to $(117,000) for the first quarter of 2024 as compared to ($558,000) for the same period of 2023. A reconciliation of adjusted EBITDA to net loss is provided in this release.

As of March 31, 2024, the Company had cash and cash equivalents in the form of U.S. Treasuries that totaled $9.2 million and stockholders’ equity totaled $17.2 million.

The unaudited financial results reported today do not consider any adjustments that may be required in connection with the completion of the Company’s review process and should be considered preliminary until Intellicheck files its Form 10-Q for the three months ended March 31, 2024.

Conference Call Information

The Company will hold an earnings conference call on May 13 at 4:30 p.m. ET/1:30 p.m. PT to discuss operating results. To listen to the earnings conference call, please dial 877-407-8037. For callers outside the U.S., please dial 201-689-8037.

A replay of the conference call will be available shortly after completion of the live event. To listen to the replay, please dial 877-660-6853 and use conference identification number 13745587. For callers outside the U.S., please dial 201-612-7415 and use conference identification number 13745587. The replay will be available beginning approximately three hours after the completion of the live event and will remain available until May 20, 2024

INTELLICHECK, INC.

UNAUDITED CONDENSED BALANCE SHEETS

MARCH 31, 2024 and DECEMBER 31, 2023

(in thousands except share amounts)

| | | | | | | | | | | |

| March 31,

2024 | | December 31,

2023 |

| | | |

| ASSETS | | | |

| CURRENT ASSETS: | | | |

| Cash and cash equivalents | $ | 9,239 | | | $ | 3,980 | |

| Short-term investments | — | | | 5,000 | |

Accounts receivable, net of allowance of $85 and $69 at March 31, 2024 and December 31, 2023, respectively | 2,744 | | | 4,703 | |

| Other current assets | 654 | | | 692 | |

| Total current assets | 12,637 | | | 14,375 | |

| | | |

| PROPERTY AND EQUIPMENT, NET | 628 | | | 666 | |

| GOODWILL | 8,102 | | | 8,102 | |

| INTANGIBLE ASSETS, NET | 1,157 | | | 575 | |

| OTHER ASSETS | 91 | | | 90 | |

| Total assets | $ | 22,615 | | | $ | 23,808 | |

| | | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | | | |

| | | |

| CURRENT LIABILITIES: | | | |

| Accounts payable | $ | 1,121 | | | $ | 884 | |

| Accrued expenses | 2,657 | | | 3,245 | |

| Equity awards liability | — | | | 4 | |

| Liability for shares withheld | 190 | | | 190 | |

| Deferred revenue, current portion | 1,469 | | | 2,209 | |

| Total current liabilities | 5,437 | | | 6,532 | |

| | | |

| Total liabilities | 5,437 | | | 6,532 | |

| | | |

| | | |

| STOCKHOLDERS’ EQUITY: | | | |

Preferred stock - $0.01 par value; 30,000 shares authorized; Series A convertible preferred stock, zero shares issued and outstanding at March 31, 2024 and December 31, 2023, respectively | — | | | — | |

Common stock - $.001 par value; 40,000,000 shares authorized; 19,404,561 and 19,354,335 shares issued and outstanding at March 31, 2024 and December 31, 2023, respectively | 19 | | | 19 | |

| Additional paid-in capital | 151,166 | | | 150,822 | |

| Accumulated deficit | (134,007) | | | (133,565) | |

| Total stockholders’ equity | 17,178 | | | 17,276 | |

| | | |

| Total liabilities and stockholders’ equity | $ | 22,615 | | | $ | 23,808 | |

INTELLICHECK, INC.

UNAUDITED CONDENSED STATEMENTS OF OPERATIONS

FOR THE THREE MONTHS ENDED MARCH 31, 2024 AND 2023

(in thousands except share and per share amounts)

| | | | | | | | | | | |

| Three months ended March 31, |

| 2024 | | 2023 |

| | | |

| REVENUES | $ | 4,680 | | | $ | 4,254 | |

| COST OF REVENUES | (435) | | | (332) | |

| Gross profit | 4,245 | | | 3,922 | |

| | | |

| OPERATING EXPENSES | | | |

| Selling, general and administrative | 3,949 | | | 3,995 | |

| Research and development | 819 | | | 1,308 | |

| Total operating expenses | 4,768 | | | 5,303 | |

| | | |

| Loss from operations | (523) | | | (1,381) | |

| | | |

| OTHER INCOME | | | |

| Interest and other income | 83 | | | 1 | |

| Total other income | 83 | | | 1 | |

| | | |

| Net loss before provision for income taxes | (440) | | | (1,380) | |

Provision for income taxes | 2 | | | 7 | |

| | | |

| Net loss | $ | (442) | | | $ | (1,387) | |

| | | |

| PER SHARE INFORMATION | | | |

| Loss per common share - | | | |

| Basic/Diluted | $ | (0.02) | | | $ | (0.07) | |

| | | |

| Weighted average common shares used in computing per share amounts - | | | |

| Basic/Diluted | 19,404,561 | | 19,088,752 |

INTELLICHECK, INC.

UNAUDITED CONDENSED STATEMENTS OF STOCKHOLDERS’ EQUITY

FOR THE THREE MONTHS ENDED MARCH 31, 2024 AND 2023

(in thousands, except number of shares)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended March 31, 2024 |

| Common Stock | | Additional

Paid-in

Capital | | Accumulated

Deficit | | Total

Stockholders’

Equity |

| Shares | | Amount | | |

| | | | | | | | | |

| BALANCE, December 31, 2023 | 19,354,335 | | $ | 19 | | | $ | 150,822 | | | $ | (133,565) | | | $ | 17,276 | |

| | | | | | | | | |

| Stock-based compensation | – | | – | | | 344 | | | – | | | 344 | |

| Issuance of shares for vested restricted stock grants | 50,226 | | – | | | – | | | – | | | – | |

| Net loss | – | | – | | | – | | | (442) | | | (442) | |

| BALANCE, March 31, 2024 | 19,404,561 | | $ | 19 | | | $ | 151,166 | | | $ | (134,007) | | | $ | 17,178 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended March 31, 2023 |

| Common Stock | | Additional

Paid-in

Capital | | Accumulated

Deficit | | Total

Stockholders’

Equity |

| Shares | | Amount | | |

| | | | | | | | | |

| BALANCE, December 31, 2022 | 18,957,366 | | $ | 19 | | | $ | 149,233 | | | $ | (131,585) | | | $ | 17,667 | |

| | | | | | | | | |

| Stock-based compensation | – | | – | | | 642 | | | – | | | 642 | |

| Issuance of shares for vested restricted stock grants | 258,497 | | – | | | – | | | – | | | – | |

| Net loss | – | | – | | | – | | | (1,387) | | | (1,387) | |

| BALANCE, March 31, 2023 | 19,215,863 | | $ | 19 | | | $ | 149,875 | | | $ | (132,972) | | | $ | 16,922 | |

INTELLICHECK, INC.

UNAUDITED CONDENSED STATEMENTS OF CASH FLOWS

FOR THE THREE MONTHS ENDED MARCH 31, 2024 AND 2023

| | | | | | | | | | | |

| Three months ended March 31, |

| 2024 | | 2023 |

| (in thousands) |

| | | |

| CASH FLOWS FROM OPERATING ACTIVITIES: | | | |

| Net loss | $ | (442) | | | $ | (1,387) | |

Adjustments to reconcile net loss to net cash provided by operating activities | | | |

| Depreciation and amortization | 72 | | | 70 | |

| Stock-based compensation | 334 | | | 682 | |

| Allowance for credit losses | 16 | | | 10 | |

| Change in accrued interest and accretion of discount on short-term investments | — | | | (1) | |

| Changes in assets and liabilities: | | | |

| Decrease (Increase) in accounts receivable | 1,944 | | | (900) | |

| Decrease (Increase) in other current assets and long-term assets | 38 | | | (145) | |

| (Decrease) Increase in accounts payable and accrued expenses | (353) | | | 783 | |

| (Decrease) Increase in deferred revenue | (740) | | | 1,121 | |

| Net cash provided by operating activities | 869 | | | 233 | |

| | | |

| | | |

| CASH FLOWS FROM INVESTING ACTIVITIES: | | | |

| Purchases of property and equipment | (9) | | | (17) | |

| Proceeds from maturity of short-term investments | 5,000 | | | — | |

Software development costs | (601) | | | — | |

| Net cash provided by (used in) investing activities | 4,390 | | | (17) | |

| | | |

| CASH FLOWS FROM FINANCING ACTIVITIES: | | | |

| Proceeds of insurance financing arrangement | — | | | 49 | |

| Repayment of insurance financing arrangements | — | | | (106) | |

Net cash provided by (used in) financing activities | — | | | (57) | |

| | | |

Net increase in cash | 5,259 | | | 159 | |

| | | |

| CASH, beginning of period | 3,980 | | | 5,196 | |

| | | |

| CASH, end of period | $ | 9,239 | | | $ | 5,355 | |

| | | |

| Supplemental disclosures of cash flow information: | | | |

| Cash paid for interest | $ | — | | | $ | 1 | |

Adjusted EBITDA

We use Adjusted EBITDA as a non-GAAP financial performance measurement. Adjusted EBITDA is calculated by adjusting net loss for certain reductions such as interest and other income and certain addbacks such as income taxes, sales tax accruals, depreciation, amortization, and stock-based compensation expense. Adjusted EBITDA is provided to investors to supplement the results of operations reported in accordance with GAAP. Management believes that Adjusted EBITDA provides an additional tool for investors to use in comparing our financial results with other companies that also use Adjusted EBITDA in their communications to investors. By excluding non-cash charges such as sales tax accruals,, amortization, depreciation, and stock-based compensation, as well as non-operating charges for interest and income taxes, investors can evaluate our operations and can compare the results on a more consistent basis to the results of other companies. In addition, Adjusted EBITDA is one of the primary measures management uses to monitor and evaluate financial and operating results.

We consider Adjusted EBITDA to be an important indicator of our operational strength and performance of our business and a useful measure of our historical operating trends. However, there are significant limitations to the use of Adjusted EBITDA since it excludes, interest and other income, stock-based compensation expense, all of which impact our profitability, as well as depreciation and amortization related to the use of long-term assets which benefit multiple periods. We believe that these limitations are compensated by providing Adjusted EBITDA only with GAAP net loss and clearly identifying the difference between the two measures. Consequently, Adjusted EBITDA should not be considered in isolation or as a substitute for net loss presented in accordance with GAAP. Adjusted EBITDA as defined by us may not be comparable with similarly named measures provided by other companies.

The reconciliation of GAAP net loss to Non-GAAP Adjusted EBITDA is as follows:

| | | | | | | | | | | |

| Three Months Ended March 31, |

| 2024 | | 2023 |

| (in thousands) |

| | | |

| Net loss | $ | (442) | | | $ | (1,387) | |

| Reconciling items: | | | |

| Provision for income taxes | 2 | | | 7 | |

Interest and other income | (83) | | | (1) | |

| Sales tax accrual | — | | | 71 | |

| Depreciation and amortization | 72 | | | 70 | |

| Stock-based compensation including liability classified awards | 334 | | | 682 | |

| | | |

| Adjusted EBITDA | $ | (117) | | | $ | (558) | |

Contact

Investor Relations: Gar Jackson (949) 873-2789

Media and Public Relations: Sharon Schultz (302) 539-3747

About Intellicheck

Intellicheck (Nasdaq: IDN) is an identity company that delivers on-demand digital identity validation solutions for KYC, fraud, and age verification needs. Intellicheck validates both digital and physical identities for financial services, fintech companies, BNPL providers, e-commerce and retail commerce businesses, law enforcement and government agencies across North America. Intellicheck can be used through a mobile device, a browser, or a retail point-of-scale scanner. For more information on Intellicheck, visit us on the web and follow us on follow us on LinkedIn, Twitter, Facebook, and YouTube.

Safe Harbor Statement

Statements in this news release about Intellicheck’s future expectations, including: the advantages of our products, future demand for Intellicheck’s existing and future products, whether revenue and other financial metrics will improve in future periods, whether Intellicheck will be able to execute its turn-around plan or whether successful execution of the plan will result in increased revenues, whether sales of our products will continue at historic levels or increase, whether brand value and market awareness will grow, whether the Company can leverage existing partnerships or enter into new ones, whether there will be any impact on sales and revenues

due to an epidemic, pandemic or other public health issue and all other statements in this release, other than historical facts, are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 (PSLRA). These statements, which express management’s current views concerning future events, trends, contingencies or results, appear at various places in this release and use words like “anticipate,” “assume,” “believe,” “continue,” “estimate,” “expect,” “forecast,” “future,” “intend,” “plan,” “potential,” “predict,” “project,” “sense”, “strategy,” “target” and similar terms, and future or conditional tense verbs like “could,” “may,” “might,” “should,” “will” and “would” are forward-looking statements within the meaning of the PSLRA. This statement is included for the express purpose of availing Intellicheck, Inc. of the protections of the safe harbor provisions of the PSLRA. It is important to note that actual results and ultimate corporate actions could differ materially from those in such forward-looking statements based on such factors as: market acceptance of our products and the presently anticipated growth in the commercial adoption of our products and services; our ability to successfully transition pilot programs into formal commercial scale programs; continued adoption of our SaaS product offerings; changing levels of demand for our current and future products; our ability to reduce or maintain expenses while increasing sales; our ability to successfully expand the sales of our products and services into new areas including health care and auto dealerships; customer results achieved using our products in both the short and long term; success of future research and development activities; the impact of inflation on our business and customer’s businesses and any effect this has on economic activity with our customer’s businesses; our ability to successfully market and sell our products, any delays or difficulties in our supply chain coupled with the typically long sales and implementation cycle for our products; our ability to enforce our intellectual property rights; changes in laws and regulations applicable to the our products; our continued ability to access government-provided data; the risks inherent in doing business with the government including audits and contract cancellations; liability resulting from any security breaches or product failure, together with other risks detailed from time to time in our reports filed with the SEC. We do not assume any obligation to update the forward-looking information.

v3.24.1.1.u2

Cover

|

May 13, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

May 13, 2024

|

| Entity Registrant Name |

Intellicheck, Inc.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-15465

|

| Entity Tax Identification Number |

11-3234779

|

| Entity Address, Address Line One |

200 Broadhollow Road

|

| Entity Address, Address Line Two |

Suite 207

|

| Entity Address, City or Town |

Melville

|

| Entity Address, State or Province |

NY

|

| Entity Address, Postal Zip Code |

11747

|

| City Area Code |

516

|

| Local Phone Number |

992-1900

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $.001 par value

|

| Trading Symbol |

IDN

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity Central Index Key |

0001040896

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

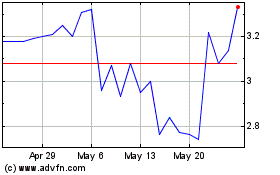

Intellicheck (NASDAQ:IDN)

Historical Stock Chart

From Apr 2024 to May 2024

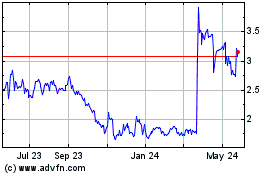

Intellicheck (NASDAQ:IDN)

Historical Stock Chart

From May 2023 to May 2024