Inception Growth Acquisition Limited (NASDAQ: IGTA), a

publicly traded special purpose acquisition company

(“

Inception Growth”), and AgileAlgo Pte Ltd.

(“

AgileAlgo”), a maker of enterprise-grade natural

language code generator for machine-learning and data management

platforms, announced today the signing of an amended and restated

non-binding letter of intent (“

Amended

LOI”), which amends, restates and supersedes the

June 6, 2023 letter of intent previously signed by the parties.

Transaction Overview

Under the terms of the Amended LOI, Inception

Growth and AgileAlgo would become a combined entity, with

AgileAlgo’s existing equity holders rolling 100% of their equity

into the combined public company. Inception Growth expects to

announce additional details regarding the proposed business

combination if a definitive merger agreement is executed.

Completion of a business combination with

AgileAlgo is subject to, among other matters, the completion of due

diligence, the negotiation of a definitive agreement providing for

the transaction, satisfaction of the conditions negotiated therein

and approval of the transaction by the board and shareholders of

both Inception Growth and AgileAlgo. There can be no assurance that

a definitive agreement will be entered into or that the proposed

transaction will be consummated on the terms or timeframe currently

contemplated, or at

all. About AgileAlgo Pte

Ltd.

AgileAlgo is a maker of enterprise-grade natural

language code generator for machine-learning and data management

platforms. It utilizes Generative-Artificial Intelligence (“AI”)

techniques to automate AI codes development and scaling to other

technology stacks. AgileAlgo intends to grow and acquire IT

consulting practices as well as work with large-scale project

owners to drive down complexity, time and cost of producing

software scripts and code, ultimately transforming the global

workforce which is now still heavily reliant on offshoring costs

and capability. Porche Capital Ltd is acting as AgileAlgo’s

business advisor in the proposed business combination.

For more information,

visit https://www.agilealgo.ai/.

About Inception Growth Acquisition

Limited

Inception Growth is a blank check company whose

business purpose is to effect a merger, capital stock exchange,

asset acquisition, stock purchase, reorganization, or similar

business combination with one or more businesses or entities.

Additional Information and Where to Find

It

If a legally binding definitive agreement with

respect to the proposed business combination is executed, Inception

Growth intends to file with the U.S. Securities and Exchange

Commission (the “SEC”) a registration statement on

Form F-4, which will include a preliminary proxy

statement/prospectus (a “Proxy Statement/Prospectus”). A definitive

Proxy Statement/Prospectus will be mailed to Inception Growth’s

stockholders as of a record date to be established for voting on

the proposed business combination. Inception Growth may also

file other relevant documents regarding the proposed business

combination with the SEC. Stockholders will also be able to

obtain copies of the registration statement and the

preliminary and definitive Proxy Statement/Prospectus (if and

when available) and all other relevant documents that are filed or

that will be filed with the SEC by Inception Growth, without

charge, at the SEC’s website at www.sec.gov or by

directing a request to: Inception Growth Acquisition Limited, 875

Washington Street, New York, NY 10014.

This communication may be deemed to be offering

or solicitation material in respect of the proposed business

combination, which will be submitted to the shareholders of

Inception Growth for their consideration. Inception Growth urges

investors, shareholders and other interested persons to carefully

read, when available, the preliminary and definitive Proxy

Statement/Prospectus as well as other documents filed or that

will be filed with the SEC (including any amendments or

supplements to the Proxy Statement/Prospectus, as applicable), in

each case, before making any investment or voting decision with

respect to the proposed business combination, because these

documents will contain important information about Inception

Growth, AgileAlgo, and the proposed business combination.

No Offer or Solicitation

This release shall not constitute an offer to

sell, or a solicitation of an offer to buy, or a recommendation to

purchase, any securities in any jurisdiction, or the solicitation

of any vote, consent or approval in any jurisdiction in respect of

the proposed business combination, nor shall there be any sale,

issuance or transfer of any securities in any jurisdiction where,

or to any person to whom, such offer, solicitation or sale may be

unlawful under the laws of such jurisdiction. This release does not

constitute either advice or a recommendation regarding any

securities. No offering of securities shall be made except by means

of a prospectus meeting the requirements of the Securities Act of

1933, as amended, or an exemption therefrom.

Forward-Looking Statements

The disclosure herein includes certain

statements that are not historical facts but are forward-looking

statements for purposes of the safe harbor provisions under the

United States Private Securities Litigation Reform Act of 1995.

Forward-looking statements generally are accompanied by words such

as “believe,” “may,” “will,” “estimate,” “continue,” “anticipate,”

“intend,” “expect,” “should,” “would,” “plan,” “project,”

“forecast,” “predict,” “potential,” “seem,” “seek,” “future,”

“outlook,” and similar expressions that predict or indicate future

events or trends or that are not statements of historical matters,

but the absence of these words does not mean that a statement is

not forward looking. These forward-looking statements include, but

are not limited to, (1) statements regarding estimates and

forecasts of other financial, performance and operational metrics

and projections of market opportunity; (2) references with respect

to the anticipated benefits of the proposed business combination,

the addressable market and changes in the market for AgileAlgo’s

services and technology, and expansion plans and opportunities; (3)

the projected technological developments of AgileAlgo, (4) current

and future potential commercial and customer relationships; (5) the

ability to operate efficiently at scale; (6) expectations related

to the terms and timing of the proposed business combination; and

(7) the satisfaction of the closing conditions to the proposed

business combination. These statements are based on various

assumptions, whether or not identified in this release, and on the

current expectations of Inception Growth’s and AgileAlgo’s

management and are not predictions of actual performance. These

forward-looking statements are provided for illustrative purposes

only and are not intended to serve as, and must not be relied on by

any investor as, a guarantee, an assurance, a prediction or a

definitive statement of fact or probability. Actual events and

circumstances are difficult or impossible to predict and will

differ from assumptions. Many actual events and circumstances are

beyond the control of AgileAlgo. These forward-looking statements

are subject to a number of risks and uncertainties, that could

cause actual results to differ materially from expected results.

Most of these factors are outside the control of Inception Growth

and are difficult to predict. Factors that may cause such

differences include, but are not limited to: (1) the occurrence of

any event, change or other circumstances that could give rise to

the termination of the proposed business combination; (2) the

inability to consummate the proposed business combination in a

timely manner or at all, including due to failure to obtain

approval of the stockholders of Inception Growth or other

conditions to the closing in the business combination agreement,

which may adversely affect the price of Inception Growth’s

securities; (3) delays in obtaining or the inability to obtain any

necessary regulatory approvals required to complete the proposed

business combination; (4) the risk that the proposed business

combination may not be completed by Inception Growth’s business

combination deadline and the potential failure to obtain an

extension of the business combination deadline if sought by

Inception Growth; (5) the ability to maintain the listing of

Inception Growth’s securities on a national securities exchange;

(6) the inability to obtain or maintain the listing of the combined

company’s securities on the Nasdaq Stock Market LLC following the

proposed business combination; (7) the risk that the proposed

business combination disrupts current plans and operations as a

result of the announcement and consummation of the proposed

business combination; (8) the ability to recognize the anticipated

benefits of the proposed business combination and to achieve its

commercialization and development plans, and identify and realize

additional opportunities, which may be affected by, among other

things, competition, the ability of AgileAlgo to grow and manage

growth economically and hire and retain key employees; (9) costs

related to the proposed business combination; (10) changes in

applicable laws or regulations, and AgileAlgo’s ability to comply

with such laws and regulations; (11) the effect of the COVID-19

pandemic on Inception Growth or AgileAlgo and their ability to

consummate the proposed business combination; (12) the outcome of

any legal proceedings that may be instituted against AgileAlgo or

against Inception Growth related to the proposed business

combination; (13) the enforceability of AgileAlgo’s intellectual

property, including any potential infringement on the intellectual

property rights of others, (14) the risk of downturns in the highly

competitive industry in which AgileAlgo operates; (15) the

possibility that Inception Growth or AgileAlgo may be adversely

affected by other economic, business, and/or competitive factors;

and (16) other risks and uncertainties to be identified in the

Registration/Proxy Statement (when available) relating to the

proposed business combination, including those under “Risk Factors”

therein, and in other filings with the SEC made by Inception Growth

or AgileAlgo, and in those documents that Inception Growth has

filed, or will file, with the SEC. If any of these risks

materialize or our assumptions prove incorrect, actual results

could differ materially from the results implied by these

forward-looking statements. The risks and uncertainties above are

not exhaustive, and there may be additional risks that neither

Inception Growth nor AgileAlgo presently know or that Inception

Growth and AgileAlgo currently believe are immaterial that could

also cause actual results to differ from those contained in the

forward-looking statements. In addition, forward looking statements

reflect Inception Growth’s and AgileAlgo’s expectations, plans or

forecasts of future events and views as of the date of this report.

Inception Growth and AgileAlgo anticipate that subsequent events

and developments will cause Inception Growth’s and AgileAlgo’s

assessments to change. However, while Inception Growth and

AgileAlgo may elect to update these forward-looking statements at

some point in the future, Inception Growth and AgileAlgo

specifically disclaim any obligation to do so. These

forward-looking statements should not be relied upon as

representing Inception Growth’s and AgileAlgo’s assessments as of

any date subsequent to the date of this release. Accordingly, undue

reliance should not be placed upon the forward-looking

statements.

Contacts

Cheuk Hang ChowChief Executive OfficerInception Growth

Acquisition Limitedcheukhangchow@inceptiongrowth1.com(315)

636-6638

Tony PorcheronChief Executive OfficerPorche Capital

Ltdtporcheron@porchecapital.com353 (0) 8706 50447

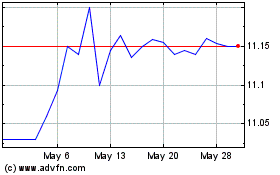

Inception Growth Acquisi... (NASDAQ:IGTA)

Historical Stock Chart

From Nov 2024 to Dec 2024

Inception Growth Acquisi... (NASDAQ:IGTA)

Historical Stock Chart

From Dec 2023 to Dec 2024