Move sharpens ISG’s focus, strengthens

balance sheet and immediately enhances shareholder value

Information Services Group (ISG) (Nasdaq: III), a leading global

technology research and advisory firm, said today it has sold its

automation unit to UST, a leading digital transformation solutions

company, for $27 million in an all-cash transaction, with a portion

of the proceeds placed in escrow, to be released contingent upon

meeting certain conditions.

The unit offers robotic process automation (RPA) software

implementation and licensing services. It was established as a

startup business in 2017 to meet the emerging demand for RPA.

ISG Chairman and CEO Michael P. Connors said the sale is a

“win-win” for both ISG and UST.

“With this sale, ISG emerges as a stronger, more focused firm,

devoted to serving our clients by leveraging our towering strengths

in sourcing, powered by our AI-driven ISG Tango™ platform; digital

transformation, including enterprise change and

training-as-a-service; AI advisory, technology research and

supplier governance,” Connors said. “In addition, the cash proceeds

of the sale immediately strengthen our balance sheet and improve

shareholder value.

“At the same time, our former automation unit will benefit from

being part of a larger technology services organization in UST, one

that we have known and respected for years, with the resources and

scale to compete in the intelligent automation space,” Connors

said.

Commenting on UST’s acquisition, Sajesh Gopinath, general

manager and go-to-market leader, UST SmartOps, said: “This

strategic investment in the intelligent automation space solidifies

UST’s position as a market leader in a dynamic sector that has the

potential to transform industries, enhance productivity, improve

customer experiences, and generate new revenue streams. By

onboarding experienced intelligent automation consultants and

capabilities, UST is strengthening its standing in a competitive

market and broadening its partner ecosystem to position itself for

future growth and meet the emerging needs of our clients.”

Connors said ISG decided to exit the business because its

implementation and software licensing activities no longer were a

strategic fit with ISG’s position as an independent, third-party

advisory firm.

ISG received $20 million in cash at closing with the remaining

$7 million held in escrow. Of this amount, $4 million is to be

released from escrow over the next 90 days as certain contractual

conditions with clients are met, and the remaining $3 million is to

be released after the end of the first quarter of 2025, based on

the achievement of certain revenue targets. Net proceeds from the

transaction are expected to provide the opportunity to reduce debt

and return capital to shareholders.

To reflect the impact of the divestiture activity, ISG said it

is updating its third-quarter guidance, targeting revenues in the

range of $60 million to $61 million, and adjusted EBITDA (a

non-GAAP measure defined below under “Non-GAAP Financial Measures”)

in the range of $6.5 million to $7.0 million.

Sett & Lucas served as financial advisor to ISG, and Katten

Muchin Rosenman LLP served as legal advisor.

ISG will file a Form 8-K with the Securities and Exchange

Commission in connection with the sale.

Conference Call

ISG will hold a conference call today, Wednesday, October 2, at

4:30 p.m., US ET, to discuss the transaction. The call can be

accessed by dialing (800) 715-9871, or, for international

callers, by dialing +1 (646) 307-1963. The access code is

3455640. A recording of the call will be available on ISG’s

investor relations page for approximately four weeks following the

call.

Forward-Looking Statements

This communication contains “forward-looking statements” which

represent the current expectations and beliefs of management of ISG

concerning future events and their potential effects. Statements

contained herein including words such as “anticipate,” “believe,”

“contemplate,” “plan,” “estimate,” “target,” “expect,” “intend,”

“will,” “continue,” “should,” “may,” and other similar expressions

are “forward-looking statements” under the Private Securities

Litigation Reform Act of 1995. These forward-looking statements are

not guarantees of future results and are subject to certain risks

and uncertainties, many of which are beyond the control of ISG, its

directors and its management, that could cause actual results to

differ materially from those anticipated, including, without

limitation: (1) the occurrence of any event, change or other

circumstance that could affect ISG’s rights or obligations under

the Share Purchase Agreement governing the divestiture, (2) risks

related to the disruption of management’s attention from ISG’s

ongoing business operations due to the divestiture and ISG’s

obligations under the Share Purchase Agreement, (3) risks that the

divestiture may disrupt current plans and operations and any

potential difficulties in employee retention as a result and (4)

the effect of the announcement of the transaction on the ISG’s

relationships with its customers and suppliers and on its business

generally. Certain of these and other applicable risks, cautionary

statements and factors that could cause actual results to differ

from ISG’s forward-looking statements are included in ISG’s filings

with the U.S. Securities and Exchange Commission. ISG undertakes no

obligation to update or revise any forward-looking statements to

reflect subsequent events or circumstances.

Non-GAAP Financial Measures

ISG reports all financial information required in accordance

with U.S. generally accepted accounting principles (GAAP). In its

updated third-quarter guidance appearing in this release, ISG has

presented both GAAP financial results as well as non-GAAP

information. ISG believes that evaluating its ongoing operating

results will be enhanced if it discloses certain non-GAAP

information. These non-GAAP financial measures exclude non-cash and

certain other special charges that many investors believe may

obscure the user’s overall understanding of ISG’s current financial

performance and the Company’s prospects for the future. ISG

believes that these non-GAAP measures provide useful information to

investors because they improve the comparability of the financial

results between periods and provide for greater transparency of key

measures used to evaluate the Company’s performance.

In this press release, ISG provides adjusted EBITDA (defined as

net income, plus interest, taxes, depreciation and amortization,

foreign currency transaction gains/losses, non-cash stock

compensation, interest accretion associated with contingent

consideration, acquisition-related costs, and severance,

integration and other expense), which is a non-GAAP measure that

the Company believes provide useful information to both management

and investors by excluding certain expenses, which management

believes are not indicative of ISG’s core operations. This non-GAAP

measure is used by ISG to evaluate the Company’s business

strategies and management’s performance.

Management believes this information facilitates comparison of

underlying results over time. Non-GAAP financial measures, when

presented, are reconciled to the most closely applicable GAAP

measure. Non-GAAP measures are provided as additional information

and should not be considered in isolation or as a substitute for

results prepared in accordance with GAAP. A reconciliation of the

forward-looking non-GAAP estimates contained herein to the

corresponding GAAP measures is not being provided, due to the

unreasonable efforts required to prepare it.

About UST

Since 1999, UST has worked side by side with the world's best

companies to make a powerful impact through transformation. Powered

by technology, inspired by people, and led by our purpose, we

partner with our clients from design to operation. Our digital

solutions, proprietary platforms, engineering expertise, and

innovation ecosystem turn core challenges into impactful,

disruptive solutions. With deep industry knowledge and a

future-ready mindset, we infuse innovation and agility into our

clients' organizations—delivering measurable value and positive

lasting change for them, their customers, and communities around

the world. Together, with 30,000+ employees in 30+ countries, we

build for boundless impact—touching billions of lives in the

process. Visit us at www.UST.com.

About ISG

ISG (Information Services Group) (Nasdaq: III) is a leading

global technology research and advisory firm. A trusted business

partner to more than 900 clients, including more than 75 of the

world’s top 100 enterprises, ISG is committed to helping

corporations, public sector organizations, and service and

technology providers achieve operational excellence and faster

growth. The firm specializes in digital transformation services,

including AI, cloud and data analytics; sourcing advisory; managed

governance and risk services; network carrier services; strategy

and operations design; change management; market intelligence and

technology research and analysis. Founded in 2006, and based in

Stamford, Conn., ISG employs more than 1,600 digital-ready

professionals operating in more than 20 countries—a global team

known for its innovative thinking, market influence, deep industry

and technology expertise, and world-class research and analytical

capabilities based on the industry’s most comprehensive marketplace

data. For more information, visit www.isg-one.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241002053674/en/

Press Contact: Will Thoretz, ISG +1 203 517 3119

will.thoretz@isg-one.com

Investor Contact: Michael Sherrick +1 203 517 3104

michael.sherrick@isg-one.com

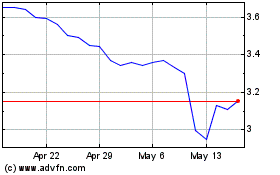

Information Services (NASDAQ:III)

Historical Stock Chart

From Oct 2024 to Nov 2024

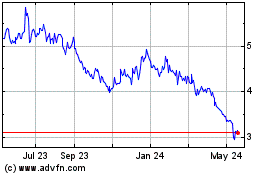

Information Services (NASDAQ:III)

Historical Stock Chart

From Nov 2023 to Nov 2024