InterCure Announces FY2023 Results: Revenue of NIS 356 million and Adjusted EBITDA of NIS 61 million

01 May 2024 - 10:27PM

Business Wire

- Revenues during 2023 reached NIS 356 million, alongside an

Adjusted EBITDA1 of NIS 61 million (Approximately 17% of revenues),

as compared to an Adjusted EBITDA of NIS 51 million in our

preliminary results.

- The Company’s cash2 on hand was NIS 111 million. Both Q3&Q4

ended with positive EBITDAs and profit from operations3 and

represents InterCure’s fourteenth & fifteenth consecutive

quarter of profitability4.

- Revenues for H2 2023 were affected by damages caused by the

terrorist attack on October 7, 2023 and the war in Gaza.

- InterCure is entitled to full compensation from the Israeli

authorities for all direct and indirect damages caused to the

Southern Facility. To date, InterCure has already received tens of

millions of NIS as partial advanced payments from the Israeli

authorities.

- Expects to launch its first products in Germany in the coming

months and continues to closely watch developments surrounding

Cannabis rescheduling in the U.S.

- Expects sequential double digit quarterly growth during

2024.

InterCure Ltd. (NASDAQ: INCR) (TASE: INCR)

("InterCure" or the "Company") today announced

results for the full year ending December 31, 2023. All amounts are

expressed in New Israeli Shekels (NIS), unless otherwise noted.

FY2023 Financial Highlights and Milestones

- Annual revenue for the year ending December 31, 2023 was NIS

356 million, and the adjusted EBITDA for the year ending December

31, 2023 was NIS 61 million, approximately 17% of revenues, as

compared to an Adjusted EBITDA of NIS 51 million in our preliminary

results.

- The company's operating profit was NIS 26 million (before

reductions of goodwill and fixed assets of NIS 68 million mainly

due to war damage).

- Both Q3&Q4 2023 represents the fourteenth & fifteenth

consecutive quarters of profitability for InterCure5, with both

Q3&Q4 2023 showing positive Adjusted EBITDA and profit from

operations6.

- Expanded the Company's branded products portfolio, launching

more than 40 new GMP SKUs during 2023.

- Continued expansion of the Company's dedicated medical cannabis

pharmacy chain to a of total 24 active locations as of today. As of

October 2023, the Company holds 100% of Cannolam LTD including the

full rights to Cookies™ international agreements, alongside

Israel’s largest chain of dedicated medical cannabis pharmacies,

Givol™.

- Since October 7, 2023, war situation was declared by the

Israeli government. As of this date, there is limited access to the

Company’s Southern Facility, and parts of the facility are being

used by the Israel Defense Forces (the "IDF"), including, among

others, the IDF’s medical corps.

- According to Israeli Law, due to the location of the Company’s

Southern Facility, the company is entitled to full compensation for

all the direct and indirect damages caused to the Southern Facility

by the terrorist attack and the war in Gaza. The Company has begun

the process of restoring the Southern Facility, and to date, the

Company has already received tens of millions of NIS as advance

payments from the Israeli authorities in relation to such

compensation.

- The October 7th terror attack effected the company’s revenues

in H2 2023, however, the Company expects to resume sequential

quarterly growth during 2024.

- Continued execution of the Company's global expansion plan. As

recently announced, the Company plans to launch its first products

in Germany in the coming months, following the groundbreaking

cannabis reform passed.

Alexander Rabinovitch, CEO of InterCure Noted: "Despite

extraordinary external challenges this year, InterCure showed solid

performance, achieving our fifteenth straight quarter of

profitability. This consistent performance highlights the

commitment of our team and the effectiveness of the Company’s

operational strategy. As the global landscape for pharmaceutical

cannabis evolves, we are encouraged by the latest FDA

recommendations and the optimistic outlook regarding rescheduling

of Cannabis in the U.S. Our leadership in the field, dedication to

expanding internationally, enhancing our product offerings, and our

focus on adding value for our customers and investors remain

pivotal to our ongoing success and growth."

InterCure is thankful to its managers and employees for their

commitment and to its strategic partners in Israel and worldwide

who stand with us during this time of war.

About InterCure (dba Canndoc)

InterCure (dba Canndoc) (NASDAQ: INCR) (TASE: INCR) is the

leading, profitable, and fastest growing cannabis company outside

of North America. Canndoc, a wholly owned subsidiary of InterCure,

is Israel’s largest licensed cannabis producer and one of the first

to offer Good Manufacturing Practices (GMP) certified and

pharmaceutical-grade medical cannabis products. InterCure leverages

its market leading distribution network, best in class

international partnerships and a high-margin vertically integrated

"seed-to-sale" model to lead the fastest growing cannabis global

market outside of North America.

For more information, visit: https://www.intercure.co

Non-IFRS Measures

This press release makes reference to certain non-IFRS financial

measures. Adjusted EBITDA, as defined by InterCure, means earnings

before interest, income taxes, depreciation, and amortization,

adjusted for changes in the fair value of inventory, share-based

payment expense, impairment losses (and gains) on financial assets,

non-controlling interest and other expenses (or income). This

measure is not a recognized measure under IFRS, does not have a

standardized meaning prescribed by IFRS and is therefore unlikely

to be comparable to similar measures presented by other companies.

InterCure’s method of calculating this measure may differ from

methods used by other entities and accordingly, this measure may

not be comparable to similarly titled measured used by other

entities or in other jurisdictions. InterCure uses this measure

because it believes it provides useful information to both

management and investors with respect to the operating and

financial performance of the company. A reconciliation of Adjusted

EBITDA to an IFRS measure (revenue), which is incorporated by

reference to this press release, is available in InterCure’s

MD&A included in our Annual Report on Form 20-F under the

heading “Results of Operations”, available under the Company’s

profile on EDGAR at www.sec.gov.

Forward-Looking Statements

This press release contains forward-looking statements.

Forward-looking statements may include, but are not limited to, the

Company’s success of its global expansion plans, its expansion

strategy to major markets worldwide, statements relating to the

security events in Israel, as well as statements, other than

historical facts, that address activities, events or developments

that InterCure intends, expects, projects, believes or anticipates

will or may occur in the future. These statements are often

characterized by terminology such as "believes," "hopes," "may,"

"anticipates," "should," "intends," "plans," "will," "expects,"

"estimates," "projects," "positioned," "strategy" and similar

expressions and are based on assumptions and assessments made in

light of management’s experience and perception of historical

trends, current conditions, expected future developments and other

factors believed to be appropriate. Forward-looking statements are

not guarantees of future performance and are subject to risks and

uncertainties that could cause actual results to differ materially

from those expressed or implied in such statements. Many factors

could cause InterCure’s actual activities or results to differ

materially from the activities and results anticipated in

forward-looking statements, including, but not limited to, the

following: the Company’s success of its global expansion plans, its

continued growth, the expected operations, financial results

business strategy, competitive strengths, goals and expansion and

growth plans, expansion strategy to major markets worldwide, the

impact of the COVID-19 pandemic, the impact of the war in Israel

and the war in Ukraine and the conditions of the markets generally.

Forward-looking information is based on a number of assumptions and

is subject to a number of risks and uncertainties, many of which

are beyond InterCure’s control, which could cause actual results

and events to differ materially from those that are disclosed in or

implied by such forward-looking information. Such risks and

uncertainties include, but are not limited to: changes in general

economic, business and political conditions, changes in applicable

laws, the U.S. regulatory landscapes and enforcement related to

cannabis, changes in public opinion and perception of the cannabis

industry, and reliance on the expertise and judgment of our senior

management. More detailed information about the risks and

uncertainties affecting us is contained under the heading "Risk

Factors" included in the Company's most recent Annual Report on

Form 20-F and in other filings that we have made and may make with

the Securities and Exchange Commission in the future.

1 Adjusted EBITDA means EBITDA for the cannabis sector adjusted

for changes in the fair value of inventory, share-based payment

expense, impairment losses (and gains) on financial assets,

non-controlling interest and other expenses. This is a non-IFRS

financial measure and does not have a standardized meaning

prescribed by IFRS, please see "Non-IFRS Measures" below. 2

Including Restricted cash. 3 Before non-cash goodwill and property

impairments of NIS 68 million mainly due to damages caused by the

war. 4 Adjusted EBITDA. 5 Adjusted EBITDA. 6 Before non-cash

goodwill and property impairments of NIS 68 million mainly due to

damages caused by the war.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240430357217/en/

InterCure Ltd. Amos Cohen, Chief Financial Officer

amos@intercure.co

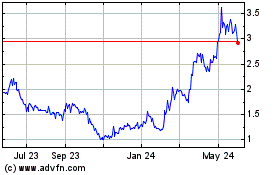

Intercure (NASDAQ:INCR)

Historical Stock Chart

From Dec 2024 to Jan 2025

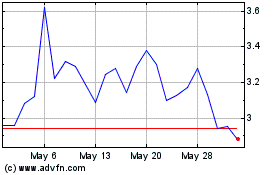

Intercure (NASDAQ:INCR)

Historical Stock Chart

From Jan 2024 to Jan 2025