false

0000903651

0000903651

2024-11-07

2024-11-07

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported):

November 7, 2024

INNODATA

INC.

(Exact name of registrant as specified in its charter)

| Delaware |

001-35774 |

13-3475943 |

| (State or other jurisdiction of |

(Commission File Number) |

(I.R.S. Employer |

| incorporation) |

|

Identification No.) |

| |

|

|

| 55 Challenger Road |

|

|

| Ridgefield Park, NJ |

|

07660 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant's telephone number, including area code (201) 371-8000

(Former

name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written communications pursuant

to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to

Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications

pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications

pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| Common Stock |

INOD |

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 2.02 | Results of Operations

and Financial Condition. |

On November 7, 2024,

Innodata Inc. issued a press release announcing its third quarter 2024 financial results. A copy of the press release is furnished

with this Current Report on Form 8-K as Exhibit 99.1.

In accordance with General

Instruction B.2 of Form 8-K, the information in this Current Report on Form 8-K, including Exhibit 99.1, shall not be deemed to be “filed”

for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to

the liabilities of that section, and shall not be incorporated by reference into any registration statement or other document filed under

the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits

See Exhibit Index below.

Exhibit Index

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto

duly authorized.

| |

|

INNODATA INC. |

| |

|

| |

|

| Date: November 7, 2024 |

By: |

/s/ Marissa B. Espineli |

| |

|

Marissa B. Espineli |

| |

|

Interim Chief Financial Officer |

Exhibit 99.1

Innodata Reports

Third Quarter 2024 Results; Record 136% Revenue Growth Year-Over-Year

NEW YORK –

November 7, 2024 – INNODATA INC. (Nasdaq: INOD) today reported results for the third quarter ended September 30,

2024.

| · | Revenue of $52.2 million,

136% revenue growth year-over-year. |

| · | Net income of $17.4 million,

or $0.60 per basic share and $0.51 per diluted share, compared to net income of $0.4 million, or $0.01 per basic and diluted share, in

the same period last year. Third quarter net income included a $5.6 million benefit as a result of recognizing a deferred tax asset that

related to our accumulated net operating losses and other deferred expenses from prior periods. |

| · | Adjusted EBITDA of $13.9

million, an increase of 337% from $3.2 million in the same period last year.* |

| · | Cash, cash equivalents

and short-term investments of $26.4 million at September 30, 2024 and $13.8 million at December 31, 2023. |

| · | Guidance raised to between

88% and 92% year-over-year revenue growth for full year 2024. |

*Adjusted EBITDA is defined below.

Jack Abuhoff, CEO, said “Innodata continued

to build on its recent progress, leading to record third quarter revenue of $52.2 million, an increase of 136% year-over-year. As a result

of strong business momentum, Innodata is raising 2024 full-year revenue guidance to between 88% and 92% year-over-year revenue growth.

“We are seeing strong business momentum

reflected in revenue growth, margin expansion, broadening customer relationships, and continuing progress on our strategic roadmap. We

believe increasing investments by the world’s largest tech companies in generative AI and large language models (LLMs) will continue

to be a growth catalyst for Innodata.

“The hard work and dedication of our talented

team has enabled us to scale and to meet or exceed the expectations of some of the most demanding, fast-moving companies in the world.

We believe Innodata is well positioned to capture the generative AI market opportunity and continue to drive value for shareholders.”

Big Tech Customer Roster and New Win

Beyond the Big Tech customer we ramped up considerably

this quarter, we have seven other Big Tech customers that we believe will collectively become a significant part of our revenue makeup

next year. Our confidence is bolstered by the progress we made this quarter in broadening these relationships, expanding our engagements

and securing new wins.

Our Big Tech customer roster now includes five

of the Magnificent Seven, one of the most prominent AI research and development companies and a prominent social media company. We are

proud to announce that we won this prominent social media company, our eighth Big Tech customer, in the third quarter. These companies

are all investing significantly in generative AI development initiatives, for which Innodata is providing data engineering support.

The Company also secured its second federal government

agency win. The agency will be leveraging the new generative AI capabilities built into Innodata’s Agility platform.

Record Revenue and Strong Balance Sheet

Revenue for third quarter 2024 reached $52.2 million,

reflecting a year-over-year increase of 136%. On a sequential basis, the Company observed a 60% increase of $19.7 million from

its second quarter 2024 revenue of $32.6 million.

Innodata continues to operate a strong balance

sheet, which enables the Company to invest in growth. As of September 30, 2024, the Company’s cash balances were $26.4 million,

up approximately $10 million from the second quarter 2024.

Amounts in this press release have been rounded.

All percentages have been calculated using unrounded amounts.

Timing of Conference

Call with Q&A

Innodata will conduct

an earnings conference call, including a question-and-answer period, at 5:00 PM eastern time today. You can participate in this call

by dialing the following call-in numbers:

The call-in numbers for the conference

call are:

| 1-800-343-4136 |

(Domestic) |

| +1 203-518-9848 |

(International) |

| Participant Access Code |

INNODATA |

| |

|

| 888-562-2817 |

(Domestic Replay) |

| 402-220-7354 |

(International Replay) |

It

is recommended that participants dial in approximately 10 minutes prior to the start of the call. Investors

are also invited to access a live Webcast of the conference call at the Investor Relations section of www.innodata.com.

Please note that the Webcast feature will be in listen-only mode.

Call-in replay

will be available for 7 days following the conference call, and Webcast replay will be available for 30 days following the conference

call.

About

Innodata

Innodata

(Nasdaq: INOD) is a global data engineering company. We believe that data and Artificial Intelligence (AI) are inextricably

linked. That’s why we’re on a mission to help the world’s leading technology companies and enterprises drive Generative

AI / AI innovation. We provide a range of transferable solutions, platforms, and services for Generative AI / AI builders and adopters.

In every relationship, we honor our 35+ year legacy delivering the highest quality data and outstanding outcomes for our customers.

Visit www.innodata.com to

learn more.

Forward-Looking

Statements

This

press release may contain certain forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of

1934, as amended, and Section 27A of the Securities Act of 1933, as amended. These forward-looking statements include, without limitation,

statements concerning our operations, economic performance, financial condition, developmental program expansion and position in the

generative AI services market. Words such as “project,” “believe,” “expect,” “can,” “continue,”

“could,” “intend,” “may,” “should,” “will,” “anticipate,” “indicate,”

“predict,” “likely,” “estimate,” “plan,” “potential,” “possible,”

or the negatives thereof, and other similar expressions generally identify forward-looking statements.

These

forward-looking statements are based on management’s current expectations, assumptions and estimates and are subject to a number

of risks and uncertainties, including, without limitation, impacts resulting from ongoing geopolitical conflicts, including between Russia

and Ukraine, Hamas’ attack against Israel and the ensuing conflict and increased hostilities between Hezbollah and Israel and Iran

and Israel; investments in large language models; that contracts may be terminated by customers; projected or committed volumes of work

may not materialize; pipeline opportunities and customer discussions which may not materialize into work or expected volumes of work;

the likelihood of continued development of the markets, particularly new and emerging markets, that our services support; the ability

and willingness of our customers and prospective customers to execute business plans that give rise to requirements for our services;

continuing reliance on project-based work in the Digital Data Solutions (DDS) segment and the primarily at-will nature of such contracts

and the ability of these customers to reduce, delay or cancel projects; potential inability to replace projects that are completed, canceled

or reduced; our DDS segment’s revenue concentration in a limited number of customers; our dependency on content providers in our

Agility segment; the Company’s ability to achieve revenue and growth targets; difficulty in integrating and deriving synergies

from acquisitions, joint ventures and strategic investments; potential undiscovered liabilities of companies and businesses that we may

acquire; potential impairment of the carrying value of goodwill and other acquired intangible assets of companies and businesses that

we acquire; a continued downturn in or depressed market conditions; changes in external market factors; the potential effects of U.S.

monetary policy, including the interest rate policies of the Federal Reserve; changes in our business or growth strategy; the emergence

of new, or growth in existing competitors; various other competitive and technological factors; our use of and reliance on information

technology systems, including potential security breaches, cyber-attacks, privacy breaches or data breaches that result in the unauthorized

disclosure of consumer, customer, employee or Company information, or service interruptions; and other risks and uncertainties indicated

from time to time in our filings with the Securities and Exchange Commission.

Our actual results

could differ materially from the results referred to in any forward-looking statements. Factors that could cause or contribute to such

differences include, but are not limited to, the risks discussed in Part I, Item 1A. “Risk Factors,” Part II, Item

7. “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and other parts of our

Annual Report on Form 10-K, filed with the Securities and Exchange Commission on March 4, 2024, as updated or amended by our

other filings that we may make with the Securities and Exchange Commission. In light of these risks and uncertainties, there can be no

assurance that the results referred to in the forward-looking statements will occur, and you should not place undue reliance on these

forward-looking statements. These forward-looking statements speak only as of the date hereof.

We undertake no

obligation to update or review any guidance or other forward-looking statements, whether as a result of new information, future developments

or otherwise, except as may be required by the U.S. federal securities laws.

Company

Contact

Jelena

Sutovic

Innodata

Inc.

Jsutovic@innodata.com

(201) 371-8024

Non-GAAP Financial Measures

In addition to

the financial information prepared in conformity with U.S. GAAP (“GAAP”), we provide certain non-GAAP financial information.

We believe that these non-GAAP financial measures assist investors in making comparisons of period-to-period operating results. In some

respects, management believes non-GAAP financial measures are more indicative of our ongoing core operating performance than their GAAP

equivalents by making adjustments that management believes are reflective of the ongoing performance of the business.

We believe that

the presentation of this non-GAAP financial information provides investors with greater transparency by providing investors a more complete

understanding of our financial performance, competitive position, and prospects for the future, particularly by providing the same information

that management and our Board of Directors use to evaluate our performance and manage the business. However, the non-GAAP financial measures

presented in this press release have certain limitations in that they do not reflect all of the costs associated with the operations

of our business as determined in accordance with GAAP. Therefore, investors should consider non-GAAP financial measures in addition to,

and not as a substitute for, or as superior to, measures of financial performance prepared in accordance with GAAP. Further, the non-GAAP

financial measures that we present may differ from similar non-GAAP financial measures used by other companies.

Adjusted EBITDA

We define Adjusted

EBITDA as net income (loss) attributable to Innodata Inc. and its subsidiaries in accordance with U.S. GAAP before interest expense,

income taxes, depreciation and amortization of intangible assets (which derives EBITDA), plus additional adjustments for loss on impairment

of intangible assets and goodwill, stock-based compensation, income (loss) attributable to non-controlling interests, non-recurring severance,

and other one-time costs.

We use Adjusted

EBITDA to evaluate core results of operations and trends between fiscal periods and believe that these measures are important components

of our internal performance measurement process.

A reconciliation

of Adjusted EBITDA to the most directly comparable GAAP measure is included in the tables that accompany this release.

INNODATA INC.

AND SUBSIDIARIES

CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS

(Unaudited)

(In thousands,

except per-share amounts)

| | |

Three Months Ended | | |

Nine Months Ended | |

| | |

September 30, | | |

September 30, | |

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| Revenues | |

$ | 52,224 | | |

$ | 22,169 | | |

$ | 111,281 | | |

$ | 60,663 | |

| Direct operating costs | |

| 30,893 | | |

| 13,945 | | |

| 70,964 | | |

| 39,534 | |

| Selling and administrative expenses | |

| 9,910 | | |

| 7,401 | | |

| 27,235 | | |

| 22,772 | |

| Interest (income) expense, net | |

| (26 | ) | |

| 66 | | |

| (55 | ) | |

| 122 | |

| | |

| 40,777 | | |

| 21,412 | | |

| 98,144 | | |

| 62,428 | |

| | |

| | | |

| | | |

| | | |

| | |

| Income (loss) before provision for income taxes | |

| 11,447 | | |

| 757 | | |

| 13,137 | | |

| (1,765 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Provision for (benefit from) income taxes | |

| (5,944 | ) | |

| 374 | | |

| (5,235 | ) | |

| 780 | |

| | |

| | | |

| | | |

| | | |

| | |

| Consolidated net income (loss) | |

| 17,391 | | |

| 383 | | |

| 18,372 | | |

| (2,545 | ) |

| Income attributable to non-controlling interests | |

| 2 | | |

| 12 | | |

| 8 | | |

| 15 | |

| Net Income (loss) attributable to Innodata Inc. and Subsidiaries | |

$ | 17,389 | | |

$ | 371 | | |

$ | 18,364 | | |

$ | (2,560 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Income (loss) per share attributable to Innodata Inc. and Subsidiaries: | |

| | | |

| | | |

| | | |

| | |

| Basic | |

$ | 0.60 | | |

$ | 0.01 | | |

$ | 0.64 | | |

$ | (0.09 | ) |

| Diluted | |

$ | 0.51 | | |

$ | 0.01 | | |

$ | 0.55 | | |

$ | (0.09 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Weighted average shares outstanding: | |

| | | |

| | | |

| | | |

| | |

| Basic | |

| 28,994 | | |

| 28,459 | | |

| 28,873 | | |

| 27,930 | |

| Diluted | |

| 34,007 | | |

| 32,463 | | |

| 33,297 | | |

| 27,930 | |

Tax provision for the three months

and nine months ended September 30, 2024 includes a net tax benefit of $5.6 million resulting from the recognition of deferred tax asset

of the company’s accumulated net loss carry forward (NOLCO) and other deferred expenses.

INNODATA INC.

AND SUBSIDIARIES

CONDENSED CONSOLIDATED

BALANCE SHEETS

(Unaudited)

(In thousands)

| | |

September 30,

2024 | | |

December 31,

2023 | |

| ASSETS | |

| |

| Current assets: | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 26,364 | | |

$ | 13,806 | |

| Short term investments – other | |

| 14 | | |

| 14 | |

| Accounts receivable, net | |

| 23,186 | | |

| 14,288 | |

| Prepaid expenses and other current assets | |

| 5,221 | | |

| 3,969 | |

| Total current assets | |

| 54,785 | | |

| 32,077 | |

| Property and equipment, net | |

| 3,325 | | |

| 2,281 | |

| Right-of-use-asset, net | |

| 4,435 | | |

| 5,054 | |

| Other assets | |

| 1,771 | | |

| 2,445 | |

| Deferred income taxes, net | |

| 7,890 | | |

| 1,741 | |

| Intangibles, net | |

| 13,880 | | |

| 13,758 | |

| Goodwill | |

| 2,084 | | |

| 2,075 | |

| Total assets | |

$ | 88,170 | | |

$ | 59,431 | |

| | |

| | | |

| | |

| LIABILITIES, NON-CONTROLLING INTERESTS AND STOCKHOLDERS’ EQUITY | |

| | | |

| | |

| Current liabilities: | |

| | | |

| | |

| Accounts payable and accrued expenses | |

$ | 7,692 | | |

$ | 5,722 | |

| Accrued salaries, wages and related benefits | |

| 9,619 | | |

| 7,799 | |

| Deferred revenues | |

| 6,500 | | |

| 3,523 | |

| Income and other taxes | |

| 3,961 | | |

| 3,848 | |

| Long-term obligations - current portion | |

| 1,166 | | |

| 1,261 | |

| Operating lease liability - current portion | |

| 855 | | |

| 782 | |

| Total current liabilities | |

| 29,793 | | |

| 22,935 | |

| | |

| | | |

| | |

| Deferred income taxes, net | |

| 30 | | |

| 22 | |

| Long-term obligations, net of current portion | |

| 7,311 | | |

| 6,778 | |

| Operating lease liability, net of current portion | |

| 4,027 | | |

| 4,701 | |

| Total liabilities | |

| 41,161 | | |

| 34,436 | |

| | |

| | | |

| | |

| Non-controlling interests | |

| (700 | ) | |

| (708 | ) |

| STOCKHOLDERS’ EQUITY: | |

| 47,709 | | |

| 25,703 | |

| Total liabilities, non-controlling interests and stockholders’ equity | |

$ | 88,170 | | |

$ | 59,431 | |

The company’s Deferred Tax Assets as of September 30, 2024

includes deferred tax assets related to the company’s accumulated net loss carry forward (NOLCO) and other deferred expenses previously

with a full valuation allowance.

INNODATA INC.

AND SUBSIDIARIES

CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS

(Unaudited)

(In thousands)

| | |

Nine Months Ended | |

| | |

September 30, | |

| | |

2024 | | |

2023 | |

| Cash flows from operating activities: | |

| | | |

| | |

| Consolidated net income (loss) | |

$ | 18,372 | | |

$ | (2,545 | ) |

| Adjustments to reconcile consolidated net income (loss) to net cash provided by operating activities: | |

| | | |

| | |

| Depreciation and amortization | |

| 4,219 | | |

| 3,479 | |

| Stock-based compensation | |

| 2,881 | | |

| 2,998 | |

| Deferred income taxes | |

| (6,153 | ) | |

| (120 | ) |

| Pension cost | |

| 948 | | |

| 791 | |

| Changes in operating assets and liabilities: | |

| | | |

| | |

| Accounts receivable | |

| (8,834 | ) | |

| (1,198 | ) |

| Prepaid expenses and other current assets | |

| (1,222 | ) | |

| 449 | |

| Other assets | |

| 673 | | |

| (243 | ) |

| Accounts payable and accrued expenses | |

| 1,892 | | |

| 268 | |

| Deferred revenues | |

| 2,977 | | |

| 702 | |

| Accrued salaries, wages and related benefits | |

| 1,822 | | |

| 1,019 | |

| Income and other taxes | |

| 109 | | |

| 189 | |

| Net cash provided by operating activities | |

| 17,684 | | |

| 5,789 | |

| | |

| | | |

| | |

| Cash flows from investing activities: | |

| | | |

| | |

| Capital expenditures | |

| (5,522 | ) | |

| (4,320 | ) |

| Proceeds from sale of short term investments - others | |

| - | | |

| 494 | |

| Net cash used in investing activities | |

| (5,522 | ) | |

| (3,826 | ) |

| | |

| | | |

| | |

| Cash flows from financing activities: | |

| | | |

| | |

| Proceeds from exercise of stock options | |

| 810 | | |

| 3,158 | |

| Withholding taxes on net settlement of restricted stock units | |

| (97 | ) | |

| - | |

| Payment of long-term obligations | |

| (516 | ) | |

| (329 | ) |

| Net cash provided by financing activities | |

| 197 | | |

| 2,829 | |

| | |

| | | |

| | |

| Effect of exchange rate changes on cash and cash equivalents | |

| 199 | | |

| 228 | |

| | |

| | | |

| | |

| Net increase in cash and cash equivalents | |

| 12,558 | | |

| 5,020 | |

| Cash and cash equivalents, beginning of period | |

| 13,806 | | |

| 9,792 | |

| Cash and cash equivalents, end of period | |

$ | 26,364 | | |

$ | 14,812 | |

INNODATA INC.

AND SUBSIDIARIES

RECONCILIATION

OF GAAP TO NON-GAAP FINANCIAL MEASURES

(Unaudited)

(In thousands)

| | |

Three Months Ended September 30, | | |

Nine Months Ended September 30, | |

| Consolidated | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| Net income (loss) attributable to Innodata Inc. and Subsidiaries | |

$ | 17,389 | | |

$ | 371 | | |

$ | 18,364 | | |

$ | (2,560 | ) |

| Provision for (benefit from) income taxes | |

| (5,944 | ) | |

| 374 | | |

| (5,235 | ) | |

| 780 | |

| Interest expense | |

| 21 | | |

| 163 | | |

| 190 | | |

| 295 | |

| Depreciation and amortization | |

| 1,535 | | |

| 1,237 | | |

| 4,219 | | |

| 3,479 | |

| Severance** | |

| - | | |

| - | | |

| - | | |

| 580 | |

| Stock-based compensation | |

| 855 | | |

| 1,017 | | |

| 2,881 | | |

| 2,998 | |

| Non-controlling interests | |

| 2 | | |

| 12 | | |

| 8 | | |

| 15 | |

| Adjusted EBITDA - Consolidated | |

$ | 13,858 | | |

$ | 3,174 | | |

$ | 20,427 | | |

$ | 5,587 | |

| | |

Three Months Ended September 30, | | |

Nine Months Ended September 30, | |

| DDS Segment | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| Net income (loss) attributable to DDS Segment | |

$ | 16,526 | | |

$ | 444 | | |

$ | 16,492 | | |

$ | (751 | ) |

| Provision for (benefit from) income taxes | |

| (5,887 | ) | |

| 371 | | |

| (5,183 | ) | |

| 772 | |

| Interest expense | |

| 20 | | |

| 162 | | |

| 187 | | |

| 291 | |

| Depreciation and amortization | |

| 670 | | |

| 328 | | |

| 1,513 | | |

| 811 | |

| Severance** | |

| - | | |

| - | | |

| - | | |

| 33 | |

| Stock-based compensation | |

| 760 | | |

| 854 | | |

| 2,523 | | |

| 2,524 | |

| Non-controlling interests | |

| 2 | | |

| 12 | | |

| 8 | | |

| 15 | |

| Adjusted EBITDA - DDS Segment | |

$ | 12,091 | | |

$ | 2,171 | | |

$ | 15,540 | | |

$ | 3,695 | |

| | |

Three Months Ended September 30, | | |

Nine Months Ended September 30, | |

| Synodex Segment | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| Net income (loss) attributable to Synodex Segment | |

$ | 381 | | |

$ | (154 | ) | |

$ | 973 | | |

$ | (19 | ) |

| Depreciation and amortization | |

| 112 | | |

| 155 | | |

| 406 | | |

| 479 | |

| Severance** | |

| - | | |

| - | | |

| - | | |

| 6 | |

| Stock-based compensation | |

| 38 | | |

| 60 | | |

| 136 | | |

| 177 | |

| Adjusted EBITDA - Synodex Segment | |

$ | 531 | | |

$ | 61 | | |

$ | 1,515 | | |

$ | 643 | |

| | |

Three Months Ended September 30, | | |

Nine Months Ended September 30, | |

| Agility Segment | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| Net income (loss) attributable to Agility Segment | |

$ | 482 | | |

$ | 81 | | |

$ | 899 | | |

$ | (1,790 | ) |

| Provision for (benefit from) income taxes | |

| (57 | ) | |

| 3 | | |

| (52 | ) | |

| 8 | |

| Interest expense | |

| 1 | | |

| 1 | | |

| 3 | | |

| 4 | |

| Depreciation and amortization | |

| 753 | | |

| 754 | | |

| 2,300 | | |

| 2,189 | |

| Severance** | |

| - | | |

| - | | |

| - | | |

| 541 | |

| Stock-based compensation | |

| 57 | | |

| 103 | | |

| 222 | | |

| 297 | |

| Adjusted EBITDA - Agility Segment | |

$ | 1,236 | | |

$ | 942 | | |

$ | 3,372 | | |

$ | 1,249 | |

**Represents non-recurring severance

incurred for a reduction in headcount in connection with the re-alignment of the Company’s cost structure.

INNODATA INC.

AND SUBSIDIARIES

CONSOLIDATED

REVENUE BY SEGMENT

(Unaudited)

(In thousands)

| | |

For the Three Months

Ended

September 30, | | |

For the Nine Months Ended

September 30, | |

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| Revenues: | |

| | |

| | |

| | |

| |

| DDS | |

$ | 44,694 | | |

$ | 16,003 | | |

$ | 89,810 | | |

$ | 41,929 | |

| Synodex | |

| 1,935 | | |

| 1,728 | | |

| 5,792 | | |

| 5,705 | |

| Agility | |

| 5,595 | | |

| 4,438 | | |

| 15,679 | | |

| 13,029 | |

| Total Consolidated | |

$ | 52,224 | | |

$ | 22,169 | | |

$ | 111,281 | | |

$ | 60,663 | |

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

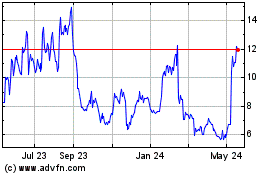

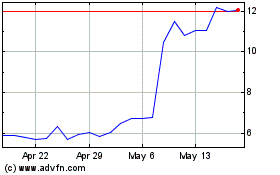

Innodata (NASDAQ:INOD)

Historical Stock Chart

From Oct 2024 to Nov 2024

Innodata (NASDAQ:INOD)

Historical Stock Chart

From Nov 2023 to Nov 2024