false

0001080014

0001080014

2024-05-13

2024-05-13

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event

reported): May 13, 2024

INNOVIVA, INC.

(Exact Name of Registrant as Specified in its

Charter)

| Delaware |

000-30319 |

94-3265960 |

(State or Other Jurisdiction of

Incorporation) |

(Commission File Number) |

(I.R.S. Employer Identification

Number) |

1350 Old Bayshore Highway,

Suite

400

Burlingame, California 94010

(650) 238-9600

(Addresses, including zip code, and telephone

numbers, including area code, of principal executive offices)

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see

General Instruction A.2. below):

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, par value $0.01 per share |

|

INVA |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an

emerging growth company as defined in Rule 405 of the Securities Act of 1933(§230.405 of this chapter) or Rule 12b-2

of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ¨

If an emerging

growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with

any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 7.01. Regulation FD Disclosure.

On May 13, 2024, Innoviva, Inc. (the “Company”)

made available on its website a revised Company investor presentation. A copy of the presentation is attached hereto as Exhibit 99.1

and is incorporated by reference herein.

The information included in this Current Report on Form 8-K that

is furnished pursuant to this Item 7.01, including the information contained in Exhibit 99.1 hereto, shall not be deemed to be “filed”

for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that

section or Sections 11 and 12(a)(2) of the Securities Act of 1933, as amended. In addition, the information included in this Current

Report on Form 8-K that is furnished pursuant to this Item 7.01, including the information contained in Exhibit 99.1 hereto,

shall not be incorporated by reference into any filing of the Company, whether made before or after the date hereof, regardless of any

general incorporation language in such filing, unless expressly incorporated by specific reference into such filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

| 99.1 |

|

Investor Presentation |

| 104 |

|

Cover Page Interactive File (the cover page tags are embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly

authorized.

| |

INNOVIVA, INC. |

| |

|

| Date: May 13, 2024 |

By: |

/s/ Pavel Raifeld |

| |

|

Pavel Raifeld |

| |

|

Chief Executive Officer |

Exhibit 99.1

Corporate Presentation May 2024

Forward - looking statements The information in this presentation contains forward looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended (the “Securities Act”). Such forward looking statements in vol ve substantial risks, uncertainties and assumptions. All statements in this herein, other than statements of historical fact, including, without li mit ation, statements regarding our strategy, future operations, future financial position, future revenue, projected costs, prospects, plans, intentions, ex pec tations, goals and objectives may be forward looking statements. The words “anticipates,” “believes,” “could,” “designed,” “estimates,” “expects,” “goal,” “in tends,” “may,” “objective,” “plans,” “projects,” “pursuing,” “will,” “would” and similar expressions (including the negatives thereof) are intended to id ent ify forward looking statements, although not all forward - looking statements contain these identifying words. We may not actually achieve the plans, intentions, expectations or objectives disclosed in our forward - looking statements and the assumptions underlying our forward - looking statements may prov e incorrect. Therefore, you should not place undue reliance on our forward - looking statements. Actual results or events could differ material ly from the plans, intentions, expectations and objectives disclosed in the forward - looking statements that we make. All written and verbal forward looking statements attributable to us or any person acting on our behalf are expressly qualified in their entirety by the cautionary statements con tained or referred to in this section. Important factors that we believe could cause actual results or events to differ materially from our forward looking statemen ts include, but are not limited to, risks related to: lower than expected future royalty revenue from respiratory products partnered with GSK, the commercial iza tion of RELVAR®/BREO® ELLIPTA®, ANORO® ELLIPTA®, GIAPREZA®, XERAVA®, and XACDURO® in the jurisdictions in which these products have been approved; the strategies, plans and objectives of the Company (including the Company's growth strategy and corporate development initiatives); the timi ng, manner, and amount of potential capital returns to shareholders; the status and timing of clinical studies, data analysis and communication of r esu lts; the potential benefits and mechanisms of action of product candidates; expectations for product candidates through development and commercialization ; t he timing of regulatory approval of product candidates; and projections of revenue, expenses and other financial items; the impact of the nov el coronavirus (“COVID - 19”); the timing, manner and amount of capital deployment, including potential capital returns to stockholders. Any person reviewing this presentation is advised to review our “Risk Factors” and other information in our Annual Report on For m 10 - K for the year ended December 31, 2023 filed with the Securities and Exchange Commission (“SEC”) on February 29, 2024, (“2023 Form 10 - K”), and the information in the other reports and documents that we file with the SEC from time to time. All information in this presentation should be rea d in conjunction with the information we have filed with the SEC. All forward - looking statements in this presentation are based on current expectations as of the date hereof and we do not assume any obligation to update any forward - looking statements on account of new information, future events or otherwi se. 2

Innoviva at a glance 3 1. Strongly cashflow - positive, durable core royalty business stemming from widely used respiratory products 2. Commercial stage, growth - oriented critical care and infectious disease platform supported by late - stage pipeline 3. Diversified, valuable portfolio of healthcare assets 4. Thoughtful, robust approach to long - term capital deployment 5. Strong track record and value creation focus

Innoviva has a valuable portfolio of royalties, a robust operating therapeutics platform, and other healthcare assets Royalty assets Innoviva Specialty Therapeutics assets Strategic healthcare assets Durable royalty stream from two widely used, differentiated respiratory products marketed by GSK RELVAR ® / BREO ® ELLIPTA ® ANORO ® ELLIPTA ® Robust, growing therapeutic platform anchored by three marketed products and a late - stage pipeline Diversified portfolio of promising healthcare assets with high growth potential currently valued at approximately $628M 1 Over $315M royalty and net product revenue generated in last twelve months (LTM) ISP fund Zoliflodacin 1. As of 3/31/2024, ISP Fund valued at $287M, Armata ownership valued at $279M, and other assets valued at $62M per the Company For m 10 - Q for Q1 2024. Note: LTM in this presentation refers to the last twelve months ending March 31, 2024. LTM royalty revenue $209M $45M $71M LTM net product sales and license revenue 4

Royalty Assets 5 Our royalty assets, composed of widely used respiratory therapies commercialized by GSK, have produced durable, resilient revenues that are de - risked via geographic and drug class diversification 1. According to analyst consensus projections on GSK forecast website accessed April 28, 2024; analyst forecasts updated on Marc h 1 5, 2024; GBP converted to USD using March 15 exchange rate of $1.26 2. 15% on first $3B in annual sales; 5% on sales over $3B 3. Tiered 6.5 - 10.0% RELVAR ® / BREO ® ELLIPTA ® ANORO ® ELLIPTA ® First once - daily inhaled corticosteroid / long - acting beta - agonist for asthma and chronic obstructive pulmonary disease Best - in - class long - acting beta - agonist /long - acting muscarinic antagonist for COPD 15% 2 6.5% 3 ~$0.2B ~$0.9B $6.2B $3.4B Total ~$1.1B Product 5 - year consensus projected sales 1 Royalty rate 5 - year projected royalty to Innoviva 1 $1.4B $0.7B LTM global net sales

Relvar/Breo and Anoro are protected by an IP estate with meaningful remaining exclusivity 6 1. US patent 7,439,393. Original expiration 9/11/2022, granted additional exclusivity to 2025 through 35 USC § 156 2. US patents 9,750,726 and 11,090,294 3. US patent 8,746,242. Original expiration 10/11/2030, granted additional exclusivity to 2031 through pediatric sNDA exclusivity 4. US patent 9,763,965 Manufacturing complexity provides further protection ANORO ® ELLIPTA ® RELVAR ® / BREO ® ELLIPTA ® Primary US patent Vilanterol drug substance 1 Specified LABA/LAMA combination for treatment of COPD and asthma 2 Key secondary US patent ELLIPTA device 3 Process for aggregating particles of umeclidinium and/or vilanterol and/or fluticasone furoate 4 Potential expiration 2025 2030 Potential expiration 2031 2033 The terms of the collaboration agreement with GSK indicate that royalties will be paid until the later of: • The expiration of the last patent covering each product in such country • 15 years from first commercial sale of each product in such country For each of the portfolio products, the secondary patent expiration date would be the later date for purposes of royalties IP protection in international markets is generally longer dated than in the US Royalty Assets

Innoviva Specialty Therapeutics (“IST”) highlights IST is a robust, rapidly growing critical care and infectious disease business uniquely positioned to unlock value Synergistic “infectious disease plus” portfolio with 3 approved products and 1 Pre - NDA program Commercial platform anchored by an experienced field force and supported by strong medical, regulatory, and CMC teams with proven track record Strong topline growth driven by two re - energized products and recent XACDURO launch with significant operating leverage (LTM revenue of $71M 1 ) Multiple patents with significant remaining exclusivity and options for further extension Leading critical care and infectious disease franchise with a robust, scalable foundation for future strategic opportunities, and further potential upside from public incentive programs Differentiated, complementary portfolio Efficient, fully - integrated platform Attractive, high - growth financial profile Durable business with strong IP protection Significant expansion potential and upside Innoviva Specialty Therapeutics Assets 7 1. Net sales and license revenue for the last twelve months ending March 31, 2024

IST has a diversified portfolio of high growth hospital and critical care products addressing sizeable markets with significant unmet needs Zoliflodacin Indication LTM net sales and license revenue Selected future growth drivers Vasoconstrictor to increase blood pressure in adults with septic or other distributive shock Antibacterial for the treatment of complicated intra - abdominal infections Antibacterial for the treatment of HABP/VABP caused by Acinetobacter baumanii Oral antibacterial in development for treatment of uncomplicated gonorrhea , including resistant strains $44M $23M 1 $4M (Sept 2023 launch) N/A (NDA submission planned early 2025) • Potential guidelines update and inclusion of GIAPREZA • Additional data generation and real - world evidence, including investigator - initiated studies • Rising rates of ESBL resistance 2 • Growing urgency of the need for carbapenem - sparing agents • Only therapy indicated specifically for Acinetobacter infections • Rising rates of resistance globally • Rising rates of resistance to only remaining standard of care, ceftriaxone • Convenience of oral (vs. in - person intramuscular injection) Innoviva Specialty Therapeutics Assets 8 Marketed products Development pipeline Product 1. Includes $3M in milestone license revenue 2. Antimicrobial Resistance Infection Control 10: 118 (2021)

GIAPREZA: Rapid - acting vasoconstrictor for shock patients Indications and usage Key differentiators Unmet need • GIAPREZA was approved in Dec 2017 to increase blood pressure in adults with septic or other distributive shock, an indication with persistently high mortality rates • GIAPREZA mimics the body’s endogenous angiotensin II peptide which is central to the RAAS system that naturally regulates blood pressure • Approximately 140K shock patients each year fail 1st and 2nd line vasopressor therapies 2 , usually resulting in death; these patients need a new rapid - acting option with a unique mechanism of action • Other patient types (e.g., cardiac patients) need shock treatments that do not act directly on the heart due to safety concerns 70% 23% Increase in Mean Arterial Pressure Response 1 In a pivotal trial, GIAPREZA demonstrated statistically significant (p< 0.0001) improvement in mean arterial pressure in patients already receiving standard of care Unique mechanism of action • GIAPREZA regulates blood pressure through the body’s own renin - angiotensin - aldosterone system (RAAS); it is the only RAAS regulator available for patients Potential survival benefit when initiated with lower vasopressor doses • In an exploratory post hoc analysis of ATHOS - 3, early use of GIAPREZA plus standard of care was associated with improved survival vs. placebo plus standard of care 3 Rapidly achieves therapeutic response • Median response time of only 5 minutes, allowing for real - time monitoring and therapeutic adjustment 4 Flexible dosing for rapid adjustment and diverse patient types • Short plasma half - life (<1m) allows for easy titration and near real - time adjustment of the therapeutic response Addresses highest cost hospital - treated condition • Sepsis is the most expensive hospital condition in the U.S. 5; reducing mechanical ventilation or avoiding renal replacement therapy may save $15,000 - $36,000 in total hospital charges 6 Giapreza + SOC (n=163) Placebo + SOC (n=158) Innoviva Specialty Therapeutics Assets 9 Note: RAAS = renin - angiotensin - aldosterone system; SOC = standard of care vasopressors 1. MAP of 75 mm Hg or higher or an increase in MAP from baseline of at least 10 mm Hg at Hour 3 without an increase in the dose of background vasopressors 2. Estimate based on CDC, Rhee et al, Mahapatra et al, Kumar et al, Angus et al, Rudd et al, with LoT split derived from Trinity PMR data 3. Wieruszewski PM, Bellomo R, Busse LW, et al. Initiating angiotensin II at lower vasopressor doses in vasodilatory shock: an exploratory post - hoc analysis of the ATHOS - 3 clinical trial. Crit Care. 2023;27(1):175 4. Wieruszewski PM, Bellomo R, Busse LW, et al. Crit Care. 2023;27(1):175 5. Paoli CJ, Reynolds MA, Sinha M, et al. Crit Care Med. 2018;46(12):1889 - 1897 6. Self WH, Liu D, Strayer N, et al. Chest. 2019;155(2):315 - 321

XERAVA: Broad - spectrum antibiotic with unique strengths to address rising ESBL strains and carbapenem resistance Indications and usage Key differentiators Unmet need • XERAVA is a tetracycline - class antibiotic approved in August 2018 for the treatment of complicated intra - abdominal infections (cIAI) caused by susceptible microorganisms • Potential and recommended uses as a: – Empiric therapy for patients with cIAI – Consolidation therapy – Tetracycline of choice (therapeutic substitution) • Rising ESBL rates worldwide – Dramatic increase in ESBL - producing bacteria worldwide; rates of ESBL bacteria in U.S. hospitals as high as >30% for some common cIAI pathogens 1 • Overreliance on carbapenems – Growing carbapenem resistance across multiple pathogens requires carbapenem - sparing treatment options for empiric therapy • CDI infections a persistent concern for hospital systems – Clostridium difficile continues to be a serious problem in many hospital systems, affecting approximately 500,000 patients per year in the U.S. 2 Clinical trials demonstrated non - inferiority to most common carbapenems at test of cure visits Carbapenem - sparing empiric therapy • Broad - spectrum therapy with proven efficacy when compared head - to - head with carbapenems allows for empiric choice that reduces overreliance on these therapies, an important priority for preventing resistance development More tolerable and potent substitution for previous tetracyclines • The most popular third generation tetracycline, tigecycline, has significant utilization despite clear tolerability disadvantages compared to XERAVA • XERAVA is 2 to 4 times more potent than tigecycline in vitro against gram - positive and gram - negative bacteria 3 Preferred option against specific resistant pathogens • cIAI is caused by a wide variety of pathogens; XERAVA is an attractive option for certain resistance profiles, including growing ESBL - driven infections Supports antibiotic stewardship, including C. difficile mitigation • Recommended XERAVA use follows the key tenets of antibiotic stewardship which, among other benefits, helps reduce C. difficile infections 4 Simple administration as monotherapy with convenient dosing • Can be administered to patients with penicillin allergy and no dosage adjustment necessary in patients with renal impairment Innoviva Specialty Therapeutics Assets 10 1. Antimicrobial Resistance Infection Control 10: 118 (2021) 2. BMC Infectious Diseases 23, 132 (2023) 3. Drugs 76(5):567 - 588 (2016) 4. Centers for Disease Control and Prevention. Core elements of hospital antibiotic stewardship programs. Accessed November 28, 202 3

XACDURO: First pathogen - targeted therapy approved for life threatening Acinetobacter infections Indications and usage Key differentiators Unmet need • XACDURO is the first pathogen - targeted therapy approved for the treatment of hospital - acquired and ventilator - associated bacterial pneumonia caused by susceptible strains of Acinetobacter baumannii - calcoaceticus complex • Drug resistant Acinetobacter has been identified by the CDC and WHO as an urgent global public health threat with over 300K annual deaths 1 associated with carbapenem - resistant infections worldwide • Carbapenem - resistant Acinetobacter (CRAB) infections have a ~40% mortality rate in the United States despite best current antibiotic treatment XACDURO demonstrated statistical non - inferiority to colistin on 28 - day all - cause mortality in patients with carbapenem - resistant Acinetobacter infections Only therapy specifically approved for Acinetobacter infections • With no existing antibiotics proven effective for carbapenem - resistant cases, XACDURO is a clear standout as first choice for these infections Specific pathogen - targeted drug design • End - to - end R&D focus on resistant Acinetobacter cases provides a unique advantage with clear and easy messaging to HCPs and hospital systems Statistically significant difference in nephrotoxicity vs. colistin • Pivotal trial demonstrated overall positive benefit / risk profile compared to colistin, with lower incidence in nephrotoxicity – a serious complication, particularly for ICU patients Positioned to avoid common stewardship and access concerns • Other branded antibiotics push for broad empiric use but are held back by stewardship and budget concerns; XACDURO is positioned to be used for specific infections only, allowing it to be used in these settings without raising the same stewardship or budget concerns New - Technology Add - On Payment (NTAP) • Starting October 1, 2023, NTAP provides hospitals an incremental payment in addition to the standard MS - DRG reimbursement up to $13,680 for patients treated with XACDURO per qualifying case Innoviva Specialty Therapeutics Assets 11 Note: SOC = Standard of Care 1. Antimicrobial Resistance Collaborators Lancet 2022; 399: 629 – 55 2. Kaye et al. Lancet Infect Dis. 2023 May 11:S1473 - 3099(23)00184 - 6

Zoliflodacin: Potential to be the only effective treatment for ceftriaxone - resistant gonorrhea, pending approval Zoliflodacin About zoliflodacin Zoliflodacin is a novel orally administered antibiotic in development for the treatment of uncomplicated gonorrhea. Gonorrhea is one of the most commonly diagnosed sexually transmitted infections , with more than 80 million cases a year around the world and over 1 million a year in the U.S. We believe there is a growing unmet need for a single - dose oral antibiotic that will reliably treat patient with gonorrhea, including multidrug - resistant strains which are emerging globally In a pivotal Phase 3 trial, zoliflodacin met the primary efficacy endpoint and was non - inferior to treatment with intramuscular (IM) injection of ceftriaxone and oral azithromycin (CRO - AZI), a current global standard of care regimen In this study, zoliflodacin was safe and generally well - tolerated ; majority of adverse events were mild to moderate with no discontinuations due to adverse events, serious adverse events, or deaths 90.90% 96.80% 96.20% 100% 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% Micro-ITT population Evaluable population Zoliflodacin Ceftriaxone + azithromycin 5.3% difference 95% CI: 1.4%, 8.7% 3.2% difference 95% CI: 1.1%, 5.1% Microbiological cure rate at test of cure visit Results from pivotal Phase 3 trial About zoliflodacin Innoviva Specialty Therapeutics Assets 12

Zoliflodacin, if approved, could address both near - term and long - term unmet needs as a single dose oral therapy Gonorrhea is a large and growing market with ~1M treated patients per year in the U.S. (700 - 800K reported and 1.6m estimated by U.S. CDC) 1 Current U.S. standard of care is a 500mg intramuscular injection of ceftriaxone administered in a clinic or physician office If approved, we see unmet need and commercial opportunity for zoliflodacin in two primary areas Reported U.S. gonorrhea cases by year (K) 1 333 350 395 468 555 583 616 678 710 2013 2014 2015 2016 2017 2018 2019 2020 2021 10% 2. Growing unmet need for ceftriaxone - resistant strains Telehealth An increasing number of STI patients initially present through remote consultation; an efficacious oral option could be preferred to minimize required site visits, especially if paired with local or at - home diagnostics EPT Some prescribers offer patients oral therapies to deliver to partners after being diagnosed with STIs, including gonorrhea Oral preference If covered, some patients with private insurance would opt for a copay and an oral therapy vs. a painful injection, especially if the dose continues to rise Unique patient populations Other populations where stockable oral therapies would be preferred due to uneven access to healthcare infrastructure (e.g., military, government contracts, international travelers, global health settings) 1. Potential market opportunities for oral therapies Rapidly increasing international ceftriaxone - resistance; over 30% of isolates in some southeast Asian regions 1 First confirmed gonorrhea cases with reduced susceptibility to ceftriaxone in the U.S. in 2023 U.S. resistance patterns could follow global trends and create a need for new efficacious therapies and resulting shifts in guidelines Gonorrhea market dynamics Zoliflodacin Innoviva Specialty Therapeutics Assets 13 1. U.S. Centers for Disease Control, STD Surveillance 2021 2. The Lancet 2021. Vol 2 issue 11, E627 - 636

Minority investments in high growth areas • Strategic equity and convertible debt investments in high - potential healthcare companies with significant promise ISP Fund providing further exposure to healthcare • $300M initially committed to ISP Fund in Dec 2020 primarily to public equity investments in healthcare in areas of significant value dislocation, providing long - term upside Innovative anti - infectives R&D • Armata has R&D and manufacturing capabilities along with a platform in bacteriophages, a new therapeutic modality 14 Our robust portfolio of strategic healthcare assets in areas of high unmet medical need with significant long term value creation potential Strategic Healthcare Assets Value as of 3/31/2024 1 $279M $62M $287M 1. Innoviva Form 10 - Q

We have actively deployed capital to maximize shareholder value 15 Return of capital to shareholders Repurchased GSK’s 32% equity stake for $392M and completed $100M share repurchase program Opportunistic asset monetization Monetized Innoviva’s share of TRELEGY® royalties for $282M upfront, additional asset rights, plus $50M milestone Value - accretive company acquisitions Acquired Entasis and La Jolla to form an integrated commercial - stage critical care and ID business Thoughtful asset acquisitions Deployed over $550M 1 of capital into differentiated assets across a diverse healthcare portfolio Capital structure optimization Issued $261M 2028 notes on advantageous terms and fully redeemed $241M 2023 notes We thoughtfully approach capital deployment with a strong value focus 1. As of 3/31/2024; includes $300M placed with ISP fund, over $180M deployed into Armata, and approx. $75M deployed into investm ent s into InCarda, ImaginAb, Nanolive, and Gate Neurosciences

Innoviva has robust financials with multiple sources of value 16 $254M Cash and Receivables (as of March 31, 2024) Equity and Long - term Investments (as of March 31, 2024) LTM Product Sales and License Revenue $71M $628M $454M Debt (as of March 31, 2024) LTM Anoro & Breo Royalty Revenue $254M Note: LTM in this presentation refers to the last twelve months ending March 31, 2024

Q1 2024 demonstrated growth across the portfolio Net product sales and license revenue Royalty income RELVAR ® / BREO ® ELLIPTA ® ANORO ® ELLIPTA ® Q1 2023 Q1 2023 Q1 2024 Q1 2024 YoY growth YoY growth 17 “Our first quarter financial results continue to demonstrate the successful transformation for Innoviva. We had a strong performance driven by resilient cash flows from our core GSK royalties portfolio and robust revenue growth across our commercial products marketed by IST, a leader in critical care medicine and infectious disease. We also remain laser focused on utilizing our strong financials to drive shareholder value by continuing to exercise cost discipline, investing prudently in our strategic healthcare assets, and completing our share buyback plan.” Pavel Raifeld, CEO N/A (Sept 2023 launch) $2.2M $12.1M ($0.1M ex - US license revenue) $9.0M ($0.0M ex - US license revenue) 34% $2.5M ($0.0M ex - US license revenue) $4.8M ($1.5M ex - US license revenue) 91% All products $11.5M $19.1M 66% $52.2M $50.9M 2% $9.7M $9.4M 3% Combined $61.9M $60.3M 3%

Innoviva’s team has world - class healthcare experience: Management 18 Innoviva Team Superior capabilities and network Unique and complementary skill sets Strong value creation focus Proven track record of success Pavel Raifeld Chief Executive Officer Steve Basso Chief Financial Officer Marianne Zhen, CPA Chief Accounting Officer Marcie Cain Chief People Officer Matt Ronsheim, Ph.D. President, IST Experienced finance and life sciences professional with background in senior roles in consulting, banking, and investing Finance professional with over 30 years of financial leadership with both established and growth stage pharmaceutical companies Finance professional with over 20 years in accounting and strategic operations in life sciences and technology companies Human resources executive with a focus on rapidly growing & scaling life sciences companies Accomplished leader with decades of biopharma leadership experience across a range of functions and operational roles

Innoviva’s team has world - class healthcare experience: Board of directors 19 Innoviva Team Superior capabilities and network Unique and complementary skill sets Strong value creation focus Proven track record of success Mark DiPaolo , Esq., Chairperson Jules Haimovitz Odysseas Kostas, M.D. Sarah J. Schlesinger, M.D. Senior Partner and General Counsel at Sarissa Capital; former senior member Icahn Capital’s investment team Founder, executive, and director of multiple companies in life sciences and entertainment; former director of Ariad Pharma Partner and Senior Managing Director at Sarissa Capital; former life sciences analyst and physician Professor at Rockefeller University with governance and clinical / medical expertise; former director of MDCO and Ariad Pharma (Icahn Capital) Sapna Srivastava, Ph.D. Senior biopharma executive; former CFO, senior biotech analyst, and experienced director Derek Small Senior biopharma executive; founder and CEO of multiple successful therapeutics companies

Thank you Investor contact: Innoviva@argotpartners.com Media contact: David.Patti@inva.com

Appendices

Key events in the history of Innoviva 2020 May 2022 July 2022 Nov 2023 First royalty product (Breo) launches in U.S. Announced successful Phase III trial results for novel oral gonorrhea treatment Innoviva’s initial infectious disease investments, including private placements in Entasis Therapeutics and Armata Pharmaceuticals Announced acquisition of La Jolla Pharmaceutical – manufacturers of XERAVA and GIAPREZA 2013 2014 Second royalty product (Anoro) launches in U.S. Zoliflodacin 2017 Announced acquisition of Entasis Therapeutics with clinical assets SUL - DUR and Zoliflodacin Integration of Entasis and La Jolla into Innoviva Specialty Therapeutics FDA approval of XACDURO (“SUL - DUR”) Sale of Trelegy Ellipta Royalty Interests to Royalty Pharma Third royalty product ( Trelegy ) launches in U.S. Timeline of major Innoviva events May 2023 22

23 Relvar / Breo detail: First once - daily inhaled corticosteroid / long - acting beta - agonist for asthma and chronic obstructive pulmonary disease Net global sales ($B) RELVAR ® / BREO ® ELLIPTA ® (fluticasone furoate 100 mcg and vilanterol 25 mcg inhalation powder) Indications (US) • Long - term, once - daily, maintenance treatment of airflow obstruction and reducing exacerbations in patients with COPD • Once - daily treatment of asthma in patients aged 18 years and older • Launched in 2013 as first and only once - daily ICS / LABA in the US • Relvar / Breo delivers superior, lasting proactive asthma control, with simple once - daily dosing in an easy - to - use device • Historical resilience in a competitive, volatile environment supported by positive demographic trends Implied royalties ($M) Royalty assets 1. Projections per analyst consensus on GSK forecast website accessed February 28, 2024; analyst forecasts updated on January 25 , 2 024; GBP converted to USD using January 25 exchange rate of $1.27 US Ex - US Consensus 1 0.9 1.3 1.5 1.3 1.5 1.6 1.4 1.4 1.3 1.3 1.3 1.2 0.0 0.2 0.4 0.6 0.8 1.0 1.2 1.4 1.6 1.8 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 2026 2027 129 199 220 189 222 234 215 208 0 50 100 150 200 250 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 2026 2027

24 Anoro detail: Best - in - class long - acting beta - agonist / long - acting muscarinic antagonist for COPD 1. Projections per analyst consensus on GSK forecast website accessed February 28, 2024; analyst forecasts updated on January 25 , 2 024; GBP converted to USD using January 25 exchange rate of $1.27 2. Superior improvement in lung function has been demonstrated in clinical trials of ANORO vs. Tiotropium (LAMA) and Spiolto (LA MA/ LABA) Net global sales ($B) ANORO ® ELLIPTA ® (umeclidinium 62.5 mcg and vilanterol 25 mcg inhalation powder) Indications (US) • Long - term, once - daily, maintenance treatment of airflow obstruction and reducing exacerbations in patients with COPD • Launched in 2014 as first - in - class LABA / LAMA single inhaler product in the US • ANORO delivers superior lung function improvement vs common initial maintenance therapy options 2 • Class leader in the US due to clear differentiation • 2022 net sales decline due to idiosyncratic pricing pressures in the US Implied royalties ($M) US Ex - US Consensus 1 Royalty assets 0.3 0.4 0.6 0.7 0.7 0.7 0.6 0.7 0.7 0.7 0.7 0.7 0.0 0.1 0.2 0.3 0.4 0.5 0.6 0.7 0.8 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 2026 2027 18 29 41 43 46 45 38 45 0 10 20 30 40 50 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 2026 2027

XACDURO: Significant ex - U.S. value as many countries have high CRAB prevalence Global percentages of carbapenem resistance and incidence of A. baumannii Carbapenem resistance 1,2 CRAB incidence 3,4,5 United States 45% ~18,400 Latin/South America 86% >80,000 Europe/Russia 78% 45,000 - 60,000 SE Asia/Australia 69% China 72% 330,000 6 >1M cases / yr 3 >50% average resistance rates 1,2 >300K deaths / yr 3 25 1. Clinical Infectious Diseases. 76: S166 - S178 (2023) 2. Emerging Microbes & Infections. 11: 1730 - 1741 (2022) 3. The Lancet. 399: 629 - 655 (2022) 4. Medica Brasileira. 61(3): 244 - 249 (2015) 5. Data on file; Decision Resources Group 6. Market research on file Innoviva Specialty Therapeutics Assets

Top line summary: positive zoliflodacin Phase 3 results • An estimated 82 million patients contract gonorrhea each year 1 , with rising rates of resistance to standard of care regimens in many countries 2 . • We, in collaboration with GARDP, conducted a global pivotal phase 3 trial to evaluate the efficacy of a single 3g oral dose of zoliflodacin in treatment of uncomplicated gonorrhea, comparing to treatment with a combination of intramuscular injection of ceftriaxone and oral azithromycin. • Zoliflodacin met the primary efficacy endpoint and was non - inferior to the comparator arm in participants with urogenital disease (point estimate 5.3% (95% confidence interval: 1.4%, 8.7%)). • For the key secondary analyses of infections at rectal and pharyngeal sites, the rates of cure in the zoliflodacin arm were comparable to those observed in the comparator arm, although these analyses were not powered for statistical significance. • In this study, zoliflodacin was found to be safe and generally well - tolerated; majority of adverse events were mild to moderate with no discontinuations due to adverse events, serious adverse events, or deaths. • The study outcome could offer an important therapeutic option for patients and represents a positive milestone in the development of zoliflodacin and the fight against antimicrobial resistance. Innoviva Specialty Therapeutics Assets 1. WHO global antimicrobial resistance suveillance. Lancet Microbe 2021; 2: e627 – 36 2. Lancet 2023; 9: e332 - 33 26

Armata is an innovator in anti - infectives addressing significant unmet medical need Armata is a clinical - stage biotechnology company focused on the development of precisely targeted bacteriophage therapeutics for the treatment of antibiotic - resistant and difficult - to - treat bacterial infections 27 Diverse bacteriophage pipeline with multiple “shots on goal” Broad, robust capabilities Strategic Healthcare Assets

Additional minority portfolio investments 28 Abbreviations: PAF – Paroxysmal atrial fibrillation; IO - Immuno - oncology InCarda focuses on cardiovascular diseases; its lead drug is in late - stage development for PAF ImaginAb is a leader in radio - pharmaceutical imaging with a differentiated solution for IO patient care and other areas of unmet medical need Gate Neurosciences is developing next - generation therapies for psychiatric and neurological disorders Nanolive is a microscopy company that has developed a method for live cell 3D imaging and analysis with applications across drug discovery and biotech R&D Strategic Healthcare Assets

v3.24.1.1.u2

Cover

|

May 13, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

May 13, 2024

|

| Entity File Number |

000-30319

|

| Entity Registrant Name |

INNOVIVA, INC.

|

| Entity Central Index Key |

0001080014

|

| Entity Tax Identification Number |

94-3265960

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

1350 Old Bayshore Highway

|

| Entity Address, Address Line Two |

Suite

400

|

| Entity Address, City or Town |

Burlingame

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

94010

|

| City Area Code |

650

|

| Local Phone Number |

238-9600

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.01 per share

|

| Trading Symbol |

INVA

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

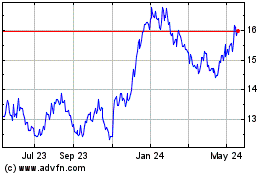

Innoviva (NASDAQ:INVA)

Historical Stock Chart

From Jan 2025 to Feb 2025

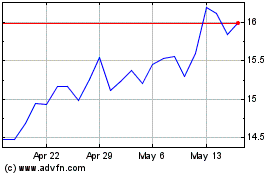

Innoviva (NASDAQ:INVA)

Historical Stock Chart

From Feb 2024 to Feb 2025