UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE TO

(Amendment No. 3)

Tender Offer Statement Under Section 13(e)(1)

of the Securities Exchange Act of 1934

ASSURE HOLDINGS CORP.

(Name of Subject Company (Issuer) and Filing

Person (Offeror))

9% CONVERTIBLE DEBENTURES DUE 2023 AND 2024

(Title of Class of Securities)

|

04625J303

(CUSIP Number of Common Stock Underlying Debentures) |

| |

|

John Farlinger

Executive Chairman and Chief Executive Officer

7887 East Belleview Avenue, Suite 240

Denver, Colorado 80111

Telephone: 720-287-3093 |

| (Name, Address and Telephone Number of Person Authorized to Receive Notices and Communications on Behalf of Filing Person) |

| |

| |

| Copies to: |

| |

|

Jason K Brenkert, Esq.

Dorsey & Whitney LLP

1400 Wewatta Street, Suite 400

Denver, Colorado 80202

Telephone: (303) 352-1133

Fax Number: (303) 629-3450 |

| |

| ¨ |

Check the box if the filing relates solely to preliminary communications made before the commencement of a tender offer. |

Check the appropriate boxes below to designate

any transactions to which the statement relates:

| ¨ |

third party tender offer subject to Rule 14d-1. |

| x |

issuer tender offer subject to Rule 13e-4. |

| ¨ |

going-private transaction subject to Rule 13e-3. |

| ¨ |

amendment to Schedule 13D under Rule 13d-2. |

Check the following box if the filing is a final

amendment reporting the results of the tender offer: ¨

If applicable, check the appropriate box(es) below

to designate the appropriate rule provision(s) relied upon:

| ¨ |

Rule 13e-4(i) (Cross-Border Issuer Tender Offer) |

| ¨ |

Rule 14d-1(d) (Cross-Border Third-Party Tender Offer) |

INTRODUCTORY STATEMENT

This Amendment No. 3 (“Amendment No.

3”) amends the Tender Offer Statement on Schedule TO originally filed by Assure Holdings Corp., a Nevada corporation (the “Company”,

“we”, “us” or “our”), on June 21, 2024, as amended on July 3, 2024 and July 9,

2024 (as amended through July 9, 2024 the “Second Amended Schedule TO”), in connection with an offer (the “Convertible

Note Exchange Offer”) by Assure to exchange, for each $1,000 claim, consisting of principal amount, and accrued and unpaid interest

through, and including, July 19, 2024, of the Company’s 9% Convertible Debentures due 2023 and 2024 (the “Assure Convertible

Debentures”), 238.44 shares (4,291.85 shares on a pre-reverse split basis) of the Company’s common stock (the “Common

Stock”) equal to the quotient of $1,000 divided by a per share price of $4.194 ($0.233 on a pre-reverse split basis), as adjusted

for a 1-for-18 reverse stock split which took effect on July 9, 2024. Assure is seeking to exchange any and all outstanding Assure

Convertible Debentures in the Convertible Note Exchange Offer for the offered shares of Common Stock.

The Convertible Note Exchange Offer commenced

on June 21, 2024 and will expire at 11:59 p.m. (Denver time) on July 19, 2024, unless extended by the Company.

This Amendment No. 3 is being filed, among other

things, to amend and restate certain sections of the Offer Letter dated June 21, 2024 as amended through the Amendment No.1 to the Offer

Letter dated July 3, 2024 (as amended through July 3, 2024, the “Amended Offer Letter”) through Amendment No. 2 to

the Offer Letter dated July 12, 2024 (“Amendment No. 2 to Offer Letter”) to: (i) remove a sentence in the sixth paragraph

of the cover page of the Amended Offer Letter, which inadvertently states that the Convertible Note Exchange Offer is subject to potential

withdraw if the terms and conditions of the Convertible Note Exchante Offer are not satisfied, to clarify that there are no conditions

to the Convertible Note Exchange Offer, as is currently stated in the other sections of the Amended Offer Letter, (ii) amend and restated

Q&A 30 to remove references to terms and conditions and correct typographical errors, and (iii) revise our risk factor on page 16

of the Amended Offer Letter to clarify that our determinations as to the validility, form, eligibility and accpetance of tendered Assure

Convertible Debentures and the required forms related thereto is subject to the judgements of any courts with jurisdiction over us that

might provide otherwise.

Only those items amended are reported in this

Amendment No. 3. Except to the extent specifically provided herein, as amended hereby, in the Amendment No. 2 to Offer Letter, the information

contained in the Second Amended Schedule TO, the Amended Offer Letter, and the other exhibits to the Schedule TO remain unchanged and

are hereby expressly incorporated into this Amendment No. 3 by reference in response to Items 1 through 13. This Amendment No. 3 and the

Amendment No. 2 to the Offer Letter, filed as Exhibit (a)(1)(iii) hereto, should be read with the Second Amended Schedule TO and the Amended

Offer Letter.

Items 1 and 4-7.

All descriptions and references in respect of

the ‘Offer Letter’ in the Second Amended Schedule TO are hereby amended to refer to the Amended Offer Letter as amended by

Amendment No. 2 to the Offer Letter.

Items 1 and 4-7 of the Original Schedule TO are hereby amended and

updated as set forth below:

| |

(1) |

The sixth paragraphs of the Offer Letter cover page under the heading “The Offer” is amended and restated as follows: |

“The Offer is made upon the terms

in this Offer Letter and related Letter of Transmittal. The Offer will be open until July 19, 2024, at 11:59 p.m. Denver Time, unless

otherwise extended by the Company (the period during which the Convertible Note Exchange Offer is open, giving effect to any further extension,

is referred to herein as the “Offer Period”). The Offer is not made to those holders who reside in states or

other jurisdictions where an offer, solicitation or sale would be unlawful.”

| |

(2) |

On page 13, Question 30 and its answer is amended and restated as follows: |

“Q30. Under what circumstances

can the Convertible Note Exchange Offer be extended or amended?

A30. We reserve the right to

extend the Convertible Note Exchange Offer for any reason or no reason at all. We also expressly reserve the right, at any time or from

time to time, to amend the terms of the Convertible Note Exchange Offer in any respect prior to the Expiration Date of the Convertible

Note Exchange Offer. Further, we may be required by law to extend the Convertible Note Exchange Offer if we make a material change in

the terms of the Convertible Note Exchange Offer or in the information contained in this Offering Letter. During any extension of the

Convertible Note Exchange Offer, Assure Convertible Debentures that were previously tendered and are not validly withdrawn will remain

subject to the Convertible Note Exchange Offer. For more information regarding our right to extend or amend the Convertible Note Exchange

Offer, see “The Convertible Note Exchange Offer—Expiration of the Convertible Note Exchange Offer; Extension of Offer.””

| |

(3) |

On page 16, the risk factor Holders may not receive Exchange Consideration in the Convertible Note Exchange Offer if the procedures for the Convertible Note Exchange Offer are not followed is amended and restated as follows: |

“Holders may not receive

Exchange Consideration in the Convertible Note Exchange Offer if the procedures for the Convertible Note Exchange Offer are not followed.

We will determine, in our discretion,

all questions about the validity, form, eligibility (including time of receipt), and acceptance of any Assure Convertible Debentures.

We reserve the right to reject any form or any Assure Convertible Debentures tendered for exchange that we determine are not in appropriate

form or that we determine are unlawful to accept., which judgment shall be final, subject to the judgments of any courts with jurisdiction

over us that might provide otherwise. We will accept all properly tendered Assure Convertible Debentures that are not validly withdrawn,

subject to the terms of this Convertible Note Exchange Offer. No tender of Assure Convertible Debentures will be deemed to have been properly

made until all defects or irregularities have been cured or waived by us. We have no obligation to give notice of any defects or irregularities,

and we will not incur any liability for failure to give any notice.”

Item 12. Exhibits.

* - Previously filed

SIGNATURES

After due inquiry and to the best of my knowledge

and belief, I certify that the information set forth in this statement is true, complete and correct.

| |

ASSURE HOLDINGS CORP. |

|

| |

|

|

| By: |

/s/ John Farlinger |

|

| |

John Farlinger |

|

| |

Chief Executive Officer |

|

Dated: July 12, 2024

INDEX TO EXHIBITS

* - Previously filed

Exhibit (a)(1)(iii)

AMENDMENT NO. 2

ASSURE HOLDINGS CORP.

OFFER TO EXCHANGE

SHARES OF COMMON STOCK

FOR

OUTSTANDING 9% CONVERTIBLE NOTES DUE 2023 AND

2024

ISSUED BY ASSURE HOLDINGS CORP.

JULY 12, 2024

THE CONVERTIBLE NOTE EXCHANGE OFFER WILL EXPIRE

AT 11:59 P.M., DENVER TIME, ON JULY 19, 2024 UNLESS EXTENDED (SUCH TIME AND DATE, AS IT MAY BE EXTENDED, THE “EXPIRATION

DATE”).

This Amendment No. 2 (this “Amendment

No. 2”) amends the information previously provided in the Offer Letter, dated June 21, 2024, as amended by the Amendment No.

1 to the Offer Letter dated July 3, 2024 (as amended through July 3, 2024 the “Amended Offer Letter”) of Assure Holdings

Corp. (the “Company”), whereby the Company is offering to certain holders of 9% convertible debentures of the Company

(“Holders”) issued between December 2019 and April 2020 (the “Assure Convertible Debentures”) the

opportunity to exchange, for each $1,000 claim, consisting of principal amount, and accrued and unpaid interest through, and including,

July 19, 2024, 238.44 shares (4,291.85 shares on a pre-reverse split basis) of the Company’s common stock (the “Common

Stock”) equal to the quotient of $1,000 divided by a per share price of $4.194 ($0.233 on a pre-reverse split basis), as adjusted

for a 1-for-18 reverse stock split which took effect on July 9, 2024 (the “Convertible Note Exchange Offer’). Except

as amended and supplemented hereby, the information in the Amended Offer Letter remains unchanged. To the extent there are any conflicts

between the information in this Amendment No. 2 and the information in the Amended Offer Letter, the information in this Amendment No.

2 hereby replaces and supersedes all such information.

All capitalized terms used but not defined herein

shall have the meanings ascribed to them in the Amended Offer Letter.

The amendments set forth below are identical to

those set out in Amendment No. 3 to the Tender Offer Statement on Schedule TO (the “Schedule TO-I/A”), which was filed

by the Company with the SEC on July 12, 2024. The Schedule TO-I/A amends and supplements the Tender Offer Statement on Schedule TO initially

filed by the Company with the SEC on June 21, 2024, as amended on July 3, 2024 and July 9, 2024.

This Amendment No. 2 should be read in conjunction

with the Amended Offer Letter and the Letter of Transmittal (as amended). All references to the “Convertible Note Exchange Offer”

in the Amended Offer Letter and Letter of Transmittal (as amended) mean the Convertible Note Exchange Offer as amended hereby, all references

in such documents to the “Offer Letter” mean the Amended Offer Letter as amended hereby, and all references in such documents

to the “Letter of Transmittal” include the Letter of Transmittal, as amended. Except as set forth in the amendments below

or as otherwise set forth herein, the terms set forth in the Amended Offer Letter continue to be applicable in all respects. Unless the

context requires otherwise, capitalized terms used in this Amendment No. 2 and not defined herein that are defined in the Amended Offer

Letter have the respective meanings ascribed thereto in the Amended Offer Letter.

The expiration date of the Convertible Note Excahnge Offer is not

being extended at this time. The Convertible Note Exchange Offer expires at 11:59 p.m. (Denver time) on July 19, 2024, unless extended

by the Company.

The Amended Offer Letter is amended as follows:

| |

(1) |

The sixth paragraphs of the Offer Letter cover page under the heading “The Offer” is amended and restated as follows: |

“The Offer is made upon the terms

in this Offer Letter and related Letter of Transmittal. The Offer will be open until July 19, 2024, at 11:59 p.m. Denver Time, unless

otherwise extended by the Company (the period during which the Convertible Note Exchange Offer is open, giving effect to any further extension,

is referred to herein as the “Offer Period”). The Offer is not made to those holders who reside in states or

other jurisdictions where an offer, solicitation or sale would be unlawful.”

| |

(2) |

On page 13, Question 30 and its answer is amended and restated as follows: |

“Q30. Under what circumstances

can the Convertible Note Exchange Offer be extended or amended?

A30. We reserve the right to

extend the Convertible Note Exchange Offer for any reason or no reason at all. We also expressly reserve the right, at any time or from

time to time, to amend the terms of the Convertible Note Exchange Offer in any respect prior to the Expiration Date of the Convertible

Note Exchange Offer. Further, we may be required by law to extend the Convertible Note Exchange Offer if we make a material change in

the terms of the Convertible Note Exchange Offer or in the information contained in this Offering Letter. During any extension of the

Convertible Note Exchange Offer, Assure Convertible Debentures that were previously tendered and are not validly withdrawn will remain

subject to the Convertible Note Exchange Offer. For more information regarding our right to extend or amend the Convertible Note Exchange

Offer, see “The Convertible Note Exchange Offer—Expiration of the Convertible Note Exchange Offer; Extension of Offer.””

| |

(3) |

On page 16, the risk factor Holders may not receive Exchange Consideration in the Convertible Note Exchange Offer if the procedures for the Convertible Note Exchange Offer are not followed is amended and restated as follows: |

“Holders may not receive

Exchange Consideration in the Convertible Note Exchange Offer if the procedures for the Convertible Note Exchange Offer are not followed.

We will determine, in our discretion,

all questions about the validity, form, eligibility (including time of receipt), and acceptance of any Assure Convertible Debentures.

We reserve the right to reject any form or any Assure Convertible Debentures tendered for exchange that we determine are not in appropriate

form or that we determine are unlawful to accept., which judgment shall be final, subject to the judgments of any courts with jurisdiction

over us that might provide otherwise. We will accept all properly tendered Assure Convertible Debentures that are not validly withdrawn,

subject to the terms of this Convertible Note Exchange Offer. No tender of Assure Convertible Debentures will be deemed to have been properly

made until all defects or irregularities have been cured or waived by us. We have no obligation to give notice of any defects or irregularities,

and we will not incur any liability for failure to give any notice.”

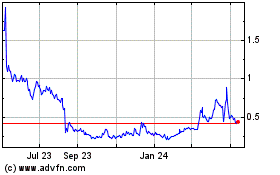

Assure (NASDAQ:IONM)

Historical Stock Chart

From Jan 2025 to Feb 2025

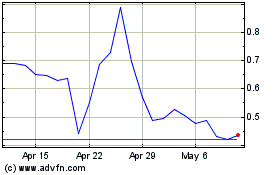

Assure (NASDAQ:IONM)

Historical Stock Chart

From Feb 2024 to Feb 2025